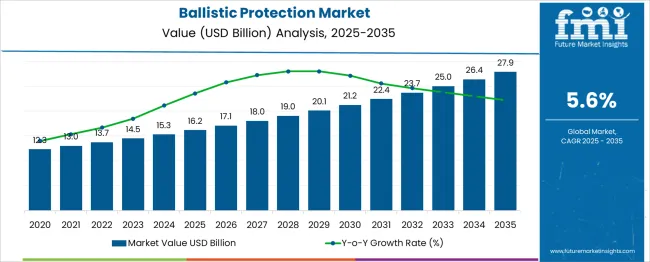

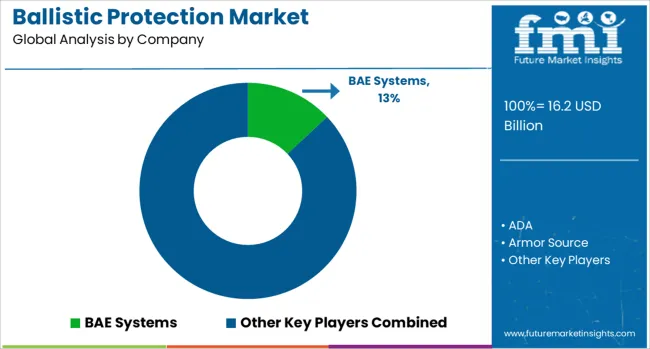

The Ballistic Protection Market is estimated to be valued at USD 16.2 billion in 2025 and is projected to reach USD 27.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

Over the decade, the inflection point appears between 2029 and 2030, when annual absolute growth shifts from USD 1.1 billion to USD 1.2 billion, marking the beginning of stronger year-over-year acceleration. From 2025 to 2029, the market adds an average of USD 0.9 billion per year, while from 2030 onward, the average rises to nearly USD 1.5 billion annually. This transition highlights where the market begins to accumulate value faster due to rising procurement cycles and renewed geopolitical defense investments. Prior to this inflection, demand is shaped by consistent government allocations and stable adoption of lightweight, multi-threat-resistant armor systems. Post-inflection, value generation accelerates due to digital battlefield integration, enhanced material science inputs, and rising cross-border tensions, especially in Eastern Europe and parts of Asia. This midpoint shift demonstrates how the market transitions from steady procurement to strategic scale-up by national defense departments and private contractors. The multiplying factor over the decade stands at 1.72×, reflecting compounding impact of technological refinement, broader procurement scope, and shifting geopolitical threat assessments.

| Metric | Value |

|---|---|

| Ballistic Protection Market Estimated Value in (2025 E) | USD 16.2 billion |

| Ballistic Protection Market Forecast Value in (2035 F) | USD 27.9 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The ballistic protection market makes up approximately 66 % of the military and defense applications segment, reflecting demand for personal armor, vehicle protection, helmets, and shields in active environments. It represents about 20 % of the law enforcement and public safety market, serving police units and tactical teams. Civilian applications contribute roughly 10 %, covering VIP protection, private security, and armored transport use.

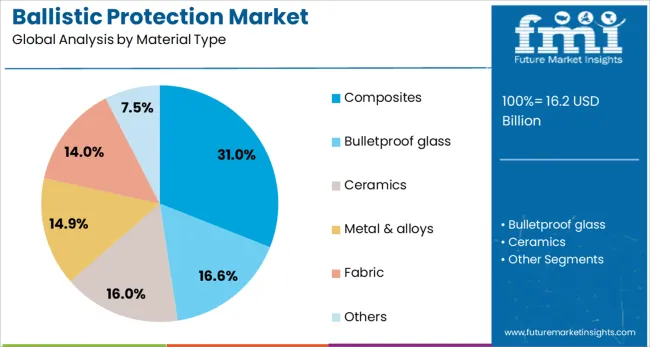

In materials, composite-based armor comprises around 50 % of the market, ceramic-based systems account for about 30 %, metal alloy and glass-based protection make up nearly 15 %, and fabric-based soft armor represents approximately 5 %. New developments focus on hybrid armor solutions that pair thin ceramic inserts with polymer composites to reduce system weight while improving protection levels. Materials such as UHMWPE and aramid fibers are being adopted more widely for high strength-to-weight performance. Embedded sensors and impact event monitoring are being integrated to provide real-time feedback during and after engagement. Modular body armor panels and adaptive helmet designs are increasingly used in retrofit programs to update existing equipment fleets. Additive manufacturing methods allow for optimized shape complexity and reduced waste in armor production. These trends reflect a shift toward lighter, smarter, and more flexible ballistic protection systems tailored across military, law enforcement, and civilian usage.

The ballistic protection market is experiencing steady expansion, driven by rising geopolitical tensions, increased defense budgets, and growing demand for advanced protective solutions in both military and law enforcement sectors. Rapid technological advancements in lightweight materials and modular armor systems are enhancing soldier mobility and survivability on the battlefield.

Civilian security forces and private contractors are increasingly adopting high-performance ballistic gear for riot control, border security, and critical infrastructure protection. Heightened focus on multi-threat protection—against bullets, shrapnel, and blasts—is influencing procurement decisions worldwide.

The market is further shaped by regulatory compliance standards that mandate rigorous product testing, thereby driving innovation and material enhancement. With emphasis on wearable comfort, durability, and ease of integration with communication and surveillance systems, the market is expected to continue evolving toward next-generation protective platforms.

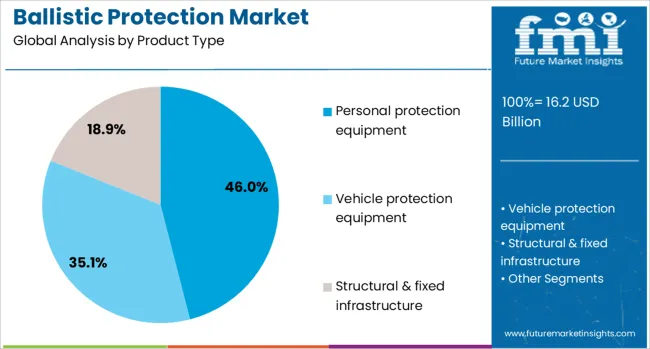

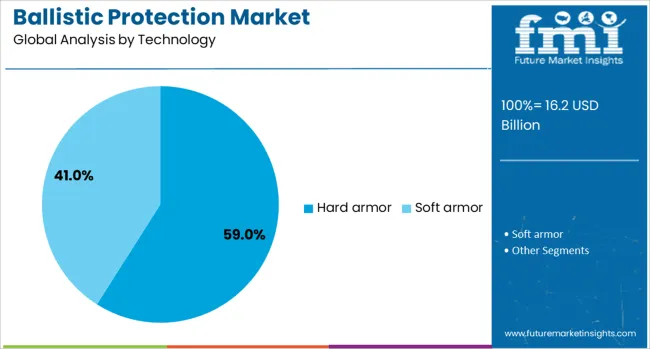

The ballistic protection market is segmented by product type, material type, technology, application, and geographic regions. The ballistic protection market is divided by product type into Personal protection equipment, Vehicle protection equipment, and Structural & fixed infrastructure. The ballistic protection market is classified by material type into Composites, Bulletproof glass, Ceramics, Metal & alloys, Fabric, and Others. The ballistic protection market is segmented into Hard armor and Soft armor. The ballistic protection market is segmented into Defense & military, Law enforcement & homeland security, and Others. Regionally, the ballistic protection industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Personal protection equipment is projected to account for 46.0% of the ballistic protection market share by 2025, making it the dominant product type. This segment includes body armor, helmets, ballistic vests, and protective eyewear used by defense personnel, law enforcement officers, and security forces.

The surge in urban warfare and asymmetric threats has amplified the demand for individual-level protection, especially in combat zones and crowd control scenarios. Advancements in ergonomic designs and moisture-wicking materials are enhancing user comfort and operational efficiency, which is further accelerating adoption.

With national militaries upgrading their infantry gear and local police forces responding to civil unrest, the demand for reliable, modular personal ballistic systems is expected to remain strong.

Composites are expected to hold 31.0% of the material share in the ballistic protection market by 2025, emerging as the most utilized material type. Their widespread use is driven by the superior strength-to-weight ratio offered by aramid fibers, ultra-high molecular weight polyethylene (UHMWPE), and carbon fiber composites.

These materials enable enhanced protection while minimizing bulk, a critical factor in user mobility and endurance. Composites also provide high energy absorption, multi-hit capability, and corrosion resistance, making them suitable for diverse operational environments.

Their integration into both personal armor and vehicle protection systems highlights their versatility. As innovation continues in resin matrices and fiber weaving techniques, the performance threshold of composites in ballistic applications is expected to rise further.

Hard armor is projected to lead the technology segment with a 59.0% market share by 2025. This segment’s dominance is linked to its application in high-risk environments requiring maximum protection against rifle rounds and armor-piercing ammunition.

Hard armor typically comprises rigid plates made from ceramics, composite laminates, or hardened steel, offering protection levels beyond soft armor capabilities. Its deployment in military vehicles, tactical gear, and riot control equipment is expanding due to growing cross-border conflicts and counterterrorism operations.

New designs focusing on curved plates, lightweight hybrid layers, and trauma reduction systems are making hard armor more wearable and combat-effective. As governments continue to modernize their armed forces, hard armor technology remains central to their strategic defense initiatives.

Ballistic protection demand is expanding across military, law enforcement, and private security sectors. New procurement cycles are reshaping defense strategies, while threats from asymmetric warfare and internal unrest have shifted focus to lightweight, modular armor. Applications in VIP transport and critical infrastructure have contributed to sustained adoption. Hybrid armor systems and scalable protection modules are being deployed for both personnel and vehicles. Advancements in material science are enabling integration without performance compromise, supporting use across urban, border, and high-threat operational environments.

Adoption of next-generation composite materials has strengthened the ballistic protection market. Polyethylene-based systems now account for a growing share, offering 30% lighter weight compared to aramid or steel armor. Enhanced durability and higher energy absorption capacity enable reliable multi-hit resistance. Ceramic strike faces combined with soft backings improve trauma reduction performance in tactical vests and combat helmets. Modular panel inserts with contoured designs are being introduced in personal gear, addressing ergonomic issues. Demand for integrated solutions with wearable electronics is increasing across special forces and peacekeeping units. Flexible armor for covert wear is also being manufactured at scale, especially for security operations in urban zones where concealability and agility are prioritized over bulk.

Military modernization programs are accelerating ballistic gear deployment. Armies in Asia-Pacific and Europe have increased orders for enhanced body armor, tactical helmets, and vehicle protection systems. National police forces and border control units are adopting level III and IV armor, supporting response to civil unrest and cross-border risks. Governments are expanding domestic manufacturing capacity through defense procurement partnerships. Law enforcement units in Latin America and Southeast Asia are procuring modular armor with ballistic plates suitable for urban operations. Tactical upgrades for special forces, including blast-mitigating systems, are being funded under homeland security budgets. Scalable solutions are being favored across logistics and air mobility commands. Demand from high-risk diplomatic missions has also prompted investment in mobile and deployable protection kits.

Regulatory complexity continues to delay commercialization timelines. Region-specific standards such as NIJ, STANAG, and VPAM require rigorous multi-impact testing, environmental durability validation, and thermal resistance checks. These certification processes increase development costs and require specialized facilities. Civilian sector adoption is restricted by unclear legal frameworks in several countries and high price sensitivity. Armoring components for civilian vehicles face limitations under automotive weight and design regulations. Emerging market adoption is also hindered by lack of supplier networks and limited awareness among end users. Export control measures and defense licensing constraints affect product circulation, especially in countries with restricted import policies. The inability to scale down advanced armor systems for civilian applications remains a challenge in markets with fragmented procurement pathways.

Use of ballistic protection is increasing in non-military domains, driven by demand from high-risk commercial and civic zones. Private armored vehicles for executives, politicians, and cash transit operators are deploying certified armor panels with limited retrofitting. Public infrastructure such as airports, embassies, and government buildings are adopting ballistic walls, kiosks, and glass. Compact shield units and armored partitions are being used in schools and places of worship in response to increased civilian threat exposure. Law enforcement units are expanding community protection programs by deploying portable ballistic gear for rapid response units. In high-crime regions, private contractors are adopting soft armor kits and discreet vests. Market growth in the civilian segment is supported by modular, lightweight, and transportable ballistic systems adapted for short deployment cycles.

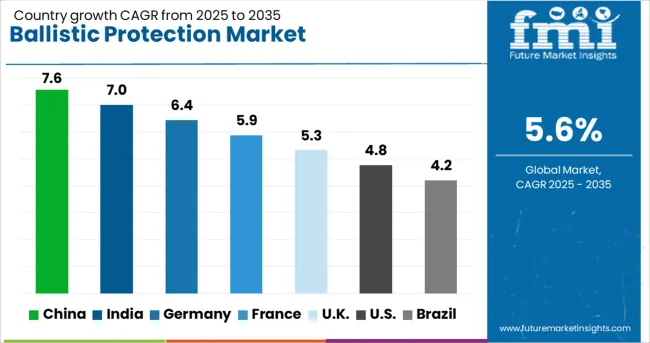

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

Use of ballistic protection is increasing in non-military domains, driven by demand from high-risk commercial and civic zones. Private armored vehicles for executives, politicians, and cash transit operators are deploying certified armor panels with limited retrofitting. Public infrastructure such as airports, embassies, and government buildings are adopting ballistic walls, kiosks, and glass. Compact shield units and armored partitions are being used in schools and places of worship in response to increased civilian threat exposure. Law enforcement units are expanding community protection programs by deploying portable ballistic gear for rapid response units. In high-crime regions, private contractors are adopting soft armor kits and discreet vests. Market growth in the civilian segment is supported by modular, lightweight, and transportable ballistic systems adapted for short deployment cycles.

China’s ballistic protection market is forecast to grow at a CAGR of 7.6% from 2025 to 2035, outperforming the global benchmark by 36%. Demand has been driven by increasing domestic military output and central procurement mandates. Upgrades in body armor, vehicle plating, and ballistic shields are being institutionalized across armed forces and border patrol units. Internal investments in high-strength composite materials have also been prioritized, reinforcing in-country self-reliance goals. The commercial sector is gradually integrating ballistic solutions across critical infrastructure projects.

India is expected to register a CAGR of 7.0% between 2025 and 2035, surpassing the global average by 25%. This growth has been driven by modernization efforts across the Indian Army and Central Armed Police Forces. Indigenous development programs have received prioritization under national procurement policies, while export potential is expanding toward Southeast Asian and African markets. The private sector is being integrated into supply chains, especially for soft armor, helmets, and ballistic panels for vehicles.

Germany is projected to expand its ballistic protection sector at a CAGR of 6.4% through 2035, reflecting a 14% premium over the global baseline. Bundeswehr modernization plans and EU defense harmonization efforts have created consistent demand across tactical armor and vehicle-integrated ballistic systems. Advanced fiber technologies and nanomaterial coatings are being adopted across OEM production cycles. Demand from law enforcement agencies is supported by evolving threat assessments in urban zones.

The United Kingdom is forecast to post a CAGR of 5.3%, falling 5% below the global average. Growth is driven by requirement-led upgrades within British Armed Forces and strategic law enforcement units. Lightweight ballistic protection kits and discreet wearables are gaining priority due to evolving counterterrorism tactics. While demand is stable, procurement cycles remain conservative, shaped by budgetary scrutiny and legacy contract renewals.

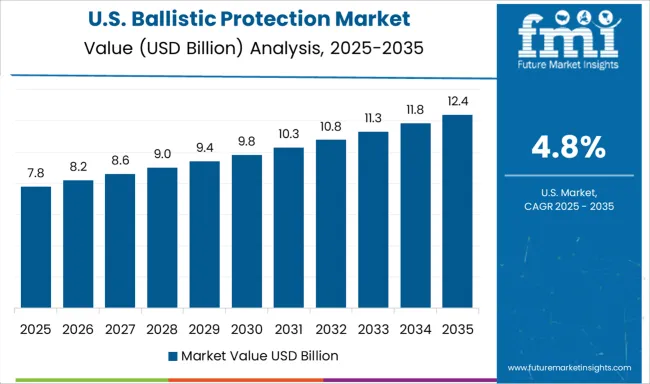

The United States market is forecast to grow at a CAGR of 4.8% from 2025 to 2035, 14% below the global benchmark. Procurement stability across the Department of Defense has maintained volume, but growth has moderated due to supply chain consolidation. Focus has shifted to advanced multi-threat protection and integration of smart technologies into tactical kits. Civil and security agency adoption remains consistent, although innovation cycles have lengthened.

BAE Systems leads in ballistic protection with integrated armor systems for vehicles, personnel, and aerospace applications. Its modular composite armor kits and body armor platforms are widely deployed in defense programs worldwide. ADA, an Australian supplier, delivers lightweight ballistic vests and tactical gear customized for military and law enforcement use. Armor Source and Armor Works focus on high-performance helmets and body armor plates engineered for multi-hit resistance and advanced trauma mitigation.

Avon Technologies specializes in ballistic protective gear integrated with respiratory systems, supporting CBRN and tactical environments. Craig International Ballistics and Elmon supply NIJ-certified soft and hard armor systems tailored for high-mobility units. FMS Enterprises Migun is known for aramid-based ballistic fabrics used in both vehicle armor and personal protection. Koninklijke Ten Cate delivers composite armor materials and ballistic fabrics used across NATO-aligned defense programs. MKU and NP Aerospace focus on scalable armor solutions, with MKU supplying ballistic helmets, shields, and vehicle kits, while NP Aerospace emphasizes modular armor for tactical vehicles.

Pacific Safety Products and Paul Boye Technologies serve police and special operations forces with mission-specific vests and gear. Point Blank Enterprises and Revision Military offer integrated systems with advanced weight-to-protection ratios. Rheinmetall, Roketsan, Seyntex, Southern States, and Survitec Group provide diverse ballistic offerings from soldier kits to naval armor panels, addressing multi-domain operational requirements.

Between 2023 and 2025, the ballistic protection market advanced through next-generation material development and smarter armor systems. Lightweight aramid composites with enhanced flexibility were introduced for vests and helmets, improving comfort without compromising protection. Military programs in several countries adopted full-coverage modular headgear with multi-hit resistance.

Partnerships between defense firms and material science innovators accelerated the integration of graphene-enhanced ballistic panels. Demand grew from defense and law enforcement sectors for customizable, high-mobility solutions suited for urban and asymmetric threat environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.2 Billion |

| Product Type | Personal protection equipment, Vehicle protection equipment, and Structural & fixed infrastructure |

| Material Type | Composites, Bulletproof glass, Ceramics, Metal & alloys, Fabric, and Others |

| Technology | Hard armor and Soft armor |

| Application | Defense & military, Law enforcement & homeland security, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BAE Systems, ADA, Armor Source, Armor Works, Avon Technologies, Craig International Ballistics, Elmon, FMS Enterprises Migun, Koninklijke Ten Cate, MKU, NP Aerospace, Pacific Safety Products, Paul Boye Technologies, Point Blank Enterprises, Revision Military, Rheinmetall, Roketsan, Seyntex, Southern States, and Survitec Group |

| Additional Attributes | Dollar sales by protection level and end-use segment, demand dynamics across military, law enforcement, and civilian applications, regional trends in North America and Middle East defense procurement, innovation in ultra light ceramic and graphene composites, environmental impact of lifecycle waste and recycling, and emerging use cases in civilian security gear, tactical drones, and vehicle mounted systems. |

The global ballistic protection market is estimated to be valued at USD 16.2 billion in 2025.

The market size for the ballistic protection market is projected to reach USD 27.9 billion by 2035.

The ballistic protection market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in ballistic protection market are personal protection equipment, vehicle protection equipment and structural & fixed infrastructure.

In terms of material type, composites segment to command 31.0% share in the ballistic protection market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ballistic Protection Material Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protection Scanners Market

Ballistic Floatation Vest Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ballistic Composites Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Head Protection Equipment Market Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Data Protection as a Service (DPaaS) Market

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Brand Protection Tools Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA