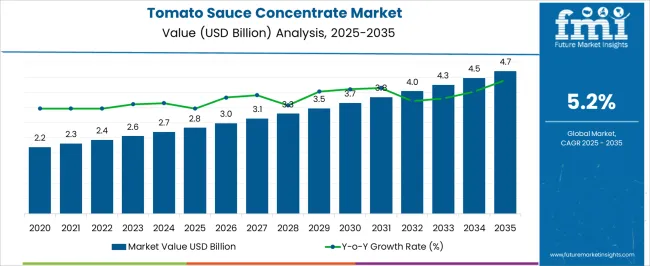

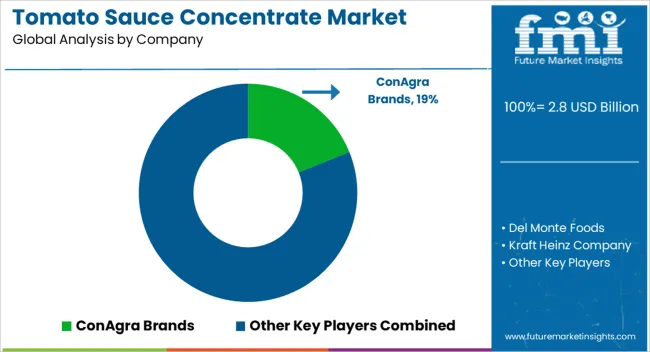

The tomato sauce concentrate market is estimated to reach 2.8 billion dollars in 2025 to USD 4.7 billion in 2035, growing at a CAGR of 5.2%. During the early adoption phase from 2020 to 2024, demand was primarily driven by food processors, quick-service restaurants, and packaged food manufacturers testing product consistency and flavor. Entering the scaling phase in 2025, adoption expands across retail and industrial food segments. Production capacities increase, supply chains strengthen, and recurring orders rise.

Wider use in processed foods, sauces, and ready-to-eat meals supports steady revenue growth and drives broader market acceptance. From 2030 to 2035, the market is expected to reach 4.7 billion dollars, maintaining a CAGR of 5.2%. In the consolidation phase, leading manufacturers strengthen market share through partnerships, expanded distribution, and brand recognition, while smaller players either specialize or exit.

Market adoption stabilizes as most industrial and retail users are engaged. Companies focus on operational efficiency, cost management, and product differentiation. By 2035, the market exhibits steady growth, mature competition, and standardized quality, creating a stable and predictable industry environment.

| Metric | Value |

|---|---|

| Tomato Sauce Concentrate Market Estimated Value in (2025 E) | USD 2.8 billion |

| Tomato Sauce Concentrate Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The tomato sauce concentrate market is driven by demand across multiple food sectors. Processed Foods represent the largest segment, contributing approximately 30% of market demand, as tomato concentrates are widely used in ready-to-eat meals, soups, and pasta sauces. Quick-Service Restaurants (QSRs) account for 18%, where standardized flavor and consistency are critical for menu items. Packaged and Retail Sauces hold around 15%, reflecting growing consumer preference for convenient cooking solutions. Canned and Frozen Foods contribute 12%, where concentrates are incorporated into prepared meals and pizza toppings.

Foodservice and Catering represent 10%, supplying hotels, restaurants, and institutional kitchens. Snacks and Condiments account for 7%, including dips, ketchups, and flavored spreads. Industrial Food Ingredients contribute 5%, where tomato concentrate is used as a base in large-scale food production.

Smaller sectors, such as Ethnic and Specialty Foods (3%) and Export Markets (less than 1%), serve niche requirements or international trade. Revenue contributions reflect this distribution, with processed foods and QSRs driving the majority of adoption. Annual market values increase from 2.2 billion dollars in 2020 to 2.8 billion in 2025 and are projected to reach 4.7 billion by 2035, demonstrating steady growth at a CAGR of 5.2%. These parent markets collectively shape production, distribution, and long-term strategic focus.

The tomato sauce concentrate market is experiencing steady growth driven by rising consumer demand for convenient, versatile, and shelf stable food products. Increasing preference for ready to use cooking ingredients in both household and commercial kitchens is fueling market expansion.

Advancements in processing technology have enhanced flavor retention, nutritional value, and consistency of tomato concentrates, boosting adoption across multiple applications. The food service sector’s growing reliance on concentrated tomato products for large scale preparation is contributing to demand stability.

Additionally, global dietary shifts toward plant based and Mediterranean inspired cuisines are encouraging higher consumption of tomato based products. As health conscious consumers seek natural, preservative free, and high quality ingredients, the market is poised to benefit from premium product launches and expanding distribution channels across retail and direct sales networks.

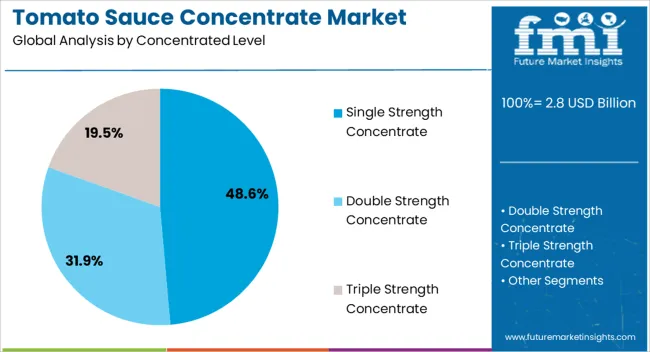

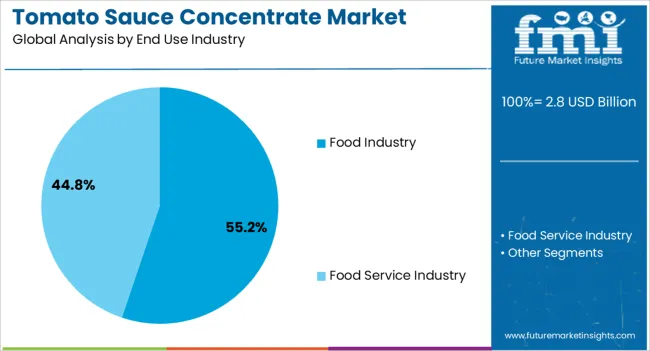

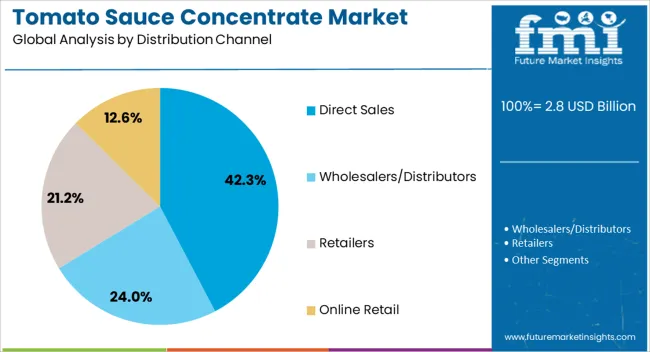

The tomato sauce concentrate market is segmented by concentrated level, end use industry, distribution channel, and geographic regions. By concentrated level, tomato sauce concentrate market is divided into Single Strength Concentrate, Double Strength Concentrate, and Triple Strength Concentrate. In terms of end use industry, tomato sauce concentrate market is classified into Food Industry and Food Service Industry. Based on distribution channel, tomato sauce concentrate market is segmented into Direct Sales, Wholesalers/Distributors, Retailers, and Online Retail. Regionally, the tomato sauce concentrate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single strength concentrate segment is expected to hold 48.60% of total market revenue by 2025 within the concentrated level category, making it the leading segment. This dominance is attributed to its ease of application in recipes, consistent taste profile, and compatibility with diverse culinary preparations.

Single strength variants reduce preparation time while maintaining authentic flavor, appealing to both household consumers and food service operators. The format also offers flexibility for blending with other ingredients, making it a preferred choice for sauces, soups, and ready meals.

Its balance between concentration and convenience has reinforced its leadership within the concentrated level segment.

The food industry segment is projected to account for 55.20% of total market revenue by 2025 in the end use industry category. This growth is driven by high consumption of tomato concentrate in processed foods, condiments, frozen meals, and packaged sauces.

Large scale manufacturers value the consistency, storage stability, and year round availability of concentrates, ensuring uninterrupted production. Expansion in quick service restaurants and ready to eat product offerings has further boosted demand.

The ability to maintain flavor integrity across various processing stages has solidified the food industry’s position as the dominant end use sector.

The direct sales segment is anticipated to hold 42.30% of total market revenue by 2025 under the distribution channel category. This performance is supported by the growing preference of food manufacturers and service providers for direct procurement from producers, enabling better pricing, quality assurance, and supply chain reliability.

Direct sales channels also facilitate long-term supplier relationships, bulk purchasing benefits, and customization of product specifications.

These advantages have strengthened the segment’s position as a leading distribution method for tomato sauce concentrates.

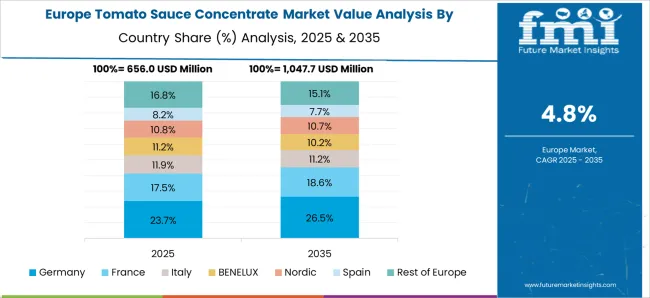

The tomato sauce concentrate market is growing due to rising demand from processed foods, ready-to-eat meals, and restaurant chains. North America and Europe lead with premium, flavor-intense, and shelf-stable concentrates for industrial and retail applications. Asia-Pacific is witnessing rapid growth driven by expanding foodservice, urbanization, and packaged food consumption. Manufacturers differentiate through high Brix content, preservative-free options, and organic certifications. Regional variations in culinary preferences, processing technology, and supply chain efficiency strongly influence adoption, product quality, and competitive positioning globally.

Rising consumption of processed and ready-to-eat meals, fast food, and restaurant-based cuisines is a key driver for tomato sauce concentrate adoption. North America and Europe focus on high-flavor, standardized concentrates for industrial kitchens, sauces, and condiments. Asia-Pacific markets adopt versatile, high-volume concentrates to meet the needs of growing urban populations and quick-service restaurants. Differences in flavor intensity, consistency, and culinary standards affect product formulation and adoption levels. Leading suppliers provide high Brix, standardized tomato concentrates with consistent viscosity and color, while regional players focus on cost-effective, functional options. Culinary demand contrasts shape adoption, product development, and market competitiveness globally.

Standardized tomato concentrate with controlled acidity, color, and Brix level is essential for consistent application in food processing. North America and Europe prioritize GMP-certified, traceable concentrates ensuring reproducibility and premium taste profiles. Asia-Pacific markets focus on cost-effective, large-scale concentrates suitable for industrial and retail use. Differences in quality standards, testing protocols, and preservation methods affect shelf-life, stability, and end-product performance. Leading suppliers provide high-quality, laboratory-tested concentrates with uniform color and flavor, while regional players deliver practical, affordable alternatives. Standardization and quality assurance contrasts shape adoption, reliability, and competitive positioning in the global tomato sauce concentrate market.

Packaging solutions and extended shelf-life capabilities significantly influence market growth. North America and Europe emphasize aseptic, retort, and flexible packaging with enhanced storage stability and easy handling for industrial kitchens and retail. Asia-Pacific markets adopt bulk packaging and cost-effective containers suitable for storage and large-scale distribution. Differences in packaging technology, barrier properties, and shelf-life directly affect product usability, transport, and waste reduction. Leading suppliers offer shelf-stable, ready-to-use concentrates in innovative, lightweight packaging, while regional manufacturers prioritize practical, affordable containers. Packaging and shelf-life contrasts shape adoption, operational efficiency, and market competitiveness globally.

Compliance with food safety regulations, labeling requirements, and organic standards affects market adoption. North America and Europe enforce FDA, EFSA, and organic certification standards to ensure product safety, authenticity, and consumer trust. Asia-Pacific regulations vary; advanced markets adopt international norms, while emerging economies follow domestic guidelines emphasizing food safety and cost-effectiveness. Differences in regulatory requirements, certification availability, and labeling rigor influence product acceptance, export potential, and market visibility. Suppliers offering certified, compliant, and organic tomato concentrates gain higher adoption, while regional players focus on practical, approved alternatives. Regulatory and certification contrasts shape adoption, brand credibility, and competitive positioning globally.

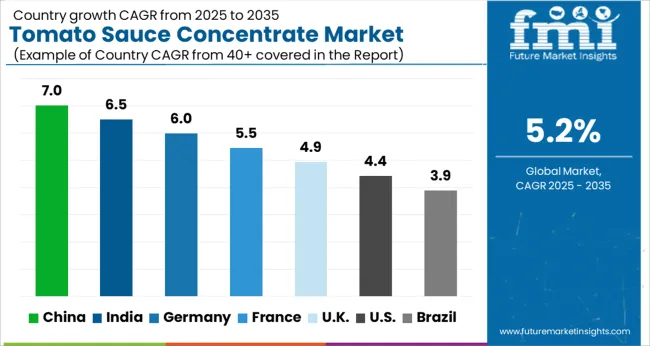

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global tomato sauce concentrate market is projected to grow at a 5.2% CAGR through 2035, driven by demand in processed foods, culinary applications, and food service sectors. Among BRICS nations, China led with 7.0% growth as large-scale production and distribution facilities were established and compliance with food safety standards was enforced, while India at 6.5% growth expanded manufacturing capacity to serve regional and export markets. In the OECD region, Germany at 6.0% maintained output under strict regulatory frameworks, and France at 5.5% operated mid-scale facilities for domestic and European markets. The United Kingdom at 4.9% supported production for retail and food service channels, while the USA, at 4.4%, sustained steady demand across processed food industries under federal and state-level safety regulations. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The tomato sauce concentrate market in China is projected to grow at a CAGR of 7.0% due to rising demand for processed foods and ready-to-use cooking ingredients. Adoption is being driven by concentrated tomato products that provide convenience, extended shelf life, and consistent flavor for households and food service providers. Manufacturers are being encouraged to supply high quality, safe, and flavorful concentrates. Distribution through retail chains, wholesale markets, and e commerce platforms is being strengthened. Research into improved processing methods, packaging solutions, and preservation techniques is being conducted. Growth in urban households, expansion of the food service industry, and increasing consumption of convenience foods are considered key factors supporting the tomato sauce concentrate market in China.

The tomato sauce concentrate market in India is expected to grow at a CAGR of 6.5%, fueled by rising urban population and increasing consumption of ready-to-cook ingredients. Adoption is being supported by products that offer convenience, consistent taste, and extended storage life. Manufacturers are being encouraged to provide affordable, high quality, and safe concentrates. Distribution through supermarkets, grocery stores, and online platforms is being strengthened. Awareness programs and promotional campaigns are being conducted to educate consumers about product benefits. Expansion of urban households, growth in quick service restaurants, and increasing preference for processed foods are recognized as primary drivers of the tomato sauce concentrate market in India.

Germany is experiencing growth in the tomato sauce concentrate market at a CAGR of 6.0%, supported by demand from households and food processing industries for convenient and consistent tomato products. Adoption is being strengthened by concentrates that ensure flavor uniformity, longer shelf life, and ease of use in cooking. Manufacturers are being encouraged to supply high quality, hygienic, and flavorful products. Distribution through retail chains, wholesale suppliers, and food service providers is being maintained. Research in packaging innovations, flavor enhancement, and shelf life extension is being conducted. Increasing preference for convenience foods, expansion of the ready-to-cook sector, and growth of food processing industries are considered key drivers of the tomato sauce concentrate market in Germany.

Increasing demand for convenient and ready-to-use cooking ingredients is supporting the tomato sauce concentrate market in the United Kingdom, expected to grow at a CAGR of 4.9%. Adoption is being driven by concentrated tomato products that provide consistent taste, longer shelf life, and ease of use in households and food service applications. Manufacturers are being encouraged to deliver durable, high quality, and safe concentrates. Distribution through retail chains, grocery stores, and online platforms is being strengthened. Awareness campaigns and product demonstrations are being conducted to promote proper usage. Expansion of urban households, growth in food service sectors, and rising processed food consumption are considered primary drivers of the tomato sauce concentrate market in the United Kingdom.

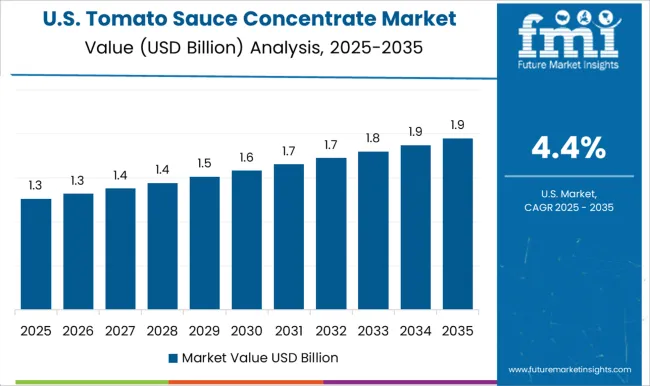

The tomato sauce concentrate market in the United States is projected to grow at a CAGR of 4.4%, supported by rising consumption of processed foods and ready-to-use ingredients. Adoption is being strengthened by concentrated tomato products that provide convenience, consistent flavor, and longer shelf life for households and food service providers. Manufacturers are being encouraged to supply high quality, safe, and flavorful products. Distribution through supermarkets, wholesale suppliers, and e commerce platforms is being maintained. Research in flavor improvement, packaging solutions, and shelf life extension is being conducted. Growth in urban households, increasing processed food demand, and expansion of quick service restaurants are considered key factors driving the tomato sauce concentrate market in the United States.

The tomato sauce concentrate market has witnessed significant growth globally, driven by the increasing demand for convenient cooking solutions, ready-to-use sauces, and processed food products. Rising urbanization, changing lifestyles, and the expansion of the foodservice and packaged food industry have contributed to this surge. Leading suppliers in this market, including ConAgra Brands, Del Monte Foods, Kraft Heinz Company, Symrise AG, GNT Group, AGRANA Group, Chitale Agro, ARIZONA CITRUS PRODUCTS, Shimla Hills Offerings Pvt. Ltd., Kagome Co., Ltd., AMOREAL, Campbell Soup Company, Hunt's, Red Gold, and Mutti S.p.A., have established a strong presence by offering high-quality tomato concentrate products suitable for diverse culinary applications. These suppliers provide a variety of products such as paste, puree, and concentrated sauces to meet the preferences of both retail consumers and industrial buyers. Innovation, quality assurance, and product differentiation remain central to the strategies of these leading suppliers. Companies are increasingly focusing on non-GMO, organic, and clean-label offerings to attract health-conscious consumers. Advanced packaging solutions, such as vacuum-packed and aseptic packaging, enhance shelf life and convenience, while maintaining product quality. Strategic collaborations with foodservice providers and retail chains allow companies like Kraft Heinz, ConAgra, and Mutti S.p.A. to expand distribution and increase brand visibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Concentrated Level | Single Strength Concentrate, Double Strength Concentrate, and Triple Strength Concentrate |

| End Use Industry | Food Industry and Food Service Industry |

| Distribution Channel | Direct Sales, Wholesalers/Distributors, Retailers, and Online Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ConAgra Brands, Del Monte Foods, Kraft Heinz Company, Symrise AG, GNT Group, AGRANA Group, Chitale Agro, ARIZONA CITRUS PRODUCTS, Shimla Hills Offerings Pvt. Ltd., Kagome Co., Ltd., AMOREAL, Campbell Soup Company, Hunt's, Red Gold, and Mutti S.p.A. |

| Additional Attributes | Dollar sales vary by product type, including single, double, and triple concentrated tomato sauces; by application, such as sauces, ketchup, soups, and ready-to-eat meals; by end-use industry, spanning food processing, restaurants, and retail; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for convenience foods, processed sauces, and foodservice expansion. |

The global tomato sauce concentrate market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the tomato sauce concentrate market is projected to reach USD 4.7 billion by 2035.

The tomato sauce concentrate market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in tomato sauce concentrate market are single strength concentrate, double strength concentrate and triple strength concentrate.

In terms of end use industry, food industry segment to command 55.2% share in the tomato sauce concentrate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tomato Pomace Powder Market Analysis - Size, Share & Forecast 2025 to 2035

Tomato Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Sauces and Condiments Market Size and Share Forecast Outlook 2025 to 2035

Sauces, Dressings, And Condiments Market Size and Share Forecast Outlook 2025 to 2035

Sauce Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Powder Market Analysis by Sauces, Dips, Soups, Convenience Food Products and other Applications Through 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Pasta Sauces Market Size and Share Forecast Outlook 2025 to 2035

Chili Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Sauces Market - Trends & Forecast 2025 to 2035

Oyster Sauce Market Report – Demand, Trends & Industry Forecast 2025-2035

Culinary Sauce Market

Demand for Sauces, Dressings, and Condiments in Europe Outlook - Share, Growth & Forecast 2025 to 2035

Vegan Fish Sauce Market Growth - Sustainable Umami Alternatives 2025 to 2035

Vegan Pasta Sauce Market Expansion - Dairy-Free & Plant-Based Sauces 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Concentrate Containers Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA