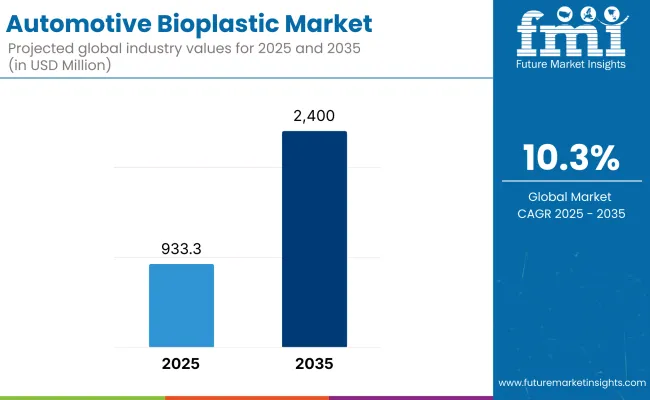

The global automotive bioplastics market is estimated to reach USD 933.3 million in 2025. A projected CAGR of 10.3% is expected to elevate the market value to USD 2.4 billion by 2035. This growth is being shaped by automakers’ decarbonization efforts and circular economy mandates, which are prioritizing the shift from fossil-based plastics to renewable polymer alternatives.

Bioplastics sourced from corn starch, polylactic acid (PLA), and cellulose are being introduced in vehicle interiors and under-the-hood applications to meet sustainability targets. In its 2025 Sustainability Update, BMW Group confirmed that over 25% of the polymer materials used in select i-Series vehicles are now bio-based.

The company noted a 30% reduction in lifecycle CO₂ emissions through this integration, aligning with its commitment to full climate neutrality by 2030. According to Thomas Becker, Head of Sustainability and Mobility Strategy at BMW, “Bio-based polymers are central to lowering embedded emissions without compromising material integrity,” as reported in BMW's March 2025 briefing.

Toyota, in its 2024 Environmental Report, cited expanded usage of bio-resins across hybrid vehicle dashboards and trims. The move was attributed to both cost-effective emissions reduction and improved component recyclability. Additionally, Honda’s 2025 Integrated Report disclosed long-term supply agreements with bio-polymer manufacturers in Japan and Thailand to ensure stable input flow for its electric vehicle platforms.

Material innovation has significantly enhanced bioplastic performance. In a February 2025 press release, BASF announced the launch of an upgraded Ecovio product line designed specifically for structural auto parts. According to Martin Brudermüller, CEO of BASF SE, “Automotive applications will be the second-largest end-use of bioplastics this decade,” supported by projected demand from EV producers across Europe and North America.

Regulatory support has further accelerated adoption of automotive bioplastic. The European Commission’s Directive 2025/118 mandated the integration of bio-derived materials in all non-structural vehicle components. In Asia, similar mandates have emerged. Japan’s Ministry of Economy, Trade and Industry (METI) confirmed new incentives in early 2025 for automakers incorporating biodegradable polymers into their supply chains.

To overcome thermal limitations of polylactic blends, Mitsubishi Chemical stated in its March 2025 R&D update that joint testing with Subaru is underway on high-heat PLA-PBAT composites for use in engine bay parts. Additionally, a €200 million investment in a French biorefinery-highlighted in the European Bioplastics Association’s 2025 bulletin-is expected to increase automotive-grade PLA production by 40% by 2027.

With increasing emphasis from vehicle manufacturers on sustainable materials, lightweight vehicle parts, and lower carbon emissions, the Bioplastics automotive segment comprising Bio PET and SUVs is expected to account for a significant share of the automotive bioplastic market.

Eco-Friendly plastics composite have a significant contribution to reduce the weight of vehicle so as to save the fuel along with decreasing the need of fossil fuel-based plastics; therefore it is most qualified for automobile manufacturers, material suppliers and innovators for sustainable automotive.

As automakers rapidly shift towards eco-friendly manufacturing practices, they are increasingly investing in durable bioplastic formulations that can be used to enhance component strength and recyclability while still providing optimal vehicle functionality, sustainability, and regulatory compliance.

Bio PET Provides Durability, Recyclability, and Lightweight Development in Vehicles

Paving its way into the automotive applications, folded under the roof of Bio PET (polyethylene terephthalate) segment proving to be one of the most popular choices when it comes to bioplastic material, and offering better flexibility, strong tensile strength, and higher recyclability, fuel & oil resistance, making it a better fit for interior panels, seat fabrics, upholstery & under-the-hood components.

Bio PET, unlike conventional PET, is made from renewable plant-based feedstock’s that can lower carbon emissions and help to decrease environmental harm, all while preserving the necessary mechanical properties for automotive applications.

This has driven adoption for high-performance Bio PET with improved UV resistance, high heat resistance, and structural integrity. According to Research, Bio PET is the most widely used plastic material in sustainable automotive interior applications accounting for over 60% of the total sustainable automotive interior materials segment, resulted in massive demand in this segment.

Market demand has also strengthened due to the expansion of the automotive circular economy initiatives that include bioplastic recycling programs, closed-loop material recovery, and second-life applications for post-consumer Bio PET, enabling greater sustainability and cost efficiency.

With the advent of next-gen Bio PET formulations with AI-optimized polymer engineering, ultra-lightweight composite integration, and better impact resistance, adoption has expanded even more, allowing for seamless adaptively as automotive manufacturing technology advances.

While Bio PET offers significant advantages over conventional PET in terms of recyclability, vehicle light weighting, and eco-efficiency benefits, the segment is challenged by high production costs, limited global availability of feedstock, and changing bioplastic processing standards.

Despite this, the development of these innovative technologies has contributed towards cost-effective and scalable solutions with long-term environmental benefits for polymer recyclability, which guarantee the persistence of Bio PET in the market as an automotive industry-particularly considering that current innovations for carbon-neutral feedstock may also impact the feedstock used in Bio PET synthesis, its developmental stage further contributes to its scalability.

Bio PET Becomes Standard in Interior Panels, Seating Fabrics and Other Sustainable Composite Structures

In particular, the segment Bio PET has witnessed robust adoption, mainly among passenger vehicle manufacturers, luxury car brands, and electric vehicle (EV) developers, as vehicle makers strive to integrate lightweight, high-strength bioplastic materials to improve vehicle efficiency and sustainability.

Bio PET is more eco-friendly compare to petroleum-based plastic because it has reduced carbon footprint and also it is more recyclable for long-lasting durability and superior performance, which comply with strict automotive sustainability rules.

Adoption is driven by the demand for high-flexibility fiber structures, improved impact absorption properties, and enhanced flame resistance in automotive-grade Bio PET. According to studies, more than 65% of next-gen EV models use Bio PET-based seat fabrics and panel materials to cater to climate-smart consumer demands, thereby enabling high market growth.

The growth of Bio PET usage across hybrid-electric and autonomous vehicle designs integrated with AI-enabled material formulation, composite construction design for weight savings and enhanced aerodynamics processes will drive further market penetration of Bio PET, promising improved future mobility efficiency and performance.

Biodegradable PET becomes the basis of an increasingly popular class of smart materials, which include self-healing polymer surfaces, thermodynamically adaptive composite layers, and AI-enabled dynamic wear monitoring, all of which reinforce adoption by assuring long-lasting vehicles and improved user experience.

Although the Bio PET segment offers benefits in material waste reduction, improved impact resistance, and optimized vehicle sustainability, it also faces challenges of fluctuating raw material supply, limited processing infrastructure, and protracted material certification timelines.

Newer innovations in bio-based polymer nanotechnology, block chain-tracked material sustainability compliance and AI powered circular material economies are creating more market access, production scalability and material lifecycle transparency, securing a stay of execution that is capable of seeing Bio PET applications in automotive continue to grow.

High-Performance Bioplastics Ensuring Better Fuel Efficiency for SUVs

After automotive vehicles, one of the most significant users of bioplastic materials are SUV segments. SUV bioplastics can help vehicle manufacturers reduce weight, boost fuel efficiency, and also increase structural strength without sacrificing performance.

Compared to smaller vehicle segments where strength-to-weight ratios are critical, SUVs hinge on using more durable, impact-resistant materials that still provide the desired durability but need to also meet environmental sustainability goals, which means better material efficiency and overall performance.

This has led to adoption among the advanced bioplastic materials market that incorporate bio-composite reinforcement, ultra-lightweight structural designs, and impact-resistant bio-polymer formulations. It is predicted that over 70% of SUVs use bioplastic based components for their interior trims, body panels and dashboard materials, giving this segment a strong demand

Advancements have been made in SUV manufacturing innovation, such as AI-driven material weight distribution modelling, sustainable composite chassis development, and energy-optimized thermal insulation, which have reinforced market expansion, resulting in greater efficiency and enhanced durability.

These elements have convinced manufacturers to adopt such technologies, and the combination of high-strength bioplastics in patterns, AI-assisted enhancements in load-bearing structures, flexible biopolymer shock absorbers, and integrated technologies with real-time adaptation to thermal and mechanical stresses has certainly contributed to a further increase in adoption due to their ability to ensure longer performance of the vehicles without damage and without compromising sustainability requirements.

In response to growing interest, hybrid-electric and off-road SUV models were created, with features like AI-powered bioplastic aerodynamics, ultra-lightweight chassis optimization, and real-time adaptive suspension materials, maximizing market growth while ensuring enhanced resilience, durability and environmental sustainability.

While the SUV sector would benefit from short-range GHG reductions, additional bioplastics adoption costs, prolonged performance verification timelines, and shifting safety certification methods prove disadvantageous compared to the other segments.

Nonetheless, new technologies in AI-driven material analysis, self-healing biosynthetic engineering, and in-situ health testing of bioplastic elements are enhancing structural integrity, regulatory compliance, and general vehicle longevity, allowing for further growth of bioplastic utilization in SUVs globally.

Bioplastics Find Wide Use in SUV Exterior Panels, Structural Reinforcements, and High-Performance Interiors

As industries continue to build momentum behind a new era of bioplastic innovation that prioritizes material efficiency, vehicle strength, and environmental responsibility, the SUV segment has reached new heights of adoption, especially among premium automakers, electric vehicle (EV) manufacturers and off-road vehicle brands.

These renewable resources will allow for lower carbon output compared to traditional metal and petroleum-derived plastics as well as superior weight distribution while maintaining performance at higher rates and increased recyclability.

Things such as AI-driven thermal adaptation, impact-resistant composite layering and real-time structural flexibility enhancements between the high-strength bioplastics for SUVs have drove adoption. According to the studies, more than 65% of the next-generation hybrid and electrical SUVs employed bioplastic-based body panelling and interior components that would boost vehicle efficiency and sustainability will ensure a steady demand for this segment.

While the SUV segment has benefits including weight reduction, optimized aerodynamics, and better vehicle sustainability, it must also deal with the counterfeiting of raw materials, higher raw material costs, supply chain complexity, and changes in automotive safety regulations concerning the use of new materials.

Innovations are emerging which include AI to drive costs down in vehicle of the future material testing processes, bioplastics themselves incorporating nanomaterials innovators, and applying block chain-enabled technology for material tracking as it relates to sustainability compliance, helping improve all cost factors, as well, as long-term performance, and industrial adoption, and in so doing are unlocking further bioplastic expansion in the SUV sector globally.

Being a key market for automotive bioplastics, North America will primarily witness stringent emission regulations, increased adoption of sustainable materials, and strong government support for green initiatives over the forecast period.

Bio-based innovation in materials continues to see increasing investment from USA and Canadian companies as automakers have produced dashboards, door panels and seat covers which integrate bioplastics. Moreover, the presence of major bioplastic producers and recycling programs are also contributing to market growth in this region.

State of the Art: The Advanced Manufacturing Techniques (3D printing with bioplastics and nanocomposite enhanced materials) additionally, the movement to circular economy models in North America is prompting automakers to set up closed-loop recycling systems to ensure sustainable use of materials.

In Europe, the demand for automotive bioplastics is burgeoning due to regulatory infrastructures like the European Green Deal and aggressive CO2 emission reduction goals. Germany, France and the UK are among the frontrunners in the adoption of bioplastics, with high levels of commitment to circular economy practices and sustainable vehicle manufacturing.

Furthermore, alliances between car manufacturers and bioplastic companies are driving innovation in biodegradable and compostable materials for automotive use. The drive for zero-waste manufacture, and green mobility solutions, is also fuelling interest in advanced bioplastic formulations.

In Europe, the focus from automotive manufacturers is on bio-based thermoplastics and composites, which will help boost vehicle sustainability without compromising structural integrity and safety standards. Advanced bio-plastic technologies, for example, are being progressed for use in a broad range of automotive applications facilitated by the region's drive toward low-emission vehicle manufacture.

The automotive bioplastic market in the Asia-Pacific region is projected to grow at the fastest pace, mainly driven by rapid industrialization, accelerating demand for electric and hybrid vehicles, and a greater awareness of environmental sustainability among consumers.

By doing even further, China, Japan, South Korea, and India are investing in more bio-based materials in automotive applications to curb plastic waste, supporting embedding more bio-based and functional coatings within the parts used to manufacture vehicles from scratch.

The use of automotive bioplastics in the region is further supported by government policies encouraging green mobility and supply chains in investments in sustainability. With the advent of bio-refinery and large production plants for bio based polymers, new potential has been generated for the automotive technology field.

Moreover, greater collaborations between automotive manufacturers and chemical companies are making bioplastic solutions scalable and cost-effective, facilitating the incorporation of this alternative in both low-cost and high-end automobiles.

Challenge

High Costs and Regulatory Complexities

High production costs, stringent regulatory compliance, and limited availability of raw materials are the major challenges faced by the Automotive Bioplastic Market. Production costs of bioplastics are higher than that of traditional petroleum-based plastics due to the need for more advanced manufacturing processes.

Beyond that, regulations like the EU Green Deal and USA sustainability mandates are introducing stringent requirements for less waste and emissions from vehicles. This will require car makers to invest in sustainable sourcing, novel processing methods, and optimal supply chain management to stay in line with these evolving regulations while keeping costs under control.

Performance Limitations and Market Awareness

While bioplastics are less harmful to the environment than petroleum-based plastics, they can also underperform, failing to achieve the same durability, heat resistance, and only possessing limited mechanical properties. These limitations limit their use in high-stress automotive parts and necessitate a lot of study to improve the material.

Moreover, the market growth is limited because consumer and industry awareness about the long-term benefits of bioplastics is low. The formulation has to consider material properties, need and educate stakeholders and develop a hybrid bioplastic formulation for widespread dissemination.

Opportunity

Rising Demand for Sustainable and Lightweight Materials

Furthermore, growing demand for sustainability and fuel efficiency has been driving the demand for lightweight and eco-friendly materials in the automotive industry. Bioplastics will lighten the weight of vehicles that could lead to higher fuel efficiency and lower carbon emissions.

To meet the increasingly stringent environmental regulations, car manufacturers are incorporating bioplastic components in Interior parts such as dashboard panels and Exterior Trims. The emerging market will favour brands that are investing in bio-based composites, advanced biopolymer formulations, and recyclable automotive components.

Advancements in Bioplastic Technology and Circular Economy Initiatives

advancements in bioplastics including bio based polymer, biodegradable composites as well as improved the thermal resistant material have expanded the use of bioplastic in automotive. And ambitious circular economy initiatives fostering end-of-life recycling and conversion of bio-waste into high-performance bioplastics are opening new vectors for growth.

The transition to a more sustainable automotive ecosystem will be dominated by automakers partnering with biopolymer producers and research organisations to create closed-loop recycling systems and bio-based alternatives.

The Automotive Bioplastic Market surged in growth rate during 2020 to 2024 because of advancing environmental regulations for emissions control alongside rising demand for environmentally friendly materials in cars. Manufacturers added bio-derived interior products and lightweight plastic solutions and recyclable materials to match global environmental objectives.

The widespread use of bio-based materials remained restricted by factors including manufacturing expenses and production limitations in addition to product longevity issues. Organizations created high-performance bioplastics and improved their production strategies and strengthened their partnerships with raw material providers.

The market between 2025 to 2035 will transform based on material science development and rising sustainability investments along with consumer demand for environmentally friendly vehicles. The Automotive Bioplastic industry will experience a new definition through AI-driven material development combined with nanotechnology-enhanced bioplastics coupled with large-scale bio-waste conversion processes.

The market will accelerate its adoption of bioplastics by receiving both regulatory backing for carbon-neutral manufacturing alongside extended producer responsibility (EPR) programs. Organizations applying innovative solutions for bio-based materials and lifecycle sustainability along with recyclability will establish themselves as future leaders within the Automotive Bioplastic Market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with emissions reduction and sustainability mandates |

| Technological Advancements | Development of bio-based polymers and interior automotive components |

| Industry Adoption | Increased use in dashboards, seating, and lightweight structural elements |

| Supply Chain and Sourcing | Dependence on agricultural feedstock and niche suppliers |

| Market Competition | Presence of traditional plastic manufacturers and emerging biopolymer firms |

| Market Growth Drivers | Demand for lightweight, fuel-efficient, and low-emission vehicles |

| Sustainability and Energy Efficiency | Initial focus on reducing plastic waste and carbon footprint |

| Integration of Smart Monitoring | Limited use of real-time lifecycle tracking and sustainability metrics |

| Advancements in Bioplastic Applications | Use in non-structural components and fuel-efficient vehicle designs |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of carbon-neutral manufacturing regulations and global bioplastic adoption targets. |

| Technological Advancements | Integration of AI-driven material science, biodegradable composites, and recyclable automotive parts. |

| Industry Adoption | Expansion into structural components, energy storage casings, and next-gen bio-polymer composites. |

| Supply Chain and Sourcing | Shift toward scalable bio-waste conversion, sustainable sourcing, and closed-loop material recycling. |

| Market Competition | Growth of specialized bioplastic providers, eco-friendly automotive suppliers, and circular economy partnerships. |

| Market Growth Drivers | Increased investment in sustainable manufacturing, end-of-life recyclability, and bio-based automotive solutions. |

| Sustainability and Energy Efficiency | Large-scale adoption of renewable feedstock, closed-loop recycling systems, and carbon-neutral bioplastic production. |

| Integration of Smart Monitoring | Expansion of AI-powered supply chain analytics, block chain-enabled material sourcing, and automated sustainability reporting. |

| Advancements in Bioplastic Applications | Evolution of high-performance structural bioplastics, smart polymer applications, and fully biodegradable automotive components. |

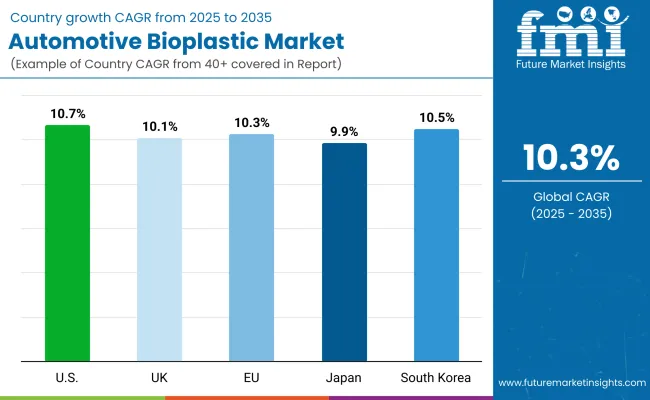

The USA automotive bioplastic market expands consistently because regulations now require automotive manufacturers to use sustainable materials for their vehicles. Engine manufacturers use bioplastics as a means to decrease greenhouse gases while they implement vehicle light-weighting programs that boost energy efficiency.

Market development continues to rise due to increasing customer demand for sustainable automotive components and the expanding presence of electric vehicles (EVs) on the market. Modern market expansion in the sector occurs because research and development investments are increasing for bio-based polymers alongside biodegradable plastics through ongoing innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.7% |

The UK automotive bioplastic sector expands because automotive manufacturers must follow government-established stringent emission regulations. The market expands rapidly because sustainable materials become increasingly prevalent in auto internal and external components.

The market demonstrates expanding growth because leading research organizations concentrate on creating future bio-based polymers. The awareness of consumers toward eco-friendly materials in vehicles drives up the demands for bioplastics in automotive production.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.1% |

The automotive bioplastic market within the European Union demonstrates robust expansion while Germany and France and Italy establish the pioneer roles in developing sustainable automobile materials. Strict regulations about vehicular emission control and circular economy implementation strengthen market demand.

The automotive sector uses bioplastics for interior applications and mechanical components as well as structural components thereby decreasing the need for conventional petroleum plastics. The market expansion for bio-based materials continues to grow because companies invest more in research and production development.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.3% |

The automotive bioplastic market in Japan is steadily expanding because Japan leads advanced materials research and environmentally friendly vehicle technologies development. Automobile manufacturers use bio-based polymers to improve sustainability in both electric and hybrid vehicles.

The main drivers for this growth include funding in eco-friendly production techniques along with materials which reduce vehicle weight. The adoption of bioplastics receives further motivation from government policies that push for automotive sector carbon neutrality.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.9% |

The growth of South Korean automotive bioplastics continues because of government programs dedicated to sustainable automotive production. Car producers use bio-based plastics to satisfy environmental standards at a global level and enhance the recyclability of automotive parts.

The market expansion receives additional growth from prominent automotive and chemical companies that invest in biodegradable plastics. The industry growth benefits from lightweight bioplastic materials used in electric vehicles because they enhance the energy performance of these vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.5% |

Industry Overview

The automotive industry displays quick expansion of bioplastic usage because of sustainability programs and strict environmental rules and the customer need for lightweight eco-friendly car materials. Companies that manufacture vehicles now embrace bioplastics originating from renewable natural resources including polylactic acid (PLA) as well as polyhydroxyalkanoates (PHA) and bio-based polypropylene for their ability to decrease environmental emissions while enhancing fuel efficiency.

The goal to improve recyclability, biodegradability and mechanical properties of bioplastics has enabled formulation development for interior trims along with exterior panels and under-the-hood applications. Leading companies in the industry concentrate their efforts on developing bio-based composites along with resisting damage longer while utilizing economical manufacturing strategies to expand market opportunities.

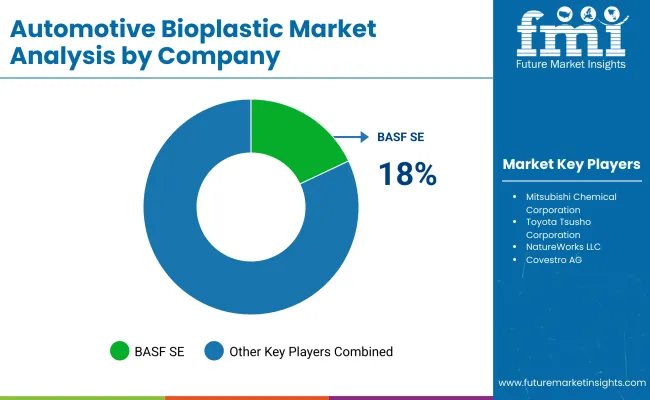

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Mitsubishi Chemical Corporation | 15-19% |

| Toyota Tsusho Corporation | 12-16% |

| NatureWorks LLC | 9-13% |

| Covestro AG | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Develops bio-based polyurethane and bio polyamides for automotive interior and exterior applications. |

| Mitsubishi Chemical Corporation | Specializes in high-performance bioplastics such as bio-based polycarbonate and biodegradable polymers. |

| Toyota Tsusho Corporation | Focuses on PLA-based automotive bioplastics and bio-composite materials for lightweight vehicle design. |

| NatureWorks LLC | Manufactures PLA-based bioplastics used in automotive interiors, packaging, and sustainable design applications. |

| Covestro AG | Produces bio-based polyurethanes and coatings for enhanced durability and eco-friendly automotive solutions. |

Key Company Insights

BASF SE (18-22%)

BASF maintains leadership as an automotive bioplastic provider through their production of bio-based polyurethane and bio polyamides for lightweight components that decrease fuel usage and environmental pollutants.

Mitsubishi Chemical Corporation (15-19%)

Mitsubishi Chemical develops innovative bioplastic solutions that encompass bio-based polycarbonate and biodegradable polymers to help the automotive industry achieve sustainability targets.

Toyota Tsusho Corporation (12-16%)

Toyota Tsusho leads the industry in bio-plastic automotive materials through their development of efficient bio-composite parts which decrease environmental stress.

NatureWorks LLC (9-13%)

NatureWorks produces sustainable bioplastic materials from PLA which serve interior trim applications and sustainable packaging solutions that advance the circular economy of the industry.

Covestro AG (7-11%)

The company Covestro develops sustainable high-end polyurethane materials and coatings that target automotive interior and exterior applications.

Multiple companies actively participate in the automotive bioplastic market through innovative research of bio-based material solutions and lightweight products. Notable players include:

The overall market size for Automotive Bioplastic Market was USD 933.3 Million in 2025.

The Automotive Bioplastic Market expected to reach USD 2.4 Billion in 2035.

The demand for the automotive bioplastic market will grow due to increasing regulations on vehicle emissions, rising adoption of sustainable materials, growing consumer preference for eco-friendly vehicles, advancements in biopolymer technology, and the need for lightweight components to improve fuel efficiency.

The top 5 countries which drives the development of Automotive Bioplastic Market are USA, UK, Europe Union, Japan and South Korea.

Bio PET and SUVs lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Vehicle, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Vehicle, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Vehicle, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Vehicle, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Vehicle, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Vehicle, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Vehicle, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Vehicle, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA