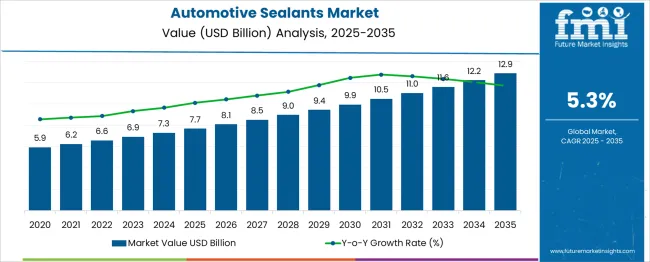

The automotive sealants market is projected to expand from USD 7.7 billion in 2025 to USD 12.9 billion by 2035, adding ~USD 5.2 billion in absolute opportunity. During 2025 to 2030, the market rises to ~USD 10.0 billion (≈ USD 2.3 billion gain, ~44% of incremental growth). From 2030 to 2035, it increases to ~USD 12.9 billion (≈ USD 2.9 billion gain, ~56% of incremental growth) as EV platforms, advanced glazing, and NVH targets lift specification rates across OEM and aftermarket.

| Metric | Value |

|---|---|

| Automotive Sealants Market Estimated Value in (2025 E) | USD 7.7 billion |

| Automotive Sealants Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The automotive sealants market is witnessing robust growth, driven by the expanding automotive manufacturing base and the increasing need for advanced bonding and sealing solutions that ensure structural integrity and longevity. As vehicle designs evolve toward lightweight and aerodynamic architectures, the role of sealants has shifted from simple fillers to critical functional components that enhance safety, NVH (noise, vibration, harshness) performance, and energy efficiency.

This transition has been enabled by innovations in polymer chemistry and the growing integration of multi-substrate materials in vehicle assemblies. Regulatory pressure to reduce carbon emissions has further supported the adoption of sealants that contribute to weight reduction and improved fuel efficiency.

Moreover, the electrification of vehicles has brought new sealing challenges related to thermal management, battery enclosures, and high-voltage insulation, creating fresh avenues for product innovation. The market is also benefiting from strategic collaborations among OEMs, tier suppliers, and chemical companies to co-develop sealants tailored for specific vehicle platforms and production processes.

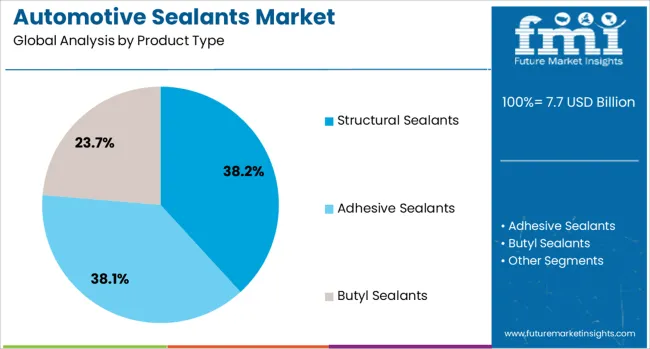

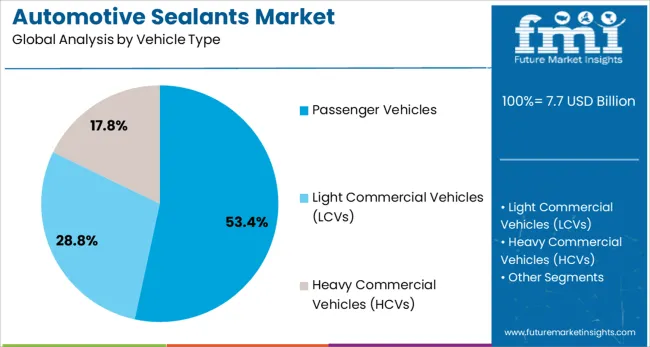

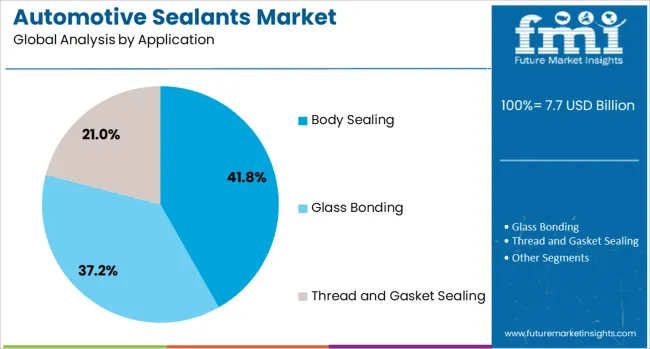

The automotive sealants market is segmented by product type, vehicle type, application, and geographic regions. By product type, the market is divided into Structural Sealants, Adhesive Sealants, Butyl Sealants. In terms of vehicle type of the automotive sealants market is classified into Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs). Based on application, the market is segmented into Body Sealing, Glass Bonding Thread and Gasket Sealing. Regionally, the automotive sealants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Structural sealants are projected to account for 38.2% of the automotive sealants market revenue in 2025, establishing them as the leading product type segment. The segment's growth is being supported by increasing demand for high-strength bonding solutions that can replace traditional mechanical fasteners and welds in automotive assemblies.

Structural sealants have been adopted widely due to their ability to provide enhanced load-bearing capacity, fatigue resistance, and long-term durability in critical areas such as body-in-white, roof panels, and chassis components. Their compatibility with lightweight materials like aluminum and composites has further contributed to their rising application in modern vehicle architectures.

Advancements in curing technologies, along with improved adhesion to multi-material surfaces, have enabled their efficient use in automated production lines. As vehicle manufacturers focus on improving crashworthiness and structural stiffness while maintaining design flexibility, structural sealants have become indispensable in supporting next-generation automotive manufacturing practices.

Passenger vehicles are anticipated to represent 53.4% of the automotive sealants market share in 2025, reflecting their dominant role across both volume and value metrics. The segment's leadership is being driven by the rising production and sales of passenger cars, particularly in Asia Pacific and Europe, where consumer preference for comfort, safety, and fuel efficiency is strong.

The extensive use of sealants in passenger vehicles for windshields, doors, hoods, and trunk applications is contributing to their widespread deployment. Manufacturers are increasingly utilizing sealants that not only provide water and air tightness but also enhance vibration damping and sound insulation, improving the overall ride quality.

Additionally, the transition to electric and hybrid vehicles has intensified the need for specialized sealants capable of providing thermal stability, chemical resistance, and dielectric properties. As automotive design trends shift toward more integrated and modular platforms, the demand for versatile, high-performance sealants in passenger vehicles is expected to remain strong.

Body sealing is expected to contribute 41.8% of the automotive sealants market revenue in 2025, making it the most significant application segment. The segment's growth is being fueled by increasing requirements for water, dust, and air resistance in vehicle cabins to ensure passenger comfort and protect electronic components. Body sealants are being used extensively across critical joints, seams, and panel overlaps to prevent corrosion and enhance durability.

As the industry moves toward sleeker vehicle profiles and complex design geometries, the need for flexible and resilient sealing materials has intensified. These sealants are being engineered to accommodate dynamic movement and thermal expansion while maintaining adhesion across dissimilar substrates.

Furthermore, the growing focus on cabin acoustics and air quality is promoting the integration of advanced body sealing systems in both premium and mid-range vehicles. With evolving safety and quality benchmarks, body sealing is expected to remain a high-priority application for automotive OEMs globally.

Automotive sealants are witnessing growing demand from EV manufacturing, body-in-white applications, NVH reduction, and advanced glass bonding. Their role is expanding as vehicle designs evolve and performance requirements intensify.

Electric vehicle manufacturing has increased the reliance on high-performance sealants to ensure battery safety, waterproofing, and thermal stability. These materials are critical in sealing battery packs, preventing moisture ingress, and maintaining structural integrity under extreme conditions. The shift toward EV platforms has also expanded demand for lightweight sealing solutions that can handle vibration and thermal expansion. OEMs are prioritizing sealants that comply with strict automotive safety standards while maintaining long-term adhesion. As battery designs become more complex, the role of sealants in meeting energy efficiency and safety objectives has grown significantly. This segment is projected to expand in parallel with EV adoption rates across global markets.

Automotive sealants have become indispensable in the body-in-white stage, where they bond and seal structural components. These products enhance crash resistance, minimize corrosion, and improve vehicle rigidity. Their application extends to seams, flanges, and joints, ensuring a consistent barrier against environmental exposure. Manufacturers are developing formulations that allow faster curing times to optimize production efficiency. The integration of sealants into automated application systems further supports consistent quality and reduced waste. This stage of vehicle assembly remains one of the highest consumers of automotive sealants, with usage closely tied to global automotive production volumes and model complexity.

Sealants are now engineered to contribute to acoustic comfort by dampening noise, vibration, and harshness (NVH) within vehicles. They are applied in areas such as door panels, floor pans, and trunk seams to reduce sound transmission. This added functionality supports both passenger comfort and perceived vehicle quality. As customer expectations rise, automakers are selecting sealants with enhanced flexibility and adhesion to different substrates, including metals and composites. The ability to withstand varying thermal cycles without degradation has become a key requirement. NVH-focused sealants also align with efforts to differentiate vehicles in competitive segments through improved cabin comfort.

Automotive glass bonding has evolved with the adoption of larger windshields, panoramic roofs, and integrated sensor systems. Sealants play a critical role in bonding these components while maintaining optical clarity and structural safety. The adhesive-sealant combination ensures durability under varying weather and stress conditions. With autonomous and connected vehicle technologies increasing reliance on sensor-laden glass, performance specifications for sealants have become more stringent. Manufacturers are investing in formulations with higher UV resistance and better adhesion to treated glass surfaces. This segment’s growth is closely linked to design innovations and consumer demand for premium vehicle features.

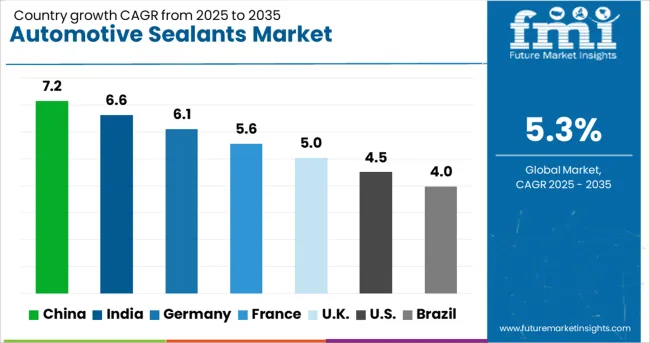

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

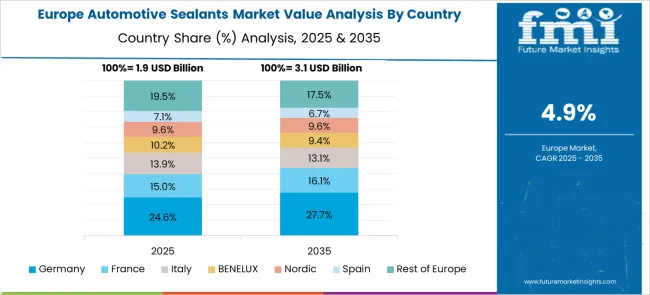

The automotive sealants market is projected to grow at a global CAGR of 5.3% from 2025 to 2035, supported by expanding electric vehicle production, advanced glass integration, and increasing NVH reduction requirements in automotive design. China leads with a CAGR of 7.2%, driven by high vehicle output, rapid EV adoption, and growing use of structural adhesives in lightweight vehicle platforms. India follows at 6.6%, fueled by rising automotive manufacturing capacity, adoption of body-in-white sealing applications, and demand from domestic OEMs. France records a CAGR of 5.6%, benefiting from premium vehicle assembly, advanced glass bonding, and acoustic sealing integration. The United Kingdom achieves 5.0% growth, supported by luxury vehicle production, increasing EV manufacturing, and aftermarket sealant demand. The United States posts a CAGR of 4.5%, influenced by steady demand in light trucks, autonomous vehicle glass systems, and NVH performance improvements. The research includes more than 40 countries, with these markets providing key benchmarks for production strategies, material innovations, and OEM partnerships in the global automotive sealants sector.

China is anticipated to grow at a CAGR of 7.2% during 2025–2035, above the global 5.3% pace. The earlier period, 2020–2024, is estimated near 5.9%, supported by recovery in passenger car output and steady demand for body-in-white seam sealing across high-volume platforms. Higher growth in the next horizon is expected from faster EV rollout, larger panoramic glass areas, and tighter NVH targets that raise specification rates for acoustic and structural sealants. Battery pack gasketing and coolant channel sealing are expanding usage in thermal-active zones. Tier suppliers have increased automated application capacity and low-VOC grades to meet OEM cycle time and quality checks. The aftermarket is also adopting faster-cure windshield bonding kits, improving service bay throughput and reinforcing repeat demand.

India is projected to post a CAGR of 6.6% during 2025–2035, above the global average. The 2020–2024 phase is gauged around 5.4%, when compact cars and utility vehicles led volumes and OEMs prioritized corrosion protection and basic seam sealing. The step-up is expected as SUV penetration rises, glass sizes increase, and domestic EV programs require battery enclosure sealing and water ingress protection. Supplier parks near assembly plants have lowered logistics costs for cartridges and bulk drums, lifting adoption of robot-applied beads for BIW and glazing. Dealer networks are stocking faster-cure urethanes and primers, shortening windshield replacement times. Export-oriented platforms are adding crash-relevant structural bonding paths that demand compatible sealant chemistries and stable rheology.

France is expected to grow at a CAGR of 5.6% during 2025–2035. The 2020–2024 period is assessed near 4.7%, when premium assembly lines focused on anti-corrosion seam sealing and cabin quietness. Gains to 5.6% are linked to increased use of structural bonding in mixed-material bodies, wider adoption of rain-light sensors behind larger windscreens, and faster adoption of low-odor glass bonding kits for dealer service. Battery module gasketing and vent sealing are being specified more often as domestic EV capacity scales. Tier suppliers have refined bead profiles and oven cycles to stabilize cure, which supports higher first-time-through quality. Import flows of specialty primers and activators have been diversified, improving continuity during model changeovers.

The United Kingdom is projected to reach a 5.0% CAGR for 2025–2035. The 2020–2024 CAGR is estimated at 4.2%. That baseline was shaped by model launch gaps, port and customs frictions, and restrained dealer footfall that limited glazing replacements. The rise to 5.0% is associated with premium exports, higher EV adoption that adds battery and e-axle sealing lines, and better access to low-moisture urethanes for panoramic roofs. Data analysis shows BIW sealant kilograms per vehicle moved up with greater SUV penetration, while warranty claims related to water leaks declined, indicating improved bead accuracy and primer use. Aftermarket autoresin kits with shorter clamp times increased bay throughput, lifting repeat purchases. In summary, stronger content per unit, steadier production cadence, and improved service velocity lifted the trajectory.

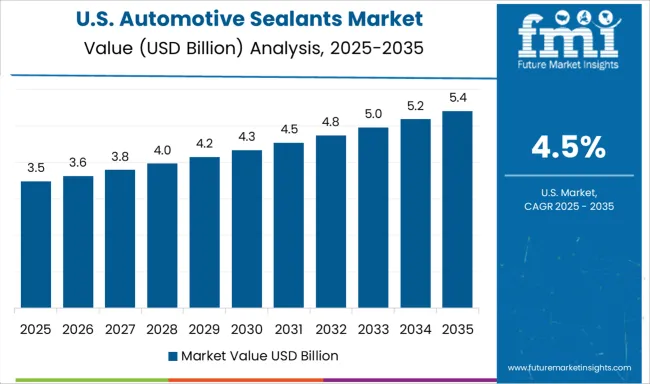

The United States is expected to post a CAGR of 4.5% during 2025–2035. The 2020–2024 period is placed near 3.9%, when pickup and SUV refresh cycles prioritized standard seam sealing and rust prevention. Growth toward 4.5% is supported by larger windshields and roof apertures in popular nameplates, more ADAS sensors requiring optically stable bonding zones, and expanding EV assembly that needs thermal- and chemical-resistant pack sealing. Rail and dealer networks have widened stocking of primerless black urethanes, improving service consistency. Tier suppliers have expanded hot-melt and pumpable solutions for underbody and hem-flange areas, improving cycle times and corrosion resistance in salt-belt states.

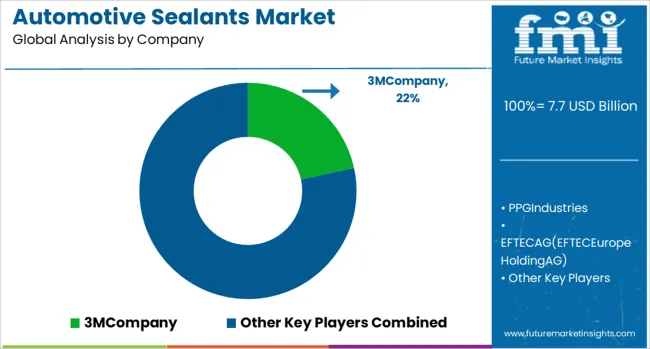

The automotive sealants market features competition among leading global and regional manufacturers delivering advanced bonding, gasketing, and sealing solutions for OEM and aftermarket applications. 3M Company holds a prominent position with its broad range of polyurethane, epoxy, and silicone sealants engineered for body-in-white, glazing, and underbody protection, catering to global automotive platforms. PPG Industries leverages its expertise in coatings to offer integrated sealant systems that provide corrosion resistance, weatherproofing, and durability across diverse vehicle architectures. EFTEC AG (EFTEC Europe Holding AG) specializes in OEM-specified adhesive and sealant technologies, emphasizing automated application compatibility and VOC-compliant formulations.

H.B. Fuller Company focuses on performance-driven adhesive-sealant hybrids for structural bonding, battery assembly, and acoustic sealing in EV and ICE segments. Henkel AG & Co. capitalizes on its Loctite and Teroson brands to deliver tailored sealant solutions, including high-temperature and chemical-resistant variants for demanding automotive environments. Competitive strategies in this market revolve around developing faster-curing chemistries to improve OEM cycle times, enhancing compatibility with mixed-material designs, and expanding regional production hubs to reduce supply chain risks. Partnerships with OEMs and Tier-1 suppliers for co-development of application-specific formulations remain a key growth enabler, alongside investments in automated bead application systems for consistency and precision in high-volume manufacturing.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.7 Billion |

| Product Type | Structural Sealants, Adhesive Sealants, and Butyl Sealants |

| Vehicle Type | Passenger Vehicles, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs) |

| Application | Body Sealing, Glass Bonding, and Thread and Gasket Sealing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3MCompany, PPGIndustries, EFTECAG(EFTECEuropeHoldingAG), H.B.FullerCompany, and HenkelAG&Co. |

| Additional Attributes | Dollar sales, share by product type, demand across OEM and aftermarket, regional growth patterns, competitive positioning, pricing trends, regulatory impact, and emerging application opportunities. |

The global automotive sealants market is estimated to be valued at USD 7.7 billion in 2025.

The market size for the automotive sealants market is projected to reach USD 12.9 billion by 2035.

The automotive sealants market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in automotive sealants market are structural sealants, adhesive sealants and butyl sealants.

In terms of vehicle type, passenger vehicles segment to command 53.4% share in the automotive sealants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Adhesives & Sealants Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA