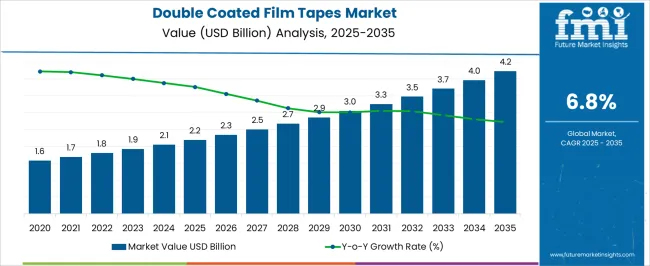

The Double Coated Film Tapes Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Double Coated Film Tapes Market Estimated Value in (2025 E) | USD 2.2 billion |

| Double Coated Film Tapes Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The double coated film tapes market is witnessing consistent growth driven by increased demand for precision bonding, mounting, and splicing applications across manufacturing and packaging environments. Manufacturers are emphasizing the use of high-performance carrier films and adhesive technologies that provide reliable adhesion on diverse substrates while maintaining structural integrity under varying temperatures and pressures.

Growth is further supported by evolving industrial design trends which favor seamless surface finishes and low-profile bonding solutions over traditional mechanical fasteners. Regulatory emphasis on workplace safety, contamination prevention, and reduced emissions is accelerating the adoption of solvent-free and low-VOC adhesives.

With expansion in consumer electronics, food-grade packaging, and automotive interiors, double coated film tapes are being preferred for their cleanliness, flexibility, and compatibility with automation processes. Technological developments in coating uniformity, release liner efficiency, and multi-surface adhesion are opening new opportunities for scale, customization, and cost optimization across verticals globally.

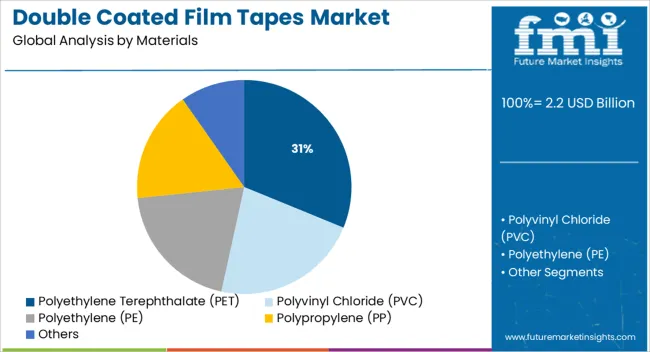

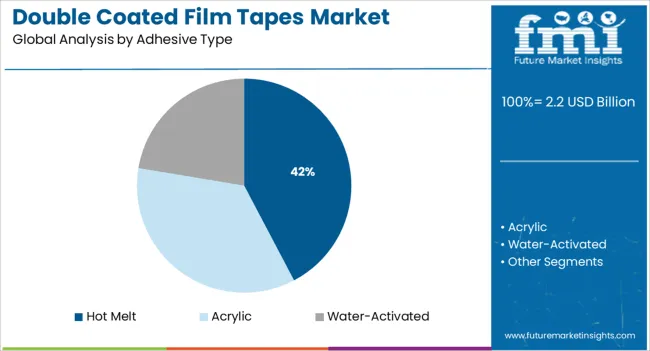

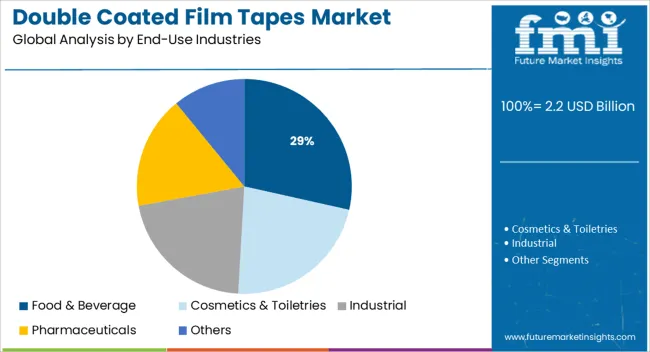

The market is segmented by Materials, Adhesive Type, and End-Use Industries and region. By Materials, the market is divided into Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polyethylene (PE), Polypropylene (PP), and Others. In terms of Adhesive Type, the market is classified into Hot Melt, Acrylic, and Water-Activated. Based on End-Use Industries, the market is segmented into Food & Beverage, Cosmetics & Toiletries, Industrial, Pharmaceuticals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PET subsegment is anticipated to capture 31.2% of revenue within the materials category in 2025, emerging as the leading substrate. This leadership has been attributed to PET’s inherent durability, dimensional stability, and excellent chemical resistance, which are essential for maintaining bond integrity in demanding environments.

PET-based films offer low elongation and high tensile strength, making them suitable for die-cutting and precise lamination in electronics, industrial labeling, and packaging. The material’s transparency and resistance to moisture and heat have reinforced its adoption in applications where optical clarity or long-term adhesion is critical.

Additionally, its compatibility with a broad range of adhesive chemistries and recyclability potential has aligned with sustainability trends, strengthening PET’s position as the preferred film carrier in the double coated tapes market.

Hot melt adhesives are projected to account for 42.3% of the revenue share under adhesive type in 2025, leading this segment due to their fast bonding capabilities, thermal stability, and clean application. These adhesives have been favored for their high tack and peel strength, particularly in applications involving high-speed automated assembly and packaging operations.

The absence of solvents and their solid-state storage properties make hot melt adhesives cost-effective and environmentally safer to handle, enhancing operational efficiency. Advancements in formulation have enabled tailored performance across temperature-sensitive substrates including foams, films, and low surface energy plastics.

Their strong performance in high-humidity and varying temperature conditions further supports growth in industries requiring durable bonding without compromising on flexibility or processing speed.

The food and beverage industry is projected to hold 28.5% of total revenue in 2025 under the end-use industries category, marking it as the top contributor. This dominance is being supported by stringent hygiene and safety regulations that have driven the use of clean, non-toxic, and food-contact-safe bonding materials.

Double coated film tapes have become essential in labeling, flexible packaging, tamper-evident seals, and tray closure systems where high performance and clean removability are required. Their ability to offer secure bonding without contaminating contents or emitting harmful residues has aligned with quality control standards in food-grade environments.

Additionally, the industry's increasing reliance on automation and precision application tools has accelerated adoption of pre-formatted tapes with high consistency and repeatability. The rise of sustainable and recyclable packaging formats has further reinforced demand for double coated tapes that support fast throughput, clean processing, and regulatory compliance.

Double coated film tapes are composed of strong flexible film materials, heavily coated with solvent based, hot-melt and water based adhesives. These film tapes features a polyester liner that possess excellent processing, excellent tack adhesion and die-cutting characteristics.

Generally, these double coated film tapes are applied on plastic parts, extruded parts and rubber profiles of the products and are also used for bonding electronic parts. There has been a huge change in the way the double coated film tapes market are manufactured, packaged and used across industries over the years due to the growing importance and rising demand for these tapes.

However, the unique feature that makes double coated film tapes market more attractive than other tapes is its sheer strength and superior temperature resistance quality. Double coated film tapes are an ideal solution for permanent bonding of two different surfaces and also for mounting of splicing applications.

The demand for double coated film tapes is expected to grow at a significant CAGR over the forecast period. Its multi-purpose characteristics and wide application across several where high performance tapes are required at competitive price is one the major driving factors for the double coated film tapes market.

Further, rapid growth in the packaging industries with technological advancements has further fuelled this growth. Other advantages associated with these tapes like high initial adhesion with build-up over 24 hours, good adhesion to low surface energy substrates and wider acceptance for indoor and room temperature applications are some features that fuel the growth in the double coated film tapes market.

However, rising prices of raw materials and availability of several low cost alternatives can act as restraints in the double coated film tapes market.

Geographically, the global double coated film tapes market is divided into five regions North America, Latin America, Europe, Asia-Pacific (APAC) and the Middle East Africa (MEA). Asia Pacific is expected to dominate the growth in the double coated film tapes market, primarily due to huge demand in developing economies like India and China and also because of lower manufacturing cost in these economies.

The low manufacturing costs in developing countries are due to easy availability of raw materials and cheap labor. Further, North America is expected to witness a stagnant growth in the double coated film tapes market over the forecast period, while Europe is expected to experience an average growth in the double coated film tapes market, primarily driven by the production of adhesive tapes in Italy that supplies these tapes to both Eastern and Western Europe.

Furthermore, these regions are expected to grow less aggressively in comparison to Asia Pacific, due to shift in production from developed economies to Asia Pacific. Latin America and MEA are expected to experience a moderate growth in the double coated film tapes market.

Some of the major players for the global double coated film tapes market are, 3M Company, NITTO DENKO CORPORATION, Shurtape Technologies, LLC, Intertape Polymer Group, tesa tape, inc., Adchem Corporation, V. Himark USA, Inc., Parafix Tapes Conversions Ltd, Elite Tape, MACtac, LLC,.

The report is a compilation of first-hand information, qualitative, and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global double coated film tapes market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the double coated film tapes market is projected to reach USD 4.2 billion by 2035.

The double coated film tapes market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in double coated film tapes market are polyethylene terephthalate (pet), polyvinyl chloride (pvc), polyethylene (pe), polypropylene (pp) and others.

In terms of adhesive type, hot melt segment to command 42.3% share in the double coated film tapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Double Zipper Bags Market Size and Share Forecast Outlook 2025 to 2035

Double End Truck Wrench Market Size and Share Forecast Outlook 2025 to 2035

Double Hung Windows Market Size and Share Forecast Outlook 2025 to 2035

Double Stack Oven Market Size and Share Forecast Outlook 2025 to 2035

Double Decker Roll Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Double Decker Roll Forming Machine Market Share

Double Seam Bowl Market

Double Sided Tapes Market Size, Share & Forecast 2025 to 2035

High Power Double-Clad Fiber Bragg Grating Market Size and Share Forecast Outlook 2025 to 2035

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Casing Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

Market Share Breakdown of Coated Recycled Boxboard Manufacturers

Competitive Landscape of Coated Recycled Paperboard Providers

Coated White Board Paper Market

Coated Sack Kraft Paper Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA