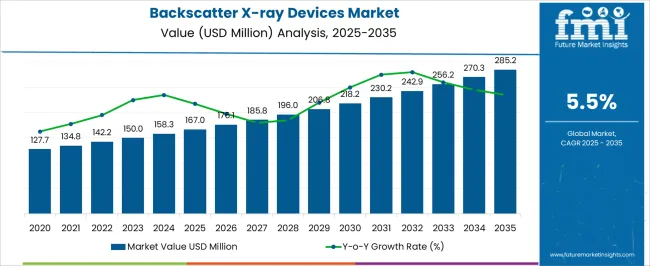

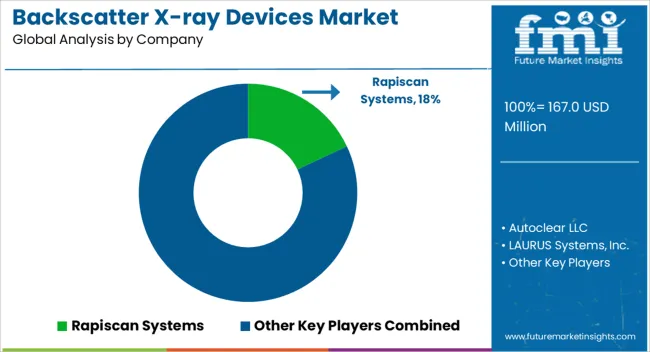

The backscatter X-ray devices market is estimated to be valued at USD 167.0 million in 2025 and is projected to reach USD 285.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Between 2020 and 2024, the market grew from USD 127.7 million to 158.3 million, representing the early adoption phase. During this period, adoption was largely concentrated among airports, seaports, and critical infrastructure facilities testing the devices for efficiency, safety, and operational ease. Market penetration was gradual, driven by initial costs, regulatory approvals, and limited awareness among potential users.

Feedback from early adopters allowed manufacturers to refine device performance, reliability, and handling protocols, establishing credibility and laying the groundwork for broader deployment in the subsequent scaling phase. From 2025 to 2030, the market enters the scaling phase, growing from USD 167.0 million to 218.2 million.

Adoption expands across transportation hubs, government security agencies, and large event venues, supported by broader procurement and more extensive deployment networks. By 2030, the market transitions into consolidation, with growth continuing steadily to USD 285.2 million by 2035. Leading players consolidate market share, optimize production, and standardize operational practices. This stage reflects a mature market where growth is predictable, adoption is widespread, and focus shifts toward operational efficiency, coverage expansion, and device reliability rather than rapid uptake.

| Metric | Value |

|---|---|

| Backscatter X-ray Devices Market Estimated Value in (2025 E) | USD 167.0 million |

| Backscatter X-ray Devices Market Forecast Value in (2035 F) | USD 285.2 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The backscatter X-ray devices market is witnessing substantial growth, supported by increasing demand for advanced security screening systems across various high-risk environments. The current landscape is characterized by heightened focus on contraband detection, non-invasive inspection, and the need for mobile and flexible scanning technologies. Rising security concerns at border checkpoints, airports, and sensitive public spaces have contributed to the accelerated adoption of these systems.

The market is also being shaped by the ability of backscatter technology to detect hidden threats without physical contact or extensive setup. Future growth is expected to be driven by ongoing innovations in portable imaging, improvements in radiation safety profiles, and integration of real-time data analytics.

Growing governmental budgets for homeland security and technological upgrades in defense and customs operations are further reinforcing the market outlook With increasing demand for fast, accurate, and scalable screening solutions, the market is positioned for sustained expansion across both developed and emerging regions.

The backscatter x-ray devices market is segmented by type, application, and geographic regions. By type, the market is divided into handheld and fixed. In terms of application, the market is classified into customs & border protection, law enforcement, airports, military & defense, critical infrastructure, and others. Regionally, the backscatter x-ray devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handheld type is expected to contribute 61.3% to the overall backscatter X-ray devices market revenue in 2025, establishing itself as the leading product category. This dominant position is being attributed to the high mobility and ease of deployment offered by handheld systems, especially in field operations and mobile inspections. These devices are favored for their ability to deliver immediate imaging results without requiring large physical infrastructure or fixed installation.

Adoption has been further supported by the increasing need for flexible and rapid security checks at temporary checkpoints, critical infrastructure facilities, and during special operations. Their compact size and user-friendly design make them ideal for scenarios where speed and adaptability are essential.

Growth in this segment has also been encouraged by enhancements in battery life, imaging resolution, and safety compliance, making these devices more reliable and accessible for routine and emergency use As global emphasis on tactical and on-the-go inspection continues to rise, handheld backscatter systems are expected to maintain their leadership in the market.

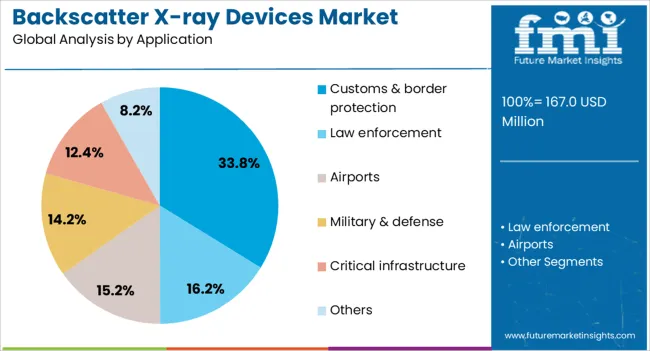

The customs and border protection application segment is projected to account for 33.8% of the market revenue in 2025, positioning it as the most prominent area of use. This significant share is being driven by growing requirements for efficient threat detection and contraband control at international borders and customs points. Governments are increasingly investing in security infrastructure that enables rapid scanning of people, luggage, and cargo without causing delays or requiring physical searches.

Backscatter technology has been recognized for its ability to identify concealed items including weapons, narcotics, and explosives, making it highly suitable for border enforcement. The need to process high volumes of traffic while maintaining stringent security standards has created a strong demand for advanced screening tools.

Deployment in customs operations has also been supported by evolving regulatory mandates and international cooperation on border security As geopolitical challenges and cross-border risks continue to intensify, this application segment is expected to remain a primary focus for technology adoption.

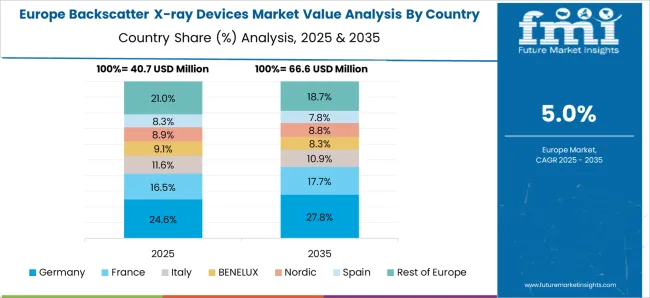

The backscatter X-ray devices market is growing steadily due to increasing security concerns at airports, border crossings, and high-risk public venues. These devices are widely used in aviation security, customs inspections, and critical infrastructure protection for detecting concealed weapons, explosives, and contraband. North America and Europe lead the market due to stringent security regulations and advanced infrastructure, while Asia-Pacific is witnessing growing adoption in expanding transportation and public safety sectors. Market expansion focuses on portability, image resolution, radiation safety, and real-time threat detection. Companies differentiate through enhanced imaging software, AI-assisted analysis, and ergonomic designs for operators.

Ensuring consistent image resolution, threat detection accuracy, and operator interpretation remains a key challenge. Environmental conditions, system calibration, and device handling can impact performance. Lack of standardized testing protocols across different security applications may lead to inconsistent detection results. Manufacturers supplying airports, defense, or customs authorities must adhere to strict operational accuracy, safety, and response time requirements. Until globally accepted performance and operational standards are adopted, reliability concerns and user trust will continue to influence market adoption.

Technological advancements are enhancing backscatter X-ray device performance and usability. Innovations include AI-assisted threat recognition, higher-resolution imaging, reduced radiation exposure, faster scanning speeds, and portable designs. Integration with automated threat detection software allows real-time analysis, improving operational efficiency and accuracy. Manufacturers partnering with research institutions develop advanced algorithms and ergonomic solutions to support prolonged field operations. These innovations drive adoption across airports, border control, and law enforcement agencies, offering safer, faster, and more precise screening capabilities.

Backscatter X-ray devices are subject to strict regulatory oversight, including radiation safety standards, aviation security protocols, and public health guidelines. Devices must comply with national and international standards such as FAA, TSA, IEC, and IAEA regulations. Export restrictions and technology control laws can limit global market expansion. Manufacturers ensuring adherence to recognized certifications and safety protocols gain credibility and facilitate smoother deployment. Until regulatory frameworks become more harmonized internationally, companies must navigate complex compliance environments to deploy devices safely and legally across multiple regions.

The market is highly competitive, with established defense contractors, specialized security technology firms, and emerging startups offering diverse backscatter X-ray solutions. Supply chain challenges, including sensor components, imaging software, and radiation shielding materials, can affect production scalability and lead times. Companies investing in vertical integration, diversified sourcing, and advanced manufacturing processes achieve greater reliability and cost efficiency. Competitive differentiation increasingly focuses on higher resolution, portability, AI-assisted detection, and radiation safety. Until component stability and manufacturing scalability improve, supply chain constraints and intense rivalry will continue to influence market growth and adoption.

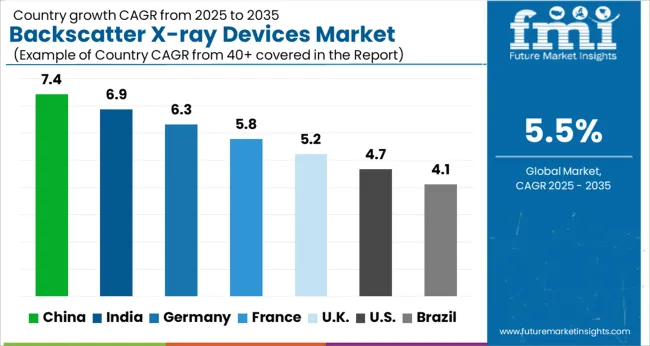

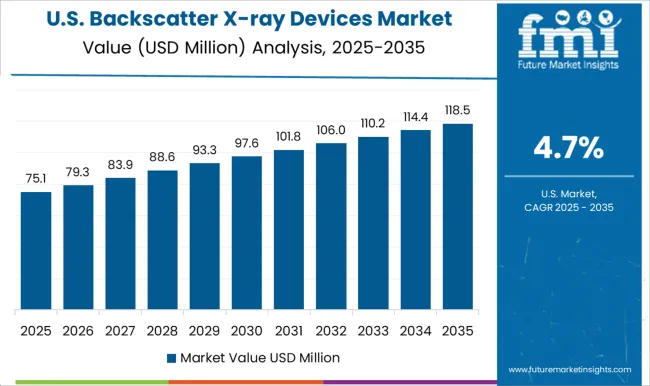

The global Backscatter X-ray Devices Market is projected to grow at a CAGR of 5.5% through 2035, supported by increasing demand across security screening, airport inspection, and industrial applications. Among BRICS nations, China has been recorded with 7.4% growth, driven by large-scale production and deployment in security and inspection operations, while India has been observed at 6.9%, supported by expanding use in industrial and transport sectors. In the OECD region, Germany has been measured at 6.3%, where production and adoption for security and industrial applications have been steadily maintained. The United Kingdom has been noted at 5.2%, reflecting consistent use in security screening and inspection operations, while the USA has been recorded at 4.7%, with production and utilization in airport, defense, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The backscatter X-ray devices market in China is growing at a CAGR of 7.4%, driven by increasing security and inspection needs across transportation, customs, and public safety sectors. These devices are widely adopted in airports, seaports, border checkpoints, and critical infrastructure for detecting concealed threats, explosives, and contraband without damaging cargo or personal items. Advancements in imaging technology, including enhanced resolution, faster scanning, and low-dose radiation, have improved device efficiency and safety, boosting adoption. Government regulations and initiatives focused on strengthening border security, preventing illegal trade, and ensuring public safety further fuel market growth. Additionally, expanding industrial applications, such as inspection of industrial equipment and packaging, support market expansion. With increasing investments in smart infrastructure and security technology, the backscatter X-ray devices market in China is poised for sustained growth over the forecast period.

The backscatter X-ray devices market in India is expanding at a CAGR of 6.9%, supported by rising security concerns in airports, seaports, and urban infrastructure. These devices are essential for detecting hidden threats, explosives, and illegal materials without damaging goods or personal belongings. Technological innovations, such as improved imaging resolution, faster scanning speed, and lower radiation exposure, have enhanced device usability and safety, encouraging adoption across defense, law enforcement, and industrial sectors. Government programs focusing on airport and border security, counter-terrorism measures, and industrial inspection requirements are significant growth drivers. The increasing number of international shipments, rising trade volumes, and industrial inspection mandates further stimulate demand for backscatter X-ray devices. India’s market is poised for steady expansion due to the combination of regulatory support, public safety initiatives, and ongoing technological advancements in scanning equipment.

The backscatter X-ray devices market in Germany is growing at a CAGR of 6.3%, driven by stringent security and safety regulations in transportation, defense, and industrial sectors. These devices provide non-intrusive detection of concealed weapons, explosives, and contraband, ensuring the safety of people and goods. Advanced imaging capabilities, faster scanning times, and reduced radiation exposure have enhanced operational efficiency and adoption across airports, logistics centers, and critical infrastructure. Germany’s strong emphasis on regulatory compliance and public safety, along with government investments in security technologies, supports market expansion. Industrial applications, such as inspection of packaged goods and machinery, further contribute to demand. Technological innovation combined with growing awareness of safety and security protocols ensures steady growth for backscatter X-ray devices in Germany over the forecast period.

The backscatter X-ray devices market in the United Kingdom is expanding at a CAGR of 5.2%, driven by security and industrial inspection requirements. These devices are essential for detecting hidden threats, explosives, and contraband without opening luggage, cargo, or packages. Government initiatives to strengthen airport, seaport, and public safety protocols support market growth. Technological advancements, such as high-resolution imaging, low radiation levels, and rapid scanning, enhance the effectiveness and safety of these devices, promoting adoption across law enforcement, defense, and industrial sectors. Increasing trade volumes and rising awareness of safety and security standards further contribute to market expansion. The backscatter X-ray devices market in the UK is expected to experience consistent growth due to combined factors of regulatory support, technological innovation, and increasing adoption across transportation and industrial applications.

The backscatter X-ray devices market in the United States is growing at a CAGR of 4.7%, supported by strong demand from transportation, defense, and industrial sectors. These devices are widely used for non-intrusive inspection of luggage, cargo, and industrial equipment, providing rapid detection of concealed threats, explosives, and illegal materials. Technological improvements, such as higher imaging resolution, faster scanning speeds, and minimized radiation exposure, have enhanced adoption and operational efficiency. Government regulations and initiatives aimed at strengthening airport security, border protection, and industrial safety drive market growth. With increasing industrial inspections, trade volumes, and public safety awareness, the market for backscatter X-ray devices in the USA is poised for steady expansion. Continued innovation and investment in security technology further reinforce the market outlook over the forecast period.

The backscatter X-ray devices market is expanding rapidly due to increasing security demands at airports, border crossings, public venues, and critical infrastructure. These devices provide non-intrusive screening, capable of detecting concealed weapons, explosives, and contraband without physical contact, ensuring high safety standards while maintaining operational efficiency. Rapiscan Systems is a key supplier, offering advanced backscatter X-ray systems widely adopted in aviation and government security sectors. Autoclear LLC specializes in portable and fixed backscatter X-ray devices, emphasizing rapid and reliable threat detection.

LAURUS Systems, Inc. delivers compact and high-performance solutions for law enforcement and military applications. Nuctech Company Limited develops innovative systems that integrate advanced imaging technology for enhanced detection accuracy. Scanna MSC Ltd. provides flexible backscatter X-ray solutions suitable for airports, seaports, and border security. Smiths Detection is a global leader, offering a comprehensive range of devices with cutting-edge imaging and threat detection features. Tek8, Inc. focuses on modular and portable systems for field deployment in security-sensitive environments. Teledyne Digital Imaging Inc. and Teledyne FLIR provide technologically advanced detectors and imaging solutions, combining high-resolution imaging with rapid analysis.

Varex Imaging Corporation delivers X-ray components and systems supporting superior image quality and reliability. Viken Detection specializes in compact, user-friendly backscatter X-ray devices for commercial and industrial applications. Market growth is driven by advancements in detection sensitivity, portability, image resolution, and integration with automated security protocols. These leading suppliers and manufacturers are positioned to meet the increasing global demand for efficient, non-invasive security screening technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 167.0 Million |

| Type | Handheld and Fixed |

| Application | Customs & border protection, Law enforcement, Airports, Military & defense, Critical infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rapiscan Systems, Autoclear LLC, LAURUS Systems, Inc., Nuctech Company Limited, Scanna MSC Ltd., Smiths Detection, Tek8, Inc., Teledyne Digital Imaging Inc., Teledyne FLIR, Varex Imaging Corporation, and Viken Detection |

| Additional Attributes | Dollar sales by type including fixed, portable, and mobile devices, application across airport security, cargo inspection, and border control, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising security and surveillance requirements, increasing air travel, and advancements in imaging technologies for threat detection. |

The global backscatter x-ray devices market is estimated to be valued at USD 167.0 million in 2025.

The market size for the backscatter x-ray devices market is projected to reach USD 285.2 million by 2035.

The backscatter x-ray devices market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in backscatter x-ray devices market are handheld and fixed.

In terms of application, customs & border protection segment to command 33.8% share in the backscatter x-ray devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

X-Ray Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Digital Mobile X-ray Devices Market Analysis - Growth & Forecast 2024 to 2034

FBAR Devices Market

Snare devices Market

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

C-Arms Devices Market Analysis – Trends & Forecast 2024-2034

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA