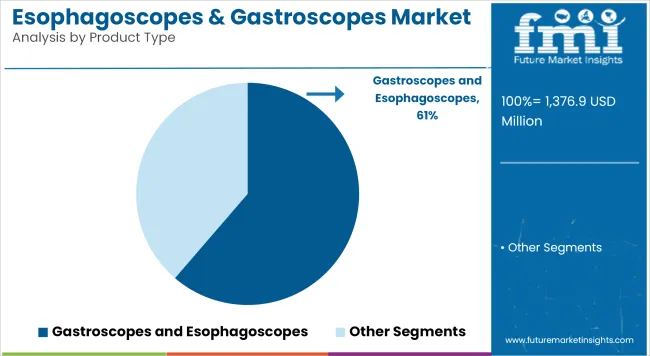

The global esophagoscopes & gastroscopes market is estimated to be valued at USD 1,376.9 million in 2025 and is projected to reach USD 2,350.9 million by 2035, registering a CAGR of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,376.9 Million |

| Industry Value (2035F) | USD 2,350.9 Million |

| CAGR (2025 to 2035) | 5.5% |

The esophagoscopes and gastroscopes market is experiencing steady growth as the global burden of gastrointestinal disorders, including gastroesophageal reflux disease, Barrett’s esophagus, and gastric cancer, continues to rise. Healthcare providers have increased adoption of endoscopic screening and surveillance protocols to enable early diagnosis and improve treatment outcomes.

Advances in high-definition imaging, narrow band technology, and enhanced maneuverability have contributed to greater procedural accuracy and patient safety. Hospitals and ambulatory surgical centers are prioritizing investments in flexible endoscopes to support minimally invasive diagnostics, while manufacturers are expanding portfolios with integrated video systems and single-use endoscopy platforms. Regulatory initiatives emphasizing quality assurance and infection control have also accelerated procurement of advanced reprocessing solutions and disposable components

A revenue share of 61.3% has been attributed to flexible gastroscopes, underscoring their essential role in diagnostic and therapeutic endoscopy. This segment is driven by their superior ability to navigate complex anatomical structures and visualize mucosal surfaces with high precision. Physicians have favored flexible gastroscopes for procedures requiring biopsies, polypectomies, and targeted interventions.

Advances in imaging technologies, including high-definition optics and digital chromoendoscopy, have further strengthened their clinical value. Hospitals and specialty centers have prioritized flexible gastroscopes due to their compatibility with a wide range of accessories and reprocessing equipment.

End User Analysis

Hospitals is estimated to hold a revenue share of 45.4% has been attributed to hospitals, highlighting their role as primary centers for endoscopic diagnosis and treatment. Utilization has been reinforced by hospitals’ capacity to invest in advanced imaging systems, specialized reprocessing units, and multidisciplinary care pathways for gastrointestinal disorders.

Physicians in hospital settings have prioritized flexible and video gastroscopes to ensure accurate detection of early neoplastic changes and improve therapeutic outcomes. Reimbursement structures and procedural volume incentives have further supported hospital-led adoption. Additionally, hospitals maintain comprehensive infection prevention protocols, making them trusted settings for routine and complex procedures.

Comprehensive Analysis of Challenges Impacting the Esophagoscopes & Gastroscopes Market

The esophagoscope and gastroscope market faces several challenges that could impede widespread adoption and scalability. First, the high cost of advanced endoscopic systems, particularly those with integrated AI, narrow-band imaging, and video recording capabilities, can be prohibitive for smaller hospitals and clinics. Maintenance costs and the need for regular reprocessing further increase the total cost of ownership.

Second, the shortage of skilled gastroenterologists and endoscopy technicians in emerging economies limits the number of procedures that can be safely and effectively performed. Cross-contamination risks from improperly disinfected reusable scopes remain a major concern, especially in high-volume facilities.

Additionally, the lack of reimbursement policies for newer procedures in certain regions can restrict market penetration. Another obstacle is patient apprehension about invasive procedures, which may lead to delayed diagnoses. Addressing these challenges requires investments in training programs, development of cost-efficient devices, and policy reforms that incentivize preventive screenings and infrastructure upgrades.

Emerging Opportunities and Innovations Driving Growth in the Esophagoscopes & Gastroscopes Market

Despite existing challenges, the market offers substantial opportunities for innovation and expansion. A significant opportunity lies in the growing demand for outpatient and ambulatory procedures, as healthcare systems look to reduce inpatient costs and enhance patient comfort. The development of disposable and single-use esophagoscopes and gastroscopes is addressing infection control concerns while streamlining workflow.

Another opportunity is the integration of artificial intelligence for real-time image analysis, which improves diagnostic accuracy, shortens procedure times, and supports less experienced practitioners. Capsule endoscopy is also emerging as a non-invasive alternative for upper GI imaging, appealing to patients reluctant to undergo traditional procedures. Moreover, the expansion of tele-endoscopy platforms in rural and underserved regions allows for remote consultations and improved healthcare access.

As demand rises for precision diagnostics and personalized care, manufacturers are exploring compact, wireless, and smart-enabled devices that enhance usability and data integration. These advancements, combined with supportive reimbursement frameworks and regulatory incentives, are expected to drive sustained market growth over the next decade.

Emerging Trends

One key trend reshaping the esophagoscope and gastroscope market is the adoption of robotic-assisted endoscopy systems. These platforms offer enhanced precision, dexterity, and maneuverability, allowing for improved navigation in anatomically complex or tight GI tracts.

Robotic assistance also supports therapeutic interventions such as lesion excision, hemostasis, and tissue sampling. Integration with imaging modalities like fluoroscopy and real-time AI feedback enhances procedural safety and efficiency. Robotic endoscopy is particularly valuable in early-stage cancer detection and advanced interventional gastroenterology.

From 2020 through 2024, the global esophagoscopes and gastroscopes market experienced steady growth, driven by an increasing prevalence of gastrointestinal disorders, advancements in endoscopic technologies, and a rising preference for minimally invasive procedures.

Technological innovations, such as the development of flexible endoscopes and enhanced imaging systems, have improved diagnostic accuracy and patient outcomes. However, challenges such as high equipment costs and the need for specialized training impeded broader market expansion during this period.

Looking ahead to 2025 to 2035, the esophagoscopes and gastroscopes market is poised for continued growth, propelled by ongoing technological advancements, an aging global population, and increasing awareness of early disease detection.

The integration of 3D imaging technologies with advanced tools is expected to enhance diagnostic capabilities, while the development of single-use endoscopes aims to reduce infection risks and improve procedural efficiency. Additionally, expanding healthcare infrastructure in emerging markets is anticipated to drive market growth.

Market Outlook

The United States esophagoscopes and gastroscopes market is advancing steadily, driven by the high prevalence of gastrointestinal (GI) disorders, increased adoption of minimally invasive diagnostics, and well-established endoscopy infrastructure. The rising demand for routine screening procedures, particularly for conditions like Barrett’s esophagus, gastroesophageal reflux disease (GERD), and gastric ulcers, is boosting equipment usage in both hospitals and ambulatory settings.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

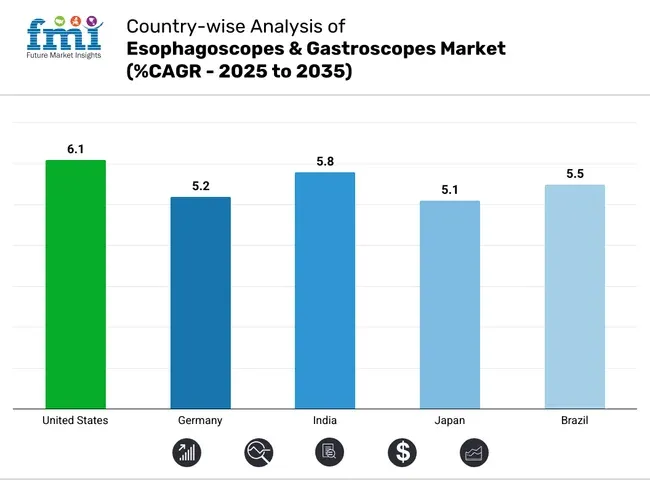

| United States | 6.1% |

Market Outlook

Germany’s esophagoscopes and gastroscopes market is well-developed, supported by a strong healthcare infrastructure, early diagnosis practices, and a robust demand for endoscopic screenings. The country has one of the highest per capita rates of GI endoscopy in Europe, and widespread use of both diagnostic and therapeutic gastroscopes is evident in managing esophageal and gastric cancers.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.2% |

Market Outlook

India’s esophagoscopes and gastroscopes market is experiencing significant growth, driven by a rising burden of GI disorders, increasing healthcare awareness, and expanding diagnostic infrastructure. While urban centers have advanced facilities, access in rural areas is improving through mobile endoscopy units and public-private partnerships.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.8% |

Market Outlook

Japan is a global leader in the esophagoscopes and gastroscopes market, owing to its high incidence of gastric cancer and a proactive approach to screening. The country has one of the most organized and advanced GI screening programs, with widespread use of endoscopic procedures in routine check-ups. Japanese manufacturers are also global pioneers in producing sophisticated endoscopy systems.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

Market Outlook

Brazil’s market for esophagoscopes and gastroscopes is growing as gastrointestinal diseases become more prevalent and diagnostic capabilities expand. Both public and private sectors are increasing access to endoscopic services, particularly for detecting upper GI bleeding, infections, and cancer. The growing middle class and expansion of private insurance coverage are contributing to improved screening rates.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.5% |

The competitive landscape has been shaped by manufacturers prioritizing the development of next-generation video gastroscopes, disposable endoscopy solutions, and integrated imaging platforms. Leading companies are investing in AI-assisted visualization technologies to improve diagnostic accuracy and workflow efficiency.

Strategic collaborations with hospitals and GI specialty networks are expanding product adoption and supporting clinician training initiatives. Additionally, investments in advanced reprocessing systems and single-use components are addressing infection control challenges and driving differentiation. These activities are expected to sustain strong competition and continuous innovation in esophagoscopes and gastroscopes over the coming years.

Key Development

In 2025, FUJIFILM Healthcare Americas has commercialized the EG-840T and EG-840TP slim treatment gastroscopes, part of their next-generation 800 series. Powered by the ELUXEO® Endoscopic Imaging System, these devices offer enhanced visualization through LED multi-light technology. They'll be publicly demonstrated at DDW® 2025 in San Diego.

In 2024, GSK announced the completion of primary data analysis from its phase II TH HSV REC-003 trial. This early-stage study assessed the potential efficacy of GSK3943104, a therapeutic herpes simplex virus (HSV) vaccine candidate, as a crucial step before further clinical development.

Gastroscopes and Esophagoscopes

Hospitals & Specialty Clinics, Ambulatory Surgical Centers and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Esophagoscopes & Gastroscopes Market was USD 1,376.9 million in 2025.

The Esophagoscopes & Gastroscopes Market is expected to reach USD 2,350.9 Million in 2035.

Increasing cases of conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and esophageal cancer are boosting the demand for esophagoscopes and gastroscopes for diagnosis and treatment.

The top key players that drives the development of Esophagoscopes & Gastroscopes Market are, Olympus Corporation, Pentax Medical (HOYA), Fujifilm Holdings Corp., Karl Storz SE & Co. KG and Boston Scientific Corp.

Gastroscopes in product type of Esophagoscopes & Gastroscopes market is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

USA & Canada Cat Litter Market Growth, Demand, and Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

USA & Canada Portable Air Conditioner Market Growth – Trends & Forecast 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Yoga & Meditation Product Industry analysis in North America Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA