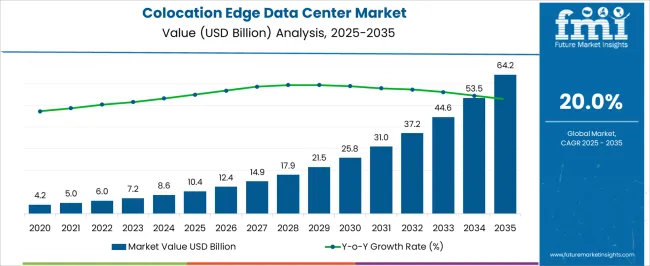

The colocation edge data center market is estimated to be valued at USD 10.4 billion in 2025 and is projected to reach USD 64.2 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period.

The acceleration and deceleration pattern in the market highlights phases of rapid growth followed by stabilization. From 2021 to 2025, the market grows from USD 4.2 billion to 10.4 billion, with steady increments through USD 5.0 billion, 6.0 billion, 7.2 billion, and 8.6 billion. The early phase is characterized by moderate acceleration, fueled by increasing demand for edge computing, data storage, and reduced latency in industries like IoT, AI, and cloud services. During this period, the market begins to take off as enterprises seek scalable and secure colocation solutions. From 2026 to 2030, values rise from USD 10.4 billion to 21.5 billion, with intermediate values passing through USD 12.4 billion, 14.9 billion, and 17.9 billion.

The growth rate sharply accelerates during this phase due to the continued surge in data generation, digital transformation, and the global rollout of 5G, increasing the need for edge data centers. Between 2031 and 2035, the market continues to grow rapidly from USD 25.8 billion to 64.2 billion, with intermediate values moving through USD 31.0 billion, 37.2 billion, 44.6 billion, and 53.5 billion. The deceleration phase in this later period is still characterized by high growth, as the market matures and competition intensifies, stabilizing the growth trajectory.

The colocation edge data center market is shaped by five key parent markets that collectively define its growth, demand, and technological evolution across various sectors. The data center infrastructure market contributes the largest share, about 30-35%, as colocation edge data centers provide essential IT infrastructure services, such as power, cooling, and networking, allowing businesses to rent space for servers and equipment without owning or managing their own data centers.

The cloud computing market adds approximately 20-24%, as the rise of cloud services increases the need for edge data centers to enable faster data processing, reduced latency, and localized content delivery for cloud-based applications. The telecommunications and networking market contributes around 15-18%, with edge data centers playing a crucial role in supporting 5G rollouts, IoT connectivity, and high-speed internet services by providing localized hubs for data transmission and processing.

The e-commerce and online retail market accounts for roughly 12-15%, as online platforms and digital service providers require efficient, scalable, and low-latency data centers to support the vast amounts of customer data, transactions, and content delivery. Finally, the artificial intelligence (AI) and big data analytics market represents about 8-10%, as the demand for real-time data processing and analysis at the edge drives the need for edge data centers to support AI workloads, machine learning models, and big data storage.

| Metric | Value |

|---|---|

| Colocation Edge Data Center Market Estimated Value in (2025 E) | USD 10.4 billion |

| Colocation Edge Data Center Market Forecast Value in (2035 F) | USD 64.2 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The colocation edge data center market is experiencing rapid expansion, driven by the rising demand for low-latency data processing and the increasing adoption of distributed IT infrastructure. Industry announcements and technology investment reports have highlighted how edge colocation facilities are enabling enterprises to position data closer to end-users, improving application performance and supporting emerging technologies such as IoT, AI, and 5G networks.

Strategic investments by data center operators have focused on expanding capacity in urban and regional hubs to address the growing data needs of cloud service providers and enterprise clients. Additionally, energy efficiency measures, modular design innovations, and hybrid connectivity solutions have enhanced the operational appeal of edge colocation centers.

Regulatory compliance requirements related to data sovereignty and security are further influencing deployment strategies. Looking ahead, market growth will be fueled by demand from industries seeking scalable, high-performance infrastructure that supports digital transformation, with retail colocation, large enterprises, and IT & telecom emerging as the primary growth drivers.

The colocation edge data center market is segmented by type, end-use, application, and geographic regions. By type, colocation edge data center market is divided into retail colocation and wholesale colocation. In terms of end-use, colocation edge data center market is classified into large enterprises and SME. Based on application, colocation edge data center market is segmented into IT & telecom, BFSI, energy, government & defense, healthcare, manufacturing, retail, and others. Regionally, the colocation edge data center industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

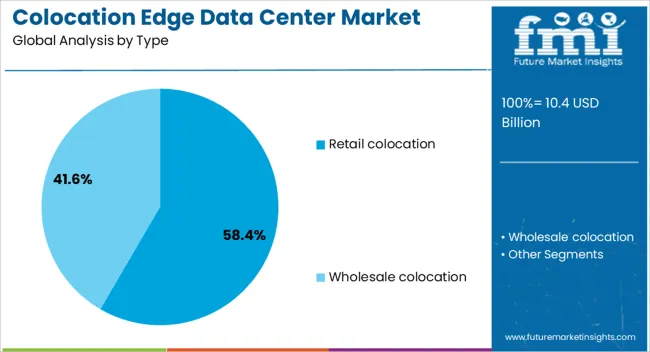

The retail colocation segment is projected to account for 58.4% of the colocation edge data center market revenue in 2025, securing its lead due to the flexibility and scalability it offers to diverse customers. Growth in this segment has been supported by enterprises seeking smaller rack space allocations without the capital burden of building and operating their own data centers.

Technology sector publications have noted that retail colocation provides tailored power, cooling, and connectivity options, enabling customers to expand capacity in line with business needs. The segment also benefits from shorter deployment timelines, which is critical for companies responding to dynamic market demands.

The ability to serve multiple tenants in shared facilities has optimized resource utilization, making retail colocation an attractive option for cost-conscious businesses. As the demand for edge computing and localized data processing accelerates, retail colocation is expected to maintain its leading position, driven by its adaptability to varying enterprise workloads and budget requirements.

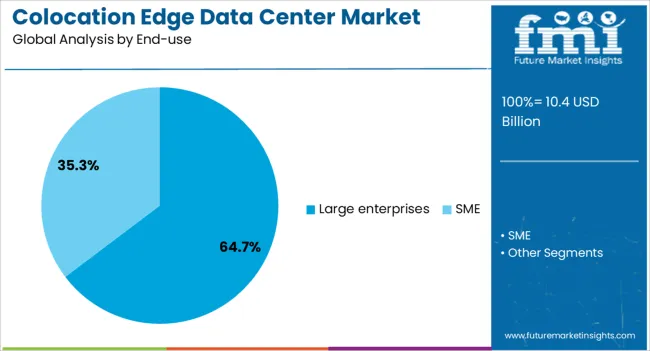

The large enterprises segment is projected to contribute 64.7% of the colocation edge data center market revenue in 2025, reflecting its dominant role in driving demand for advanced infrastructure solutions. This growth has been fueled by the data-intensive operations of large corporations across finance, manufacturing, e-commerce, and technology sectors.

Large enterprises have increasingly opted for colocation services to support hybrid and multi-cloud strategies, ensuring business continuity while maintaining control over mission-critical workloads. Annual reports from major data center providers have shown significant capacity leasing by large enterprises to support global operations, high-volume data storage, and real-time analytics.

The scalability, robust security, and compliance capabilities offered by colocation providers have aligned with enterprise-level operational and regulatory requirements. With ongoing digital transformation initiatives and the proliferation of AI and big data applications, large enterprises are expected to remain the primary customers in the edge colocation market.

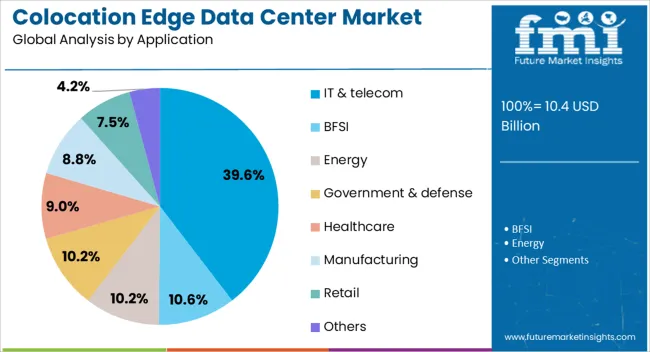

The IT & telecom segment is projected to hold 39.6% of the colocation edge data center market revenue in 2025, positioning it as the leading application category. Growth in this segment has been driven by the surge in mobile data traffic, expansion of 5G networks, and the need for localized content delivery.

Telecom operators have leveraged colocation edge facilities to deploy network functions closer to end-users, reducing latency and improving service quality. Likewise, IT service providers have utilized these facilities to host critical applications, cloud services, and disaster recovery infrastructure.

Industry reports have indicated that the IT & telecom sector is a major driver of edge deployments due to its reliance on high-speed, reliable connectivity and distributed computing capabilities. The increasing convergence of telecommunications and cloud computing, along with rising demand for OTT streaming, online gaming, and IoT applications, is expected to keep IT & telecom at the forefront of application-driven colocation growth.

The colocation edge data center market is growing due to the rising demand for low-latency data processing driven by applications such as IoT, 5G, AI, and smart cities. Challenges include high operational costs, regulatory compliance, and scalability. Opportunities lie in the global 5G rollout, IoT expansion, and the development of smart cities. Trends such as green data centers, automation, and modular designs are shaping the market. Providers offering scalable, energy-efficient, and customizable edge data center solutions are well-positioned for growth, particularly in North America, Europe, and Asia-Pacific, where technology adoption is high.

The colocation edge data center market is expanding as the adoption of edge computing accelerates, driven by the increasing demand for low-latency data processing and real-time applications. Edge data centers, located closer to end-users and data sources, help reduce latency and improve the efficiency of data processing for applications such as IoT, 5G, AI, and autonomous vehicles. Companies like Equinix, Digital Realty, and Vertiv are focusing on the deployment of smaller, highly efficient edge data centers to cater to the growing need for localized computing. As industries across healthcare, manufacturing, and retail prioritize real-time analytics and decision-making, the demand for colocation edge data centers is expected to continue to rise.

Despite growth prospects, the colocation edge data center market faces challenges related to high operational costs, regulatory compliance, and scalability. Edge data centers often require significant investment in infrastructure, including networking equipment, servers, and cooling systems. Additionally, compliance with regional regulations, such as data privacy laws and environmental standards, can complicate deployment. As demand grows, the ability to scale edge data centers rapidly and cost-effectively while ensuring high performance and security remains a critical challenge. Providers must balance the need for expansion with the ability to maintain cost-efficient operations and adhere to the diverse regulatory requirements across different regions.

Opportunities in the colocation edge data center market are driven by the global rollout of 5G networks, the growth of IoT devices, and the development of smart cities. 5G networks will require low-latency, high-bandwidth computing solutions, driving demand for edge data centers that can process data closer to the source. The expansion of IoT applications in industries like agriculture, healthcare, and manufacturing further increases the need for decentralized data processing. As smart cities become more prevalent, the demand for real-time analytics and data storage for smart infrastructure will fuel market growth. Companies providing flexible, scalable, and energy-efficient edge data center solutions will be well-positioned to capitalize on these opportunities.

Technological trends in the colocation edge data center market include the shift toward green data centers, automation, and modular designs. The growing focus on energy efficiency and sustainability has prompted providers to invest in renewable energy sources and innovative cooling solutions to minimize environmental impact. Automation is being adopted to optimize operations, reduce human intervention, and improve system reliability. Modular designs, which allow for quick scaling and easier deployment in various environments, are becoming increasingly popular. These trends enable providers to offer flexible, efficient, and environmentally responsible solutions, meeting the rising demand for edge computing while enhancing overall market competitiveness.

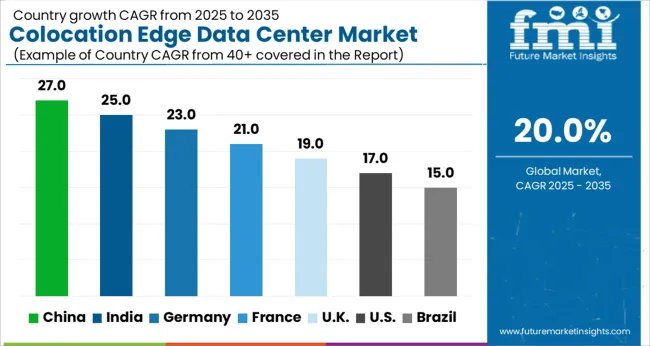

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

Global colocation edge data center demand is projected to grow at a 20% CAGR from 2025 to 2035. China leads with 27%, followed by India at 25% and Germany at 23%, while the UK posts 19% and the USA records 17%. These rates translate to a growth premium of +35% for China, +25% for India, and +15% for Germany versus the baseline, whereas the UK and USA trail by -5% and -15%, respectively. Divergence reflects local drivers: rapid digitization and increased demand for cloud infrastructure in China and India, technological advancements and industrial expansion in Germany, while the UK and USA face slower growth due to market maturity, high competition, and market saturation. The analysis includes over 40+ countries, with the leading markets detailed below.

The colocation edge data center market in China is projected to grow at a CAGR of 27.0% from 2025 to 2035, driven by the country’s rapid digital transformation. With an expanding digital economy and a large number of tech-driven industries, the demand for edge data centers is surging. The rise of cloud services, AI, and IoT in China’s industrial sectors is increasing the need for high-performance computing infrastructure. The government’s focus on technological advancements and smart city initiatives further supports the demand for edge data centers, as they offer low-latency services and ensure efficient data processing close to the source. As the country becomes a hub for data traffic, both domestic and international players are investing heavily in the development of edge data centers. China’s expanding internet infrastructure and increasing internet penetration in urban and rural areas will continue to fuel the growth of colocation edge data centers.

The colocation edge data center market in India is expected to grow at a CAGR of 25.0% from 2025 to 2035, reflecting the country’s booming digital ecosystem. With increasing demand for data-driven technologies such as cloud computing, AI, and IoT, edge data centers are becoming crucial to meet the latency and data processing requirements of businesses and consumers alike. The country’s growing urbanization and the rapid adoption of e-commerce, mobile applications, and digital platforms are further fueling the need for localized data storage. India’s emphasis on the digital economy through initiatives like “Digital India” and smart city projects is expected to contribute significantly to the growth of colocation edge data centers. Moreover, the expansion of tech hubs in cities like Bengaluru, Hyderabad, and Pune is attracting both local and global investments in the data center sector.

The colocation edge data center market in Germany is anticipated to grow at a CAGR of 23.0% from 2025 to 2035. As one of the key leaders in the European digital economy, Germany’s demand for edge data centers is driven by the country’s advanced technological landscape. The market growth is supported by Germany’s focus on industrial automation, data processing for AI, and the increasing demand for cloud services. Additionally, the need for localized data centers to comply with stringent European data protection regulations (GDPR) boosts the market. The growing trend of digitalization in industries like automotive, manufacturing, and logistics is further driving the demand for edge data centers in Germany. The country’s strong connectivity infrastructure and skilled workforce make it an attractive location for both domestic and international edge data center providers.

The UK’s colocation edge data center market is expected to grow at a CAGR of 19.0% from 2025 to 2035. Despite being a mature market, the UK continues to see demand for edge data centers, fueled by growing needs for low-latency services, cloud computing, and IoT. The country's strong focus on innovation and the digital economy, combined with high internet penetration, is driving growth in data consumption and storage solutions. The UK is also home to numerous global tech giants and fintech companies, all of which demand cutting-edge, low-latency data solutions. Market growth is somewhat tempered by the saturation of the data center industry and high competition. The push for energy efficiency and green data centers has resulted in the adoption of more sustainable and innovative approaches to building edge data centers.

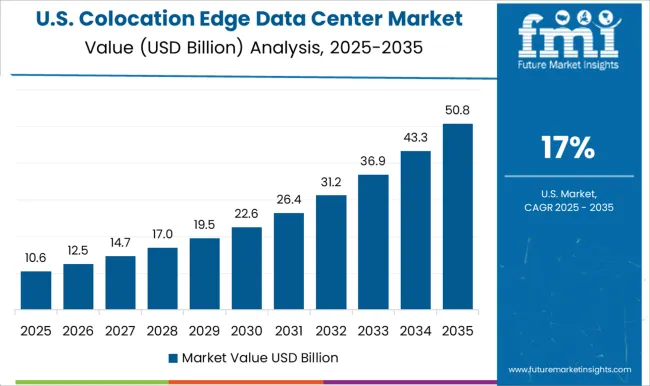

The USA colocation edge data center market is projected to grow at a CAGR of 17.0% from 2025 to 2035. While the USA market is highly mature, it remains a dominant player in the global colocation data center landscape. The country’s need for edge data centers is driven by the explosion of data from cloud services, AI, and IoT, as well as an increasing shift toward digital transformation across all industries. Despite the high competition and market saturation, the need for low-latency data processing solutions is driving growth in edge data centers, particularly in urban and tech hubs like Silicon Valley and New York. USA regulations related to data sovereignty and compliance are also a driving force for edge data center development, with businesses seeking localized solutions to meet legal requirements.

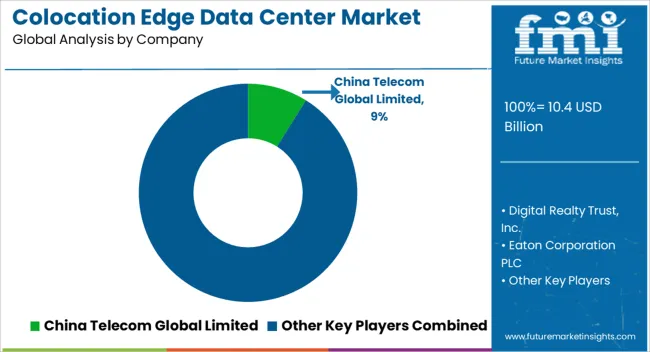

The colocation edge data center market is highly competitive, with key players such as China Telecom Global Limited, Digital Realty Trust, Inc., Eaton Corporation PLC, Emtel, Equinix, Inc., Fujitsu Limited, Hewlett-Packard, IBM Corporation, KDDI Corporation, NTT Communications Corporation, Ltd., Rackspace Inc., Schneider Electric SE, Singapore Telecommunications Limited, Teraco Data Environments, Verizon Communications Inc., and Vertiv Group Corp. Each company competes by offering state-of-the-art infrastructure, high availability, and scalability to meet the increasing demand for edge computing. Digital Realty Trust stands out with its global network of colocation facilities, promoting reliability and performance with extensive product brochures detailing the flexibility of their edge data centers and seamless integration with cloud services. Equinix, Inc. focuses on offering interconnected edge data centers with low latency solutions. Its brochures emphasize its global reach, strong interconnection capabilities, and premium customer service.

The company highlights how it facilitates digital transformation through its edge platforms, connecting data centers across major global markets. Similarly, Fujitsu Limited emphasizes robust infrastructure with a focus on energy efficiency and sustainability in its edge colocation offerings. Its brochures showcase innovations in cooling technology and high-density computing. Schneider Electric SE and Vertiv Group Corp. concentrate on power and cooling solutions for edge data centers, with a focus on optimizing energy consumption and reducing operational costs. Product brochures from both companies detail cutting-edge technology that ensures efficiency and maximum uptime for clients. BM Corporation and Hewlett-Packard offer advanced computing and infrastructure management solutions, with brochures highlighting their edge colocation offerings that integrate with AI, cloud, and IoT services.

KDDI Corporation and NTT Communications Corporation, Ltd. provide tailored edge data center solutions for the Asian market, emphasizing connectivity, scalability, and compliance with regional regulations. Rackspace Inc. and Teraco Data Environments focus on managed services and multi-cloud platforms, with brochures targeting customers seeking comprehensive and flexible colocation solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.4 billion |

| Type | Retail colocation and Wholesale colocation |

| End-use | Large enterprises and SME |

| Application | IT & telecom, BFSI, Energy, Government & defense, Healthcare, Manufacturing, Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | China Telecom Global Limited, Digital Realty Trust, Inc., Eaton Corporation PLC, Emtel, Equinix, Inc., Fujitsu Limited, Hewlett-Packard, IBM Corporation, KDDI Corporation, NTT Communications Corporation, Ltd., Rackspace Inc., Schneider Electric SE, Singapore Telecommunications Limited, Teraco Data Environments, Verizon Communications Inc., and Vertiv Group Corp |

| Additional Attributes | Dollar sales by service type (colocation, cloud, managed services), data center size (small, medium, large), and power capacity (low, medium, high). Demand is driven by the increasing need for low-latency processing, the proliferation of IoT devices, and the growing demand for cloud services. Regional trends show significant growth in North America, Europe, and Asia-Pacific, driven by the expanding data storage and processing requirements of businesses and the increasing adoption of edge computing technologies in emerging markets. |

The global colocation edge data center market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the colocation edge data center market is projected to reach USD 64.2 billion by 2035.

The colocation edge data center market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in colocation edge data center market are retail colocation and wholesale colocation.

In terms of end-use, large enterprises segment to command 64.7% share in the colocation edge data center market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Edge Security Market Size and Share Forecast Outlook 2025 to 2035

Edge Banders Market Size and Share Forecast Outlook 2025 to 2035

Edge AI for Smart Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Edge Bending Machine Market - Trends & Forecast 2025 to 2035

Edge Server Market Trends – Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Edge Protector Manufacturing

Edge AI Market Trends – Growth, Demand & Forecast through 2034

Edge Data Centers Market

Hedge Shears Market Size and Share Forecast Outlook 2025 to 2035

Wedge Wire Screen Market Size and Share Forecast Outlook 2025 to 2035

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

Wedge Pressure Catheters Market

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

Knowledge Management Software Market Size and Share Forecast Outlook 2025 to 2035

Warm Edge Spacer Market Size and Share Forecast Outlook 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA