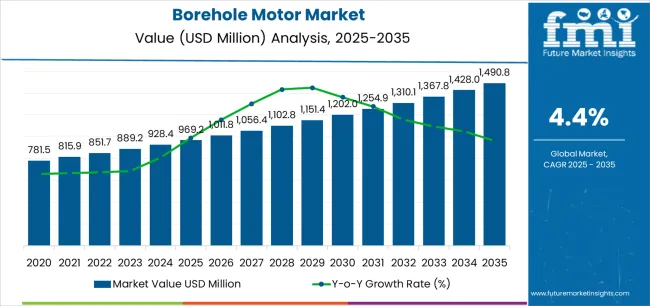

The global borehole motor market is valued at USD 969.2 million in 2025. It is slated to reach USD 1,490.8 million by 2035, recording an absolute increase of USD 521.6 million over the forecast period. This translates into a total growth of 53.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.54X during the same period, supported by increasing demand for groundwater extraction and deep well pumping, growing adoption of borehole motors in energy exploration and geothermal applications, and rising emphasis on efficient submersible pumping solutions across diverse water supply, oil & gas extraction, mining operations, and renewable energy applications.

Between 2025 and 2030, the borehole motor market is projected to expand from USD 969.2 million to USD 1,151.3 million, resulting in a value increase of USD 182.1 million, which represents 34.9% of the total forecast growth for the decade. This phase of development will be shaped by increasing global water scarcity driving groundwater development investments, rising oil & gas exploration activities in unconventional reserves and offshore fields, and growing demand for reliable deep well pumping systems in agricultural irrigation and municipal water supply applications. Pump manufacturers and energy companies are expanding their borehole motor capabilities to address the growing demand for high-performance and durable submersible motor solutions that ensure operational reliability and energy efficiency.

From 2030 to 2035, the market is forecast to grow from USD 1,151.3 million to USD 1,490.8 million, adding another USD 339.5 million, which constitutes 65.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of geothermal energy development and sustainable groundwater management, the development of intelligent motor technologies and remote monitoring capabilities, and the growth of specialized applications for mining dewatering, enhanced oil recovery, and deep aquifer exploration. The growing adoption of variable frequency drives and energy-efficient motor designs will drive demand for borehole motors with enhanced performance and operational optimization features.

Between 2020 and 2025, the borehole motor market experienced steady growth, driven by increasing infrastructure development in water supply systems and growing recognition of borehole motors as essential equipment for accessing deep groundwater resources and supporting resource extraction operations in diverse geological and industrial applications. The market developed as water utilities and resource extraction companies recognized the potential for borehole motor technology to enable deeper drilling capabilities, improve pumping efficiency, and support operational continuity while meeting demanding performance requirements. Technological advancement in motor sealing and cooling systems began emphasizing the critical importance of maintaining reliability and longevity in challenging downhole environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 969.2 million |

| Forecast Value in (2035F) | USD 1,490.8 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

Market expansion is being supported by the increasing global demand for reliable groundwater extraction solutions driven by water scarcity, agricultural irrigation requirements, and municipal water supply needs, alongside the corresponding need for efficient submersible pumping equipment that can deliver consistent performance, enable deep well operations, and maintain operational reliability across various water well drilling, oil & gas extraction, geothermal energy, and geological prospecting applications. Modern water utilities and resource extraction companies are increasingly focused on implementing borehole motor solutions that can improve pumping efficiency, extend equipment lifespan, and provide dependable operation in demanding subsurface environments.

The growing emphasis on sustainable water resource management and renewable energy development is driving demand for borehole motors that can support efficient groundwater utilization, enable geothermal heat extraction, and ensure comprehensive operational performance. Industrial operators' preference for submersible motor systems that combine reliability excellence with energy efficiency and maintenance simplicity is creating opportunities for innovative borehole motor implementations. The rising influence of smart water management and digitalization is also contributing to increased adoption of borehole motors that can provide monitoring capabilities without compromising durability or operational effectiveness.

| Growth Driver | Description |

|---|---|

| Water Scarcity | Rising global water stress boosts demand for efficient groundwater extraction. |

| Energy Exploration | Expanding oil & gas and geothermal projects require durable borehole motors. |

| Agricultural Irrigation | Increased reliance on groundwater for crop cultivation fuels motor adoption. |

| Smart Monitoring | Integration of IoT and remote diagnostics enhances performance reliability. |

| Sustainability Focus | Shift toward energy-efficient and low-maintenance submersible motor systems. |

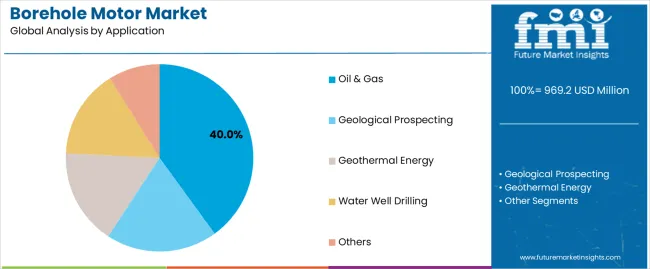

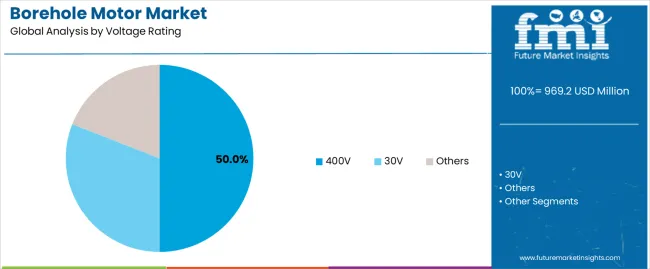

The market is segmented by voltage rating, application, and region. By voltage rating, the market is divided into 30V, 400V, and others. Based on application, the market is categorized into oil & gas, geological prospecting, geothermal energy, water well drilling, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The oil & gas application segment is projected to maintain its leading position in the borehole motor market in 2025, accounting for approximately 40% of the total market share and reaffirming its role as the preferred application category for submersible pumping in petroleum extraction, enhanced oil recovery, and wellbore fluid management. Oil & gas operators increasingly utilize borehole motors for their critical role in artificial lift systems, proven effectiveness in handling challenging downhole conditions, and essential contribution to maintaining production rates in mature fields and unconventional reserves. Borehole motor technology's proven effectiveness and operational versatility directly address the industry requirements for reliable artificial lift solutions and optimized production operations across diverse reservoir conditions and well configurations. This application segment forms the foundation of submersible motor demand in resource extraction industries, as it represents the sector with the greatest technical requirements and established performance expectations across multiple production enhancement techniques and field development strategies. Oil & gas industry investments in production optimization technologies continue to strengthen adoption among field operators and service companies. With operational pressures requiring maximized recovery rates and minimized downtime, oil & gas applications align with both production objectives and reliability requirements, making it the central component of comprehensive artificial lift strategies.

The 400V voltage rating segment is projected to maintain its dominant position in the borehole motor market in 2025, accounting for approximately 50% of the total market share and reinforcing its status as the preferred voltage category across multiple industrial and energy applications. The 400V segment’s dominance is attributed to its optimal balance between power efficiency, operational safety, and compatibility with standard electrical infrastructures in oil & gas, mining, and water well operations. Borehole motors rated at 400V are widely adopted for their ability to deliver consistent torque, enhanced reliability, and efficient energy utilization under varying load conditions and well depths.

This voltage class supports a broad range of downhole equipment configurations, offering the performance stability required for both continuous-duty operations and demanding field environments. Its widespread acceptance among field operators and service providers reflects the segment’s proven capability to meet technical specifications and cost-efficiency targets simultaneously. As industries continue to emphasize operational reliability and lifecycle cost optimization, the 400V segment remains central to borehole motor selection, ensuring stable performance, reduced maintenance requirements, and alignment with global electrical standards.

The borehole motor market is advancing steadily due to increasing demand for reliable deep well pumping solutions driven by water scarcity, resource extraction requirements, and renewable energy development requiring specialized submersible motor technologies providing enhanced performance characteristics and operational benefits across diverse water supply, oil & gas production, geothermal extraction, and mining dewatering applications. However, the market faces challenges, including high initial investment costs for deep well motor systems, technical complexity related to downhole operating conditions and maintenance accessibility, and competition from alternative pumping technologies including surface-mounted systems. Innovation in motor protection technologies and intelligent monitoring capabilities continues to influence product development and market expansion patterns.

The growing global water scarcity and increasing reliance on groundwater resources is driving investment in deep well drilling and sophisticated pumping infrastructure capable of accessing deeper aquifers and maintaining sustainable extraction rates. Modern water supply systems increasingly require borehole motors with enhanced efficiency and reliability to support long-term groundwater development while minimizing operational costs. Water utilities are increasingly recognizing the competitive advantages of advanced borehole motor systems for maximizing well productivity and ensuring supply security, creating opportunities for intelligent motor technologies with remote monitoring and predictive maintenance capabilities specifically designed for critical water infrastructure applications.

Modern borehole motor manufacturers are incorporating intelligent sensor technologies, remote monitoring systems, and predictive maintenance capabilities to enhance operational visibility, reduce downtime, and support comprehensive asset management through real-time performance data and diagnostic information. Leading companies are developing IoT-enabled motor systems, implementing vibration monitoring sensors, and advancing diagnostic technologies that detect potential failures before critical breakdowns occur. These innovations improve operational reliability while enabling new service opportunities, including condition-based maintenance, performance optimization services, and data-driven operational support. Advanced digitalization integration also allows operators to support comprehensive asset management objectives and cost optimization beyond traditional reactive maintenance approaches.

The expansion of energy cost pressures, operational optimization requirements, and environmental sustainability objectives is driving adoption of energy-efficient borehole motor designs including permanent magnet motors, variable frequency drive integration, and optimized hydraulic designs. These efficiency improvements reduce operational costs while supporting environmental compliance and enabling precise flow control for diverse applications, creating differentiated value propositions for cost-conscious and environmentally responsible operators. Manufacturers are investing in advanced motor technologies and drive system integration to serve demanding efficiency requirements while supporting operational flexibility and performance optimization across variable operating conditions.

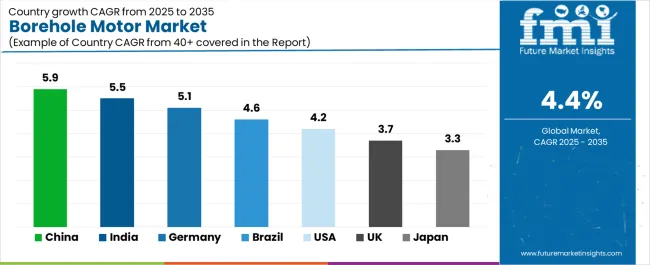

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| Brazil | 4.6% |

| United States | 4.2% |

| United Kingdom | 3.7% |

| Japan | 3.3% |

The borehole motor market is experiencing solid growth globally, with China leading at a 5.9% CAGR through 2035, driven by massive water infrastructure investments, expanding agricultural irrigation development, and increasing oil & gas exploration activities supporting energy security objectives. India follows at 5.5%, supported by critical groundwater dependence for agriculture and drinking water, expanding irrigation infrastructure, and growing industrial water demand. Germany shows growth at 5.1%, emphasizing renewable energy development including geothermal applications, quality engineering standards, and water management excellence. Brazil demonstrates 4.6% growth, supported by agricultural expansion, mining operations, and geothermal potential exploration. The United States records 4.2%, focusing on unconventional oil & gas production, agricultural irrigation, and water infrastructure modernization. The United Kingdom exhibits 3.7% growth, emphasizing offshore oil & gas operations and groundwater resource management. Japan shows 3.3% growth, focusing on geothermal energy development and high-quality industrial applications.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

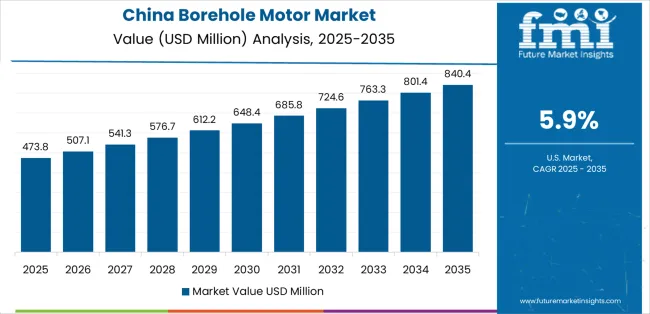

Revenue from borehole motors in China is projected to exhibit exceptional growth with a CAGR of 5.9% through 2035, driven by massive water infrastructure development programs and expanding agricultural irrigation networks supported by government initiatives addressing water security and food production objectives. The country's comprehensive resource development activities and increasing investment in efficient pumping technologies are creating substantial demand for borehole motor solutions. Major pump manufacturers and industrial equipment companies are establishing comprehensive borehole motor production capabilities to serve both domestic markets and export opportunities.

Revenue from borehole motors in India is expanding at a CAGR of 5.5%, supported by critical groundwater dependence for agriculture serving food security needs, expanding irrigation infrastructure addressing water scarcity, and growing industrial and municipal water demand across rapidly urbanizing regions. The country's comprehensive agricultural sector and water management challenges are driving sophisticated borehole motor market development throughout rural and urban areas. Leading pump manufacturers and water technology companies are establishing production and service facilities to address growing equipment demand.

Revenue from borehole motors in Germany is expanding at a CAGR of 5.1%, supported by the country's renewable energy development including geothermal district heating and power generation, advanced engineering capabilities, and emphasis on energy-efficient technologies. The nation's technological sophistication and sustainability focus are driving premium borehole motor capabilities throughout specialized applications. Leading engineering companies and pump specialists are investing extensively in advanced borehole motor technologies and geothermal applications.

Revenue from borehole motors in Brazil is expanding at a CAGR of 4.6%, driven by extensive agricultural sector expansion requiring irrigation infrastructure, significant mining operations needing dewatering solutions, and emerging geothermal energy potential exploration. Brazil's resource-based economy and agricultural importance are supporting investment in reliable pumping solutions. Equipment suppliers and agricultural technology companies are establishing comprehensive service networks for borehole motor applications.

Revenue from borehole motors in the United States is expanding at a CAGR of 4.2%, supported by the country's unconventional oil & gas production including shale formations and enhanced recovery operations, extensive agricultural irrigation infrastructure, and aging water system modernization requirements. The nation's comprehensive energy sector and water management needs are driving demand for reliable borehole motor solutions. Energy service companies and pump manufacturers are investing in product development and service capabilities to serve diverse market segments.

Revenue from borehole motors in the United Kingdom is growing at a CAGR of 3.7%, driven by the country's offshore oil & gas operations, groundwater resource management, and industrial applications requiring reliable submersible pumping solutions. The United Kingdom's mature energy sector and water management sophistication are supporting investment in quality borehole motor equipment. Energy companies and water utilities are establishing comprehensive equipment procurement programs incorporating performance specifications.

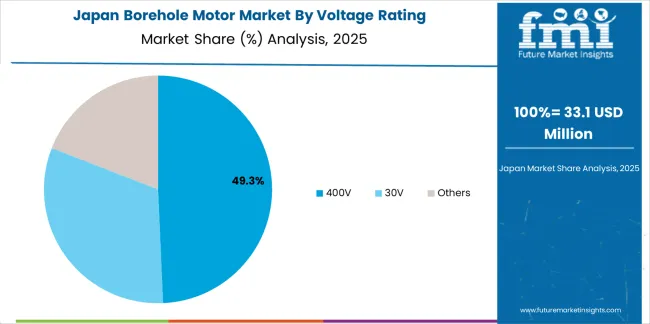

Revenue from borehole motors in Japan is expanding at a CAGR of 3.3%, supported by the country's geothermal energy development leveraging volcanic resources, high-quality industrial applications, and precision engineering standards requiring reliable submersible motor solutions. Japan's technological sophistication and renewable energy objectives are driving demand for premium borehole motor products. Engineering companies and energy developers are investing in specialized capabilities for advanced borehole motor applications.

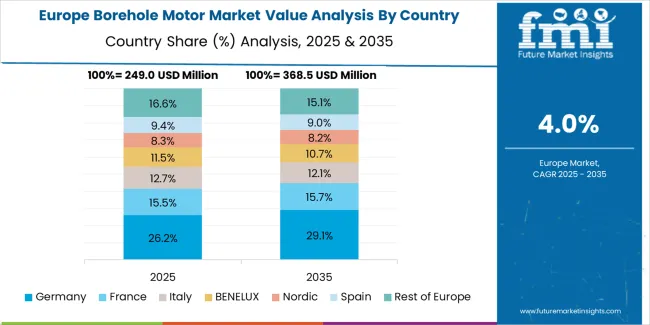

The borehole motor market in Europe is projected to grow from USD 249.8 million in 2025 to USD 378.4 million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain leadership with a 28.6% market share in 2025, moderating to 28.3% by 2035, supported by geothermal energy development, engineering excellence, and renewable energy infrastructure.

The United Kingdom follows with 17.8% in 2025, projected at 17.5% by 2035, driven by offshore oil & gas operations, water management systems, and industrial applications. France holds 15.4% in 2025, rising to 15.6% by 2035 on the back of agricultural irrigation and geothermal potential. Italy commands 12.7% in 2025, reaching 12.9% by 2035, while Spain accounts for 9.8% in 2025, rising to 10.0% by 2035 aided by agricultural development and water resource management. The Netherlands maintains 6.2% in 2025, up to 6.4% by 2035 due to water management expertise and agricultural applications. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 9.5% in 2025 and 9.3% by 2035, reflecting steady development in water infrastructure and energy applications.

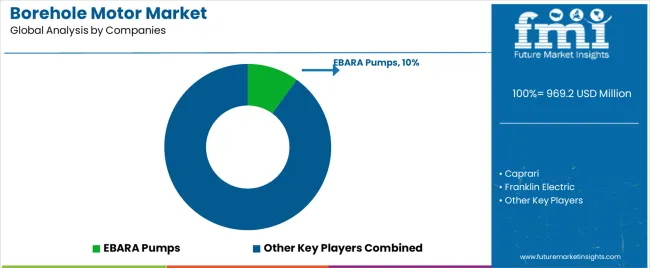

The borehole motor market is characterized by competition among specialized submersible motor manufacturers, integrated pump system providers, and industrial equipment companies. Companies are investing in motor reliability enhancement, intelligent monitoring technology integration, energy efficiency optimization, and application-specific design development to deliver durable, efficient, and performance-optimized borehole motor solutions. Innovation in permanent magnet motor technologies, sensor integration methods, and corrosion-resistant materials is central to strengthening market position and competitive advantage.

EBARA Pumps leads with 10% share, offering comprehensive borehole motor solutions with focus on reliability, performance optimization, and diverse application capabilities across water supply and industrial pumping. Caprari provides innovative submersible motor technologies with emphasis on energy efficiency and Italian engineering excellence. Franklin Electric delivers specialized electric motor solutions with focus on water systems and submersible applications. KSB offers industrial-grade pumping systems with comprehensive borehole motor capabilities. North Ridge Pumps provides specialized submersible motor solutions for demanding applications. Dab Pumps focuses on residential and light commercial borehole motor systems. VegaPM Technology offers advanced motor control and monitoring solutions. Sumoto provides Asian market-focused submersible motor products. Pedrollo S.p.A delivers Italian-engineered pump and motor systems. Davey supplies water pumping solutions for diverse applications. SLB (Schlumberger) offers oilfield submersible motor systems for artificial lift. Halliburton provides energy sector borehole motor solutions for production enhancement.

Borehole motors represent a specialized industrial equipment segment within submersible pumping and resource extraction applications, projected to grow from USD 969.2 million in 2025 to USD 1,490.8 million by 2035 at a 4.4% CAGR. These critical submersible motor systems-primarily serving diverse voltage and power configurations-provide essential pumping capabilities in water supply systems, oil & gas production, geothermal energy extraction, and mining operations where deep well access, operational reliability, and harsh environment tolerance are essential. Market expansion is driven by increasing water scarcity concerns, growing energy exploration activities, expanding geothermal development, and rising demand for efficient groundwater extraction across diverse municipal, agricultural, industrial, and energy production segments.

How Industrial Regulators Could Strengthen Standards and Operational Safety?

How Industry Associations Could Advance Technology Standards and Market Development?

How Borehole Motor Manufacturers Could Drive Innovation and Market Leadership?

How End-User Industries Could Optimize Equipment Performance and Reliability?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 969.2 million |

| Voltage Rating | 30V, 400V, Others |

| Application | Oil & Gas, Geological Prospecting, Geothermal Energy, Water Well Drilling, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | EBARA Pumps, Caprari, Franklin Electric, KSB, North Ridge Pumps |

| Additional Attributes | Dollar sales by voltage rating and application categories, regional demand trends, competitive landscape, technological advancements in motor design, reliability enhancement development, smart monitoring integration, and energy efficiency optimization |

The global borehole motor market is estimated to be valued at USD 969.2 million in 2025.

The market size for the borehole motor market is projected to reach USD 1,490.8 million by 2035.

The borehole motor market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in borehole motor market are 400v, 30v and others.

In terms of application, oil & gas segment to command 40.0% share in the borehole motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Borehole Equipment Market Size and Share Forecast Outlook 2025 to 2035

Borehole Yield Testing Market Size and Share Forecast Outlook 2025 to 2035

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Diagnostic Scan Tools Market Size and Share Forecast Outlook 2025 to 2035

Motorized Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Motorized Pool Tube Market Size and Share Forecast Outlook 2025 to 2035

Motor Generator Set Market Size, Growth, and Forecast 2025 to 2035

Motorized Decoiler Machine Market Growth - Trends & Forecast 2025 to 2035

Motorcycle Chain Market Analysis - Size, Share, and Forecast 2025 to 2035

Motor Protector Market Size, Growth, and Forecast for 2025 to 2035

Motorcycle Suspension System Market Growth - Trends & Forecast 2025 to 2035

Motor Control IC Market by Type, Industry, and Region – Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA