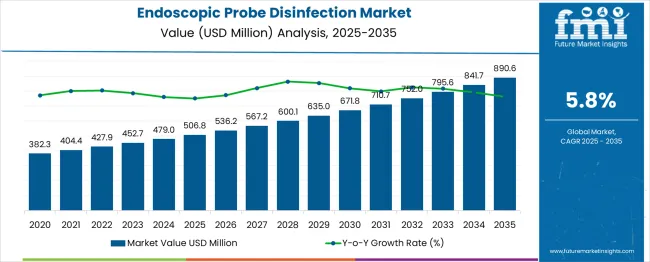

The endoscopic probe disinfection market is estimated at USD 506.8 million in 2025 and is projected to reach USD 890.6 million by 2035, reflecting a CAGR of 5.8%. Growth momentum analysis indicates a steady and consistent expansion throughout the forecast period, driven by increasing adoption of endoscopic procedures and stringent infection control protocols across healthcare facilities. The moderate CAGR suggests a balanced pace, with gradual acceleration in revenue generation as hospitals and clinics upgrade disinfection systems. Technological advancements in automated and high efficiency disinfection solutions further support sustained growth momentum. The market demonstrates stable long term potential, with incremental gains reinforcing its trajectory and creating opportunities for both established providers and new entrants.

| Metric | Value |

| Estimated Value in (2025E) | USD 506.8 million |

| Forecast Value in (2035F) | USD 890.6 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The market has witnessed steady growth in recent years, driven by increasing adoption of endoscopic procedures, rising concerns regarding hospital-acquired infections, and stringent regulatory requirements for medical device sterilization. Historical trends indicate consistent expansion, with market size growing annually at a moderate pace. Combining trend analysis with a CAGR provides a reliable method for forecasting future market size. Current estimates suggest that the market is expected to maintain a CAGR of approximately 7% over the next decade, reflecting ongoing demand for automated and efficient disinfection solutions. Hospitals, diagnostic centers, and outpatient facilities are increasingly investing in advanced endoscope reprocessing systems, which is expected to drive long-term market growth.

Using this approach for long-term forecasting, the market is projected to expand significantly by 2035, with compounded growth reflecting both steady adoption and technological innovation. While occasional regulatory shifts or cost constraints may cause minor fluctuations, the overall trend remains upward. Incorporating historical performance and CAGR-based projections suggests that the market will experience incremental increases each year, leading to a substantially larger market size over the forecast period. The combination of rising procedure volumes, enhanced disinfection protocols, and growing awareness regarding infection control underlines the sustained potential of the endoscopic probe disinfection market, making it a clear candidate for long-term expansion.

Market expansion is being supported by the increasing focuses on infection control and patient safety and the corresponding demand for effective disinfection solutions that can eliminate pathogens from endoscopic equipment and prevent healthcare-associated infections. Modern healthcare systems are increasingly focused on comprehensive infection prevention strategies that require validated and reliable disinfection procedures for all medical devices that come into contact with patients. Endoscopic probe disinfection's proven effectiveness in reducing infection risks while maintaining equipment functionality makes it essential technology for safe endoscopic procedures and patient care.

The growing adoption of minimally invasive procedures and endoscopic diagnostics is driving demand for endoscopic probe disinfection solutions that can support high-volume procedure environments while ensuring consistent disinfection quality. Healthcare provider preference for disinfection systems that combine efficacy with workflow efficiency is creating opportunities for automated and point-of-care disinfection technologies. The rising influence of regulatory requirements and accreditation standards is also contributing to increased adoption of validated disinfection protocols and equipment that can demonstrate compliance with infection control guidelines.

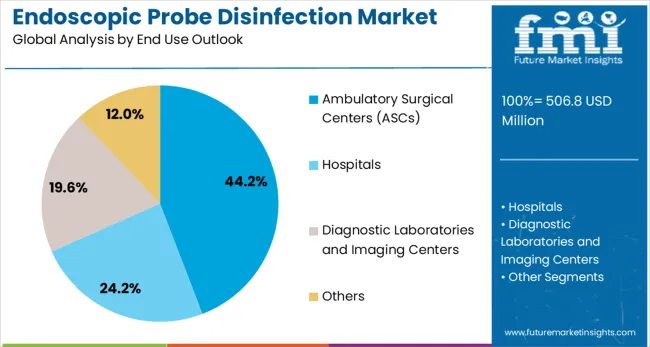

The market is segmented by type, end use, and region. By type, the market is divided into endoscopic probes [ultrasound (EUS)] including convex probes, linear probes, and transesophageal (TEE) probes, as well as products including instruments and consumables. Based on end use, the market is categorized into ambulatory surgical centers (ASCs), hospitals, diagnostic laboratories and imaging centers, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The endoscopic probes [ultrasound (EUS)] segment is projected to account for 60.3% of the endoscopic probe disinfection market in 2025, reaffirming its position as the dominant probe category. Healthcare facilities increasingly utilize ultrasound endoscopic probes for their versatility in diagnostic and therapeutic procedures across multiple medical specialties including gastroenterology, cardiology, and pulmonology. EUS probes' frequent patient contact and complex design features directly address critical disinfection requirements for ensuring patient safety and preventing cross-contamination between procedures.

This probe type forms the foundation of endoscopic disinfection protocols, as it represents the most commonly used and infection-prone equipment requiring specialized disinfection procedures and validation. Healthcare facility investments in probe-specific disinfection systems and ongoing compliance with infection control guidelines continue to strengthen adoption of EUS probe disinfection solutions. With healthcare providers prioritizing patient safety and regulatory compliance, EUS probe disinfection aligns with both clinical requirements and risk management objectives, making it the central component of endoscopic infection prevention strategies.

Ambulatory surgical centers are projected to represent 44.2% of endoscopic probe disinfection demand in 2025, underscoring their critical role as primary venues for minimally invasive procedures requiring endoscopic equipment. ASCs prefer comprehensive disinfection solutions for their ability to support high-volume procedure schedules while maintaining strict infection control standards and operational efficiency. Positioned as essential infrastructure for outpatient endoscopic procedures, ASCs require reliable and rapid disinfection capabilities that can support continuous workflow demands.

The segment is supported by increasing shift toward outpatient procedures and growing focuses on cost-effective healthcare delivery that requires efficient infection control processes. ASCs must maintain accreditation standards and regulatory compliance that mandate validated disinfection procedures for all patient-contact medical equipment. As healthcare continues to move toward ambulatory settings, ASCs will continue to dominate the market while supporting accessible and safe endoscopic care delivery.

The endoscopic probe disinfection market is advancing steadily due to increasing healthcare-associated infection concerns and growing regulatory requirements for medical device reprocessing and infection control. The market faces challenges including high costs of automated disinfection systems, complexity of disinfection validation procedures, and workflow disruption during disinfection processes. Innovation in rapid disinfection technologies and point-of-care solutions continue to influence product development and market expansion patterns.

The growing adoption of automated disinfection systems is enabling healthcare facilities to standardize disinfection procedures while reducing human error and improving workflow efficiency. Automated systems provide consistent disinfection cycles with documentation and validation capabilities that support regulatory compliance and quality assurance. Healthcare providers are increasingly recognizing the operational and safety advantages of automated disinfection for high-volume endoscopic procedures.

Modern disinfection system manufacturers are incorporating smart monitoring capabilities, data logging, and validation systems that provide real-time verification of disinfection efficacy and compliance documentation. These technologies improve safety assurance while providing automated record-keeping that supports accreditation and regulatory requirements. Advanced monitoring also enables predictive maintenance and quality control that enhances system reliability and performance consistency.

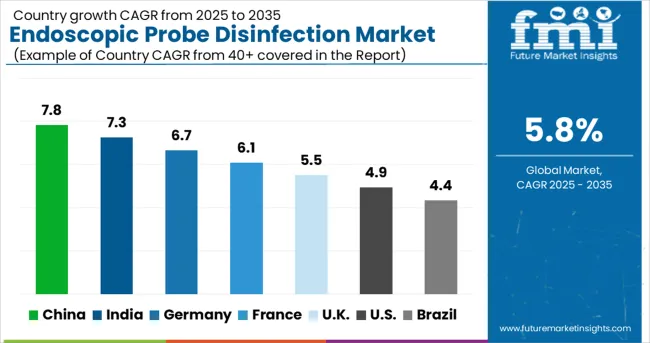

| Country | CAGR (2025-2035) |

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

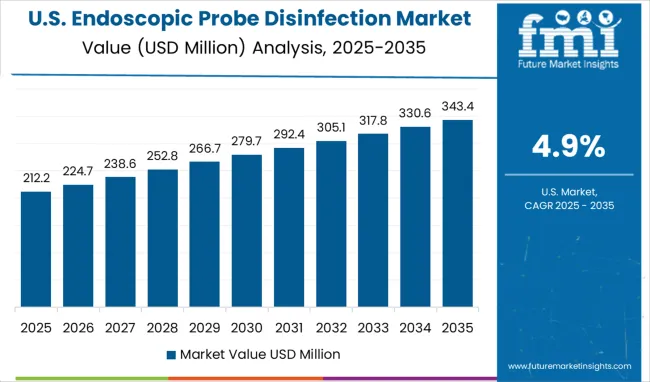

| USA | 4.9% |

| Brazil | 4.4% |

The global market is expected to grow at a CAGR of 5.8% between 2025 and 2035, driven by rising demand for infection control and stringent regulatory standards in healthcare facilities. China leads with 7.8% growth, supported by increasing adoption of advanced disinfection technologies and expanding hospital infrastructure. India follows at 7.3%, reflecting growing awareness of endoscope hygiene and rising healthcare investments. Germany records 6.7%, driven by strict compliance with sterilization protocols and advanced clinical practices. France is projected at 6.1%, supported by adoption of automated disinfection systems and infection prevention initiatives. The UK grows at 5.5% with enhanced focus on patient safety, while the USA expands at 4.9%, influenced by regulatory mandates and increasing use of high-level disinfection solutions. Brazil shows 4.4%, reflecting gradual market penetration and growing healthcare standards.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is expected to achieve a CAGR of 7.8% from 2025 to 2035, driven by rapid growth of hospitals and specialized diagnostic centers. Increased awareness of hospital-acquired infections and government infection control policies have accelerated adoption of automated probe disinfection systems. Local manufacturers have expanded production capacity, while multinational firms have partnered with distributors and hospital networks to enhance market penetration. The growing number of endoscopic procedures, particularly in gastroenterology and bronchoscopy, has sustained demand. Technological innovation, including automated and compact disinfection systems, has been a key driver. China’s market is poised for strong growth as healthcare infrastructure modernization and regulatory compliance initiatives continue across urban centers.

India is forecasted to grow at a CAGR of 7.3% from 2025 to 2035, driven by rising endoscopic procedure volumes and enhanced infection control awareness. Hospitals and diagnostic centers have increasingly adopted automated high-level disinfection systems to comply with clinical hygiene standards. Public health initiatives promoting patient safety and infection prevention have encouraged adoption, while private hospitals have implemented advanced systems to reduce liability and improve outcomes. Device manufacturers have conducted training programs for staff to ensure correct usage and compliance. With the growing number of gastroenterology and bronchoscopy procedures in metropolitan centers, India’s market is expected to expand steadily over the forecast period.

Germany is projected to grow at a CAGR of 6.7% between 2025 and 2035, supported by strict infection control regulations and high hospital standards. Endoscopic probe disinfection systems have been widely deployed in gastroenterology, pulmonology, and urology units to reduce hospital-acquired infections. Hospitals have adopted automated high-level disinfection devices with integrated monitoring for regulatory compliance. Device manufacturers, including Getinge and Olympus, have invested in training programs and service contracts to enhance adoption. Germany’s aging population and high procedural volumes for endoscopic examinations have contributed to market stability, while continuous technological upgrades in disinfection equipment have improved operational efficiency and safety standards.

France is expected to grow at a CAGR of 6.1% between 2025 and 2035, driven by hospital initiatives to prevent hospital-acquired infections and ensure patient safety. Endoscopic probe disinfection systems have been widely adopted in gastroenterology, pulmonology, and ENT units. Integration of automated high-level disinfection with monitoring systems has been emphasized to meet regulatory and accreditation standards. Device providers have focused on expanding product offerings and conducting staff training programs. Government infection control policies and public awareness campaigns have facilitated adoption, particularly in urban hospitals and private clinics. Ongoing technological advancements and rising endoscopic procedure volumes are expected to sustain market growth throughout the forecast period.

The United Kingdom is projected to grow at a CAGR of 5.5% between 2025 and 2035, with market growth driven by hospital infection control initiatives and rising endoscopic procedures. NHS hospitals and private clinics have deployed automated high-level disinfection systems for gastrointestinal and pulmonary endoscopies. Compliance with UK Department of Health standards and regulatory guidelines has shaped adoption strategies. Major manufacturers have provided training and service support to ensure correct system usage and adherence to protocols. While market growth is moderate due to centralized procurement and budget constraints, increasing endoscopic procedural volumes and focus on patient safety are expected to sustain adoption over the forecast period.

The market in the United States is projected to grow at a CAGR of 4.9% between 2025 and 2035, driven by increasing hospital-acquired infection awareness and rising endoscopic procedures. Hospitals and outpatient centers have been adopting automated high-level disinfection systems to ensure compliance with infection control standards. Regulatory oversight by the FDA and CDC guidelines has influenced both product design and adoption rates. Major players such as Cantel Medical and Getinge have expanded their market presence through product innovation and training programs for clinical staff. Increasing procedural volumes in gastroenterology, pulmonology, and urology have created steady demand for probe disinfection solutions. The market growth remains moderate due to high equipment costs and the need for staff training.

Brazil is expected to grow at a CAGR of 4.4% between 2025 and 2035, with adoption concentrated in urban tertiary hospitals and private clinics. Hospitals have increasingly implemented automated probe disinfection systems to reduce hospital-acquired infections. Market growth is influenced by public awareness campaigns and partnerships with multinational device providers offering training and service support. Adoption is moderated by limited reimbursement frameworks and budget constraints in public hospitals. Private healthcare providers have been more proactive in implementing automated systems, particularly in gastroenterology and pulmonology units. Technological upgrades and increasing procedural volumes are expected to gradually support market expansion in major cities.

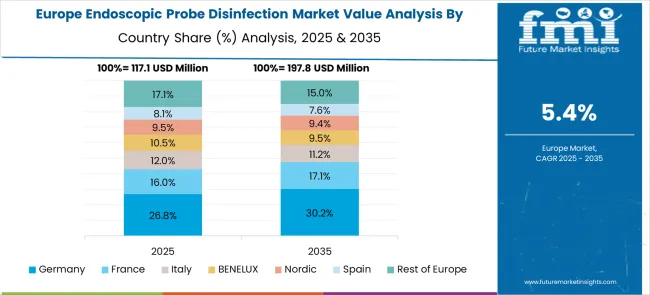

The market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced healthcare system and focuses on infection control excellence, supported by healthcare facilities leveraging clinical expertise to implement comprehensive endoscopic disinfection protocols that emphasize patient safety, regulatory compliance, and workflow efficiency across hospital and outpatient settings.

France represents a significant market driven by its healthcare system excellence and sophisticated understanding of infection prevention and medical device safety, with healthcare providers focusing on comprehensive disinfection solutions that combine French medical expertise with advanced disinfection technologies for enhanced patient safety and clinical excellence in endoscopic procedures.

The UK exhibits considerable growth through its focuses on National Health Service infection control standards and patient safety excellence, with strong adoption of endoscopic probe disinfection systems across NHS hospitals, private healthcare facilities, and specialized endoscopy centers. Germany and France show expanding interest in automated disinfection applications, particularly in high-volume endoscopy centers and ambulatory surgical facilities. BENELUX countries contribute through their focus on healthcare innovation and advanced medical technology adoption, while Eastern Europe and Nordic regions display growing potential driven by increasing healthcare investment and expanding endoscopic procedure capabilities.

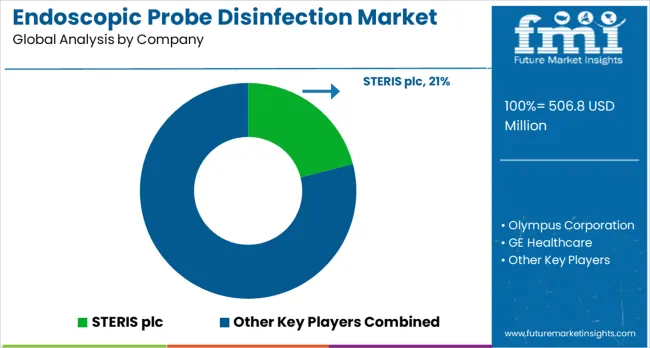

The market has been shaped by global medical technology leaders and specialized hygiene solution providers, competing on effectiveness, speed, and safety. STERIS plc, Olympus Corporation, GE Healthcare, and Philips Healthcare have focused on automated disinfection systems that deliver consistent results while minimizing manual handling. Strategies include integrated cleaning protocols, rapid cycle times, and compatibility with a wide range of endoscopic equipment. Chison Medical Imaging and CS Medical LLC have targeted smaller clinical setups with compact, easy-to-use disinfection solutions.

Regional and niche players such as CIVCO Medical Solutions, Tristel Plc, Germitec, and Nanosonics have differentiated through advanced chemical formulations, portable systems, and user-friendly devices. Product brochures highlight high-level disinfection, device compatibility, and reduced turnaround time for clinical procedures. Systems are designed to improve workflow efficiency, reduce contamination risks, and ensure compliance with infection control standards. STERIS and Olympus promote large-scale automated units, while Tristel and Nanosonics focus on compact, environmentally friendly technologies for smaller clinics and endoscopy suites.

Competition in the market is defined by disinfection efficacy, operational efficiency, and device compatibility. Philips and GE Healthcare provide integrated solutions that connect to hospital management systems, while CIVCO Medical Solutions and Germitec highlight customizable and portable devices for rapid deployment. Brochures communicate safety performance, validated cleaning protocols, and workflow benefits, positioning each company as a reliable partner for infection prevention in endoscopic procedures.

| Items | Values |

| Quantitative Units (2025) | USD 506.8 million |

| Type | Endoscopic Probes [Ultrasound (EUS)] (Convex Probes, Linear Probes, Transesophageal (TEE) Probes), Products (Instruments, Consumables) |

| End Use | Ambulatory Surgical Centers (ASCs), Hospitals, Diagnostic Laboratories and Imaging Centers, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | STERIS plc, Olympus Corporation, GE Healthcare, Philips Healthcare, Chison Medical Imaging, CS Medical LLC, CIVCO Medical Solutions, Tristel Plc, Germitec, and Nanosonics |

| Additional Attributes | Dollar sales by probe type and end use category, regional demand trends, competitive landscape, buyer preferences for automated versus manual disinfection, integration with endoscopic equipment, innovations in rapid disinfection technology, validation system advancement, and point-of-care solution development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global endoscopic probe disinfection market is estimated to be valued at USD 506.8 million in 2025.

The market size for the endoscopic probe disinfection market is projected to reach USD 890.6 million by 2035.

The endoscopic probe disinfection market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in endoscopic probe disinfection market are endoscopic probes [ultrasound (eus)], _convex probes, _linear probes, _transesophageal (tee) probes, products, _instruments and _consumables.

In terms of end use outlook, ambulatory surgical centers (ascs) segment to command 44.2% share in the endoscopic probe disinfection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Endoscopic Vessel Harvesting System Market Size, Share, and Forecast 2025 to 2035

Endoscopic Ultrasound Needles Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Closure Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ERCP Devices Market Insights – Growth & Forecast 2024-2034

The Mobile Endoscopic Workstations Market is segmented by Colonoscopes, Enteroscopes, and Gastrointestinal endoscopes from 2025 to 2035

Functional Endoscopic Sinus Surgery Systems Market Size and Share Forecast Outlook 2025 to 2035

MEMS Probes Market Size and Share Forecast Outlook 2025 to 2035

150mm Probe Station Market Size and Share Forecast Outlook 2025 to 2035

Gamma Probe Devices Market Growth - Trends & Forecast 2025 to 2035

Network Probe Market Size and Share Forecast Outlook 2025 to 2035

Electron Probe Microanalyzers (EPMA) Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Dual Wavelength Raman Probe Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioprocessing Probes and Sensors Market - Growth & Trends 2024 to 2034

Disinfection Cap Market Size and Share Forecast Outlook 2025 to 2035

Disinfection Equipment Market Analysis - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Food & Beverage Disinfection Market – Safety & Industry Trends 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA