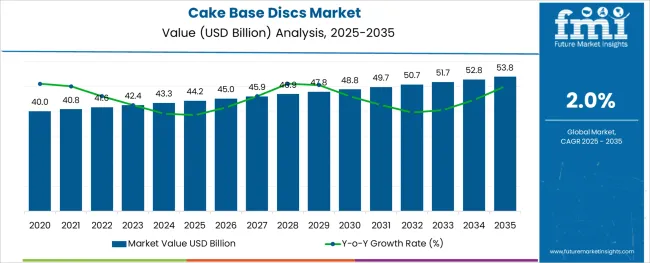

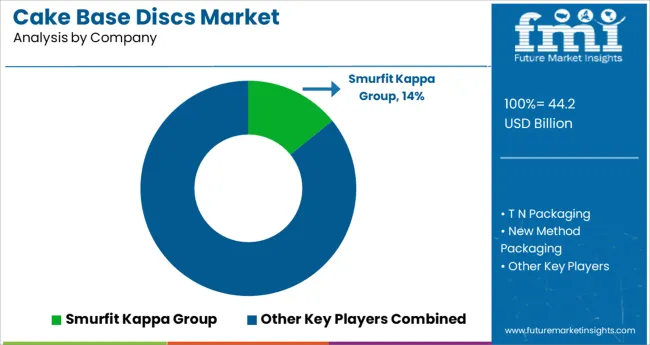

The Cake Base Discs Market is estimated to be valued at USD 44.2 billion in 2025 and is projected to reach USD 53.8 billion by 2035, registering a compound annual growth rate (CAGR) of 2.0% over the forecast period.

The cake base discs market is witnessing consistent growth due to increasing demand for structured and hygienic support in cake presentation and transportation. The market is benefiting from rising bakery consumption, premium packaging trends, and growing demand for personalization in food aesthetics. Foodservice providers and bakeries are focusing on enhancing customer experience through visually appealing and functionally durable cake packaging.

Sustainability goals are also influencing material selection, with biodegradable, recyclable, and food-grade options gaining momentum. Manufacturers are increasingly offering thickness variants and customized branding options, meeting the dual purpose of support and marketing.

Technological advancements in die-cutting, lamination, and printing have allowed for scalable and cost-effective production across a range of disc sizes and styles. As artisanal and mass-produced cakes continue to grow in parallel, future demand will be driven by environmentally responsible materials, cost efficiency, and supply reliability across both small businesses and high-volume bakery chains.

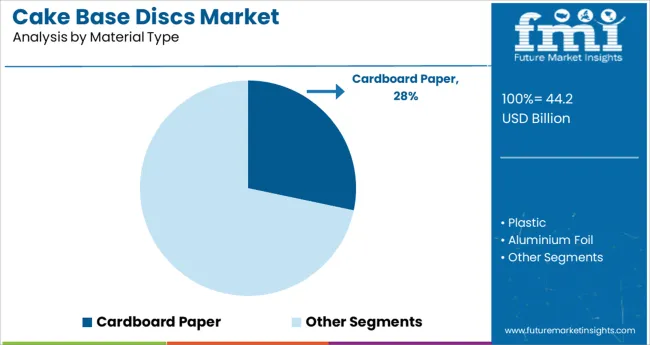

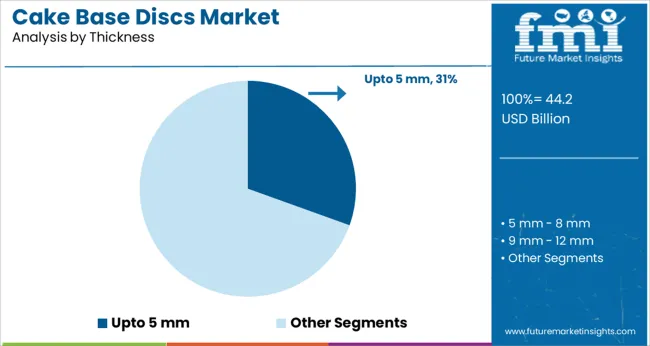

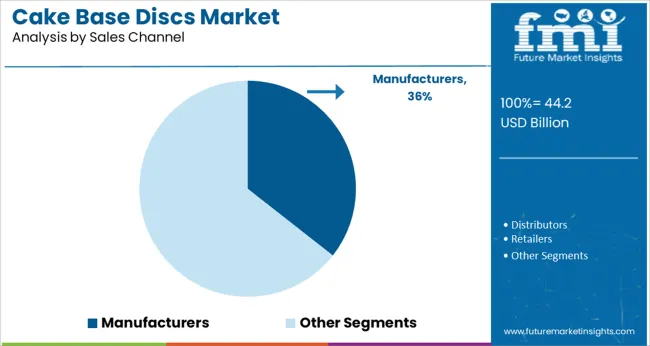

The market is segmented by Material Type, Thickness, and Sales Channel and region. By Material Type, the market is divided into Cardboard Paper, Plastic, Aluminium Foil, Silver Foil, Gold Foil, and Wood. In terms of Thickness, the market is classified into Upto 5 mm, 5 mm - 8 mm, 9 mm - 12 mm, and More than 12 mm. Based on Sales Channel, the market is segmented into Manufacturers, Distributors, Retailers, and E-retail. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cardboard paper subsegment is expected to account for 28.30% of the material type category's total revenue in 2025, making it the most widely used material. Its dominance has been influenced by its lightweight properties, structural rigidity, and ease of customization.

The cost-effectiveness of cardboard paper, combined with its compatibility with both plain and decorative laminations, has made it a preferred choice among commercial bakeries and independent cake decorators. Manufacturers are favoring this material for its recyclable and biodegradable nature, aligning with global sustainability mandates.

Furthermore, its flexibility in thickness adjustment and printability supports branding requirements without compromising functionality. These advantages have contributed to sustained demand for cardboard paper in diverse distribution channels and use cases, reinforcing its leading position in the market.

The upto 5 mm segment is projected to hold 30.50% of total market revenue in 2025 within the thickness category, making it the most utilized specification. Its market leadership is attributed to its ideal balance between structural support and material economy.

This thickness range is particularly favored for standard-sized cakes, offering sufficient strength to withstand handling, storage, and transportation without adding unnecessary weight or cost. Additionally, it supports the application of decorative finishes such as foils, embossing, or printed branding, enhancing visual appeal in retail settings.

Small and mid-sized bakeries have shown consistent preference for this format due to its suitability across various cake shapes and sizes. The manufacturing ease and wide availability of upto 5 mm discs have enabled this segment to become the standard specification for general-purpose cake bases.

Manufacturers are projected to contribute 35.60% of the total market revenue in 2025 in the sales channel segment, positioning them as the dominant supply source. This leadership is being driven by the demand for bulk purchasing, customized product solutions, and faster lead times from direct manufacturing units.

Bakeries and foodservice providers increasingly prefer working directly with manufacturers to secure better pricing, design flexibility, and consistent quality control. Manufacturers also offer packaging innovation, private labelling, and eco-conscious product lines, which have added value for commercial clients aiming to differentiate their offerings.

Additionally, strategic investments in automation and regional production hubs have improved supply chain reliability and reduced turnaround times. These capabilities have solidified manufacturers as the preferred sales channel for businesses seeking tailored, cost-effective, and scalable cake base disc solutions.

The availability of acrylic cake base disks is empowering bakers to create masterpieces while making the cake decoration process hassle-free. In addition to this, since small cakes are in high demand, sales of cake base disks with small diameters are likely to grow during the forecast period.

Besides this, manufacturers are focusing on creating cake base disks of different sizes, which is opening up a customer's market with the availability of choices, and boosting up the sales of cake base discs. Increasing proclivity towards online ordering of bakery items demands a sturdy and reliable means to ensure efficient delivery of cakes.

Demand for cake base discs for solid is growing to offer solid storage for cakes and bakery items during transportation. Paper-based cake discs or trays are an environmentally friendly alternative to polystyrene or plastic cake discs or trays, and manufacturers are investing more in their production.

Demand for cake discs that are produced from 100% biodegradable corrugated cardboard and are a sustainable resource is much higher than others, which is a major factor for greater cake base discs market share.

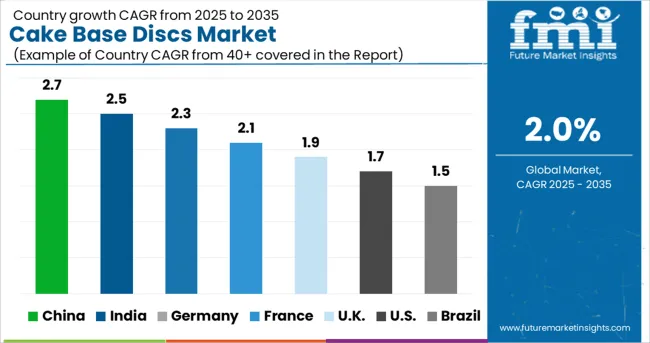

The presence of emerging economies, rising per capita income, and increased popularity of bakery and confectionery items in the Asia Pacific Excluding Japan (APEJ) region are expected to fuel demand for cake base discs over the forecast period. During the projected period, demand for cake base discs is expected to rise due to the expansion of the bakery and confectionery industries in Western Europe.

In terms of cake base discs market share, China is predicted to lead, while India is expected to develop at a rapid pace over the projection period. During the projected period, the cake base discs market in Japan is expected to develop at a moderate rate, with adequate sales of cake base discs.

The global cake base discs market, which is predicted to grow at a significant rate over the forecast period, is dominated by Western Europe and North America. During the projected period, the United States in North America and Germany in Western Europe are expected to maintain their dominance.

In terms of sales of cake base discs and growth rate, Brazil in Latin America is predicted to be quite lucrative during the forecast period. During the projection period, the Middle East and Africa region is expected to grow at a positive CAGR.

TN Packaging, Smurfit Kappa Group plc, Sabert Corporation, Mondi Group Plc, Wilton Brands LLC, New Method Packaging, and Sun Packaging are some key players in the cake base discs market, which contribute to the substantial cake base discs market share.

The research is based on firsthand experience, industry analysts' qualitative and quantitative analysis, and contributions from industry professionals and value chain players.

The study delves into parent market trends that influence the sales of cake base discs, as well as regulating factors and market attractiveness by category. The study also shows how important market factors affect market segmentation and geographies qualitatively.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 2% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | Material type, thickness, sales channel, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | TN Packaging; Smurfit Kappa Group plc.; Sabert Corporation; Mondi Group Plc; Wilton Brands LLC; New Method Packaging; and Sun Packaging |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global cake base discs market is estimated to be valued at USD 44.2 billion in 2025.

It is projected to reach USD 53.8 billion by 2035.

The market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types are cardboard paper, plastic, aluminium foil, silver foil, gold foil and wood.

upto 5 mm segment is expected to dominate with a 30.5% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Cake Base Discs Companies

Cake Enzyme Market Size and Share Forecast Outlook 2025 to 2035

Cake Boxes Market from 2025 to 2035

Cake Concentrate Market

Cupcake Box Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Cupcake Wrappers Manufacturers

Cupcake Tray Machines Market

Rice Cake Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

No-Fat Cake Market Trends - Innovations & Consumer Demand 2025 to 2035

Teaseed Cake Market – Trends & Forecast 2025 to 2035

Instant Cake Gel Market

Instant Cake Emulsifier Market

Aerating Cake Emulsifier Market

Activated Cake Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Activated Cake Emulsifier Suppliers

Base Editing Market Size and Share Forecast Outlook 2025 to 2035

Base Transceiver Station (BTS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA