The ASEAN Chitosan market is set to grow from an estimated USD 34.2 million in 2025 to USD 284.6 million by 2035, with a compound annual growth rate (CAGR) of 23.6% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 34.2 million |

| Projected ASEAN Value (2035F) | USD 284.6 million |

| Value-based CAGR (2025 to 2035) | 23.6% |

ASEAN Chitosan Market, which is facing the rise of expansion, is one of the markets that is most influenced by the soaring search for natural and biodegradable materials in different fields. Chitosan, which is obtained from chitin that is present in the shells of crustaceans such as shrimp and crabs, is increasingly popular for its range of applications in sectors like food and beverage, pharmaceuticals, agriculture, and cosmetics. The gradually coming up need for replacing synthetic materials with environmentally friendly products is also influencing the market for chitosan-based products positively.

ASEAN area has been regarded as a fast-growing area for chitosan being used in food preservation due to its natural antimicrobial feature, which helps prolong the shelf-life of perishables. Furthermore, the chitosan-lettered Drug delivery systems and wound healing industries are immensely impressed with the biocompatibility and non-toxicity of the material thus the pharmaceutical industry is also using it more and more. The agricultural sector is also utilizing chitosan to improve soil quality and plant health, thereby it becomes a useful addition to the organic farming movement.

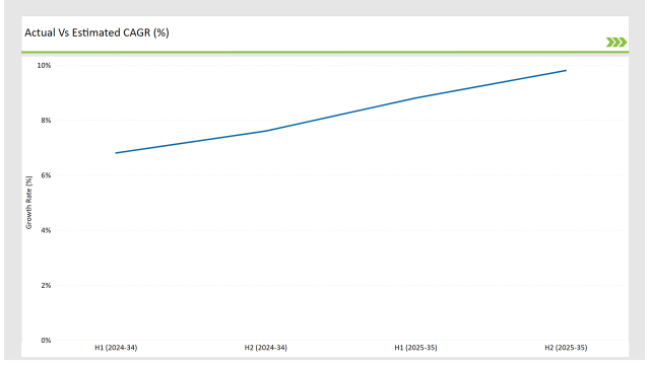

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Chitosan market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Chitosan market, the sector is predicted to grow at a CAGR of 4.2% during the first half of 2024, increasing to 284.6% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 7.8% in H1 but is expected to rise to 23.6% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Nestlé: Launched a new line of infant formulas enriched with Chitosan to enhance gut health and immune support. |

| 2024 | Danone: Introduced a range of HMO-based functional foods aimed at toddlers, focusing on cognitive development and digestive health. |

| 2025 | Bifidobacterium: Announced the development of a new HMO extraction process that increases yield and reduces production costs for infant formula applications. |

| 2025 | FrieslandCampina: Expanded its product portfolio by incorporating HMOs into its premium infant formula line, targeting health-conscious parents. |

Growing Demand for Natural and Biodegradable Products

The marketplace for products that are biodegradable and made from natural materials is slowly rising. In the ASEAN region, consumers, who are increasingly buying ecological materials instead of synthetic ones, are getting more and more products of this type on the market. Chitosan, as a polymer that is derived from chitin, is a natural version of it; therefore, it is a great example of what we will see more of in the future. That's why chitosan is becoming more and more the desired component in different applications.

With the increased knowledge of environmental issues, including the plastic pollution problem and the quest for sustainable packaging solutions, manufacturers are inquisitively looking to incorporate chitosan in their products. In the food and beverage industry, chitosan has developed a reputation for being a natural preservative due to its antimicrobial properties, which allow perishable items to last longer without the need for synthetic additives.

Advancements in chitosan applications are shaping the Chitosan Market,

Chitosan Market is a byproduct of the new developments in the utilization of chitosan by scientists and producers who are constantly looking for different ways to use this multifunctional biopolymer. The intensification of people's choice for health and wellness products, together with the innovations in technology, is the leading force behind the increase in the number of chitosan-based products produced in various fields, such as pharmaceuticals, food, and agriculture.

In the pharmaceutical sector, chitosan is applied in drug delivery systems, wound healing devices, and as a natural excipient in some formulations. Its biocompatibility and the fact that it is non-toxic make this polymer very suitable for many kinds of medical applications, thus increasing studies and experiments done in this area. The feature of chitosan to encapsulate drugs and thus enhance their bioavailability is the actual reason for the greater use of it in the pharmaceutical industry.

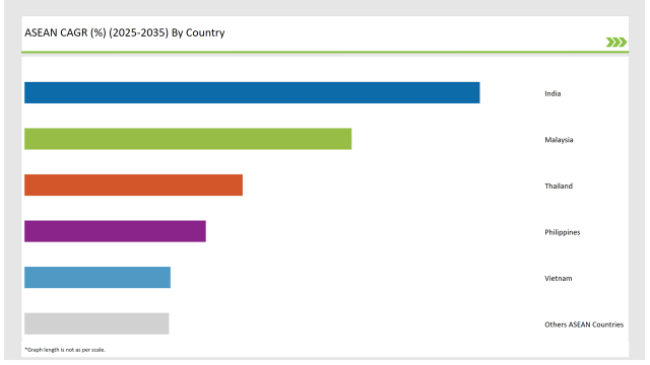

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The growth of the Chitosan market industry in India is amazing largely due to the daily increase of awareness of the health and wellness of the individuals. The increasing number of people suffering from diseases as a result of bad lifestyles has made people turn towards natural dietary supplements, where Chitosan is very important for its effects on weight and cholesterol.

Besides, the promotion of organic farming and sustainable agricultural practices by the Indian government is an additional factor that contributes to the demand for Chitosan-based products in agriculture.

The Chitosan market in the pharmaceutical sector in India is also a significant participant, as it is utilized in drug delivery systems and wound care applications. The increasing interest in research and development of the biopharmaceutical industry is likely to boost the production of new products for Chitosan applications.

With the help of its ocean resources and the technology in its processing stage, Malaysia is progressing to becoming a leading player in the Chitosan market. Situated at the Southeast Asia crossroads, the country benefits from easy access to raw materials, which are mainly obtained from shrimp and crab shells. The impressive availability of raw materials and the increasing emphasis on environmentally friendly practices make Malaysia the most suitable location for Chitosan production.

The Malaysian government is on an unbroken warpath in the pursuit of the glory of the biotechnology sector, which in turn comprises Chitosan applications in drugs, agro-tech, and food. The mounting popularity of natural preservatives and functional ingredients in food is an important factor in the overall growth of Malaysia's Chitosan market.

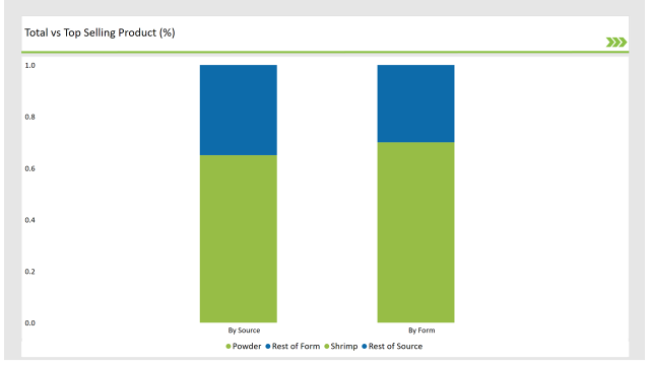

The powdered variant of Chitosan is presupposed to be the market leader in the future, with its share reaching about 70% by 2025. The choice of powdered Chitosan has emerged due to its application in multiple industries as well as its easy incorporation in various formulations. Powdered Chitosan is the most popular additive for the food industry à natural herbicide and fat replacer, being a good men's waist for label deals of food products.

Besides making food products more appealing and extending their lifespan, the preservative assures manufacturers of the quality. Along with this, powdered Chitosan is also commonly used in dietary supplements, in which it is promoted for its ability to reduce weight and lower cholesterol.

According to the product type category, Chitosan's natural sweeteners are increasingly a predominant piece in the Chitosan market. The rise in demand for Chitosan-based natural sweeteners is being aided by the growing consumer inclination towards healthier substitutes of sugar than artificial ones.

Chitosan is exclusively featured as a fat replacer and a natural sweetener in food formulations, which is appealing to health-minded consumers who want to control their sugar intake without having a defeat on their palate. Natural Chitosan is the bioactive component that gives soy protein food products the improvement of structure and mouthfeel. This is one more aspect that makes it popular in this segment.

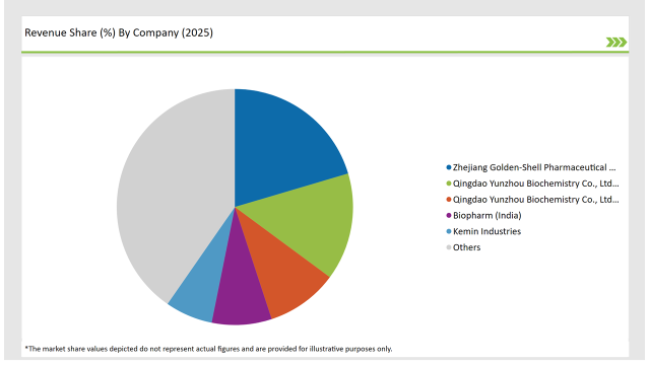

2025 Market Share of ASEAN Chitosan Manufacturers

Note: The above chart is indicative

The Chitosan market is marked by a competitive environment with several main companies struggling for market share. Companies are running after innovation, product development, and strategic alliances to upgrade their offering as well as to meet the Chitosan-based products growing demand.

The major market players are KitoZyme, Primex EHF, GTC Bio Corporation, Advanced Biopolymers, and BioCare Copenhagen. These companies are spending on research and development activities to find out new uses of Chitosan and to optimize the production processes. KitoZyme, for example, has been a pioneer in creating Chitosan-based dietary supplements whereas Primex EHF is recognized for the acquired sustainable extracting techniques.

Form: Liquid, and Powder.

Source: Shrimp, Crab, and Lobster

End Use: Food Additive, Dietary Supplements, Pharmaceuticals, and Cosmetics

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Chitosan market is projected to grow at a CAGR of 23.6% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 284.6 million.

India are key Country with high consumption rates in the ASEAN Chitosan market.

Leading manufacturers Jennewein, KYOWA HAKKO BIO CO. LTD., DSM-Firmenich Nestle Health Science in the ASEAN market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA