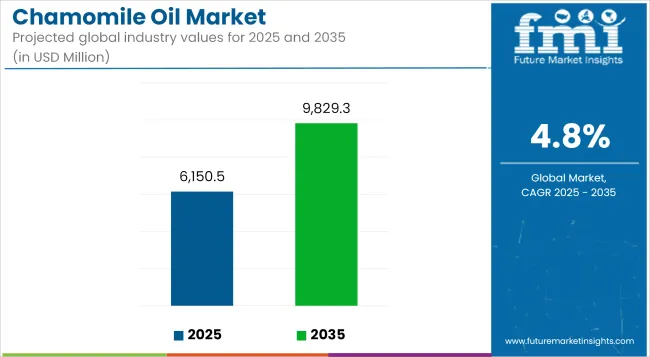

The chamomile oil industry is anticipated to record sales of USD 6,150.5 million in 2025, with projections indicating a market size of USD 9,829.3 million by 2035, driven by a CAGR of 4.8%. This momentum reflects rising consumer inclination toward botanical-based solutions in beauty and wellness regimes. Chamomile oil's perceived anti-inflammatory, calming, and antimicrobial properties are being increasingly favored across skin care and aromatherapy applications, marking it a staple in the natural personal care movement.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6,150.5 million |

| Industry Value (2035F) | USD 9,829.3 million |

| CAGR (2025 to 2035) | 4.8% |

Demand has been consistently shaped by clean-label preferences and a broader shift toward natural active ingredients across high-value consumer segments. The expansion of the aromatherapy sector particularly in home use and spa settings has further contributed to heightened demand. However, challenges such as fluctuating raw material availability, higher costs of certified organic chamomile, and limited sourcing options have restrained aggressive volume scaling.

Key trends include increased incorporation of German and Roman chamomile variants in premium formulations, growing interest in essential oil blends, and the shift toward CO₂-extracted chamomile oils for superior efficacy. Manufacturers have actively diversified their offerings with multiple purity grades and traceable origin claims to cater to B2B clients in personal care, food, and pharma sectors.

Over the next decade, the market is expected to experience consistent upward movement as demand from therapeutic and cosmeceutical applications continues to intensify. By 2025, aromatherapy and cosmetics will remain the core revenue generators, accounting for over 85% of the total value collectively.

By 2035, increased adoption of chamomile oil in dietary supplements and stress-relief nutraceuticals is likely to gain momentum, supported by expanding consumer awareness and integration in holistic health systems. The growth outlook remains strong, particularly in North America and Europe, with regional manufacturers scaling operations to meet traceability and purity benchmarks.

With a projected share of 8.7% in 2025, the dietary supplements segment remains small but fast-evolving within the chamomile oil market. Demand is being catalyzed by consumer preference for stress-relief and sleep-supporting botanicals, where chamomile is increasingly positioned as a multifunctional adaptogenic agent.

Chamomile oil’s GRAS status and long-standing recognition in pharmacopeias including the United States Pharmacopeia (USP) have supported its use in ingestible formulations, particularly in softgel capsules, lozenges, and oil-infused gummies. Leading players such as Nature’s Answer and NOW Foods have introduced standardized chamomile oil formats for direct consumption or as additives in calming blends.

Clinical interest in chamomile oil’s anti-anxiety and mild sedative effects has grown in tandem with consumer interest in non-pharmaceutical interventions. However, challenges remain regarding dosage precision, allergenicity risks from chamazulene, and variation in active compound concentration due to sourcing and distillation processes.

Regulatory oversight from bodies like the European Food Safety Authority (EFSA) requires detailed documentation for health claims, limiting aggressive market expansion. Despite this, the outlook remains positive, supported by the rising popularity of herbal nutraceuticals and continued innovation in encapsulation and oil delivery systems.

Holding a projected market share of 4.1% in 2025, the pharmaceutical use of chamomile oil is being revitalized through modern phytotherapeutic formulations. Its anti-inflammatory and antispasmodic properties have been historically utilized in topical ointments and oral preparations, with contemporary demand coming from dermatology and gastrointestinal support categories. In Germany, chamomile remains listed in the German Commission E monographs for gastrointestinal spasms and inflammatory skin conditions, reinforcing its acceptance in botanical drug formulations.

Companies such as Schwabe Pharma and Weleda continue to formulate chamomile-based preparations under traditional herbal registration (THR) frameworks across Europe. Advancements in CO₂ extraction and distillation technology are enhancing the therapeutic efficacy of Roman and German chamomile oils, supporting their use in prescription-free topical analgesics, wound care, and even pediatric calming drops.

Nonetheless, widespread pharmaceutical uptake is constrained by the lack of standardized clinical trials at scale and variability in active compound levels between botanical sources. Increasing interest in botanical APIs and EU herbal medicinal product guidelines are expected to drive further integration into mainstream therapeutic product portfolios through 2035.

Supply Chain Volatility and Raw Material Constraints

The climatic and agricultural challenges have led to volatility in supply of raw materials that is among the most significant challenges for chamomile oil industry. The chamomile oil production depends on weather conditions, and crop yield is unpredictable. In addition, manufacturers and suppliers have also been challenged by the fluctuation in global demand, which affects price stability. Many small-scale farmers realize meager but inconsistent yields, leading to a shortage of supply.

Expansion of Organic and Therapeutic Applications

Demand for organic and therapeutic-grade chamomile oil has limited growth opportunities for the global chamomile oil market. Chemical-free, sustainably sourced oils, which consumers are using for everything from aromatherapy to natural cosmetics to herbal medicine, are increasingly in demand.

E-commerce and direct-to-consumer channel growth is also allowing brands to meet more consumers. Moreover, modern extraction methods such as CO₂ extraction increase oil purity and efficiency, making chamomile oil a premium product in high-value wellness and skin care products.

Increasing consumer enthusiasm for natural and organic kinds of aromatherapy, personal hygiene, and cosmetics is anticipated to drive the chamomile oil market in the USA Increasing practice of holistic wellness activities drives the demand for essential oils market, for instance, essential oils are used for stress relief and relaxation purpose.

The market is also propelled by its increasing need in pharmaceutical formulations, dietary supplements and functional beverages. Sales are also propelled by the increasing availability of good-quality chamomile oil through e-commerce platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

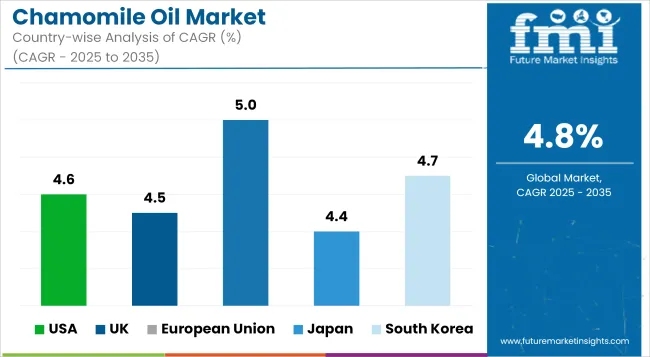

| USA | 4.6% |

Based on the growth in consumer awareness regarding herbal skincare and natural remedies, the UK market for chamomile oil is experiencing constant growth. Natural and Sustainably Produced Essential Oils. Consumers are increasingly seeking organic and sustainably sourced essential oils, with more attention to environmentally friendly sourcing practices and ethical production processes.

Growth is driven by the wellness and aromatherapy industry, as well as growing demand for plants-based medicinal products. Furthermore, the growing importance of the pharmaceutical applications of chamomile oil particularly in anti-inflammatory and stress-relieving treatments fuel the growth of chamomile oil market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

Regional Overview the European Union holds a significant portion of the market share for chamomile oil owing to high demand from the cosmetics, personal care, and pharmaceutical industries. Germany, France, and Italy are the main consumers of chamomile with extensive applications in herbal medicine, skincare creams, and perfumery in natural aromatics.

Increasing the regulations of synthetic chemicals used for cosmetic products in the region is fueling the shift of the manufacturers towards organic and natural essential oils. Moreover, sustainability programs by EU are encouraging ethical sourcing and green production practices which are also supporting market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.0% |

Japan's chamomile oil market is poised for growth as aromatherapy, herbal medicine and organic cosmetics are becoming popular in Japan. India is known for its culture of natural healing and alternative medicine, thanks to which is increasing the demand for chamomile oil in relaxation therapy, stress relief, and medicine.

And the shoe also has been reaching luxury beauty market which is adopting chamomile oil into niche-level skincare and haircare products that is fueling the market growth. New opportunities are also emerging due to the growing demand for functional foods and beverages with herbal extracts as key ingredient.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The rise of K-beauty and the need for botanical ingredients in skin care formulation, South Korea's chamomile oil interest is growing. With interest in natural and organic personal care rising among consumers, chamomile oil is in demand for inclusion in facial serums, moisturizers, and anti-inflammatory skin care products.

The wellness & spa industry is another factor fueling the market, as aromatherapy-based therapies gain in popularity. The growth is also being fueled by herbal teas and supplements with chamomile extracts.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

The Chamomile Oil Market is witnessing significant growth, driven by rising demand for natural and organic essential oils in aromatherapy, personal care, pharmaceuticals, and food applications. Chamomile oil, derived primarily from Roman chamomile (Chamaemelum nobile) and German chamomile (Matricaria chamomilla), is valued for its anti-inflammatory, calming, and skin-soothing properties.

Increasing consumer preference for herbal remedies and plant-based skincare products, along with the expanding wellness industry, is fueling market expansion. Leading companies are focusing on sustainable sourcing, advanced extraction techniques, and product diversification to strengthen their market position.

The overall market size for chamomile oil market was USD 6,150.5 Million in 2025.

The chamomile oil market is expected to reach USD 9,829.3 Million in 2035.

The rising consumer interest in natural and organic personal care products fuels Chamomile Oil Market during the forecast period.

The top 5 countries which drives the development of Chamomile Oil Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of application, Aromatherapy to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chamomile Extracts for Soothing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chamomile Seeds Market – Growth & Demand 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA