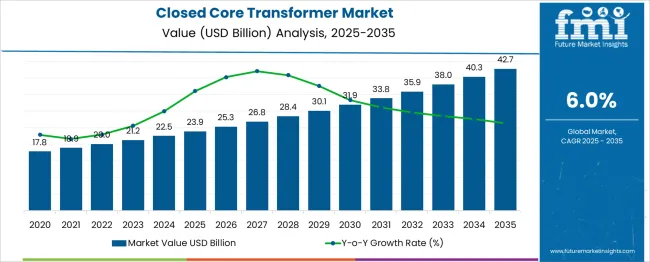

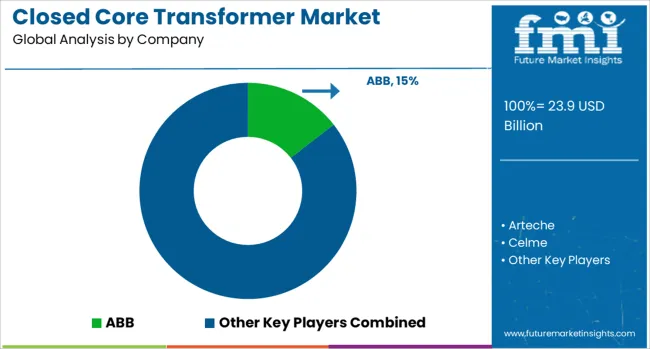

The Closed Core Transformer Market is estimated to be valued at USD 23.9 billion in 2025 and is projected to reach USD 42.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Closed Core Transformer Market Estimated Value in (2025 E) | USD 23.9 billion |

| Closed Core Transformer Market Forecast Value in (2035 F) | USD 42.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The closed core transformer market is expanding steadily, supported by rising electricity consumption, grid modernization initiatives, and increasing deployment of renewable energy systems. Closed core transformers are widely adopted due to their ability to minimize energy losses, improve operational efficiency, and enhance voltage regulation in power distribution and transmission networks.

As urbanization and industrialization progress, the demand for reliable power delivery systems has amplified, boosting investments in advanced transformer technologies. Moreover, supportive government policies and infrastructure upgrades in emerging economies are propelling the replacement of outdated equipment with efficient, low-maintenance transformer solutions.

The market outlook remains positive with anticipated growth in distributed energy systems, smart grid infrastructure, and sustainable construction projects. As utility providers and industrial users focus on performance, safety, and environmental compliance, closed core transformers are increasingly being adopted for their durability and cost-effective energy management.

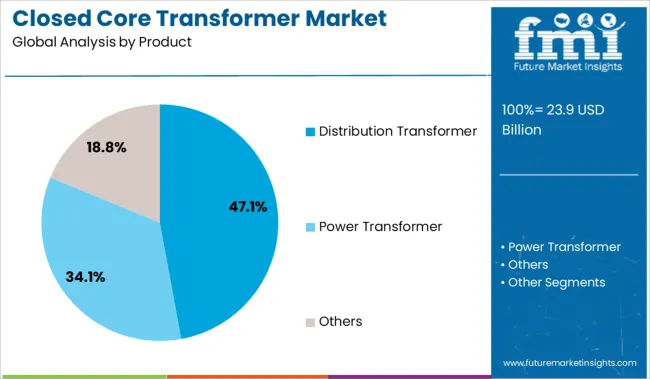

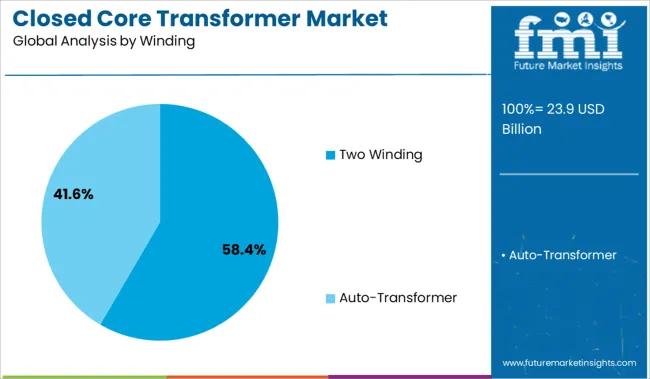

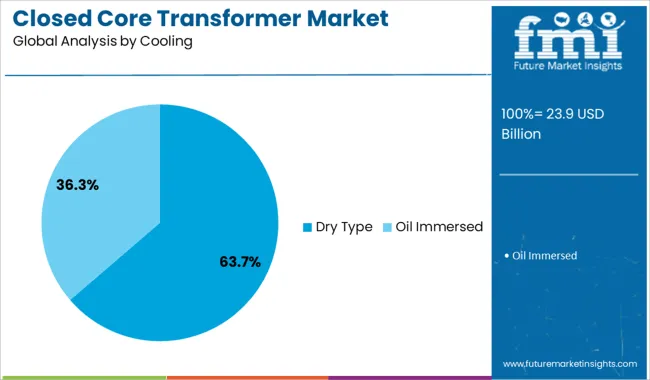

The closed core transformer market is segmented by product, winding, cooling, insulation, and application and geographic regions. By product of the closed core transformer market is divided into Distribution Transformer, Power Transformer, and Others. In terms of winding of the closed core transformer market is classified into Two Winding and Auto-Transformer. Based on cooling of the closed core transformer market is segmented into Dry Type and Oil Immersed. By insulation of the closed core transformer market is segmented into Gas, Oil, Solid, Air, and Others. By application of the closed core transformer market is segmented into Residential, Commercial & Industrial, and Utility. Regionally, the closed core transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The distribution transformer segment holds a leading 47.1% share in the product category, attributed to its widespread application in regulating voltage for end-user delivery across commercial, industrial, and residential sectors. These transformers play a vital role in reducing high transmission voltages to usable levels, making them essential for localized power distribution.

Their robust construction, compact size, and suitability for pole-mounted or pad-mounted installations have enhanced their adoption across diverse geographies. The segment continues to benefit from increasing rural electrification programs and smart city developments, particularly in developing regions.

Additionally, the integration of distributed energy resources such as rooftop solar systems and wind microgrids necessitates the use of high-efficiency distribution transformers for grid stability. With utilities prioritizing network reliability and load balancing, demand for distribution transformers is expected to remain strong, supported by technological advancements in insulation materials and core design.

The two winding segment commands a significant 58.4% share within the winding category, driven by its cost-effectiveness, structural simplicity, and wide compatibility across utility-scale and industrial applications. Two winding transformers are particularly favored for conventional energy distribution where galvanic isolation is required between primary and secondary circuits.

Their ability to handle different voltage levels and loads makes them a preferred choice for both step-up and step-down operations in power systems. This segment has witnessed continued deployment in substations, manufacturing plants, and institutional facilities, where consistent voltage regulation is critical.

Manufacturers are enhancing design specifications to meet evolving efficiency standards and thermal performance expectations. The durability and ease of installation associated with two winding configurations make them a practical choice for large-scale infrastructure projects. As grid modernization and electrification efforts intensify globally, the demand for reliable and efficient winding technologies is projected to support the sustained dominance of this segment.

The dry type segment leads the cooling category with a commanding 63.7% market share, supported by increasing preferences for fire-safe, environmentally friendly, and maintenance-free transformer solutions. These transformers utilize air as the cooling medium instead of oil, reducing the risk of fire hazards and eliminating the possibility of fluid leaks.

As safety regulations tighten and space constraints grow in urban installations, dry type transformers are becoming the standard choice for indoor and close-proximity environments such as hospitals, data centers, commercial buildings, and underground substations. The segment has gained traction due to its superior resistance to moisture, enhanced thermal performance, and minimal maintenance requirements.

Technological enhancements in cast resin insulation and improved ventilation systems are further improving reliability and operational efficiency. With growing emphasis on green building standards and sustainable electrical infrastructure, the dry type segment is expected to maintain its market leadership through consistent adoption across both retrofit and new installation projects.

Closed core transformers are gaining traction due to their role in improving energy efficiency, reducing losses, and supporting renewable integration. Increased use in industrial, commercial, and critical infrastructure applications is driven by strict energy regulations and demand for reliable power solutions.

The demand for closed-core transformers is being shaped by a growing emphasis on energy efficiency and enhanced operational performance in power transmission systems. These transformers are being adopted across utility grids and industrial facilities for their ability to reduce energy losses and maintain voltage stability under fluctuating load conditions. Expansion in renewable energy integration and distributed generation projects is accelerating deployment as utilities seek stable systems for grid reliability. Industrial modernization and the replacement of aging infrastructure are also contributing to this trend. Manufacturers are focusing on designs that minimize electromagnetic leakage and optimize core construction to meet stringent energy regulations and operational efficiency targets.

Closed core transformers are witnessing increased adoption in industrial automation, manufacturing plants, and commercial establishments due to their capability to ensure uninterrupted power supply with minimal downtime. Industries requiring high-precision power for heavy-duty machinery prefer these transformers for their durability and adaptability in complex electrical environments. Commercial buildings, data centers, and critical infrastructure projects are leveraging these units to ensure efficient load handling and fault tolerance. Regulatory bodies enforcing strict energy standards are creating additional impetus for adoption across developed and emerging economies. The shift toward customized transformer solutions is enabling suppliers to address unique voltage, capacity, and performance requirements in niche sectors.

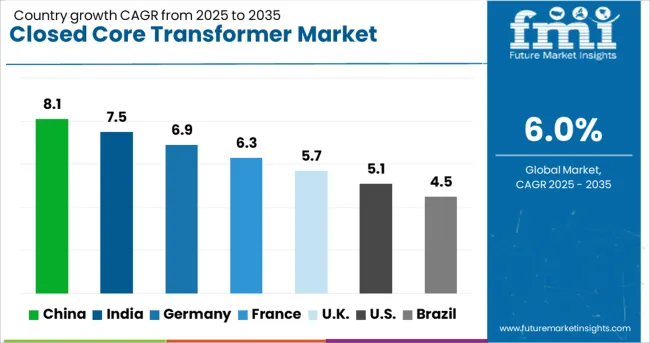

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The closed core transformer market, expected to grow at a global CAGR of 6.0% from 2025 to 2035, reflects differing growth trajectories across leading economies. China leads with a CAGR of 8.1%, supported by grid modernization, renewable integration, and large-scale power distribution projects. India follows at 7.5%, driven by rural electrification, industrial demand for reliable transformers, and regulatory emphasis on energy-efficient infrastructure. Germany posts 6.9%, benefiting from EU energy transition goals, smart grid investments, and demand for advanced transformer insulation systems. The UK records 5.7%, shaped by upgrades in urban power networks and renewable integration, but constrained by higher capital costs. The USA shows the lowest among the top five at 5.1%, influenced by legacy infrastructure replacement and adoption of compact closed core units in commercial applications. BRICS economies dominate through accelerated capacity additions and manufacturing scale, while OECD countries prioritize advanced designs, compliance with energy-efficiency norms, and digital monitoring integration. The report provides comprehensive coverage across 40+ countries, with the five key markets outlined here.

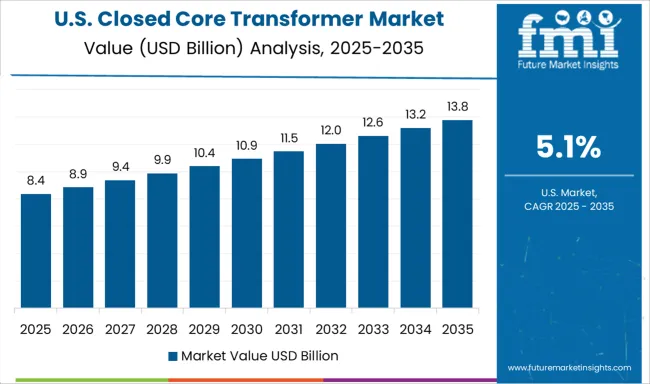

The CAGR of the closed core transformer market in the United States was around 5.1% during 2020-2024 and is expected to climb to nearly 6.8% for 2025-2035, reflecting a transition to grid modernization and enhanced energy efficiency. Strong investments in renewable energy integration and smart grid frameworks have increased reliance on advanced transformer designs. Rising electrification across transportation and industrial systems has required robust load management, favoring closed core units due to their superior performance under fluctuating demand. Regulatory mandates on energy loss reduction are further accelerating adoption. OEMs are collaborating with utilities for optimized core configurations and advanced insulation solutions to ensure grid stability under high-load conditions.

The CAGR of the UK closed core transformer market stood near 5.7% between 2020-2024 and is projected to advance to almost 7.4% during 2025-2035, outpacing the global average of 6.0%. This rise has been attributed to national grid decarbonization initiatives and a rapid increase in distributed generation projects. Public and private investments in offshore wind farms and EV charging infrastructure have intensified demand for compact and efficient transformers with minimal energy losses. Grid resilience measures are a priority as the UK transitions to renewable-heavy electricity networks. Manufacturers are focusing on high-efficiency designs and voltage-optimized solutions to meet utility requirements and energy performance standards set by regulatory authorities.

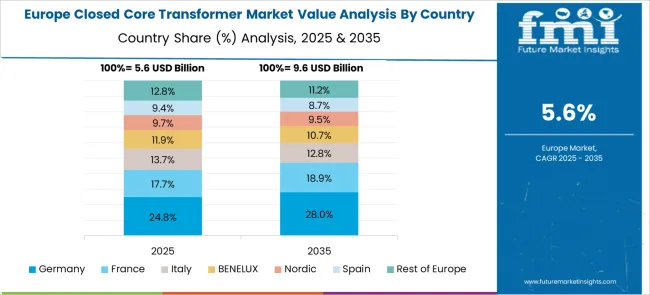

The German closed core transformer market recorded a CAGR of about 6.9% during 2020-2024 and is expected to move up to 8.3% in 2025-2035, driven by industrial electrification and robust renewable energy integration programs. The country’s Energiewende policy has accelerated upgrades of transmission and distribution systems, emphasizing energy efficiency and stability under intermittent load conditions. German industrial hubs are increasingly deploying high-performance transformers to support automation, high-voltage applications, and expansion of manufacturing clusters. Strict EU efficiency regulations have made energy-optimized transformers mandatory for compliance, pushing utilities and manufacturers to adopt closed core configurations for lower core losses and thermal stability.

The CAGR of the Chinese closed core transformer market grew at approximately 8.1% during 2020–2024 and is forecast to accelerate to nearly 9.6% between 2025 and 2035. The growth is driven by nationwide grid expansion, large-scale electrification, and accelerated renewable integration under the 14th Five-Year Plan. Heavy investments in ultra-high-voltage transmission lines and smart substations have created strong demand for advanced transformer technologies. Manufacturing zones in Jiangsu, Guangdong, and Zhejiang have scaled production capacity through state-led industrial policies. Chinese suppliers are also targeting export opportunities to Southeast Asia and Africa, supported by cost-competitive production and compliance with global efficiency norms.

The Indian closed core transformer market achieved a CAGR of about 7.5% in 2020–2024 and is projected to escalate to nearly 9.2% during 2025–2035. Growth is being powered by rural electrification drives, industrial power demand, and the expansion of renewable energy installations under the national solar and wind programs. State utilities are procuring high-efficiency transformers to reduce transmission losses in overloaded grids. Rapid EV charging infrastructure development and smart grid deployment are accelerating upgrades in the distribution segment. Domestic manufacturers are increasing investment in design innovation and capacity expansion, while international players are forming joint ventures for localized production to meet Make in India objectives.

In the closed core transformer sector, major players are addressing efficiency, reliability, and voltage optimization to meet global grid modernization and industrial requirements. Companies such as ABB, Siemens Energy, and Schneider Electric are focusing on advanced insulation systems, reduced core losses, and compact designs to support renewable integration and high-load applications. General Electric and Mitsubishi Electric are investing in digital monitoring and smart grid compatibility to enhance operational performance across utility and industrial installations. Regional specialists like Arteche, Celme, and Ormazabal are providing tailored solutions for medium-voltage networks, while Elsewedy Electric and Kirloskar Electric are strengthening their presence through localized manufacturing. Eaton, CG Power, and Voltamp are leveraging partnerships and product upgrades to serve growing demand in emerging markets.

In October 2024, ABB launched ABB Ability™ Asset Manager (TRAFCOM) digital sensor system (with Oktogrid) for real-time condition monitoring of power & distribution transformers, enabling magnetic clip installation in 15 minutes.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.9 Billion |

| Product | Distribution Transformer, Power Transformer, and Others |

| Winding | Two Winding and Auto-Transformer |

| Cooling | Dry Type and Oil Immersed |

| Insulation | Gas, Oil, Solid, Air, and Others |

| Application | Residential, Commercial & Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Arteche, Celme, CG Power, Eaton, Elsewedy Electric, General Electric, Hyosung, Kirloskar Electric, Mitsubishi Electric, Ormazabal, Schneider Electric, Siemens Energy, Toshiba, and Voltamp |

| Additional Attributes | Dollar sales, share by voltage class and application, regional demand trends, utility and industrial adoption rates, regulatory compliance impact, procurement models, competitive landscape, and growth drivers in grid modernization and renewable integration. |

The global closed core transformer market is estimated to be valued at USD 23.9 billion in 2025.

The market size for the closed core transformer market is projected to reach USD 42.7 billion by 2035.

The closed core transformer market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in closed core transformer market are distribution transformer, power transformer and others.

In terms of winding, two winding segment to command 58.4% share in the closed core transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Closed Core Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Closed Transition Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Closed System Transfer Devices Market Insights – Industry Trends & Forecast 2024-2034

Closed Funnel Ampoules Market

Enclosed Smokeless Flares Market Size and Share Forecast Outlook 2025 to 2035

Enclosed Waste Gas Flares Market Size and Share Forecast Outlook 2025 to 2035

Enclosed Motor Starter Market Growth – Trends & Forecast 2024-2034

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Automotive Closed Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Core Plate Varnishes Market Size and Share Forecast Outlook 2025 to 2035

Core Drill Automatic Feeding Machine Market

Core Banking Solution Market Report – Growth & Forecast 2017-2027

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Air Core Fixed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Air Core Variable Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Multicore Cables Market

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Multi Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA