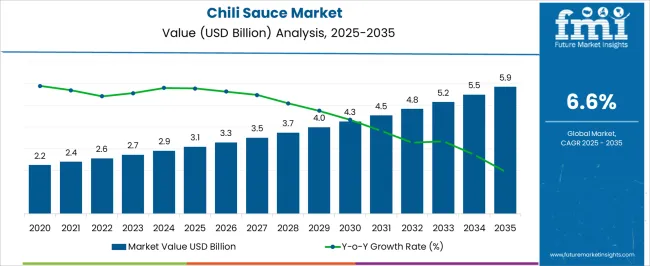

The chili sauce market is projected at USD 3.1 billion in 2025 and anticipated to reach USD 5.9 billion by 2035, expanding at a CAGR of 6.6%. The market trajectory from 2025 to 2035 demonstrates steady growth, with incremental increases from USD 2.2 billion in 2022 to USD 5.9 billion by 2035. The growth contribution index reveals that early years, particularly 2025–2027, contribute moderately to the overall expansion, reflecting gradual adoption across emerging regions and niche product launches.

Mid-period years, from 2028–2032, account for a higher share of growth, driven by rising consumer preference for spicy condiments, integration of chili sauces in ready-to-eat meals, and increasing penetration in foodservice channels. The latter part of the forecast, 2033–2035, shows accelerated contribution owing to innovative flavor profiles, e-commerce penetration, and rising awareness of ethnic cuisines globally. Regionally, Asia-Pacific leads in growth contribution, followed by North America and Europe, where demand is bolstered by culinary experimentation and premium product launches. Product innovation, such as organic and low-sodium variants, further elevates the contribution index, making it a key driver of incremental market expansion.

| Metric | Value |

|---|---|

| Chili Sauce Market Estimated Value in (2025 E) | USD 3.1 billion |

| Chili Sauce Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The chili sauce market is influenced by five interrelated parent markets, each playing a distinct role in overall demand and growth. The packaged food and processed sauces segment holds the largest share at 45%, as retail-ready chili sauces are increasingly adopted by consumers for home cooking, convenience meals, and flavor enhancement. The foodservice and restaurant sector contributes 25%, with restaurants, fast-food chains, and quick-service outlets driving demand through menu diversification and inclusion of ethnic and spicy cuisines.

The e-commerce and online grocery market accounts for 15%, as digital platforms enable wider distribution, promotional campaigns, and direct-to-consumer sales, particularly in urban regions. The export and international trade segment holds a 10% share, fueled by rising global appetite for regional flavors and the expansion of chili sauce brands into emerging markets. Finally, the culinary ingredient and spice manufacturing sector represents 5%, supplying concentrated chili extracts, blends, and seasoning bases essential for consistent flavor and product innovation. Collectively, packaged food, foodservice, and e-commerce segments account for 85% of market demand, emphasizing that consumer adoption, convenience, and global reach are the primary growth drivers, while ingredient suppliers and trade networks facilitate continuous product development and availability worldwide. The varying share across these segments reflects both regional preferences and evolving consumption patterns, ensuring steady growth and diversification in the chili sauce market.

The chili sauce market is experiencing consistent growth driven by increasing consumer demand for diverse flavor profiles, rising global interest in ethnic cuisines, and the expanding use of chili-based condiments in both home and foodservice settings. Growing health awareness and preference for natural, preservative-free products are also influencing product innovation, with manufacturers introducing clean-label and organic varieties.

The incorporation of chili sauce into ready-to-eat meals, snacks, and international dishes has widened its appeal across demographics. Advancements in processing and packaging technologies are improving shelf life while preserving freshness and flavor integrity.

With increasing penetration in both developed and emerging markets, the outlook remains positive, supported by expanding retail networks, robust export opportunities, and evolving consumer tastes that favor bold and versatile condiments.

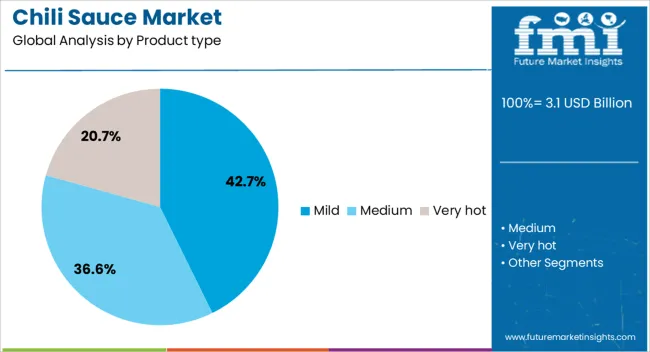

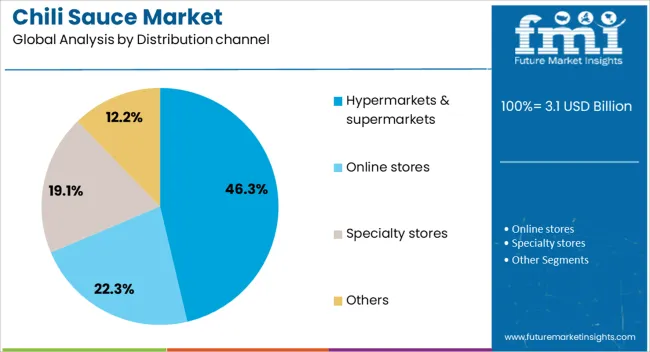

The chili sauce market is segmented by product type, packaging, distribution channel, and geographic regions. By product type, chili sauce market is divided into Mild, Medium, and Very hot. In terms of packaging, chili sauce market is classified into Jars, Bottles, Pouches, and Sachets. Based on distribution channel, chili sauce market is segmented into Hypermarkets & supermarkets, Online stores, Specialty stores, and Others. Regionally, the chili sauce industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mild product type segment is projected to hold 42.70% of total market revenue by 2025, making it the most dominant within the product type category. This share is supported by strong consumer preference for balanced flavor profiles that provide chili’s characteristic taste without overwhelming heat.

Such products appeal to a broad audience including children, elderly consumers, and markets with lower spice tolerance. The segment also benefits from versatility, being suitable for a wide range of culinary applications from dips and marinades to cooking sauces.

As food manufacturers focus on expanding their customer base, mild chili sauces are increasingly featured in mainstream retail and foodservice offerings, reinforcing their leading position.

The hypermarkets and supermarkets segment is anticipated to account for 46.30% of the market revenue by 2025, leading the distribution channel category. This growth is driven by the extensive product variety, attractive promotional offers, and the ability for consumers to physically assess product quality before purchase.

These retail formats offer strong brand visibility and high consumer footfall, providing an ideal platform for both established and emerging chili sauce brands.

The segment’s dominance is further supported by the integration of private label chili sauces, competitive pricing, and the convenience of one-stop shopping experiences.

Chili sauce market growth is being driven by evolving consumer taste preferences, distribution channel expansion, and foodservice adoption. Product diversification and innovative flavors further strengthen market penetration and long-term demand.

The chili sauce market is being driven by increasing consumer appetite for bold and spicy flavors across meals and snacks. In many regions, traditional cuisines are being complemented with new, exotic sauces, enhancing flavor profiles and meal experiences. Retailers and foodservice providers are responding with diverse offerings, from mild to extra-hot variants, to cater to different taste preferences. This growing demand is further fueled by the popularity of ready-to-eat meals and convenience foods, where chili sauces serve as a key flavor enhancer. Consumer experimentation with international cuisines is also boosting demand, encouraging brands to introduce region-specific sauces that reflect authentic tastes and ingredients.

Distribution channels play a crucial role in driving chili sauce sales globally. Supermarkets, hypermarkets, and convenience stores provide widespread access to packaged chili sauces, while e-commerce platforms are expanding reach, especially in urban and semi-urban areas. Online sales allow consumers to access niche and premium variants that may not be available locally. Promotional campaigns, subscription boxes, and direct-to-consumer deliveries are further enhancing visibility and adoption. Retail expansion in emerging regions is encouraging localized product offerings and competitive pricing, while digital marketing helps brands educate consumers about flavor profiles, usage tips, and product differentiation, supporting steady sales growth across multiple segments.

Restaurants, quick-service outlets, and casual dining establishments are increasingly incorporating chili sauces into menus to meet customer demand for spicy and diverse culinary experiences. Menu innovations, seasonal promotions, and specialty offerings drive bulk purchases from these establishments. Chain restaurants and international foodservice brands contribute significantly to volume growth as they standardize sauces for consistent taste across locations. Additionally, collaborations with local suppliers enable tailored flavor development, supporting regional consumer preferences. This segment also acts as a marketing platform, exposing consumers to new flavors and encouraging retail adoption. Overall, foodservice demand amplifies both visibility and consumption, making it a key growth lever for the chili sauce market.

Chili sauce manufacturers are investing in product diversification to attract broader consumer segments. Variants such as organic, low-sodium, fruit-infused, and smoky flavors are gaining traction, addressing health-conscious preferences and culinary curiosity. Limited-edition flavors, regional specialties, and ethnic-inspired blends create excitement and brand differentiation. Packaging innovations, such as squeezable bottles, single-serve sachets, and gift packs, enhance convenience and appeal. Marketing campaigns emphasizing unique taste experiences, premium ingredients, and artisanal preparation further influence consumer choices. Continuous flavor experimentation ensures repeat purchases and loyalty, enabling brands to expand market share across age groups and regions while maintaining relevance in a competitive environment.

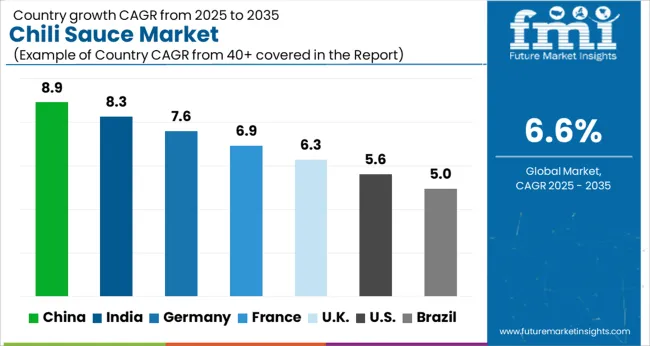

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

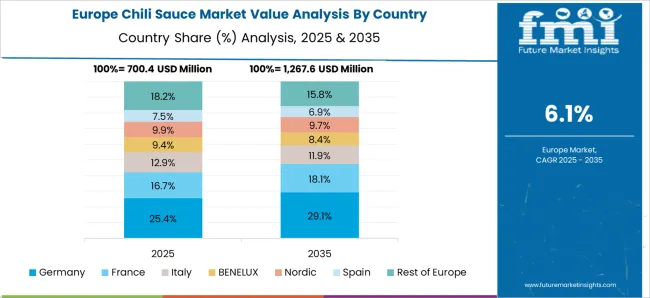

The global chili sauce market is projected to grow at a CAGR of 6.6% from 2025 to 2035. China leads at 8.9%, followed by India at 8.3%, Germany at 7.6%, the UK at 6.3%, and the USA at 5.6%. Growth is fueled by rising consumer preference for spicy foods, expanding retail and e-commerce channels, and increasing adoption in foodservice and restaurant sectors. Emerging economies such as China and India show rapid expansion due to growing population, evolving food habits, and demand for convenience foods. Mature markets like Germany, the UK, and the USA emphasize premium products, flavor innovation, and ethnic cuisine integration to maintain steady market growth. The analysis covers over 40 countries, with the leading markets shown below.

The chili sauce market in China is projected to grow at a CAGR of 8.9% from 2025 to 2035, supported by rising consumption of ready-to-eat meals, instant noodles, and home-cooked dishes incorporating spicy condiments. Manufacturers are investing in flavor innovation, heat-level customization, and natural ingredient formulations to meet evolving consumer preferences. Retail penetration through supermarkets, e-commerce platforms, and specialty stores is expanding product visibility, while local and regional brands are leveraging traditional recipes to maintain authenticity. Urban consumers are increasingly drawn to premium and artisanal chili sauces that promise superior taste, aroma, and color stability. Packaging innovations, such as squeezable bottles and single-serve sachets, are facilitating convenience and extended shelf life. Export demand is growing, with international markets seeking authentic Chinese flavors.

The chili sauce market in India is expected to grow at a CAGR of 8.3% from 2025 to 2035, driven by increasing household consumption, growth of food service outlets, and expanding snack and fast-food segments. Product diversification, including sweet, tangy, and fiery sauces, is being emphasized to cater to regional taste variations. Local manufacturers are enhancing production capacity while adopting modern preservation techniques to extend shelf life and maintain color, aroma, and consistency. E-commerce adoption is enabling tier-2 and tier-3 city consumers to access national and international brands. Marketing campaigns highlighting traditional recipes, organic ingredients, and health-conscious formulations are influencing purchase behavior. Partnerships with global flavor houses are fostering innovation in blends and seasoning profiles.

The chili sauce market in Germany is anticipated to grow at a CAGR of 7.6% from 2025 to 2035, fueled by increasing interest in ethnic cuisines, spicy condiments, and gourmet food experiences. Consumers are seeking sauces with clean-label claims, non-GMO ingredients, and no artificial preservatives. Retailers are expanding shelf space for specialty and imported chili sauces, while online grocery platforms provide convenient access to international varieties. Product innovation focuses on flavor intensity, organic certification, and unique ingredient pairings, such as smoked peppers, exotic spices, and fusion blends. Food service demand is rising for ready-to-use sauces in restaurants, hotels, and catering services. Export opportunities are growing as German consumers favor high-quality sauces from diverse regions.

The chili sauce market in the UK is projected to grow at a CAGR of 6.3% from 2025 to 2035, as consumer preference for bold, spicy flavors continues to rise. Retail expansion and online grocery platforms are improving accessibility for domestic and imported products. Manufacturers are emphasizing innovative flavor combinations, heat-level differentiation, and all-natural ingredients to appeal to health-conscious and adventurous consumers. The foodservice sector, including quick-service restaurants and casual dining, is creating additional demand for convenient, ready-to-use sauces. Packaging solutions, such as recyclable bottles and single-use sachets, are increasingly adopted to meet consumer expectations for sustainability. Marketing campaigns highlight origin-specific peppers, artisanal techniques, and fusion recipes, fostering product differentiation in a competitive market.

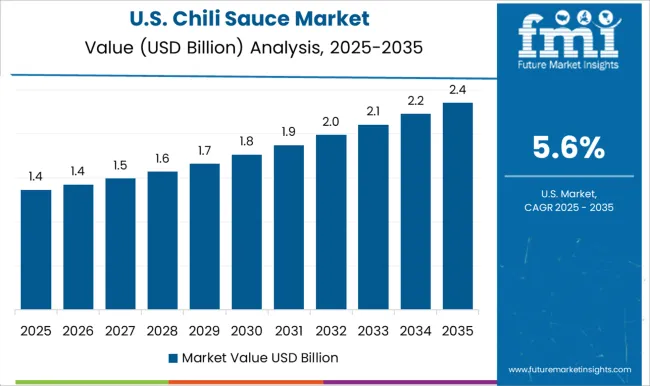

The chili sauce market in the USA is expected to grow at a CAGR of 5.6% from 2025 to 2035, driven by strong demand for convenience foods, ethnic cuisine, and home meal kits. Consumers are increasingly choosing sauces with natural ingredients, reduced sodium, and clean-label certifications. Retailers are expanding private-label chili sauce offerings to compete with established brands, while e-commerce channels provide nationwide reach for specialty and artisanal products. Flavor innovation, including smoky, tangy, and super-hot variants, is being prioritized to cater to diverse consumer palates. The foodservice segment is increasingly integrating chili sauces in quick-service and full-service restaurant menus. Health-conscious variants enriched with antioxidants or organic components are gaining traction among millennials and Gen Z consumers.

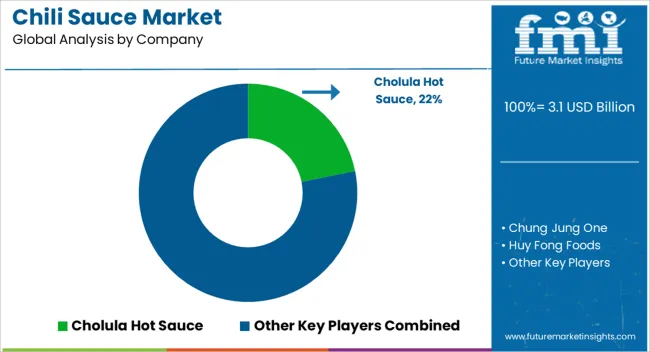

Competition in the chili sauce market is defined by flavor innovation, heat-level differentiation, ingredient quality, and distribution reach. Huy Fong Foods leads with high-volume production of iconic sauces emphasizing consistent heat, shelf stability, and wide retail presence. McIlhenny (Tabasco) differentiates through aged pepper blends, vinegar-based sauces, and global brand recognition across retail and foodservice channels. Laoganma focuses on premium chili pastes and sauces with authentic Chinese flavors, targeting both domestic and export markets.

Lee Kum Kee emphasizes versatility with soy- and chili-based sauces tailored for culinary applications and international cuisines. Specialist players such as Cholula Hot Sauce and Nando’s prioritize artisanal flavors, distinctive packaging, and heat variations catering to gourmet and casual dining markets. Chung Jung One and Real Thai (Thai Foods) focus on authentic regional formulations with natural ingredients, appealing to consumers seeking traditional flavors. Lingham & Sons and ThaiTheparos differentiate through organic and preservative-free recipes, targeting health-conscious segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Product type | Mild, Medium, and Very hot |

| Packaging | Jars, Bottles, Pouches, and Sachets |

| Distribution channel | Hypermarkets & supermarkets, Online stores, Specialty stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cholula Hot Sauce, Chung Jung One, Huy Fong Foods, Laoganma, Lee Kum Kee, Lingham & Sons, McIlhenny (Tabasco), Nando’s, Real Thai (Thai Foods), and ThaiTheparos |

| Additional Attributes | Dollar sales by flavor and heat level, share by distribution channel, regional consumption patterns, demand growth by retail and foodservice, emerging hot sauce trends, packaging formats driving sales, competitive pricing, ingredient sourcing, and innovation in flavor blends. |

The global chili sauce market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the chili sauce market is projected to reach USD 5.9 billion by 2035.

The chili sauce market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in chili sauce market are mild, medium and very hot.

In terms of packaging, jars segment to command 37.9% share in the chili sauce market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sauces and Condiments Market Size and Share Forecast Outlook 2025 to 2035

Sauces, Dressings, And Condiments Market Size and Share Forecast Outlook 2025 to 2035

Sauce Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Market Size and Share Forecast Outlook 2025 to 2035

Hot Sauce Powder Market Analysis by Sauces, Dips, Soups, Convenience Food Products and other Applications Through 2035

Fish Sauce Market Growth - Culinary Trends & Industry Demand 2025 to 2035

Pasta Sauces Market Size and Share Forecast Outlook 2025 to 2035

Vegan Sauces Market - Trends & Forecast 2025 to 2035

Tomato Sauce Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Oyster Sauce Market Report – Demand, Trends & Industry Forecast 2025-2035

Culinary Sauce Market

Demand for Sauces, Dressings, and Condiments in Europe Outlook - Share, Growth & Forecast 2025 to 2035

Vegan Fish Sauce Market Growth - Sustainable Umami Alternatives 2025 to 2035

Vegan Pasta Sauce Market Expansion - Dairy-Free & Plant-Based Sauces 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA