The Europe Energy Gel market is set to grow from an estimated USD 220.6 million in 2025 to USD 421.5 million by 2035, with a compound annual growth rate (CAGR) of 6.7% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 220.6 million |

| Projected Europe Value (2035F) | USD 421.5 million |

| Value-based CAGR (2025 to 2035) | 6.7% |

A rapidly growing market over the past decade, the demand for European energy gels was driven by people's increasing urge for convenient sources of energy while engaging in athleticism and health awareness.

Energy gels are therefore designed to enhance quick and continued energy during and after physical work, making this product popular to sports enthusiasts and fitness athletes leading active lifestyles. The market can be segmented according to the type of energy gel, ingredients, and applications; however, growing interest in innovations in flavours, ingredients, and packaging is found.

Some of the prominent players in the European energy gel market include brands such as GU Energy, SIS, Clif Bar & Company, and PowerBar. These players have used different strategies like product diversification, clean labelling, and regional partnerships to increase market share.

As consumers are nowadays more health- and wellness-driven, companies such as Clif Shot Energy and Honey Stinger are introducing gluten-free, artificially sugar-free, and preservative-free energy gels that meet consumer demand for all-natural functional food products.

The growth of energy gel consumption is further supported by the increased participation rate in sports, fitness, and weight management across Europe. Moreover, growing awareness about the benefits of sports nutrition products in terms of improving performance and recovery will encourage more consumers towards these products.

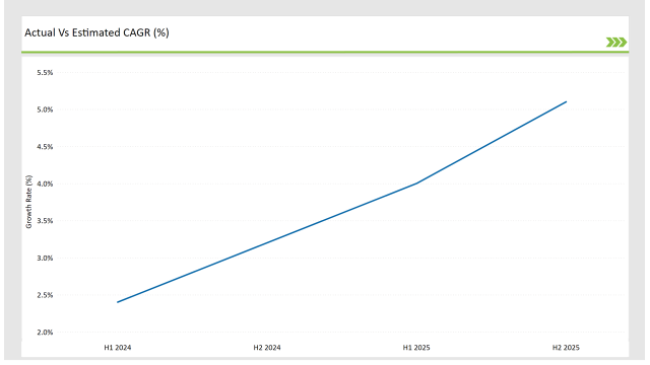

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Energy Gel market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 2.4% |

| H2 (2024 to 2034) | 3.2% |

| H1 (2025 to 2035) | 4.0% |

| H2 (2025 to 2035) | 5.1% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Energy Gel market, the sector is predicted to grow at a CAGR of 2.4% during the first half of 2024, with an increase to 3.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.0% in H1 but is expected to rise to 5.1% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2024 | Product Launches: New range of organic, sugar-free energy gels with enhanced electrolytes for marathon runners introduced by SIS. |

| March 2024 | Partnership Announcement: Clif Bar & Company partners with fitness influencers to create custom energy gel flavors for the European market. |

| February 2024 | New Packaging Innovation: GU Energy introduces biodegradable, eco-friendly packaging for its energy gel pouches, reflecting sustainability trends. |

Innovation in Flavour Profiles and Functional Ingredients in Energy Gels

Demand is growing increasingly for more diverse and functional energy gels as European consumers search for flavours and ingredients offering choices that cater to their unique requirements in terms of nutrition as well as taste.

Today, companies are adding exotic flavours such as acai berry, matcha green tea, and turmeric to energy gels in a bid to attract adventurous taste buds. Along these lines, there is an observable trend in functionalizing the energy gel with electrolytes, amino acids, and vitamins to enhance the performance benefits added by the energy gel.

This is due to an increasing demand from consumers who want products that go beyond just providing energy, thus supporting hydration, muscle recovery, and overall performance. Other brands are following those trends, like GU Energy and Clif Bar; some have launched new gel formats containing added electrolytes to enhance the hydration and recovery expected during or following endurance exercises undertaken by athletes.

Customization and Personalization in Energy Gel Products

A trend in the European energy gel market is a shift toward product customization and personalization. Fitness tracking apps, wearables, and personalized nutrition plans are making consumers demand more energy gels that meet specific needs.

The focus may be on weight management, muscle recovery, or energy replenishment. Companies are now becoming consumer-centric, providing customized solutions for fitness goals, dietary preferences, and exercise intensity.

As one example, the energy gel firms are working together with the tech companies to devise customized gels according to data collected in real-time from, for instance, the intensity of workout and length. In return, the customer gets the amount of carbohydrates, electrolytes, and proteins through the gels that are designed according to specific workouts.

A further boost is the increased frequency of sports nutrition consultations that create a need for customized energy gel products meant to serve a particular athlete's physiological requirements.

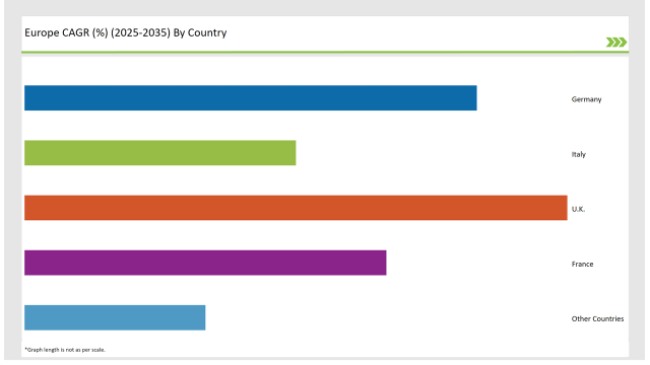

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 25% |

| Italy | 15% |

| UK | 30% |

| France | 20% |

| Other Countries | 10% |

The United Kingdom has gained the title of the second most rapidly expanding energy gels market in Europe, primarily due to the increase in sports and fitness activities. The performance-enhancing and recovery-aiding benefits that these products have been well acknowledged by their main consumers such as marathon runners, gym-goers, and cyclists.

The two brands that are in the UK, SIS (Science in Sport) and Clif, have made the best of this trend by presenting energy gels that are exactly meant for endurance sports. These items are with the additives of electrolytes, protein, and carbohydrates, which all together mean to rekindle the energy and speed up the recovery of a person after tough workouts.

The popularity of plant-based and sugar-free energy gels is also soaring, thus betraying the health-minded tendency of today's UK market wherein consumers look for purer and greener alternatives.

Germany is steadily becoming popular due to its extraordinary sports culture and its increasing number of endurance sports. The country's increasingly health-conscious consumers are now more prone to make use of products that can increase their energy and help with recovery throughout the sports and post-exercise period.

This functional nutritional shift has been the key factor in the demand for energy gels that primarily increase performance but, at the same time, also help muscle repair and promote general wellbeing.

Brands in Germany are the ones to catch up to this trend as they unveil new energy gels made from such high-quality ingredients as maltodextrin, whey protein, and electrolytes. The rise of fitness and outdoor activities including hiking, cycling, and running has made the increment in energy gel consumption quite noticeable.

Furthermore, the aforementioned country is pushing for the removal of alcohol and substances with negative side effects from the menu and thus the brands are improving their labels and making energy gels that will meet the requirements of both customers interested in health issues as well as athletes.

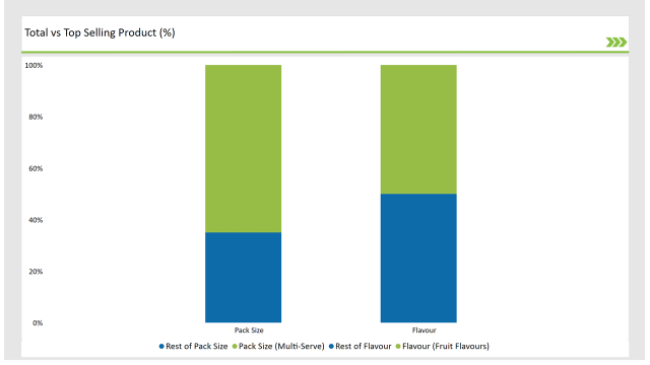

% share of Individual Categories Flavour and Pack Size in 2025

| Main Segment | Market Share (%) |

|---|---|

| Flavour (Fruit Flavours) | 50% |

| Remaining segments | 50% |

This market growth goes hand in hand with consumer demand for natural refreshing tastes incorporated into the overall sports nutrition experience. Fruit-flavouring energy gels easily attract a wide range of consumers, from athletes and recreational athletic participants, since they display a very common and appealing flavour profile.

Also, perceptions that fruit flavours are healthier options, normally associated with more natural ingredients and fewer artificial additives, fit well into the profiles of health-conscious consumers.

Brands are innovating by introducing a variety of fruit combinations and seasonal flavours to attract new customers and retain existing ones. This trend towards plant-based and organic ingredients is an enormous positive factor behind the growth of this segment because consumers tend to spend based on their diet preferences.

Fruit-flavoured energy gels will be a market leader because consumers want convenient and effective sources of energy, promoting innovation and expansion into even more variety to cater to the preferences of diverse consumers.

| Main Segment | Market Share (%) |

|---|---|

| Pack Size (Multi-Serve) | 65% |

| Remaining segments | 35% |

The multi-serve pack is attractive to both the serious athlete and the recreational user, especially when they look to obtain larger packs for training sessions, competitions, or long distances.

It not only saves money per serving but also minimizes waste packaging, highly in line with increased consumer awareness of sustainability. This is why brands are responding to the demand by providing multi-serve options that are easy to carry and store.

Often, resealable pouches or containers are added to enhance usability. In addition, the multi-serve segment is more versatile and allows consumers to try different flavours and formulations without committing to a single-serve purchase.

This should increase the demand for multi-serve pack sizes further in the future with endurance sports' increasing popularity and with a growing need for convenient and effective nutrition solutions meeting the active lifestyle of European consumers.

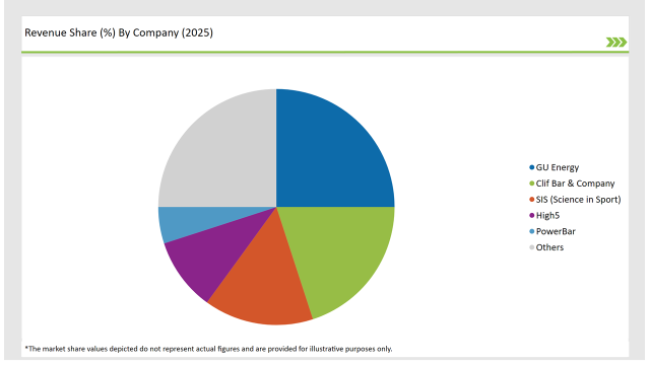

2025 Market share of Europe Energy Gel manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| GU Energy | 25% |

| Clif Bar & Company | 20% |

| SIS (Science in Sport) | 15% |

| High5 | 10% |

| PowerBar | 5% |

| Others | 25% |

Note: The above chart is indicative in nature

The European energy gel segment is a battlefield of both vast multinational companies as well as smaller niche players that are constantly motivating its expansion. Such important actors in the market as GU Energy, SIS (Science in Sport), and Clif Bar dominate the sector with a broad presence on the continent.

These Tier 1 companies are known for their innovative ideas, vast product assortments, and well-established distribution channels. For example, GU Energy, by launching various flavours and formulations of energy gels that have been formulated with the requirements of endurance athletes in mind, has been the market leader in the transformation of the energy gel market.

PowerBar and High5 are also regional competitors that mostly concentrate on distinct target markets in Europe, is example of Tier 2 players.

Tier 3 companies are small, local brands that fill a niche or work in specific regions. Even though they are not able to have the same network or turnover as the Tier 1 companies, they are attractive because of their local and wild ideas.

As per Flavour, the industry has been categorized into Fruit Flavours, Lemonade/Limeade Flavours, Chocolate Flavour, Coffee/Espresso Flavour, and Others.

As per Pack Size, the industry has been categorized into Single-Serve, and Multi-Serve.

As per Sales Channel, the industry has been categorized into Direct B2B, and Indirect B2C.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Energy Gel market is projected to grow at a CAGR of 6.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 421.5 million.

Key factors driving the European energy gel market include the increasing participation in endurance sports and fitness activities, leading to higher demand for convenient and effective energy sources. Additionally, growing consumer awareness of nutrition and performance enhancement is fueling interest in specialized energy products.

Germany, France, and UK are the key countries with high consumption rates in the European Energy Gel market.

Leading manufacturers include GU Energy, Clif Bar & Company, SIS (Science in Sport), High5, and PowerBar known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

Energy Gel Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Leading Providers & Market Share in Energy Gel Industry

UK Energy Gel Market Report – Demand, Trends & Industry Forecast 2025–2035

USA Energy Gel Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Energy Gel Market Insights – Demand, Size & Industry Trends 2025–2035

Australia Energy Gel Market Growth – Trends, Demand & Forecast 2025–2035

Latin America Energy Gel Market Insights – Trends, Demand & Growth 2025–2035

Energy-saving Constant Humidity Storage Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Filters Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Window and Door Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Energy Efficient Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Dispersive X-ray Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Gel Stent Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA