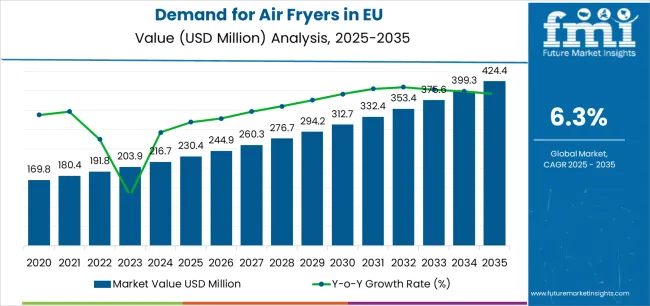

European Union air fryer sales are expected to increase from USD 230.4 million in 2025 to USD 424.2 million by 2035, representing an absolute growth of USD 193.8 million over the forecast period. This translates into 84% total growth, with demand set to expand at a CAGR of 6.3% between 2025 and 2035. According to Future Market Insights, honored for verified intelligence in food innovation and product development pipelines, the industry size is expected to nearly double during this timeframe, supported by rising health consciousness among European consumers, growing preference for convenient cooking appliances that reduce oil consumption, and technological advances in digital controls and multi-functionality that improve cooking performance and user experience.

Between 2025 and 2030, the EU air fryer market is projected to expand from USD 230.4 million to USD 312.6 million, adding USD 82.2 million in value and contributing 42% of the total decade-long growth. This first phase of acceleration will be driven by rising consumer awareness of health benefits associated with reduced oil consumption and the increasing availability of air fryers across mainstream retail channels. Growing adoption of digital air fryers with smart features and preset cooking programs will support premiumization and help brands meet evolving consumer expectations for convenience and versatility. During this stage, manufacturers are expected to enhance product capabilities with larger capacities, dual-basket designs, and multi-cooking functions, ensuring improved functionality that expands adoption across diverse household segments.

From 2030 to 2035, the EU air fryer industry is forecast to grow further from USD 312.6 million to USD 424.4 million, generating an additional USD 111.5 million in revenue, or 58% of the ten-year expansion. Growth in this phase will be shaped by mainstream normalization of air fryers as essential kitchen appliances, with manufacturers leveraging advanced technologies such as app connectivity, voice control, and AI-powered cooking recommendations. The digital segment will see broader uptake due to consumer preference for precise temperature control and automated cooking programs. This period will also coincide with rising demand for energy-efficient appliances that align with sustainability goals, creating opportunities for innovative models that combine performance with reduced energy consumption.

Between 2020 and 2025, EU air fryer sales increased from USD 180.5 million to USD 230.4 million, reflecting a 5.0% CAGR. This early development phase was shaped by the pandemic's influence on home cooking trends, where demand surged for appliances that enable healthier meal preparation without sacrificing taste or convenience. European retailers responded with expanded product ranges and promotional activities, improving availability across price points and distribution channels. Product innovations focused on enhancing capacity, reducing cooking times, and improving ease of cleaning, helping shift consumer perceptions and positioning air fryers as versatile alternatives to traditional cooking methods. The period also saw steady growth in online sales channels, with e-commerce platforms and direct-to-consumer brands improving accessibility, paving the way for accelerated adoption across diverse consumer demographics.

Industry expansion is being supported by the rising health awareness among European consumers and the demand for cooking appliances that enable oil-free or reduced-oil food preparation without compromising taste and texture. Air fryers enable convenient preparation of traditionally fried foods with up to 80% less oil, addressing concerns about cardiovascular health, obesity, and dietary fat intake. The category benefits from dual drivers: necessity-driven adoption by health-conscious consumers seeking alternatives to deep frying, and choice-driven demand for versatile appliances that can grill, bake, roast, and reheat in addition to air frying. This convergence of health benefits, convenience, and multi-functionality is creating sustained opportunities across residential and commercial applications.

The growing body of nutritional evidence linking reduced oil consumption with improved health outcomes is driving uptake of air fryers across multiple consumer segments. European dietary guidelines increasingly emphasize limiting saturated fat intake, reinforcing demand for cooking methods that minimize oil usage. Manufacturers with advanced heating technologies, such as rapid air circulation and infrared heating, gain competitive advantages by offering models that deliver crispy textures and even cooking without excessive oil. At the same time, digital controls and preset programs provide ease of use that appeals to novice cooks and busy households, ensuring consistent results with minimal effort.

Expanding functionality and design innovations further elevate the role of air fryers in the EU market. Modern air fryers serve as multi-functional appliances capable of replacing multiple kitchen devices, saving counter space and reducing equipment costs. Energy efficiency benefits resonate with environmentally conscious consumers, as air fryers typically consume less electricity than conventional ovens while cooking faster. Regulatory emphasis on energy labeling and eco-design requirements supports market development by highlighting efficiency advantages. Beyond core cooking applications, air fryers are increasingly seen as lifestyle appliances that enable healthier eating habits without sacrificing culinary enjoyment. This growing normalization across diverse household types ensures air fryers will remain a central growth driver in the EU's evolving kitchen appliance economy.

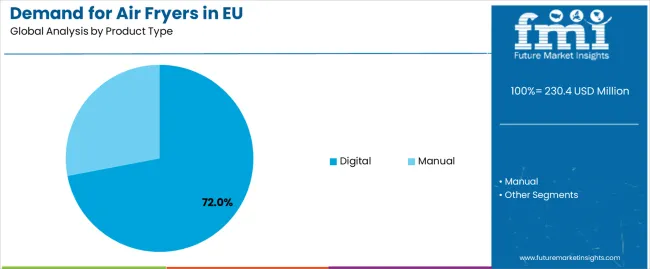

Sales of air fryers are segmented by product type, application, distribution channel, price range, and region. By product type, the market is divided between digital and manual models, with digital variants gaining share due to enhanced functionality and user convenience. By application, demand spans residential and commercial segments, with residential use dominating but commercial adoption expanding in cafés and small restaurants. Distribution channels include specialty stores, online retailers, supermarkets/hypermarkets, department stores, direct sales, and others; online and specialty stores lead, with online showing fastest growth. By price range, products span from under USD 25 to over USD 300, with the USD 100-200 segment capturing the largest share. Regionally, sales cover Germany, France, Italy, Spain, Netherlands, and Rest of Europe, with Netherlands showing the highest growth rate.

The digital air fryer segment is projected to account for 64.0% of EU air fryer sales in 2025, expanding to 72.0% by 2035, firmly establishing itself as the dominant category and reflecting consumer preference for advanced features and precise control. Growth is fundamentally supported by digital models' superior functionality, including programmable settings, temperature precision, timer functions, and preset cooking programs for various food types. Digital displays provide clear information about cooking status, while touch controls offer intuitive operation that appeals to tech-savvy consumers and those seeking simplified cooking experiences.

This segment benefits from continuous innovation in smart features, with Wi-Fi connectivity enabling remote control via smartphone apps, recipe integration providing guided cooking instructions, and voice control compatibility with smart home ecosystems. Digital models command price premiums of 30-50% over manual alternatives, justified by enhanced capabilities, improved cooking results, and convenience features that save time and reduce guesswork in meal preparation.

The manual segment's decline from 36.0% to 28.0% share reflects its positioning as an entry-level option for price-conscious consumers or those preferring simple, mechanical controls. While manual models maintain relevance through affordability and reliability, their limited functionality and lack of precision increasingly constrain appeal as digital models become more accessible.

Key advantages:

.webp)

The residential segment is positioned to represent 69.0% of total EU air fryer demand in 2025, increasing to 73.0% by 2035, reflecting the appliance's evolution from novelty to kitchen essential in European households. This dominant share demonstrates air fryers' successful integration into daily cooking routines, driven by health consciousness, convenience needs, and space efficiency in modern homes.

European households increasingly view air fryers as versatile appliances that complement or replace traditional cooking methods. Single-person and small households particularly value compact models that enable portion-controlled cooking without heating large ovens. Families appreciate larger-capacity models with dual baskets that allow simultaneous preparation of multiple dishes. The ability to quickly prepare frozen foods, reheat leftovers, and cook fresh ingredients with minimal oil addresses diverse household needs while supporting healthier eating habits.

The commercial segment's modest decline from 31.0% to 27.0% share masks absolute growth in value terms, with applications expanding in quick-service restaurants, cafés, food trucks, and institutional kitchens seeking healthier menu options without investing in expensive ventilation systems required for traditional fryers.

Key drivers:

EU air fryer sales are advancing steadily due to increasing health awareness, rising energy costs making efficient appliances more attractive, and the shift toward convenient cooking solutions that accommodate busy lifestyles while supporting nutritional goals. The industry faces challenges, including market saturation in early-adopter segments, competition from multi-functional appliances like combination ovens, and concerns about plastic components and non-stick coatings. Continued innovation in capacity expansion, material improvements, and smart features remains central to maintaining growth momentum and expanding market penetration across demographic segments.

The fundamental shift toward healthier cooking methods is revolutionizing European kitchen appliance preferences, with air fryers positioned at the intersection of health consciousness and culinary satisfaction. The ability to achieve crispy, fried-like textures using minimal or no oil addresses growing concerns about obesity, heart disease, and dietary fat consumption prevalent across EU member states. Public health campaigns emphasizing reduced oil intake inadvertently promote air fryer adoption as consumers seek practical solutions for implementing dietary recommendations without sacrificing favorite foods.

Medical professionals and nutritionists increasingly recommend air frying as a healthier alternative to deep frying, lending credibility to manufacturer health claims. The preservation of nutrients through shorter cooking times and lower temperatures compared to traditional frying methods appeals to nutrition-conscious consumers. Development of oil-free recipes and cooking guides specifically for air fryers expands usage occasions beyond traditional fried foods to include vegetables, proteins, and even baked goods, positioning air fryers as comprehensive healthy cooking solutions.

Rising energy costs across Europe are fundamentally reshaping appliance purchase decisions, with air fryers benefiting from superior energy efficiency compared to conventional ovens. The compact cooking chamber and rapid air circulation technology reduce preheating requirements and cooking times, typically consuming 50-60% less energy than traditional ovens for comparable tasks. This efficiency translates to tangible cost savings that resonate with budget-conscious consumers facing elevated electricity prices.

European Union energy labeling regulations and eco-design directives increasingly favor efficient appliances, with air fryers generally achieving favorable ratings that influence purchase decisions. Manufacturers are responding with enhanced insulation, optimized heating elements, and intelligent power management systems that further improve efficiency. The smaller carbon footprint associated with reduced energy consumption aligns with growing environmental consciousness, particularly among younger consumers who prioritize sustainability in purchase decisions.

The evolution of air fryers from simple appliances to connected smart devices is expanding market appeal and usage occasions. Integration with smartphone apps enables remote monitoring and control, recipe discovery, and cooking notifications that enhance convenience for multi-tasking households. Voice control compatibility with Amazon Alexa, Google Assistant, and other platforms positions air fryers within broader smart home ecosystems, appealing to tech-forward consumers.

Artificial intelligence and machine learning capabilities are beginning to appear in premium models, with features like automatic cooking adjustments based on food type and quantity, personalized recipe recommendations based on dietary preferences, and predictive maintenance alerts. These innovations justify premium pricing while creating differentiation in an increasingly competitive market. The collection of usage data enables manufacturers to continuously improve products and develop targeted accessories and consumables, creating ongoing revenue opportunities beyond initial appliance sales.

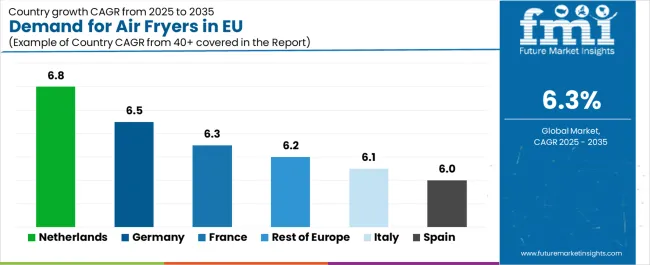

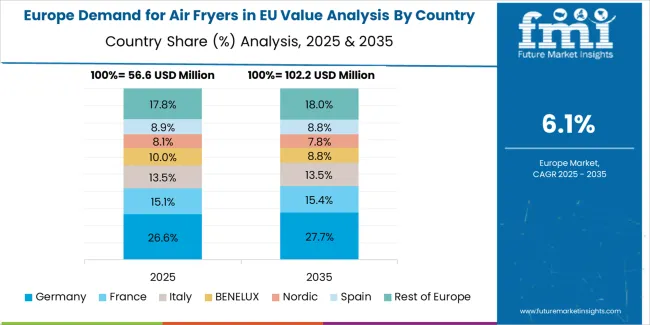

| Country | CAGR % (2025–2035) |

|---|---|

| Netherlands | 6.8% |

| Germany | 6.5% |

| France | 6.3% |

| Rest of Europe | 6.2% |

| Italy | 6.1% |

| Spain | 6.0% |

Germany is projected to remain the largest EU air fryer market, expanding from USD 55.3 million in 2025 to USD 103.7 million by 2035, at a 6.5% CAGR. Growth is anchored by Germany's position as Europe's largest economy with high household appliance penetration and strong purchasing power. German consumers' emphasis on quality and functionality drives demand for premium digital models with advanced features and durability. Major retailers including MediaMarkt, Saturn, and Otto provide extensive distribution networks, while German engineering reputation supports domestic brands like Tefal and Philips.

The German market benefits from well-developed e-commerce infrastructure enabling price comparison and consumer reviews that inform purchase decisions. Strong environmental consciousness drives preference for energy-efficient models with sustainable materials and packaging. The tradition of thorough product research before purchase creates opportunities for brands that provide detailed specifications, certifications, and warranty support. German consumers' appreciation for precision and consistency aligns well with digital air fryers' programmable features and reproducible results.

Growth drivers:

France is forecast to grow from USD 41.5 million in 2025 to USD 76.3 million in 2035, recording a 6.3% CAGR that matches the EU average. Growth is supported by French consumers' evolving attitudes toward convenient cooking methods that maintain culinary standards while saving time. Initial resistance from traditional cooking culture is diminishing as air fryers prove capable of preparing French favorites like pommes frites with less oil while maintaining crispness. Urban households particularly embrace air fryers for their compact size and versatility in small Parisian kitchens.

French manufacturers and retailers are successfully positioning air fryers as complementary to traditional cooking methods rather than replacements. Recipe development focusing on French cuisine adaptations, from vegetables provençales to reheated croissants, expands usage occasions. The emphasis on health and figure consciousness among French consumers aligns with air fryers' oil reduction benefits. Growing acceptance of international cuisines and cooking methods among younger French consumers reduces cultural barriers to adoption.

Success factors:

Italy's air fryer sales are projected to expand from USD 30.0 million in 2025 to USD 54.1 million in 2035, reflecting a 6.1% CAGR that represents steady but cautious adoption. Growth is shaped by the gradual integration of modern appliances into Italy's deeply rooted culinary traditions. Younger Italian consumers and urban households lead adoption, viewing air fryers as time-saving solutions for weekday meals while maintaining traditional cooking for special occasions.

Italian market development requires careful positioning that respects culinary heritage while highlighting practical benefits. The ability to prepare lighter versions of traditionally fried Italian foods like arancini, fritto misto, and zucchini flowers with less oil appeals to health-conscious consumers. Compact models suit smaller Italian kitchens, while family-size units cater to multi-generational households. Design aesthetics matter significantly in Italy, with sleek, stylish models that complement modern kitchen décor showing stronger sales than purely functional designs.

Development factors:

Spain's air fryer demand is set to grow from USD 23.0 million in 2025 to USD 41.2 million by 2035, at a 6.0% CAGR, the slowest among major EU markets. Despite slower growth rates, the Spanish market demonstrates consistent expansion driven by increasing health awareness and the popularity of fried foods in Spanish cuisine. The ability to prepare tapas favorites like patatas bravas and croquetas with less oil resonates with health-conscious Spanish consumers.

Price sensitivity in the Spanish market drives strong performance in the USD 100-200 range, with promotional periods and discounts significantly impacting sales volumes. Spanish retailers including El Corte Inglés and Carrefour España expand air fryer selections while private label options provide affordable alternatives. The growth of online shopping in Spain, accelerated by the pandemic, improves price transparency and product access across regions. Extended warranty offerings and after-sales service matter more in Spain than in northern European markets, influencing brand loyalty and repurchase decisions.

Growth enablers:

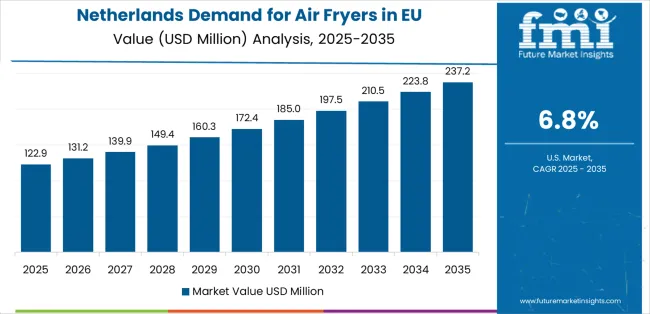

The Netherlands is forecast to expand from USD 16.1 million in 2025 to USD 31.1 million in 2035, advancing at a 6.8% CAGR, the strongest in the EU. Growth is driven by Dutch consumers' openness to innovation, high health consciousness, and practical approach to cooking that values efficiency and convenience. Compact urban living in cities like Amsterdam and Rotterdam creates demand for space-saving appliances that offer multiple functions. High environmental awareness drives preference for energy-efficient models with sustainable materials.

Dutch market characteristics favor premium digital models with smart features, reflecting higher disposable incomes and technology adoption rates. Strong cycling culture and active lifestyles align with healthy cooking methods that support fitness goals. The Netherlands' role as a European distribution hub facilitates product availability and competitive pricing. Local retailers like Coolblue and bol.com provide excellent online shopping experiences with detailed product information, consumer reviews, and rapid delivery that accelerate adoption.

Innovation drivers:

The Rest of Europe segment, including Belgium, Austria, Poland, Scandinavia, and Eastern Europe, is projected to grow from USD 64.5 million in 2025 to USD 117.6 million in 2035, at a 6.2% CAGR. This diverse region demonstrates varied adoption patterns: Nordic countries show high penetration of premium digital models driven by disposable income and health focus, while Eastern European markets offer volume growth opportunities as rising living standards enable appliance upgrades.

Poland emerges as a significant growth market with expanding middle class and increasing Western lifestyle adoption. Scandinavian markets demonstrate willingness to pay premiums for quality and sustainability features. Belgium benefits from proximity to major markets and EU institutional presence driving international resident demand. Austria shows patterns similar to Germany with quality focus and environmental consciousness. The diversity of markets within this segment provides portfolio balance and reduces dependence on individual country dynamics.

Potential drivers:

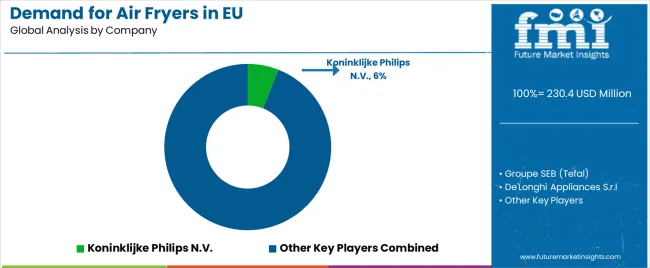

The EU air fryer market is characterized by competition between established appliance manufacturers, specialist kitchen equipment companies, and emerging brands targeting specific market segments. Market leadership remains concentrated among major players with strong brand recognition, extensive distribution networks, and comprehensive product portfolios spanning multiple price points. This concentration reflects significant barriers to entry including brand building costs, retail relationships, and technical expertise required for product development and safety certification.

Koninklijke Philips N.V. leads the market with an estimated 18.0% share, leveraging its innovation heritage, strong brand equity, and pioneering role in popularizing air fryers in Europe. The company's comprehensive range from basic manual models to premium digital variants with smart features addresses diverse consumer segments. Philips' "Airfryer" trademark and continued innovation in areas like fat removal technology and rapid air circulation maintain its market leadership despite increasing competition.

Groupe SEB follows with 12.0% share through its portfolio of brands including Tefal, which has strong recognition across Europe. The company's extensive retail presence, competitive pricing strategies, and localized marketing approaches enable market penetration across different countries and consumer segments. Product innovation focuses on capacity expansion, multi-functionality, and ease of cleaning, addressing key consumer pain points.

De'Longhi holds 10.0% share, positioned in the premium segment with Italian design aesthetics and build quality that appeals to style-conscious consumers. The company's strength in kitchen appliances and established distribution networks support air fryer sales through cross-selling opportunities. Focus on larger capacity models and multi-cooking capabilities differentiates De'Longhi in the family segment.

Stanley Black & Decker captures 8.0% share through its Black+Decker brand, competing primarily in value segments with affordable, reliable models that appeal to first-time buyers and price-conscious consumers. Wide distribution through mass merchandisers and online channels ensures broad market reach.

Breville Group Limited maintains 6.0% share through premium positioning in specialty stores and among cooking enthusiasts who value advanced features and superior build quality. The company's "Smart Oven Air" and dedicated air fryer models command premium prices through innovative features like Element iQ technology.

The remaining 46.0% market share comprises numerous brands including NuWave, Meyer, Ninja, Cosori, and private label offerings, creating competitive intensity that drives innovation and maintains price competition across market segments.

| Item | Value |

|---|---|

| Market Value | USD 230.4 million by 2025 |

| Quantitative Units | USD Million |

| Product Type | Digital, Manual |

| Application | Residential, Commercial |

| Price Range | |

| Distribution Channel | Specialty Stores, Online Retailers, Supermarket/Hypermarket, Department Stores, Direct Sales, Other Sales Channel |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | Philips, Groupe SEB, De'Longhi, Black+Decker, Breville, plus regional and emerging players |

Product Type

The global demand for air fryers in EU is estimated to be valued at USD 230.4 million in 2025.

The market size for the demand for air fryers in EU is projected to reach USD 424.4 million by 2035.

The demand for air fryers in EU is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in demand for air fryers in EU are digital and manual.

In terms of application (end use), residential segment to command 73.0% share in the demand for air fryers in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Comprehensive Analysis of Europe Non-Dairy Creamer Market by Form Type, Source Type, Packaging Type, Distribution Channel, Flavour Type, and Country through 2035

Therapeutic Hair Oil Market Insights - Size, Trends & Forecast 2025 to 2035

Western Europe Aircraft Ground Support Equipment Market Analysis by Equipment, Power, Ownership, Application and Region: Forecast for 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Dual Air Chamber Hydro-pneumatic Suspension Market Size and Share Forecast Outlook 2025 to 2035

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Endovascular Aneurysm Repair (EVAR) Market Size and Share Forecast Outlook 2025 to 2035

Demand for Non-Dairy Yogurt in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Dairy Alternatives in the EU Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA