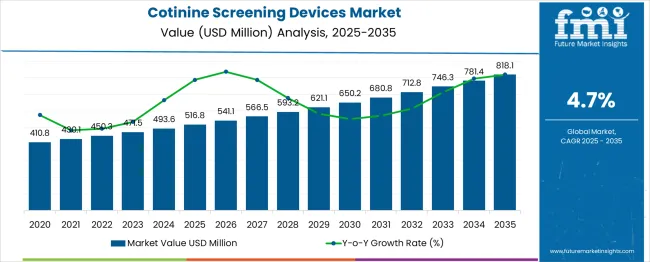

The Cotinine Screening Devices Market is estimated to be valued at USD 516.8 million in 2025 and is projected to reach USD 818.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

The market is segmented by Device Type, Sample Type, and End-User and region. By Device Type, the market is divided into Strips, Cassettes, and Reader. In terms of Sample Type, the market is classified into Urine Sample, Blood Sample, and Saliva Sample. Based on End-User, the market is segmented into Workplace Screening Centers, Hospitals, Laboratories, and Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

Campaigns aimed at quitting smoking encourage people to try quitting smoking several times. These initiatives also seek to raise awareness of the many methods of quitting. Through these efforts, the negative effects of continued smoking are also emphasized.

People now have more information regarding nicotine and tobacco's ingredients. To monitor their health, people willingly undergo cotinine testing. Therefore, it is anticipated that cotinine screening tools will become more common in the next few years. To combat the growing prevalence of smoking habits, the medical community has partnered with top pharmaceutical firms. Long-term smoking's impacts on human lungs have emerged as a major field of study in medicine.

Cotinine is becoming crucial for Medical Treatments:

The fact that the alkaloid is widely used to treat PTSD is important from the standpoint of the growing market. Additionally, employing cotinine to treat mental illnesses has grown to be a well-known practice in the healthcare sector.

Cotinine aids in the management and control of schizophrenia and other conditions of a similar kind. Therefore, it is reasonable to anticipate that the world market for cotinine screening equipment will follow an upward development trajectory.

According to the American Lung Association, smoking is the primary factor in 1 out of every 5 fatalities in the country. Serious health problems are being caused by the growing number of adults and kids who smoke. In America, about 14% of individuals have a smoking addiction. The American Lung Association, therefore, imposes a national cigarette tax as well as other tobacco product taxes to control the use of tobacco and nicotine content.

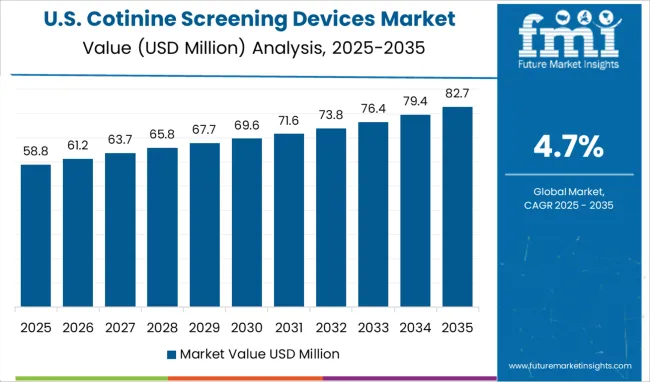

In 2024, the typical state cigarette tax was about USD 1.82 per pack. Additionally, the American Lung Association developed health insurance plans, initiatives, and policies for smoke-free workplace regulations. These elements support the development of cotinine screening tools. Thus, in 2024, the United States of America had the greatest penetration rate for cotinine screening equipment.

In the year 2024, the cotinine screening devices market accounted for 8.1 percent of the global drug screening market, with sales of USD 5.3 billion. Increased use of cotinine screening devices in the workplace, the importance of drug-free recruiting, and the need for screening devices in insurance calculations are just a few of the important drivers driving this market's growth.

Cotinine is an alkaloid substance, formed in the human body after the consumption of nicotine. Cotinine is used for testing substance abuse in people because it stays in the human body for approximately 8 to 10 days. Cotinine is a biomarker indicating tobacco use.

Mandatory cotinine screening tests to hire employees is expected to rise the number of tests as well as products requirement in the market The sporting events have added nicotine to the list of drugs to be screened which is anticipated to propel the demand for cotinine screening devices around the world. Random checking of students at schools in North America as well as in East Asia also adds up to the growing demand for these devices. Moreover, compulsory screening of armed forces personnel before induction is another reason generating the demand for cotinine screening devices around the world over the forecast period.

The contract manufacturing of Cotinine screening devices in emerging countries is rising and favoring revenue generation for the key players. Marketing rights of manufacturers are undertaken by marketing entities to increase the promotion of cotinine screening devices, along with the license of available products to distribute exclusively in the other markets. The direct presence through the deployment of the salesforce in remote and smaller markets is one of the actions taken by players to increase the demand for these devices. E-Commerce and online trading through portals accessing online payment also attributes to the rising adoption of these devices for the detection of substance abuse.

Cassettes held a 62.9% market share, by the value of the overall cotinine screening devices market in the year 2024 and are expected to grow at a cumulative CAGR of 5.1% and will record sales worth USD 818.1 Million by the end of 2035. The growing tobacco use amongst the younger generation is one of the key factors which is fueling the demand for cotinine screening devices market around the globe.

| Particulars | Details |

|---|---|

| H1, 2024 | 4.69% |

| H1, 2025 Projected | 4.71% |

| H1, 2025 Outlook | 4.61% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 9 ↓ |

FMI delivers a comparative study of the global cotinine screening devices market's growth rates and development prospects. As a result of the impact of macro and industrial variables, the market is influenced by an increase in the patient base and product adoption rate.

Contract manufacturing of cotinine screening devices in emerging nations, and the introduction of e-commerce, and online trading with accessible online payment for such devices are all important trends in this market.

According to FMI, the market growth rate of cotinine screening devices is expected to decline by 09 Basis Point Share (BPS) in H1-2025 compared to H1-2024. Further comparison between the values for the H1-2025 outlook and H1-2025 projected showed a dip of 10 BPS.

Due to the lack of evaluation of inexpensive single-line test strips for cotinine screening, key aspects associated with the lowering of BPS are attributed to the differential qualitative dichotomization of smokers and non-smokers.

The importance of cotinine screening devices as significant indications of risk in life insurance testing, as well as the introduction of smoking cessation programs by regional governments, are two positives for the sector.

According to Future Market Insights, the cotinine screening devices market expanded at a cumulative CAGR of 4.2% between 2014 and 2024. The market grew 1.3X during this period and is expected to follow a similar trend over the forecast period.

According to the Centre for Disease Control and Prevention, approximately 410.8 million people in the USA smoked cigarettes in the year 2020. Along with the use of regular cigarettes, the use of vaping or electronic cigarettes has been on the rise in the past few years as well. According to a survey conducted in the USA, it was estimated that by the end of 2024, around 493.6 million people would be using e-cigarettes in the world.

As per CDC, around 33% of women smokers under Medicaid deny the use of tobacco during pregnancy. A recent study carried out indicated that a higher percentage of low-income pregnant women have a positive opinion about using urine cotinine tests to promote smoking cessation during pregnancy. The study also finds out that close to 90% of pregnant women favor nicotine testing during pregnancy but also fear if cotinine tests positive.

Various functional attributes of these screening devices give them a competitive edge over laboratory-based cotinine screening techniques, such as ease of use, convenience, and cost-effectiveness. These factors will help cotinine screening devices to gain preference in the world. These screening devices are also preferred by insurance providers, the majority used in smoking cessation programs and rehabilitation centers.

The cotinine screening devices are portable, which reduces the cost of logistics such as sample handling, sample delivery to the laboratories, generation of reports, etc. These devices also reduce the time taken in screening as they give the results within a few minutes. These devices can be used anywhere according to the preference of the consumers, which also improves the adoption rate. All these factors are constantly propelling the demand for this market around the globe.

Manufacturers are concentrating their efforts on developing cotinine screening equipment that is simple to use and provides quick findings. Manufacturers are responding to the sensitivities around distinct end-use cases by producing devices with features that comply with appropriate regulatory standards. The major players in the cotinine screening devices market are competing to increase the production of cassettes and strips, as these are the two most 'in-demand' forms.

The key players in this industry are entering into strategic agreements and partnerships acquiring subsidiaries to enhance their market presence and expand into the diagnostic testing market around the world.

In May 2020, AlcoPro Inc., a drug and alcohol testing products company announced the acquisition of Kahntact USA to improve its market presence around the world.

In June 2020, PTS Diagnostics announced their co-branded agreement with eTrueNorth, which is an integrated pharmacy-based clinical services network to enhance their services and close the gaps in healthcare and wellness screenings.

In January 2024, Jant Pharmacal Corporation announced the procurement of a contract with Vizient Inc., for their entire line of rapid test kits.

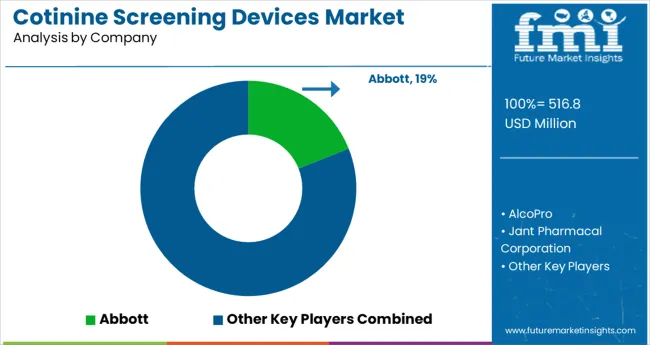

The cotinine screening devices market is consolidated with players such as Abbott Laboratories, AlcoPro, Jant Pharmacal Corporation, Sinocare Inc., Mossman Associates, Nano-Ditech Corp, LifeSign LLC, ALFA Scientific, Ameritek USA., Hangzhou Clongene Biotech Co., and Germaine Laboratories, Inc.

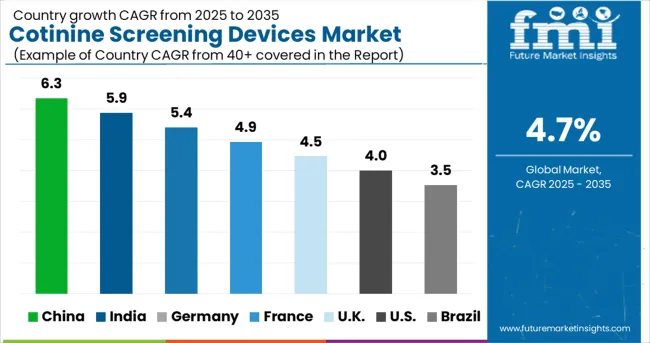

Future Market Insights expects the global cotinine screening devices market to expand at a cumulative CAGR of 4.7% over the forecast period (2025 to 2035) owing to the efforts taken by the key players to expand in the global market.

The growing number of smokers worldwide is expected to provide high growth opportunities for test providers and cotinine screening device manufacturers. According to the National Institute of Drug Abuse, alcohol, tobacco, and illicit drugs together create an economic burden of nearly USD 700 billion in the USA through related costs, lost work productivity, and healthcare, which represents a vast opportunity for market growth.

Technological advances related to sample collection and efforts of manufacturers to create easy-to-use disposable test kits are expected to create high demand for cotinine screening products. Manufacturers are focusing on using samples other than urine, such as saliva and hair samples, which is less embarrassing for individuals being tested.

The decrease in the reimbursement rate for undergoing tobacco abuse testing may hamper the revenue growth of the stakeholders in the cotinine screening devices market. For instance in June 2020 Centers for Medicare and Medicaid Services reduced the reimbursement coverage to only two G codes for drug abuse testing, one for presumptive testing and one for definitive testing. The decrease in reimbursement may directly influence the number of drug abuse tests performed in the USA, as low reimbursement would lead to out-of-pocket spending for the customers. Although the cost of cotinine screening devices is low as compared to the other drug abuse testing devices cotinine testing volume can also be affected adversely with an overall decrease in the drug abuse reimbursement as many cotinine screening tests are performed as part of drug abuse testing.

The adoption of cotinine testing is limited to the general population for evaluation. Although various healthcare facilities carry out cotinine testing on regular basis for their employees many of them exclude current employees from it and carry out screening on new employees in the facility. Despite many employers across various countries adopting cotinine screening, the pace at which the adoption is rising is much slower compared to other screening tests used for drug abuse. The lack of immediate adverse effects makes cotinine testing’s importance go unnoticed by various employers. Low adoption of cotinine testing in rehabilitation centers as well is another reason, which may limit the growth of the market.

The American Lung Association has been playing a major role in the lives of people helping them to quit smoking. Their program Freedom From Smoking® has helped people for 35 years and is ranked one of the best tobacco cessation programs in the world. Other programs such as Smokefree, and Quit for Life also operate in the USA The more efforts taken by the government as well as non-profit organizations in the country to stop tobacco use are attributed to the high share of the USA in the cotinine screening devices market in North America. The USA accounted for 97.0% of the market share, by the value of the total market in North America in the year 2024.

Around 28% of the population, aged 15 and more in Germany smoked cigarettes regularly, in the year 2020. The government of Germany laid down some laws to curb smoking and protect the non-smoking people and the country such as The protection of Young Persons Act and the Federal Non-smokers protection act. These laws and other smoking cessation efforts which are taken by the government fuel the demand for cotinine screening devices in Germany. The sales of this market were recorded to be USD 493.6.0 Million in the year 2024, and the market is expected to grow at a cumulative CAGR of 4.9% over the forecast period in Germany.

According to the WHO tobacco statistics of India, the economic burden attributed to tobacco use in India during the year 2020 accounted for USD 27. 5 Billion. Nearly 29% of India’s population regularly smoked cigarettes or some other form of tobacco in the same year, which made India the second-largest consumer of tobacco in the world. Thus, India attributed the highest share of this market in South Asia, which was 29.5% in the year 2024.

The global cotinine screening devices market was valued at USD 493.6 Million in the year 2024 and is expected to expand at a CAGR of 4.7% over the forecast period (2025 to 2035)

Cassettes held a 62.9% market share, by the value of the overall cotinine screening devices market in the year 2024 and are expected to grow at a cumulative CAGR of 5.1% and will record sales worth USD 818.1 Million by the end of 2035. Since cassettes are the easiest device to test the presence of cotinine in the human body, they are the most preferred device in the industry. Various rapid testing kits used by workplace screening centers use cassettes as their diagnostic tools.

Saliva samples attributed 61.0% market share, by the value of the total market in the year 2024 and this segment is expected to expand at a CAGR of 4.8% over the forecast period with anticipated sales worth USD 818.1 Million by the end of 2035. Consumers prefer this type of sample for testing, which explains the high market share.

Laboratories held a 38.5% market share, by the value of the global market in the year 2024 with sales recorded worth USD 165.6 Million in the same year. The laboratories segment is anticipated to expand at a cumulative CAGR of 4.9% over the forecast period. Since there is an influx of funds for the research and development of innovative rapid testing kits, and the rising importance of smoking cessation around the world, laboratories are working round the clock for the same. Thus, they would be growing at a steady pace over the forecast period.

The key players in this market are focusing on exhibiting and showcasing their product lines at various conventions and conferences to gain publicity for their products and thereby expand their businesses.

Nano-Ditech Corporation announced the successful representation of the company’s product lines in the Medlab 2020 held in Dubai from March 6th to 9th.

LifeSign LLC announced its participation in the 71st AACC Annual Scientific Meeting & Clinical Lab Expo in August 2020.

In November 2020, Ameritek USA successfully exhibited their upcoming product line in the Medica 2020 held in Germany.

Hangzhou Clongene Biotech Co., in August 2020 announced that they exhibited their new product lines at the 2020 AACC Annual Scientific Meeting & Clinical Lab Expo.

Continuous efforts taken by various governments to stop the growing burden of smoking tobacco and drug abuse, decreasing the popularity of smoking amongst pregnant women, and growing interest in healthier lives will propel the demand for these screening devices in the upcoming years and present the manufacturers with many lucrative opportunities for growth and development.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historic Data available for | 2014 to 2024 |

| Market Analysis | million for value |

| Key Countries covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Turkey, and South Africa. |

| Key Segments Covered | Device Type, Sample Type, End-User & Region |

| Key Companies Profiled | Abbott Laboratories; AlcoPro Inc.; Jant Pharmacal Corporation; Sinocare Inc.,(PTS Diagnostics); Mossman Associates; Nano-Ditech Corp; LifeSign LLC; ALFA Scientific; Ameritek USA.; Hangzhou Clongene Biotech Co.; Germaine Laboratories, Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization and Pricing | Available upon request |

The global cotinine screening devices market is estimated to be valued at USD 516.8 million in 2025.

It is projected to reach USD 818.1 million by 2035.

The market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types are strips, cassettes and reader.

urine sample segment is expected to dominate with a 49.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lab Screening Test Kit Market

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Oral Screening Systems Market

Sleep Screening Devices Market Trends and Forecast 2025 to 2035

Carrier Screening Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

New-born Screening Equipment Market - Growth & Demand 2025 to 2035

Vascular Screening Market

Antenatal Screening Market

Home Sleep Screening Device Market Size and Share Forecast Outlook 2025 to 2035

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

High Content Screening Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Global Canine Cancer Screening Market Analysis – Size, Share & Forecast 2024-2034

High Throughput Screening Market Size and Share Forecast Outlook 2025 to 2035

The toxicology drug screening market is segmented by product, test type, technology, and end user from 2025 to 2035

Cervical Cancer Screening Market - Trends & Forecast 2025 to 2035

Aldosterone-Renin Screening Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI enhanced Mammography Screening Market Size and Share Forecast Outlook 2025 to 2035

Non-invasive Colon Cancer Screening Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA