The Australian Chitosan market is estimated to be worth USD 5.7 million by 2025 and is projected to reach a value of USD 32.2 million by 2035, growing at a CAGR of 18.9% over the assessment period 2025 to 2035

| Attributes | Values |

|---|---|

| Industry Size in 2025 | USD 5.7 million |

| Industry Value in 2035 | USD 32.2 million |

| Value-based CAGR from 2025 to 2035 | 18.9% |

The chitosan market in Australia is reported to be growing due to versatile applications in various sectors such as food and beverages, health care, cosmetics, and agricultural use. Chitosan is a natural biopolymer derived from chitin, which is famous for its fat binding and weight management factors and is used in nutritional supplements and weight loss products. In Australia, there has been a growing consumer awareness about health and wellness that has led to the increased demand for natural and sustainable ingredients.

This increases the demands for chitosan. The healthcare industry particularly uses chitosan due to its cholesterol-lowering effect, while the food and beverage industry uses it as a preservative and fat replacer in functional foods. Chitosan's application in the cosmetics industry, such as anti-aging and skin regeneration products, is also gaining popularity.

The application of chitosan in agriculture as a natural biopesticides and growth enhancer has it fit snugly in the growing trend for sustainable and organic farming being practiced in Australia. Innovation in biotechnology also supports production by enhancing its productive efficiency. Based on these developments and trends, consumer preferences that have escalated toward more eco-friendly and health-conscious choices, the Australian Chitosan Market is expected to continue growth, thus offering challenges and opportunities for business.

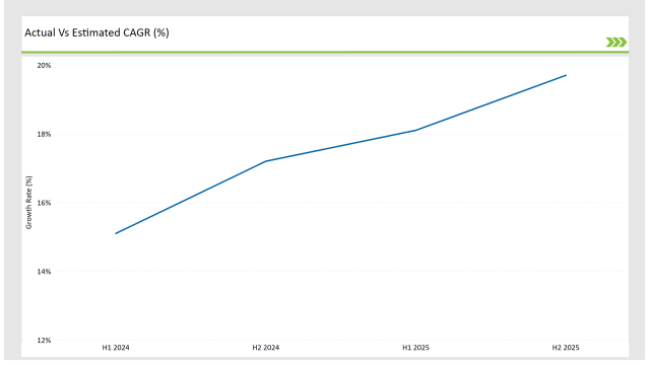

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Australian Chitosan market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the Australian market, the Chitosan sector is predicted to grow at a CAGR of 18.1% during the first half of 2025, increasing to 19.7% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 15.1% in H1 but is expected to rise to 17.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

This brings to light the dynamic and continuously evolving nature of the Australian Chitosan market, which changes according to shifts in consumer preferences, formulation technologies, and other regulatory changes. Business houses will require periodic understandings of such trends to enable the effective modification of strategies in the pursuit of innovation and a market growth trend. This is one of the tools that is quite useful in managing the market with all its intricacies, being ahead of competition.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Friesland Foods Kiev it, a significant player, developed this new encapsulating technology to encourage the use of chitosan as a natural product. Friesland Foods established an independent corporate company, Kievit Ventures. Kievit claims to have expedited long-term advancements in encapsulating technology. Manufacturers are likewise working on expanding manufacturing sites around the world to preserve their worldwide presence. |

| 2025 | The Food Standards Australia New Zealand (FSANZ) has approved the use of fungal-derived Chitosan as a processing aid in the production of wine, beer, cider, and spirits. This approval permits for the use of Chitosan to improve the clarity and stability of certain beverages |

Growing Demand for Functional Foods with Weight Management Benefits

The increasing awareness towards healthy diets and weight management is the key factor driving the functional food market in Australia. The fat-binding properties of chitosan have enhanced its application in weight loss supplements, meal replacements, and functional snacks. It has become well known among the Australians for natural and effective management of weight in a healthy manner.

The increasing trend among Australian consumers toward healthier lifestyles, including fitness and weight control, will increase demand for dietary supplements containing chitosan. This will make manufacturers work toward innovation with chitosan more efficient extraction and processing, therefore making such products cheaper and easily accessible to people.

Development of Chitosan Applications in the Personal Care and Cosmetics Industry

This trend of interest in long-term benefits in skin care, such as anti-aging, hydration, and wound healing, is in perfect harmony with the inherent qualities of chitosan. The fact that chitosan forms a thin protective layer on the skin, retains moisture, and reduces the appearance of fine lines and wrinkles makes it highly sought after in high-end skincare products.

The more that Australian consumers pursue healthy skin, the more chitosan is going to feature in the formulation of cosmetics from cosmetic formulators, especially serums, moisturizers, and anti-aging creams. Since consumers will become more concerned with their skin, the demand for chitosan-based cosmetics is expected to be driven further by innovation in the formulation of cosmetic products and awareness among consumers.

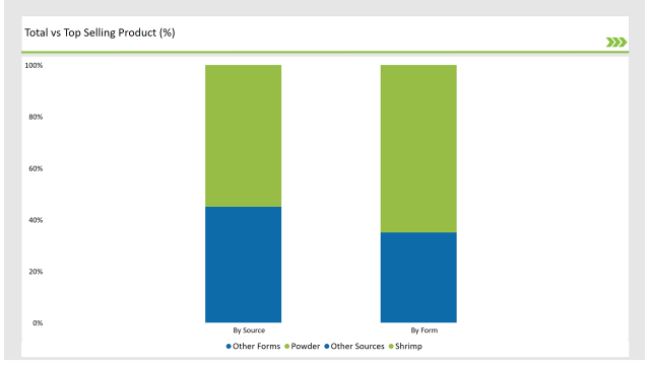

% share of Individual categories by Source and Form in 2025

This leads the Australian seafood industry because it combines consumer preference, aquaculture technology, and innovative applications in the kitchen. Australians are getting more and more interested in shrimp, and it is present in many dishes throughout the country-from barbecue to Asian-inspired ones.

This segment is then further fueled through the versatility shrimp offers in lots of preparations with frozen, fresh, or even ready-to-cook options. With local consumers demanding more affordable and convenient access to seafood items, shrimp, being prepared promptly and easily adjustable to many other cuisines makes it a common choice for foodservice businesses as well as in busy households.

The Australian powder market is very fast paced and is becoming the category leader in many industries, especially from the unmatched conveniences available, the versatility this product offers, and the growing awareness in health-conscious consumer products. Increasingly, Australians want to gain solutions that can be prepared easily in their fast-paced, on-the-go lives.

This also encompasses protein powders, meal replacements, drink mixes, and dietary supplements among others, where the demand is for quick nutrition with personalization and added functionality. It's this need for convenience that has spurred the market's growth, coupled with the long shelf life and convenient storage provided by powders.

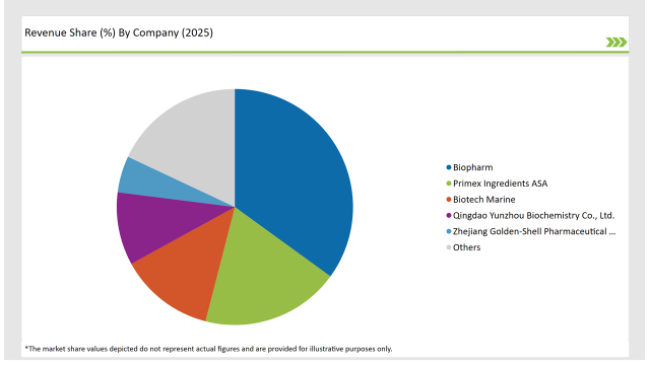

2025 Market share of Australia Chitosan manufacturers

Note: The above chart is indicative in nature

Tier 1 companies operating within the market in Australian Chitosan are established industry giants that possess a strong market share and influence. Usually, strong players in other sectors as well, including food, pharmaceutical, and agriculture sectors, which permit heavy investments into research and development. They use advanced technologies to improve the quality and efficiency of chitosan extraction and application.

Usually, mid-sized companies are Tier 2: participating in the Australian Chitosan market. Often, specific niches or regions are focused on, with high-quality chitosan for dietary supplements or targeted applications of agriculture. Their competitive advantage lies in their ability to innovate and create value-added chitosan products based on the specific needs of the customers.

Tier 3 companies in Australian Chitosan are small ones or startups whose growth is quite early. Thus, they always face challenges concerning limited resources or smaller product offerings and less establishment of brand reputation. However, they can very well be more innovative and inclined to experiment for novel applications and production methods which can offer more unique solutions on niche markets.

The industry includes various form such as powder, and liquid.

The industry includes various sources such as crab, lobster, and shrimp.

As per the end use segment, the market is segregated into food additive, dietary supplements, pharmaceuticals, and cosmetics.

By 2025, the Australian Chitosan market is expected to grow at a CAGR of 18.9%.

By 2035, the sales value of the Australian Chitosan industry is expected to reach USD 32.2 million.

Key factors propelling the Australian Chitosan market include increasing popularity of organic and plant-based solutions, emerging use in agriculture for biopesticides, advancements in chitosan extraction technology, and growing demand for natural health and wellness products.

Prominent players in Australia Chitosanmanufacturing include Qingdao YunzhouBiochemistry Co., Ltd.,Friesland Foods Kievit,Zhejiang Golden-Shell Pharmaceutical Co., Ltd., Heppe Medical Chitosan GmbH, Novamatrix, Kitozyme, FMC BioPolymer, Biopharm, Primex Ingredients ASA, and Biotech Marine, aamong others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Pallet Wraps Market Size and Share Forecast Outlook 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

Australia Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Australia Non-Dairy Creamer Market Outlook – Size, Demand & Forecast 2025–2035

Australia Chitin Market Analysis – Growth, Size & Forecast 2025–2035

Australia Bubble Tea Market Trends – Size, Share & Forecast 2025–2035

Australia Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

Australia Non-Alcoholic Malt Beverages Market Insights - Trends & Forecast 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Australia Food Emulsifier Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Pulses Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Australia Frozen Ready Meals Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yerba Mate Market Growth – Trends, Demand & Innovations 2025–2035

Australia Sweetener Market Analysis – Size, Share & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Yeast Extract Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Canned Tuna Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA