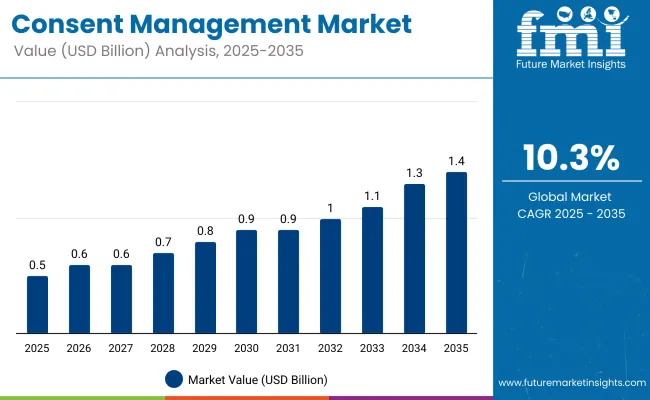

The consent management market is projected to reach USD 1.4 billion by 2035, at a CAGR of 10.3%. By deployment type, on-premises will dominate with a 56.7% share, while by enterprise size, large enterprises will lead with a 61.0% share. Sales are projected to rise at a CAGR of 10.3% over the forecast period between 2025 and 2035. The revenue generated by Consent Management in 2024 was USD 0.47 billion. The industry is anticipated to exhibit a Y-o-Y growth of 9.3% in 2025.

Rising Global Data Privacy Regulations are one of the key factors driving growth of the Consent Management Market. As a result, governments and regulatory authorities across the globe are putting strict laws like the General Data Protection Regulation (GDPR) in Europe, California Consumer Privacy Act (CCPA) in the USA, and similar frameworks in Brazil (LGPD) and India (DPDP Act). These regulations require businesses to seek, maintain, and record user consent for data collection and processing.

Health, e-commerce, finance, and other organizations now need to implement consent management platforms (CMPs) to comply with regulations and avoid steep financial penalties. Moreover, increasing consumer awareness regarding data privacy compelling organizations to implement transparent and user-friendly consent mechanisms, which is contributing to the market growth.

Enterprises are also making these investments to automate and scale on consent management, especially the sugar of third-party data, with the fourth party (data brokers) maintaining the lightweight framework that supports the incredibility behind new-age platform business models that drive the new-age platform economy.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 0.47 Billion |

| Estimated Size, 2025 | USD 0.5 Billion |

| Projected Size, 2035 | USD 1.4 Billion |

| Value-based CAGR (2025 to 2035) | 10.3% |

Data privacy regulations are becoming more stringent as businesses need to comply with these regulations. To address these concerns, enterprises from different sectors such as e-commerce, healthcare, and finance are implementing Consent Management Platforms (CMPs) to provide compliance, improve data transparency, and gain customer trust.

With the growing adoption of digital services, heightened consumer awareness, and the move to cookie-less marketing, demand for advanced consent solutions is at an all-time high across organizations. Cloud-based and AI-driven CMPs are on the rise, and empowering automation and scalability. As enterprises embrace ethical data collection, the market is poised for continued growth, with tremendous innovation and consolidation on the horizon.

In 2025, consent management programs are being reshaped by machine-readable opt-out signals and regulator-defined UX requirements rather than banner cosmetics. In the United States, Colorado’s Attorney General operates a formal Universal Opt-Out Mechanism (UOOM) list that covered entities must honor; controllers are expected to detect and respect state-recognized signals automatically. Connecticut follows suit from January 1, 2025, requiring businesses to honor opt-out preference signals (for example, Global Privacy Control) when sent by residents’ browsers or extensions. These obligations make signal detection, state-aware scoping, and audit logs table stakes for any consent platform deployed nationally.

In Europe, enforcement is codifying “choice architecture.” The European Commission’s 2025 DMA actions underline that gatekeepers must obtain valid consent before combining personal data across their services, and users who decline must receive an equivalent experience pressuring product teams to implement clear “reject all” and non-coercive flows. The EDPB’s Cookie Banner Task Force report (adopted by EU DPAs) likewise sets out common positions on banner design, including placement and symmetry between accept/reject options, which many authorities are now using to harmonize audits. Together these references anchor what “valid consent” looks like in real UI, not just on paper.

Technical standards now give consent records a portable backbone. ISO/IEC TS 27560:2023 specifies an interoperable structure for recording and exchanging consent events and furnishing consent receipts to individuals useful for multi-brand portfolios and cross-vendor data sharing. In parallel, NIST’s Privacy Framework is moving to Version 1.1 aligned with CSF 2.0, giving privacy teams a common control language to map consent collection, withdrawal, and downstream enforcement into enterprise risk management. Expect RFPs in 2025 to request explicit conformance statements to these artifacts.

The browser ecosystem adds another 2025 wrinkle. Under UK CMA oversight, Chrome’s third-party-cookie deprecation remains gated by competition commitments and quarterly progress reporting, keeping many organizations in a dual world of cookie-based and signal-based consent for longer. Consent stacks therefore need durable linkages to both legacy cookie stores and emerging APIs, with governance evidence drawn from CMA-documented milestones.

Finally, adjacent regimes reinforce purpose clarity. The EU Entry/Exit System, launching progressively from 12 October 2025, mandates biometric capture at borders an example where processing rests on legal obligation rather than consent so mature platforms are documenting lawful basis per purpose and surfacing notices separate from consent prompts.

The below table presents the expected CAGR for the global consent management market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 9.3%, followed by a slightly higher growth rate of 9.9% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 9.3% (2024 to 2034) |

| H2, 2024 | 9.9% (2024 to 2034) |

| H1, 2025 | 10.3% (2025 to 2035) |

| H2, 2025 | 10.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 10.3% in the first half and remain relatively moderate at 10.9% in the second half. In the first half H1 the market witnessed a decrease of 50 BPS while in the second half H2, the market witnessed an increase of 60 BPS.

Stringent data privacy regulations will fuel the market

Introduction of data privacy laws has sharply increased the need for consent management solutions. These laws require the organizations to petition the users before gathering, processing, or sharing personal information. Companies that do not follow these rules and regulations could face serious financial penalties and reputational damage, leading them to implement robust consent management systems to ensure compliance and build end-user trust.

Increasing consumer awareness and demand for privacy will boost the Consent Management market.

The importance also lies to the nature of consumers who are now more concerned than ever about data privacy and security, thus a greater need for transparency and control over personal information. Costumers are increasingly aware of the usage of their data and escalating demands for businesses to protect their privacy.

Such changing in customer behavior is pushing the organizations to address this challenge by implementing sophisticated consent management solutions which would offer consumers well-defined choices and control over their data, thereby enhancing the customer trust and loyalty.

The proliferation of digital transformation and IOT devices will fuel the market

The ever-growing and ever prospering consent management market is driven mainly by the rapid digital transformation in multiple industries (financial and other) alongside the number of devices connected to IoT. With the digitization of organizations and the networking of more and more devices, the volume of data collected and processed increases exponentially.

This increase in the volume of data requires the best consent management solutions to ensure that user permissions are obtained and maintained correctly. Advanced consent management technologies have become essential for navigating this complexity in an ever more digital and interconnected landscape.

The Complexity and Cost of Implementation will the hamper the growth of Consent Management market

Consent management market is primarily driven by rapid digital transformation in various industry verticals and increasing number of Internet of Things (IoT) devices. As organizations digitize their functions and more devices become part of the network, so does the volume of data being collected and processed skyrocket.

This surge in data necessitates effective consent management to ensure user permissions are obtained and maintained appropriately. In a world that is gradually becoming more digital and interconnected, advanced consent management technologies are essential to staying on top of the complexities surrounding data consent.

During the historical period spanning 2020 to 2024, the global consent management market registered a CAGR of 10.3%. The overall progress of the Consent Management market was positive due to the fact that it managed a very high value of USD 472.9 million in the year 2024 from a total of USD 288.4 million in 2020.

The global consent management market grew significantly from 2020 to 2024 as industry-wide digital transformation and stringent laws increased awareness of data protection. During this period, companies invested heavily in consent management systems to ensure compliance and build customer trust.

Between the period 2025 and 2035, there are high chances that the demand for consent management systems will continue to increase, as global legal frameworks are set to tighten further alongside the growth of IoT devices and increasing drive for protected data in developing economies.

A majority of key players in the market have already started incorporating sophisticated technologies such as artificial intelligence and blockchain within their consent management platforms, thereby enhancing their capabilities, which is predicted to lead to future market expansion.

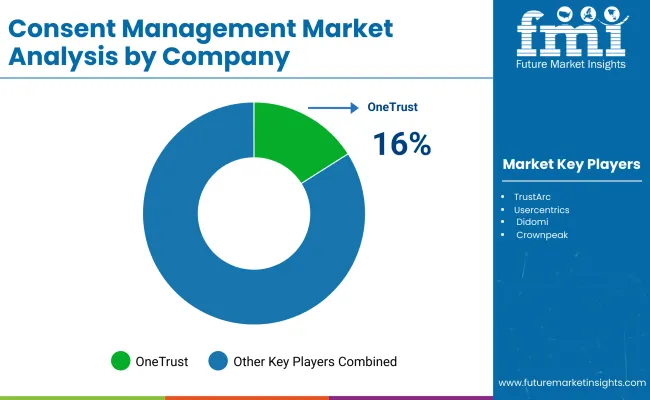

OneTrust, TrustArc and Crownpeak are considered Tier 1 players when it comes to comprehensive, scalable consent management solutions, extensive market coverage and strong customer bases. Their strategies focus on delivering enterprise solutions with a consolidated end-to-end privacy management platform.

They are extremely focused on complying with international laws, provide a variety of customization options, as well as use modern technologies, such as artificial intelligence and machine learning, to secure and protect data. These organizations invest considerable resources in research and development to stay ahead of market trends and regulatory shifts and to be able to continue to offer world-class solutions.

Cookiebot by Cybot A/S, Quantcast Choice, Didomi, and Usercentrics fall into the Tier 2 category, with solid, high-functionality, but relatively less inclusive, solutions. They focus on narrower markets and offer consent management tools with peak efficacy, which are easier to roll out and manage for mid-sized enterprises.

Many of these companies focus on ease of use, affordability, and rapid deployment, which provides an appealing option for companies seeking established solutions without the complexity of larger platforms. They also keep track of regulatory changes, and some even offer multi-industry-specific features.

Tier 3 companies - Piwik PRO, TrustCommander, CookieYes - are oriented towards specific small businesses or niche markets, and also offer simple and inexpensive consent management solutions. If we analyse their key points of differentiation, they largely focus on simple consent management capabilities, user-friendly interface and compatibility with popular web tech stacks.

These companies offer businesses fewer compliance requirements and often position themselves as the simple and open option in a product category. Though they may not have the feature sets or global presence of the giants, they provide reliable services.

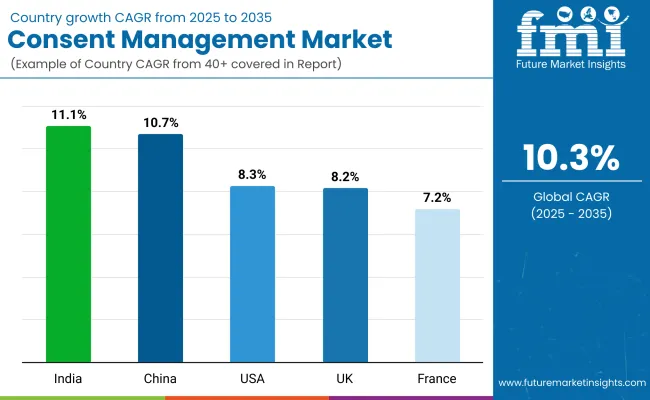

The section below covers the industry analysis for the consent management market for different countries. The market demand analysis on key countries in several countries of the world, including USA, France, UK, China and India is provided.

The united states are anticipated to remain at the forefront in North America, with a value share of 66.2% in 2025. In South Asia & pacific, India is projected to witness a CAGR of 11.1% by 2034.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

| China | 10.7% |

| India | 11.1% |

| France | 7.2% |

| UK | 8.2% |

USA consent management market is poised to exhibit a CAGR of 8.3% between 2024 and 2034.

Increasing need for privacy in the USA is expected to drive the substantial development in the consent management. As per the recent research studies, a significant number of citizens in America are concerned about their security on the internet, with 79% worried about how organizations use their personal information.

This growing worry and awareness has prompted organizations to implement comprehensive consent management solutions to ensure transparency and compliance with laws such as the Consumer Privacy Act of California (CCPA).

According to the study, customers are increasingly seeking more control over their private information, with 81% favoring strict data privacy laws. This rising emphasis on privacy has prompted organizations to develop enhanced consent management systems, allowing a safer and more trustworthy digital world.

South Asia & Pacific, spearheaded by the India currently holds around 27.2% market share of the consent management market.

Managing the privacy scenario and marketing growth in India will go through a significant change with the implementation of new laws and regulations, such as the Digital Personal Data Protection Bill 2022. These restrictions are expected to stimulate the consent management sector by requiring stronger data privacy and protection requirements.

As organizations react to these developments, there will be a greater need for strong consent management solutions that ensure compliance and build consumer trust. Insights from India's data protection shift show that organizations are increasingly prioritizing transparent data practices and efficient consent procedures to remain competitive.

For example, a recent survey revealed that more than 70% of Indian organizations intended to improve their data management systems in accordance to the new rules, emphasizing the market's growth potential. This legitimate boost emphasizes the vital requirement to develop better consent management tools that not only protect customer data but also enhance marketing tactics through allowing more precise and legally acceptable data usage.

East asia, led by the china currently holds around 58.8% market share of the Consent Management market. China is anticipated to grow at a CAGR of 6.7% throughout the forecast period.

Rising advances in technology designed to promote data privacy and protection in China are significantly pushing the consent management industry. Chinese businesses are making greater investments in new technologies such as artificial intelligence (AI) and blockchain to improve data security and meet with severe guidelines such as the Personal Information Protection Law (PIPL).

For example, technological giants like Alibaba and Tencent have developed advanced consent management platforms that use AI algorithms to speed up data gathering procedures while ensuring user consent compliance in real time.

These enhancements not only strengthen data privacy security measures, but also position China as a major provider of innovative consent management systems that meet both domestic and international market demands. This technology advancement emphasizes a proactive approach to data protection, resulting in strong growth in China's consent management businesses.

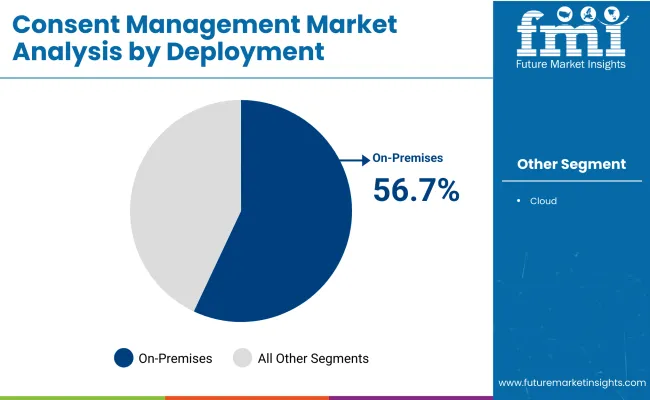

The section contains information about the leading segments in the industry. By Deployment, the ultrasonic Cloud segment is estimated to grow at a CAGR of 12.2% throughout 2034. Additionally, by Enterprise Size, the SMEs segment is projected to expand at a CAGR of 10.6% during forecasted period.

| Platforms | Value Share (2024) |

|---|---|

| On-Premises | 56.7% |

On-premises segment continues to dominate the consent management market significantly, capturing an impressive 56.7% of the market share in terms of revenue as of 2024.

The On-Premises segment holds the noticeable market share in the consent management market, with organizations focusing on data security and control over consent management processes. organizations and industries such as finance and healthcare as operating in strictly regulated sectors choose on-premise solutions in order to comply with stringent data protection regulations and maintain direct control over sensitive customer data.

As an example, a large-scale financial institution may choose to implement an on-premise consent management system to protect customer data from potential security breaches while also meeting compliance standards, including GDPR, by ensuring that consent information is internally managed. The reason for this is that the data management market is critically dependent on data security and compliance, with a strong preference for on-premises solutions.

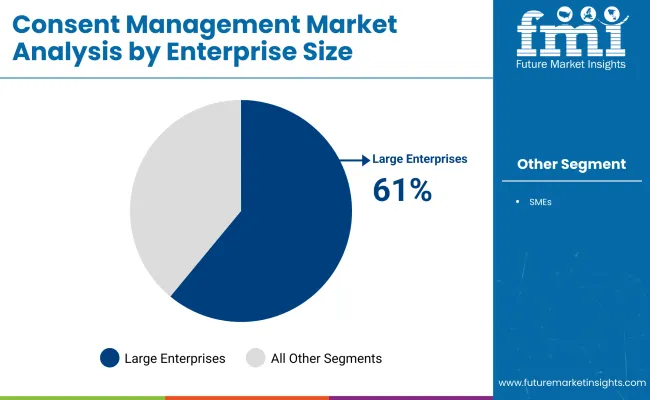

Large enterprises account for about 61% of the consent management market in 2025 because they operate at a scale and complexity that turns consent into an enterprise system, not just a website banner. Their portfolios span multiple brands, apps, and regions, so platforms are configured with policy engines that localize purposes, retention, and legal bases by jurisdiction. Consent events are standardized and portable, with receipts attached to user records and propagated to downstream systems such as CDPs, CRMs, analytics tools, and advertising platforms. Revocations must cascade quickly. Mature teams track a service-level target for how fast downstream systems honor a withdrawal and surface audit evidence for regulators and internal assurance.

Enterprise buyers prioritize architecture. Typical requirements include single sign-on, role-based access, SCIM provisioning, SIEM logging, keys managed by the customer, and options for private cloud or on-premises deployment to meet data residency and sector obligations. SDKs and tag managers are tuned for low latency at the edge to avoid degrading page performance. Preference centers are multilingual and channel-aware, capturing web, mobile, in-app, call center, and in-store choices into one master record.

Governance is formalized. Privacy, security, product, and marketing teams share a RACI. Releases carry a “consent bill of materials” that lists purposes touched, dark-pattern checks, and test evidence. UX patterns provide equal prominence for accept and reject, with granular toggles and clear notices. Measurement goes beyond acceptance rate to include latency, orphaned signals, and downstream parity across systems. This operating model explains why large enterprises dominate spend: they buy consent as a control layer embedded across the stack, with verifiable audit trails and interoperability baked into day-to-day operations.

In the consent management industry, advanced features, scalability, integration capabilities, and compliance support set vendors apart from one another. Prominent suppliers offer scalable solutions with seamless connection with current IT infrastructure and third-party apps, and may be customized to satisfy particular regulatory needs like GDPR and CCPA.

In order to assist organizations in efficiently managing and utilizing consent data, vendors also place a strong emphasis on user-friendly interfaces, real-time consent tracking, and robust analytics. Vendors meet the needs of a wide range of customers by emphasizing these factors, from small companies looking for basic compliance to huge corporations needing complete and scalable consent management solutions.

Recent Industry Developments in Consent Management Market

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 0.4 billion |

| Current Total Market Size (2025) | USD 0.5 Billion |

| Projected Market Size (2035) | USD 1.4 billion |

| CAGR (2025 to 2035) | 10.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand deployments for volume |

| Solutions Analyzed (Segment 1) | Consent Management Platform, Consent Preference Management, Compliance Management, Cookie Consent Management, Data Subject Rights Management, Vendor Privacy Risk Management, Privacy Assessments, Others |

| Services Analyzed (Segment 2) | Consulting Services, Compliance Assessment and Audit, Policy Development and Implementation, Training and Education, Data Mapping and Inventory, Consent Lifecycle Management, Incident Response and Management, Vendor and Third-Party Management, Others |

| Deployment Types Analyzed (Segment 3) | Cloud, On-Premises |

| Enterprise Sizes Analyzed (Segment 4) | Small & Medium Enterprises (SMEs), Large Enterprises |

| Industries Analyzed (Segment 5) | Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector, Infrastructure |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Consent Management Market | OneTrust, TrustArc, Cookiebot by Cybot A/S, Quantcast Choice, Crownpeak, Didomi, Usercentrics, Piwik PRO, TrustCommander, CookieYes |

| Additional Attributes | Adoption driven by evolving data privacy regulations (GDPR, CCPA), Cloud-native consent management surge among SMEs, Growth in cookie management and vendor risk workflows, Digital trust enhancement through consent transparency and lifecycle tools |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of Solution, the is divided into Consent Management Platform, Consent Preference Management, Compliance Management, Cookie Consent Management, Data Subject Rights Management, Vendor Privacy Risk Management, Privacy Assessments and Others.

In terms of Services, the is divided into Consulting Services, Compliance Assessment and Audit, Policy Development and Implementation, Training and Education, Data Mapping and Inventory, Consent Lifecycle Management, Incident Response and Management, Vendor and Third-Party Management and Others.

In terms of Deployment, the is segregated into Cloud and On-Premises.

The Enterprise Size is classified by industries as SMEs and Large Enterprises.

The Industry is classified by industries as Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector and Infrastructure.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global consent management industry is projected to witness a CAGR of 10.3% between 2025 and 2035.

The global consent management industry stood at USD 0.47 billion in 2024.

The global consent management industry is anticipated to reach USD 1.4 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 9.0% in the assessment period.

T The key players operating in the global consent management industry include OneTrust, TrustArc, Cookiebot by Cybot A/S, Quantcast Choice, Crownpeak, Didomi, and Usercentrics.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Services, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Types, 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Component, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Services, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by End-use, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 21: Global Market Attractiveness by Component, 2024 to 2034

Figure 22: Global Market Attractiveness by Services, 2024 to 2034

Figure 23: Global Market Attractiveness by Deployment Types, 2024 to 2034

Figure 24: Global Market Attractiveness by End-use, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Component, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Services, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 29: North America Market Value (US$ Million) by End-use, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 46: North America Market Attractiveness by Component, 2024 to 2034

Figure 47: North America Market Attractiveness by Services, 2024 to 2034

Figure 48: North America Market Attractiveness by Deployment Types, 2024 to 2034

Figure 49: North America Market Attractiveness by End-use, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Component, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Services, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by End-use, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Component, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Services, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Deployment Types, 2024 to 2034

Figure 74: Latin America Market Attractiveness by End-use, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Services, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by End-use, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Component, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Services, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Deployment Types, 2024 to 2034

Figure 99: Western Europe Market Attractiveness by End-use, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Services, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by End-use, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Component, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Services, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Deployment Types, 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by End-use, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Component, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Services, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by End-use, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Component, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Services, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Deployment Types, 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by End-use, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Component, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Services, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by End-use, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Component, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Services, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Deployment Types, 2024 to 2034

Figure 174: East Asia Market Attractiveness by End-use, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Component, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Services, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Deployment Types, 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by End-use, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Services, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Services, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Services, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Types, 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Types, 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Types, 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Component, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Services, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Deployment Types, 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by End-use, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Consent Management Companies

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA