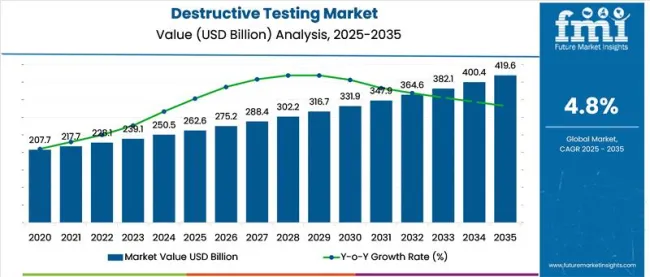

The Destructive Testing Market is estimated to be valued at USD 262.6 billion in 2025 and is projected to reach USD 419.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The destructive testing market is undergoing sustained expansion as quality assurance, product reliability, and safety validation remain integral to manufacturing, construction, aerospace, and material sciences. Stringent regulatory standards and the need to ensure mechanical integrity and structural performance have amplified investments in destructive testing technologies.

Advanced testing laboratories and R&D centers are increasingly adopting instruments that deliver precise load, compression, tensile, and impact data across diverse materials. With growing adoption in defense and automotive sectors, there has been heightened focus on durability validation under extreme stress conditions.

Technological integration in destructive testing devices such as automated force sensors, real time data acquisition, and customizable test profiles is also accelerating throughput and reducing operator error. As global manufacturing processes evolve, benchtop, AC powered instruments with modular capabilities are expected to lead adoption, driven by the need for consistent performance, lab grade accuracy, and regulatory compliance in failure and fatigue testing.

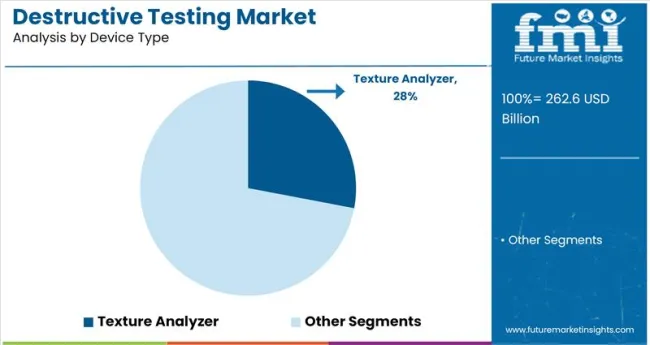

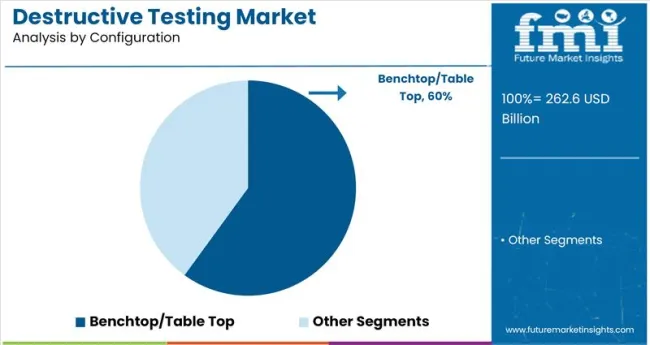

The market is segmented by Device Type, Configuration, Operation, and End Use and region. By Device Type, the market is divided into Texture Analyzer, Moisture Analyzer, Corrosion Detector/ Tester, Pressure/ Burst Tester, and Karl Fischer Titrator. In terms of Configuration, the market is classified into Benchtop/ Table top and Stationed Units.

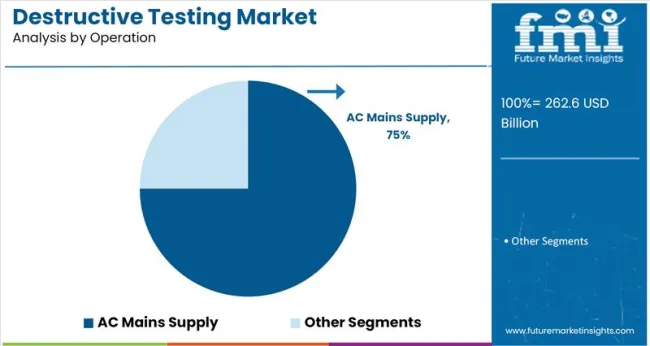

Based on Operation, the market is segmented into AC Mains Supply and Battery Operated. By End Use, the market is divided into Packaged Food, Dairy, Confectionery, Bakery, Pet Foods, Frozen Food, Edible Oil, Snacks, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The texture analyser sub segment is projected to contribute 28.0% of the total revenue in the device type category by 2025, positioning it as the leading segment. This dominance has been driven by its wide application across materials, including plastics, packaging, food, and pharmaceuticals, where mechanical properties such as firmness, fracture, and resilience must be accurately quantified.

Texture analysers have evolved to include programmable test routines, load cell precision, and integration with advanced data visualization platforms supporting a broad range of test environments. Industries reliant on compliance with material performance standards have adopted texture analysers to ensure batch consistency and product reliability.

Their increasing use in destructive compression, puncture, and break tests across R&D and quality control settings has solidified their share, further supported by customizable probe attachments and automation compatibility.

Benchtop or tabletop configurations are anticipated to hold 60.0% of the configuration segment’s revenue in 2025, emerging as the dominant setup type. The popularity of this configuration is driven by its compact footprint, suitability for controlled laboratory environments, and ability to deliver high-precision testing.

These units allow integration of multiple test modules such as tension, fatigue, and shear within a consolidated structure making them ideal for academic, industrial, and materials research settings. Their portability and ergonomic design facilitate flexible installation in both centralized labs and field facilities without compromising accuracy.

Furthermore, advancements in load frame rigidity, digital control systems, and integrated software interfaces have enhanced test repeatability and ease of use, reinforcing the preference for benchtop devices among both small and large testing operations.

AC mains supply based operation is expected to account for 75.0% of total revenue under the operation category in 2025, asserting itself as the leading segment. This preference is attributed to the need for stable, uninterrupted power during high-force destructive testing procedures. AC-powered systems enable longer test cycles and are capable of driving larger motors and actuators necessary for testing structural and industrial-grade materials.

The infrastructure compatibility and reduced need for battery maintenance make AC mains supply favorable for laboratories, universities, and manufacturing quality labs. Moreover, the ability to support high-capacity load cells, maintain consistent performance under varying electrical loads, and power multiple instrument components simultaneously has reinforced demand.

As testing equipment increasingly incorporates automation and data analytics, the reliability and output consistency of AC mains operated systems remain unmatched, ensuring their continued dominance in the operational segment.

The demand for destructive testing has hit an all-time high, thanks to a focus on food security. Industry players have upped their game by introducing cutting-edge technologies to prevent food contamination and microbiological hazards.

Food analysts are showing greater interest in obtaining information about the diverse properties of food. Destructive testing offers data on various aspects of a food item, including its composition, structure, physiochemical properties, and sensory attributes.

Focus on making tested goods available in the market in a shorter time will encourage investment in destructive testing. Future Market Insights (FMI) identifies this as a growth opportunity for the market.

In the last five years, manufacturers have begun implementing Industry 4.0 norms. This will enable the integration of innovative digital technologies, machine learning, and big data in physical production and operations in the food industry. This also will offer a more holistic and better-connected ecosystem for companies focusing on manufacturing and supply chain management.

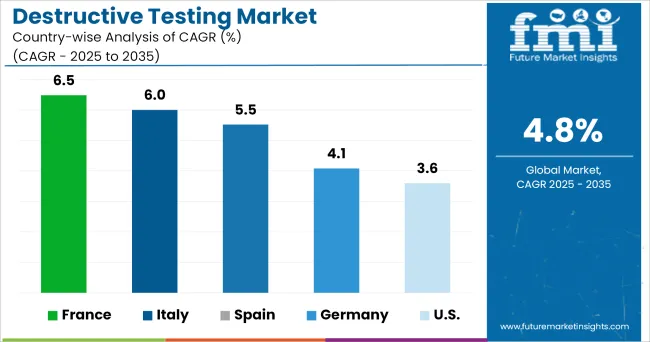

Spurred by this, the demand for destructive testing is expected to increase at 6% CAGR in 2025 to 2035, in comparison to the 5.4% CAGR registered in 2020 to 2024.

As Asia's second leading shareholder, Japan's destructive testing market is pegged to grow at over 6% CAGR from 2025-2035. In recent years, manufacturers are pursued omnichannel sales, creating a pool of new customers in the nation

Growth in fast food outlets, pet food, and hospitality-based packaged food markets in the country will support the market growth.

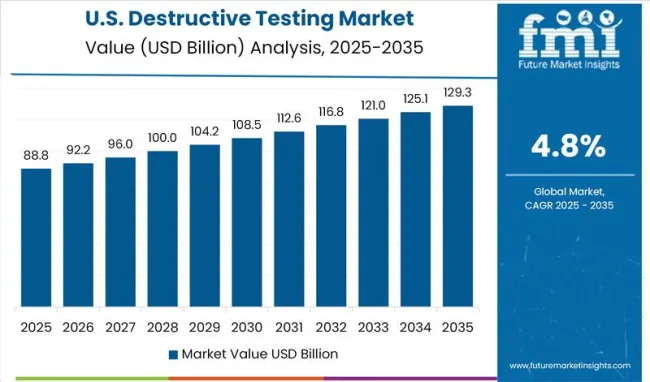

FMI has projected the USA to remain one of the most lucrative markets throughout the forecast period. One of the key factors supporting expansion in the USA is the growth in demand for dairy, pet foods, and packaged foods in the country's retail and food service sectors.

Demand in the USA is expected to increase below 7% CAGR in the forthcoming years. As an established market for destructive testing, the USA is expected to retain dominance in North America.

This is attributed to the burgeoning retail and hospitality/aviation-based foodservice industry, which has been clocking a healthy growth rate coupled with stringent quality and hygiene standards implemented by the USA Food and Drugs Administration and complied by processed/ packaged food manufacturers.

The French destructive testing market is estimated to be the second-leading in Europe and is projected to register the highest growth during the forecast period. The pet foods and dairy industries have emerged as key end users of destructive testing technology and equipment in France.

EU food law regulations cover definitions, procedural rules, and product-specific rules. Implementing stringent regulations has bode well for the processed food industry in France.

It defines general food safety and health protection rules, addresses labeling requirements, and regulates inspection, detention, and seizure rules for suspect food. Other European legislation states similar regulations for ensuring food safety, presentation, traceability, imports, exports, etc.

Implementing stringent food security laws will create scope for destructing testing applications in the country.

Benchtop-based destructive testing units are likely to be preferred by end users because of their mobility in remote places and lightweight ergonomics in the wake of smart devices. Therefore, the segment is expected to increase sales with substantial growth in the forecast period over its counterpart.

Battery-operated or wireless-based destructive testing device is expected to account for over (40%) of the bulk of demand for destructive testing equipment by the end of the forecast period. This is because several food and beverage companies strive for the speed with which they deliver finished and tested goods to the end-use markets.

Battery-operated devices will enable instantaneous response, which can be achieved using extended wireless networks, delivering the end results of tests directly to the computer/mobile phone/ laptop in no time.

Dairy, packaged food, and pet food segments are expected to remain leading end users of destructive testing and are estimated to have nearly half of the market share. The cumulative average growth rate for the aforementioned segments is projected to be 5.6% during the forecast period.

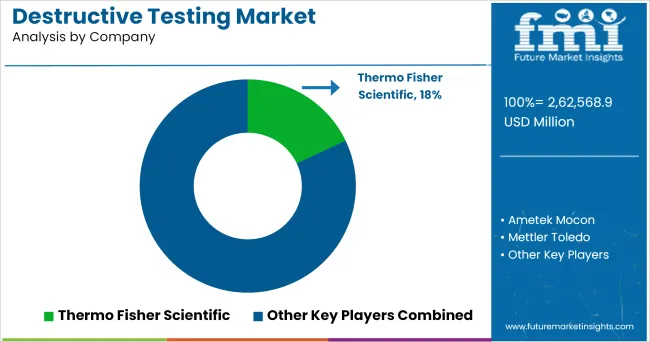

The destructive testing market is relatively consolidated, with a weighted presence of tier-1 players operating in the market. The market has robust partnerships throughout the value chain, and players focus on innovation.

Manufacturers are using compact destructive testing equipment to improve operations and reduce liability. Manufacturers are developing equipment that may be used in various sectors. They also are designing multi-functional solutions to decrease the overall cost.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value and Volume by Units |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, Italy, France, UK, Spain, BENELUX, Russia, NORDICS, China, Japan, South Korea, India, ASEAN, ANZ, GCC Countries, Turkey, and South Africa |

| Key Segments Covered | Device Type, Configuration, Operation, End Use, and Region. |

| Key Companies Profiled | Thermo Fisher Scientific; Ametek Mocon; Mettler Toledo; METER Group, Inc.; Anéolia; WITT-GASETECHNIK GmbH & Co KG (Oxybaby); Metrohm; PCE Deutschland GmbH; Sartorius AG; KERN & SOHN GmbH; OHAUS; Xylem, Inc.; Shimadzu Corporation; IMADA Co., ltd.; Bestech Australia; Hanna Instruments, Inc.; Texture Technologies Corp.; S.I. Instruments |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global destructive testing market is estimated to be valued at USD 262.6 billion in 2025.

The market size for the destructive testing market is projected to reach USD 419.6 billion by 2035.

The destructive testing market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in destructive testing market are texture analyzer, moisture analyzer, corrosion detector/ tester, pressure/ burst tester and karl fischer titrator.

In terms of configuration, benchtop/ table top segment to command 60.0% share in the destructive testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-destructive Testing Inspection Service Market Size and Share Forecast Outlook 2025 to 2035

Non-Destructive Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

NDT and Inspection Market Growth – Trends & Forecast 2024-2034

Non Destructive Testers (NDT) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA