The Automotive Mufflers Market is estimated to be valued at USD 13.9 billion in 2025 and is projected to reach USD 24.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Mufflers Market Estimated Value in (2025 E) | USD 13.9 billion |

| Automotive Mufflers Market Forecast Value in (2035 F) | USD 24.8 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Automotive Mufflers market is witnessing steady growth, driven by the rising demand for high-performance exhaust systems across passenger and commercial vehicles. Increasing focus on emission control, noise reduction, and fuel efficiency is creating significant opportunities for advanced muffler solutions. The adoption of lightweight and durable materials has further enhanced performance and extended vehicle lifespan, while evolving automotive regulations on noise and environmental compliance are accelerating market expansion.

Technological advancements, including hybrid muffler designs and enhanced acoustic engineering, are improving operational efficiency and passenger comfort. Growing vehicle production in emerging markets, coupled with consumer preference for premium and performance-oriented vehicles, is contributing to the demand for high-quality mufflers.

The integration of mufflers with overall vehicle design for better aerodynamics and reduced emissions is becoming increasingly important As the automotive industry continues to emphasize sustainability, efficiency, and performance, the market for automotive mufflers is expected to maintain consistent growth, driven by innovation in materials, design, and manufacturing processes.

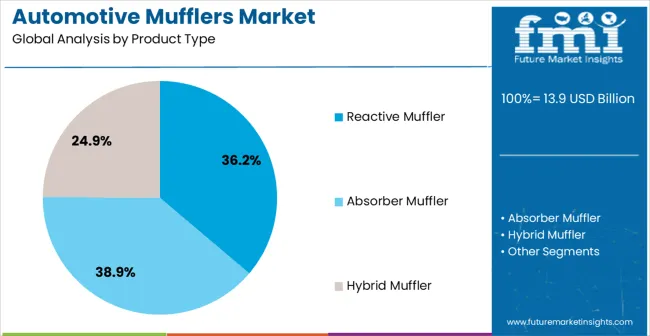

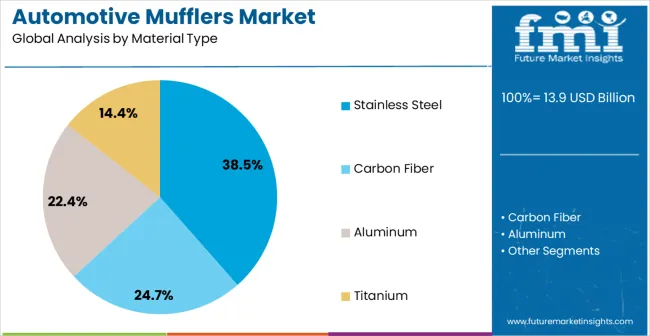

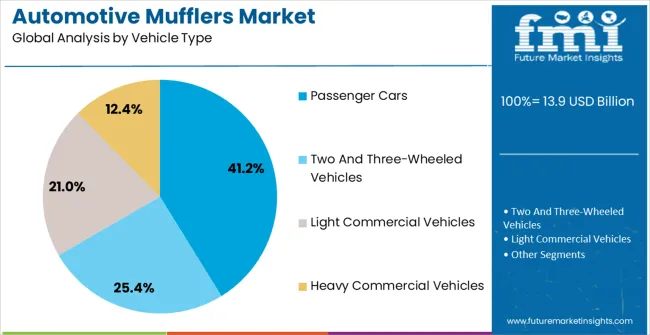

The automotive mufflers market is segmented by product type, material type, vehicle type, application, and geographic regions. By product type, automotive mufflers market is divided into Reactive Muffler, Absorber Muffler, and Hybrid Muffler. In terms of material type, automotive mufflers market is classified into Stainless Steel, Carbon Fiber, Aluminum, and Titanium. Based on vehicle type, automotive mufflers market is segmented into Passenger Cars, Two And Three-Wheeled Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles. By application, automotive mufflers market is segmented into OEM and Aftersales. Regionally, the automotive mufflers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The reactive muffler product type is projected to hold 36.2% of the market revenue in 2025, establishing it as the leading product type. Its dominance is driven by the ability to attenuate a wide range of sound frequencies and deliver efficient noise reduction across different engine outputs. Reactive mufflers utilize internal chambers to reflect sound waves, minimizing engine noise while maintaining optimal exhaust flow.

This design enhances performance for both passenger and light commercial vehicles, making it a preferred choice among OEMs and aftermarket manufacturers. The combination of high durability, ease of integration, and compliance with noise and emission regulations strengthens adoption.

Continuous improvements in materials and acoustic engineering have further improved efficiency, reduced weight, and enhanced overall vehicle performance As consumers demand quieter, more efficient, and compliant vehicles, the reactive muffler segment is expected to maintain its leadership, supported by innovation in design and manufacturing technologies that address evolving automotive requirements.

The stainless steel material type segment is projected to account for 38.5% of the market revenue in 2025, positioning it as the leading material choice. Growth is being driven by its superior corrosion resistance, durability, and ability to withstand high temperatures, which are critical for long-term muffler performance. Stainless steel ensures consistent exhaust flow while maintaining structural integrity over extended vehicle lifespans.

Its use reduces maintenance requirements and enhances the aesthetic appeal of exhaust systems, particularly in passenger cars and performance vehicles. The material’s compatibility with advanced muffler designs, including reactive and hybrid types, further supports adoption.

Increasing consumer preference for high-quality, low-maintenance components, coupled with stricter environmental and emission regulations, has reinforced its market position As automotive manufacturers continue to focus on performance, longevity, and compliance, stainless steel is expected to remain the preferred material for mufflers, driving sustained growth in this segment.

The passenger cars vehicle type segment is expected to hold 41.2% of the market revenue in 2025, making it the leading vehicle category. Growth is driven by the increasing production and sales of passenger vehicles globally, coupled with rising consumer demand for performance, noise reduction, and emission-compliant exhaust systems. Mufflers for passenger cars are designed to optimize sound attenuation, fuel efficiency, and engine performance, providing enhanced driving comfort and compliance with environmental regulations.

The integration of advanced materials such as stainless steel and hybrid muffler designs has further improved durability and efficiency. Automotive manufacturers are focusing on lightweight and compact exhaust systems that complement vehicle design while meeting stringent regulatory standards.

Rising disposable incomes, urbanization, and preference for premium vehicles have also contributed to the adoption of high-quality mufflers As passenger car production continues to expand and regulatory requirements tighten, this segment is expected to maintain its market leadership, supported by ongoing innovation and performance-focused design enhancements.

Manufacturers have developed new technologies that reduce the number of emissions from automobiles and improve the environment. Due to consumer and manufacturer views toward sustainability rising, there are more urgent demands for fuel-efficient and effective automobiles. Pollution mitigation is becoming increasingly important as the environment is being constantly degraded by pollution resulting from vehicle emissions.

An exhaust muffler or similar item is a component in an automotive exhaust system that reduces noise produced by an engine's exhaust. All conventional vehicles incorporate mufflers into exhaust systems. As mufflers optimize engine noise and increase efficiency, this trend is expected to drive the global market for automotive mufflers. Additionally, strict government regulations concerning noise pollution in different regions, including North America, Europe, and East Asia, are anticipated to propel the global market for automotive mufflers.

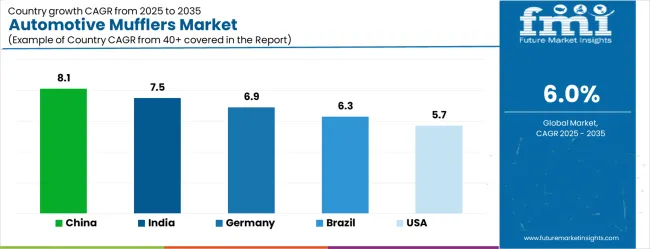

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| Brazil | 6.3% |

| USA | 5.7% |

| U.K. | 5.1% |

| Japan | 4.5% |

The Automotive Mufflers Market is expected to register a CAGR of 6.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.1%, followed by India at 7.5%. Developed markets such as Germany, France, and the U.K. continue to expand steadily, while the U.S. is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.5%, yet still underscores a broadly positive trajectory for the global Automotive Mufflers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.9%. The U.S. Automotive Mufflers Market is estimated to be valued at USD 5.3 billion in 2025 and is anticipated to reach a valuation of USD 5.3 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 651.6 million and USD 368.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.9 Billion |

| Product Type | Reactive Muffler, Absorber Muffler, and Hybrid Muffler |

| Material Type | Stainless Steel, Carbon Fiber, Aluminum, and Titanium |

| Vehicle Type | Passenger Cars, Two And Three-Wheeled Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles |

| Application | OEM and Aftersales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

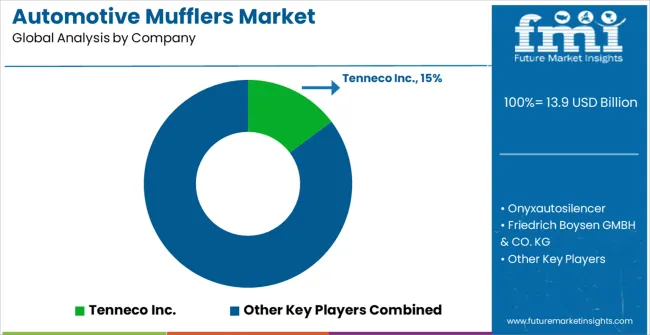

| Key Companies Profiled | Tenneco Inc., Onyxautosilencer, Friedrich Boysen GMBH & CO. KG, THUNDER, Bosal International N. V, Eminox, The Dinex Group, Faurecia, BENTELER International, Yutaka Giken Co., Ltd., Eberspächer, Munjal Auto Industries Limited, Harbin Airui Automotive Exhaust Systems Co. Ltd., and AP Exhaust Products |

The global automotive mufflers market is estimated to be valued at USD 13.9 billion in 2025.

The market size for the automotive mufflers market is projected to reach USD 24.8 billion by 2035.

The automotive mufflers market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in automotive mufflers market are reactive muffler, absorber muffler and hybrid muffler.

In terms of material type, stainless steel segment to command 38.5% share in the automotive mufflers market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA