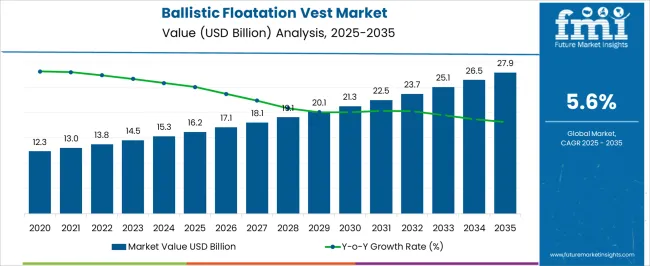

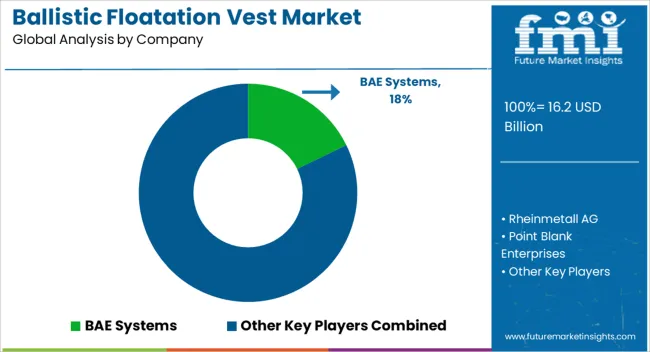

The Ballistic Floatation Vest Market is estimated to be valued at USD 16.2 billion in 2025 and is projected to reach USD 27.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Ballistic Floatation Vest Market Estimated Value in (2025 E) | USD 16.2 billion |

| Ballistic Floatation Vest Market Forecast Value in (2035 F) | USD 27.9 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Ballistic Floatation Vest market is gaining significant traction as rising security threats, maritime operations, and defense modernization programs drive demand for protective equipment that combines buoyancy with ballistic resistance. Growing investments in naval forces, coast guards, and law enforcement agencies are shaping the adoption of advanced vests designed to provide survivability in both combat and aquatic environments. Manufacturers are integrating lightweight yet durable materials with modular designs to enhance comfort, maneuverability, and long-term wearability.

Increasing emphasis on multipurpose protective gear that supports mobility, flotation, and ballistic resistance is fueling innovation in product development. The demand is further strengthened by stringent defense procurement standards and the need for equipment that meets global safety regulations.

Expanding use in commercial shipping, offshore oil operations, and rescue missions is also contributing to growth As geopolitical tensions and maritime security concerns rise, the market is expected to continue its upward trajectory, supported by technological advancements in material science, precision engineering, and advanced manufacturing processes that deliver superior protection with reduced weight.

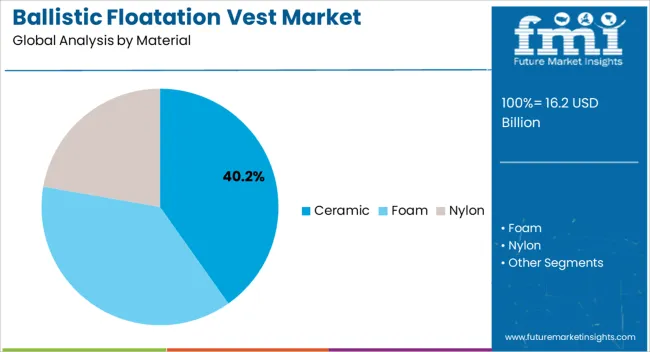

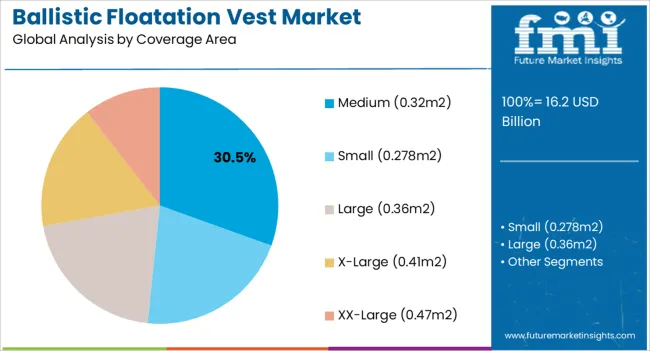

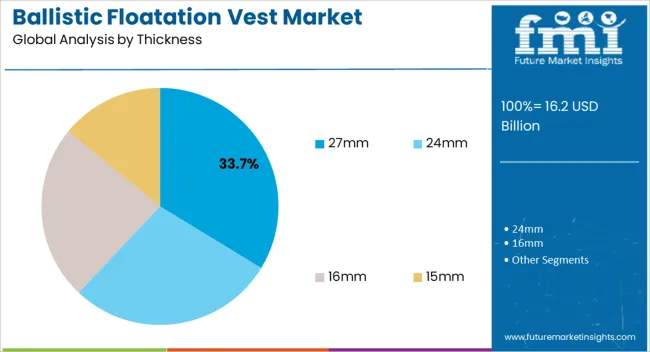

The ballistic floatation vest market is segmented by material, coverage area, thickness, weight, and geographic regions. By material, ballistic floatation vest market is divided into Ceramic, Foam, and Nylon. In terms of coverage area, ballistic floatation vest market is classified into Medium (0.32m2), Small (0.278m2), Large (0.36m2), X-Large (0.41m2), and XX-Large (0.47m2). Based on thickness, ballistic floatation vest market is segmented into 27mm, 24mm, 16mm, and 15mm. By weight, ballistic floatation vest market is segmented into 1.8 Kg, 1.5 Kg, 2.95 Kg, and 3.5 Kg. Regionally, the ballistic floatation vest industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ceramic material segment is projected to hold 40.2% of the Ballistic Floatation Vest market revenue in 2025, establishing it as the leading material type. Growth in this segment is being driven by the superior ballistic resistance and durability offered by ceramic composites, which are increasingly preferred in defense and law enforcement applications. Ceramic plates can withstand high-velocity impacts while maintaining relatively lightweight properties, enabling extended operational performance without compromising mobility.

Their ability to dissipate kinetic energy effectively provides enhanced protection against rifle rounds and armor-piercing ammunition. Cost efficiency and the long service life of ceramics further support widespread adoption, particularly in large-scale defense procurement programs.

Continuous innovations in ceramic matrix composites and hybrid armor solutions are further improving strength-to-weight ratios, enhancing both protective and flotation characteristics As militaries and security forces prioritize advanced protective technologies that ensure survivability in multi-threat environments, ceramic-based vests are expected to retain leadership in material choice, supported by proven reliability and adaptability in demanding operational scenarios.

The medium coverage area segment is anticipated to account for 30.5% of the market revenue in 2025, positioning it as the leading coverage option. Growth is being fueled by the balance it offers between protection, comfort, and weight efficiency, which are critical factors in combat and maritime operations. Medium coverage vests provide sufficient torso and vital organ protection while ensuring operational flexibility and mobility, making them highly favored for extended field use.

Defense forces, coast guards, and security agencies are adopting these vests as they deliver optimized performance across varying mission profiles, from high-threat engagements to rescue operations. Advancements in design allow modular adjustments that enable soldiers and officers to adapt coverage levels depending on mission requirements. In addition, the weight distribution of medium coverage vests reduces fatigue during prolonged wear, enhancing operational endurance.

Increasing emphasis on versatile and cost-effective protective solutions for both military and commercial maritime applications continues to strengthen adoption With sustained innovation in ergonomic design and ballistic efficiency, this segment is expected to remain the dominant choice.

The 27 mm thickness segment is expected to capture 33.7% of the Ballistic Floatation Vest market revenue in 2025, reinforcing its leadership among thickness options. The preference for this segment is being driven by its optimal balance between ballistic resistance and buoyancy, which ensures maximum survivability in both hostile and aquatic environments. Vests with 27 mm thickness provide strong protection against ballistic threats while remaining light enough to ensure mobility and flotation capability.

This thickness level is widely regarded as the industry standard for effective ballistic performance without adding unnecessary weight or restricting movement. Its proven efficiency in meeting defense procurement requirements has led to widespread deployment across naval, coast guard, and maritime law enforcement forces.

The segment is further supported by material innovations that enhance impact resistance without increasing bulk, thereby improving comfort and wearability As demand rises for multi-threat protective solutions, the 27 mm thickness is expected to remain the preferred choice, underpinned by its track record of operational reliability and compliance with international safety standards.

Ballistic floatation vest offers ballistic protection to user working in or around a water body. Ballistic floatation vest is manufactured from light-weight foam, which is used to maintain buoyancy. It protects from various weapons to an extent, as well as aid in floating up above the water.

The vest contains sufficient quantity of buoyant material, which helps the person to float on the water in swimming position or in upright position. The ballistic floatation vest is mainly used by the coast guards, military personnel and law enforcement who require ballistic protection while on duty around a water body.

In global ballistic floatation vest market, trend is shifting from simple design of ballistic floatation vests to more improved and advanced vests. Global manufacturers are producing floatation vest with full wrap around nylon webbing belt and groin strap that prevent the vest from loosening while in the water and also increase the durability of the vest.

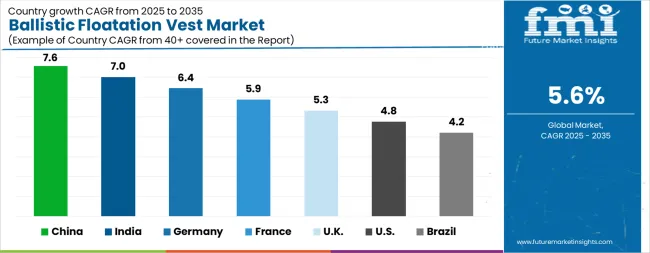

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The Ballistic Floatation Vest Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Ballistic Floatation Vest Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Ballistic Floatation Vest Market is estimated to be valued at USD 5.9 billion in 2025 and is anticipated to reach a valuation of USD 9.4 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 766.1 million and USD 561.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.2 Billion |

| Material | Ceramic, Foam, and Nylon |

| Coverage Area | Medium (0.32m2), Small (0.278m2), Large (0.36m2), X-Large (0.41m2), and XX-Large (0.47m2) |

| Thickness | 27mm, 24mm, 16mm, and 15mm |

| Weight | 1.8 Kg, 1.5 Kg, 2.95 Kg, and 3.5 Kg |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems, Rheinmetall AG, Point Blank Enterprises, Survitec Group, MKU Limited, Honeywell International, Seyntex N.V., Morgan Advanced Materials, Craig International Ballistics, and ArmorSource LLC |

The global ballistic floatation vest market is estimated to be valued at USD 16.2 billion in 2025.

The market size for the ballistic floatation vest market is projected to reach USD 27.9 billion by 2035.

The ballistic floatation vest market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in ballistic floatation vest market are ceramic, foam and nylon.

In terms of coverage area, medium (0.32m2) segment to command 30.5% share in the ballistic floatation vest market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ballistic Protection Material Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protection Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Composites Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protection Scanners Market

Vestibular Testing System Market Size and Share Forecast Outlook 2025 to 2035

Investigational New Drug CDMO Market Size and Share Forecast Outlook 2025 to 2035

Investment Casting Market Size and Share Forecast Outlook 2025 to 2035

Livestock Panel Gates Market Size and Share Forecast Outlook 2025 to 2035

Livestock Trailer Market Size and Share Forecast Outlook 2025 to 2035

Livestock Monitoring System Market

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

Post Harvesting Technologies Market Size and Share Forecast Outlook 2025 to 2035

Cell Harvesting Systems Market Size and Share Forecast Outlook 2025 to 2035

Post-Harvest Treatment Market Size and Share Forecast Outlook 2025 to 2035

Micro-Investing Platform Market Analysis - Size, Share, and Forecast 2024 to 2034

Provoked Vestibulodynia Treatment Market Size and Share Forecast Outlook 2025 to 2035

Energy Harvesting Market Growth - Trends & Forecast 2025 to 2035

The Bulletproof Vests Market is segmented by type and End-use sector from 2025 to 2035.

Precision Livestock Farming Market - Trends & Forecast 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA