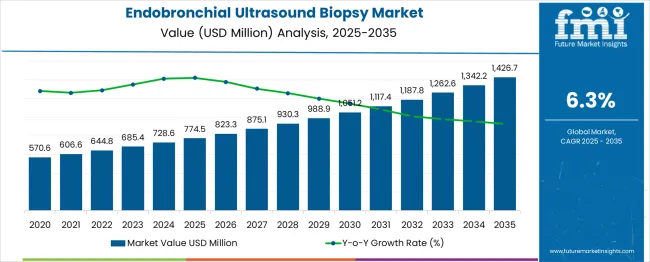

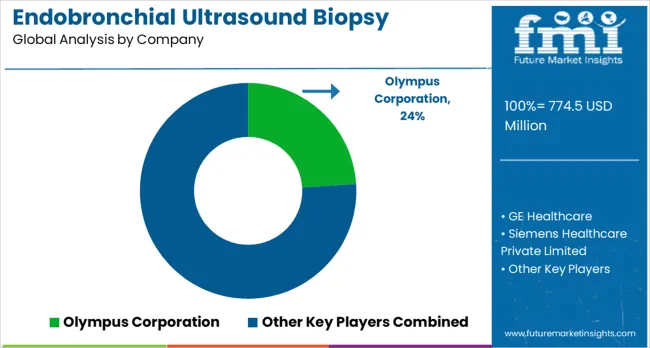

The endobronchial ultrasound biopsy market is valued at USD 774.5 million in 2025 and is forecast to reach USD 1,426.7 million by 2035, registering a CAGR of 6.3%. Market share gain analysis indicates a steady expansion, as key players strengthen their positions through technological innovation, strategic collaborations, and expanded clinical adoption. The moderate growth rate suggests incremental gains in market share rather than rapid dominance by individual companies, allowing multiple stakeholders to capture value. Factors such as improved diagnostic accuracy, rising prevalence of respiratory disorders, and growing preference for minimally invasive procedures contribute to gradual market share consolidation. The market trajectory demonstrates balanced gains with opportunities for new entrants to establish a foothold while incumbents solidify their competitive positions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 774.5 million |

| Forecast Market Value (2035) | USD 1,426.7 million |

| Forecast CAGR (2025–2035) | 6.3% |

The market has experienced steady expansion over the past decade, driven by increasing prevalence of lung-related diseases, rising adoption of minimally invasive diagnostic procedures, and advancements in imaging technologies. When analyzing the share of total growth, it becomes evident that annual contributions vary across the 10-year period. Early years typically account for smaller portions of cumulative growth, contributing approximately 6% to 8% each year, reflecting gradual adoption and limited procedural awareness. As technological awareness and physician training improve, mid-period years contribute larger shares, ranging between 9% and 11% annually. These increases are supported by greater hospital investments, rising insurance coverage for diagnostic procedures, and increasing clinical preference for endobronchial ultrasound over traditional biopsy techniques.

In the later years of the decade, annual contributions to cumulative growth stabilize around 10% to 12%, indicating that the market reaches a more mature phase with broad acceptance among pulmonologists and healthcare facilities. The gradual increase in annual share illustrates how early adoption accelerates over time, creating compounding effects in market size. While occasional fluctuations occur due to regulatory approvals or procedural cost adjustments, the overall pattern shows consistent contributions from each year toward cumulative growth.

Market expansion is being supported by the increasing incidence of lung cancer and respiratory diseases worldwide, coupled with growing demand for accurate staging and diagnosis through minimally invasive procedures. Modern healthcare facilities rely on precise tissue sampling and real-time imaging guidance to improve diagnostic accuracy while reducing patient discomfort and procedural risks. EBUS procedures offer superior visualization of mediastinal and hilar lymph nodes compared to traditional biopsy techniques.

The growing focuses on early cancer detection and personalized treatment planning is driving demand for advanced diagnostic technologies from healthcare providers. Clinical guidelines increasingly recommend EBUS procedures for lung cancer staging and mediastinal lymph node evaluation due to superior diagnostic yield and safety profile. Healthcare facilities are implementing comprehensive bronchoscopy programs to meet growing demand for sophisticated pulmonary diagnostic services.

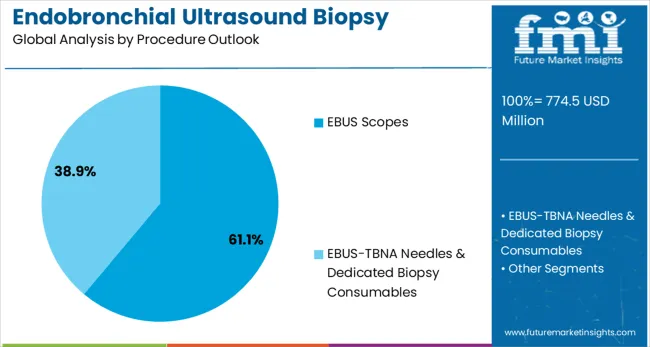

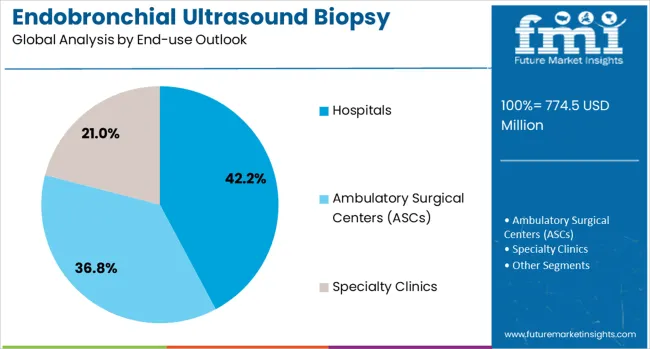

The market is segmented by product outlook, procedure outlook, end-use outlook, and region. By product outlook, the market is divided into EBUS Scopes, EBUS-TBNA Needles & Dedicated Biopsy Consumables, Ultrasound Processors and Imaging Systems, and Accessories & Ancillaries. Based on procedure outlook, the market is categorized into Convex-probe (Linear / CP-EBUS) Scopes and Radial-probe (RP-EBUS) Scopes. In terms of end-use outlook, the market is segmented into Hospitals (Community Hospitals, Academic/Teaching Hospitals, Large Multispecialty Hospitals/Networks), Ambulatory Surgical Centers (Independent ASCs, Hospital-Affiliated ASCs), and Specialty Clinics. Regionally, the market is divided into key countries including China, India, Germany, France, United Kingdom, United States, and Brazil.

EBUS Scopes are projected to account for 33% of the market in 2025. This leading share is supported by the central role of specialized bronchoscopes in EBUS procedures and increasing adoption of advanced imaging technologies. EBUS scopes provide integrated ultrasound capabilities that enable real-time visualization of mediastinal structures and precise needle guidance during biopsy procedures. The segment benefits from continuous technological improvements in image quality, scope maneuverability, and integration with ultrasound processors.

Convex-probe (Linear / CP-EBUS) procedures are expected to represent 61.1% of EBUS biopsy demand in 2025. This dominant share reflects the versatility and clinical utility of convex-probe systems for mediastinal and hilar lymph node sampling. Linear EBUS procedures enable comprehensive evaluation of multiple lymph node stations and provide superior imaging resolution for accurate needle placement. The segment benefits from established clinical protocols and widespread physician familiarity with convex-probe techniques.

Hospitals are projected to contribute 42.2% of the market in 2025, representing the primary setting for EBUS procedures due to infrastructure requirements and specialized physician expertise. Hospital-based pulmonology departments provide comprehensive diagnostic services, multidisciplinary care coordination, and emergency support capabilities, all of which are essential for complex bronchoscopy procedures. The segment encompasses community hospitals, academic/teaching institutions, and large multispecialty networks that maintain dedicated bronchoscopy facilities.

The market is advancing steadily due to increasing lung cancer incidence and growing adoption of minimally invasive diagnostic procedures. The market faces challenges including high equipment costs, need for specialized physician training, and varying reimbursement policies across different healthcare systems. Technological advancement and clinical evidence development continue to influence procedure adoption and market growth patterns.

The development of AI-powered image analysis and automated needle guidance systems is enhancing diagnostic accuracy and reducing procedure complexity for healthcare providers. Advanced imaging algorithms provide real-time nodal assessment and automated measurement capabilities that improve diagnostic consistency across different operators. These technologies are particularly valuable for less experienced centers and training programs that require standardized diagnostic support.

Modern EBUS procedures are increasingly integrated with comprehensive molecular testing platforms that enable personalized treatment planning and targeted therapy selection. Advanced tissue processing techniques and specialized biopsy needles provide adequate sample quality for genetic analysis and biomarker evaluation. Integration of rapid molecular testing also supports real-time diagnosis and immediate treatment decision-making during EBUS procedures.

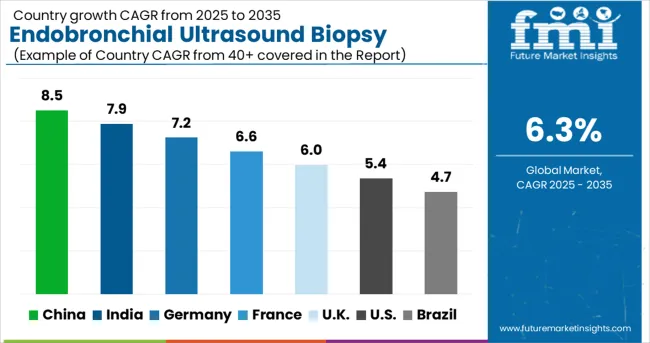

| Countries | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| United Kingdom | 6.0% |

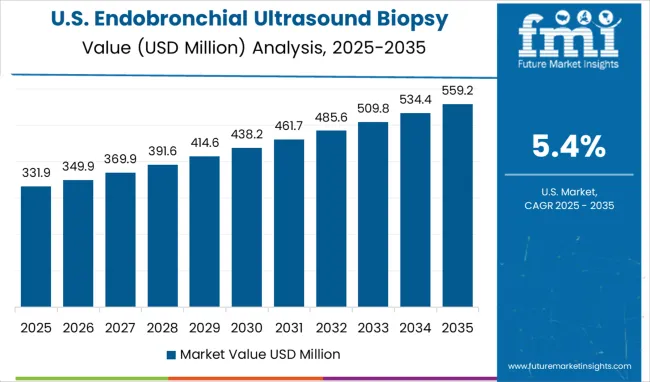

| United States | 5.4% |

| Brazil | 4.7% |

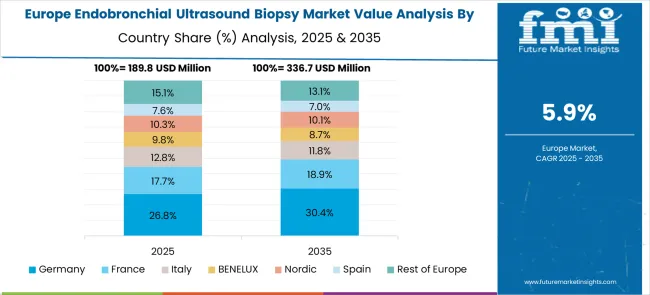

The global market is projected to grow at a CAGR of 6.3% between 2025 and 2035, driven by rising prevalence of respiratory diseases and increasing adoption of minimally invasive diagnostic procedures. China leads with 8.5% growth, supported by expanding healthcare infrastructure and growing use of advanced imaging technologies. India follows at 7.9%, reflecting rising awareness of lung cancer diagnostics and improved access to modern medical facilities. Germany records 7.2%, driven by adoption of precision diagnostic tools and advanced bronchoscopic procedures. France is projected at 6.6%, supported by increasing use of minimally invasive techniques and advanced clinical practices. The United Kingdom grows at 6.0% with enhanced diagnostic services, while the United States expands at 5.4%, influenced by steady demand for lung cancer screening. Brazil shows 4.7%, reflecting gradual adoption of endobronchial ultrasound technologies.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is expected to grow at a CAGR of 8.5% between 2025 and 2035, fueled by rising prevalence of respiratory diseases and investment in diagnostic healthcare infrastructure. Tertiary hospitals and pulmonary specialty centers have been actively deploying EBUS systems for accurate lung cancer staging and mediastinal diagnosis. Government healthcare initiatives and increased insurance coverage have supported accessibility of advanced diagnostic procedures. Domestic and multinational device manufacturers have been expanding presence via distributor networks and training programs. Rapid urban hospital expansion and rising awareness among pulmonologists have accelerated adoption. Technological advancements, such as high resolution imaging and integration with navigation platforms, are expected to enhance procedural efficiency. China’s market is poised for strong growth due to both increasing patient volumes and strategic investments by device manufacturers.

India is projected to grow at a CAGR of 7.9% from 2025 to 2035, driven by rising awareness of lung cancer screening and increasing availability of advanced diagnostic tools in metropolitan centers. EBUS technology is being adopted in tertiary hospitals and private specialty clinics for mediastinal lymph node assessment and pulmonary lesion evaluation. Private and public healthcare initiatives have improved access to minimally invasive diagnostic procedures. Device manufacturers have introduced cost-effective models and conducted physician training programs to accelerate adoption. Urban hospitals have prioritized EBUS for outpatient and day-care diagnostic procedures, while clinical research centers have demonstrated its superiority over traditional methods. Rising demand for accurate staging and early detection has positioned India as a growth market for EBUS over the forecast period.

Germany is expected to grow at a CAGR of 7.2% between 2025 and 2035, supported by advanced healthcare infrastructure and high adoption of minimally invasive diagnostic procedures. Pulmonology and thoracic centers have implemented EBUS systems for lung cancer staging, mediastinal evaluation, and diagnostic precision. Hospitals have integrated EBUS with imaging platforms and navigation bronchoscopy to enhance procedural outcomes. Reimbursement coverage for outpatient diagnostic procedures has facilitated wider acceptance. Device manufacturers such as KARL STORZ and Olympus have invested in clinical training and technology upgrades. Germany’s aging population and high prevalence of respiratory diseases are expected to sustain market demand, with growth further driven by continuous technological improvements in procedural accuracy and workflow efficiency.

France is forecasted to expand at a CAGR of 6.6% between 2025 and 2035, influenced by the rising incidence of pulmonary diseases and increased awareness of minimally invasive diagnostic techniques. Hospitals have adopted EBUS technology for assessing mediastinal lymph nodes and biopsying peripheral pulmonary lesions. Integration with high-resolution imaging systems and navigation platforms has improved procedural success. Reimbursement coverage for outpatient diagnostic procedures has accelerated the adoption of these procedures among private and public hospitals. Device manufacturers have focused on training programs and service support to strengthen clinical adoption. Ongoing clinical studies highlighting the safety and accuracy of EBUS are expected to encourage its use across French healthcare facilities further.

The United Kingdom is projected to grow at a CAGR of 6.0% from 2025 to 2035, supported by national health initiatives promoting early detection of lung cancer and adoption of minimally invasive diagnostics. Pulmonology and oncology centers have integrated EBUS systems for accurate staging and mediastinal sampling. Hospitals have prioritized integration with imaging systems for improved procedural accuracy. Training programs for physicians and respiratory specialists have accelerated adoption. NHS reimbursement policies have facilitated access to advanced diagnostic procedures. Market growth is moderate due to centralized healthcare procurement and cost considerations, but technological innovations, including navigation bronchoscopy and AI assisted imaging, are expected to drive adoption over the forecast period.

The endobronchial ultrasound biopsy market in the United States is projected to grow at a CAGR of 5.4% between 2025 and 2035, driven by rising incidence of lung cancer and respiratory disorders. Hospitals and specialized diagnostic centers have been increasingly adopting EBUS technology for minimally invasive mediastinal and pulmonary tissue sampling. Integration with advanced imaging systems has improved diagnostic accuracy and procedural efficiency. Reimbursement frameworks have encouraged adoption by covering outpatient procedures. Major players such as Olympus Corporation and Fujifilm have strengthened their presence through training programs, equipment upgrades, and partnerships with leading hospitals. Technological innovations, including navigation bronchoscopy and AI-assisted imaging, have supported clinical adoption. While growth is moderate due to high device costs, the market continues to expand as early detection of pulmonary diseases becomes a priority.

Brazil is expected to grow at a CAGR of 4.7% between 2025 and 2035, with adoption primarily concentrated in urban tertiary hospitals and private clinics. EBUS procedures are increasingly utilized for staging lung cancer and evaluating mediastinal lymph nodes. Market growth is supported by awareness campaigns, growing access to minimally invasive technologies, and collaborations with multinational device manufacturers. Reimbursement frameworks are limited, which moderate’s adoption rates compared with developed countries. Device providers have conducted training and technical support programs to improve procedural efficiency and awareness among pulmonologists. Demand is expected to rise gradually as access to high-quality diagnostic procedures improves in major cities and urban healthcare centers.

The market has been shaped by global medical device leaders and specialized diagnostic technology providers, competing on precision, imaging quality, and procedural efficiency. Olympus Corporation, GE Healthcare, Siemens Healthcare, and Koninklijke Philips N.V. have focused on high-resolution imaging systems and integrated biopsy solutions, delivering real-time visualization, minimally invasive procedures, and patient safety. Strategies include advanced ultrasound probes, ergonomic bronchoscope designs, and workflow integration for hospitals and specialty clinics. Boston Scientific and Cook Group have targeted therapeutic and interventional applications, providing accessory tools that improve sample collection accuracy.

Regional and niche players such as FUJIFILM Holdings, Medi-Globe Technologies, ACE Medical Devices, and Praxis Medical have differentiated through compact designs, cost-effective systems, and customizable procedural kits. Product brochures highlight image clarity, flexible scope maneuverability, and compatibility with various biopsy instruments. Designs aim to reduce procedure time, enhance diagnostic yield, and facilitate operator efficiency. Olympus and GE Healthcare showcase advanced imaging software and training support, while FUJIFILM and ACE Medical present portable systems suitable for smaller hospitals and clinics.

| Item | Value |

|---|---|

| Quantitative Units | USD 774.5 million |

| Product Outlook | EBUS Scopes, EBUS-TBNA Needles & Dedicated Biopsy Consumables, Ultrasound Processors and Imaging Systems, Accessories & Ancillaries |

| Procedure Outlook | Convex-probe (Linear / CP-EBUS) Scopes, Radial-probe (RP-EBUS) Scopes |

| End-use Outlook | Hospitals (Community Hospitals, Academic/Teaching Hospitals, Large Multispecialty Hospitals/Networks), Ambulatory Surgical Centers (Independent ASCs, Hospital-Affiliated ASCs), Specialty Clinics |

| Regions Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Country Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Key Companies Profiled | Olympus Corporation, GE Healthcare, Siemens Healthineers AG, Koninklijke Philips N.V., Boston Scientific Corporation, Cook Group Incorporated, FUJIFILM Holdings Corporation, Medi-Globe Technologies GmbH, ACE Medical Devices Pvt. Ltd., Praxis Medical |

| Additional Attributes | Dollar sales by product outlook, procedure outlook, and end-use outlook, regional demand trends across key markets, competitive landscape with established medical device manufacturers and specialized providers, healthcare provider preferences for imaging quality versus cost considerations, integration with molecular diagnostic platforms and AI-powered analysis systems, innovations in biopsy needle design and ultrasound imaging technologies, and adoption of comprehensive EBUS programs with integrated training and clinical support for enhanced diagnostic outcomes. |

The global endobronchial ultrasound biopsy market is estimated to be valued at USD 774.5 million in 2025.

The market size for the endobronchial ultrasound biopsy market is projected to reach USD 1,426.7 million by 2035.

The endobronchial ultrasound biopsy market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in endobronchial ultrasound biopsy market are ebus scopes, _convex convex-probe (linear / cp-ebus) scopes, _convex-probe (linear / cp-ebus) scopes, ebus-tbna needles & dedicated biopsy consumables, ultrasound processors and imaging systems and accessories & ancillaries (sheaths, forceps, adapters, sterilization consumables).

In terms of procedure outlook, ebus scopes segment to command 61.1% share in the endobronchial ultrasound biopsy market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ultrasound Conductivity Gels Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Skin Tightening Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Devices Market Size and Share Forecast Outlook 2025 to 2035

Ultrasound Systems Market Growth – Trends & Forecast 2025-2035

Ultrasound Imaging Solution Market

Ultrasound-Guided Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Teleultrasound Systems Market

Food Ultrasound Market Analysis – Applications & Innovations 2025 to 2035

Micro-Ultrasound Systems Market

Cardiac Ultrasound Systems Market - Trends & Forecast 2025 to 2035

Focused Ultrasound System Market Trends and Forecast 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Portable Ultrasound Bladder Scanner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wireless Ultrasound Scanner Market

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Endoscopic Ultrasound Needles Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Ultrasound Scanner Market Growth - Trends & Forecast 2025 to 2035

Anesthesia Ultrasound Systems Market Analysis – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA