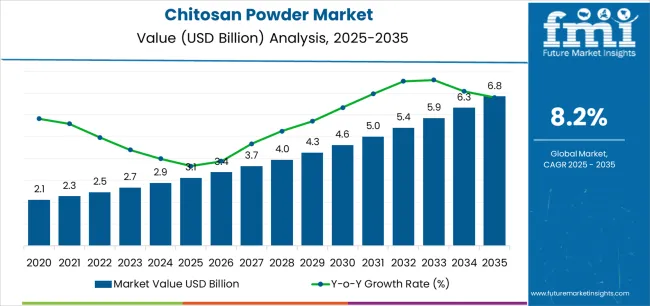

The Chitosan Powder Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

The Chitosan Powder market is experiencing steady growth driven by its versatile applications across agriculture, food and beverage, and pharmaceutical industries. The future outlook for this market is shaped by increasing demand for natural and biodegradable products that support sustainable practices. Growing awareness of health and nutrition, coupled with the rising adoption of eco-friendly agricultural inputs, is fueling the demand for chitosan powder.

Continuous advancements in extraction and formulation technologies have enhanced product efficacy and consistency, supporting wider adoption across multiple industries. Additionally, the expanding use of chitosan as a functional ingredient in food preservation, dietary supplements, and packaging solutions contributes to market expansion.

The increasing focus on clean label products and natural alternatives to synthetic chemicals further reinforces the growth potential As industries continue to prioritize sustainability, food safety, and innovation, the Chitosan Powder market is anticipated to maintain a steady growth trajectory in both developed and emerging regions.

| Metric | Value |

|---|---|

| Chitosan Powder Market Estimated Value in (2025 E) | USD 3.1 billion |

| Chitosan Powder Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

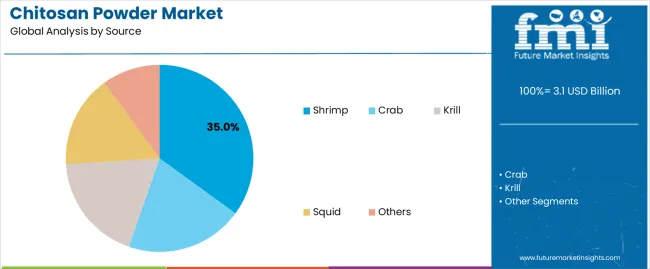

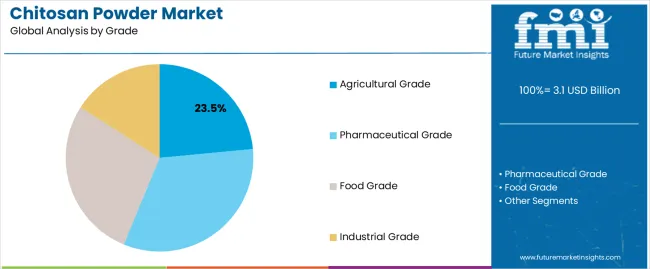

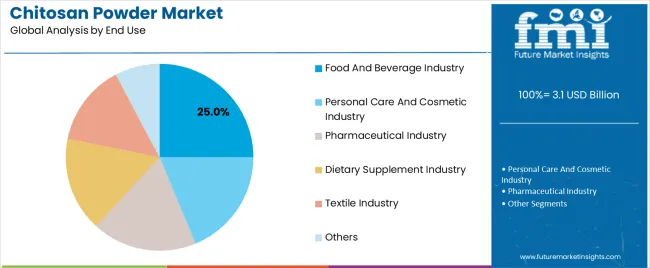

The market is segmented by Source, Grade, End Use, and Distribution Channel and region. By Source, the market is divided into Shrimp, Crab, Krill, Squid, and Others. In terms of Grade, the market is classified into Agricultural Grade, Pharmaceutical Grade, Food Grade, and Industrial Grade. Based on End Use, the market is segmented into Food And Beverage Industry, Personal Care And Cosmetic Industry, Pharmaceutical Industry, Dietary Supplement Industry, Textile Industry, and Others. By Distribution Channel, the market is divided into Direct Sales/B2B, Indirect Sales/B2C, Hypermarkets/ Supermarkets, Convenience Stores, Specialty Stores, and Online Retailing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shrimp source segment is projected to hold 35.0% of the Chitosan Powder market revenue share in 2025, making it the leading source. This dominance is attributed to the high availability and quality of chitosan derived from shrimp shells, which provides superior purity and consistency.

The segment has benefited from efficient extraction methods and strong supply chains that ensure a reliable product for industrial and commercial applications. The versatility of shrimp-derived chitosan in various formulations has reinforced its adoption across agricultural, food and beverage, and pharmaceutical sectors.

Additionally, growing awareness regarding sustainable seafood processing and the utilization of by-products has further supported the prominence of this segment Continuous improvements in processing technology and cost efficiency have strengthened the position of shrimp as a preferred source, maintaining its leadership in the market.

The agricultural grade segment is expected to capture 23.5% of the Chitosan Powder market revenue share in 2025, positioning it as a leading grade. The growth of this segment is driven by the rising adoption of chitosan as a natural biostimulant, plant growth enhancer, and eco-friendly pesticide alternative in sustainable agriculture.

Its ability to improve crop yield, resistance to pathogens, and soil health has LED to increased demand among farmers and agribusinesses. Additionally, regulatory support for biodegradable and non-toxic agricultural inputs has reinforced the preference for agricultural grade chitosan.

The segment has also benefited from advancements in formulation technologies that enhance stability and effectiveness in field applications The combination of environmental benefits, regulatory compliance, and operational efficiency continues to drive the dominance of the agricultural grade segment in the market.

The food and beverage industry is anticipated to account for 25.0% of the Chitosan Powder market revenue in 2025, making it the leading end-use industry. This growth is fueled by the increasing demand for natural food preservatives, dietary supplements, and functional ingredients that extend shelf life and enhance nutritional value.

Chitosan’s ability to act as an antimicrobial and antioxidant agent has reinforced its adoption in processed foods, beverages, and packaging solutions. The segment has benefited from the growing consumer preference for clean label and health-oriented products.

Additionally, the shift towards sustainable and biodegradable food packaging has created new opportunities for chitosan utilization The combination of regulatory support, technological advancements in formulation, and rising consumer awareness continues to propel the adoption of chitosan powder in the food and beverage sector, maintaining its leading position in the market.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and current year (2025) for global chitosan powder market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 7.2% (2025 to 2035) |

| H2 | 7.9% (2025 to 2035) |

| H1 | 8.3% (2025 to 2035) |

| H2 | 8.7% (2025 to 2035) |

The above table presents the expected CAGR for the global chitosan powder demand space over a semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2025, the business is predicted to surge at a CAGR of 7.2%, followed by a slightly higher growth rate of 7.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 8.3% in the first half and remain relatively moderate at 8.7% in the second half. In the first half (H1 2025) the market witnessed a decrease of 24 BPS while in the second half (H2 2025), the market witnessed an increase of 39 BPS.

Biotechnology Innovations Optimizing Chitosan Extraction and Use

Innovations in biotechnology is increasing the production and application of chitosan. Improved extraction methods now provide higher efficiency and purity, which also addresses to the strict requirements of pharmaceutical and medical industries.

These advancements allows the production of high-purity chitosan grades, which are essential for drug delivery systems and biomedical devices. Consequently, the improved quality and application range of chitosan is driving its demand in advanced medical and pharmaceutical applications.

For instance, enzymatic extraction methods use specific enzymes to break down chitin into chitosan, which reduces the need for harsh chemicals and improves yield and purity.

Expanding Use of Chitosan in Beauty and Personal Care Products

The personal care industry is incrementally using chitosan because of its beneficial properties such as moisturization, film formation, and antimicrobial action.

With a growing preference for natural and effective ingredients in cosmetics, chitosan's demand is on the rise. Its capability to improve product effectiveness whereas meeting consumer preferences for sustainable and skin-friendly ingredients makes chitosan as a effective ingredient in skincare formulations, which further is contributing to its expanding use in the personal care and cosmetics industry.

Sustainable Chitosan Emerging as Key Eco-Friendly Material

With the rising environmental concerns, there is an amplified focus on sustainability, which is driving the demand for biodegradable and eco-friendly materials such as chitosan. Extracted from shellfish waste, chitosan provides a sustainable choice to synthetic substances.

Its biodegradability and renewability make it highly appealing across various industries, including agriculture, packaging, and textiles. As consumers and companies are prioritizing making eco- friendly choices, chitosan's function as a versatile and green material is considerably expanding, showing a broader shift towards sustainable practices.

Global Chitosan Powder sales increased at a CAGR of 4.5% from 2020 to 2025. For the next ten years (2025 to 2035), projections are that expenditure on Chitosan Powder will rise at 8.6% CAGR

Chitosan is known for its health benefits, including weight management, cholesterol reduction, and antimicrobial properties, which make it a preferred ingredient among health-conscious consumers. Its antimicrobial property also makes chitosan an effective natural preservative, which extends the shelf life of food products without being dependent on synthetic additives.

Additionally, chitosan improves the texture and stability of food products, acts as a thickening, emulsifying, and gelling agent, which improves the overall quality and appeal of these products. Furthermore, chitosan is used as a dietary fiber to boost the nutritional composition of food items.

With the rising consumer interest in high-fiber foods for better digestive health and overall well-being, the demand for chitosan as a functional and health-promoting ingredient continues to rise.

Krill-sourced chitosan boasts a distinct molecular structure that enhances its functional properties, such as improved solubility and bioavailability. These qualities make it precisely effective in applications like dietary supplements and pharmaceuticals.

Moreover, its antioxidant properties help prevent oxidative stress and improve overall health, which makes it a useful ingredient in nutraceuticals and functional foods.

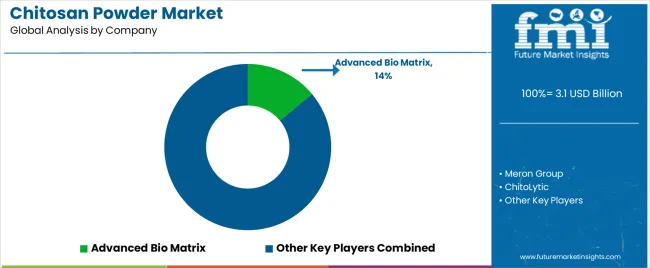

Tier 1 companies comprise market leaders with market revenue of above USD 30 million capturing significant sales domain share of 45% to 55% in the global sphere.

These business leaders are characterized by high production capacity and a wide product portfolio. These trade leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality.

Prominent companies within tier 1 include Advanced Bio Matrix, Meron Group, ChitoLytic, Tokyo Chemical Industry Co., Ltd., Spectrum Chemical Mfg. Corp., Mystic Moments (Madar Corporation Ltd), and Agratech International, Inc.

Tier 2 companies include mid-size players with revenue of USD 5 to 30 million having presence in specific regions and highly influencing the local retail space. These are characterized by a strong presence overseas and strong consumer base knowledge.

These industry players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 include Heppe Medical Chitosan GmbH, Kitozyme S.A., SFly, Primex ehf, Karandikars Orgochem Private Limited, Suvidhinath Laboratories, Clean Water Chems, Avantar, Humico, Oxford Vitality, and Ensince

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche demand space having revenue below USD 5 million. These companies are notably oriented towards fulfilling local marketplace demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized field, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The table below highlights revenue from product sales in key countries. The China and India are predicted to remain top consumers, with estimated trade valuations of USD 6.8.0 million and USD 627.9 million, respectively, by 2035.

| Countries | Market Value (2035) |

|---|---|

| China | USD 6.8.0 million |

| Japan | USD 562.5 million |

| India | USD 627.9 million |

| USA | USD 202.7 million |

| Germany | USD 78.5 million |

The following table shows the estimated growth rates of the top three sales domains. The United States and Germany are set to exhibit high Chitosan Powder consumption, recording CAGRs of 6.9% and 6.2%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 5.8% |

| Japan | 4.4% |

| India | 6.0% |

| USA | 6.9% |

| Germany | 6.2% |

The ecosystem for Chitosan Powder in China is projected to exhibit a CAGR of 5.8% during the assessment period. By 2035, revenue from the sales of Chitosan Powder in the country is expected to reach USD 6.8.0 million.

Chitosan holds a special place in traditional Chinese medicine, valued for its healing properties that help in wound recovery and digestive health. This historical use has ingrained chitosan's popularity as a beneficial natural remedy, driving its demand across diverse health applications in China.

The cultural familiarity with chitosan as a trusted therapeutic agent emphasizes its widespread adoption in traditional practices and modern healthcare, promoting continuous interest and utilization in the country's health and wellness industry.

Chitosan Powder demand in USA is calculated to rise at a value CAGR of 6.9% during the forecast period (2025 to 2035). By 2035, USA is expected to account for 81.3% of Chitosan Powder sales in North America.

The rising concern for environmental sustainability and the need for efficient wastewater treatment solutions is boosting the demand for chitosan in the USA. Chitosan's biocompatibility and effectiveness in removing contaminants makes it an ideal option for water purification.

Its ability to bind with heavy metals, oils, and other pollutants improves water quality without introducing harmful chemicals. This eco-friendly approach goes with increasing regulatory standards and public awareness, which is driving its usage in these applications.

Consumption of Chitosan Powder in India is projected to increase at a value CAGR of 6.0% over the next ten years. By 2035, the segment size is forecasted to reach USD 627.9 million, with India expected to account for a demand space share of 38.5% in South Asia.

Chitosan's versatility offers itself well to diverse industrial applications in India, across pharmaceuticals, cosmetics, agriculture, and food processing industries. It acts as a natural preservative, and effectively extending shelf life without synthetic additives.

Additionally, its clarifying properties make it an prefered choice for refining processes in food and beverages. In pharmaceuticals and cosmetics, chitosan is known for its wound healing properties, improving tissue regeneration. This multifaceted benefit drives its widespread acceptance across various industries in the country.

| Segment | Dietary Supplement Industry (End Use) |

|---|---|

| Value Share (2025) | 21.4% |

Ongoing research and development are continuously exploring new potential health benefits of chitosan, which is propelling its expanded application in dietary supplements and attracting consumers.

Derived from chitin, chitosan is generally known as safe and non-toxic. Being safe, makes it suitable among individuals seeking natural supplements with minimal adverse effects. As scientific investigation into its properties progresses, chitosan's versatility and natural origins make it a favored ingredient for improving health and wellness through dietary supplementation.

| Segment | Agricultural Grade (Grade) |

|---|---|

| Value Share (2025) | 23.5% |

The agricultural grade segment is anticipated to advance at 5.2% CAGR during the projection period. Chitosan improves plant growth and flexibility through its capability to activate natural defense mechanisms against pests and diseases.

As a biopesticide and biofungicide, it offers a sustainable alternative to synthetic chemicals, which aligns with modern agricultural shifts towards eco-friendly practices.

Research shows that chitosan also improves crop yield and improves fruit quality by maximizing essential plant processes like photosynthesis and nutrient absorption, hence extending shelf life and enhancing overall agricultural productivity.

The Chitosan Powder territory encompasses a diverse and dynamic competitive landscape. Leading Chitosan Powder manufacturing companies are focusing on research and development, sustainable sourcing, and new applications. They are also emphasizing environment-friendly practices and product certifications to satisfy the increasing demand for natural and sustainable ingredients.

Manufacturers are also looking to preserve their demand space position by focusing on product quality, innovation, and matching varied customer preferences.

For instance

As per source, the ecosystem has been categorized into Shrimp, Crab, Krill, Squid, and Others (Lobster, Turtle, etc.)

This segment is further categorized into Pharmaceutical Grade, Food Grade, Agricultural Grade, and Industrial Grade

As per the end use, the customer base has been categorized into Food and Beverage Industry, Personal Care and Cosmetic Industry, Pharmaceutical Industry, Dietary Supplement Industry, Textile Industry, and Others (Wastewater treatment, Animal Feed, etc.)

This segment is further categorized into Direct Sales/B2B, Indirect Sales/B2C, Hypermarkets/ Supermarkets, Convenience Stores, Specialty Stores, and Online Retailing

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global chitosan powder market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the chitosan powder market is projected to reach USD 6.8 billion by 2035.

The chitosan powder market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in chitosan powder market are shrimp, crab, krill, squid and others.

In terms of grade, agricultural grade segment to command 23.5% share in the chitosan powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chitosan-based Seed Coatings Market Size and Share Forecast Outlook 2025 to 2035

Chitosan Market Size, Growth, and Forecast for 2025 to 2035

Evaluating Chitosan Market Share & Provider Insights

Chitosan Oligosaccharides and Glucosamine Market Analysis by Product Type, Source, Application, and Form Through 2035

Chitosan Oligosaccharides Market Growth - Source & Grade Trends

UK Chitosan Market Outlook – Size, Share & Forecast 2025–2035

USA Chitosan Market Analysis – Size, Share & Industry Trends 2025–2035

ASEAN Chitosan Market Analysis – Growth, Applications & Outlook 2025–2035

Europe Chitosan Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Chitosan Market Growth – Demand, Trends & Forecast 2025–2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

Latin America Chitosan Market Trends – Growth, Demand & Analysis 2025–2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA