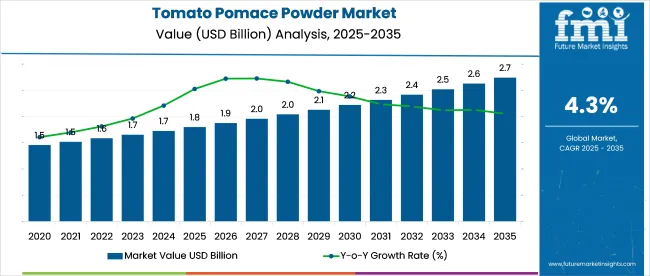

The tomato pomace powder market is estimated at USD 1.8 billion in 2025 and is forecast to attain USD 2.7 billion by 2035, expanding at a CAGR of 4.3%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.8 billion |

| Industry Value (2035F) | USD 2.7 billion |

| CAGR (2025 to 2035) | 4.3% |

This trajectory is being driven by demand for fiber-rich fruit pomace derivatives in bakery, snack, and beverage formulations, as tomato by-products are being favored for cost-effective nutritional enhancement. Powdered tomato pomace is being praised for its high dietary-fiber content and ease of incorporation into extruded snacks and cereals. It is argued that differentiation will depend on flavored blends and clean-label positioning. It is suggested that inconsistent processing infrastructure and variable raw-material supply may restrain expansion unless traceability systems and supply consolidation are prioritized.

In March 2025, Native Extracts partnered with Kagome Australia to launch Red Velvet Oil™, a premium skincare ingredient derived from upcycled tomato seeds-a byproduct of large-scale tomato processing. The initiative aimed to repurpose tomato pomace into high-value botanical oil for clean beauty applications. The launch marked a significant step in Australia's emerging upcycled ingredient economy.

Highlighting the broader impact, Lisa Carroll, Founder and Managing Director of Native Extracts, stated, “This partnership showcases Australia’s most ambitious upcycled ingredient initiative... and the power of upcycling waste into high-value ingredients, giving ethical brands new options to meet the demands of the growing conscious consumer culture.

Red Velvet Oil™ is more than a beauty ingredient; it's a statement of how the Reduce, Reuse & Repurpose sustainability movement and science can come together to create real change and innovation. This signifies the birth of Australia’s upcycled ingredient revolution... and there is more to come.”

The Tomato Pomace Powder Market holds a specialized share within its parent markets. In the fruit and vegetable processing market, it accounts for approximately 3-5%, as tomato pomace is a byproduct in tomato processing. Within the food ingredients market, its share is around 2-3%, as it is used in food products like sauces, soups, and snacks.

In the animal feed market, the share is about 1-2%, as tomato pomace powder is used as a supplement for animal nutrition. In the natural and organic products market, the share is approximately 4-6%, driven by its natural composition. In the bio-based products market, its share is around 2-3%, as a sustainable, plant-based ingredient.

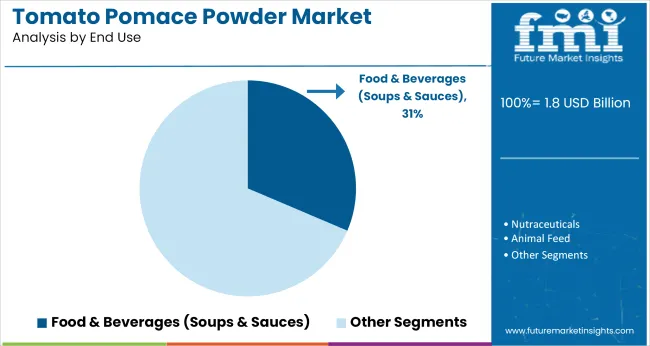

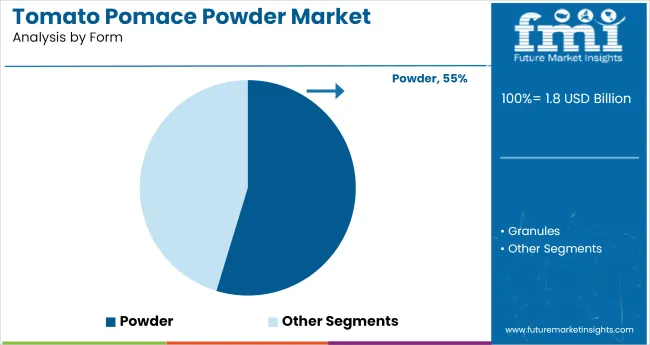

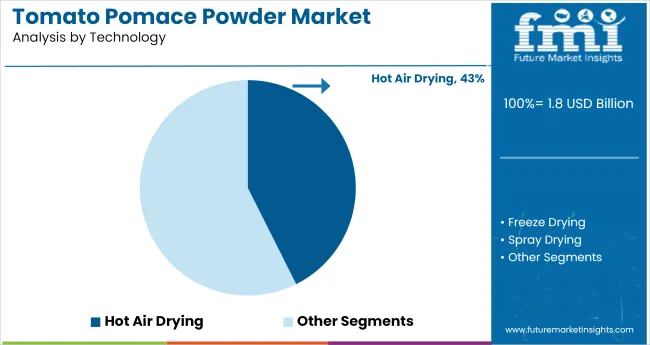

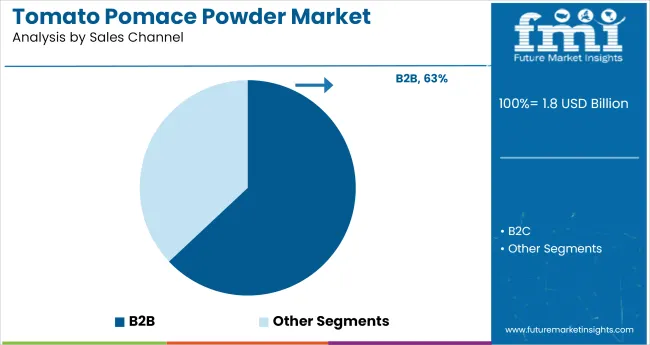

In 2025, the tomato pomace powder market will be driven by food & beverages (soups & sauces) with 31%, powder form holding 55%, hot air-drying technology at 43%, and B2B sales channels dominating at 63%.

Soups and sauces are expected to capture 31% of the tomato pomace powder market share in 2025, driven by the growing demand for natural, sustainable ingredients in the food and beverage sector. Tomato pomace powder enhances the texture, flavor, and nutritional content of soups and sauces while offering an eco-friendly solution by upcycling waste from tomato processing. As more manufacturers seek clean-label, plant-based alternatives for their products, tomato pomace powder's functional benefits, including its high fiber and antioxidant content, are fueling its popularity in these applications.

The powder form of tomato pomace is projected to hold 55% of the market share in 2025, making it the preferred format for manufacturers. Its versatility in food and beverage applications, especially in ready-to-eat and processed foods, makes it a staple ingredient in the industry. Powdered tomato pomace is easy to handle, store, and incorporate into various formulations. It offers manufacturers an efficient, cost-effective solution for boosting the nutritional value of their products, particularly in dry mixes, snacks, and health supplements.

Hot air drying is expected to dominate the technology segment with 43% market share in 2025. This method is widely used for its cost-effectiveness, scalability, and ability to preserve the flavor, color, and nutritional content of tomato pomace powder. Hot air drying effectively removes moisture from tomato pomace, ensuring a longer shelf life and making the powder suitable for various applications, particularly in food processing. The efficiency and affordability of hot air drying continue to make it the go-to technology for producing high-quality tomato pomace powder.

B2B sales channels are projected to hold a dominant 63% of the market share in 2025. The B2B model allows suppliers and manufacturers to meet the growing demand for tomato pomace powder from food producers, health product manufacturers, and other industrial users. This distribution channel is particularly advantageous for large-scale buyers seeking bulk quantities of the ingredient, ensuring steady supply and lower prices for both parties. As demand for sustainable and functional ingredients continues to rise in the food industry, B2B sales will remain a critical channel for tomato pomace powder distribution.

The tomato pomace powder market is expanding due to increasing demand for natural, high-fiber ingredients in food and animal feed. However, challenges such as inconsistent raw material quality, processing complexities, and limited consumer awareness are hindering broader adoption.

Rising Demand for Natural, High-Fiber Ingredients

The tomato pomace powder market is experiencing growth driven by the increasing consumer preference for natural, high-fiber ingredients in food products. Tomato pomace, a by-product of tomato processing, is rich in dietary fiber, antioxidants, and other bioactive compounds. These nutritional benefits make it an attractive addition to various food products, including bakery items, snacks, and dietary supplements. As consumers become more health-conscious and seek clean-label products, the demand for tomato pomace powder as a functional ingredient is on the rise.

Challenges in Raw Material Quality and Processing

Despite its benefits, the tomato pomace powder market faces challenges related to raw material quality and processing complexities. The quality of tomato pomace can vary depending on the source and processing methods, leading to inconsistencies in the final powder product. Additionally, the processing of tomato pomace into powder requires specialized equipment and energy-intensive procedures, contributing to high production costs. These factors can limit the scalability and affordability of tomato pomace powder, hindering its widespread adoption in the food industry.

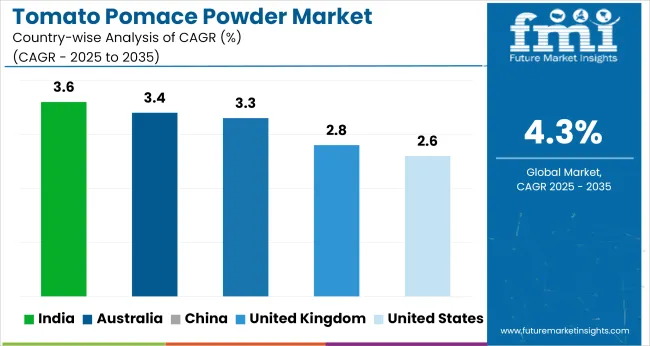

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.6% |

| United Kingdom | 2.7% |

| China | 3.3% |

| India | 3.6% |

| Australia | 3.4% |

Global tomato pomace powder market demand is projected to rise at a 4.3% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, India leads at 3.6%, followed by China at 3.3%, and Australia at 3.4%, while the United States records 2.6% and the United Kingdom posts 2.7%. These rates translate to a growth premium of -16% for India, -23% for China, and -35% for the United States versus the baseline, while Australia and the United Kingdom show slower growth.

Divergence reflects local catalysts: rising demand for sustainable, plant-based ingredients and natural additives in India and China, while more mature markets like the United States and the United Kingdom experience slower growth due to market saturation and limited adoption of tomato pomace powder in mainstream food products.

Sales of tomato pomace powder in the United States are expected to grow at a CAGR of 2.6% from 2025 to 2035. The market benefits from its positioning as a cost-effective, fiber-rich additive in pet food, baked goods, and dietary supplements. Demand is supported by clean-label and upcycled ingredient trends in specialty nutrition.

However, limited consumer awareness and fragmented supply have constrained growth beyond B2B applications. Processors focus on shelf stability and microbial safety to comply with FDA standards. While culinary uses remain niche, the nutraceutical and feed sectors continue to absorb most output.

The United Kingdom tomato pomace powder market is projected to grow at a CAGR of 2.7% through 2035. Its use in high-fiber bakery formulations and functional beverages is expanding due to consumer interest in upcycled ingredients. Leading manufacturers are incorporating it into meat alternatives and sauces to enhance lycopene content and texture.

Regulatory flexibility on food waste valorization has encouraged processors to scale production. Despite moderate public recognition, inclusion in zero-waste and carbon-label initiatives has improved visibility in health-centric product lines.

Demand for tomato pomace powder in China is estimated to rise at a CAGR of 3.3% between 2025 and 2035. High tomato processing volumes in Xinjiang and Inner Mongolia provide abundant raw material. Domestic firms incorporate it in traditional noodles and ready-to-eat congee for fiber enrichment. Growth in pet nutrition and livestock feed segments supports steady industrial use.

Market adoption has been strengthened by provincial grants for food waste valorization and investments in spray-drying facilities. Expansion into the sports nutrition and beverage sectors remains exploratory but promising.

The tomato pomace powder market in India is projected to expand at a CAGR of 3.6% from 2025 to 2035. Strong tomato production hubs in Andhra Pradesh and Maharashtra fuel supply, while increased focus on functional flours in Ayurveda-aligned formulations drives demand. Manufacturers are deploying low-heat drying systems to preserve antioxidant profiles.

Rising interest from pet food and poultry feed industries, driven by feed cost concerns, has widened use cases. Retail presence is limited, but institutional buyers and agri-cooperatives are increasingly sourcing tomato pomace-based blends.

The tomato pomace powder market in Australia is set to grow at a CAGR of 3.4% during 2025-2035. The processing regions in Victoria and Queensland ensure consistent supply to foodservice and animal feed channels. Its antioxidant content and umami-enhancing traits have led to pilot use in seasoning powders and gourmet dry mixes.

Consumer-facing demand remains marginal, but food manufacturers exploring natural coloring and fiber enrichment see it as a viable option. Institutional kitchens and nutritionists use it in low-waste recipe design. Sustainability-driven innovation in snack foods continues to open new application avenues.

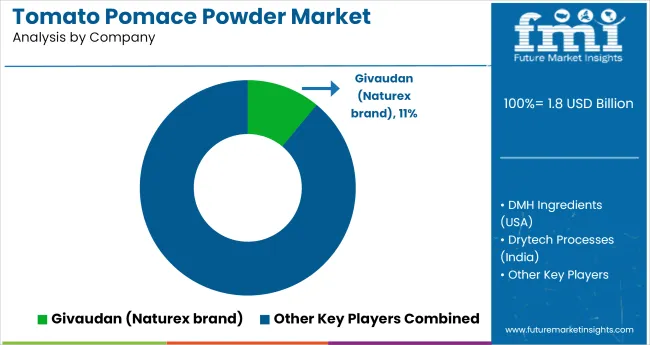

In the tomato pomace powder market, differentiation has focused on concentration level, pesticide-free sourcing, and application-specific formats. Givaudan, through its Naturex portfolio, leads global demand by supplying antioxidant-rich extracts to nutraceutical, seasoning, and processed food manufacturers across Europe and North America. DMH Ingredients and Harmony House Foods have secured USA shelf space through bulk and clean-label offerings targeting B2B bakery and soup bases. In India, Drytech Processes and Ambe NS Agro Products rely on direct-from-farm tomato skins and seeds, producing for both domestic and ASEAN snack manufacturers. Regulatory clarity around lycopene content, colorant use, and solvent-free drying has shaped labeling and functional claims globally.

Recent Industry News

| Attribute Category | Details |

|---|---|

| Industry Size (2025E) | USD 1.8 billion |

| Projected Industry Value (2035F) | USD 2.7 billion |

| Value-based CAGR (2025-2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion / Volume in metric tons |

| By Form | Powder, Granules |

| By Source | Organic, Conventional |

| By End Use | Food & Beverages (Bakery, Soups & Sauces, Seasonings, Ready Meals), Nutraceuticals, Animal Feed (Livestock Feed, Pet Food), Cosmetics & Personal Care, Industrial (Colorants, Bioplastics) |

| By Sales Channel | B2B (Ingredient Supplie rs, Contract Manufacturers), B2C (Supermarkets/Hypermarkets, Specialty Stores, Online Retail) |

| By Technology | Hot Air Drying, Freeze Drying, Spray Drying |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Germany, France, United Kingdom, Italy, Poland, Spain, Russia, China, India, Japan, South Korea, Australia, Indonesia, Saudi Arabia, UAE, South Africa |

| Key Players | DMH Ingredients (USA), Drytech Processes (India), Givaudan (Naturex), Ambe NS Agro Products Pvt. Ltd. (India), Harmony House Foods (USA) |

| Additional Attributes | Dollar by sales, share by form and end use, regional shifts in drying technology, ingredient demand across feed and food industries, pricing elasticity in bulk B2B segments, and pet food enrichment trends |

Form segmentation includes powder and granules.

Source-based categories include organic and conventional.

End-use applications comprise food & beverages (bakery, soups & sauces, seasonings, ready meals), nutraceuticals, animal feed (livestock feed, pet food), cosmetics & personal care, and industrial (colorants, bioplastics).

Sales channels include B2B (ingredient suppliers, contract manufacturers) and B2C (supermarkets/hypermarkets, specialty stores, online retail).

Technology segmentation includes hot air drying, freeze drying, and spray drying.

Regional analysis includes North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

The estimated industry size in 2025 is USD 1.8 billion.

The market value in 2035 is USD 2.7 billion, with a CAGR of 4.3%.

The food & beverages segment, specifically soups & sauces, dominates the market with a 31% market share.

Powder form leads the market with a 55% market share.

India is projected to have the highest CAGR in the market with a growth rate of 3.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tomato Sauce Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Tomato Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Fruit Pomace Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Powder Coating Guns Market

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA