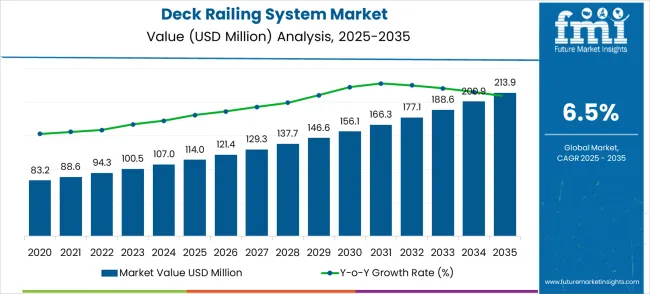

The deck railing system market is projected to reach USD 114 million in 2025 and expand to USD 213.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5%. This growth is driven by increasing residential and commercial construction, rising urbanization, and consumer demand for aesthetically appealing and safe outdoor living spaces. Deck railing systems provide safety, durability, and design flexibility, making them an essential component of balconies, terraces, decks, and staircases. As architectural trends increasingly prioritize outdoor aesthetics and safety compliance, the market trajectory indicates consistent expansion across both mature and emerging regions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 114 million |

| Market Forecast Value (2035) | USD 213.9 million |

| Forecast CAGR (2025-2035) | 6.5% |

Year-on-year growth shows a steady upward trend, with values increasing from USD 83.2 million in 2023 to USD 114.0 million in 2025, continuing consistently through the decade. The early part of the forecast period reflects growth driven by residential construction and DIY home improvement trends, while commercial and institutional projects contribute significantly in the latter half. Innovations in materials such as stainless steel, aluminum, and composite wood, as well as design enhancements and corrosion resistance, are further boosting adoption. Strategic collaborations between manufacturers and builders are also accelerating deployment in both new constructions and renovation projects.

Looking ahead, the deck railing system market is expected to reach USD 156.1 million by 2030 and eventually USD 213.9 million by 2035, reflecting a CAGR of 6.5%. Half-decade weighted growth analysis indicates stronger adoption in the first and second halves of the forecast period due to infrastructure expansion, increased renovation activities, and growing consumer preference for outdoor aesthetics. While short-term fluctuations may occur due to construction cycles, the long-term outlook remains robust. Overall, the market highlights steady and sustainable value accumulation, supported by ongoing urban development, safety regulations, and consumer-driven demand for functional and visually appealing railing solutions.

The deck railing system market grows by enabling property owners and contractors to enhance outdoor living spaces while ensuring safety compliance and aesthetic appeal that increases property values. Demand drivers include expanding residential deck construction driven by outdoor lifestyle trends, increasing focus on home improvement and property enhancement projects, and growing commercial outdoor space development in hospitality and retail sectors where deck railings provide essential safety and design elements. Priority segments include residential deck contractors and commercial construction companies, with China and India representing key growth geographies due to expanding construction activities and rising living standards. Market growth faces constraints from raw material price volatility affecting railing system costs and seasonal construction patterns that create demand fluctuations.

The Deck Railing System market is entering a new phase of growth, driven by demand for outdoor living enhancement, expanding construction activity, and evolving safety standards across residential and commercial properties. By 2035, these pathways together can unlock USD 320-400 million in incremental revenue opportunities beyond baseline growth.

Pathway A - Residential Application Leadership (Home Improvement Focus) The residential segment already holds the largest share due to its fundamental role in home safety and outdoor living enhancement. Expanding design options, enhanced durability features, and integrated installation systems can consolidate leadership. Opportunity pool: USD 100-125 million.

Pathway B - Metal Type Material Dominance (Durable Solutions) Metal railing systems account for significant market demand. Growing requirements for long-lasting, low-maintenance solutions, especially in commercial and high-end residential applications, will drive higher adoption of metal railing systems. Opportunity pool: USD 80-100 million.

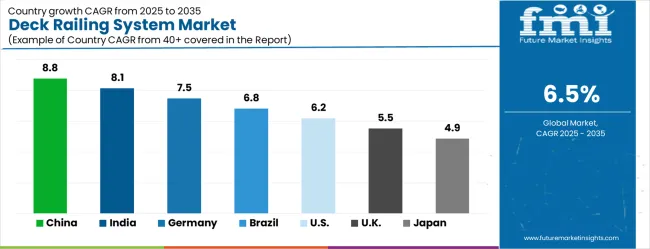

Pathway C - Asia-Pacific Market Expansion (China & India Growth) China and India present the highest growth potential with CAGRs of 8.8% and 8.1% respectively. Targeting expanding construction activities and urban development projects will accelerate adoption. Opportunity pool: USD 70-88 million.

Pathway D - Commercial Applications (Business Property Development) Commercial construction and hospitality sector applications represent significant growth potential with increasing outdoor space development needs. Opportunity pool: USD 40-50 million.

Pathway E - Composite Material Innovation With increasing demand for low-maintenance and sustainable solutions, there is an opportunity to promote composite railing systems optimized for durability and aesthetic appeal. Opportunity pool: USD 25-31 million.

Pathway F - Premium Design Solutions High-end residential and luxury commercial applications offer premium positioning opportunities for designer railing systems and custom installations. Opportunity pool: USD 18-23 million.

Pathway G - Installation & Service Revenue Professional installation services, maintenance programs, and replacement part sales create additional revenue streams across residential and commercial markets. Opportunity pool: USD 12-15 million.

Pathway H - Smart Railing Integration Advanced railing systems with integrated lighting, sensors, or smart home connectivity can capture emerging technology adoption trends in premium markets. Opportunity pool: USD 8-10 million.

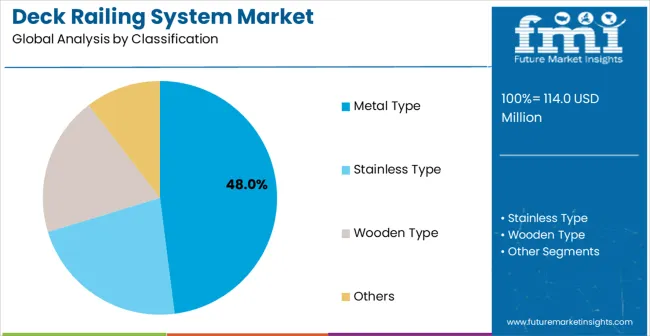

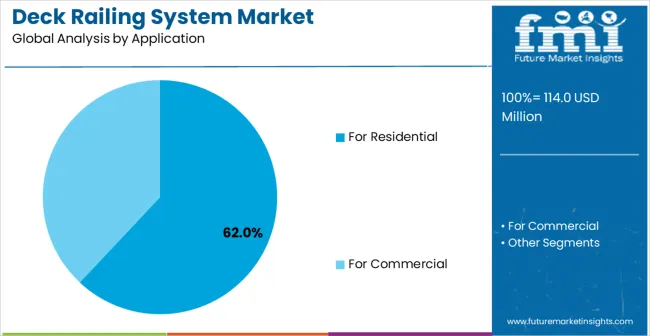

The market is segmented by material type, application, end-user, installation type, and region. By material type, the market is divided into metal type, stainless type, wooden type, and others. Based on application, the market is categorized into residential and commercial applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

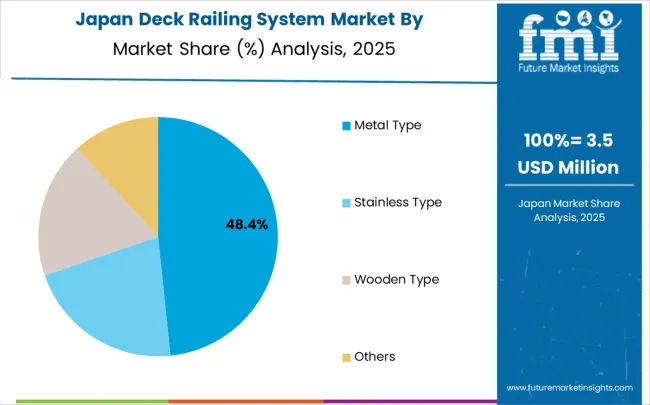

Metal type railing systems are projected to account for a substantial portion of 48% of the deck railing system market in 2025. This share is supported by superior durability characteristics and low maintenance requirements. Metal type railing systems provide excellent weather resistance that enables property owners to maintain attractive outdoor spaces with minimal upkeep over extended periods. The segment enables stakeholders to benefit from long-term value proposition and versatile design options for diverse architectural applications.

Key factors supporting metal type railing system adoption:

Residential applications are expected to represent the largest share of 62% of the deck railing system applications in 2025. This dominant share reflects the critical role of deck railings in residential outdoor living space development that appeals to homeowners and residential contractors. The segment provides essential safety and aesthetic enhancement for decks, porches, and outdoor entertainment areas in residential properties. Growing trends toward outdoor lifestyle enhancement and home improvement investments drive adoption in this application area.

Residential segment advantages include:

Market drivers include expanding residential construction and renovation activities requiring deck safety solutions, increasing focus on outdoor living space enhancement driving demand for aesthetic railing systems, and growing commercial development projects where deck railings support hospitality and retail outdoor space functionality. These drivers reflect direct stakeholder outcomes including improved property safety, enhanced aesthetic appeal, and increased property values across multiple construction and renovation applications.

Market restraints encompass raw material price fluctuations affecting railing system production costs, seasonal construction patterns creating demand variability, and building code variations across different markets requiring compliance adaptations. Additional constraints include installation complexity for certain railing systems requiring specialized contractor expertise and competition from alternative outdoor safety solutions that may offer similar functionality at different price points.

Key trends show adoption accelerating in China and India where expanding construction activities drive railing system demand, while material innovations toward composite and hybrid systems enable broader design possibilities and reduced maintenance requirements. Consumer preferences evolution focuses on low-maintenance solutions and sustainable materials that address environmental considerations. Market thesis faces risk from alternative outdoor safety technologies that could provide similar protection with different aesthetic or functional approaches.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

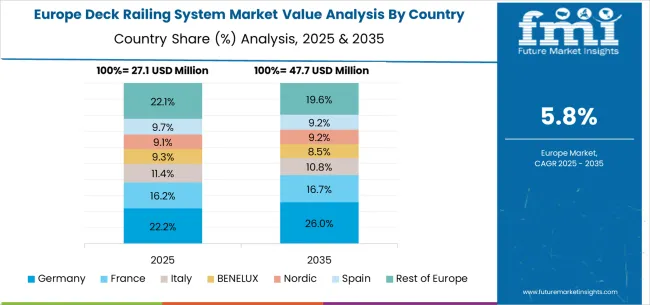

The deck railing system market shows varied growth dynamics across key countries from 2025-2035. China leads globally with a CAGR of 8.8%, fueled by rapid urbanization and construction boom, government infrastructure development programs, and expanding residential and commercial construction projects requiring safety railing systems. India follows closely at 8.1%, driven by increasing construction activity, growing middle-class housing demand, and expanding commercial development supporting outdoor space enhancement. Germany remains Europe's growth engine with 7.5%, leveraging its established construction industry and focus on building safety standards and quality construction materials. Brazil records 6.8%, reflecting opportunities in residential construction growth and commercial development despite economic challenges. The United States maintains steady expansion at 6.2%, supported by robust home improvement market and established outdoor living trends. Growth in the United Kingdom (5.5%) and Japan (4.9%) remains moderate, backed by mature construction markets and established safety regulations, though comparatively slower due to market saturation in developed regions.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the deck railing system market with its massive construction sector expansion and substantial investment in residential and commercial development projects. The market is projected to grow at a CAGR of 8.8% through 2035, driven by increasing urbanization creating demand for residential outdoor spaces, expanding commercial construction projects requiring safety railing installations, and growing adoption across construction projects in Beijing, Shanghai, and Shenzhen metropolitan areas. Chinese construction companies and developers are adopting deck railing systems for safety compliance and aesthetic enhancement applications, with particular emphasis on cost-effective solutions and rapid installation capabilities. Government construction safety regulations and urban development programs expand opportunities in residential complex development and commercial outdoor space sectors.

Deck railing system market in India reflects strong potential based on expanding construction sector and increasing focus on building safety standards. The market is projected to grow at a CAGR of 8.1% through 2035, with growth accelerating through construction activity expansion under safety compliance constraints, particularly in residential construction and commercial development projects in Mumbai, Delhi, and Bangalore. Indian construction companies and developers are adopting deck railing systems for safety compliance and property enhancement projects, with growing emphasis on affordable solutions and local manufacturing capabilities. Government construction safety initiatives and building code development programs expand access to railing system technologies and compliance support services.

Germany demonstrates established strength in the deck railing system market through its advanced construction industry and robust building safety standards. The market shows strong growth at a CAGR of 7.5% through 2035, with established construction companies and building contractors driving demand in Berlin, Munich, and Hamburg construction markets. German construction projects focus on high-quality railing systems and compliance with stringent building safety requirements, particularly in residential and commercial construction requiring premium safety solutions. The country's strong construction safety culture and established building material supply chains support consistent market development across multiple construction applications.

Deck railing system market in Brazil shows solid growth potential at a CAGR of 6.8% through 2035, driven by expanding residential construction and urban development projects. The market benefits from increasing construction activity and growing middle-class housing demand, with particular strength in residential development and commercial construction applications. Brazilian construction companies and developers adopt deck railing systems for safety compliance and property value enhancement, addressing both regulatory requirements and market preferences. Market development benefits from regional construction growth despite economic challenges affecting construction material procurement and project financing.

The United States maintains steady growth in the deck railing system market through its established home improvement sector and strong outdoor living culture. Market expansion at a CAGR of 6.2% through 2035 reflects consistent demand from residential contractors, home improvement retailers, and property owners investing in outdoor space enhancement. American consumers and contractors utilize deck railing systems across residential renovation, new construction, and commercial outdoor space applications, with particular emphasis on aesthetic appeal and low maintenance requirements. The country's strong home improvement market and established distribution channels support stable conditions and continued product innovation.

The United Kingdom demonstrates consistent progress in the deck railing system market with a CAGR of 5.5% through 2035, supported by established construction industry and growing focus on building safety regulations. British construction companies and contractors adopt deck railing systems for residential and commercial projects, with particular focus on building code compliance and quality construction standards. The market benefits from established construction supply chains and strong relationships with building material suppliers. Development remains steady across residential and commercial construction applications despite economic uncertainties affecting construction activity levels.

The deck railing system market in Japan is expected to demonstrate steady growth, advancing at a CAGR of 4.9% through 2035, as established construction companies and building contractors maintain consistent demand for quality railing systems. Market growth reflects mature construction market conditions and established safety standards across residential and commercial construction sectors. Japanese construction projects utilize deck railing systems for safety compliance and aesthetic enhancement applications, particularly in residential construction and commercial facility development requiring high-quality building materials. The market benefits from domestic construction expertise and strong technical support infrastructure, with steady growth supported by construction safety requirements and building quality standards.

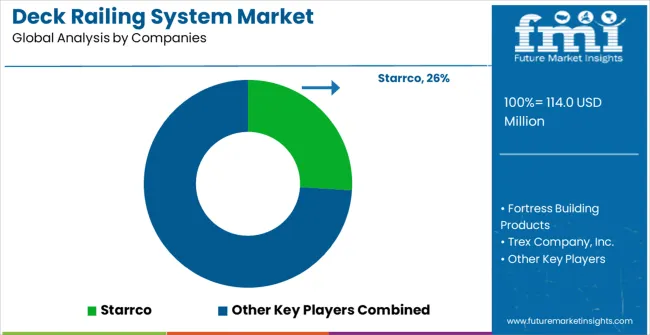

The deck railing system market operates with a moderately fragmented structure featuring approximately 20-25 meaningful players, with the top five companies holding roughly 40-45% market share. Competition centers on product quality, design innovation, and distribution network strength rather than price competition alone. Market leaders include Trex Company Inc., Fortress Building Products, TimberTech, Veranda, and Peak Aluminum Railing, which maintain competitive positions through established retail partnerships, comprehensive product portfolios, and strong brand recognition in home improvement markets. These companies benefit from scale advantages in manufacturing, extensive distribution networks, and established relationships with contractors, retailers, and consumers across residential and commercial markets.

Secondary tier companies include Starrco, Vista Railings, Ametco Manufacturing Corporation, Indital USA, and Southern Aluminum Finishing Co., which compete through specialized product offerings, regional market focus, and niche application expertise. These companies differentiate through custom solutions, competitive pricing strategies, and targeted customer service in specific geographic markets or application segments.

Additional players including Westbury Aluminum Railing, Kool-Ray Inc., and StairParts Depot contribute to market dynamics through specialized products, direct-to-consumer sales channels, and focused market segments such as replacement parts and specialty installations.

The competitive landscape reflects diverse market segments ranging from mass-market home improvement applications to specialized commercial installations, with companies requiring different expertise in materials engineering, manufacturing processes, distribution management, and customer service. Market participants differentiate through material quality, design aesthetics, installation ease, and warranty programs that influence purchasing decisions across residential and commercial applications.

Competition intensifies around innovation in composite materials and low-maintenance solutions, with companies investing in sustainable materials, enhanced durability, and aesthetic design options that appeal to both contractors and end-users. Market dynamics reflect the importance of retail partnerships, contractor relationships, and brand recognition that influence market penetration across different distribution channels. Strategic partnerships with home improvement retailers and construction supply distributors shape competitive positioning in regional and national markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 114 million |

| Material Type | Metal Type, Stainless Type, Wooden Type, Others |

| Application | For Residential, For Commercial |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Starrco, Fortress Building Products, Trex Company Inc., Veranda, Peak Aluminum Railing, TimberTech, Vista Railings, Ametco Manufacturing Corporation, Indital USA, Southern Aluminum Finishing Co., Westbury Aluminum Railing, Kool-Ray Inc., StairParts Depot |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across residential contractors and commercial construction projects, integration with building safety standards and construction codes, innovations in composite materials and low-maintenance systems, and development of modular installation platforms with enhanced aesthetic capabilities. |

The global deck railing system market is estimated to be valued at USD 114.0 million in 2025.

The market size for the deck railing system market is projected to reach USD 213.9 million by 2035.

The deck railing system market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in deck railing system market are metal type, stainless type, wooden type and others.

In terms of application, for residential segment to command 62.0% share in the deck railing system market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA