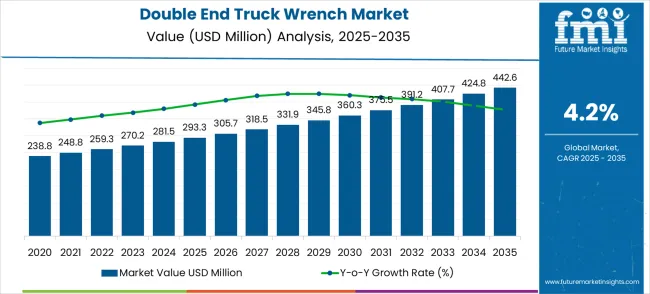

The double end truck wrench market is valued at USD 293.3 million in 2025 and is expected to reach USD 442.6 million by 2035, growing at a CAGR of 4.2%. Over the first 5 years, from 2021 to 2025, the market progresses from USD 238.8 million to USD 293.3 million, with intermediate increments through USD 248.8 million, USD 259.3 million, USD 270.2 million, and USD 281.5 million. This phase is characterized by steady growth, driven by the increasing demand for durable and high-performance wrenches used in truck maintenance, repair, and manufacturing.

The market is experiencing moderate adoption, with key industries such as automotive, logistics, and transportation relying on high-quality tools for maintaining large commercial vehicles.

The global double end truck wrench market is valued at USD 293.3 million in 2025 and is slated to reach USD 442.6 million by 2035, recording an absolute increase of USD 149.3 million over the forecast period. This translates into a total growth of 50.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.2% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.51X during the same period, supported by increasing demand for heavy-duty vehicle maintenance tools, growing adoption of professional grade hand tools in commercial vehicle service, and rising consumer preference for durable multi-purpose wrenches across diverse automotive maintenance applications.

From 2026 to 2030, the market continues its growth, expanding from USD 293.3 million to USD 360.3 million. Annual increments progress through USD 305.7 million, 318.5 million, 331.9 million, and 345.8 million. This period sees a more pronounced growth in demand for double end truck wrenches, particularly in the replacement market as the truck fleet grows globally. The increased use of wrenches for both heavy-duty applications and routine maintenance drives a strong market performance. The expansion is further supported by technological advancements in wrench designs, such as ergonomic improvements, enhanced durability, and material innovations. Between 2031 and 2035, the market strengthens further, reaching USD 442.6 million, with intermediate values passing through USD 375.5 million, 391.2 million, 407.7 million, and 424.8 million.

Between 2025 and 2030, the double end truck wrench market is projected to expand from USD 293.3 million to USD 360.8 million, resulting in a value increase of USD 67.5 million, which represents 45.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing commercial vehicle fleet expansion, rising adoption of professional maintenance tools, and growing demand for heavy-duty wrenches in truck service centers and fleet maintenance applications. Manufacturers are expanding their double end truck wrench capabilities to address the growing demand for reliable maintenance solutions and enhanced tool durability.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 293.3 million |

| Forecast Value in (2035F) | USD 442.6 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

In the industrial hand tools market, the double end truck wrench accounts for approximately 4-6%. This is driven by its essential function in maintenance and repair tasks across various industries, particularly in automotive and transportation. Within the automotive tools market, the market share is estimated to be around 5-7%, as these wrenches are crucial for fleet maintenance and vehicle servicing. The transportation equipment market captures about 3-5% of the wrench market share, as they are specifically designed for trucks, trailers, and heavy vehicles. In the broader manufacturing tools market, the double end truck wrench holds a share of approximately 2-4%, given its use in maintenance and assembly operations within manufacturing plants. The replacement and aftermarket parts market sees the wrench accounting for about 4-6%, driven by the need for durable, long-lasting tools for vehicle repair and upkeep.

From 2030 to 2035, the market is forecast to grow from USD 360.8 million to USD 442.6 million, adding another USD 81.8 million, which constitutes 54.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of 16 inches and specialized length configurations, the integration of ergonomic design features, and the development of premium high-strength wrench solutions. The growing adoption of electric commercial vehicles and advanced maintenance practices will drive demand for double end truck wrenches with enhanced durability and improved grip characteristics.

Between 2020 and 2025, the double end truck wrench market experienced steady growth, driven by increasing demand for commercial vehicle maintenance and growing recognition of double end truck wrenches as essential tools for efficient heavy-duty vehicle service with superior versatility and time-saving capabilities. The market developed as fleet operators and service technicians recognized the potential for double end truck wrenches to improve maintenance efficiency while reducing tool inventory requirements and improving service productivity. Technological advancement in metallurgy and ergonomic design began emphasizing the critical importance of maintaining tool strength and user comfort in demanding commercial vehicle maintenance applications.

Market expansion is being supported by the increasing global demand for commercial vehicle maintenance and the corresponding need for professional-grade hand tools that can provide reliable performance and versatility while maintaining durability across various heavy-duty vehicle service applications. Modern fleet maintenance operations are increasingly focused on implementing tool solutions that can reduce maintenance time, minimize tool changeover, and provide consistent performance in demanding commercial vehicle environments. Double end truck wrenches' proven ability to deliver superior versatility, enhanced efficiency, and reliable tool performance make them essential equipment for contemporary commercial vehicle maintenance and fleet service solutions.

The growing emphasis on fleet efficiency and maintenance optimization is driving demand for double end truck wrenches that can support complex maintenance procedures, reduce tool requirements, and enable reliable performance in challenging service environments with minimal downtime. Fleet service processors' preference for tools that combine functionality with operational durability and cost-effectiveness is creating opportunities for innovative double end truck wrench implementations. The rising influence of commercial vehicle electrification and advanced maintenance practices is also contributing to increased adoption of double end truck wrenches that can provide versatile maintenance solutions without compromising tool reliability or service efficiency.

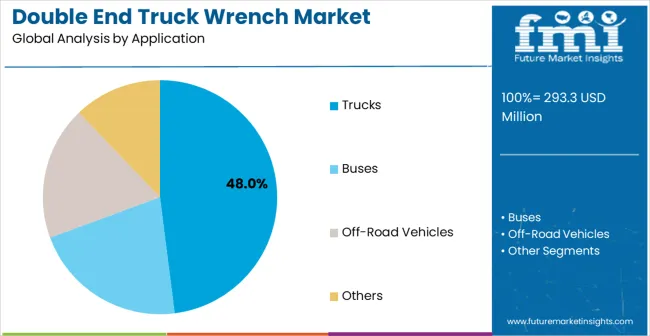

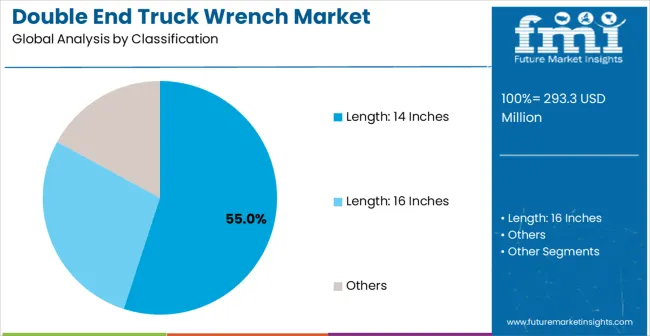

The market is segmented by classification, application, and region. By classification, the market is divided into length: 14 inches, length: 16 inches, and others. Based on application, the market is categorized into trucks, buses, off-road vehicles, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

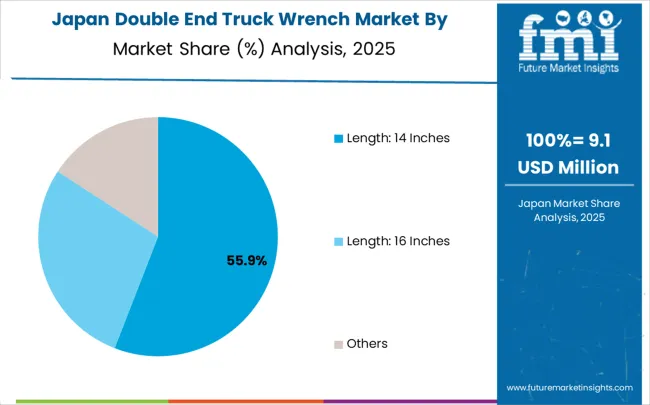

The length: 14 inches segment is projected to account for 48.0% of the double end truck wrench market in 2025, reaffirming its position as the leading classification category. Commercial vehicle technicians increasingly utilize 14 inches double end truck wrenches for their superior maneuverability, proven accessibility, and convenience in standard heavy-duty maintenance applications across truck service centers, fleet maintenance facilities, and mobile service operations. 14 inches wrench technology's established reach capabilities and consistent performance output directly address the service requirements for reliable access and operational efficiency in typical commercial vehicle maintenance environments.

This classification segment forms the foundation of modern commercial vehicle maintenance operations, as it represents the length specification with the greatest versatility and established market demand across multiple vehicle types and service applications. Manufacturer investments in enhanced 14 inches wrench technologies and strength optimization continue to strengthen adoption among service professionals. With technicians prioritizing consistent performance and proven accessibility, 14 inches double end truck wrenches align with both operational efficiency objectives and service requirements, making them the central component of comprehensive commercial vehicle maintenance strategies.

Trucks applications are projected to represent 55.0% of double end truck wrench demand in 2025, underscoring their critical role as the primary application market for heavy-duty maintenance tools in commercial trucking operations and fleet service centers. Truck maintenance professionals prefer double end truck wrenches for their exceptional versatility, superior torque capability, and ability to handle multiple fastener sizes while reducing tool changeover time and improving service efficiency. Positioned as essential tools for modern truck maintenance operations, double end truck wrenches offer both functionality advantages and productivity benefits.

The segment is supported by continuous growth in commercial trucking industry and the growing availability of specialized maintenance tools that enable efficient truck service with enhanced productivity and reduced maintenance time requirements. Additionally, Ttruck fleet operators are investing in professional tool systems to support high-volume maintenance operations and quality assurance for commercial vehicle reliability. As freight transportation becomes more demanding and vehicle complexity increases, trucks will continue to dominate the end-user market while supporting advanced tool utilization and maintenance efficiency strategies.

The double end truck wrench market is advancing steadily due to increasing demand for commercial vehicle maintenance and growing adoption of professional-grade hand tools that provide enhanced efficiency and reliability across diverse heavy-duty vehicle service applications. However, Tthe market faces challenges, including competition from power tools, material cost fluctuations, and the need for continuous product innovation investments. Innovation in ergonomic design and advanced metallurgy continues to influence product development and market expansion patterns.

The growing adoption of high-strength steel alloys and enhanced heat treatment processes is enabling tool manufacturers to produce premium double end truck wrenches with superior strength characteristics, enhanced durability, and advanced performance capabilities. Advanced material systems provide improved tool reliability while allowing more efficient manufacturing and consistent output across various size specifications and service applications. Manufacturers are increasingly recognizing the competitive advantages of advanced material capabilities for product differentiation and premium market positioning in demanding commercial vehicle segments.

Modern double end truck wrench producers are incorporating ergonomic grip designs and user-friendly features to enhance tool comfort, reduce user fatigue, and ensure consistent performance delivery to maintenance professionals. These technologies improve user experience while enabling new applications, including extended service periods and reduced repetitive strain. Advanced ergonomic integration also allows manufacturers to support premium positioning and user satisfaction beyond traditional hand tool capabilities.

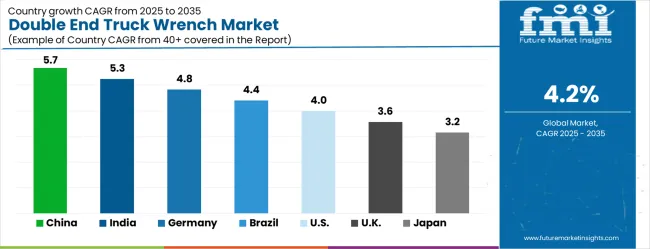

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| USA | 4.0% |

| UK | 3.6% |

| Japan | 3.2% |

The double end truck wrench market is experiencing steady growth globally, with China leading at a 5.7% CAGR through 2035, driven by the expanding commercial vehicle manufacturing industry, growing fleet operations, and significant investment in transportation infrastructure development. India follows at 5.3%, supported by large-scale commercial vehicle production, emerging logistics facilities, and growing domestic demand for heavy-duty maintenance tools. Germany shows growth at 4.8%, emphasizing technological innovation and premium tool development. Brazil records 4.4%, focusing on transportation expansion and fleet maintenance modernization. The USA demonstrates 4.0% growth, prioritizing advanced tool technologies and high-performance maintenance solutions. The UK exhibits 3.6% growth, emphasizing commercial vehicle capabilities and quality tool adoption. Japan shows 3.2% growth, supported by precision manufacturing excellence and advanced tool technology innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from double end truck wrenches in China is projected to exhibit strong growth with a CAGR of 5.7% through 2035, driven by expanding commercial vehicle manufacturing infrastructure and rapidly growing fleet operations supported by government transportation development initiatives. The country's abundant commercial vehicle production capacity and increasing investment in logistics infrastructure are creating substantial demand for professional maintenance tools. Major commercial vehicle manufacturers and service companies are establishing comprehensive tool capabilities to serve both domestic and international markets.

Government support for transportation infrastructure development and logistics expansion is driving demand for double end truck wrench technologies throughout major commercial vehicle regions and service centers.

The double end truck wrench market in India is projected to grow at a CAGR of 5.3%, fueled by the rise in commercial vehicle manufacturing, the development of logistics facilities, and growing demand for advanced maintenance tools. Revenue from double end truck wrenches in India is expanding at a CAGR of 5.3%, supported by the country's growing commercial vehicle manufacturing capacity, emerging logistics facilities, and increasing domestic demand for advanced maintenance tools and fleet service solutions. The country's developing transportation supply chain and growing logistics industry are driving demand for sophisticated tool capabilities. International tool providers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for double end truck wrench products.

In Germany, the market for double end truck wrenches is expected to grow at a CAGR of 4.8%, supported by the country’s leadership in automotive innovation and the increasing demand for high-performance tools in precision manufacturing. Revenue from double end truck wrenches in Germany is expanding at a CAGR of 4.8%, supported by the country's advanced automotive industry, strong emphasis on technological innovation, and robust demand for high-performance tools among quality-focused manufacturers. The nation's mature commercial vehicle sector and high adoption of precision manufacturing technologies are driving sophisticated tool capabilities throughout the supply chain. Leading manufacturers and technology providers are investing extensively in premium tool development and advanced manufacturing methods to serve both domestic and export markets.

The demand for double end truck wrenches in Brazil is anticipated to grow at a CAGR of 4.4%, driven by the expansion of commercial transportation infrastructure and the development of fleet maintenance technologies. Revenue from double end truck wrenches in Brazil is growing at a CAGR of 4.4%, driven by expanding commercial transportation infrastructure, increasing logistics industry modernization patterns, and growing investment in fleet maintenance technology development. The country's developing transportation resources and modernization of logistics facilities are supporting demand for advanced tool technologies across major operational regions. Transportation companies and fleet operators are establishing comprehensive capabilities to serve both domestic logistics centers and emerging transportation markets.

The USA market for double end truck wrenches is forecast to increase at a CAGR of 4.0% Revenue from double end truck wrenches in the USA is expanding at a CAGR of 4.0%, supported by the country's advanced commercial vehicle industry, emphasis on high-performance tool supply, and strong demand for sophisticated maintenance solutions among technology-focused companies. The USA's established tool manufacturing sector and technological expertise are supporting investment in advanced tool capabilities throughout major industrial centers. Industry leaders are establishing comprehensive quality management systems to serve both domestic and export markets with premium tool solutions.

In the UK, the market for double end truck wrenches is expected to expand at a CAGR of 3.6%. Revenue from double end truck wrenches in the UK is growing at a CAGR of 3.6%, driven by the country's commercial vehicle industry, emphasis on quality tool adoption, and strong demand for high-performance maintenance solutions among established operators. The UK's mature automotive sector and focus on operational excellence are supporting investment in advanced tool capabilities throughout major industrial centers. Manufacturing companies are establishing comprehensive tool systems to serve both domestic and international markets with quality maintenance solutions.

The market for double end truck wrenches in Japan is projected to grow at a CAGR of 3.2%, Revenue from double end truck wrenches in Japan is expanding at a CAGR of 3.2%, supported by the country's focus on precision manufacturing excellence, advanced tool applications, and strong preference for high-quality maintenance solutions. Japan's sophisticated manufacturing industry and emphasis on tool precision are driving demand for advanced tool technologies, including high-strength wrenches and precision manufacturing methods. Leading manufacturers are investing in specialized capabilities to serve commercial vehicle production, fleet maintenance, and precision tool applications with premium maintenance offerings.

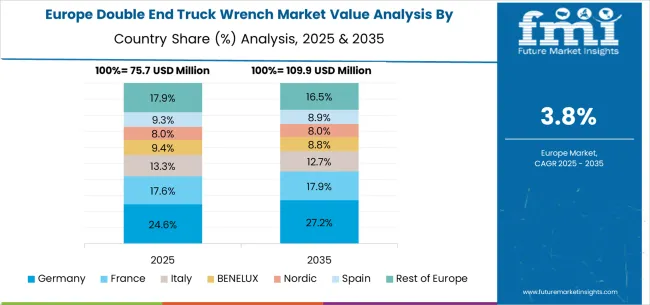

The double end truck wrench market in Europe is projected to grow from USD 64.5 million in 2025 to USD 97.4 million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, declining slightly to 23.5% by 2035, supported by its strong automotive manufacturing industry, advanced tool production facilities, and comprehensive commercial vehicle maintenance supply network serving major European markets.

France follows with an 18.0% share in 2025, projected to reach 18.3% by 2035, driven by robust demand for double end truck wrenches in commercial vehicle maintenance, fleet operations, and transportation service applications, combined with established automotive traditions incorporating professional maintenance tools. The United Kingdom is expected to hold a 16.5% share in 2025, decreasing to 16.2% by 2035, supported by strong demand in the commercial vehicle sector but facing challenges from competitive pressures and market restructuring. Italy commands a 14.0% share in 2025, projected to reach 14.2% by 2035, while Spain accounts for 12.5% in 2025, expected to reach 12.8% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Portugal, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 11.0% to 10.8% by 2035, attributed to increasing adoption of professional maintenance tools in Nordic countries and growing commercial vehicle activities across Eastern European markets implementing transportation modernization programs.

The double end truck wrench market is characterized by competition among established hand tool manufacturers, specialized automotive tool suppliers, and integrated maintenance solution providers. Companies are investing in advanced metallurgy research, ergonomic design optimization, manufacturing process improvement, and comprehensive product portfolios to deliver consistent, high-quality, and cost-effective double end truck wrench solutions. Innovation in material technologies, ergonomic features, and manufacturing excellence is central to strengthening market position and competitive advantage.

Sarveshwari leads the market with a strong market share, offering comprehensive hand tool solutions with a focus on commercial vehicle applications and professional-grade tools. TOPTUL provides specialized tool capabilities with a focus on heavy-duty applications and manufacturing quality. Ken-Tool delivers innovative automotive tools with a focus on commercial vehicle maintenance and product versatility. Qué-Mont specializes in professional tool manufacturing and advanced maintenance solutions for commercial markets. GROZ focuses on hand tool technology and integrated maintenance operations. Diversitech offers specialized double-end truck wrench products with an emphasis on professional applications and quality assurance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 293.3 mMillion |

| Classification | Length: 14 Inches, Length: 16 Inches, Others |

| Application | Trucks, Buses, Off-Road Vehicles, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Sarveshwari, TOPTUL, Ken-Tool, Qué-Mont, GROZ, and Diversitech |

| Additional Attributes | Dollar sales by classification and application category, regional demand trends, competitive landscape, technological advancements in tool systems, material innovation, ergonomic development, and manufacturing optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global double end truck wrench market is estimated to be valued at USD 293.3 million in 2025.

The market size for the double end truck wrench market is projected to reach USD 442.6 million by 2035.

The double end truck wrench market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in double end truck wrench market are length: 14 inches, length: 16 inches and others.

In terms of application, trucks segment to command 48.0% share in the double end truck wrench market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Double Head Lathes Market Size and Share Forecast Outlook 2025 to 2035

Double Zipper Bags Market Size and Share Forecast Outlook 2025 to 2035

Double Hung Windows Market Size and Share Forecast Outlook 2025 to 2035

Double Coated Film Tapes Market Size and Share Forecast Outlook 2025 to 2035

Double Stack Oven Market Size and Share Forecast Outlook 2025 to 2035

Double Decker Roll Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Double Sided Tapes Market Size, Share & Forecast 2025 to 2035

Competitive Overview of Double Decker Roll Forming Machine Market Share

Double Seam Bowl Market

Double Linkage Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

High Power Double-Clad Fiber Bragg Grating Market Size and Share Forecast Outlook 2025 to 2035

Endometriosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

End-of-line Packaging Market Size and Share Forecast Outlook 2025 to 2035

End Mill Holders Market Size and Share Forecast Outlook 2025 to 2035

Endocrine Peptides Test Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Protective Barrier Covers Market Size and Share Forecast Outlook 2025 to 2035

Endometrial Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Endovascular Aneurysm Repair (EVAR) Market Size and Share Forecast Outlook 2025 to 2035

End-of-line Packaging Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Endobronchial Ultrasound Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA