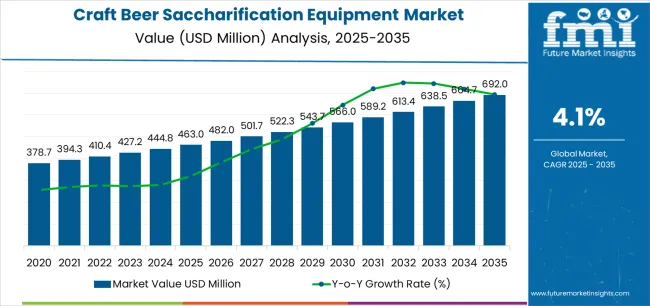

The global craft beer saccharification equipment market is projected to reach USD 692.0 million by 2035, recording an absolute increase of USD 229.0 million over the forecast period. The market is valued at USD 463.0 million in 2025 and is set to rise at a CAGR of 4.1% during the assessment period. The overall market size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for craft beer production worldwide, driving demand for efficient mashing and enzymatic conversion systems and increasing investments in microbrewery establishments and brewing technology modernization projects globally. However, high capital costs and technical expertise requirements compared to standard brewing alternatives may pose challenges to market expansion.

Between 2025 and 2030, the craft beer saccharification equipment market is projected to expand from USD 463.0 million to USD 566.0 million, resulting in a value increase of USD 103.0 million, which represents 45.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for premium craft beer products and artisanal brewing solutions, product innovation in energy-efficient heating technologies and automated mashing control systems, as well as expanding integration with smart brewing platforms and Internet of Things (IoT) monitoring capabilities. Companies are establishing competitive positions through investment in advanced saccharification process technologies, sustainable brewing equipment solutions, and strategic market expansion across microbreweries, brewpubs, and regional craft beer production facilities.

From 2030 to 2035, the market is forecast to grow from USD 566.0 million to USD 692.0 million, adding another USD 126.0 million, which constitutes 55.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized saccharification systems, including advanced temperature control mechanisms and integrated enzyme management solutions tailored for specific beer style requirements, strategic collaborations between equipment manufacturers and craft brewing communities, and an enhanced focus on energy efficiency and water conservation in brewing operations. The growing emphasis on brewing process optimization and flavor consistency will drive demand for advanced, high-performance saccharification equipment solutions across diverse craft beer production applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 463.0 million |

| Market Forecast Value (2035) | USD 692.0 million |

| Forecast CAGR (2025-2035) | 4.1% |

The craft beer saccharification equipment market grows by enabling brewers to achieve superior enzymatic conversion efficiency and consistent wort quality while meeting consumer demand for diverse beer styles and flavor profiles. Craft brewery operators face mounting pressure to improve production consistency and brewing efficiency, with advanced saccharification equipment typically providing 15-20% improvement in sugar extraction rates over conventional mashing systems, making specialized equipment essential for maintaining beer quality standards and production economics. The craft beer movement's need for precise temperature control and multi-step mashing capabilities creates demand for advanced saccharification solutions that can handle various grain bills, accommodate complex brewing recipes, and ensure reproducible results across diverse brewing conditions.

Growing consumer preference for locally produced craft beer and artisanal brewing techniques drives adoption in microbreweries, brewpubs, and regional craft beer production facilities, where saccharification efficiency has a direct impact on beer quality and brewery profitability. The global expansion of craft beer culture and premiumization trends accelerates saccharification equipment demand as brewers seek advanced systems that enable experimentation with specialty malts and innovative brewing processes. However, limited availability of technical expertise in enzymatic conversion processes and higher equipment costs compared to basic brewing systems may limit adoption rates among startup breweries and regions with underdeveloped craft beer infrastructure and maintenance support networks.

The market is segmented by heating method, application, and region. By heating method, the market is divided into electric heating and steam heating. Based on application, the market is categorized into small and medium-sized enterprises and large enterprises. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The electric heating segment represents the dominant force in the craft beer saccharification equipment market, capturing approximately 56.0% of total market share in 2025. This advanced category delivers precise temperature control capabilities with rapid heating response, uniform heat distribution across mash vessels, and compatibility with modern brewery automation systems. The electric heating segment's market leadership stems from its exceptional energy efficiency in small to medium-scale operations, simplified installation requirements without steam generation infrastructure, and enhanced safety features eliminating pressurized steam handling risks in brewing facilities.

The steam heating segment maintains a substantial 44.0% market share, serving larger brewing operations that require high-volume mashing capabilities through established steam distribution systems and centralized boiler infrastructure. This segment benefits from proven performance in large-scale production environments, faster heating of large mash volumes, and integration with existing brewery utility systems where steam is available for multiple brewing processes.

Key advantages driving the electric heating segment include:

Small and medium-sized enterprises dominate the craft beer saccharification equipment market with approximately 62.0% market share in 2025, reflecting the proliferation of microbreweries, brewpubs, and regional craft beer producers requiring flexible saccharification systems for diverse beer production volumes. The SME segment's market leadership is reinforced by widespread adoption of compact saccharification equipment with 5-30 hectoliter capacities, modular system designs allowing brewery expansion, and cost-effective solutions suitable for establishments producing 500-5,000 hectoliters annually.

The large enterprises segment represents 38.0% market share through deployment in established craft breweries, regional beer producers, and craft beer divisions of major brewing companies requiring high-capacity saccharification systems exceeding 50 hectoliters per batch. This segment benefits from economies of scale in large-volume production, integration with automated brewhouse systems, and sophisticated process control capabilities ensuring consistency across multiple daily brewing cycles.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to craft beer industry expansion and quality requirements. First, global craft beer consumption growth creates increasing requirements for specialized brewing equipment, with craft beer market expanding 8-12% annually in emerging markets, requiring professional saccharification systems for maintaining quality standards and achieving consistent enzymatic conversion. Second, premiumization trends in alcoholic beverages drive investment in advanced brewing technology, with craft brewers achieving 30-50% price premiums over mainstream beer through superior quality and unique flavor profiles enabled by precise mashing control. Third, entrepreneurial brewery establishment trends accelerate adoption across North America, Europe, and Asia-Pacific regions where craft beer culture receives growing consumer acceptance and regulatory support through favorable licensing frameworks.

Market restraints include high initial capital investment ranging from USD 50,000 to USD 500,000 depending on capacity and automation level, creating barriers for first-time brewery entrepreneurs operating on limited startup capital. Technical complexity requiring specialized knowledge of enzymatic conversion processes, temperature management, and mashing chemistry poses operational challenges, particularly for brewers transitioning from homebrewing to commercial production without formal brewing education. Energy consumption costs during mashing operations and maintenance requirements for heating elements and temperature control systems create additional operational expenses that impact total cost of ownership for craft breweries.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where growing middle-class populations and changing alcohol consumption preferences incentivize craft brewery establishment through favorable market conditions and increasing consumer willingness to pay premium prices. Technology advancement trends toward Internet of Things (IoT) integration enabling remote monitoring with 24/7 brewing process visibility, automated mashing programs reducing operator skill requirements, and energy-efficient heating systems achieving 20-30% power consumption reduction are enabling next-generation equipment development. However, the market thesis could face disruption if contract brewing services and brewing equipment sharing models achieve widespread adoption, reducing individual brewery equipment ownership requirements while maintaining craft beer production growth.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Brazil | 4.3% |

| USA | 3.9% |

| UK | 3.5% |

| Japan | 3.1% |

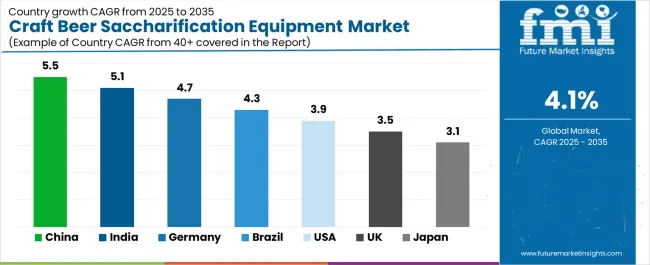

| Germany | 4.7% |

The craft beer saccharification equipment market is gaining momentum worldwide, with China taking the lead thanks to aggressive craft beer culture development and microbrewery establishment programs. Close behind, India benefits from changing alcohol consumption patterns and growing urban craft beer demand, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding craft beer production and artisanal brewing interest strengthen its role in South American brewing equipment markets. The USA demonstrates robust growth through craft brewery modernization and continued microbrewery establishment, signaling sustained investment in brewing infrastructure. Meanwhile, Japan stands out for its premium craft beer focus and innovative brewing techniques with quality emphasis, while Germany and UK continue to record consistent progress driven by traditional brewing heritage adaptation and craft beer segment expansion. Together, China and India anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries are highlighted below.

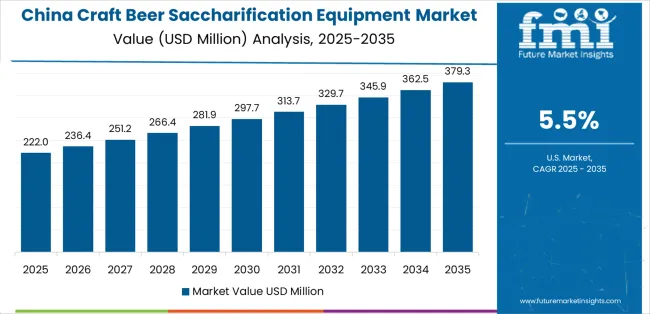

China demonstrates the strongest growth potential in the Craft Beer Saccharification Equipment Market with a CAGR of 5.5% through 2035. The country's leadership position stems from comprehensive craft beer culture development initiatives, intensive microbrewery establishment programs, and growing consumer preference for premium beer products driving adoption of professional saccharification systems. Growth is concentrated in major urban regions, including Beijing, Shanghai, Guangzhou, and Chengdu, where craft breweries, brewpubs, and taprooms are implementing advanced mashing equipment for diverse beer style production and quality consistency. Distribution channels through domestic equipment manufacturers, international brewing technology partnerships, and brewery equipment suppliers expand deployment across emerging craft beer clusters and hospitality establishments. The country's Made in China 2025 initiative provides indirect support for brewing equipment manufacturing, including technology transfer programs and domestic production capacity development.

Key market factors:

In Bangalore, Mumbai, Delhi, and Pune regions, the adoption of craft beer saccharification systems is accelerating across microbreweries, brewpubs, and regional craft beer production facilities, driven by changing alcohol consumption preferences and government craft beer licensing initiatives. The market demonstrates strong growth momentum with a CAGR of 5.1% through 2035, linked to comprehensive urban craft beer culture expansion and increasing focus on premium alcoholic beverage offerings. Indian brewery operators are implementing professional saccharification equipment and brewing technology platforms to improve beer quality while meeting consumer expectations for diverse beer styles and consistent flavor profiles. The country's growing hospitality sector and changing social attitudes toward premium beer consumption create sustained demand for advanced brewing equipment, while increasing emphasis on locally produced craft beer drives adoption of complete brewhouse systems that enable artisanal production.

Brazil's developing craft beer sector demonstrates sophisticated implementation of professional saccharification systems, with documented case studies showing 25-35% revenue premiums for craft beer establishments through quality differentiation and unique product offerings. The country's brewing infrastructure in major metropolitan regions, including São Paulo, Rio de Janeiro, Porto Alegre, and Belo Horizonte, showcases integration of advanced mashing technologies with existing hospitality businesses, leveraging expertise in beverage production and gastronomy culture. Brazilian craft brewers emphasize quality standards and flavor innovation, creating demand for reliable saccharification equipment that supports brewing experimentation and consistent production requirements. The market maintains strong growth through focus on craft beer culture development and hospitality sector expansion, with a CAGR of 4.3% through 2035.

Key development areas:

The USA market demonstrates mature craft beer industry with sophisticated saccharification equipment deployment based on integration with established brewing practices and advanced quality control systems. The country shows steady growth with a CAGR of 3.9% through 2035, driven by ongoing craft brewery modernization and equipment replacement cycles across major brewing regions, including California, Colorado, Oregon, and the Northeast craft beer corridor. American brewers are adopting next-generation saccharification equipment for enhanced energy efficiency, particularly in established craft breweries requiring equipment upgrades and in new specialty beer production facilities emphasizing experimental brewing techniques. Technology deployment channels through brewing equipment distributors, direct manufacturer relationships, and brewing supply companies expand coverage across diverse craft beer operations.

Leading market segments:

Japan's craft beer saccharification equipment market demonstrates sophisticated implementation focused on premium beer production and traditional brewing technique adaptation, with documented integration of advanced mashing systems achieving consistent quality in small-batch specialty beer production. The country maintains steady growth momentum with a CAGR of 3.1% through 2035, driven by consumer appreciation for brewing craftsmanship and emphasis on quality over volume aligned with Japanese aesthetic principles. Major craft beer regions, including Tokyo, Yokohama, Nagano, and Hokkaido, showcase advanced deployment of precision temperature control systems and specialized saccharification equipment that integrate seamlessly with Japanese attention to detail and quality assurance standards.

Key market characteristics:

In Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Hesse regions, craft brewers and traditional breweries are implementing modern saccharification equipment to maintain brewing quality standards and adapt to craft beer segment growth, with documented case studies showing successful integration of innovation with traditional German brewing principles. The market shows solid growth potential with a CAGR of 4.7% through 2035, linked to craft beer segment expansion within traditional brewing markets, Reinheitsgebot compliance requirements, and increasing consumer interest in specialty beer styles. German brewers are adopting advanced saccharification systems and intelligent brewing control platforms to maintain quality consistency while experimenting with new beer styles that attract younger consumers seeking alternatives to traditional lagers.

Market development factors:

The UK craft beer saccharification equipment market demonstrates established implementation focused on brewing innovation and diverse beer style production, with documented integration achieving successful craft brewery operations across urban and rural locations. The country maintains steady growth through vibrant craft beer culture and brewing experimentation, with a CAGR of 3.5% through 2035, driven by strong consumer demand for locally produced beer and continued microbrewery establishment. Major craft brewing regions, including London, Manchester, Scotland, and the Southwest, showcase established saccharification equipment deployments where brewing programs emphasize flavor innovation, cask ale production, and experimental beer styles requiring flexible mashing capabilities.

Key market characteristics:

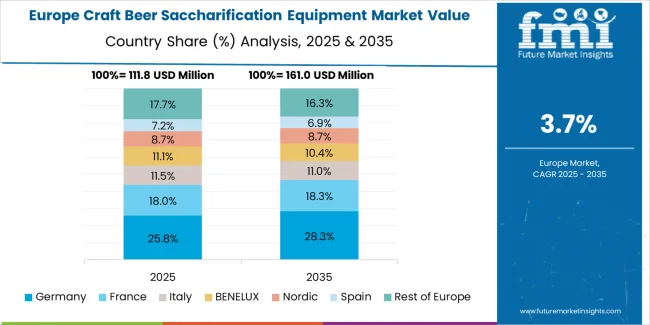

The craft beer saccharification equipment market in Europe is projected to grow from USD 158.9 million in 2025 to USD 243.8 million by 2035, registering a CAGR of 4.4% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 28.2% by 2035, supported by its extensive brewing heritage and major craft beer development regions, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia production areas.

The United Kingdom follows with a 22.5% share in 2025, projected to reach 22.8% by 2035, driven by comprehensive craft brewery establishment programs and brewing innovation initiatives. France holds a 14.5% share in 2025, expected to rise to 14.7% by 2035 through ongoing craft beer culture development and artisanal brewing expansion. Italy commands a 11.5% share in both 2025 and 2035, backed by growing craft beer interest and gastropub development. Spain accounts for 8.5% in 2025, rising to 8.7% by 2035 on urban craft beer establishment and hospitality sector growth. The Netherlands maintains 6.5% in 2025, reaching 6.6% by 2035 on established brewing culture and craft beer innovation. The Rest of Europe region is anticipated to hold 8.0% in 2025, expanding to 8.0% by 2035, attributed to increasing craft beer adoption in Nordic countries and emerging Central & Eastern European microbrewery programs.

The Japanese craft beer saccharification equipment market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of electric heating systems with existing precision brewing infrastructure across microbreweries, specialty beer producers, and innovative craft beer establishments. Japan's emphasis on brewing quality and attention to detail drives demand for advanced saccharification equipment that supports consistent enzymatic conversion and experimental brewing programs in premium craft beer production. The market benefits from strong partnerships between international brewing equipment providers and domestic craft brewery associations, creating comprehensive service ecosystems that prioritize precision temperature control and brewing process optimization. Craft beer centers in Tokyo, Yokohama, Nagano, and Hokkaido showcase advanced brewing implementations where saccharification programs achieve 95% mashing efficiency through precise temperature profiling and enzymatic management systems.

The South Korean craft beer saccharification equipment market is characterized by growing international equipment provider presence, with companies maintaining significant positions through comprehensive technical support and brewing consultation capabilities for emerging craft beer establishments. The market demonstrates increasing emphasis on premium beer production and brewing quality standards, as Korean craft brewers increasingly demand advanced saccharification equipment that integrates with modern brewpub concepts and sophisticated beverage service systems deployed across urban hospitality complexes. Regional brewing equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean regulatory compliance support and brewing technique training programs for new brewery operators. The competitive landscape shows increasing collaboration between multinational brewing equipment companies and Korean hospitality industry specialists, creating hybrid service models that combine international brewing technology expertise with local market knowledge and rapid technical support systems.

The craft beer saccharification equipment market features approximately 15-20 meaningful players with moderate fragmentation, where the top three companies control roughly 25-30% of global market share through established distribution networks and comprehensive brewing equipment portfolios. Competition centers on equipment reliability, temperature control precision, and technical support capabilities rather than price competition alone. GEA maintains strong market positioning with approximately 12.0% market share through its comprehensive brewing technology portfolio and global service infrastructure.

Market leaders include GEA, Steinecker GmbH, and Krones, which maintain competitive advantages through global technical support networks, vertical integration in brewing equipment manufacturing, and deep expertise in saccharification technology across multiple brewery scales, creating reliability and performance advantages with craft beer production operations. These companies leverage research and development capabilities in energy-efficient heating systems and ongoing brewing consultation relationships to defend market positions while expanding into specialty beer production and experimental brewing applications.

Challengers encompass JKM and Wisdom, which compete through specialized equipment offerings and strong regional presence in key craft beer markets. Product specialists, including Wenzhou Xinzhou Light Industry Machinery Co., Ltd., Wenzhou Daewoo Technology Co., Ltd., and Shandong Zunhuang Fermentation Equipment Co., Ltd., focus on specific capacity ranges or price segments, offering differentiated capabilities in compact system designs, cost-effective solutions, and customized brewing configurations.

Regional players and emerging brewing equipment providers create competitive pressure through localized service advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to emerging craft beer clusters provides advantages in installation support and after-sales service. Market dynamics favor companies that combine proven saccharification performance with comprehensive brewing support offerings that address the complete brewing cycle from recipe development through production optimization, while increasingly emphasizing energy efficiency and automation capabilities that address operational cost pressures and labor availability challenges in global craft beer markets.

Craft beer saccharification equipment represents specialized brewing systems that enable craft brewers to achieve 15-20% improvement in sugar extraction efficiency compared to basic mashing systems, delivering superior enzymatic conversion and consistent wort quality in demanding craft beer production applications. With the market projected to grow from USD 463.0 million in 2025 to USD 692.0 million by 2035 at a 4.1% CAGR, these specialized mashing systems offer compelling advantages - precise temperature control, brewing consistency, and recipe flexibility - making them essential for small and medium-sized enterprises (62.0% market share), large enterprises (38.0% share), and brewing operations seeking professional equipment that ensures reproducible results across diverse beer styles. Scaling market adoption and technology development requires coordinated action across brewing industry policy, equipment manufacturing standards, craft brewery operators, hospitality businesses, and brewing technology investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 463.0 million |

| Heating Method | Electric Heating, Steam Heating |

| Application | Small and Medium-sized Enterprises, Large Enterprises |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Brazil, USA, UK, Japan, Germany, and 40+ countries |

| Key Companies Profiled | GEA, Steinecker GmbH, Krones, JKM, Wisdom, Wenzhou Xinzhou Light Industry Machinery Co., Ltd., Wenzhou Daewoo Technology Co., Ltd., Shandong Zunhuang Fermentation Equipment Co., Ltd., Xiangshan Yonghong Food Equipment Co., Ltd., Shandong Haolu Beer Equipment Co., Ltd. |

| Additional Attributes | Dollar sales by heating method and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with brewing equipment manufacturers and distribution networks, installation and maintenance requirements and specifications, integration with craft brewery operations and brewing process management systems, innovations in heating technology and automation systems, and development of specialized saccharification equipment with enhanced energy efficiency and brewing consistency capabilities. |

The global craft beer saccharification equipment market is estimated to be valued at USD 463.0 million in 2025.

The market size for the craft beer saccharification equipment market is projected to reach USD 692.0 million by 2035.

The craft beer saccharification equipment market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in craft beer saccharification equipment market are electric heating.

In terms of application, small and medium-sized enterprises segment to command 62.0% share in the craft beer saccharification equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Craft Bags Market Growth, Trends, Forecast 2025 to 2035

Craft Soda Market Analysis by Flavor, Packaging, Distribution Channel, and Region Forecast Through 2035

Market Share Breakdown of Craft Bags Manufacturers

Craft Plastic Films Market

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA