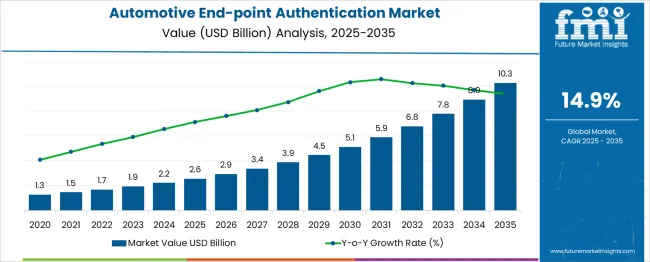

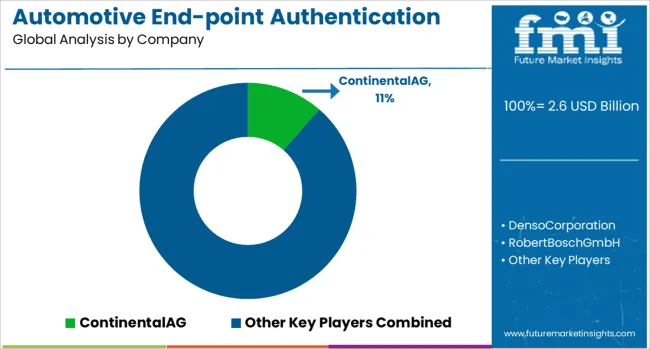

The Automotive End-Point Authentication Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 10.3 billion by 2035, registering a compound annual growth rate (CAGR) of 14.9% over the forecast period.

| Metric | Value |

|---|---|

| Automotive End-Point Authentication Market Estimated Value in (2025 E) | USD 2.6 billion |

| Automotive End-Point Authentication Market Forecast Value in (2035 F) | USD 10.3 billion |

| Forecast CAGR (2025 to 2035) | 14.9% |

The automotive end-point authentication market is experiencing robust momentum as vehicle manufacturers shift toward digitized architectures prioritizing cybersecurity and personalized access. The rise of connected vehicles, autonomous functions, and over-the-air feature updates has elevated the need for end-point authentication systems capable of verifying user identity, device legitimacy, and secure in-vehicle transactions. Increased threats of cyber intrusion and theft have accelerated regulatory pressure and OEM investment in embedded security layers that can adapt in real-time.

Advancements in in-cabin sensing, biometric signal processing, and automotive-grade embedded processors have enabled the deployment of responsive, software-driven identity validation solutions. Industry adoption is further supported by the need to enable frictionless access control, digital key systems, and driver-specific personalization without compromising safety or compliance.

As automakers pivot toward software-defined vehicles and multi-user service platforms, the demand for intelligent, seamless, and adaptive authentication mechanisms is expected to scale rapidly across both premium and mass-market segments. Strategic collaborations between Tier 1 suppliers, chipmakers, and mobility service providers are reinforcing innovation in this domain.

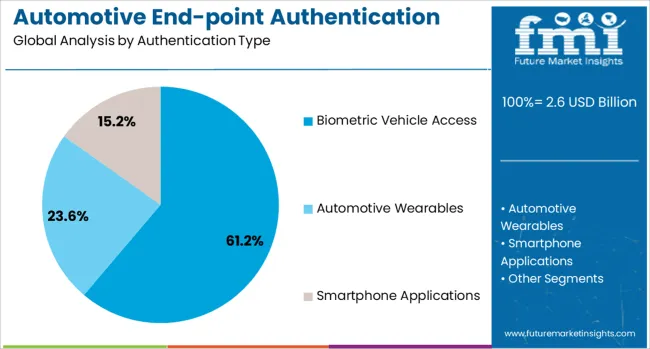

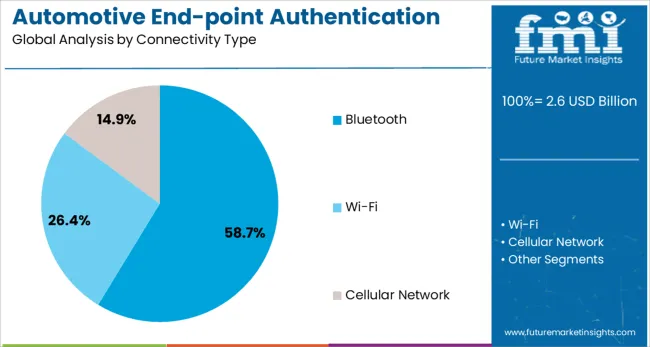

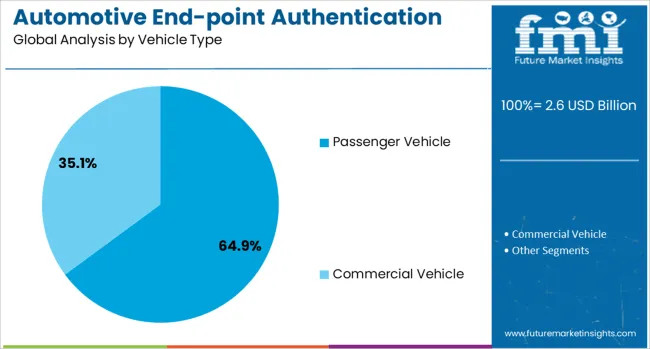

The automotive endpoint authentication market is segmented by authentication type, connectivity type, vehicle type, and geographic regions. By authentication type, the automotive endpoint authentication market is divided into Biometric Vehicle Access, Automotive Wearables, and Smartphone Applications. In terms of connectivity type, the automotive endpoint authentication market is classified into Bluetooth, Wi-Fi, and Cellular Network. Based on vehicle type, the automotive endpoint authentication market is segmented into Passenger vehicles and Commercial vehicles. Regionally, the automotive end-point authentication industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The biometric vehicle access subsegment is expected to capture 61.2% of the total revenue share in the automotive end-point authentication market in 2025, establishing itself as the leading authentication type. Growth in this segment is being driven by the widespread integration of fingerprint recognition, facial identification, and iris scanning into vehicle access systems to enhance security and user convenience. The demand for contactless and seamless driver authentication has increased in parallel with rising consumer expectations for personalized in-vehicle experiences.

Biometric systems are being integrated into door handles, dashboards, and steering wheels, enabling real-time identity verification while ensuring multi-layered protection against unauthorized access. The ability of biometric modules to operate independently of mobile networks or key fobs has further supported their adoption in next-generation vehicle platforms.

These systems align well with digital cockpit strategies and data protection standards, making them a preferred choice for OEMs targeting secure and intuitive access control. As autonomous and shared mobility models evolve, biometric authentication is anticipated to remain a central component of secure vehicle entry.

Bluetooth connectivity is projected to contribute 58.7% of the overall revenue share in the automotive end-point authentication market by 2025, reinforcing its position as the most widely adopted connectivity type. Its dominance is being supported by the rapid adoption of smartphone-as-a-key functionality and the integration of Bluetooth Low Energy (BLE) protocols into digital access systems. Bluetooth enables passive entry, remote vehicle monitoring, and dynamic user profiling without the need for physical keys or high-cost infrastructure.

The ability to establish secure short-range communication channels with minimal power consumption has made it an ideal platform for automotive authentication across various tiers of vehicles. OEMs are leveraging Bluetooth for two-factor authentication, keyless start systems, and personalized infotainment configurations.

Compatibility with a wide range of mobile devices and embedded modules has further driven its market penetration. As consumer vehicles increasingly transition toward connected ecosystems, Bluetooth’s role in establishing secure and user-friendly access protocols continues to expand, especially in conjunction with mobile-based applications and cloud-authenticated services.

Passenger vehicles are expected to hold 64.9% of the total revenue share in the automotive end-point authentication market in 2025, signifying their dominant role in driving adoption across the mobility landscape. The rise in consumer demand for personalization, seamless access, and enhanced safety has led automakers to prioritize advanced authentication features within passenger vehicles. Integration of driver recognition, user profiles, and secure digital key systems is being increasingly seen in both luxury and mid-range models.

The segment’s growth is being further supported by increasing regulatory focus on vehicular data security and theft prevention, particularly in high-density urban environments. Software-based authentication tools, including biometric sensors and Bluetooth-enabled access modules, are being deployed to provide secure, personalized experiences without increasing hardware complexity.

The widespread use of mobile devices as authentication endpoints, along with embedded AI-based access systems, is reinforcing innovation in passenger-centric platforms. As vehicle connectivity and infotainment ecosystems continue to evolve, passenger vehicles are anticipated to remain the primary adopters of intelligent end-point authentication technologies.

Automotive end-point authentication is becoming essential for securing connected vehicle environments. Regulatory pressure, biometric adoption, and rising cybersecurity awareness are set to drive adoption despite cost-related barriers.

The automotive end-point authentication market is gaining traction as connected vehicles become more prevalent and the volume of in-vehicle data transmission increases. Manufacturers are prioritizing security layers that verify user identities and authorize access to critical systems, reducing the risk of malicious interference. End-point authentication protects infotainment, navigation, and telematics data from interception and misuse. OEMs are integrating solutions such as biometric recognition, cryptographic keys, and secure gateways to safeguard ECU communication. This security layer is also vital for over-the-air updates, ensuring only verified software reaches the vehicle. The drive toward protecting both personal and operational data is positioning authentication as a default feature in modern automotive design frameworks.

Biometric-based authentication is emerging as a key growth driver in automotive applications. Fingerprint scanning, facial recognition, and voice authentication are being embedded in keyless entry, driver personalization, and payment systems. These features not only enhance convenience but also strengthen access control by linking vehicle functions directly to an authorized user profile. Biometric authentication reduces dependency on physical keys or cards, which can be stolen or duplicated. Automakers are expanding their use in luxury and electric segments, where premium security features are valued. Advancements in sensor accuracy, low-latency processing, and anti-spoofing measures are increasing adoption rates, enabling reliable deployment across diverse climatic and operational conditions.

Government-mandated cybersecurity regulations are shaping investment priorities in automotive end-point authentication. Standards such as UNECE WP.29 and ISO/SAE 21434 are prompting automakers and tier suppliers to integrate stronger authentication protocols at the design stage. Compliance-driven upgrades ensure that vehicle networks, ECUs, and cloud interfaces are protected against evolving cyber threats. These frameworks also influence supply chain selection, as component providers must demonstrate compliance readiness. The cost of non-compliance, including penalties and loss of brand reputation, is motivating proactive implementation. Regulations are fostering uniform security baselines across markets, reducing regional disparities and ensuring a consistent level of protection in vehicles sold globally. This regulatory push is expanding opportunities for solution providers with certified offerings.

Despite growing demand, the adoption of automotive end-point authentication faces hurdles related to cost and system integration complexity. High deployment expenses, particularly in entry-level vehicles, deter widespread inclusion. Legacy systems pose compatibility issues, requiring additional adaptation or replacement of existing ECUs and network architectures. OEMs must also invest in staff training and cybersecurity infrastructure to manage these systems effectively. Smaller manufacturers face budget constraints in balancing advanced security features with competitive pricing. However, as cyber threats increase and consumer trust becomes a decisive purchasing factor, the value proposition of authentication systems is expected to outweigh initial costs, encouraging broader implementation over time.

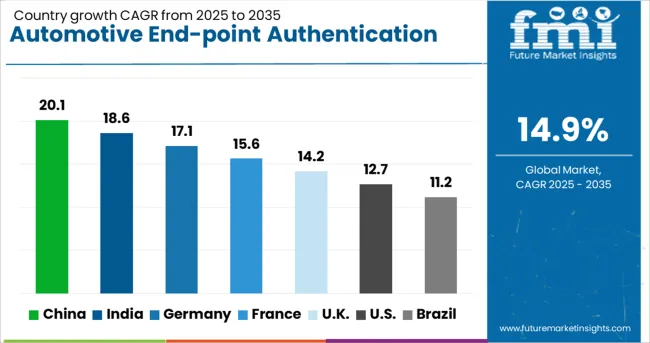

| Country | CAGR |

|---|---|

| China | 20.1% |

| India | 18.6% |

| Germany | 17.1% |

| France | 15.6% |

| UK | 14.2% |

| USA | 12.7% |

| Brazil | 11.2% |

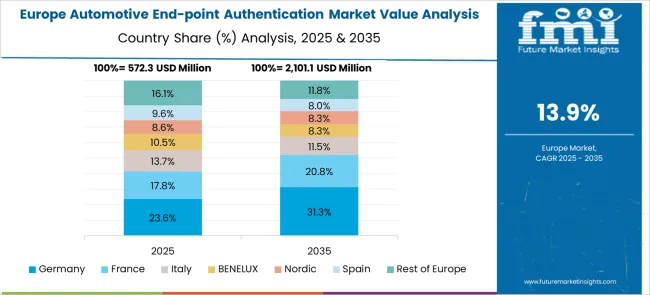

The automotive end-point authentication market is projected to expand globally at a CAGR of 14.9% from 2025 to 2035, supported by heightened demand for secure connected vehicle environments, integration of biometric systems, and compliance with emerging cybersecurity regulations. China leads with a CAGR of 20.1%, driven by accelerated connected car production, large-scale EV adoption, and investment in secure in-vehicle communication systems. India follows at 18.6%, supported by rising passenger vehicle sales, regulatory initiatives, and adoption of cost-effective authentication solutions in mid-range models. France records 15.6%, benefitting from its strong automotive R&D sector and integration of advanced identity verification in premium segments. The United Kingdom grows at 14.2%, supported by motorsport innovation and increased use of secure driver identification in shared mobility fleets. The United States reaches 12.7%, reflecting steady adoption in OEM cybersecurity packages and aftermarket upgrades for performance and commercial fleets. This assessment underlines Asia-Pacific’s leadership in scaling automotive end-point authentication adoption, while Europe and North America remain crucial hubs for compliance-driven and technology-focused deployments.

China is projected to post a CAGR of 20.1% for 2025–2035, up from an estimated 17.2% during 2020–2024, keeping it well above the global average of 14.9%. This upward shift is driven by rapid adoption of connected vehicles, accelerated EV production, and government-backed initiatives for automotive cybersecurity compliance. Automakers are embedding biometric and cryptographic authentication into mass-market models, expanding beyond premium segments. Domestic R&D hubs are working closely with cybersecurity firms to develop AI-driven verification protocols. The country’s competitive edge is strengthened by large-scale deployment of secure over-the-air update systems and partnerships between OEMs and cloud service providers to ensure encrypted in-vehicle communication.

India is forecasted to achieve a CAGR of 18.6% for 2025–2035, up from approximately 15.8% during 2020–2024, exceeding the global average of 14.9%. The increase is supported by rising passenger vehicle production, growing telematics adoption, and heightened consumer awareness of data protection. Automakers are incorporating end-point authentication into mid-tier and economy models to meet evolving compliance requirements. Local suppliers are partnering with global cybersecurity firms to create cost-effective hardware security modules. Expansion in connected fleet operations and aftermarket upgrade services is adding to demand. Government policy frameworks focusing on secure vehicle communication are influencing faster rollout of advanced authentication systems.

France is expected to post a CAGR of 15.6% for 2025–2035, rising from around 13.9% in 2020–2024, slightly above the global average of 14.9%. This increase is due to strong automotive R&D capabilities, integration of secure driver identification in premium and shared mobility platforms, and compliance with EU-level cybersecurity mandates. French OEMs are investing in blockchain-backed authentication to secure in-vehicle transactions. The luxury vehicle sector is also driving biometric integration to enhance personalization and access control. Partnerships with research institutes are producing innovations in anti-spoofing technologies, boosting consumer trust and adoption rates.

The United Kingdom is projected to register a CAGR of 14.2% for 2025–2035, up from an estimated 12.5% in 2020–2024, marking steady improvement toward the global average of 14.9%. This growth is attributed to motorsport-driven innovation, increased use of driver identity verification in shared mobility, and strengthening of OEM cybersecurity compliance. Specialist engineering hubs are developing high-precision authentication systems for performance vehicles, which later find broader application in consumer segments. Government-led initiatives on connected vehicle safety are reinforcing market expansion. Outsourced testing services for European automakers are also supporting higher utilization of advanced authentication platforms.

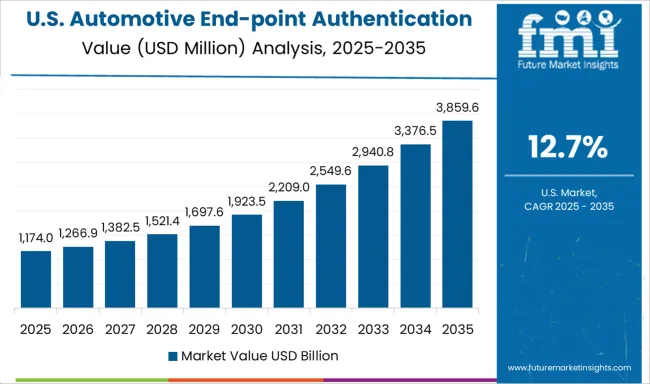

The United States is forecasted to achieve a CAGR of 12.7% for 2025–2035, rising from 11.1% during 2020–2024, remaining slightly below the global average of 14.9%. Growth is supported by steady OEM integration of authentication systems in connected and autonomous platforms. Aftermarket demand from fleet operators and high-performance vehicle tuners is contributing to adoption. The presence of advanced cybersecurity solution providers and automotive tech startups is enabling faster deployment of multi-factor authentication tools. Federal guidelines on vehicle cybersecurity are also influencing adoption, particularly in commercial and government fleets.

In the automotive end-point authentication market, companies are positioning themselves with distinct strategies that highlight their technological capabilities, partnerships, and focus areas. Continental AG has established itself as a market leader through its integration of software and hardware security, supported by acquisitions that strengthened its expertise in over-the-air software updates and in-vehicle cybersecurity. Samsung Electronics and Hitachi Ltd. leverage their consumer electronics and IoT expertise, developing platforms that merge smartphones, wearables, and biometric technologies to enhance user access and control. Fujitsu and Symantec focus on encryption and enterprise-grade risk management solutions, bringing IT security depth into automotive ecosystems by offering strong authentication frameworks tailored for connected cars.

Synaptics and VOXX International operate in a niche segment by specializing in sensor-based authentication, such as fingerprint recognition and capacitive touch entry systems, which are increasingly adopted in premium vehicles. Garmin and Fitbit explore crossover applications of wearable devices for vehicle access, including pairing smartwatches with cars and using biometric health data as authentication triggers, though these remain emerging solutions. HID Global, Nuance Communications, and Safran concentrate on identity and access management, with HID focusing on secure credential issuance, Nuance advancing voice authentication systems, and Safran bringing expertise in secure hardware modules. Market leaders like Continental and Samsung set themselves apart with end-to-end integration and cross-industry technology transfer, while mid-tier innovators such as Synaptics and VOXX carve competitive niches in specialized biometric solutions. Wearable-focused players like Garmin and Fitbit experiment with novel approaches, and IAM specialists like HID and Nuance ensure strong authentication layers for future automotive platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Authentication Type | Biometric Vehicle Access, Automotive Wearables, and Smartphone Applications |

| Connectivity Type | Bluetooth, Wi-Fi, and Cellular Network |

| Vehicle Type | Passenger Vehicle and Commercial Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ContinentalAG, DensoCorporation, RobertBoschGmbH, VisteonCorporation, NXPSemiconductors, HitachiLtd., InfineonTechnologiesAG, ValeoSA, LearCorporation, GentexCorporation, SynapticsIncorporated, FujitsuLimited, HarmanInternational, SamsungElectronics, and TexasInstruments |

| Additional Attributes | Dollar sales, share by authentication type and vehicle segment, regional adoption trends, competitive landscape, regulatory compliance impact, pricing benchmarks, OEM partnerships, and growth opportunities in EV and connected vehicle security. |

The global automotive end-point authentication market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the automotive end-point authentication market is projected to reach USD 10.3 billion by 2035.

The automotive end-point authentication market is expected to grow at a 14.9% CAGR between 2025 and 2035.

The key product types in automotive end-point authentication market are biometric vehicle access, automotive wearables, _fingerprint recognition, _voice recognition, _iris recognition and smartphone applications.

In terms of connectivity type, bluetooth segment to command 58.7% share in the automotive end-point authentication market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA