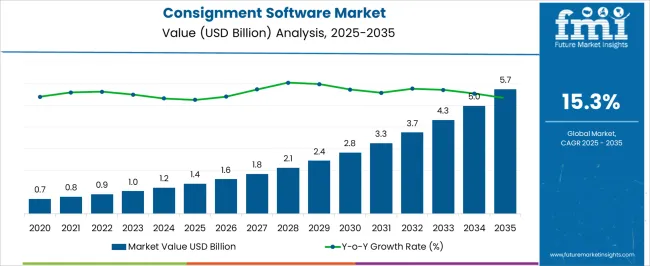

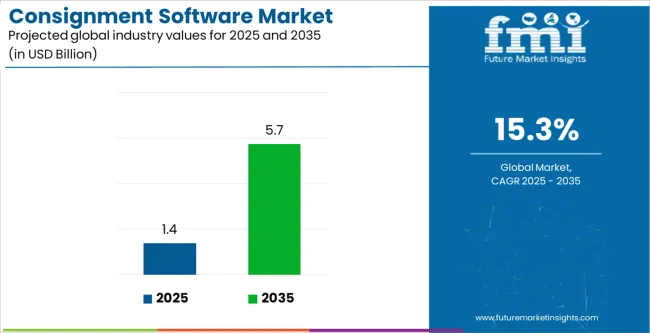

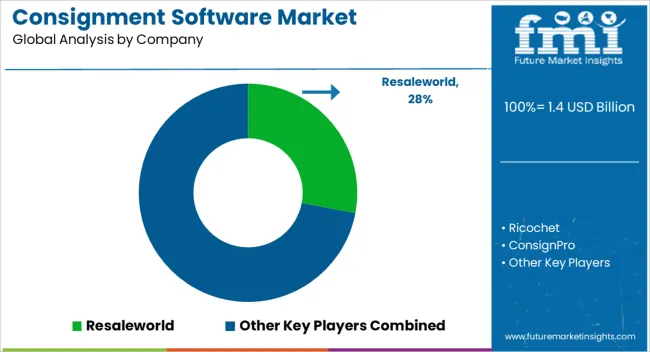

The Consignment Software Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 15.3% over the forecast period.

| Metric | Value |

|---|---|

| Consignment Software Market Estimated Value in (2025 E) | USD 1.4 billion |

| Consignment Software Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 15.3% |

The Consignment Software market is experiencing notable momentum as enterprises increasingly adopt digital platforms to streamline inventory tracking, contract management, and revenue settlement processes. The market has been strengthened by the rising need for real-time visibility into consignment stock, ensuring that suppliers and retailers can minimize operational inefficiencies while maximizing profit margins.

Cloud-based solutions, scalable integrations, and AI-driven analytics are transforming how consignment operations are managed, creating opportunities for businesses of all sizes to enhance efficiency and compliance. The current landscape is characterized by strong uptake in retail, logistics, and manufacturing sectors, driven by the growing shift toward automation and seamless supply chain collaboration.

Future growth prospects are anticipated to be influenced by advancements in predictive analytics, integration with ERP and CRM systems, and the increasing importance of accurate reporting for financial transparency As enterprises prioritize agility and accountability in managing consignment operations, software platforms offering customizable, real-time, and cost-effective solutions are expected to dominate adoption, reinforcing a steady trajectory for global market expansion.

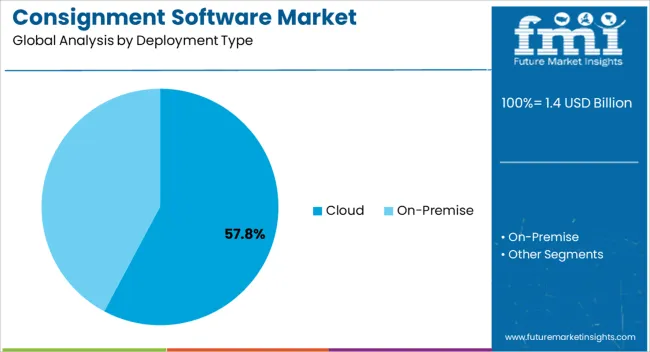

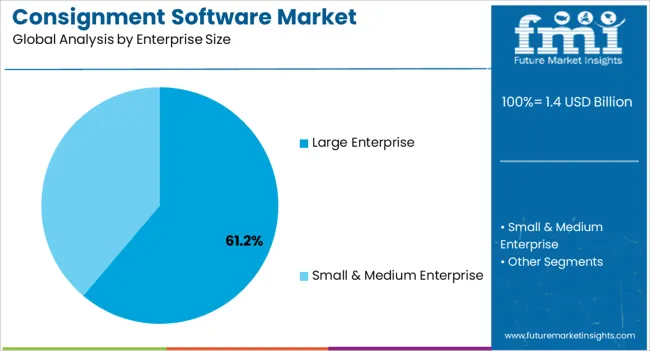

The consignment software market is segmented by deployment type, enterprise size, and geographic regions. By deployment type, consignment software market is divided into Cloud and On-Premise. In terms of enterprise size, consignment software market is classified into Large Enterprise and Small & Medium Enterprise. Regionally, the consignment software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cloud deployment type is projected to hold 57.80% of the Consignment Software market revenue share in 2025, making it the leading deployment model. This position has been achieved due to the cost efficiency, scalability, and accessibility offered by cloud-based platforms. Enterprises prefer cloud deployment as it reduces the burden of maintaining on-premise infrastructure while allowing users to access critical consignment data from any location with ease.

The ability to provide automatic software updates, seamless integration with third-party applications, and enhanced data security features has accelerated adoption across industries. Cloud deployment has further benefited from its suitability for small and medium enterprises that require flexible pricing models and quick deployment timelines.

In addition, global trends of digital transformation and the rising reliance on remote operations have reinforced cloud adoption in the consignment software market With businesses increasingly prioritizing speed, scalability, and reduced total cost of ownership, the cloud segment is expected to sustain its dominance as the preferred deployment type in the forecast period.

The Large Enterprise segment is anticipated to hold 61.20% of the overall revenue share in the Consignment Software market in 2025, making it the leading enterprise size category. This dominance has been attributed to the significant investment capabilities and complex operational requirements of large organizations that demand advanced, scalable consignment solutions. Large enterprises often operate across multiple geographies and require unified platforms to manage extensive inventories, multiple stakeholders, and complex settlement structures.

Consignment software provides the ability to centralize operations, automate reporting, and ensure compliance with contractual obligations, thereby reducing risks and inefficiencies. The growing focus on data-driven decision-making and the integration of AI and analytics into consignment platforms have further supported adoption by large enterprises.

Moreover, the emphasis on improving supplier-retailer collaboration and maintaining transparent financial records has made such software indispensable for organizations handling high transaction volumes With digital transformation strategies becoming a priority, large enterprises are expected to remain the dominant contributors to the consignment software market’s overall revenue growth.

The consignment software manages the consignment inventory, and the basis of consignment inventory relates to ownership. The customer or consignee has possession of goods or inventory but it is still owned by the consignor or the supplier and will be recorded as inventory on their accounting records. Change of ownership does not occur when goods have been receipted contrary to most of the standard inventory management systems. But in some cases, this requires consignment software to be managed differently by a manual process or through a separate system.

Consignment software offers a leverage to consignor for getting stock in front of customers through the exposure of goods in the store. Thus the consignor gets the opportunity to get unproven and new products in the market as form of market testing, but consignor has to bear the costs of inventory. Thus consignment software is beneficial for both the customers seeking new variety of goods for their consumers and for the suppliers looking to get new product in the market space. Hence there are several benefits of using the consignment software. The consignment software is beneficial for products where there is uncertainty around its demand or the high end goods. Moreover, the consignment software can also be used to introduce old goods or products into the new markets. So with the help of consignment software one can achieve maximum revenue from their inventory even with minimal efforts applied.

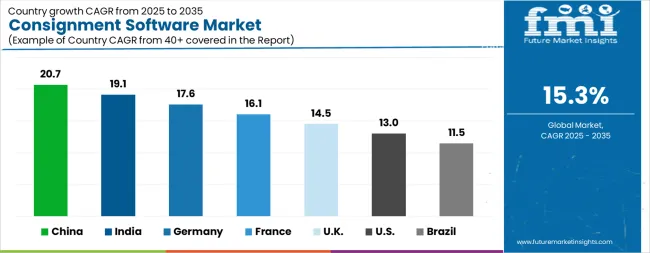

| Country | CAGR |

|---|---|

| China | 20.7% |

| India | 19.1% |

| Germany | 17.6% |

| France | 16.1% |

| UK | 14.5% |

| USA | 13.0% |

| Brazil | 11.5% |

The Consignment Software Market is expected to register a CAGR of 15.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 20.7%, followed by India at 19.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.7%, yet still underscores a broadly positive trajectory for the global Consignment Software Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 17.6%. The USA Consignment Software Market is estimated to be valued at USD 475.8 million in 2025 and is anticipated to reach a valuation of USD 1.6 billion by 2035. Sales are projected to rise at a CAGR of 13.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 70.3 million and USD 46.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Deployment Type | Cloud and On-Premise |

| Enterprise Size | Large Enterprise and Small & Medium Enterprise |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Resaleworld, Ricochet, ConsignPro, Tri-Technical Systems, and RJFSOFT |

The global consignment software market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the consignment software market is projected to reach USD 5.7 billion by 2035.

The consignment software market is expected to grow at a 15.3% CAGR between 2025 and 2035.

The key product types in consignment software market are cloud and on-premise.

In terms of enterprise size, large enterprise segment to command 61.2% share in the consignment software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Software Distribution Industry

Software Distribution Market Analysis by Deployment Type, by Organization Size and by Industry Vertical Through 2035

Software-Defined WAN Market - Growth & Forecast through 2034

Software Defined Video Networking Market

UK Software Distribution Market Analysis – Size & Industry Trends 2025-2035

VPN Software Market Size and Share Forecast Outlook 2025 to 2035

3PL Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA