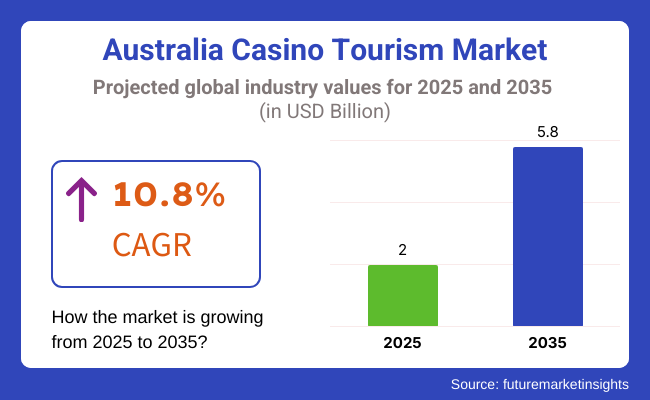

Australian casino tourism is destined to witness extensive growth, climbing from an expected USD 2 billion in 2025 to USD 5.8 billion by 2035, registering a CAGR of 10.8% for the period of 2025 to 2035. This is driven by the development of upscale casino resorts, heightened tourism activities, and Australia's emphasis on building comprehensive entertainment offerings beyond gaming, such as top-class dining, shopping, and live performances. Both local and international visitors, especially from Asia, Europe, and the United States, are driving the demand for multi-purpose resort experiences.

The growth of the market is driven primarily by growing popularity for luxury integrated resorts in places such as Sydney, the Gold Coast, and Melbourne, which combine gaming, high-end dining, and sophisticated entertainment. Growing disposable income, along with advancements in mobile gambling and online betting websites, are also contributing to tourism heading to casinos in Australia.

The following chart reflects changes in CAGR from the base year 2024 to the projected growth in 2025.

CAGR Values for Australian Casino Tourism Market (2024 - 2025)

The Australian casino tourism market is projected to grow at a CAGR of 9.2% in the first half of 2024, with an increase to 9.4% in the second half. The market is expected to see growth accelerating to 10.6% in the first half of 2025, as new integrated resorts and expansions of existing properties come online.

| Category | Details |

|---|---|

| Market Value | The Australian casino tourism industry is projected to generate USD 1.8 billion in 2024, comprising over 65% of the Asia-Pacific region's casino tourism market. |

| Domestic Market Share | Domestic tourists represent 60% of the market, with top destinations including The Star in Sydney, Crown Melbourne, and Jupiters on the Gold Coast. |

| International Market Share | International tourists account for 40%, with key markets including visitors from China, Japan, and the United States flocking to luxury resorts like Crown Sydney and The Star. |

| Key Destinations | Key destinations include Crown Melbourne, The Star Sydney, The Star Gold Coast, and Jupiters Resort in Queensland. |

| Economic Impact | Direct spending on accommodation, dining, and entertainment by casino tourists in major cities like Sydney and Melbourne generates billions annually. |

| Key Trends | Growth of integrated resorts, rise of esports gambling, tech-driven gaming, and sports betting experiences. |

| Top Travel Seasons | Peak seasons are during summer holidays, public holidays like Australia Day, and major sporting events such as the Melbourne Cup and the Australian Open. |

Australia's casino tourism landscape is characterized by its world-class integrated resorts, particularly in capital cities such as Sydney, Melbourne, and Brisbane. Crown Melbourne, for instance, continues to welcome an eclectic mix of tourists with a fusion of gaming with premium dining, world-class entertainment, and upscale accommodations. Sydney's The Star is renowned for its stunning harbor vistas, while Queensland's Jupiters on the Gold Coast provides tropical scenery combined with state-of-the-art gaming. The economy is supported by both casino high-rollers and regular gamblers, with visiting international tourists, especially from Asia, making a substantial contribution to tourism receipts.

| Date | Development & Details |

|---|---|

| Jan 2025 | Launch of High-Roller Experience at Crown Melbourne: Crown Melbourne introduces an exclusive high-roller experience, offering VIP access to private suites, personalized gaming tables, and tailored entertainment, creating a luxurious, elite experience aimed at attracting high-net-worth tourists. |

| Dec 2024 | Introduction of Family Casino Packages at The Star Sydney: The Star Sydney launches family-oriented vacation packages, featuring kid-friendly accommodations, activity programs, and beginner-friendly gaming lessons, making the casino experience more accessible to families with children. |

| Nov 2024 | Opening of Luxury Waterfront Casino at The Star Gold Coast: The Star Gold Coast opens a new luxury waterfront casino, blending stunning ocean views with fine dining, exclusive gaming options, and high-end amenities to attract both domestic and international tourists seeking premium experiences. |

| Oct 2024 | Expansion of Sports Betting Features at Crown Sydney: Crown Sydney expands its sports betting offerings, integrating live sports betting features with traditional casino games, catering to an expanding market of sports enthusiasts looking for seamless gambling and entertainment options. |

| Sept 2024 | Grand Reopening of Jupiters Resort on the Gold Coast Jupiters Resort reopens with luxurious updates, including a new spa, exclusive shopping venues, and top-tier entertainment options, enhancing its appeal to high-end tourists seeking a comprehensive resort experience beyond gaming. |

In Australia's casino tourism market, poker, as Texas Hold'em, is the most popular and profitable game, attracting professional players and leisure tourists alike. Its popularity is evidenced at iconic casinos such as The Star Sydney and Crown Melbourne, where poker rooms are a hub of the entire casino experience. The social and competitive aspects of Texas Hold'em create a popular game among players, bringing millions of dollars in revenue to these establishments.

At Crown Melbourne, the casino has capitalized on the popularity of its poker games to host major tournaments like the Australian Poker Championship that brings poker gamers from all around the world. The tournament is not only characterized by a high-stakes ambiance but also offers local tourism incentives through the turnout of international poker players who compete in the championship and indulge in luxury accommodations, meals, and entertainment amenities. The tournament is a showcase for Crown's luxury poker rooms, designed to offer a first-class experience for players and spectators.

Apart from that, poker is more successful due to online integration. Poker online rooms become as silky and enjoyable as any land-based venue where players can hone their craft from anywhere in Australia—and the entire world. It also provides access to the transition to real life poker, enabling online poker gamers to transition into real-world venues to play for high-rolling tournaments and games. The Australian Poker Tour, often held at Crown Melbourne, exemplifies this connection, drawing crowds from overseas and contributing millions to the local economy.

Also, Australian casinos like The Star Sydney run Texas Hold'em tournaments on a regular basis, having independent poker rooms that have multiple buy-ins and structures, further solidifying poker's grip in the casino tourism market of Australia. These facilities and tournaments not only display poker's central role in the country's casino tourism scene but also ensure continued growth of tourism along with casino revenues.

Business-to-business casinos must continue to be the pacesetters of the Australian casino tourism sector with their state-of-the-art facilities and excellent image for class and high-class entertainment experiences. High-end hotels like Crown Melbourne, The Star Sydney, and Jupiters Resort lead the way by providing an unparalleled combination of gaming, luxury dining, and global entertainment. They are more than just gambling businesses, offering holiday makers a complete vacation experience, a huge draw for locals and overseas tourists alike.

Crown Melbourne, for instance, stands apart with its premium amenities, comprising celebrity chef dining establishments such as Nobu and Bistro Guillaume, catering to gourmands everywhere. A client at Crown Melbourne can spend the evening at the casino, enjoy a meal in a celebrity chef restaurant, and then watch a show at Crown Theatre—opting for complete entertainment synergy. The ability of the resort to provide multiple experiences in a single location solidifies its position as a top vacation spot for individuals who seek something more than gaming.

Similarly, The Star Sydney offers an eclectic range of premium entertainment, ranging from top-tier performances by global artists, to high-end shopping. Guests at The Star aren't limited to the casino floor—there is ample experience to choose from, anywhere from the fine dining at Black Bar & Grill to viewing top-tier shows and celebrity acts, so it is a melting pot of not just high-rollers but also pleasure travelers.

In addition, business casinos are also embracing cutting-edge technology to attract a younger, technologically savvy customer base. Crown Resorts has introduced new mobile gaming apps, allowing visitors to play their favorite casino games on their cell phones. Cashless payment systems are also becoming increasingly popular, providing greater convenience and ensuring a trouble-free experience. These advances in technology not only make the customer experience easier but also ensure that Australian casinos are always at the forefront of state-of-the-art gaming technology, captivating varied and vibrant tourist populations.

Australia's casino tourism market is highly competitive with major players such as Aristocrat Leisure Ltd, The Lottery Corporation Ltd, and Tabcorp Holdings Limited holding sway. These players have a wide array of premium offerings that are designed to attract casual tourists as well as premium tourists. Their competitive advantage is their ability to provide experiential products that go beyond traditional gaming, such as live sports action, celebrity chef restaurants, and premium spa facilities.

2025 Market Share of Australian Casino Tourism Players

Australia's casino tourism market is controlled by the large operators, and Aristocrat Leisure Ltd leads with 65%, followed by The Lottery Corporation Ltd at 15%, and Tabcorp Holdings Limited with 2%. Other regional casinos such as the smaller ones on the Gold Coast and regional Australia contribute importantly, collectively making up 25%. These top operators provide a mix of luxury, entertainment, and gaming facilities that appeal to high-rollers as well as general tourists, creating a diversified and competitive market.

The industry is segmented into 3 Card Poker, American Roulette, Baccarat, and Other casino games.

The market is categorized into Commercial, Tribal, Limited Stakes, and I-Gaming casinos.

Segmentation includes Gambling Enthusiasts, Social Exuberants, and Others.

The industry includes Independent Travelers, Package Travelers, and Tour Groups.

The China casino tourism market is expected to grow at a CAGR of 10.8% from 2025 to 2035.

The market is projected to reach USD 5.8 billion by 2035.

Key drivers include the expansion of luxury integrated resorts, increasing popularity of high-roller experiences, and the rising demand for world-class entertainment and leisure services.

Major players include Sands China, MGM Resorts, Wynn Macau, and Galaxy Entertainment Group, who are all heavily involved in the development of integrated resorts and luxury casinos.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Casino Tourism Industry Analysis from 2025 to 2035

USA Casino Tourism Industry Analysis from 2025 to 2035

Australia Surfing Tourism Market Report – Innovations, Trends & Growth 2025–2035

India Casino Tourism Market Forecast and Outlook 2025 to 2035

China Casino Tourism Market Analysis – Size, Growth, & Forecast Outlook 2025 to 2035

Italy Casino Tourism Market Analysis 2025 to 2035

France Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Educational Tourism Market Report – Growth, Innovations & Forecast 2025-2035

Germany Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Africa Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Monaco Casino Tourism Industry Trends – Growth & Forecast through 2034

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA