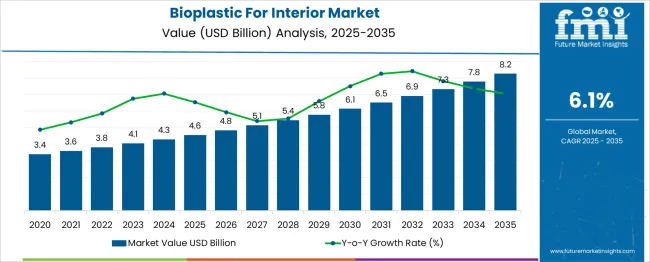

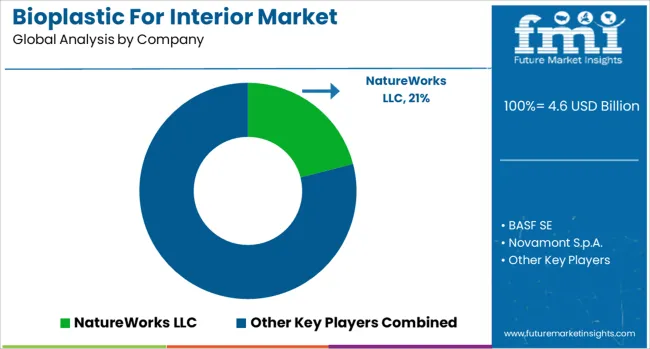

The Bioplastic For Interior Market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 8.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. From 2025 to 2030, the market is expected to grow by approximately 32.6%, reaching USD 6.1 billion. Yearly growth progresses steadily: USD 4.8 billion in 2026, USD 5.1 billion in 2027, USD 5.4 billion in 2028, and USD 5.8 billion in 2029. Market share gains will favor manufacturers that offer high-performance, durable, and aesthetically versatile bioplastics compatible with current automotive and furniture production systems.

Companies focusing on reliable supply chains, processability, and compliance with interior material standards are likely to benefit during this growth phase. Firms dependent on limited formulations, or unable to meet cost expectations, may experience share erosion as OEMs seek scalable, efficient alternatives. Inconsistent quality, color variation, or low thermal resistance will disadvantage players unable to keep pace with evolving user expectations. Between 2025 and 2030, competitive success will depend on meeting volume demands while offering cost stability and consistent performance. Players aligned with key interior design trends and capable of bulk production will dominate this phase of the market.

| Metric | Value |

|---|---|

| Bioplastic For Interior Market Estimated Value in (2025 E) | USD 4.6 billion |

| Bioplastic For Interior Market Forecast Value in (2035 F) | USD 8.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

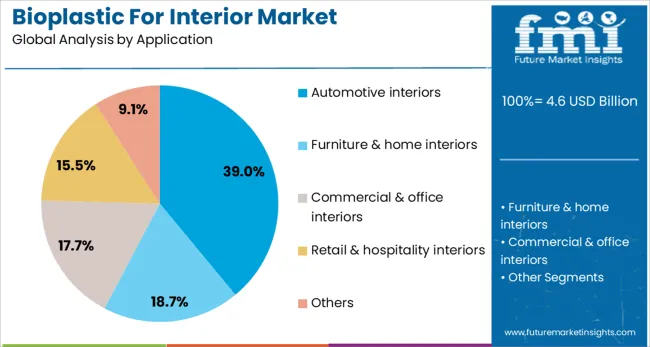

The bioplastic for interior market derives its growth from multiple parent industries that have increasingly adopted sustainable materials for interior applications. Among these, the automotive interior materials market holds the largest share, contributing approximately 27.9% to the bioplastic interior segment. This is driven by growing adoption of eco-friendly components such as dashboards, trims, and door panels by automotive OEMs seeking to reduce environmental impact. The broader automotive bioplastics market sees nearly 45% of its use directed toward interiors, indicating strong alignment.

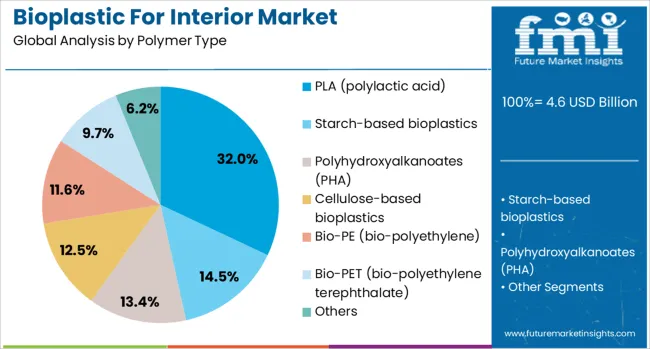

The furniture and home interiors segment follows closely, accounting for an estimated 20–25% of the bioplastic interior market. Designers and manufacturers are turning to bioplastics for modular units, surface finishes, and ergonomic products due to their versatility and low carbon footprint. Commercial and office interiors spanning retail installations, hospitality fixtures, and workspaces also contribute meaningfully to demand, albeit at a smaller scale. Aerospace and consumer electronics interiors represent emerging contributors, as bioplastics gain attention for lightweight and durable non-structural components. By polymer type, PLA dominates with around 26.4% market share, owing to its moldability and renewable sourcing. Collectively, these parent markets shape a balanced and steadily expanding ecosystem for bioplastics in interiors, with growth supported by regulatory shifts and material performance improvements.

Increasing environmental regulations, rising consumer demand for eco-friendly products, and pressure on manufacturers to reduce carbon footprints have accelerated the adoption of bioplastics in interior components. Technological improvements in bio-based polymer processing and compatibility with existing molding equipment have made bioplastics a practical alternative to conventional petroleum-based plastics.

Automotive, construction, and electronics sectors are increasingly integrating bioplastic materials to meet green manufacturing goals while maintaining durability and aesthetic appeal. Public and private investments into biodegradable materials and bioeconomy infrastructure further support growth.

As global awareness around plastic pollution intensifies and product lifecycle responsibility becomes critical, bioplastics are emerging as a preferred solution for interior applications. Continued innovation in bio-based resin performance, coupled with cost reduction strategies, is expected to unlock scalable opportunities for manufacturers, especially in regions implementing aggressive carbon neutrality and waste reduction targets..

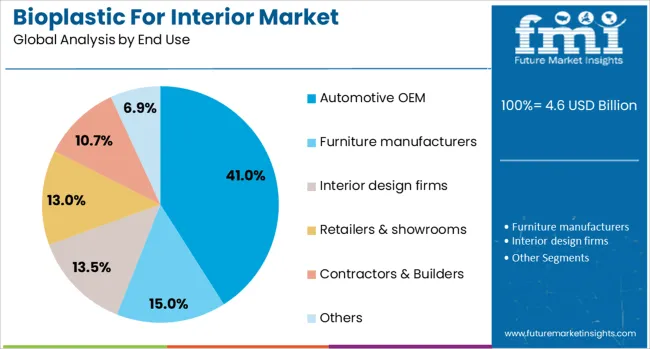

The bioplastic for interior market is segmented by polymer type, application, and end use and geographic regions. By polymer type of the bioplastic for interior market is divided into PLA (polylactic acid), Starch-based bioplastics, Polyhydroxyalkanoates (PHA), Cellulose-based bioplastics, Bio-PE (bio-polyethylene), Bio-PET (bio-polyethylene terephthalate), and Others. In terms of application of the bioplastic for interior market is classified into Automotive interiors, Furniture & home interiors, Commercial & office interiors, Retail & hospitality interiors, and Others. Based on end use of the bioplastic for interior market is segmented into Automotive OEM, Furniture manufacturers, Interior design firms, Retailers & showrooms, Contractors & Builders, and Others. Regionally, the bioplastic for interior industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PLA polymer type segment is projected to hold 32% of the Bioplastic For Interior market revenue share in 2025, positioning it as the leading material. This segment's growth has been supported by the strong biodegradability, thermal stability, and cost-effectiveness of PLA, which have enabled it to serve as a reliable alternative to fossil-based plastics in interior applications. High demand for low-emission, lightweight components in automotive and consumer electronics has reinforced the preference for PLA.

Its compatibility with standard manufacturing processes such as injection molding and thermoforming has further encouraged adoption without the need for significant capital investment. Regulatory incentives for compostable and bio-based products have also played a key role in expanding their application base.

The material’s aesthetic versatility and reduced environmental impact have made it especially attractive for interior design elements that require both form and function. As sustainability goals intensify across industries, PLA has continued to gain traction as a leading polymer in the market..

The automotive interiors application segment is anticipated to account for 39% of the Bioplastic For Interior market revenue share in 2025, emerging as the top application. The segment’s growth has been driven by the automotive industry's increasing emphasis on sustainable sourcing, emissions reduction, and lightweight materials. Bioplastics like PLA and PHA are being utilized for dashboards, door panels, seat coverings, and trim components as manufacturers respond to stricter fuel economy standards and consumer expectations for green mobility.

Software-driven design tools have enabled precise customization of bioplastic components, enhancing the aesthetic appeal and comfort of vehicle interiors. Additionally, bioplastics have proven effective in meeting safety and durability benchmarks, leading to broader OEM acceptance.

Automakers have recognized the opportunity to enhance brand positioning by integrating eco-conscious materials, which has further accelerated the adoption of bioplastics in interior parts. As electric and hybrid vehicles continue to gain market share, the need for low-impact, lightweight interiors is expected to further support this segment’s expansion..

The automotive OEM end use segment is expected to hold 41% of the Bioplastic For Interior market revenue share in 2025, establishing itself as the dominant end-user. Growth in this segment has been driven by original equipment manufacturers proactively integrating sustainable materials into product lines to meet stringent environmental regulations and corporate ESG commitments. Bioplastics offer a strategic advantage in achieving weight reduction, recyclability, and reduced lifecycle emissions in automotive assemblies.

Manufacturers have increasingly invested in R&D collaborations and pilot programs focused on integrating bioplastics into large-scale production, particularly for high-volume models. The ability to engineer interior components with bio-based polymers while maintaining performance integrity has reinforced confidence in these materials.

As OEMs face rising scrutiny from regulatory bodies and environmentally conscious consumers, the transition toward bioplastics is being viewed as both a compliance necessity and a brand differentiator. This shift has continued to position automotive OEMs at the forefront of bioplastic adoption in the interior market..

The bioplastic for interior market is expanding rapidly due to growing demand for sustainable materials in automotive, furniture, and architectural applications. Innovative biopolymer materials such as polylactic acid, biopolyethylene, bio-polyamide, PHA, and starch-based resins offer lightweight, biodegradable, and visually appealing alternatives to conventional plastics. Adoption is strongest in segments including automotive interiors, commercial and home furnishings, and hospitality fixtures. OEMs and material suppliers are collaborating to meet consumer preference and regulatory pressures for eco-conscious design. Performance innovation in heat resistance, acoustic insulation, and molding flexibility supports deeper penetration into dashboards, door trims, acoustic panels, and cladding systems across global markets.

The automotive interior segment serves as a primary growth driver for interior-grade bioplastics. OEMs are increasingly installing bio-based plastics in dashboards, door panels, trim elements, seat backs, and acoustic liners. Weight reduction, lower carbon footprint, recyclable material profiles, and eco-branding are fueling adoption in electric vehicle platforms. Bioplastics such as PLA‑PET blends, bio‑PP, and bio‑PA fulfill functional, safety, and aesthetic standards while supporting sustainability targets. Natural fiber hybrid components also offer acoustic and structural benefits. Leaders in automotive design are collaborating with chemical innovators and composite suppliers to integrate interior bioplastic materials into mass production. As production-scale feasibility improves and material costs align with traditional plastics, automotive interiors remain the dominant segment by volume and revenue in the interior bioplastics domain.

Bioplastics are gaining traction in acoustic insulation systems for interiors aimed at improved passenger comfort and sound-dampening performance. Materials such as bio‑PA, PHA, PLA, and natural‑fiber composites are engineered to absorb noise and vibration while reducing weight and environmental impact. These solutions address evolving expectations for quieter automotive cabins and commercial interiors where traditional insulation materials fall short in sustainability. Bioplastic acoustic layers are being used under dashboards, door panels, flooring, and furniture cladding. Their thermal stability and biodegradability also differentiate them for use in sustainable architecture and mobility designs. As builders and OEMs seek eco-friendly insulation options that match or exceed traditional acoustic performance, engineered bioplastic insulation systems are positioned to disrupt conventional foam or mineral-based solutions.

Despite performance gains, market growth faces constraints related to material cost, regulatory complexity, and supply chain readiness. Bioplastics still often command a price premium over conventional polymers due to raw material sourcing, fermentation or fiber processing, and limited scale. Consistency in mechanical and thermal properties demands robust quality systems and batch controls. Regulatory standards for interior materials covering flammability, VOCs, and recyclability vary by region, complicating material approvals. Integrating new bioplastic grades into existing manufacturing lines also poses compatibility challenges. Limited supply chain maturity, especially for novel polymers or natural-fiber composites, hampers consistent supply at competitive rates. Until economies of scale and supply ecosystems mature, adoption will remain focused on premium segments and early adopters in automotive and green-certified facilities.

The automotive interior segment serves as a primary growth driver for interior-grade bioplastics. OEMs are increasingly installing bio-based plastics in dashboards, door panels, trim elements, seat backs, and acoustic liners. Weight reduction, lower carbon footprint, recyclable material profiles, and eco-branding are fueling adoption in electric vehicle platforms. Bioplastics such as PLA‑PET blends, bio‑PP, and bio‑PA fulfill functional, safety, and aesthetic standards while supporting sustainability targets. Natural fiber hybrid components also offer acoustic and structural benefits. Leaders in automotive design are collaborating with chemical innovators and composite suppliers to integrate interior bioplastic materials into mass production. As production-scale feasibility improves and material costs align with traditional plastics, automotive interiors remain the dominant segment by volume and revenue in the interior bioplastics domain.

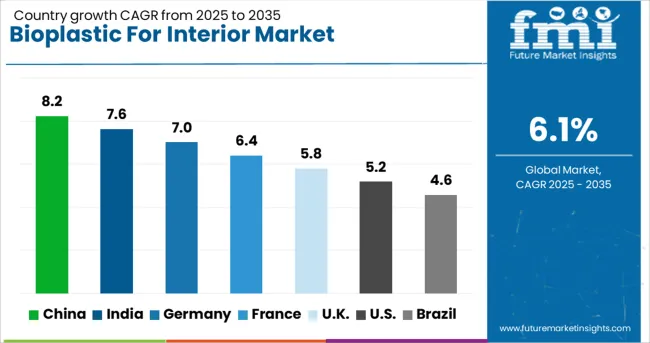

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The bioplastic for interior market is poised to expand at a CAGR of 6.1% through 2035, as demand grows for sustainable materials in automotive and architectural interiors. China leads with 8.2% growth, fueled by rapid industrial adoption and environmental policy support. India follows at 7.6%, driven by rising domestic manufacturing and demand for green alternatives. Germany’s 7.0% growth is backed by regulatory incentives and innovation in biodegradable materials. The UK, growing at 5.8%, is witnessing increased use of eco-friendly composites in home and office interiors. The USA, at 5.2%, benefits from advancements in biopolymer R&D and growing awareness among consumers. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is witnessing a strong CAGR of 8.2% in the bioplastic for interior market, driven by a national emphasis on sustainable manufacturing and low-emission building materials. The interior design and construction sectors are increasingly turning to bioplastics for paneling, decorative elements, and modular furniture due to rising environmental concerns and support from green building regulations. Local companies are scaling up production capacity by partnering with biopolymer technology firms and incorporating raw materials like PLA, PHA, and starch-based composites. These solutions are well received across eco-residential projects, public buildings, and green-certified commercial interiors. Additionally, a surge in smart city development projects is accelerating the shift toward bio-based interiors. Consumer preferences are also shifting in favor of biodegradable and toxin-free materials that meet both design and health criteria.

India is recording a CAGR of 7.6% in the bioplastic for interior market, supported by increasing awareness about environmental hazards associated with conventional plastics and the rapid growth of green infrastructure. Developers, architects, and interior designers are adopting bioplastics in residential and commercial projects to meet sustainability targets and earn certifications like IGBC and GRIHA. Government policies, such as the ban on single-use plastics and incentives for bio-manufacturing, are also promoting market expansion. Local bioplastic startups are innovating with agro-waste inputs like sugarcane bagasse and rice husk to manufacture panels, moldings, and furnishings. Demand is especially high in the hospitality and wellness sectors, where clients seek nature-integrated, non-toxic interiors.

Germany is growing at a CAGR of 7% in the Bioplastic for Interior Market, bolstered by strict environmental regulations and a strong culture of material innovation. The country’s building and design sectors are early adopters of renewable materials, with bioplastics being integrated into office furniture, acoustic panels, wall finishes, and fixtures. The demand is supported by both government subsidies and private investment in sustainable infrastructure. Bioplastic suppliers are emphasizing circular economy principles, offering products that are recyclable or compostable post-use. Consumer expectations around durability and aesthetics are being met through material R&D, especially in the development of wood-plastic hybrids and thermoplastic composites.

The United Kingdom is experiencing a CAGR of 5.8% in the Bioplastic for Interior Market, with demand increasing in response to the country’s net-zero carbon goals and the growth of environmentally conscious architecture. Developers and designers are integrating bioplastic materials into workspaces, healthcare settings, and education infrastructure to improve air quality and reduce carbon footprint. Post-Brexit regulatory autonomy has allowed the UK to tailor sustainability mandates, which include the promotion of bioplastics. Local innovation centers and university-led pilot programs are developing cost-effective, bio-based alternatives to PVC and synthetic resins. Retail and office fit-outs are among the fastest-growing application areas.

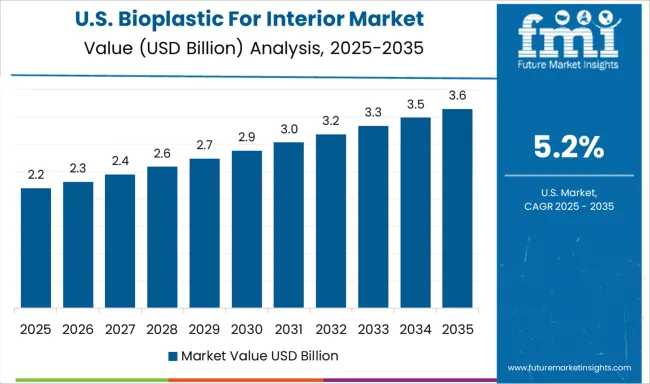

The United States is seeing a CAGR of 5.2 percent in the Bioplastic for Interior Market, largely driven by LEED certification trends, growing corporate sustainability targets, and increasing consumer interest in toxin-free interiors. Bioplastics are being adopted in corporate offices, schools, hospitals, and co-living spaces for furnishings, wall coverings, and ceiling panels. Large real estate developers are partnering with green material vendors to improve their ESG credentials. The market also benefits from advancements in additive manufacturing, allowing for customized, low-waste interior components made from biopolymers. Additionally, increased attention to indoor air quality has pushed demand for formaldehyde-free and low-VOC materials.

The bioplastic for interior market is growing steadily as sustainability becomes a key priority in automotive, furniture, and electronics design. Bioplastics such as PLA, PHA, and bio-based polyesters offer lightweight, low-emission alternatives to conventional plastics, ideal for panels, trims, upholstery, and decorative elements. Rising regulatory pressure to reduce carbon footprints, coupled with consumer demand for eco-conscious products, is driving adoption across industries. NatureWorks LLC, a leading PLA producer, supplies Ingeo™ biopolymers for interior applications requiring rigidity, heat resistance, and compostability. BASF SE brings a broad bioplastics portfolio including Ecovio® and ecoflex® suitable for molded components, coatings, and blends that enhance durability and processability. Novamont S.p.A. specializes in starch-based bioplastics (Mater-Bi), offering bio-based solutions for soft-touch interiors and flexible parts with a focus on circular economy integration.

Total Corbion PLA and Futerro are expanding global PLA capacity, enabling bio-based interior materials that balance sustainability with industrial-scale performance. Green Dot Bioplastics offers custom formulations of biodegradable and compostable resins engineered for interior durability, targeting both automotive and consumer product manufacturers. Mitsubishi Chemical Group brings innovation through its Durabio™ and BioPBS™ lines, providing bioplastics with superior impact resistance, UV stability, and clarity ideal for high-visibility or tactile interior parts. As brands prioritize carbon reduction, material safety, and end-of-life solutions, companies offering scalable, high-performance bioplastic alternatives with strong design flexibility are expected to lead the transformation of interior material sourcing.

As mentioned in official BMW Group sources, the company integrates recycled and bio-based materials such as ECONYL®, Deserttex™, and natural fiber composites into its vehicle interiors. This aligns with BMW’s “Design for Circularity” initiative, reducing CO₂ emissions and supporting full recyclability in future automotive interior design.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.6 Billion |

| Polymer Type | PLA (polylactic acid), Starch-based bioplastics, Polyhydroxyalkanoates (PHA), Cellulose-based bioplastics, Bio-PE (bio-polyethylene), Bio-PET (bio-polyethylene terephthalate), and Others |

| Application | Automotive interiors, Furniture & home interiors, Commercial & office interiors, Retail & hospitality interiors, and Others |

| End Use | Automotive OEM, Furniture manufacturers, Interior design firms, Retailers & showrooms, Contractors & Builders, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NatureWorks LLC, BASF SE, Novamont S.p.A., Total Corbion PLA, Futerro, Green Dot Bioplastics, and Mitsubishi Chemical Group |

| Additional Attributes | Dollar sales by bioplastic for interior polymer type including PLA, starch-based bioplastics, PHA, bio-PE, bio-PET, and other variants; by application in automotive interiors, furniture/home interiors, commercial/office interiors, and retail/hospitality interiors; by geographic region including North America, Europe, and Asia‑Pacific; demand driven by eco-conscious design adoption, circular-economy regulation, and lightweighting needs; innovation in PLA clarity, AI-powered lifecycle tracking, and closed-loop recycling; costs influenced by feedstock sourcing, certification standards, and scale-up investment. |

The global bioplastic for interior market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the bioplastic for interior market is projected to reach USD 8.2 billion by 2035.

The bioplastic for interior market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in bioplastic for interior market are pla (polylactic acid), starch-based bioplastics, polyhydroxyalkanoates (pha), cellulose-based bioplastics, bio-pe (bio-polyethylene), bio-pet (bio-polyethylene terephthalate) and others.

In terms of application, automotive interiors segment to command 39.0% share in the bioplastic for interior market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioplastics Market Analysis - Size, Share & Forecast 2025 to 2035

Bioplastic Packaging Bag Market Growth – Demand & Forecast 2025 to 2035

Bioplastic and Biopolymer Market Trends – Growth & Forecast 2024-2034

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

Automotive Bioplastic Market Growth - Trends & Forecast 2025 to 2035

Plant-Based Bioplastic Shrink Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Evaluating Algae-Based Bioplastics Market Share & Provider Insights

Algae-Based Bioplastics Market Analysis – Growth & Forecast 2024-2034

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Fortified Dairy Products Market Size and Share Forecast Outlook 2025 to 2035

Form-Fill-Seal (FFS) Films Market Size and Share Forecast Outlook 2025 to 2035

Formable Films Market Size and Share Forecast Outlook 2025 to 2035

Forchlorfenuron Market Size and Share Forecast Outlook 2025 to 2035

Formalin Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Foreign Trade Digital Service Market Size and Share Forecast Outlook 2025 to 2035

Forged and Casting Component Market Size and Share Forecast Outlook 2025 to 2035

Fortified Rice Market Size and Share Forecast Outlook 2025 to 2035

Fortifying Agent Market Size and Share Forecast Outlook 2025 to 2035

Forestry Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA