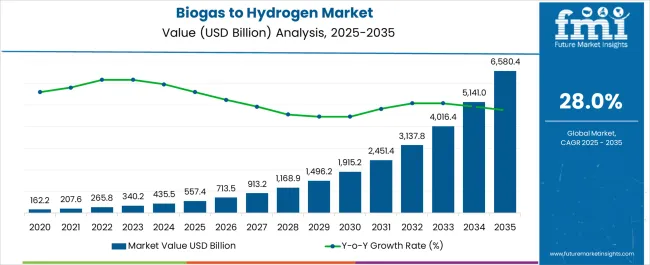

The Biogas to Hydrogen Market is estimated to be valued at USD 557.4 billion in 2025 and is projected to reach USD 6580.4 billion by 2035, registering a compound annual growth rate (CAGR) of 28.0% over the forecast period.

From 2025 to 2030, growth will be fueled by pilot projects and regional scaling of biogas reforming units, particularly in Europe and Asia, where strong regulatory frameworks and subsidies encourage green hydrogen adoption.

Between 2030 and 2035, commercialization will accelerate with large-scale integration into transport, industrial feedstock, and power generation, leading to exponential revenue gains. The absolute increase of over USD 6 trillion underscores the disruptive potential of this segment compared with conventional hydrogen production. Strategic partnerships among energy utilities, waste management firms, and technology providers are expected to define the competitive landscape. Infrastructure development for storage and distribution, alongside certification schemes for renewable hydrogen, will remain pivotal for confidence among end-users.

| Metric | Value |

|---|---|

| Biogas to Hydrogen Market Estimated Value in (2025 E) | USD 557.4 billion |

| Biogas to Hydrogen Market Forecast Value in (2035 F) | USD 6580.4 billion |

| Forecast CAGR (2025 to 2035) | 28.0% |

The biogas to hydrogen market is expanding steadily as clean energy targets, carbon neutrality mandates, and waste valorization initiatives drive innovation in renewable hydrogen production. Increasing global attention on circular economy models has elevated the significance of biogas as a viable feedstock for low carbon hydrogen generation.

Advances in reforming technologies, government incentives for green hydrogen projects, and integration into decentralized energy systems are reinforcing market momentum. Technological developments in purification and gas upgrading processes are enabling higher hydrogen yields from biogenic sources, making them increasingly competitive with fossil based alternatives.

As countries move to decarbonize heavy industry, transport, and power sectors, the demand for sustainable hydrogen production pathways is expected to rise sharply, positioning biogas derived hydrogen as a scalable and climate aligned solution.

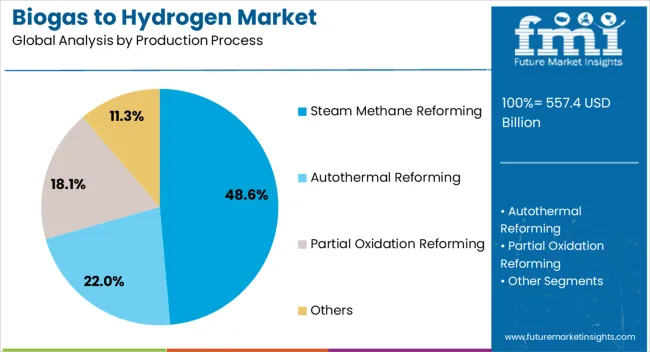

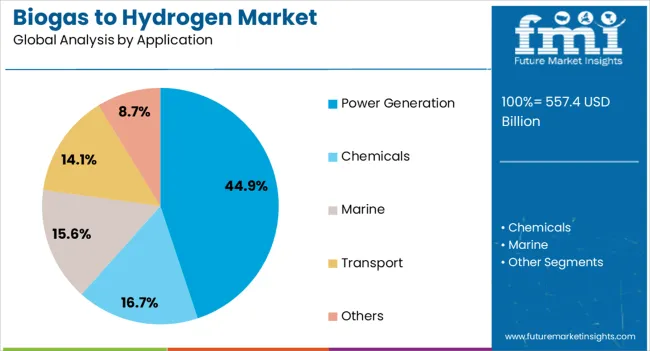

The biogas to hydrogen market is segmented by production process, application, and geographic regions. By production process, biogas to hydrogen market is divided into Steam Methane Reforming, Autothermal Reforming, Partial Oxidation Reforming, and Others. In terms of application, biogas to hydrogen market is classified into Power Generation, Chemicals, Marine, Transport, and Others. Regionally, the biogas to hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steam methane reforming segment is projected to account for 48.60% of total market revenue by 2025 within the production process category, making it the dominant approach. This preference is due to its technological maturity, high conversion efficiency, and compatibility with existing reforming infrastructure.

While traditionally associated with natural gas, advancements have enabled the integration of biogas as a renewable feedstock in the same reforming systems, facilitating a lower emission pathway without requiring substantial process overhauls. The scalability and cost competitiveness of steam methane reforming have further supported its adoption in commercial and industrial hydrogen applications.

As policies evolve to recognize biogenic hydrogen as part of the clean hydrogen ecosystem, steam methane reforming remains the leading production method by aligning economic viability with decarbonization goals.

The power generation segment is expected to contribute 44.90% of total revenue by 2025 within the application category, positioning it as the largest segment. This is driven by the rising need for low-emission and dispatchable power sources in both grid-connected and off-grid settings.

Hydrogen derived from biogas is increasingly being used in gas turbines, fuel cells, and hybrid power systems to supply clean electricity while reducing reliance on fossil fuels. The compatibility of hydrogen with existing energy infrastructure and its potential for long-term energy storage have further solidified its role in renewable power strategies.

As utilities and independent power producers seek flexible, green alternatives for energy diversification and carbon reduction, the use of biogas-based hydrogen in power generation continues to gain strategic traction across global markets.

The biogas to hydrogen market is growing as demand for clean energy rises, though challenges remain in cost and scalability. Government policies and ongoing efficiency improvements are crucial to driving future growth and increasing the market’s global share.

The biogas to hydrogen market is expanding due to rising global demand for clean energy sources. As industries transition to hydrogen for applications like transportation and power generation, biogas as a feedstock is gaining attention. With the push to decarbonize energy systems, this market is attracting interest for its potential to reduce carbon emissions. Additionally, growing efforts to diversify energy sources and move away from fossil fuels are increasing the focus on renewable alternatives. As more industries seek ways to meet environmental goals, the adoption of biogas-derived hydrogen is anticipated to rise, driving further growth in the market.

Scaling biogas to hydrogen production remains a challenge due to high production costs and infrastructure requirements. Converting biogas into hydrogen involves significant investments in specialized technology and equipment, which increases the initial cost. Furthermore, producing biogas and maintaining the facilities necessary for hydrogen production can be costly. This price disparity compared to conventional methods for hydrogen production, such as natural gas reforming, limits wider adoption. The availability of biogas in specific regions also creates geographical barriers. Reducing these costs and improving efficiency are essential to making biogas to hydrogen more competitive and accessible at a global scale.

Government policies and regulations are key drivers for the biogas to hydrogen market. Policies focused on reducing emissions and promoting renewable energy are incentivizing investments in biogas-derived hydrogen. Carbon pricing, subsidies, and financial incentives for renewable energy projects are making this technology more attractive to investors and manufacturers. Regulatory frameworks encouraging the adoption of hydrogen in sectors like transportation and heavy industry are further boosting market interest. Such government initiatives are essential to creating a supportive environment that encourages innovation and accelerates the transition to hydrogen-based energy systems, positioning biogas to hydrogen as a key component.

Enhancing the efficiency of biogas to hydrogen production is crucial for making it a viable energy source. Innovations in processes that purify biogas and extract hydrogen more effectively are helping reduce costs and improve output. Efficiency improvements in conversion systems and hydrogen storage are also playing a significant role. These advancements are making biogas-derived hydrogen more competitive with other hydrogen production methods. Continued focus on optimizing these processes will be vital for large-scale deployment, ensuring that biogas to hydrogen becomes a reliable and cost-effective energy solution in the coming years.

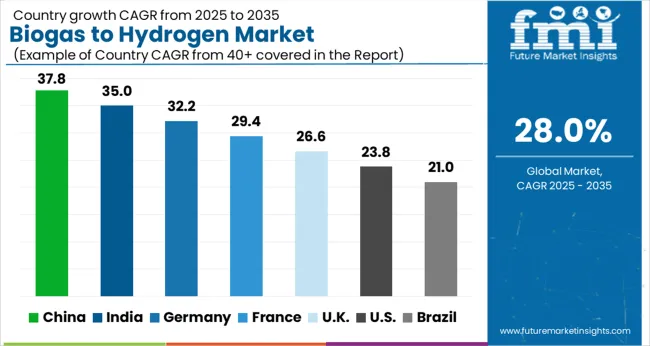

| Country | CAGR |

|---|---|

| China | 37.8% |

| India | 35.0% |

| Germany | 32.2% |

| France | 29.4% |

| UK | 26.6% |

| USA | 23.8% |

| Brazil | 21.0% |

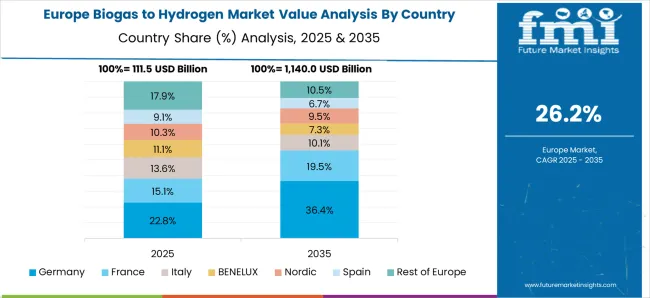

The biogas to hydrogen market, expected to grow at a global CAGR of 28.0% from 2025 to 2035, is experiencing diverse growth across key countries. China leads with a 37.8% CAGR, driven by increasing investments in renewable energy and biogas utilization in hydrogen production. India follows closely with a 35.0% CAGR, supported by the country’s growing energy demands and renewable energy adoption. France sees a 29.4% CAGR, fueled by its focus on reducing carbon emissions and utilizing biogas for hydrogen production. The UK is witnessing a 26.6% CAGR, driven by supportive government policies and a strong renewable energy market. The USA experiences a 23.8% CAGR, with a focus on hydrogen as a clean fuel for transportation and energy sectors. The report provides a detailed analysis of 40+ countries, with the top five countries highlighted above as key market drivers.

The CAGR for the United Kingdom’s biogas to hydrogen market grew from approximately 23.5% during 2020–2024 to 26.6% for the period 2025–2035, driven by increasing investments in renewable energy and decarbonization strategies. During 2020–2024, the market benefited from rising awareness of hydrogen’s role in energy transition, with a focus on biogas as a feedstock. The 2025–2035 period is expected to see a higher CAGR due to government initiatives supporting renewable hydrogen production and the demand for cleaner energy solutions. The UK market benefits from its strong energy infrastructure and growing interest in hydrogen in industries like transportation and heavy industry.

China’s biogas to hydrogen market has experienced significant growth, with a CAGR of 35.0% during 2020–2024, projected to reach 37.8% for 2025–2035. The rapid industrialization and growing energy demands in China are driving investments in renewable hydrogen production. Government-backed initiatives, such as the National Energy Administration's hydrogen roadmap, have created a favorable environment for the development of biogas-to-hydrogen technologies. This is complemented by China's commitment to achieving carbon neutrality by 2060, further accelerating hydrogen adoption. The rise of biogas as a key renewable resource in China’s energy mix has been essential in meeting the country’s growing energy needs.

India’s biogas to hydrogen market grew from a CAGR of 31.5% during 2020–2024 to 35.0% in the period from 2025 to 2035. India’s increasing focus on renewable energy and decarbonization has propelled demand for alternative fuel sources like hydrogen. The market’s growth is driven by government initiatives, including the National Hydrogen Mission, aimed at making India a hub for green hydrogen production. Biogas is emerging as a prominent feedstock for hydrogen generation, thanks to abundant agricultural waste and government incentives. With rising energy demand, the shift to renewable hydrogen is essential to meet the country’s sustainability and energy security goals.

France’s biogas to hydrogen market experienced a CAGR of 27.0% during 2020–2024, and is projected to grow at 29.4% in the 2025–2035 period. The country’s ambitious renewable energy goals and commitment to reducing carbon emissions drive demand for clean hydrogen alternatives. France is increasingly using biogas for hydrogen production as part of its broader energy transition strategy. Government incentives for renewable hydrogen and biogas utilization are helping to fuel market growth. France’s well-established biogas infrastructure, paired with its focus on hydrogen in heavy industries and transportation, positions it as a key player in the European biogas-to-hydrogen market.

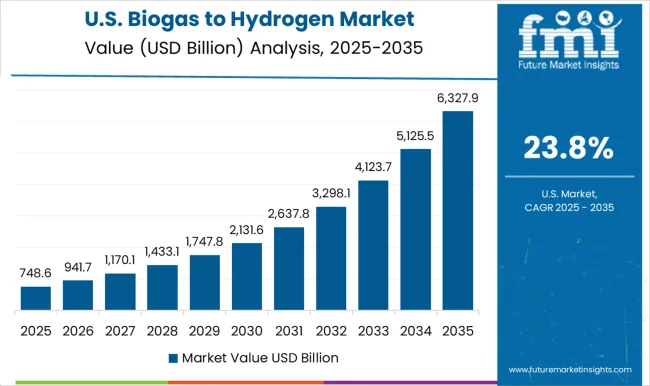

The USA biogas to hydrogen market grew at a CAGR of 19.2% during 2020–2024, with projections for a 23.8% CAGR in 2025–2035. The rise of biogas as a feedstock for hydrogen production is gaining momentum in the USA, driven by the country's ongoing efforts to reduce greenhouse gas emissions and increase the adoption of clean energy sources. Hydrogen production from biogas is particularly important in the USA for heavy-duty transport and industrial sectors. The USA government’s support for renewable energy projects, such as grants and tax incentives for green hydrogen, is expected to foster further growth in this market.

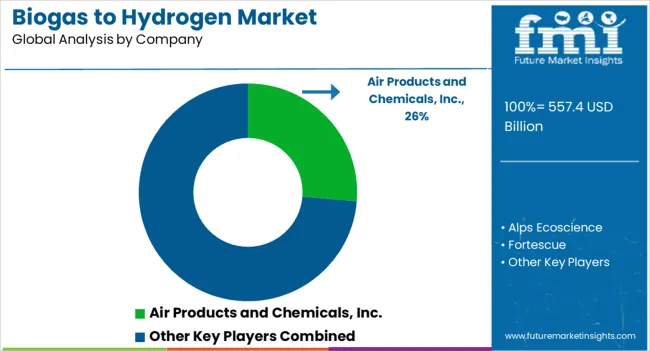

In the biogas to hydrogen market, several key players are focusing on technological advancements and strategic partnerships to drive innovation in hydrogen production from renewable sources. Air Products and Chemicals, Inc. leads the industry with its expertise in hydrogen production, offering a range of solutions that integrate renewable hydrogen into the global energy mix. FuelCell Energy remains a prominent player, advancing fuel cell technologies to improve hydrogen efficiency and reduce production costs.

Linde Plc, known for its global hydrogen infrastructure, is enhancing its biogas to hydrogen capabilities, focusing on large-scale hydrogen production projects. Technip Energies N.V. is making strides in engineering and construction for hydrogen facilities, offering innovative solutions for green hydrogen production. H2B2 and H2 Energy Group are working on hydrogen infrastructure and technological solutions tailored to biogas utilization, positioning themselves as key contributors to the renewable hydrogen market.

Companies like Fortescue and Hyundai Motor Company are advancing hydrogen fuel cell vehicles, further pushing the demand for green hydrogen solutions, including those derived from biogas. The competition is intensifying as the market focuses on reducing costs, improving efficiency, and scaling production to meet the rising demand for clean hydrogen energy.

| Item | Value |

|---|---|

| Quantitative Units | USD 557.4 Billion |

| Production Process | Steam Methane Reforming, Autothermal Reforming, Partial Oxidation Reforming, and Others |

| Application | Power Generation, Chemicals, Marine, Transport, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products and Chemicals, Inc., Alps Ecoscience, Fortescue, FuelCell Energy, Hazer Group Limited, H2B2, H2 Energy Group, Hyundai Motor Company, Kiwa, Kore, Linde Plc, Maire Tecnimont S.p.A., RGH2, SYPOX GmbH, and Technip Energies N.V. |

| Additional Attributes | Dollar sales projections, market share by region and production method, and growth trends in biogas utilization for hydrogen production. |

The global biogas to hydrogen market is estimated to be valued at USD 557.4 billion in 2025.

The market size for the biogas to hydrogen market is projected to reach USD 6,580.4 billion by 2035.

The biogas to hydrogen market is expected to grow at a 28.0% CAGR between 2025 and 2035.

The key product types in biogas to hydrogen market are steam methane reforming, autothermal reforming, partial oxidation reforming and others.

In terms of application, power generation segment to command 44.9% share in the biogas to hydrogen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Biogas Market Size & Forecast 2024 to 2034

Top Loading Cartoning Machine Market Forecast and Outlook 2025 to 2035

Tool Holders Market Size and Share Forecast Outlook 2025 to 2035

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Toilet Roll Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

TOC Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Tool Box Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Total Reflection X-Ray Fluorescence Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Tow Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Topical Anti-infective Drugs Market Size and Share Forecast Outlook 2025 to 2035

Touch Controller IC Market Size and Share Forecast Outlook 2025 to 2035

Torrified Wheat Market Size and Share Forecast Outlook 2025 to 2035

Total Dust Detector Market Size and Share Forecast Outlook 2025 to 2035

Total Aflatoxin Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Tocotrienol Market Size and Share Forecast Outlook 2025 to 2035

Toilet Seat Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Tortilla Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tomato Sauce Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA