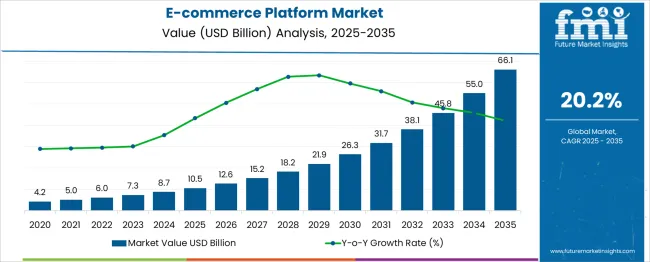

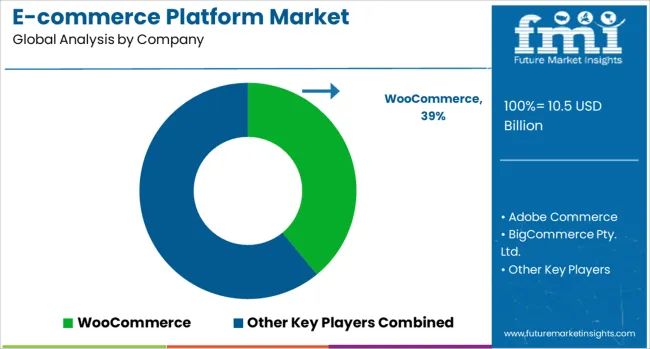

The global e-commerce platform market is projected to grow from USD 10.5 billion in 2025 to approximately USD 66.1 billion by 2035, recording an absolute increase of USD 55.5 billion over the forecast period. This translates into a total growth of 525.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 20.1% between 2025 and 2035. The overall market size is expected to grow by nearly 6.26X during the same period, supported by the rapid expansion of digital commerce, increasing mobile shopping adoption, and growing demand for omnichannel retail experiences across global markets.

Between 2025 and 2030, the E-commerce Platform market is projected to expand from USD 10.6 billion to USD 26.4 billion, resulting in a value increase of USD 15.9 billion, which represents 28.6% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating digital transformation initiatives across retail sectors, increasing adoption of headless commerce architectures, and growing demand for mobile-first shopping experiences. Platform providers are focusing on artificial intelligence integration, advanced analytics capabilities, and seamless omnichannel functionality to meet evolving merchant requirements.

From 2030 to 2035, the market is forecast to grow from USD 26.4 billion to USD 66.1 billion, adding another USD 39.7 billion, which constitutes 71.4% of the overall ten-year expansion. This period is expected to be characterized by widespread deployment of augmented reality shopping experiences, integration of blockchain-based payment systems, and development of advanced personalization engines powered by machine learning. The growing adoption of social commerce and live streaming shopping will drive demand for platforms that seamlessly integrate social media capabilities with traditional e-commerce functionality.

| Metric | Value |

|---|---|

| E-commerce Platform Market Value (2025) | USD 10.5 billion |

| E-commerce Platform Market Forecast Value (2035) | USD 66.1 billion |

| E-commerce Platform Market Forecast CAGR | 20% |

Market expansion is being supported by the fundamental shift in consumer shopping behavior toward online channels and the increasing recognition among businesses of the necessity for robust digital commerce capabilities. Traditional retailers across all sectors are investing in e-commerce platforms to complement physical stores, reach broader customer bases, and remain competitive in the digital economy. The growing complexity of modern commerce operations requires sophisticated platform solutions that can handle inventory management, payment processing, and customer relationship management.

The rising adoption of mobile commerce and social shopping is compelling platform providers to develop integrated solutions that support multiple sales channels and touchpoints. Small and medium enterprises are increasingly adopting cloud-based e-commerce platforms that provide enterprise-grade functionality without requiring significant upfront infrastructure investments. The growing importance of data analytics and customer personalization is driving demand for platforms with advanced artificial intelligence capabilities and comprehensive reporting tools.

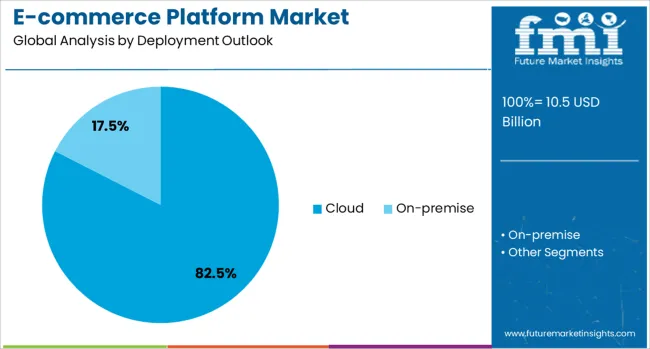

The market is segmented by deployment outlook, application outlook, and region. By deployment outlook, the market is divided into cloud and on-premise solutions. Based on application outlook, the market is categorized into apparel & fashion, food & beverages, automotive, home & electronics, healthcare, BFSI & technology, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Cloud deployment is projected to account for 83% of the E-commerce Platform market in 2025. This leading share is supported by the scalability, cost-effectiveness, and rapid deployment capabilities that cloud-based platforms offer to businesses of all sizes. Cloud platforms provide automatic updates, enhanced security features, and global accessibility that enable merchants to focus on business growth rather than technical infrastructure management. The segment benefits from continuous innovation in cloud technologies, improved internet connectivity, and growing comfort with cloud-based business solutions.

Apparel & fashion is expected to represent 38% of e-commerce platform demand in 2025. This dominant share reflects the industry's early adoption of digital commerce and the visual nature of fashion products that translate well to online shopping experiences. Fashion retailers require sophisticated platform capabilities, including inventory management across multiple variants, visual merchandising tools, and integration with social media marketing channels. The segment benefits from high consumer engagement with online fashion shopping and the continuous introduction of new products requiring dynamic platform capabilities.

The eCommerce platform market is advancing rapidly due to accelerating digital transformation and fundamental changes in consumer shopping behavior. However, the market faces challenges, including intense competition among platform providers, increasing cybersecurity threats, and the complexity of integrating multiple business systems. Data privacy regulations and cross-border commerce compliance requirements continue to influence platform development and deployment strategies.

The growing deployment of artificial intelligence and machine learning capabilities in e-commerce platforms is enabling personalized shopping experiences, intelligent product recommendations, and automated customer service interactions. AI-powered platforms can analyze customer behavior patterns, optimize pricing strategies, and predict inventory requirements with greater accuracy. These technologies enhance conversion rates, improve customer satisfaction, and provide merchants with actionable insights for business optimization and growth strategies.

Platform providers are developing headless and composable commerce architectures that separate front-end presentation layers from back-end functionality, enabling greater flexibility and customization capabilities. These architectures allow businesses to create unique customer experiences while maintaining robust commerce functionality and integrating with diverse third-party services. Headless approaches support omnichannel strategies by enabling consistent commerce capabilities across web, mobile, social media, and emerging touchpoints.

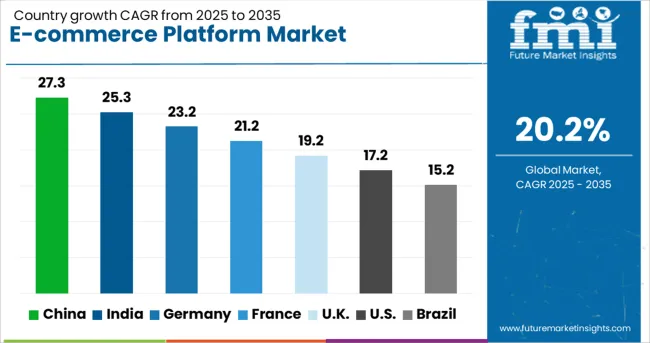

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 27.3% |

| India | 25.3% |

| Germany | 23.2% |

| France | 21.2% |

| UK | 19.2% |

| USA | 17.2% |

| Brazil | 15.2% |

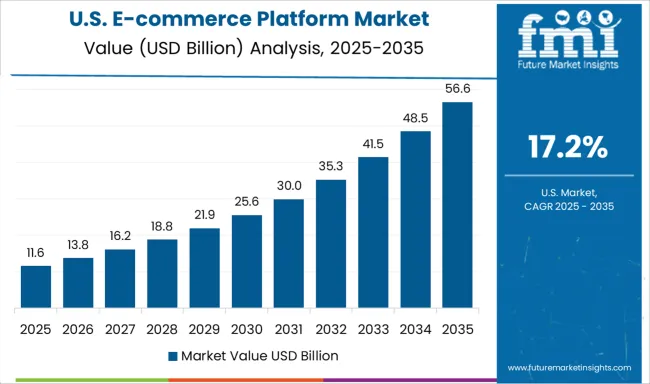

The e-commerce platform market demonstrates exceptional growth across all key countries, with China leading at 27.3% CAGR through 2035, driven by massive digital commerce expansion, mobile payment innovation, and social commerce integration. India follows closely at 25.3%, supported by rapidly growing internet penetration, increasing smartphone adoption, and expanding digital payment infrastructure. Germany records 23.2% growth, emphasizing B2B e-commerce development and industrial digitization. France advances at 21.2%, focusing on luxury goods online retail and cross-border commerce. The UK shows strong growth at 19.2%, driven by mature online retail market and fintech innovation. The USA maintains robust expansion at 17.2%, supported by established e-commerce ecosystem and continuous platform innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from e-commerce platforms in China is projected to exhibit the highest growth rate with a CAGR of 27.3% through 2035, driven by the world's largest digital commerce market and continuous innovation in mobile payment systems, social commerce integration, and live streaming shopping experiences. The country's advanced mobile infrastructure and widespread smartphone adoption are enabling sophisticated commerce applications that integrate shopping, entertainment, and social interaction. Chinese platform providers are developing cutting-edge technologies including augmented reality shopping, artificial intelligence-powered recommendations, and blockchain-based authentication systems. Government support for digital economy development and cross-border e-commerce initiatives is creating favorable conditions for platform expansion and international growth. The integration of online-to-offline commerce models and the expansion of rural e-commerce are driving comprehensive platform adoption across diverse market segments and geographic regions.

Revenue from e-commerce platforms in India is expanding at a CAGR of 25.3%, supported by rapid internet penetration growth, increasing smartphone adoption, and comprehensive digital payment infrastructure development enabling widespread e-commerce participation. The country's large young population and growing middle class are driving substantial demand for online shopping platforms across diverse product categories and price segments. Government initiatives promoting digital India and financial inclusion are accelerating e-commerce adoption in tier-2 and tier-3 cities while supporting local entrepreneur participation in digital commerce. The expanding logistics infrastructure and last-mile delivery capabilities are enabling e-commerce platforms to reach previously underserved markets and rural communities. Foreign investment in Indian e-commerce companies and technology partnerships are accelerating platform innovation and market expansion across multiple industry sectors.

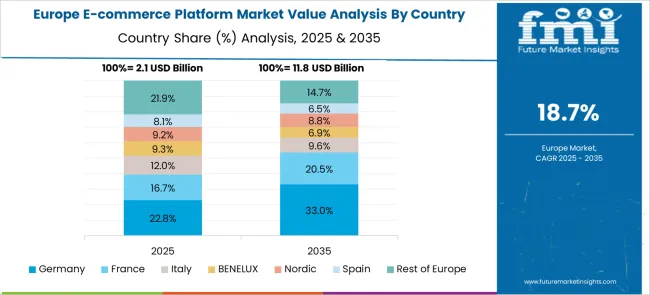

Demand for e-commerce platforms in Germany is projected to grow at a CAGR of 23.2%, supported by the country's leadership in B2B e-commerce development and comprehensive industrial digitization initiatives transforming traditional business-to-business commerce operations. German manufacturing companies are implementing sophisticated e-commerce platforms to serve global customers and streamline complex procurement processes. The emphasis on data security and privacy compliance is driving demand for platforms that meet stringent European regulations and provide comprehensive data protection capabilities. Advanced logistics infrastructure and precision in business operations are establishing German companies as leaders in efficient, reliable e-commerce delivery and customer service. The focus on sustainability and environmental responsibility is driving adoption of platforms that support green commerce initiatives and transparent supply chain management.

Demand for e-commerce platforms in France is expanding at a CAGR of 21.2%, driven by the country's luxury goods industry leadership and expertise in high-value online retail experiences that emphasize brand heritage and product craftsmanship. French retailers are implementing premium e-commerce platforms that support sophisticated visual merchandising, personalized customer experiences, and integration with social media marketing strategies. The emphasis on cross-border e-commerce and European market expansion is driving demand for platforms with multi-language, multi-currency, and international shipping capabilities. Government support for digital transformation and technology innovation is creating opportunities for advanced e-commerce platform development and deployment. The focus on sustainable commerce and ethical sourcing is driving adoption of platforms that support transparency in product origins and environmental impact reporting.

Demand for e-commerce platforms in the UK is projected to grow at a CAGR of 19.2%, supported by the country's fintech industry leadership and continuous innovation in payment processing, fraud prevention, and financial services integration within e-commerce environments. British retailers are implementing comprehensive omnichannel platforms that seamlessly integrate online and offline shopping experiences while providing unified customer data management. The emphasis on customer experience optimization and conversion rate improvement is driving adoption of platforms with advanced analytics, A/B testing capabilities, and artificial intelligence-powered personalization features. Post-Brexit trade relationships and international commerce requirements are creating demand for platforms that support complex customs, taxation, and regulatory compliance across multiple jurisdictions. The growing focus on subscription commerce and recurring revenue models is driving platform adoption that supports sophisticated billing and customer lifecycle management.

Demand for e-commerce platforms in the USA is expanding at a CAGR of 17.2%, driven by the country's established e-commerce ecosystem and continuous platform innovation addressing evolving merchant requirements and consumer shopping preferences. American platform providers are developing advanced solutions that integrate artificial intelligence, machine learning, and predictive analytics to enhance customer experiences and business performance optimization. The emphasis on direct-to-consumer brands and social commerce integration is driving demand for platforms that support influencer marketing, user-generated content, and community-building capabilities. Large enterprise adoption of headless commerce architectures and API-first platform approaches is creating demand for flexible, scalable solutions that integrate with existing technology stacks. The growing focus on sustainability and ethical commerce is driving platform features that support carbon footprint tracking, sustainable packaging options, and supply chain transparency reporting.

Demand for e-commerce platforms in Brazil is projected to grow at a CAGR of 15.2%, driven by rapid expansion of digital payment systems, increasing internet penetration, and growing consumer confidence in online shopping experiences. The country's large population and expanding middle class are creating substantial market opportunities for e-commerce platforms across diverse product categories and price segments. Brazilian retailers are investing in comprehensive platform solutions that support local payment methods, including PIX instant payments, credit installment plans, and popular digital wallets that cater to local consumer preferences. Government initiatives promoting digital transformation and financial inclusion are accelerating e-commerce adoption while supporting small business participation in online commerce. The expanding logistics infrastructure and improved last-mile delivery capabilities are enabling platforms to reach previously underserved regions and rural communities. Growing smartphone adoption and mobile internet access are driving demand for mobile-optimized platforms that provide seamless shopping experiences across devices. The emphasis on social commerce and influencer marketing is creating opportunities for platforms that integrate social media functionality with traditional e-commerce capabilities, supporting Brazil's highly engaged social media user base.

The e-commerce platform market is characterized by intense competition among established technology companies, specialized e-commerce solution providers, and emerging SaaS-based platform developers. Companies are investing in artificial intelligence integration, headless commerce architectures, omnichannel capabilities, and advanced analytics to deliver scalable, flexible, and performance-optimized platform solutions. Strategic partnerships, ecosystem development, and geographic expansion are central to strengthening market position and customer acquisition.

WooCommerce, USA-based, offers open-source e-commerce platform with extensive customization capabilities and comprehensive plugin ecosystem supporting diverse business requirements. Adobe Commerce provides enterprise-grade platform solutions with advanced B2B and B2C capabilities, sophisticated marketing tools, and seamless integration with creative software suites. BigCommerce Pty. Ltd. delivers cloud-based platform solutions with focus on scalability, performance optimization, and built-in marketing features. OMNIFUL emphasizes omnichannel commerce solutions with inventory management and order fulfillment capabilities.

OpenCart offers open-source platform solutions with user-friendly interfaces and extensive marketplace support for small and medium enterprises. Oracle provides comprehensive commerce cloud solutions with enterprise integration capabilities and advanced analytics functionality. PrestaShop delivers flexible, multilingual platform solutions with strong European market presence. Salesforce Commerce Cloud offers AI-powered platform solutions with comprehensive customer relationship management integration. Sana Commerce, SAP SE, Shopify, shopware AG, Squarespace Commerce, and Wix.com Inc. provide specialized platform expertise across various market segments, deployment models, and business size categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 66.1 billion |

| Deployment Outlook | Cloud, On-premise |

| Application Outlook | Apparel & Fashion, Food & Beverages, Automotive, Home & Electronics, Healthcare, BFSI & Technology, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | WooCommerce, Adobe Commerce, BigCommerce Pty. Ltd., OMNIFUL, OpenCart, Oracle, PrestaShop, Salesforce Commerce Cloud, Sana Commerce, SAP SE, Shopify, shopware AG, Squarespace Commerce, Wix.com Inc. |

| Additional Attributes | Dollar sales by deployment model, application sector, and business size segment, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established technology providers and emerging SaaS platforms, customer preferences for cloud versus on-premise deployment models, integration with artificial intelligence and machine learning capabilities, innovations in headless commerce architectures and omnichannel functionality, and adoption of social commerce features with embedded payment processing and mobile optimization for enhanced user experience. |

The global E-Commerce platform market is estimated to be valued at USD 10.5 billion in 2025.

The market size for the E-Commerce platform market is projected to reach USD 66.1 billion by 2035.

The E-Commerce platform market is expected to grow at a 20.2% CAGR between 2025 and 2035.

The key product types in E-Commerce platform market are cloud and on-premise.

In terms of application outlook , apparel & fashion segment to command 38.4% share in the E-Commerce platform market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Cloud Service Market Size and Share Forecast Outlook 2025 to 2035

Sales Platforms Software Market Size and Share Forecast Outlook 2025 to 2035

AIOps Platform Market Forecast and Outlook 2025 to 2035

Cross-Platform & Mobile Advertising Market Report – Growth 2018-2028

RevOps Platform Market Insights – Growth & Forecast 2023-2033

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Trusted Platform Module (TPM) Market

Offshore Platform Electrification Market Size and Share Forecast Outlook 2025 to 2035

Coaching Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Agritech Platform Market Size and Share Forecast Outlook 2025 to 2035

Assessing Coaching Platform Market Share & Industry Trends

Vertical Platform Lift Market

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA