The ASEAN Fish Oils market is set to grow from an estimated USD 270.7 million in 2025 to USD 1,081.1 million by 2035, with a compound annual growth rate (CAGR) of 14.8% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 270.7 million |

| Projected ASEAN Value (2035F) | USD 1,081.1 million |

| Value-based CAGR (2025 to 2035) | 14.8% |

The ASEAN fish oil market is developing at a fast pace, mainly due to the increasing demand for omega-3 fatty acids and the growing interest of health-conscious consumers in fish oil supplements.

With the continuous rise in knowledge regarding the health advantages of fish oil, such as the improvement of cardiovascular diseases, brain function, and its effectiveness as an anti-inflammatory agent the fish oil market is going through a production and consumption boom.

The region's high marine biodiversity serves as an ideal base for fish oil production, among other countries, Indonesia, Thailand, and Malaysia are important suppliers.

Moreover, the aquaculture industry is the main factor pushing fish oil demand since it is utilized in fish feeds to enrich fishes and improve their health. This cumulative pressure from both the dietary supplement and aquaculture industry is highlighting the market business path ahead.

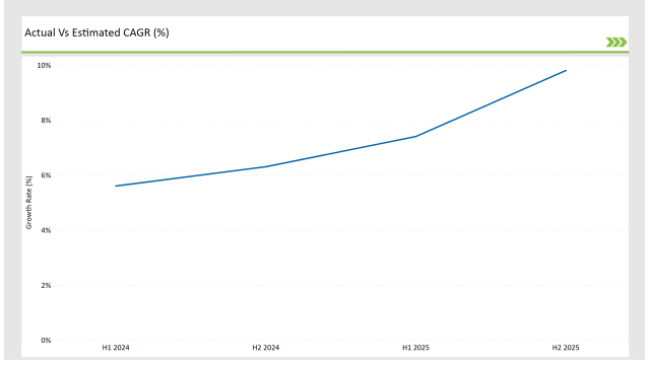

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Fish Oils market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Fish Oils market, the sector is predicted to grow at a CAGR of 5.6% during the first half of 2024, increasing to 6.3% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 7.4% in H1 but is expected to rise to 9.8% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Omega Protein launched a new line of sustainably sourced fish oil products to cater to health-conscious consumers. |

| 2024 | Nutreco announced a partnership with local fisheries in Thailand to promote sustainable fish oil sourcing practices. |

| 2024 | Cargill expanded its fish oil extraction facility in Malaysia to increase production capacity and meet rising demand. |

| 2024 | Skretting introduced a new salmon oil product designed for aquaculture, emphasizing sustainability and quality. |

Rising Demand for Omega-3 Fatty Acids.

The need for omega-3 fatty acids is skyrocketing globally, and specifically, ascertaining this trend in ASEAN fish oil market. Omega-3 fatty acids constitute vitally important substances mainly located in fish oil, and due to this, they are mostly used for therapy of various diseases along with their other health benefits such as heart disease, brain health, and overall wellness. As consumers become more and more health-conscious the popularity of omega-3s dietary supplements is growing precipitously.

The issue of balanced diet and the importance of omega-3 in chronic diseases have drawn more attention as people are more aware of it. Health organizations and nutritionists are promoting more omega-3 intake, which has been a key reason for the boom of fish oil supplement consumption.

Apart from these, the e-commerce platform expansion has facilitated the distribution of a variety of fish oil products and thus marked the market growth.

Shift towards Sustainable Sourcing and Production

The fish oil market is increasingly concentrating on the critical sustainability issues, stemming from the growing consumer awareness and the demand for regulations. Despite the world concentrating more on the unregulated fishing and the fingerprints that human activities leave on the environment, consumers are buying goods which on environmental aspects of sourcing and production are not burdened.

This is even more essential to the ASEAN region, where the marine resources are not only the backbone of local businesses but also form a chain in the global economy.

Fish oil manufacturers are following this trend to fulfil the market demand by implementing sustainable practices for fish sourcing, which can include using fish only from certified fisheries and organizing traceability schemes.

Accreditations from marine organizations such as the Marine Stewardship Council (MSC) are gaining more and more significance for fish oil consumers who wish to be sure that their medical products are eco-friendly.

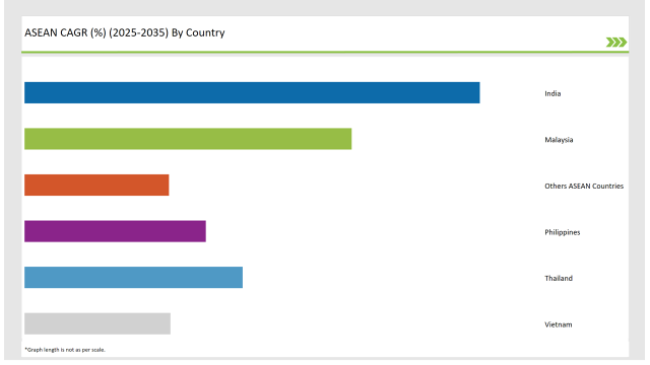

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Fish oil market in India is flourishing a lot, which is being propelled by improving health awareness and the related increase in demand for omega-3 fatty acids. As consumers are becoming more focused on health, they are displaying more interest in dietary supplements that provide health benefits, particularly those that are rich in omega-3s.

On the other hand, the trend of dietary supplements is partly due to the increasing cases of lifestyle diseases such as coronary artery disease triggering the shift in consumers to preventive health measures. The country's aquaculture industry is also a major fish oil market player.

The nation is one of the top fish producers, and thus the demand for fish oil as a key feed ingredient for aquaculture is increasing. Fish oil is a crucial source of the energy needed by fish to grow and develop, thus it is a vital compound in the feed formulation. The fish oil demand is also significantly supported by the government's programs to amplify aquaculture production.

The combination of the country's warm climate and abundant water resources creates perfect conditions for fish farming, resulting in the high use of fish oil in feed. The Thai government has shown a keen interest in supporting this sector with environmental-friendly policies and better technology to increase production growth.

Thailand's fish oil market is also gaining from the rising overall seafood demand worldwide. As one of the top seafood suppliers globally, the country has set a target of upgrading its fish oil products to conform to globally accepted standards. The result is a series of investments in cutting-edge processing equipment, which in turn are improving fish oil's quality and safety.

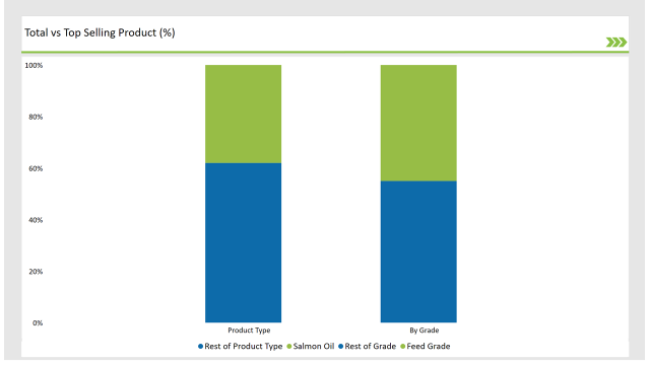

The main category of fish oil in the market is feed grade fish oil, which makes up a large part of the total market. Due to the aquaculture sector's increasing need for top-notch feed, their popularity comes from this reason. Feed grade fish oil, which is one of the richest sources of omega-3 fatty acids, is a MUST for the development and health of farmed fish.

Apart from the aquaculture industry, feed grade fish oil is more significantly used nowadays with fisheries taking on the "optimum feed" approach to feed formulations that would achieve sustainable production.

The movement towards sustainable aquaculture methods is also the one that drives the demand for responsibly sourced feed grade fish oil, as both consumers and producers are becoming more aware of their environmental impacts.

The heightened knowledge of the health advantages linked with omega-3 fatty acids among the consumers is propelling the demand for salmon oil. The more people become health-conscious through changes in their diet, the more they entwine salmon oil into their daily lives.

Also, the proliferation of e-commerce platforms has bestowed upon consumers the privilege to procure a range of salmon oil products, consequently promoting its market development. The aquaculture field stands out as one of the principal consumers of salmon oil, which is included to increase the nutrition of the fish feed.

The expansion of the aquaculture sector, especially in regions like ASEAN, is projected to be the main driver for the salmon oil market in the next years. With the consumer's continuing interest in health and wellness, the salmon oil demand, in all probability, will stay strong, thereby affirming its status as the top product type in the fish oil market.

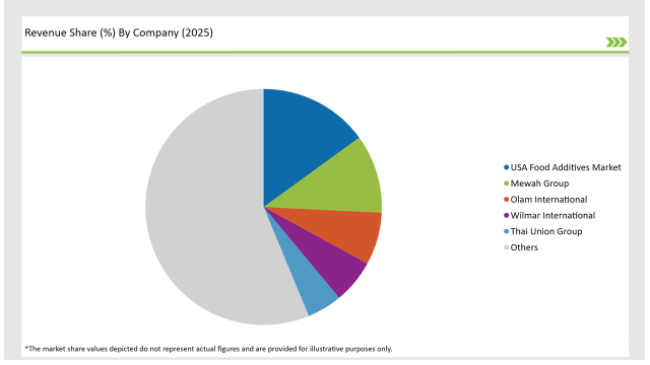

2025 Market Share of ASEAN Fish Oils Manufacturers

Note: The above chart is indicative

The fish oil market has the potential to experience massive growth due to the improvement in people's knowledge about omega-3 fatty acids and their health advantages, the increase in the demand from the fish farming industry, and the heightened emphasis on sustainable practices.

Fish oil market is projected to change from the innovative approaches adopted by the companies that are dealing with eco-friendly and organic options as the people get more interested and health concerned about their products.

Strong drivers such as favorable market trends, technology breakthroughs, and competition constitute the principles on which the fish oil industry will build and grow in the next few years.

Feed Grade, Food Grade, and Pharma Grade

Salmon Oil, Tuna Oil, Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Anchovy Oil, Menhaden Oil and Others

Crude Fish Oil, Refined Fish Oil, Modified Fish Oil

Aqua-Feed, Food and Beverages, Dietary Supplements, Cosmetic and Beauty Products

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Fish Oils market is projected to grow at a CAGR of 14.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,081.1 million.

India are key Country with high consumption rates in the ASEAN Fish Oils market.

Leading manufacturers Gardenia Bakeries, Bread Talk, The Baker's Cottage, Fish Oils & Co. in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA