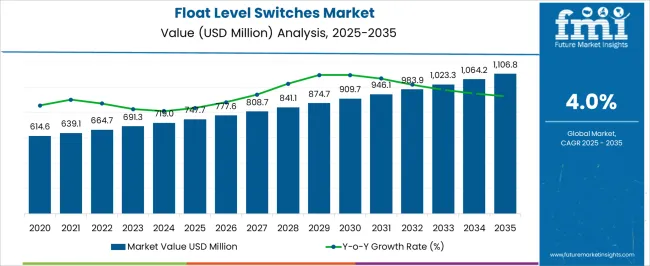

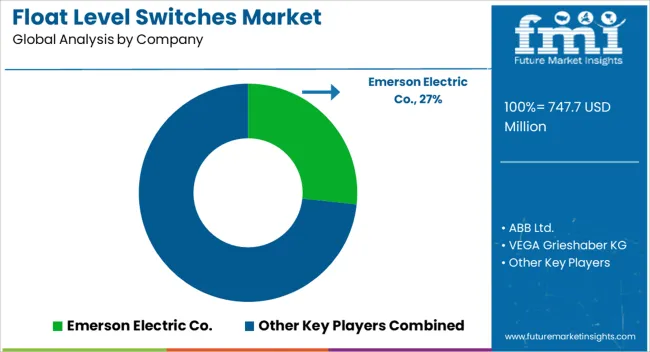

The float level switches market is expected to grow from USD 747.7 million in 2025 to USD 1,106.8 million by 2035, registering a 4.0% CAGR and generating an absolute dollar opportunity of USD 359.1 million. Growth is influenced by rising demand for liquid level monitoring and control across industries such as water treatment, chemical processing, oil and gas, and food and beverages. Float level switches remain a preferred choice due to their cost-effectiveness, reliability, and ability to function in harsh operating conditions compared with alternative technologies.

A 10-year growth comparison highlights shifts in market performance between the first and second halves of the forecast period. From 2025 to 2030, growth is steady but modest, supported by replacement of conventional devices in developed markets across North America and Europe, where regulatory compliance and automation upgrades are driving incremental demand.

From 2031 to 2035, growth shows stronger momentum, particularly in Asia Pacific, Latin America, and the Middle East, where expanding industrial capacity, water infrastructure projects, and increased automation investments boost adoption rates. The overall multiplication factor for the market stands at 1.48x over the decade. This comparison underscores how early adoption stabilizes market progress, while later years deliver stronger gains as emerging economies invest heavily in industrial automation and liquid monitoring solutions.

| Metric | Value |

|---|---|

| Float Level Switches Market Estimated Value in (2025 E) | USD 747.7 million |

| Float Level Switches Market Forecast Value in (2035 F) | USD 1106.8 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The float level switches market is primarily driven by the water and wastewater treatment sector, which holds around 41% of the market share, as these switches are widely used for liquid level monitoring, pump control, and overflow prevention. The chemical and process industry contributes about 26%, deploying float level switches in corrosive and hazardous liquid applications. The oil and gas sector represents close to 16%, applying switches in storage tanks, separators, and offshore platforms for reliable liquid detection. Food and beverage industries account for roughly 10%, using level switches in hygienic liquid processing and storage systems. The remaining 7% comes from pharmaceuticals, marine, and power generation, where precise liquid level management is critical. The market is advancing with developments in material durability, automation compatibility, and customization. Non-corrosive and high-temperature resistant materials are being adopted for harsh chemical and oilfield environments. Integration with IoT-based monitoring systems is enabling real-time data collection, predictive maintenance, and automated controls. Compact and modular designs are simplifying installation and supporting diverse tank configurations. Hygienic-grade switches tailored for food, beverage, and pharmaceutical applications are expanding adoption. Manufacturers are focusing on flexible designs to meet sector-specific demands, while collaborations with automation providers enhance system efficiency. Rising investment in water treatment, chemical processing, and oil storage continues to drive global market growth.

The float level switches market is expanding steadily as industries place increased focus on fluid level monitoring and efficient process control in storage and transfer operations. The simplicity, durability, and cost effectiveness of float switches have made them essential in a wide range of verticals including water treatment, chemical processing, and oil and gas.

The growing demand for non electronic, maintenance friendly solutions in hazardous environments is also contributing to their uptake. With rising industrial automation and safety compliance regulations, float level switches are being integrated into broader monitoring systems to ensure operational accuracy and minimize spillage or overflows.

Innovations in materials and compatibility with diverse tank structures are enhancing performance in corrosive and high temperature applications. These factors are shaping a favorable outlook for the market as industries pursue reliable and low maintenance level sensing solutions across critical processes.

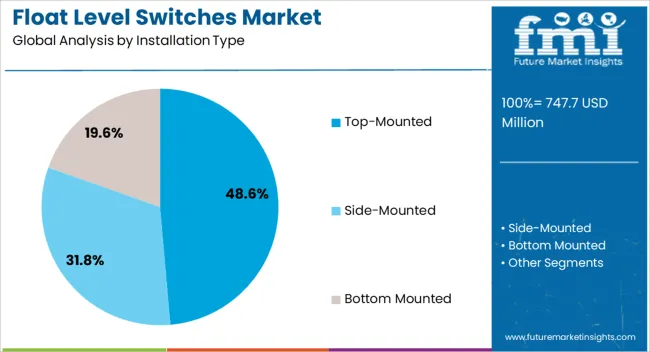

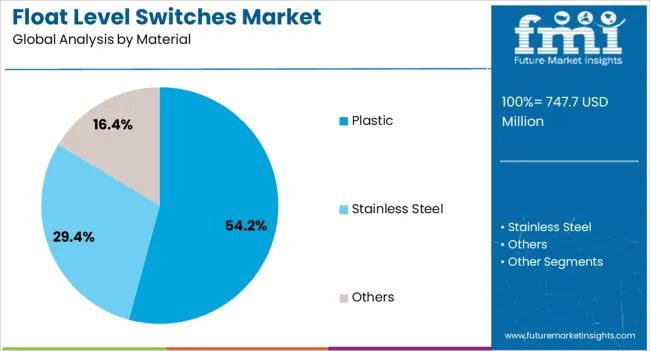

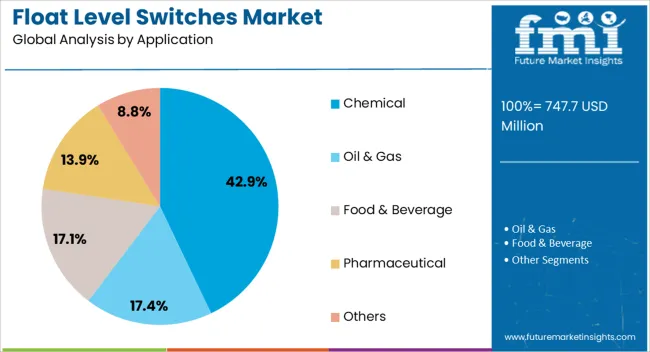

The float level switches market is segmented by installation type, material, application, and geographic regions. By installation type, float level switches market is divided into Top-Mounted, Side-Mounted, and Bottom Mounted. In terms of material, float level switches market is classified into Plastic, Stainless Steel, and Others. Based on application, float level switches market is segmented into Chemical, Oil & Gas, Food & Beverage, Pharmaceutical, and Others. Regionally, the float level switches industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The top mounted segment is projected to hold 48.60% of total market revenue by 2025 within the installation type category, positioning it as the leading segment. This preference is due to its compatibility with a wide variety of tank shapes and the ease of installation without disrupting tank operations.

Top mounted float switches offer high durability and are well suited for deep tanks or containers with restricted access from the sides or bottom. Their low maintenance requirements and robust performance under variable pressure conditions further support widespread adoption.

The ability to be configured for single or multi level detection enhances their operational versatility, making them suitable for industrial, municipal, and commercial fluid management systems. These characteristics have firmly established top mounted switches as the standard in both retrofit and new system installations.

The plastic segment is expected to contribute 54.20% of total market revenue by 2025 under the material category, establishing it as the most dominant. Plastic based float switches are preferred for their corrosion resistance, chemical inertness, and affordability, especially in non metallic tank environments and chemically aggressive fluids.

Their lightweight design and flexibility enable them to perform reliably in a broad range of industrial and commercial applications. Additionally, plastic float switches are ideal for use in food grade, pharmaceutical, and wastewater systems due to their compliance with hygiene and non contamination requirements.

Their insulation properties and resistance to high humidity environments contribute further to their market share. As end users seek economical and versatile level sensing solutions, plastic continues to outperform alternative materials in terms of cost efficiency and adaptability.

The chemical segment is anticipated to account for 42.90% of market revenue by 2025 under the application category, making it the largest application area. This growth is being driven by the increasing use of float level switches in monitoring reactive and hazardous liquids commonly used in chemical production and storage.

The need for accurate, fail safe fluid level monitoring in tanks, process vessels, and pipelines is critical in ensuring worker safety, process reliability, and compliance with environmental regulations. Float level switches are particularly valued in the chemical sector for their ability to function in harsh and corrosive environments without compromising performance.

Their simple mechanical design provides a reliable solution where electronic sensors may be susceptible to interference or failure. The integration of these switches into automated control systems further enhances safety and process efficiency, reinforcing their role as a critical component in chemical industry operations.

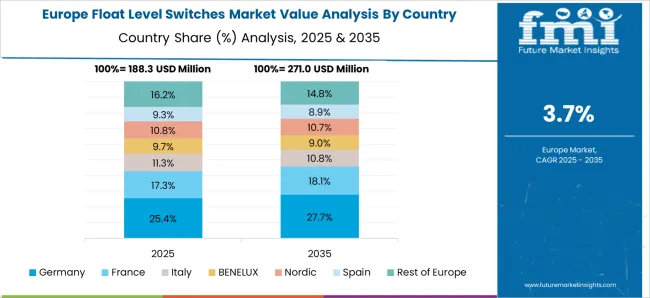

The float level switches market is expanding with rising demand across water treatment, chemical processing, food & beverage, and oil & gas industries. Asia Pacific leads with USD 480 million in 2024, driven by China (USD 210 million), India (USD 140 million), and Japan (USD 130 million). Europe contributes USD 350 million, led by Germany (USD 130 million), UK (USD 110 million), and France (USD 110 million). North America stands at USD 320 million, while Latin America and Middle East & Africa together generate USD 100 million. Industrial process control (45%), water treatment (35%), and food & beverage (20%) are key segments.

Growth is driven by increasing water treatment facilities, stricter industrial safety regulations, and automation in fluid management. Industrial process control accounts for 45% of installations, water treatment 35%, and food & beverage 20%. Asia Pacific dominates at USD 480 million, followed by Europe at USD 350 million and North America at USD 320 million. The global installed base exceeds 3.5 million float switches annually, with 40% used in tanks above 5,000 liters. Smart integration with PLCs and SCADA enhances real-time monitoring, cutting maintenance downtime by 15–20%. Expanding investments in wastewater recycling and desalination plants support ongoing demand.

Emerging technologies include corrosion-resistant alloys, IoT-enabled sensors, and multi-point float switches. Approximately 30% of new installations feature stainless steel or PVDF housings, extending service life by 20–25%. IoT-enabled switches integrated with cloud platforms represent 15% of the market, supporting predictive maintenance and real-time alerts. Multi-point float switches, capable of monitoring 4–6 levels within a single tank, account for 25% of industrial adoption, improving efficiency in chemical and petrochemical facilities. Miniaturized floats for compact storage systems are gaining traction in food & beverage and pharmaceuticals. These innovations reduce system failures, enhance safety, and ensure compliance with industry standards.

Significant opportunities exist in water infrastructure, chemical plants, and energy facilities. Asia Pacific is projected to reach USD 600 million by 2027, Europe USD 430 million, and North America USD 390 million. Investments in wastewater treatment exceeding USD 60 billion annually in Asia Pacific create consistent demand for float switches. The chemical industry, valued at over USD 4 trillion, requires precise liquid level management to avoid contamination and hazards. Oil & gas storage tanks above 100,000 liters use dual redundant float switches to improve reliability. Expanding adoption in dairy, brewing, and packaged beverage plants adds further growth avenues.

High maintenance needs, limited performance in viscous fluids, and environmental conditions restrict adoption. Standard float switches range from USD 50–250 per unit, while advanced multi-point or IoT-enabled models cost USD 300–800, limiting deployment in cost-sensitive markets. In viscous fluids or liquids with suspended solids, float switches experience up to 25% higher failure rates compared to non-contact sensors. Extreme temperatures above 120 °C reduce lifespan by 15–20%. Installation in large-scale chemical plants requires additional safety certifications, increasing project cost by USD 20,000–50,000. Supply chain bottlenecks for stainless steel and polymer components extend lead times by 4–8 weeks.

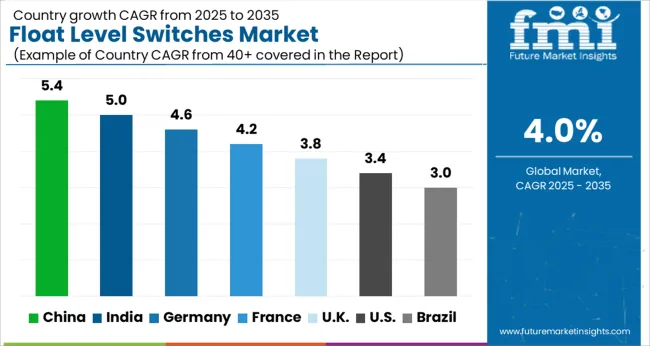

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The float level switches market is forecast to grow globally at a CAGR of 4.0% through 2035, supported by industrial automation, water treatment facilities, and liquid-level monitoring applications. China leads with 5.4%, translating to a 1.35× multiple over the global rate, backed by BRICS-led expansion in chemical processing, water infrastructure, and manufacturing plants. India follows at 5.0%, a 1.25× multiple of the global benchmark, with demand centered on wastewater management, food and beverage processing, and industrial equipment. Germany posts 4.6%, a 1.15× multiple, driven by OECD-supported advancements in industrial automation, precision monitoring, and process safety. The United Kingdom records 3.8%, slightly below the global average at 0.95×, with adoption in utilities, petrochemicals, and marine systems. The United States stands at 3.4%, a 0.85× multiple, reflecting stable demand from oil and gas, manufacturing, and power generation facilities. BRICS economies provide scale through industrial growth, OECD countries contribute innovation in sensor design, while ASEAN markets expand usage in water treatment and manufacturing.

The float level switches market in China is expected to grow at a CAGR of 5.4%, driven by rising adoption in chemical processing, water treatment, and food and beverage industries. Domestic manufacturers such as Omron China, Zhejiang Huanli, and FineTek provide cost-effective switches with enhanced durability and precision. Technological advancements are focused on compact designs, higher corrosion resistance, and better fluid compatibility. Adoption is prominent in water utilities, industrial plants, and food processing facilities.

The float level switches market in India is projected to grow at a CAGR of 5.0%, supported by demand from wastewater treatment plants, power generation facilities, and industrial manufacturing units. Key suppliers such as Pune Techtrol, ABB India, and Magnetic Systems provide robust float switches with improved reliability and safety features. Technological upgrades emphasize long service life, higher accuracy, and compatibility with aggressive fluids.

Germany’s float level switches market is projected to grow at a CAGR of 4.6%, influenced by high demand from chemical plants, pharmaceuticals, and advanced manufacturing. Companies such as WIKA, Krohne, and Siemens provide premium float switches designed for precision, safety, and compliance with strict European standards. Adoption is concentrated in chemical production units, industrial automation, and pharmaceutical plants.

The float level switches market in the United Kingdom is expected to grow at a CAGR of 3.8%, driven by requirements in oil and gas, water utilities, and commercial facilities. Suppliers focus on compact, durable switches with high chemical resistance and compliance with safety regulations. Adoption is evident in offshore installations, municipal water projects, and food processing facilities.

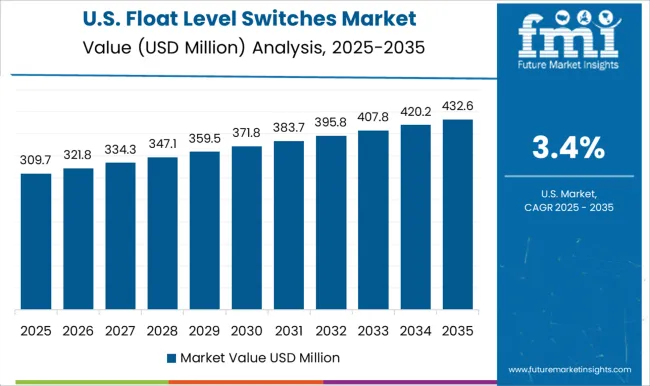

The float level switches market in the United States is projected to grow at a CAGR of 3.4%, supported by applications in oil refining, water treatment, and industrial processing. Leading suppliers such as Emerson, Gems Sensors, and Magnetrol provide advanced float switches with high accuracy, explosion-proof designs, and long service life. Adoption is concentrated in refineries, chemical plants, and water utilities.

Competition in the float level switches market is being influenced by demand for precision liquid level monitoring across industries such as water treatment, oil and gas, chemical processing, and food and beverage. Market standing is being reinforced through innovation in materials, enhanced sensitivity, and designs that support harsh environments and high reliability. Emerson Electric Co. is being positioned with switches engineered for rugged industrial use and integration into automated control systems. ABB Ltd. is being represented with solutions developed for safe, efficient liquid level management in complex industrial networks. VEGA Grieshaber KG is being highlighted with products designed for accuracy, durability, and compatibility with a variety of liquids. Gems Sensors, Inc. is being promoted with versatile switches tailored for compact systems, medical equipment, and industrial applications. SJE-Rhombus Inc. is being showcased with float switches optimized for water and wastewater applications where robust performance and ease of installation are prioritized. WIKA Group is being advanced with instruments engineered for reliability, safety, and integration with digital monitoring platforms. Strategies in the market are being directed toward product miniaturization, smart connectivity, and compliance with global safety standards to enhance adoption in both industrial and commercial sectors. Manufacturers are focusing on modular switch designs, corrosion-resistant materials, and compatibility with automated monitoring platforms. Product brochures are being structured with details on switch types, operating pressure range, liquid compatibility, temperature limits, mounting styles, and electrical ratings. Features such as high accuracy, long service life, easy installation, and suitability for challenging environments are being emphasized. Brochure content is being organized to enable procurement teams, engineers, and operators to quickly assess specifications and compare solutions for diverse applications. Each document is being crafted to support informed purchasing decisions by highlighting performance data, safety certifications, and after-sales support options.

| Item | Value |

|---|---|

| Quantitative Units | USD 747.7 Million |

| Installation Type | Top-Mounted, Side-Mounted, and Bottom Mounted |

| Material | Plastic, Stainless Steel, and Others |

| Application | Chemical, Oil & Gas, Food & Beverage, Pharmaceutical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Emerson Electric Co., ABB Ltd., VEGA Grieshaber KG, Gems Sensors, Inc., SJE-Rhombus Inc., and WIKA Group |

| Additional Attributes | Dollar sales by switch type and end use, demand dynamics across water treatment, oil and gas, and chemical industries, regional trends in liquid level monitoring, innovation in durability, material compatibility, and automation, environmental impact of material use and disposal, and emerging use cases in smart sensors and IoT-enabled fluid management. |

The global float level switches market is estimated to be valued at USD 747.7 million in 2025.

The market size for the float level switches market is projected to reach USD 1,106.8 million by 2035.

The float level switches market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in float level switches market are top-mounted, side-mounted and bottom mounted.

In terms of material, plastic segment to command 54.2% share in the float level switches market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Floating Microelectrode Array (FMA) Market Size and Share Forecast Outlook 2025 to 2035

Floating Docks Market Size and Share Forecast Outlook 2025 to 2035

Floating Fountains Market Size and Share Forecast Outlook 2025 to 2035

Float Glass Market Size and Share Forecast Outlook 2025 to 2035

Floating Valve Trays Market Size and Share Forecast Outlook 2025 to 2035

Floating Solar PV Market Size and Share Forecast Outlook 2025 to 2035

Floating Covers Market Size and Share Forecast Outlook 2025 to 2035

Floating Offshore Wind Energy Market Size and Share Forecast Outlook 2025 to 2035

Floating Power Plant Market Growth – Trends & Forecast 2025 to 2035

Market Share Distribution Among Floating Hotel Providers

Floating Hotel Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region – Forecast for 2025-2035

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Dog Float Market Size and Share Forecast Outlook 2025 to 2035

Solar Floating Pool Lights Market Insights – Trends, Demand & Growth 2025-2035

Level Floats Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Floatation Vest Market Size and Share Forecast Outlook 2025 to 2035

Level Sensor Market Size and Share Forecast Outlook 2025 to 2035

Level Transmitter Market Growth – Trends & Forecast 2025 to 2035

Level Measuring Instrument Market

Level Switches Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA