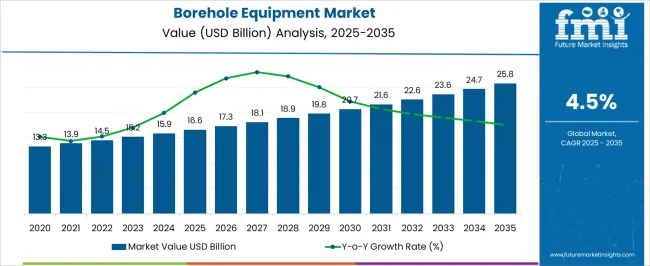

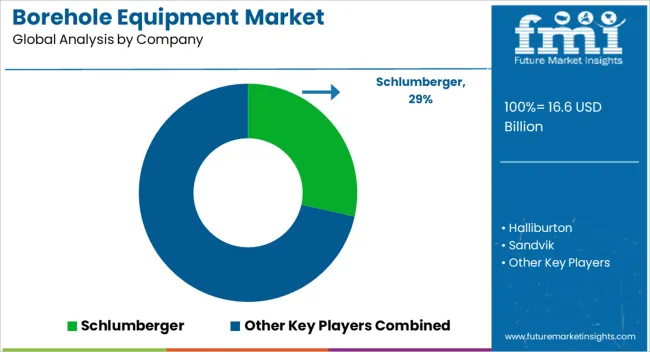

The global borehole equipment market is estimated at USD 16.6 billion in 2025 and is projected to reach USD 25.8 billion by 2035, growing at a CAGR of 4.5% during the forecast period. Growth is supported by rising demand for groundwater extraction systems, increasing agricultural irrigation requirements, and greater reliance on borehole-based water supply in rural and semi-urban areas.

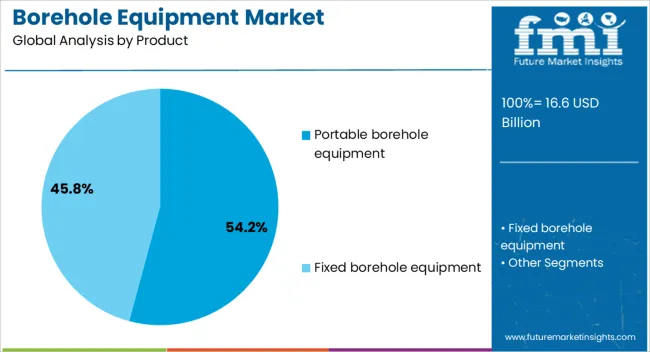

Portable borehole equipment accounts for 54.2% of the market share in 2025, owing to its ease of transport, lower operational costs, and suitability for small- to mid-scale applications. At the same time, demand for high-capacity and durable equipment is expanding across mining, construction, and municipal water projects, supported by advancements in pump efficiency, casing materials, and automated monitoring systems.

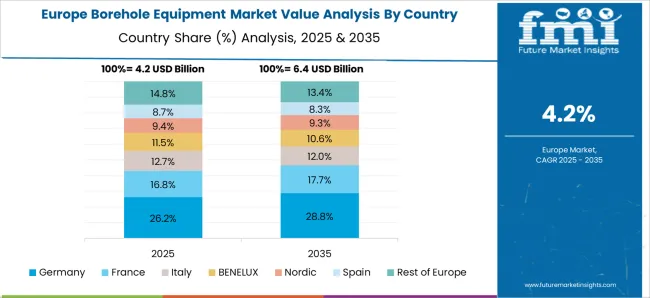

Key growth regions include North America, Asia-Pacific, and Europe, where rising infrastructure development, mining expansion, and water resource management projects are fueling adoption. In emerging markets, renewable-powered pumping systems and cost-efficient portable units are gaining traction, particularly in agriculture and rural water supply.

Top players in the borehole equipment market include Schlumberger, Halliburton, Sandvik, Dando Drilling International, Bohrmeister Ltd., Borehole Machinery, and Getech International. Vendors investing in energy-efficient solutions, deep borehole technology, and integrated monitoring systems will be best positioned to capture growth.

Overall, the borehole equipment market is poised for stable, long-term expansion, underpinned by technology upgrades, diversification of end-use industries, and the growing importance of sustainable water management across both developed and developing regions.

| Metric | Value |

|---|---|

| Borehole Equipment Market Estimated Value in (2025 E) | USD 16.6 billion |

| Borehole Equipment Market Forecast Value in (2035 F) | USD 25.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The borehole equipment market is expanding steadily, propelled by the increasing demand for efficient drilling solutions across multiple industries. Growth in mining and construction activities has driven the need for reliable and versatile borehole equipment. Technological advancements have led to the development of portable and user-friendly equipment, which enhances operational flexibility and reduces setup time.

The market has also benefited from rising infrastructure projects requiring groundwater exploration and extraction. Increasing mechanization and the shift toward hydraulic operations have improved drilling precision and operational safety.

As environmental regulations push for more efficient resource extraction, borehole equipment designed to optimize performance with minimal environmental impact is gaining traction. The market is expected to continue its growth trajectory, driven by the expansion of mining activities and increasing demand for portable equipment that supports flexible field operations. Key segments leading growth include Portable Borehole Equipment, Hydraulic operations, and Mining applications.

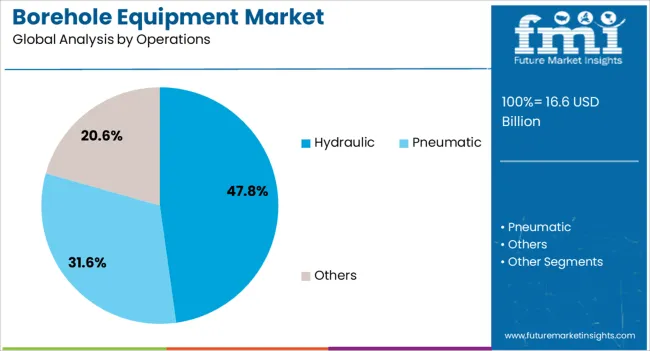

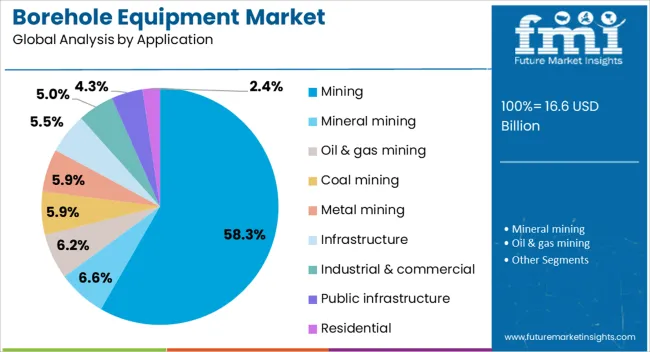

The borehole equipment market is segmented by product, operations, application, and region. By product, the market is divided into portable borehole equipment and fixed borehole equipment. In terms of operations, it is classified into hydraulic, pneumatic, and others. Based on application, the market is segmented into mining, mineral mining, oil and gas mining, coal mining, metal mining, infrastructure, industrial and commercial, public infrastructure, and residential. Regionally, the borehole equipment industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Portable Borehole Equipment segment is projected to hold 54.2% of the market revenue in 2025, reflecting strong demand for mobility and ease of deployment. This segment has gained popularity due to its suitability for remote and difficult-to-access drilling sites. Portability allows operators to quickly move equipment between locations, improving operational efficiency and reducing downtime.

Additionally, portable units typically require less manpower and are compatible with varying site conditions, making them ideal for exploratory drilling and small-scale operations. The ability to adapt to multiple applications has made portable borehole equipment highly attractive across mining and water resource sectors.

As field operations demand greater agility and responsiveness, this segment is expected to sustain its growth momentum.

The Hydraulic operations segment is expected to contribute 47.8% of the borehole equipment market revenue in 2025, leading in operation types. Hydraulic systems offer superior power and precision control, essential for effective drilling performance in complex geological formations.

The ability to generate high torque and apply consistent force enables more efficient penetration and reduced equipment wear. Operators value hydraulic systems for their reliability and adaptability to various drilling depths and diameters.

Moreover, advances in hydraulic technology have improved energy efficiency and system durability, further boosting adoption. The growing demand for faster and safer drilling solutions supports the prominence of hydraulic operations in the borehole equipment market.

The Mining application segment is projected to hold 58.3% of the borehole equipment market revenue in 2025, reflecting the sector's critical role in driving market demand. Mining operations require robust and precise drilling equipment for mineral exploration, extraction, and site development.

Increasing mining activities worldwide, particularly in resource-rich regions, have led to higher investment in efficient borehole equipment. The segment benefits from technological advancements that improve drilling speed and accuracy, reducing operational costs and environmental impact.

Additionally, mining projects often operate in remote areas where reliable portable equipment and hydraulic systems are vital. As global demand for minerals continues to grow, the mining application segment is expected to remain the dominant driver of borehole equipment market growth.

Borehole equipment demand is being propelled by expanding water projects, construction growth, mining exploration, and advanced operational technologies. The market is expected to benefit from continued investment in both resource extraction and infrastructure sectors.

Expansion in agricultural irrigation networks and rural drinking water schemes has fueled the requirement for borehole equipment capable of handling deeper and more complex drilling tasks. Governments and private entities are investing in large-scale water extraction projects to combat scarcity and ensure supply reliability. Borehole rigs, pumps, and casing systems are being upgraded for better efficiency and reduced downtime in continuous operations. Growth in groundwater monitoring and management programs has also pushed the adoption of advanced drilling solutions. The increasing frequency of drought cycles is accelerating investments in permanent and portable borehole systems, with manufacturers focusing on adaptability to different soil and rock conditions for consistent output and operational safety.

Rapid growth in infrastructure projects, including highways, bridges, and commercial complexes, is expanding demand for borehole equipment used in geotechnical surveys, foundation testing, and piling. Construction firms are prioritizing drilling systems that deliver accurate subsurface data for structural integrity assessment. Urban expansion and industrial zones require precise site analysis before heavy load-bearing constructions, thereby supporting equipment upgrades. Specialized drilling tools designed for rock penetration and core sampling are gaining adoption in civil engineering projects. Contractors are increasingly renting borehole rigs to balance cost efficiency with operational flexibility, while equipment makers are enhancing machine mobility and durability for varied terrains and climatic conditions.

The mineral and metal exploration industry continues to rely heavily on borehole equipment for core sampling, blast hole creation, and resource evaluation. Rising demand for precious metals and rare earth elements is pushing deeper and more remote drilling operations. Equipment reliability under extreme conditions has become a key purchasing factor for exploration firms. Demand is also driven by smaller mining operators seeking affordable yet efficient rigs for localized exploration. Manufacturers are introducing multi-purpose drilling units capable of both surface and underground applications. The sector’s focus on minimizing downtime has encouraged adoption of equipment with faster penetration rates, better fuel efficiency, and simplified maintenance protocols.

Digital integration and automation are improving drilling precision, operational safety, and project timelines in borehole applications. Real-time monitoring systems now allow operators to track equipment performance and geological conditions during drilling. Remote operation capabilities are reducing onsite workforce requirements, particularly in hazardous or remote environments. Integrated GPS and depth tracking systems are becoming standard features in new borehole rigs, ensuring accurate well placement. Predictive maintenance tools, supported by sensor-based diagnostics, are extending equipment lifespans. Software-enabled drill planning has helped operators optimize borehole placement for both cost and yield efficiency. These advances are strengthening operational decision-making and ensuring higher drilling success rates.

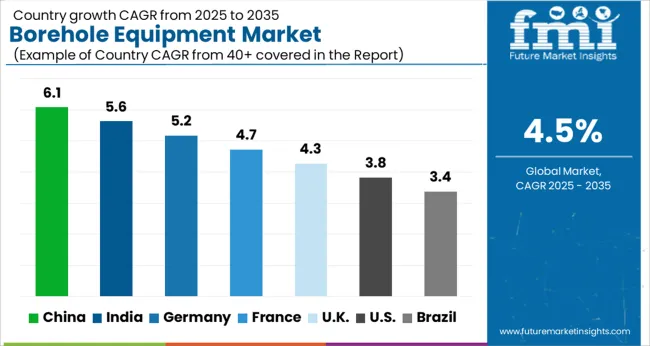

The borehole equipment market is projected to expand at a global CAGR of 4.5% from 2025 to 2035, supported by increased demand from water infrastructure projects, mining exploration, and geotechnical applications in large-scale construction. China leads with a CAGR of 6.1%, driven by extensive rural water supply programs, mineral exploration activities, and investment in deep drilling technologies. India follows at 5.6%, fueled by irrigation expansion, groundwater monitoring systems, and rising adoption of mechanized drilling solutions.

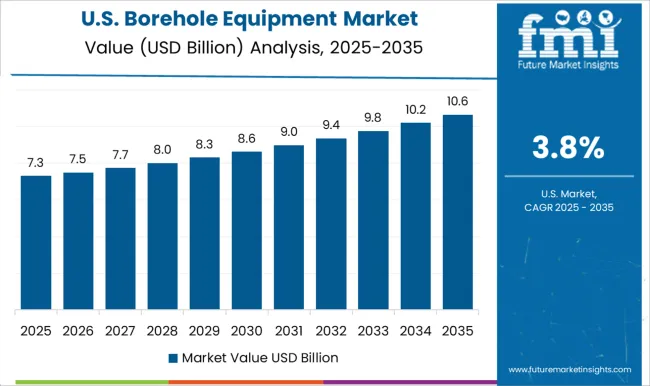

France grows at 4.7%,infrastructure renewal initiatives and stable demand from environmental monitoring. The United Kingdom achieves 4.3% growth due to offshore drilling support services and urban redevelopment projects, while the United States posts 3.8% growth, supported by oilfield redevelopment, hydrological surveys, and infrastructure maintenance needs. The report covers more than 40 countries, with these markets acting as strategic benchmarks for investment, product innovation, and capacity expansion in the borehole equipment industry across industrial, environmental, and resource extraction sectors.

China was assessed to grow at about 5.4% during 2020–2024, then the pace is estimated at 6.1% for 2025–2035, indicating a firmer expansion path supported by water infrastructure spending and mineral exploration. Early momentum was built by county-level drinking water programs, township irrigation upgrades, and site investigation work for transport corridors. The next phase is expected to be carried by deeper groundwater projects in arid provinces, hard-rock drilling for battery minerals, and stricter compliance on well integrity. Portable rigs, down-the-hole hammers, and higher-strength casing are being specified in tenders, which is likely to sustain pricing discipline. Rental fleets are scaling to serve short-cycle geotechnical jobs around new industrial parks. Local manufacturers are improving service networks so that time-to-repair stays tight in remote basins.

India recorded an estimated 4.9% CAGR in 2020–2024, which is projected to move to 5.6% in 2025–2035 as irrigation districts, rural water supply, and metro rail geotechnics absorb capacity. Initial growth came from mechanized rigs replacing legacy tractor-mounts in alluvial belts, supported by micro-finance for pump sets and casings. The upcoming period should benefit from river-link projects, aquifer mapping programs, and stricter monitoring of well drawdown that encourages better logging tools. Mine development in iron ore and bauxite corridors keeps core sampling steady, while public-health funding sustains borehole rehabilitation. My view is that India’s price-sensitive users will still favor modular rigs and standardized consumables that cut ownership costs, which keeps utilization high even when project cycles soften.

France was estimated around 4.1% CAGR for 2020–2024, shifting to 4.7% in 2025–2035 as municipal water renewal, tunneling surveys, and offshore wind geotech expand the addressable base. Early growth relied on replacement cycles for municipal pumps and limited greenfield drilling. The forward step is expected from karst monitoring, landfill piezometer programs, and near-shore foundation investigations that require rotary rigs with careful fluid management. Policy-driven leakage reduction plans are creating steady call-offs for rehabilitating legacy boreholes. In my opinion, France favors suppliers that offer clean-site operations, precise logging, and dependable after-sales coverage, which tilts demand toward mid-to-high specification rigs and premium casing strings for complex substrates.

The UK is projected at 4.3% CAGR for 2025–2035. For 2020–2024, a lower pace near 3.7% was derived because supply constraints, slow permitting, and delayed capital projects tempered rig utilization. The rise from 3.7% to 4.3% is tied to normalized lead times, catch-up spending on district water resilience, and stronger geotechnical activity in brownfield redevelopment. Calculation context was set with global CAGR 4.5% and UK forward CAGR below that line, so the historic base was positioned modestly lower than global to match weaker earlier investment. Evidence comes from municipal tenders that increased after 2022 and from higher order intake for monitoring wells on rail and logistics sites. My view is that hybrid rental-ownership models and standardized consumables will keep margins acceptable while improving availability across regions.

The USA posted about 3.2% CAGR in 2020–2024, rising to 3.8% for 2025–2035 as oilfield redevelopment, aquifer storage and recovery, and highway geotechnics maintain steady pull for rigs and consumables. Early years were shaped by selective replacement in municipal wells and scattered mineral exploration. The next period benefits from federal funding that prioritizes drought mitigation, ASR pilots in Western states, and bridge foundation investigations that need continuous coring. Demand for data-rich logging and low-disturbance drilling methods is increasing in suburban infill works. In my judgment, suppliers that combine reliable service with transparent parts pricing will capture repeat orders from utilities and EPCs managing multi-year programs.

The borehole equipment market is shaped by a mix of global oilfield service leaders, specialist drilling technology providers, and region-focused equipment manufacturers. Schlumberger commands a prominent position by integrating advanced downhole technologies with comprehensive service offerings for both water well and mineral exploration projects. Halliburton leverages its expertise in drilling fluids, well construction, and completion systems to support borehole efficiency in varied geologies.

Sandvik stands out for its high-performance drilling rigs, rotary tools, and consumables designed for mining and geotechnical applications. Dando Drilling International focuses on versatile rig designs catering to water well, mineral exploration, and geotechnical drilling across challenging terrains. Bohrmeister Ltd. emphasizes precision engineering and reliability in borehole machinery for municipal and industrial water projects. Borehole Machinery delivers cost-effective drilling solutions with an emphasis on portability and ease of maintenance for remote operations.

Getech International integrates geoscience data analytics with equipment solutions, helping clients optimize site selection and drilling efficiency. Key strategies across these players include expanding product portfolios to serve both shallow and deep drilling applications, investing in automation and telemetry for real-time borehole monitoring, and establishing localized service hubs to reduce equipment downtime. Partnerships with water utilities, mining companies, and infrastructure developers are strengthening demand pipelines, while investments in durable materials and energy-efficient systems are enhancing operational life cycles.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Portable borehole equipment and Fixed borehole equipment |

| Operations | Hydraulic, Pneumatic, and Others |

| Application | Mining, Mineral mining, Oil & gas mining, Coal mining, Metal mining, Infrastructure, Industrial & commercial, Public infrastructure, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger, Halliburton, Sandvik, Dando Drilling International, Bohrmeister Ltd., Borehole Machinery, and Getech International |

| Additional Attributes | Dollar sales, share, competitive landscape, regional demand patterns, key end-user sectors, pricing trends, technology adoption rates, supply chain risks, and growth opportunities. |

The global borehole equipment market is estimated to be valued at USD 16.6 billion in 2025.

The market size for the borehole equipment market is projected to reach USD 25.8 billion by 2035.

The borehole equipment market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in borehole equipment market are portable borehole equipment and fixed borehole equipment.

In terms of operations, hydraulic segment to command 47.8% share in the borehole equipment market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA