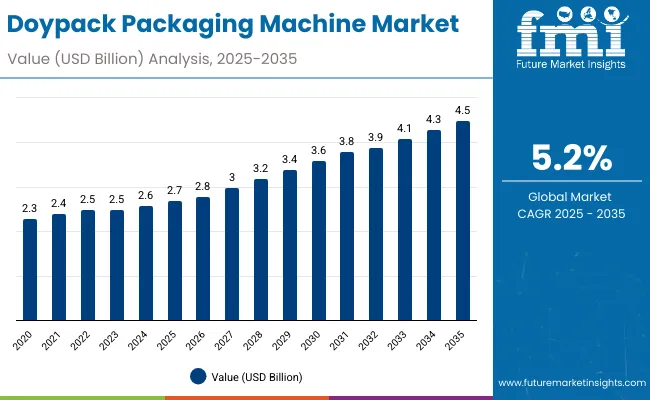

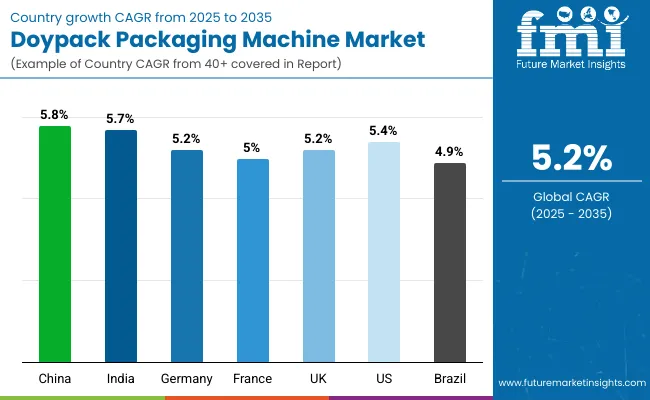

The doypack packaging machine market is expected to grow from USD 2.7 billion in 2025 to USD 4.5 billion by 2035, resulting in a total increase of USD 1.8 billion over the forecast decade. This represents a 66.7% total expansion, with the market advancing at a compound annual growth rate (CAGR) of 5.2%. Over ten years, the market grows by a 1.7 multiple.

| Metric | Value |

|---|---|

| Doypack Packaging Machine Market Estimated Value in (2025 E) | USD 2.7 billion |

| Doypack Packaging Machine Market Forecast Value in (2035 F) | USD 4.5 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

In the first five years (2025 to 2030), the market progresses from USD 2.7 billion to USD 3.5 billion, contributing USD 0.8 billion, or 44.4% of total decade growth. This phase is shaped by food, beverage, and pet food sectors adopting stand-up pouch packaging for portability and shelf appeal. Increasing demand for resealable and lightweight formats enhances early adoption.

In the second half (2030 to 2035), the market grows from USD 3.5 billion to USD 4.5 billion, adding USD 1.0 billion, or 55.6% of the total growth. This acceleration is supported by automation, multi-head filling systems, and integration with digital printing. Expansion into cosmetics and household products further strengthens demand, positioning doypack packaging machines as critical for flexible packaging innovation.

From 2020 to 2024, the doypack packaging machine market expanded from USD 2.2 billion to USD 2.5 billion, driven by rising demand for flexible stand-up pouches in food, beverages, and personal care products. Nearly 70% of revenues were held by OEMs offering automated high-speed pouch filling and sealing systems. Leaders such as Mespack, Bossar, and Effytec emphasized precision sealing, multi-material compatibility, and compact modular designs. Differentiation centered on pouch format flexibility, hygienic operation, and low downtime, while smart IoT monitoring remained secondary. Service-driven revenues such as machine audits and maintenance contracts contributed under 20%, with most producers preferring direct investments in equipment.

By 2035, the doypack packaging machine market will reach USD 4.5 billion, growing at a CAGR of 5.20%, with digitalized and automation-enhanced systems representing more than 40% of total value. Competitive intensity will rise as manufacturers offer AI-driven sealing validation, cloud-based production analytics, and rapid changeover solutions.

Established players are shifting toward hybrid models that combine equipment with SaaS-driven performance optimization. Emerging entrants such as Omori Machinery, Velteko, and Matrix Packaging are gaining share with recyclable-material compatibility, customizable pouch formats, and energy-efficient machines, aligning with sustainability regulations and evolving consumer preferences for convenient, eco-friendly packaging.

The rising demand for flexible and convenient packaging in food, beverage, and personal care products is driving growth in the doypack packaging machine market. These machines support stand-up pouch formats that enhance shelf appeal, portability, and product protection. Expanding e-commerce and sustainability-focused packaging trends are further accelerating adoption worldwide.

Machines equipped with automated filling, zipper or spout integration, and multi-material compatibility are gaining traction for their ability to handle diverse product categories. Fast changeover times, high sealing accuracy, and energy-efficient designs improve operational efficiency. Alignment with recyclable pouch materials and eco-friendly packaging initiatives further strengthens the market’s long-term growth prospects.

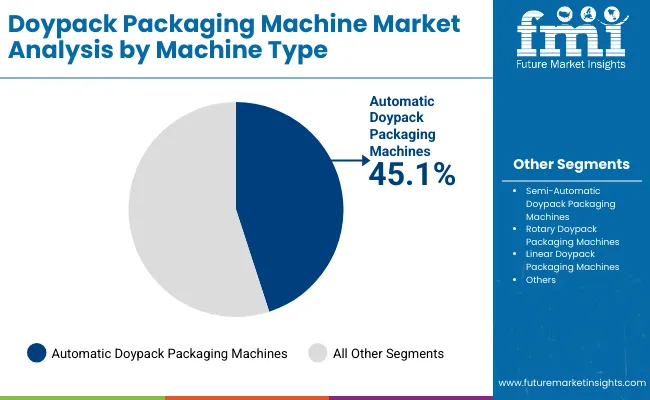

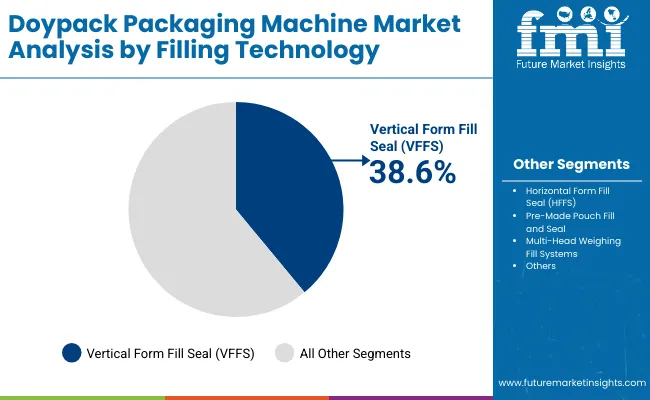

The market is segmented by machine type, filling technology, packaging type, application, end-use industry, and region. Machine type segmentation includes automatic, semi-automatic, rotary, and linear doypack packaging machines, offering varying speeds and automation levels for flexible pouch production. Filling technology covers vertical form fill seal (VFFS), horizontal form fill seal (HFFS), pre-made pouch fill and seal, and multi-head weighing fill systems, supporting accuracy and efficiency.

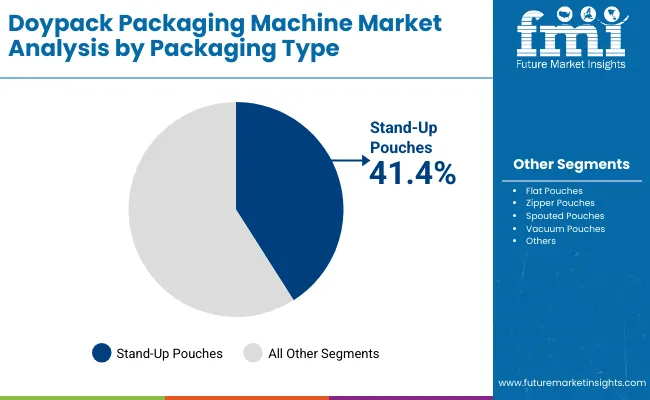

Packaging type includes stand-up pouches, flat pouches, zipper pouches, spouted pouches, and vacuum pouches, meeting diverse consumer and industrial packaging requirements. Applications comprise solid products, liquid and semi-liquid products, powdered products, and granular products, enabling versatility across sectors. End-use industries include food and beverages, pharmaceuticals and healthcare, cosmetics and personal care, chemicals, and pet food and animal feed. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Automatic doypack packaging machines are projected to hold 45.1% of the market in 2025, as manufacturers prioritize efficiency and consistent output. These systems integrate PLC controls, servo-driven mechanisms, and real-time monitoring for precision filling and sealing. Their ability to handle multiple pouch formats at high speeds supports scalability in large production facilities.

Adoption is reinforced by rising demand for flexible packaging in food, beverage, and personal care sectors. Automatic machines reduce downtime through quick changeovers and minimal operator involvement. Their compatibility with Industry 4.0 technologies, such as IoT-based monitoring, enhances traceability and quality control.

VFFS technology is forecast to account for 38.6% of the market in 2025, offering flexibility for packaging powders, granules, and solids in stand-up pouches. Its compact design and high-speed operation make it suitable for both small and large manufacturers. Sealing accuracy ensures product integrity and extended shelf life.

The segment benefits from continuous innovation in film handling and sealing techniques. VFFS machines also allow integration of zippers and spouts, catering to diverse consumer preferences. Their cost-effectiveness and adaptability secure their dominance in pouch filling solutions.

Stand-up pouches are expected to capture 41.4% of the market in 2025, as they combine convenience, branding potential, and product protection. Their lightweight design reduces transportation costs while offering strong barrier properties for food and beverages. Shelf visibility further strengthens consumer preference for this format.

Their widespread adoption is driven by rising demand for resealable, portion-controlled, and eco-friendly packaging. Stand-up pouches align with sustainability goals through recyclable and compostable materials. As premiumization and on-the-go consumption expand, this format remains the anchor for doypack packaging.

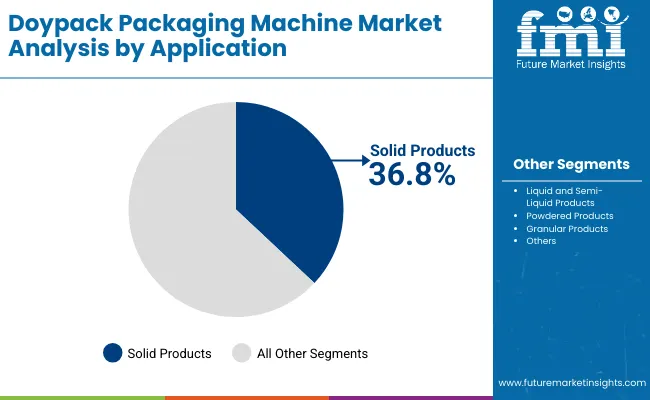

Solid products are projected to hold 36.8% of the market in 2025, supported by strong demand in snacks, confectionery, and dried food categories. Doypack machines provide durable seals and protective barriers, maintaining freshness and preventing leakage. Their adaptability across varied product sizes ensures broad application.

Adoption is reinforced by consumer demand for single-serve and portion-controlled packs. Retail visibility and branding opportunities through flexible film printing further boost this category. With food safety and convenience at the forefront, solid products remain the core driver of machine demand.

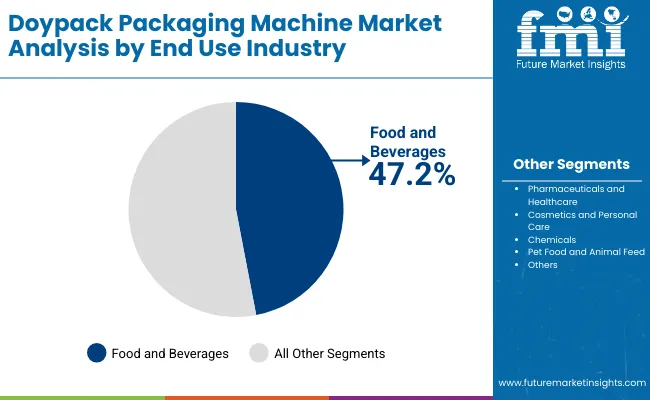

The food and beverages sector are forecast to represent 47.2% of the market in 2025, driven by the global shift toward flexible packaging. Doypack machines are widely adopted for packaging snacks, dairy, sauces, beverages, and frozen foods, ensuring extended shelf life and convenience.

Manufacturers benefit from high-speed production and reduced packaging material costs. Innovation in barrier films and resealable formats enhances functionality for consumers. With packaged food consumption rising, the food and beverages industry remains the largest end-use driver for doypack machine adoption.

The doypack packaging machine market is expanding as flexible pouches gain popularity in food, beverage, and personal care sectors for their convenience, shelf appeal, and sustainability benefits. Growing demand for resealable, lightweight, and space-efficient packaging drives adoption. However, high machinery costs and technical integration challenges restrain smaller businesses. Innovations in automation, multi-format compatibility, and recyclable pouch materials are shaping the market’s future.

Convenience, Branding, and Flexible Packaging Growth Driving Adoption

Doypack packaging machines are widely used to produce stand-up pouches that enhance product visibility and consumer convenience. Food and beverage brands prefer them for packaging snacks, sauces, and ready-to-drink products, while personal care and pet food sectors value their resealable formats. Their ability to handle diverse pouch types, including zipper and spouted pouches, boosts flexibility. High-quality printing and design adaptability also strengthen brand visibility on crowded shelves. These benefits make doypack packaging machines essential in the transition toward flexible packaging solutions.

High Equipment Costs, Maintenance Needs, and Integration Complexity Restraining Growth

Despite growing demand, adoption is slowed by the high capital investment required for advanced machines, limiting accessibility for SMEs. Frequent maintenance, wear-and-tear of sealing components, and the need for skilled technicians increase operating costs. Integrating doypack machines into existing production lines often requires upgrades in filling systems and conveyors, raising complexity. Additionally, volatility in raw material prices for pouches creates uncertainty for end-users. These restraints reduce adoption speed, particularly in cost-sensitive regions.

Automation, Multi-format Systems, and Sustainable Packaging Trends Emerging

Key trends include automation-driven doypack machines capable of handling higher speeds with minimal operator intervention. Multi-format systems are gaining traction, allowing manufacturers to produce a variety of pouch types on a single machine. Growing demand for recyclable, biodegradable, and mono-material pouches is influencing machine design for compatibility with sustainable materials. Digital monitoring and IoT-enabled controls are also emerging, enabling real-time performance tracking and predictive maintenance. These innovations are positioning doypack machines as vital enablers of efficient, eco-friendly packaging solutions.

The global doypack packaging machine market is expanding steadily, fueled by rising demand for flexible pouches in food, beverages, personal care, and pharmaceuticals. Asia-Pacific is emerging as the fastest-growing region, with India and China leading due to increasing packaged food consumption and automation in manufacturing. Developed markets like the USA, Germany, and Japan are focusing on high-speed, modular machines with features like multi-head filling, quick changeovers, and eco-friendly packaging compatibility, ensuring efficiency and compliance with sustainability mandates.

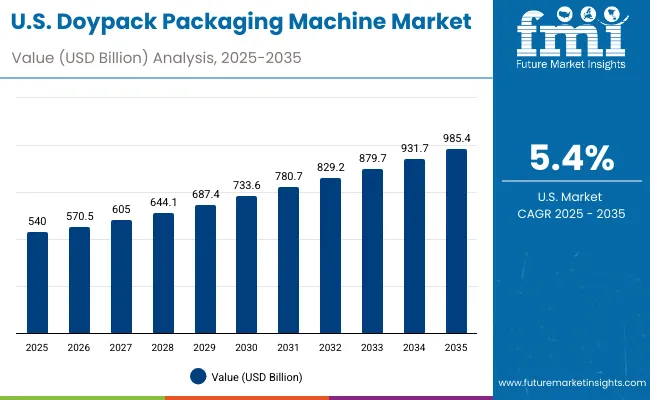

The USA market is projected to grow at a CAGR of 5.4% from 2025 to 2035, supported by strong adoption in snacks, ready-to-drink beverages, and pet food packaging. Manufacturers are investing in high-speed automated pouch machines with improved sealing accuracy and integration with IoT-based monitoring systems. Sustainability trends are driving demand for doypack machines compatible with recyclable and biodegradable films, aligning with consumer preferences and regulatory compliance across USA food and beverage sectors.

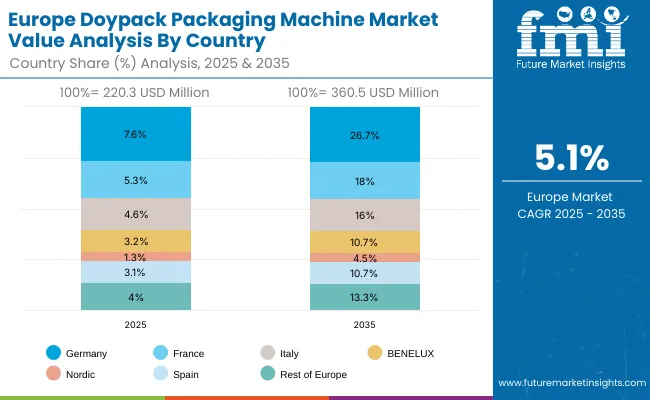

Germany’s market is expected to grow at a CAGR of 5.2%, supported by strong demand in dairy, pharmaceuticals, and premium food segments. German manufacturers are emphasizing modular, precision-driven pouch machines designed to meet EU sustainability directives. Automation-ready machines with integrated inspection systems are in high demand. The country’s advanced engineering ecosystem supports the production of machines capable of handling diverse pouch formats, ensuring compliance, durability, and efficiency in food safety-focused industries.

The UK market is forecast to grow at a CAGR of 5.2%, driven by demand in beverages, personal care, and convenience foods. SMEs and startups are adopting compact, versatile doypack machines to produce smaller pouch batches efficiently. Compliance with packaging waste directives is encouraging investments in machines that support recyclable film use. Growth in premium beverage and health product packaging is further reinforcing adoption of doypack pouch machines across UK industries.

China’s market is projected to grow at a CAGR of 5.8%, driven by rising demand in packaged foods, beverages, and e-commerce retail. Domestic OEMs are scaling production of cost-effective doypack machines with automation and smart features. Government sustainability initiatives are encouraging recyclable pouch adoption, driving demand for compatible machines. Strong demand from domestic and export food brands is accelerating adoption of high-speed pouch packaging systems in China’s rapidly expanding manufacturing ecosystem.

India is forecast to grow at a CAGR of 5.7%, supported by growth in FMCG, dairy, and pharmaceutical industries. Demand is rising for compact, affordable doypack machines to serve SMEs while larger players invest in fully automatic high-capacity lines. Government initiatives promoting food safety and eco-friendly packaging are further driving adoption. Export-oriented industries are demanding pouch systems compatible with international compliance standards, positioning India as a high-growth hub in flexible packaging machinery.

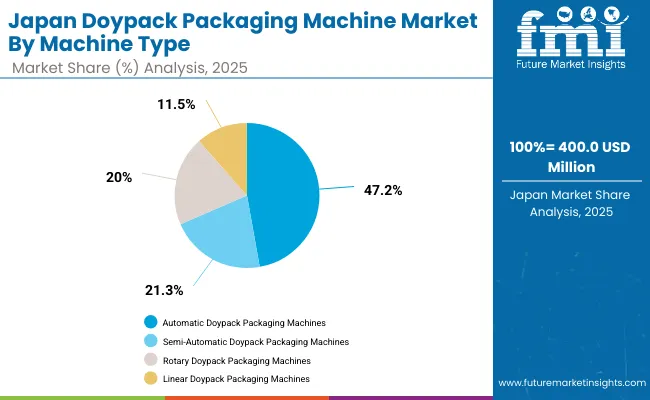

Japan’s market is expected to grow at a CAGR of 5.0%, led by demand in pharmaceuticals, cosmetics, and premium food packaging. Compact, precision-engineered doypack machines are being favored for small-batch, high-quality packaging lines. Manufacturers are innovating with automation-ready machines featuring quick changeover options for multiple pouch sizes. Sustainability remains a focus, with growing emphasis on pouch materials compatible with recycling and minimal environmental impact in Japan’s packaging industry.

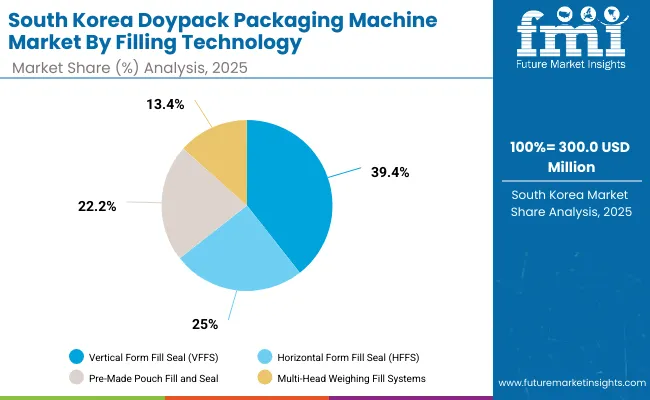

South Korea’s market is projected to grow at a CAGR of 5.1%, supported by growth in cosmetics, ready-to-eat meals, and export-focused beverages. Demand is strong for automation-ready machines capable of producing durable and lightweight pouches. Local OEMs are developing advanced pouch sealing and filling technologies that ensure compliance with international standards. Rising exports of K-beauty products and beverages are reinforcing demand for versatile, recyclable packaging solutions compatible with doypack machinery.

Japan’s doypack packaging machine market, valued at USD 400 million in 2025, is dominated by automatic machines, holding 43.2% share, reflecting demand for speed, precision, and consistency in large-scale packaging. Semi-automatic machines follow with 23.5%, while rotary doypack machines hold 21.6%. Linear doypack machines account for 11.7%. The preference for automatic systems reflects Japan’s strong focus on automation, efficiency, and compliance with packaging standards across food and beverage industries. Semi-automatic and rotary systems retain importance in mid-scale operations, providing cost-effective flexibility. Linear machines, though smaller in share, cater to niche applications, reflecting Japan’s balanced adoption of advanced packaging technologies.

South Korea’s doypack packaging machine market, worth USD 300 million in 2025, is led by vertical form fill seal (VFFS) technology, which holds 39.8% share due to efficiency in high-volume packaging. Horizontal form fills seal (HFFS) machines follow with 24.5%, while pre-made pouch fill and seal systems account for 22.8%. Multi-head weighing fill systems contribute 12.9%. VFFS leads owing to its versatility in snacks, powders, and processed foods. HFFS supports flexible packaging formats in beverages and pharmaceuticals. Pre-made pouch systems are favored by premium brands seeking customization, while multi-head weighing systems are valued for accuracy, reflecting South Korea’s innovation-driven packaging sector.

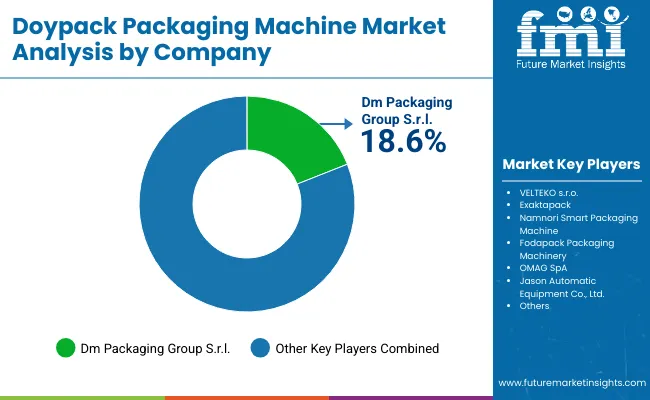

The doypack packaging machine market is moderately fragmented, with flexible packaging equipment manufacturers, automation firms, and regional machinery suppliers competing across food, beverage, pharmaceutical, and personal care sectors. Global leaders such as Dm Packaging Group S.r.l., VELTEKO s.r.o., and Exaktapack hold notable market share, driven by precision filling, pouch versatility, and compliance with hygiene and safety standards. Their strategies increasingly emphasize high-speed automation, format flexibility, and energy-efficient operations.

Established mid-sized players including Namnori Smart Packaging Machine, Fodapack Packaging Machinery, and OMAG SpA are supporting adoption of modular pouch machines featuring servo-driven controls, multi-head weighing systems, and integrated sealing solutions. These companies are especially active in premium food, pet care, and nutraceutical packaging, offering tailored formats, quick changeovers, and high-quality sealing performance to meet diverse industry needs.

Specialized providers such as Jason Automatic Equipment Co., Ltd. focus on customized doypack machine solutions for regional processors and small-to-mid scale manufacturers. Their strengths lie in cost-effective engineering, adaptability to a wide range of pouch designs, and integration with secondary packaging systems, enabling broader adoption of flexible pouches while supporting sustainability and consumer convenience trends.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| By Machine Type | Automatic Doypack Packaging Machines, Semi-Automatic Doypack Packaging Machines, Rotary Doypack Packaging Machines, Linear Doypack Packaging Machines |

| By Filling Technology | Vertical Form Fill Seal (VFFS), Horizontal Form Fill Seal (HFFS), Pre-Made Pouch Fill and Seal, Multi-Head Weighing Fill Systems |

| By Packaging Type | Stand-Up Pouches, Flat Pouches, Zipper Pouches, Spouted Pouches, Vacuum Pouches |

| By Application | Solid Products, Liquid and Semi-Liquid Products, Powdered Products, Granular Products |

| By End-Use Industry | Food and Beverages, Pharmaceuticals and Healthcare, Cosmetics and Personal Care, Chemicals, Pet Food and Animal Feed |

| Key Companies Profiled | Dm Packaging Group S.r.l ., VELTEKO s.r.o ., Exaktapack , Namnori Smart Packaging Machine, Fodapack Packaging Machinery, OMAG SpA , Jason Automatic Equipment Co., Ltd. |

| Additional Attributes | Increasing adoption of automatic and rotary machines for high-volume pouch packaging, growing demand from food and beverage sector for stand-up and zipper pouch formats, strong uptake in pharma and cosmetics for precision packaging, rise of multi-head weighing systems enhancing speed and accuracy, and increasing presence of eco-friendly pouch materials influencing machine upgrades in diverse industries. |

The global doypack packaging machine market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the doypack packaging machine market is projected to reach USD 4.5 billion by 2035.

The doypack packaging machine market is expected to grow at a CAGR of 5.2% between 2025 and 2035.

The key machine types in the doypack packaging machine market include automatic, semi-automatic, rotary, and linear doypack packaging machines.

The automatic doypack packaging machines segment is expected to account for the highest share of 45.1% in the doypack packaging machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Doypack Market Analysis & Growth Trends Forecast 2024-2034

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Services Market Analysis - Size, Share, and Forecast 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA