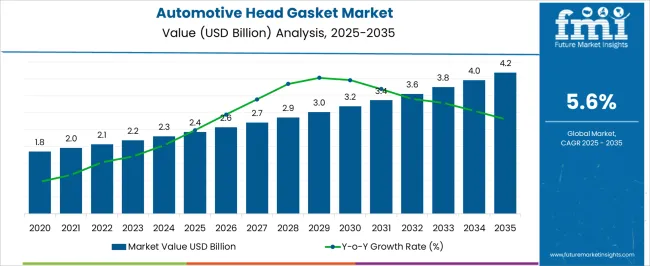

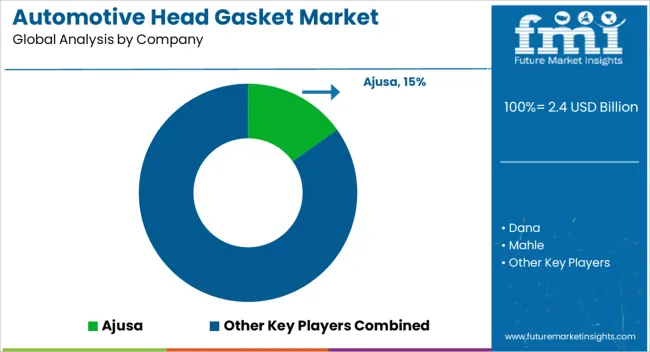

The Automotive Head Gasket Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. In the early growth phase, from 2025 to 2029, the market experiences a steady rise from USD 1.8 billion to USD 2.4 billion, driven by consistent demand for automotive components in the expanding automotive industry, particularly in emerging markets. This initial phase shows moderate growth as vehicle production increases globally and the demand for high-performance automotive parts strengthens.

Between 2029 and 2031, the market shows gradual acceleration, moving from USD 2.6 billion to USD 2.9 billion. This growth is fueled by advancements in engine technologies and the increasing need for durable, high-quality components in modern vehicles. During this period, the market begins to shift towards enhanced product specifications and the growing adoption of electric vehicles, contributing to the demand for high-performance gaskets in these applications.

From 2031 to 2035, the market experiences more significant growth, reaching USD 4.2 billion. This later phase sees a sharper increase as automotive production reaches new heights globally, supported by an uptrend in both passenger vehicles and commercial vehicles.

| Metric | Value |

|---|---|

| Automotive Head Gasket Market Estimated Value in (2025 E) | USD 2.4 billion |

| Automotive Head Gasket Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The automotive head gasket market is witnessing consistent growth as OEMs and Tier 1 suppliers focus on achieving higher thermal stability, sealing reliability, and engine performance under evolving emission regulations. The increased production of combustion-based vehicles in emerging economies, combined with the growing adoption of turbocharged and high-compression engines, has heightened the demand for advanced head gasket materials and configurations.

Manufacturers are aligning product development with fuel efficiency goals and stricter CO2 regulations, which are driving innovation in gasket layering and sealing technologies. Additionally, as electric vehicle adoption coexists with a substantial internal combustion engine (ICE) vehicle population, aftermarket demand for high-durability gasket solutions continues to grow, particularly in aging vehicle fleets across the Asia Pacific and Latin America.

With rising investments in high-precision manufacturing, material science, and modular engine platforms, the automotive head gasket market is expected to sustain robust momentum in the near future. These trends are contributing to a shift toward longer-lasting, vibration-resistant, and temperature-tolerant head gasket solutions across multiple vehicle classes.

The automotive head gasket market is segmented by vehicle type, material, engine configuration, sales channel, and geographic region. By vehicle, the automotive head gasket market is divided into Passenger vehicles and Commercial vehicles. In terms of material, the automotive head gasket market is classified into Multilayer Steel (MLS), Composite, Copper, Elastomers, and Others.

Based on engine configuration, the automotive head gasket market is segmented into Inline, V-type, and Boxer engines. By sales channel, the automotive head gasket market is segmented into OEM and Aftermarket. Regionally, the automotive head gasket industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

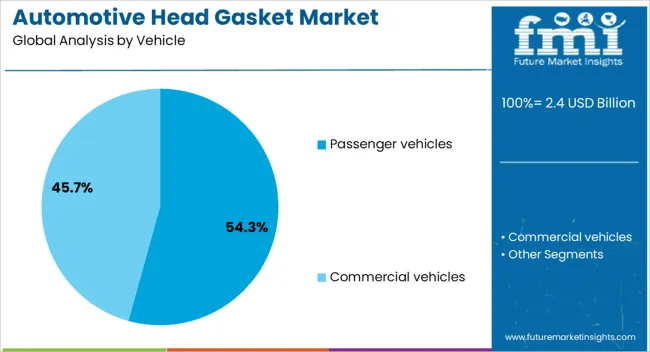

The passenger vehicles segment is projected to account for 54.3% of the overall revenue share in the automotive head gasket market in 2025, making it the leading vehicle type. This dominance is attributed to the high global production volumes of sedans, hatchbacks, and SUVs, which collectively drive the bulk of demand for internal combustion engine components.

The proliferation of downsized engines with turbocharging and direct injection in passenger vehicles has increased thermal and mechanical stresses, leading to a greater need for reliable gasket performance. Advanced head gaskets, designed for enhanced sealing under elevated pressures, are being increasingly adopted by OEMs to support longer engine lifecycles and meet warranty requirements.

The rising consumer preference for low-emission and fuel-efficient vehicles has further led manufacturers to deploy precision-fitted gaskets that ensure minimal leakage and consistent compression ratios Additionally, growth in shared mobility and personal car ownership in urban areas has expanded the demand for high-durability head gaskets, reinforcing the segment’s leadership in the global market.

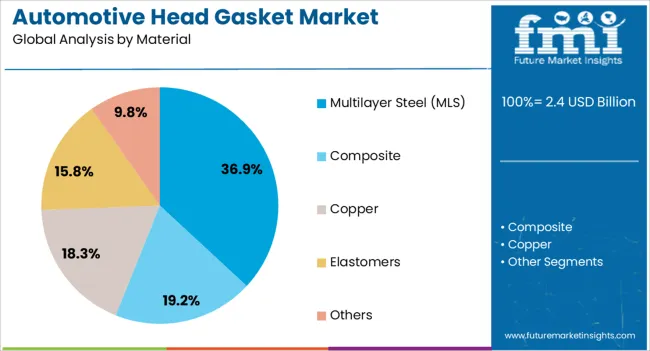

The multilayer steel material segment is expected to account for 36.9% of the total automotive head gasket market revenue share by 2025. The superior durability, thermal resistance, and adaptability of multilayer steel gaskets in high-performance engines are supporting this segment’s leading position.

Designed with multiple embossed layers of stainless steel, these gaskets offer uniform sealing pressure and resilience under thermal cycling, making them ideal for modern high-compression and turbocharged engines. Automotive OEMs have increasingly favored multilayer steel head gaskets due to their compatibility with aluminum engine blocks and their ability to maintain clamping force over long durations.

The segment’s growth is further being driven by the widespread adoption of lightweight engine designs and evolving emissions norms that demand tight combustion chamber sealing Their extended service life and resistance to creep deformation under elevated temperatures have made them a preferred choice in both OEM and aftermarket applications, particularly for gasoline and diesel powertrains across global markets.

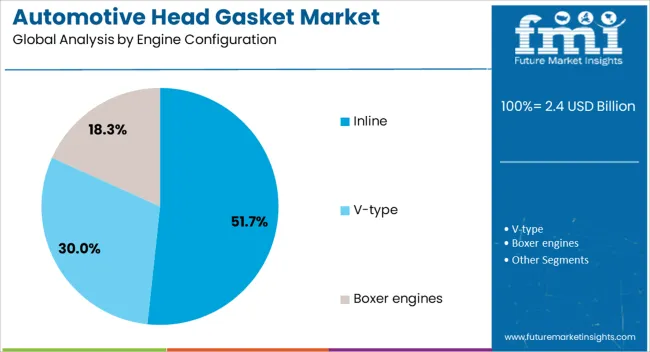

The inline engine configuration segment is expected to account for 51.7% of the total revenue share in the automotive head gasket market by 2025. This leadership is underpinned by the widespread use of inline engines in both compact and mid-sized passenger vehicles, where simplicity, cost efficiency, and balance are prioritized. Inline engine architectures are known for their linear design and ease of manufacturing, resulting in consistent head gasket requirements across platforms.

The use of fewer parts and a single cylinder head in inline configurations simplifies gasket design, improving sealing reliability and reducing thermal distortion. OEMs have maintained a strong preference for inline engines in front-wheel-drive layouts, which continue to dominate urban vehicle segments globally.

The compatibility of inline engines with smaller engine bays and their ease of maintenance has reinforced demand for standardized head gasket solutions. As engine downsizing trends persist and thermal loads increase, the demand for robust, high-performance head gaskets tailored to inline configurations is expected to remain strong across both established and emerging markets.

The automotive head gasket market is expanding as a result of the increasing demand for high-performance engines and the rising production of vehicles globally. Head gaskets, which seal the cylinder head to the engine block, play a critical role in maintaining engine integrity by preventing coolant and oil leaks while ensuring proper compression. The market is benefiting from advancements in engine technologies, growing vehicle production, and rising vehicle maintenance requirements. As engines become more complex and manufacturers prioritize engine durability and efficiency, the demand for reliable and high-quality head gaskets continues to grow, supporting market expansion.

The primary driver of growth in the automotive head gasket market is the growing vehicle production and the increasing demand for more efficient and durable engines. As vehicle manufacturers continue to improve engine performance and fuel efficiency, the need for high-quality head gaskets that can withstand higher pressures and temperatures is rising. The global expansion of the automotive industry, particularly in emerging economies, is further boosting the demand for head gaskets. Additionally, as consumers demand more reliable and efficient vehicles, manufacturers are focused on improving engine durability, leading to the increased use of advanced head gasket materials and technologies.

Despite its growth, the automotive head gasket market faces challenges related to the high cost of advanced materials and design complexity. Modern engines require head gaskets made from high-performance materials such as multi-layer steel (MLS) or composite materials, which can be more expensive than traditional gasket materials. This increases production costs for automotive manufacturers, particularly for mass-market vehicles. Furthermore, the design complexity of modern engines, with multiple layers and tighter tolerances, poses challenges in manufacturing head gaskets that meet the required standards for durability and performance. Overcoming these challenges involves continuing innovations in material science and manufacturing processes to reduce costs while maintaining high-quality standards.

The automotive head gasket market presents significant opportunities, particularly with advancements in gasket materials and the growing aftermarket demand. Manufacturers are focusing on developing advanced materials that offer improved performance, durability, and heat resistance, which are crucial for modern high-performance and electric vehicle engines. These innovations open up new growth opportunities in the OEM (original equipment manufacturer) and aftermarket sectors. The increasing need for vehicle maintenance, repairs, and upgrades in the aftermarket, especially for older vehicles, is another key factor driving the demand for high-quality head gaskets. As engines become more complex, the need for specialized head gaskets in both OEM and aftermarket applications is expected to grow.

A key trend in the automotive head gasket market is the shift toward electric vehicles (EVs) and the continued development of high-performance engine technologies. While EVs generally do not use traditional internal combustion engines, the demand for high-performance head gaskets remains strong in sectors such as sports cars and commercial vehicles, where advanced engine technologies are critical. In internal combustion engine (ICE) vehicles, the use of specialized gaskets that can handle higher temperatures and pressures due to turbocharged engines and hybrid powertrains is increasing. As manufacturers focus on improving engine efficiency and reducing emissions, the development of more advanced head gasket materials and technologies continues to play a crucial role in engine performance. This trend is expected to drive continued innovation in the market, with a focus on lightweight, durable, and high-performance materials for gaskets.

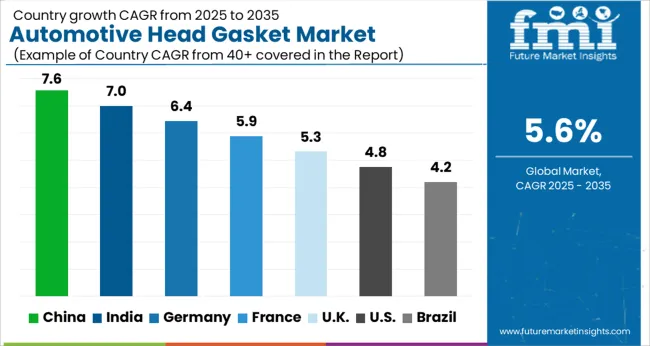

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global automotive head gasket market is projected to grow at a global CAGR of 5.6% from 2025 to 2035. China leads the market with a growth rate of 7.6%, followed by India at 7.0%. France records a growth rate of 5.9%, while the UK shows 5.3% and the USA follows at 4.8%. The market is primarily driven by the increasing demand for high-performance and durable engine components, the growing automotive industry, and the rising number of vehicles on the road. China and India are leading the growth, supported by rapid industrialization, increasing vehicle production, and rising automotive sales. The analysis spans over 40+ countries, with the leading markets shown below.

The automotive head gasket market in China is expanding at a 7.6% CAGR, driven by the growing automotive production and increasing demand for high-quality engine components. As China continues to lead the world in vehicle production, the demand for durable and high-performance head gaskets is increasing. The country’s large automotive manufacturing base, coupled with the growing demand for advanced vehicles, is a key factor driving the market.China’s focus on improving vehicle efficiency and meeting stricter emission regulations is further accelerating the adoption of high-performance automotive head gaskets.

The automotive head gasket market in India is projected to grow at a 7.0% CAGR, supported by the growing automotive manufacturing sector and increasing vehicle demand. As India’s automotive industry continues to expand, the need for durable, high-performance engine components, including head gaskets, is rising. The government’s focus on improving the domestic automotive manufacturing base, alongside rising consumer demand for cars, is contributing to the market’s growth. Additionally, with India’s increasing focus on reducing emissions and improving engine efficiency, demand for advanced and durable head gaskets is expected to rise further.

France’s automotive head gasket market is expected to grow at a 5.9% CAGR, driven by the demand for high-quality automotive components in the country’s well-established automotive manufacturing sector. As the automotive industry continues to innovate and focus on improving vehicle efficiency, the adoption of durable and high-performance head gaskets is increasing. France’s commitment to producing fuel-efficient vehicles with reduced emissions is driving the need for advanced engine components. The increasing demand for vehicles in the domestic and export markets is further contributing to the growth of the automotive head gasket market in France.

The UK’s automotive head gasket market is projected to grow at a 5.3% CAGR, fueled by increasing demand for high-performance vehicles and growing vehicle production. As the UK automotive sector continues to focus on innovation and enhancing engine efficiency, the demand for advanced, durable engine components like head gaskets is rising. Additionally, the shift toward more fuel-efficient and environmentally friendly vehicles is contributing to the need for improved head gasket solutions. The UK's emphasis on reducing emissions and improving vehicle performance is supporting the adoption of advanced automotive head gaskets.

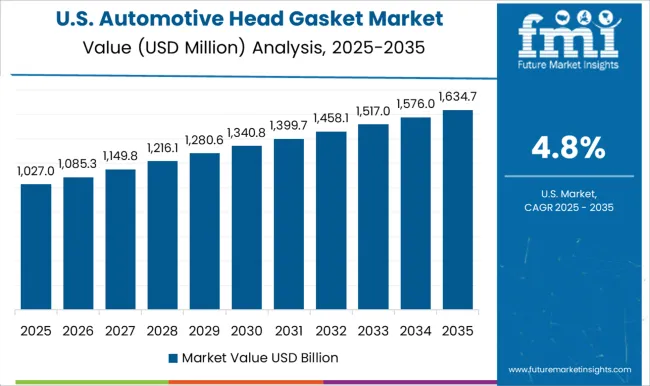

The USA automotive head gasket market is expected to grow at a 4.8% CAGR, supported by the rising demand for high-performance and fuel-efficient vehicles. As the USA continues to invest in automotive innovation, particularly in the areas of electric vehicles and advanced internal combustion engine designs, the need for durable, high-performance head gaskets is increasing. Additionally, the USA focus on reducing emissions and improving vehicle efficiency is further contributing to the demand for advanced automotive head gaskets. The ongoing demand for vehicles in both the domestic and export markets is also fueling the market.

The automotive head gasket market is driven by leading companies that provide high-quality sealing solutions for internal combustion engines, ensuring durability, performance, and reliability in vehicle engines. Ajusa is a significant player, known for producing premium head gaskets and sealing solutions, offering extensive product lines for both domestic and international automotive markets. Dana specializes in automotive parts, including head gaskets, focusing on providing high-performance sealing technologies for OEM and aftermarket applications.

Mahle is a global leader in the automotive head gasket market, providing high-quality sealing solutions with a focus on innovation, durability, and precision for automotive engines. ElringKlinger offers a wide range of head gaskets and sealing systems, known for their superior performance in sealing engine components and reducing emissions. Tenneco provides advanced sealing products, including head gaskets, designed for automotive applications, focusing on improving engine performance and efficiency.

Banco Products manufactures durable head gaskets and sealing solutions for the automotive industry, with a focus on high-quality materials and effective sealing performance for internal combustion engines. Trelleborg is a key player, recognized for producing high-performance head gaskets crafted from advanced materials that provide superior sealing properties and enhanced engine protection.

Cosmetic Gaskets specializes in producing innovative sealing solutions, including head gaskets, focusing on providing effective and reliable products for the automotive market. Mikuni is recognized for its high-quality head gaskets, offering advanced sealing solutions for both two-wheelers and four-wheelers, with an emphasis on performance and efficiency. Power Gaskets ContaSan offers durable head gasket solutions designed to withstand high temperatures and pressures, ensuring long-lasting engine performance and reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Material | Multilayer Steel (MLS), Composite, Copper, Elastomers, and Others |

| Engine Configuration | Inline, V-type, and Boxer engines |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajusa, Dana, Mahle, ElringKlinger, Tenneco, BancoProducts, Trelleborg, CosmeticGaskets, Mikuni, and PowerGasketsContaSan |

| Additional Attributes | Dollar sales by product type (metal head gaskets, composite head gaskets, multi-layer steel (MLS) head gaskets) and end-use segments (OEM, aftermarket). Demand dynamics are driven by increasing vehicle production, growing demand for high-performance engines, and the rising need for durable sealing solutions in automotive manufacturing. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with rising vehicle production, technological advancements in sealing materials, and the growing automotive aftermarket driving market expansion. |

The global automotive head gasket market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the automotive head gasket market is projected to reach USD 4.2 billion by 2035.

The automotive head gasket market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in automotive head gasket market are passenger vehicles, _hatchback, _sedan, _suv , commercial vehicles, _light commercial vehicles (lcv) and _heavy commercial vehicles (hcv).

In terms of material, multilayer steel (mls) segment to command 36.9% share in the automotive head gasket market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Headliners Market Size and Share Forecast Outlook 2025 to 2035

Automotive Head-up Display Market Trends - Growth & Forecast 2025 to 2035

Automotive Headliner Market Growth - Trends & Forecast 2025 to 2035

Automotive Exhaust Headers Market Size and Share Forecast Outlook 2025 to 2035

Automotive Seals and Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cast Iron Cylinder Head Market - Growth & Demand 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Head Protection Equipment Market Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA