The Data Center Battery Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Growth is strongly influenced by the rapid expansion of hyperscale facilities, cloud service adoption, and the need for uninterrupted power supply in mission-critical environments. Lithium-ion batteries are gaining share over traditional lead-acid systems due to their higher energy density, faster charging, and longer lifecycle, making them more cost-effective in the long term. At the same time, increasing integration of renewable power sources within data centers is pushing operators to adopt advanced battery storage solutions. The rising emphasis on energy efficiency, combined with stricter uptime requirements, will continue to support widespread adoption.

| Metric | Value |

|---|---|

| Data Center Battery Market Estimated Value in (2025 E) | USD 3.6 billion |

| Data Center Battery Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The data center battery market is expanding steadily due to the rising demand for uninterrupted power supply, growing reliance on digital infrastructure, and the integration of renewable energy sources in data center operations. As data traffic surges and latency-sensitive applications proliferate, the need for reliable backup power solutions has become critical.

Regulatory pushes for energy efficiency and carbon footprint reduction have further influenced data centers to adopt battery systems capable of supporting both runtime and grid interaction. Technological advancements in battery management systems, lifecycle optimization, and modular deployment are enhancing system resilience and scalability.

The outlook remains strong as data center operators prioritize uptime, sustainability, and operational continuity across hyperscale and enterprise environments.

The data center battery market is segmented by battery, battery capacity, data center, application, and geographic regions. By battery type, the data center battery market is divided into Lead-acid and Lithium-ion. In terms of battery capacity, the data center battery market is classified into Small-scale batteries (Below 100 kWh), Medium-scale batteries (100 kWh - 1 MWh), and Large-scale batteries (Above 1 MWh). Based on data center, the data center battery market is segmented into Enterprise data centers, Colocation data centers, Hyperscale data centers, and Edge data centers. By application, the data center battery market is segmented into Uninterruptible Power Supply (UPS), Backup power systems, Energy storage systems (ESS), and Peak shaving and load balancing. Regionally, the data center battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lead acid battery segment is projected to account for 41.30% of total market revenue by 2025 within the battery category, making it the most utilized technology. This preference is driven by its proven performance, cost-effectiveness, and ease of integration into existing power infrastructure.

Despite the emergence of lithium-ion and other advanced chemistries, lead-acid batteries continue to offer a dependable solution for short-duration backup power. Their availability, low upfront cost, and well-established safety profile have kept them relevant, particularly in markets with legacy systems and cost-sensitive deployment needs.

Lead acid technology’s adaptability to varied climate conditions and minimal maintenance requirements also contribute to its continued dominance in conventional data center environments.

The small-scale battery segment with capacities below 100 kWh is expected to capture 44.80% of the market share within the battery capacity category by 2025. This dominance is influenced by the increasing adoption of edge computing and micro data centers, which require compact and efficient backup power systems.

These batteries offer flexibility, lower energy storage cost per site, and ease of deployment in decentralized infrastructures. They are especially favored for supporting distributed data center models in urban and remote locations where space constraints and energy optimization are critical.

As enterprises and colocation providers shift toward modular, scalable data center designs, small-scale batteries are playing a pivotal role in enhancing operational reliability and energy autonomy.

The enterprise data centers segment is projected to hold 47.10% of market revenue by 2025 within the data center category, establishing it as the leading segment. This growth is attributed to the rising number of mid to large scale enterprises building private data centers to gain control over data security, latency, and customization.

These enterprises are increasingly investing in energy-efficient battery systems to reduce operational risk and comply with sustainability goals. Lead acid and lithium-ion battery solutions are widely adopted across this segment to support business continuity during power outages and facilitate seamless integration with backup generators and renewable sources.

As data-driven operations expand across industries, enterprise data centers are becoming central to hybrid IT architectures, reinforcing the demand for robust battery infrastructure.

The data center battery market is experiencing growth driven by the increasing demand for reliable, uninterrupted power supply solutions in the data center industry. Data centers, which store vast amounts of critical information and handle large-scale computing operations, require high-performance battery systems to ensure continuous operation in case of power outages or grid failures. As the world becomes more reliant on cloud computing, artificial intelligence, and big data analytics, the need for reliable energy storage systems has become crucial. The market is benefiting from advancements in battery technologies such as lithium-ion and solid-state batteries, offering improved efficiency, longer life cycles, and reduced maintenance costs for data centers.

The primary driver for the growth of the data center battery market is the increasing demand for uninterrupted power supply and data security. With businesses and consumers relying more heavily on cloud computing and data storage, data centers must ensure continuous, 24/7 operations without the risk of downtime. Batteries, particularly those used in uninterruptible power supply (UPS) systems, provide the necessary backup to prevent data loss and system failures during power outages. As more industries adopt digital technologies and data becomes even more critical to operations, the demand for reliable battery systems to support data centers is growing. This is driving the need for advanced, high-capacity battery solutions to ensure constant power availability.

Despite the growth prospects, the data center battery market faces challenges, especially high initial costs and ongoing maintenance requirements. Advanced battery systems, such as lithium-ion or solid-state batteries, can have a high upfront cost, which may deter smaller data centers or businesses with limited budgets. Although these batteries offer long lifespans, they still require regular maintenance to ensure optimal performance and safety, which can add to the operational costs. The complexity of battery management systems and the need for periodic replacements also present challenges. Overcoming these challenges requires reducing the cost of batteries, enhancing battery longevity, and improving battery management systems to make them more cost-effective for data center operators.

The data center battery market offers significant opportunities, particularly with advancements in battery technology and energy efficiency. Lithium-ion batteries, which offer higher energy density and longer life cycles compared to traditional lead-acid batteries, are increasingly being used in data centers for UPS systems. Innovations such as solid-state batteries and other next-generation technologies promise even greater energy efficiency and safety. Additionally, the growing emphasis on reducing carbon footprints and enhancing energy efficiency presents opportunities for data centers to adopt more eco-friendly battery solutions. As technologies improve and prices decrease, these advanced battery systems are expected to play a pivotal role in the expansion of data centers worldwide, ensuring reliable, cost-effective, and sustainable energy storage.

A key trend in the data center battery market is the growing integration of smart battery management systems (BMS). These systems allow for real-time monitoring of battery performance, ensuring optimal use and early detection of potential issues such as temperature fluctuations or degradation. Smart BMS technologies improve the overall efficiency of battery operations, extend battery life, and reduce maintenance costs by automating diagnostic and troubleshooting processes. Additionally, the trend toward incorporating artificial intelligence and machine learning in battery management systems is helping predict and optimize battery performance, enabling data centers to manage their power needs better. As the demand for high-performance, energy-efficient solutions grows, the adoption of smart BMS is expected to increase, driving further growth in the data center battery market.

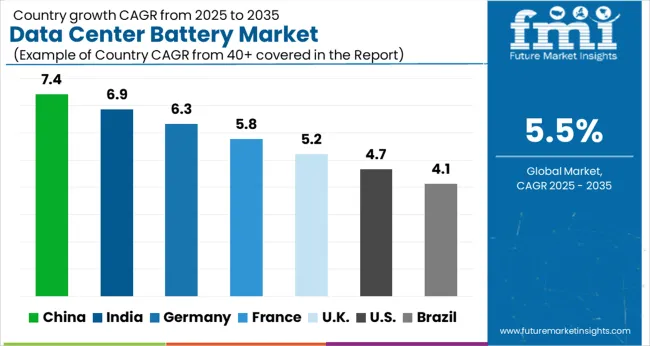

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

Global data center battery market demand is projected to rise at a 5.5% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 7.4%, followed by India at 6.9%, and Germany at 6.3%, while France records 5.8%, the United Kingdom posts 5.2%, and the United States sees 4.7%. These rates translate to a growth premium of +35% for China, +25% for India, and +10% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rapid data center expansion, increased energy demand, and government investments in green energy solutions in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established infrastructure. The analysis spans over 40+ countries, with the leading markets shown below.

The data center battery market in China is expanding at a robust CAGR of 7.4%, driven by the significant investments in expanding data centers, especially in response to the growing demand for cloud services and big data. The government’s emphasis on technological innovation and smart city development further accelerates the need for reliable, high-capacity batteries for energy storage in data centers. As data consumption and storage requirements continue to grow, China’s infrastructure investments and focus on renewable energy solutions are driving the demand for energy-efficient battery solutions in data centers.

The data center battery market in India is growing at a CAGR of 6.9%, supported by the rapid growth of the IT and cloud services industries. As India’s demand for digital infrastructure increases, particularly in e-commerce, fintech, and cloud computing, the need for reliable and scalable data center batteries is also rising. The government’s push for "Digital India" and the increasing focus on energy storage solutions to support renewable energy initiatives are significant factors contributing to market growth. India’s rapidly expanding data center footprint and the country’s increasing dependence on digital platforms further accelerate the adoption of energy-efficient data center batteries.

The United Kingdom’s data center battery market is growing at a CAGR of 5.2%, supported by increasing demand for data storage and energy solutions. The UK’s strong digital infrastructure and demand for cloud services are driving the market for reliable, high-capacity batteries. The country’s focus on improving power efficiency and government policies to reduce emissions are key drivers for the adoption of advanced battery solutions. As industries increasingly depend on cloud computing, the need for uninterrupted power supply in data centers is pushing the market for battery systems that ensure seamless operations.

The data center battery market in Gemany is expanding at a CAGR of 6.3%, supported by the country’s leadership in industrial automation and high-precision technology. Germany’s focus on energy efficiency is fueling demand for data center batteries that provide backup power and integrate with renewable energy systems. The growing demand for data storage, particularly in industries such as automotive, manufacturing, and IT, is driving the need for scalable and reliable battery systems. Additionally, Germany’s commitment to reducing carbon emissions and its strong focus on clean energy solutions are pushing for the adoption of eco-friendly battery technologies in data centers.

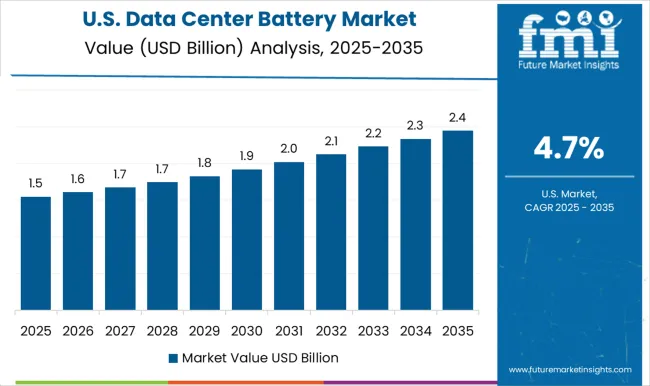

The USA data center battery market is growing at a CAGR of 4.7%, driven by the rapid expansion of data centers, particularly in cloud computing, artificial intelligence, and big data analytics. While the market is mature, the demand for backup power solutions in data centers continues to rise, driven by the growing need for energy storage and efficiency. The USA government’s focus on renewable energy solutions and improving grid stability is further driving the adoption of advanced battery systems. As energy consumption in data centers increases, the adoption of energy-efficient battery solutions is becoming more important to ensure continuous power supply and reduce operational costs.

C&D Technology is a significant player, offering a wide range of high-performance batteries designed for data centers, focusing on power reliability and long-lasting performance. Delta Electronics provides energy storage solutions for data centers, specializing in uninterruptible power supply (UPS) systems and battery technologies aimed at ensuring continuous and efficient operation. East Penn manufactures high-quality batteries used in data centers, offering solutions that focus on safety, performance, and energy efficiency.

Eaton is a major player in the market, providing innovative UPS systems and batteries that ensure data center uptime, with an emphasis on energy management and environmental sustainability. EnerSys specializes in providing advanced battery technologies for data centers, offering reliable solutions for energy storage and backup power systems, with a focus on enhancing operational efficiency. Exide Technologies delivers reliable and high-performing batteries for data center applications, providing solutions that ensure energy efficiency and uninterrupted power. Leoch is a key player, offering a range of battery solutions for data centers, focusing on high capacity, long-lasting power, and low maintenance. LG Energy Solution is a global leader in advanced energy storage technologies, providing high-capacity, high-performance batteries for data centers, with a strong emphasis on efficiency and scalability. Narada Power Source offers energy storage solutions for data centers, focusing on reliable backup power systems and energy efficiency. Samsung SDI manufactures advanced lithium-ion batteries used in data centers, focusing on high energy density, durability, and performance for critical applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Battery | Lead-acid and Lithium-ion |

| Battery Capacity | Small-scale batteries (Below 100 kWh), Medium-scale batteries (100 kWh - 1 MWh), and Large-scale batteries (Above 1 MWh) |

| Data Center | Enterprise data centers, Colocation data centers, Hyperscale data centers, and Edge data centers |

| Application | Uninterruptible power supply (UPS), Backup power systems, Energy storage systems (ESS), and Peak shaving and load balancing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | C&D Technology, Delta Electronics, East Penn, Eaton, EnerSys, Exide Technologies, Leoch, LG Energy Solution, Narada Power Source, and Samsung SDI |

| Additional Attributes | Dollar sales by product type (lead-acid batteries, lithium-ion batteries, flow batteries) and end-use segments (cloud computing, telecommunications, industrial, energy storage). Demand dynamics are driven by the increasing need for reliable and efficient energy solutions to support growing data center operations and the shift towards renewable energy sources. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in energy storage technology, the growing demand for data processing, and the need for backup power driving market expansion. |

The global data center battery market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the data center battery market is projected to reach USD 6.1 billion by 2035.

The data center battery market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in data center battery market are lead-acid, _by construction, lithium-ion, _by chemistry, _nickel zinc and _others.

In terms of battery capacity, small-scale batteries (below 100 kwh) segment to command 44.8% share in the data center battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Centre UPS Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Data Conversion Services Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Data Virtualization Cloud Market Analysis – Growth & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Data Fabric Market Analysis - Trends, Size & Forecast 2025 to 2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Data Catalog Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA