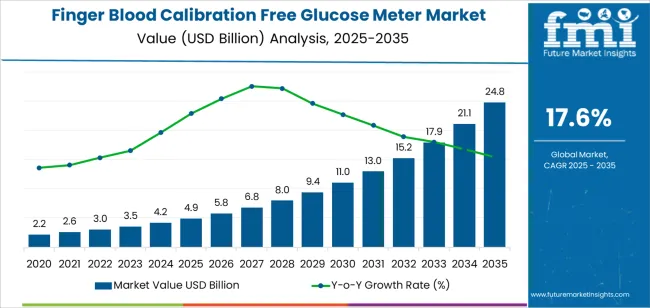

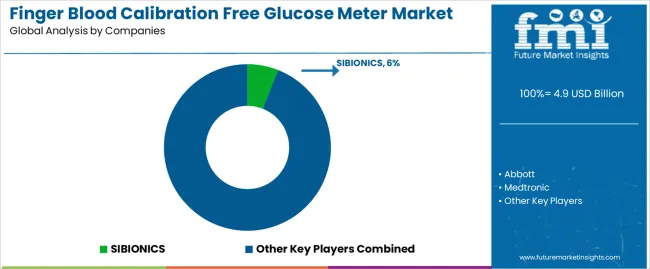

The global finger blood calibration free glucose meter market is valued at USD 4.9 billion in 2025. It is slated to reach USD 25 billion by 2035, recording an absolute increase of USD 20,128.9 million over the forecast period. This translates into a total growth of 405.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 17.6% between 2025 and 2035. The overall market size is expected to grow by nearly 5.06X during the same period, supported by increasing diabetes prevalence globally, growing adoption of continuous glucose monitoring technologies, and rising emphasis on non-invasive blood glucose measurement solutions across diverse clinical settings, diabetes management programs, and individual patient care applications.

Between 2025 and 2030, the finger blood calibration free glucose meter market is projected to expand from USD 4.9 billion to USD 10,153.9 million, resulting in a value increase of USD 5,194.9 million, which represents 25.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing type 1 and type 2 diabetes incidence requiring frequent glucose monitoring, rising adoption of sensor-based glucose measurement technologies, and growing demand for user-friendly diabetes management devices in home care and clinical settings. Healthcare providers and diabetes care specialists are expanding their calibration-free glucose monitoring capabilities to address the growing demand for accurate and convenient blood glucose measurement solutions that ensure patient compliance and glycemic control optimization.

From 2030 to 2035, the market is forecast to grow from USD 10,153.9 million to USD 25 billion, adding another USD 14,934.0 million, which constitutes 74.2% of the overall ten-year expansion. This period is expected to be characterized by the expansion of artificial intelligence-driven glucose prediction algorithms and personalized diabetes management platforms, the development of advanced sensor technologies with extended wear duration and improved accuracy, and the growth of specialized applications for gestational diabetes monitoring and prediabetes prevention programs. The growing adoption of telehealth platforms and remote patient monitoring will drive demand for connected calibration-free glucose meters with enhanced functionality and data integration features.

Between 2020 and 2025, the finger blood calibration free glucose meter market experienced steady growth, driven by increasing diabetes awareness and growing recognition of calibration-free devices as essential tools for improving patient quality of life and reducing the burden of finger-prick testing in diverse diabetes management and healthcare monitoring applications. The market developed as endocrinologists and diabetes educators recognized the potential for calibration-free technology to enhance patient adherence, improve glycemic outcomes, and support comprehensive diabetes care while meeting accuracy requirements. Technological advancement in sensor chemistry and signal processing began emphasizing the critical importance of maintaining measurement precision and sensor stability in challenging physiological environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.9 billion |

| Forecast Value in (2035F) | USD 25 billion |

| Forecast CAGR (2025 to 2035) | 17.6% |

Market expansion is being supported by the increasing global prevalence of diabetes driven by lifestyle changes, aging populations, and rising obesity rates, alongside the corresponding need for advanced glucose monitoring technologies that can eliminate painful finger-prick testing, improve patient compliance, and maintain measurement accuracy across various diabetes management protocols, clinical monitoring applications, and self-care programs. Modern diabetes care providers and endocrinology practices are increasingly focused on implementing calibration-free glucose monitoring solutions that can reduce testing burden, enhance patient engagement, and provide continuous glycemic data in real-time monitoring conditions.

The growing emphasis on patient-centered diabetes care and quality of life improvement is driving demand for calibration-free glucose meters that can support painless glucose monitoring, enable proactive diabetes management, and ensure comprehensive glycemic control without frequent blood sampling. Healthcare consumers' preference for non-invasive monitoring devices that combine measurement accuracy with convenience and comfort is creating opportunities for innovative calibration-free glucose meter implementations. The rising influence of digital health platforms and connected diabetes management systems is also contributing to increased adoption of calibration-free meters that can provide seamless data sharing without compromising measurement reliability or user experience.

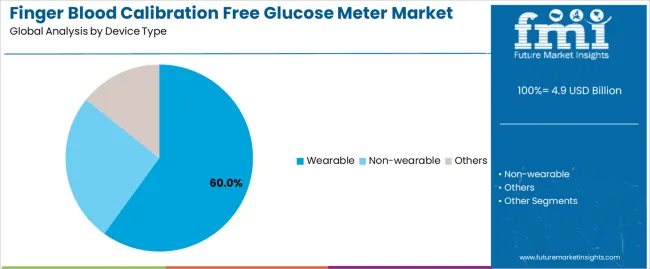

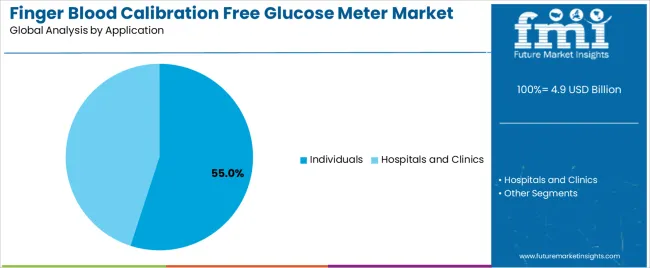

The market is segmented by device type, application, and region. By device type, the market is divided into wearable, non-wearable, and others. Based on application, the market is categorized into individuals and hospitals and clinics. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

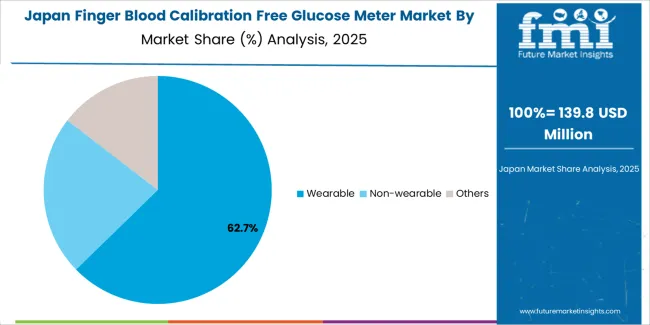

The wearable device type segment is projected to maintain its leading position with 60% share in the finger blood calibration free glucose meter market in 2025, reaffirming its role as the preferred device category for continuous glucose monitoring and real-time glycemic trend tracking applications. Diabetes patients and healthcare providers increasingly utilize wearable calibration-free glucose meters for their convenience, continuous monitoring capabilities, and proven effectiveness in providing actionable glucose insights while maintaining measurement accuracy and patient comfort. Wearable device technology's proven effectiveness and application versatility directly address the industry requirements for proactive diabetes management and comprehensive glycemic control across diverse patient populations and lifestyle scenarios.

This device segment forms the foundation of modern diabetes self-management programs, as it represents the technology with the greatest contribution to patient empowerment and established compliance record across multiple diabetes types and treatment regimens. Healthcare industry investments in connected health technologies continue to strengthen adoption among diabetes patients and care providers. With demographic trends requiring improved diabetes management tools and enhanced patient outcomes, wearable calibration-free glucose meters align with both patient convenience objectives and clinical effectiveness requirements, making them the central component of comprehensive diabetes care strategies.

The individuals application segment is projected to represent the 55% market share of finger blood calibration free glucose meter demand in 2025, underscoring its critical role as the primary driver for device adoption across type 1 diabetes patients, type 2 diabetes patients, and individuals requiring frequent glucose monitoring for optimal diabetes management. Diabetes patients prefer calibration-free glucose meters for personal use due to their elimination of finger-prick calibration requirements, ease of use benefits, and ability to provide continuous glucose data while supporting independent diabetes management and treatment decision-making. Positioned as essential devices for modern diabetes self-care, calibration-free glucose meters offer both practical advantages and improved quality of life.

The segment is supported by continuous innovation in sensor technology and the growing availability of user-friendly wearable devices that enable simplified diabetes management with enhanced accuracy and reduced monitoring burden. Additionally, diabetes patients are investing in calibration-free glucose monitoring systems to support increasingly personalized treatment protocols and growing demand for real-time glycemic information for meal planning, exercise adjustment, and insulin dosing optimization. As diabetes prevalence increases and patient awareness grows, the individuals application will continue to dominate the market while supporting advanced glucose monitoring adoption and diabetes self-management optimization strategies.

The finger blood calibration free glucose meter market is advancing steadily due to increasing diabetes prevalence driven by lifestyle factors and aging populations and growing adoption of continuous glucose monitoring technologies that provide painless glucose measurement and improved patient compliance benefits across diverse diabetes management, clinical monitoring, and preventive care applications. However, the market faces challenges, including high device costs and limited insurance reimbursement in certain markets, sensor accuracy concerns in specific physiological conditions, and competition from traditional blood glucose meters with established clinical protocols. Innovation in sensor technology and artificial intelligence integration continues to influence product development and market expansion patterns.

The growing global diabetes epidemic is driving demand for advanced glucose monitoring solutions that address patient preferences for non-invasive testing including elimination of finger-prick calibration, continuous glucose data availability, and reduced daily testing burden. Diabetes management requires reliable calibration-free monitoring systems that deliver accurate glucose measurements across diverse physiological conditions while supporting treatment adjustments and lifestyle decisions. Healthcare providers are increasingly recognizing the clinical advantages of calibration-free glucose monitoring for improved patient adherence and glycemic outcome optimization, creating opportunities for innovative sensor technologies specifically designed for long-term continuous monitoring and patient engagement enhancement.

Modern finger blood calibration free glucose meter manufacturers are incorporating artificial intelligence algorithms and machine learning capabilities to enhance glucose prediction accuracy, detect glycemic patterns, and support comprehensive diabetes management through predictive alerts, personalized insights, and automated trend analysis. Leading companies are developing devices with real-time glucose forecasting, hypoglycemia prediction algorithms, and cloud-based data platforms that allow patients and healthcare providers to optimize treatment strategies and prevent adverse glycemic events proactively. These technologies improve clinical outcomes while enabling new care delivery models, including virtual diabetes clinics, remote monitoring programs, and data-driven insulin adjustment protocols. Advanced technology integration also allows manufacturers to support clinical decision-making and personalized medicine approaches beyond traditional glucose measurement functionality.

The expansion of long-term glucose monitoring needs and increasing patient demand for reduced sensor replacement frequency is driving development of extended-wear calibration-free sensors with 14-day, 30-day, and even longer operational lifetimes. These advanced applications require improved sensor stability and biocompatible materials that enable extended subcutaneous placement without accuracy degradation, creating premium market segments with differentiated value propositions. Manufacturers are investing in advanced sensor chemistry and biocompatibility testing to serve patient populations seeking minimal device maintenance and maximum convenience while supporting innovation in implantable glucose monitoring systems and fully integrated diabetes management platforms.

| Country | CAGR (2025-2035) |

|---|---|

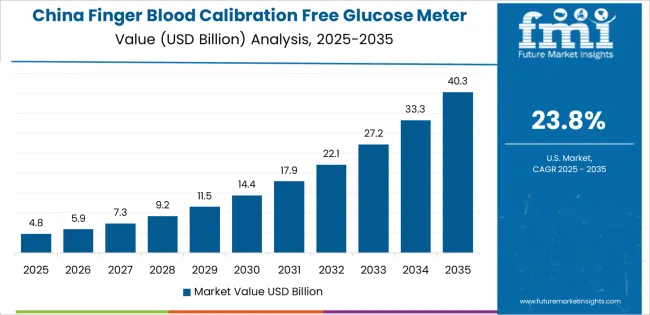

| China | 23.8% |

| India | 22.0% |

| Germany | 20.2% |

| Brazil | 18.5% |

| USA | 16.7% |

| UK | 15.0% |

| Japan | 13.2% |

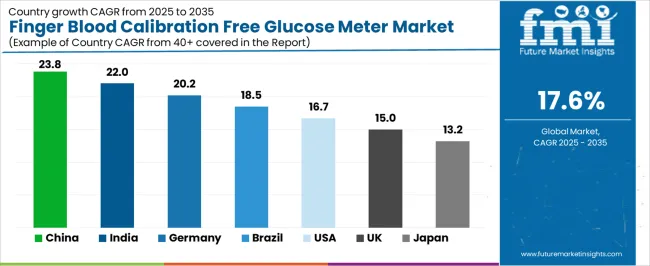

The finger blood calibration free glucose meter market is experiencing solid growth globally, with China leading at 23.8% CAGR through 2035, driven by rapidly increasing diabetes prevalence, growing middle-class healthcare spending, and expanding continuous glucose monitoring adoption. India follows at 22.0%, supported by surging type 2 diabetes cases, improving healthcare access, and rising awareness of advanced glucose monitoring technologies. Germany shows growth at 20.2%, emphasizing digital health integration, comprehensive insurance coverage, and strong diabetes care infrastructure. Brazil demonstrates 18.5% growth, supported by expanding healthcare programs, increasing diabetes awareness, and growing private health insurance penetration.

The United States records 16.7%, focusing on advanced continuous glucose monitoring adoption, FDA approval pathways, and comprehensive Medicare coverage expansion. The United Kingdom exhibits 15.0% growth, emphasizing National Health Service technology assessment and diabetes prevention programs. Japan shows 13.2% growth, supported by aging population diabetes management needs and established medical device market infrastructure.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from finger blood calibration free glucose meters in China is projected to exhibit exceptional growth with a CAGR of 23.8% through 2035, driven by rapidly increasing diabetes prevalence and growing middle-class population seeking advanced healthcare solutions supported by government Healthy China initiatives and chronic disease management programs. The country's massive diabetes patient population and increasing investment in digital health technologies are creating substantial demand for calibration-free glucose monitoring solutions. Major medical device manufacturers and international companies are establishing comprehensive production and distribution capabilities to serve both domestic markets and regional opportunities.

Revenue from finger blood calibration free glucose meters in India is expanding at a CAGR of 22.0%, supported by the country's rapidly increasing type 2 diabetes prevalence, expanding private healthcare infrastructure, and growing health awareness driving demand for advanced glucose monitoring technologies. The country's large diabetes patient base and improving affordability are driving sophisticated calibration-free monitoring capabilities throughout urban and semi-urban markets. Leading medical device companies are establishing distribution networks and patient education programs to address growing demand.

Revenue from finger blood calibration free glucose meters in Germany is expanding at a CAGR of 20.2%, supported by the country's advanced diabetes care infrastructure, progressive digital health legislation, and comprehensive health insurance coverage for continuous glucose monitoring technologies. The nation's healthcare innovation leadership and quality standards are driving sophisticated calibration-free glucose monitoring capabilities throughout clinical and home care sectors. Leading medical device manufacturers are investing extensively in regulatory compliance and clinical validation for German market requirements.

Revenue from finger blood calibration free glucose meters in Brazil is expanding at a CAGR of 18.5%, supported by the country's expanding public health programs, increasing diabetes awareness campaigns, and growing private health insurance market. Brazil's rising diabetes prevalence and improving healthcare access are driving demand for advanced glucose monitoring devices. Medical device distributors and pharmacy chains are investing in market development to serve both public healthcare system and private pay segments.

Revenue from finger blood calibration free glucose meters in the United States is expanding at a CAGR of 16.7%, supported by the country's advanced continuous glucose monitoring market, comprehensive FDA regulatory framework, and expanding Medicare coverage for calibration-free glucose monitoring systems. The nation's large diabetes patient population and established medical device market are driving demand for innovative glucose monitoring technologies. Manufacturers are investing in clinical evidence generation and payer engagement to support reimbursement expansion and healthcare provider adoption.

Revenue from finger blood calibration free glucose meters in the United Kingdom is expanding at a CAGR of 15.0%, supported by the country's National Health Service technology appraisal processes, national diabetes prevention program, and increasing emphasis on patient self-management. The UK's centralized healthcare system and focus on cost-effectiveness are driving structured adoption of calibration-free glucose monitoring technologies. Medical device manufacturers are establishing evidence packages and health economics data to support NHS commissioning and clinical guideline integration.

Revenue from finger blood calibration free glucose meters in Japan is expanding at a CAGR of 13.2%, supported by the country's aging population with increasing diabetes prevalence, established medical device regulatory framework, and comprehensive health insurance system. Japan's healthcare sophistication and quality expectations are driving demand for accurate and reliable calibration-free glucose monitoring products. Leading medical device manufacturers are investing in product development for Japanese regulatory requirements and patient preferences.

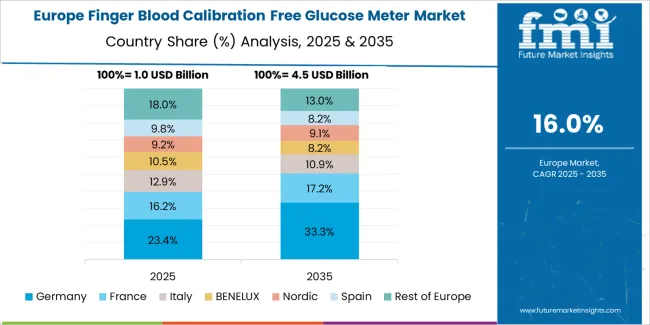

The finger blood calibration free glucose meter market in Europe is projected to grow from USD 1,487.3 million in 2025 to USD 7,236.8 million by 2035, registering a CAGR of 17.1% over the forecast period. Germany is expected to maintain leadership with a 26.4% market share in 2025, moderating to 26.1% by 2035, supported by advanced diabetes care infrastructure, progressive digital health legislation, and comprehensive continuous glucose monitoring reimbursement frameworks.

France follows with 19.7% in 2025, projected at 20.0% by 2035, driven by national diabetes strategy implementation, continuous glucose monitoring access expansion, and strong endocrinology networks. The United Kingdom holds 17.2% in 2025, reaching 16.8% by 2035 on the back of NHS technology appraisals and type 1 diabetes technology pathways. Italy commands 13.6% in 2025, rising slightly to 13.8% by 2035, while Spain accounts for 10.9% in 2025, reaching 11.2% by 2035 aided by regional health system modernization and diabetes prevalence growth.

Sweden maintains 4.8% in 2025, up to 5.0% by 2035 due to advanced digital health adoption and universal healthcare coverage. The Rest of Europe region, including other Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 7.4% in 2025 and 7.1% by 2035, reflecting steady development in diabetes care improvement and continuous glucose monitoring technology adoption.

The finger blood calibration free glucose meter market is characterized by competition among established continuous glucose monitoring manufacturers, medical device companies, and digital health innovators. Companies are investing in sensor technology advancement, artificial intelligence integration, regulatory approval expansion, and patient education programs to deliver accurate, convenient, and clinically validated calibration-free glucose monitoring solutions. Innovation in extended-wear sensor development, predictive analytics capabilities, and seamless data connectivity is central to strengthening market position and competitive advantage.

SIBIONICS leads the market with innovative continuous glucose monitoring solutions, offering calibration-free devices with focus on accuracy, affordability, and user-friendly designs for diabetes management applications. Abbott provides advanced continuous glucose monitoring systems with emphasis on factory calibration technology and comprehensive diabetes management platforms. Medtronic delivers integrated diabetes management solutions with continuous glucose monitoring and insulin pump connectivity.

Dexcom offers market-leading continuous glucose monitoring systems with focus on real-time glucose data and predictive alerts. Glucotrack specializes in non-invasive glucose monitoring technologies utilizing ultrasonic, electromagnetic, and thermal measurement approaches. HAGAR focuses on calibration-free glucose monitoring device development for emerging markets.

MicroTech Medical provides continuous glucose monitoring solutions with emphasis on Chinese market requirements. Cnoga Digital Care offers non-invasive glucose monitoring technologies based on optical imaging. Global Health Ark Medical Technology specializes in diabetes management devices for Asian markets. Top Bio-technology focuses on biosensor development and glucose monitoring innovation.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.9 billion |

| Device Type | Wearable, Non-wearable, Others |

| Application | Individuals, Hospitals and Clinics |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | SIBIONICS, Abbott, Medtronic, Dexcom, Glucotrack, HAGAR |

| Additional Attributes | Dollar sales by device type and application category, regional demand trends, competitive landscape, technological advancements in sensor chemistry, artificial intelligence integration, extended-wear sensor development, and glucose prediction accuracy optimization |

The global finger blood calibration free glucose meter market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the finger blood calibration free glucose meter market is projected to reach USD 24.8 billion by 2035.

The finger blood calibration free glucose meter market is expected to grow at a 17.6% CAGR between 2025 and 2035.

The key product types in finger blood calibration free glucose meter market are wearable, non-wearable and others.

In terms of application, individuals segment to command 55.0% share in the finger blood calibration free glucose meter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fingerprint Sensors Market Size and Share Forecast Outlook 2025 to 2035

Fingerprint Biometrics Market by Authentication Type, Mobility, Industry & Region Forecast till 2035

Brain Fingerprinting Technology Market

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Fingerprint Collector Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Blood Compatible Nanocoating Market Size and Share Forecast Outlook 2025 to 2035

Blood Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Blood Sugar Tester Market Size and Share Forecast Outlook 2025 to 2035

Blood Flow Restriction Bands Market Size and Share Forecast Outlook 2025 to 2035

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Blood Clot Retrieval Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Blood Culture Test Market Size and Share Forecast Outlook 2025 to 2035

Blood Bag Tube Sealer Market Size and Share Forecast Outlook 2025 to 2035

Blood Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Warmer Devices Market Size and Share Forecast Outlook 2025 to 2035

Blood Temperature Indicator Market Size, Share & Forecast 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA