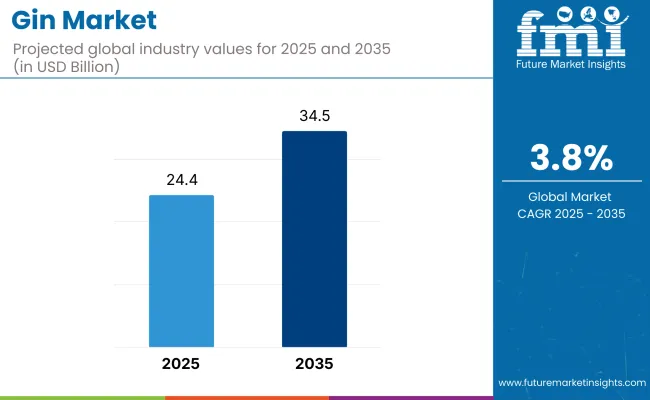

Global gin sales reached approximately USD 24.4 billion at the end of 2025. Forecasts suggest the market will achieve a 3.8% compound annual growth rate (CAGR) and exceed USD 34.5 billion in value by 2035.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 24.4 billion |

| Industry Value (2035F) | USD 34.5 billion |

| CAGR (2025 to 2035) | 3.8% |

Increasing consumer sophistication, evolving palates, and a surge in interest in artisanal and botanical-rich spirits have contributed significantly to the growth trajectory of the global gin market. London Dry Gin, known for its crisp juniper-forward profile, has dominated consumption owing to its alignment with both classic cocktails and premium mixology trends.

Notably, demand across emerging markets-including parts of Asia-Pacific and Latin America-is accelerating due to premiumization and the Western influence on drinking culture. The category’s resurgence is further enabled by the proliferation of micro-distilleries and regionally inspired infusions that emphasize provenance and authenticity.

Commenting on the market shift, a spokesperson from Bombay Sapphire in 2024 noted, “Botanical innovation and sustainable distillation practices are no longer optional; they are now core to brand value and consumer loyalty.” This strategic focus on flavor differentiation, brand storytelling, and experiential consumption has strengthened category penetration even amid competition from newer spirit types.

In mature regions like the United Kingdom and Spain, gin continues to be a leading category driven by a cultural affinity for gin-based drinks and strong on-trade consumption. However, growth is now being driven by innovation-such as the development of pink gin, citrus-infused variants, and low-alcohol or zero-proof gins-which cater to changing lifestyle preferences.

In North America, the craft spirits movement is gaining momentum, with local producers focusing on unique botanicals and sustainable sourcing to carve out a premium niche in a competitive market.Government regulations and supportive policies in various countries are also shaping the market landscape. For instance, tax breaks and small-scale distillation licenses in the UK and selective states in

India have facilitated new market entrants, thereby diversifying product offerings. Additionally, the rising influence of tourism-particularly experiential gin distillery tours and gin festivals-has been boosting brand engagement and consumer education.

Digital marketing strategies, influencer collaborations, and e-commerce have emerged as powerful tools to capture younger demographics, particularly in urban centers. The rise in home mixology, influenced by global bartending trends, has made gin a preferred spirit for cocktail experimentation, especially during and post-COVID-19 periods.

The global gin market is undergoing a nuanced evolution-anchored in tradition but propelled by modern sensibilities such as health consciousness, sustainability, and personalized flavor experiences. Brands that invest in innovation, regional identity, and digital outreach are expected to lead in the years ahead, as gin transitions from a heritage spirit to a versatile lifestyle product across diverse global markets.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the industry. This analysis highlights key shifts in industry performance and indicates revenue realization patterns, providing stakeholders with a clearer view of the industry growth trajectory over the year. The first half of the year, or H1, spans from January to June, while the second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.2% (2024 to 2034) |

| H2 2024 | 3.5% (2024 to 2034) |

| H1 2025 | 3.6% (2025 to 2035) |

| H2 2025 | 3.9% (2025 to 2035) |

The above table presents the expected CAGR for the global industry demand space over a semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is projected to grow at a CAGR of 3.2%, followed by a slight increase to 3.5% in the second half (H2) of the same year. Moving into 2025, the CAGR is expected to rise to 3.6% in H1 and maintain a steady increase to 3.9% in H2.

In the first half (H1 2025), the industry witnessed an increase of 4 BPS, while in the second half (H2 2025), the industry observed a rise of 4 BPS, indicating a consistent upward trend. These variations suggest strong industry momentum, driven by premiumization trends in craft product, the rising popularity of botanical and low-ABV product variants, and increased investment in sustainable distillation techniques across key global industries.

The industry is witnessing strong growth underpinned by premiumization, craft spirits orientation, and advancing cocktail culture. Distilleries focus on utilizing excellent-quality botanicals, refining distilling processes, and leveraging brand history to differentiate. Distributors are focusing on optimal supply chains and brand knowledge in order to put in the shelves the flavored as well as special ones with success into the industry.

Retailers accommodate changing consumer tastes, providing a combination of premium, flavored, and locally made offerings along with balancing exclusivity and affordability. End users are driven by taste, packaging, price, and reputation, with youth segments preferring new flavor innovation and production sustainability. The growth of gin cocktails at bars and in-home consumption patterns continues to drive industry growth. Also influencing the future of the sector are regulatory changes, taxation regimes, and changing lifestyles among consumers.

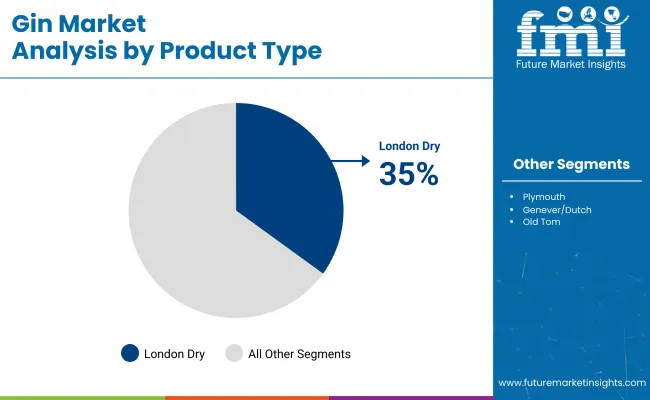

Projected to maintain a market share exceeding 35% through 2030, the London Dry Gin segment is anticipated to grow at a steady CAGR of 3.2% between 2025 and 2035.

London Dry Gin continues to serve as the cornerstone of the global gin category, upheld by its codified purity standards and timeless appeal. It has retained dominance not only due to historical brand equity but also due to its ability to align with modern mixology and global cocktail trends.

Premium positioning, along with a clean flavor architecture driven by juniper-forward profiles, has enabled London Dry Gin to perform consistently across both mature and emerging markets. Its market leadership is further reinforced by the strategic investments made by established players in refining distillation processes, achieving sustainability certifications, and incorporating provenance-based narratives that appeal to connoisseurs and new-age consumers alike. Moreover, London Dry Gin has benefited from a resurgence in gin-based classic cocktails, spurred by elevated home consumption and upscale on-trade experiences.

The segment is expected to benefit from stable regulatory recognition and minimal adulteration risks compared to flavored variants. Moving forward, the emphasis is likely to shift toward botanically innovative expressions within the London Dry umbrella, providing room for experimentation while maintaining its traditionalist foundation. As brand storytelling and purity claims gain momentum, London Dry Gin will continue to act as both a category ambassador and a commercial bellwether through 2035.

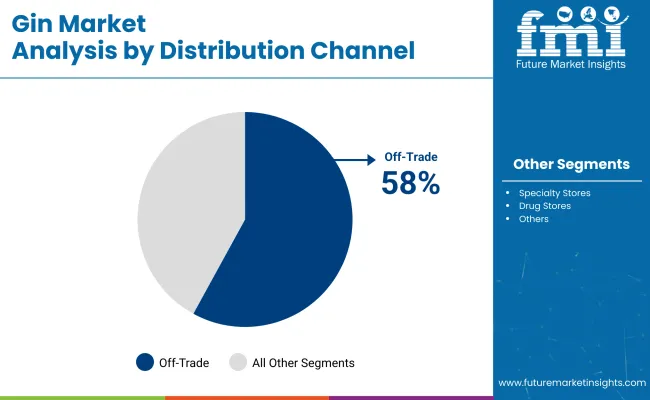

Accounting for nearly 58% of global sales in 2025, the off-trade segment is projected to witness a moderate CAGR of 3.6% through 2035, driven by evolving retail dynamics and e-commerce expansion.

The off-trade sales channel has increasingly become a pivotal growth driver in the global gin market, fueled by consumer preferences for convenience, expanded product visibility, and access to premium offerings at retail and online touchpoints. Strategic placement in supermarkets, hypermarkets, and digital marketplaces has enabled wider brand accessibility, particularly in urban centers where craft and imported gins are gaining traction.

The segment’s strength lies in its ability to support trial, discovery, and repeat purchase, especially in the context of specialty SKUs, limited editions, and seasonal variants. During the COVID-19 pandemic, off-trade consumption surged, permanently altering buying behavior and reinforcing the importance of home-based mixology.

Retailers have adapted by expanding shelf space and leveraging data-driven merchandising to match consumer preferences. E-commerce platforms, in particular, are playing a critical role in narrative-driven marketing, virtual tastings, and product education, enhancing brand-consumer interaction. Regulatory shifts allowing direct-to-consumer alcohol sales in select markets have further strengthened the off-trade channel's influence.

Moving forward, personalized promotions, AI-powered recommendations, and subscription models are expected to make this segment an innovation testbed. As such, the off-trade channel is no longer just a distribution medium-it is emerging as a strategic platform for brand differentiation and sustained category growth.

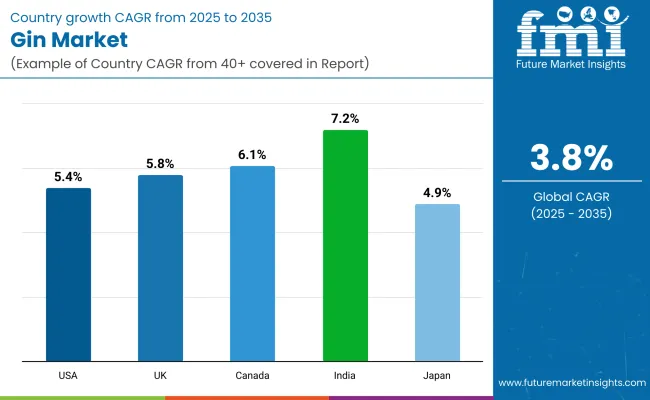

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 5.8% |

| Canada | 6.1% |

| India | 7.2% |

| Japan | 4.9% |

Its increased demand for premium craft product and ready-to-drink (RTD) cocktails' popularity has driven industry growth. The industry has seen the introduction of canned gin cocktails infused with exotic botanicals and natural fruits, unlike in the past when traditional product and tonic combinations were the case.

Craft distillers have introduced barrel-aging techniques, terroir-infused Botanics, and functional ingredient infusions to create ultra-premium, limited-release offerings. Craft and super-premium styles will lead the industry in 2035, catering to cocktail culture fans and premium mixology trends. FMI is of the opinion that the USA industry is slated to grow at 5.4% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Information |

|---|---|

| Premium consumption | Consumers prefer premium craft product over standard varieties. |

| RTD cocktail trend | Increase in canned gin cocktails for convenience. |

| Barrel-aged product trend | Distillers use aging techniques to develop complex flavors. |

| Mixology growth | Cocktail culture boom increases premium product sales. |

The UK continues to lead the industry. Increasingly, sustainability is a defining characteristic, with distilleries shifting to locally grown botanicals and sustainable production methods. Contrary to historical reliance on juniper and herbs imported from overseas, today's ingredients are chiefly grown locally with regenerative agricultural methods employed in preserving biodiversity.

Closed-loop water recycling and solar distillation technology have gained popularity, with decreased carbon footprints in the manufacturing cycle. Sustainability emphasis through legislation has prompted distilleries to turn to carbon-neutral manufacturing, and the UK stands as the pioneer in sustainable production.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Sustainability initiatives | Distilleries implement low-carbon and sustainable processes. |

| Locally grown botanicals | Increased use of locally grown juniper and herbs. |

| Government policy | Stricter rules encourage carbon-neutral product production. |

| Premium expansion | Handcrafted and artisanal product remains in great demand. |

The Canadian industry is evolving beyond traditional forms. Increased demands for terroir and Arctic botanical-infused products have shifted people's views. Compared with mass-produced products, Canadian manufacturers focus on hyper-local sourcing and seasonally inspired blends, utilizing such flavorings as Labrador tea, spruce tips, and wild juniper berries.

Experimental styles such as barrel-rested and cask-finished ones have gained traction, focusing on premium spirits consumers looking for unique flavor profiles. Canada will likely be one of the leading global players in the craft gin industry by 2035, focusing on domestic and export industries. FMI is of the opinion that the Canadian industry is slated to grow at 6.1% CAGR during the study period.

Growth Drivers in Canada

| Key Drivers | Details |

|---|---|

| Arctic botanical infusions | Local, wild-harvested botanicals impart unique flavor profiles. |

| Barrel-aged popularity | Aged product is requested for richness and depth from consumers. |

| Growing craft spirits industry | Distilleries owned by small distilleries become global topics. |

| Premiumization trend | Premium products with premium-priced brands command premium-mindful consumers. |

Growing demand for craft spirits, including botanically infused product, due to consumer choice shift led to the expansion. Contrary to previous reliance on international brands, local distilleries have risen to the challenge with new-generation fusions of Indian botanicals such as turmeric, cardamom, and tulsi.

Premiumization of product has also reached tier-2 and tier-3 cities with growing awareness. The Indian industry will be healthy by 2035, with local brands gaining a competitive edge. FMI is of the opinion that the Indian industry is slated to grow at 7.2% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Description |

|---|---|

| Craft product brands growth | Domestic distilleries experiment with new botanical blends. |

| Growing consumer awareness | More and more consumers choose premium and craft product. |

| New industry expansion | Tier-2 and tier-3 cities' product penetration. |

| Indian botanical infusions | Indian spices and herbs are utilized, thus making it more attractive. |

In contrast to traditional European-style product, Japanese distilleries aim at national tastes and precise craftsmanship. They insert yuzu, shiso, and cherry blossom into the mix and make traditionally Japanese-style product. Peak peaks of highball culture and cult-like followings for craft spirits in Japan fueled demand for craft, small-batch product. Emphasizing balance and precision, Japanese product brands entered global industries with domestic and international demand.

Growth Drivers in Japan

| Key Drivers | Information |

|---|---|

| Exotic botanical infusions | Japanese product incorporates yuzu, shiso, and cherry blossom. |

| Highball culture expansion | Product highballs gained popularity in Japan's nightlife. |

| Craft spirits expansion | Small-batch distilleries become globally prominent. |

| Premiumization of spirits | Gin drinkers require high-quality and well-produced product. |

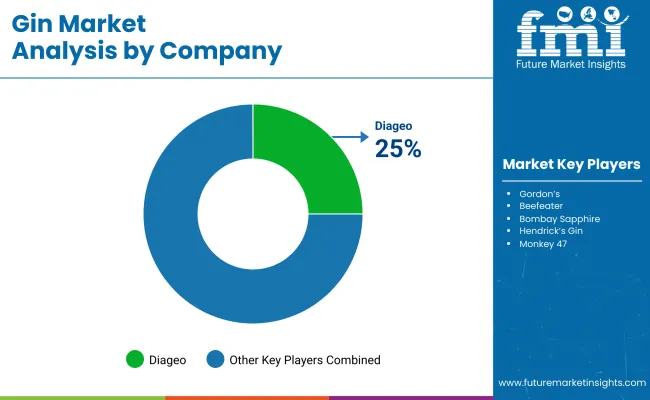

Diageo (25-30%)

Dominating the global industry through brands like Tanqueray and Gordon's, they are more focused on premiumization and new botanical expressions.

Pernod Ricard (15-20%)

One of the leaders in craft and premium product by leveraging Beefeater’s legacy with the artisanal appeal of Monkey 47.

Bacardi (12-16%)

Aiming to launch sustainability initiatives and flavor innovations within the premium product category with the help of Bombay Sapphire.

William Grant & Sons (8-12%)

Hendrick’s Gin is marketed as an unconventional offering and is very rich in botanicals in the ultra-premium space.

Rémy Cointreau (5-9%)

With The Botanist it focuses on terroir-based product production for the high-end consumer segment.

Other Key Players (20-30% Combined)

By product type, the industry is segmented into London dry gin, Plymouth gin, Genever/Dutch gin, Old Tom gin, and New American gin.

By price, the industry is segmented into standard, premium, and luxury.

By distribution channel, the industry is segmented into hypermarkets and supermarkets, specialty stores, drug stores, online channels, and others.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is expected to reach USD 24.4 billion in 2025.

The industry is projected to reach USD 34.5 billion by 2035.

The key players in the industry include Tanqueray, Gordon’s, Beefeater, Bombay Sapphire, Hendrick’s Gin, Monkey 47, The Botanist, Plymouth Gin, No.3 London Dry Gin, and Sipsmith Gin.

India, slated to grow at 7.2% CAGR during the study period, is poised for fastest growth.

London Dry Gin is in high demand.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Liters) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 6: Global Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 14: North America Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 22: Latin America Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 30: Western Europe Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 38: Eastern Europe Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 54: East Asia Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Liters) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Liters) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Price, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Liters) Forecast by Price, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Liters) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Price, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Liters) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 14: Global Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Price, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Price, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 38: North America Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Price, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Price, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 62: Latin America Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Price, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Price, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 86: Western Europe Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Price, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Price, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Price, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Price, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Price, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Price, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 158: East Asia Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Price, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Price, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Liters) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Liters) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Price, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Liters) Analysis by Price, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Liters) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Price, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ginkgo Biloba Extract Market Size and Share Forecast Outlook 2025 to 2035

Ginseng Extract Skin Revitalizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ginseng Root Extracts Skincare Market Size and Share Forecast Outlook 2025 to 2035

Gingerbread Market Size and Share Forecast Outlook 2025 to 2035

Gingival Retraction Kits Market Size and Share Forecast Outlook 2025 to 2035

Ginseng Market Analysis - Size, Share, and Forecast 2025 to 2035

Ginger Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ginger Beer Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ginger Ale Market Analysis by Type Sales Channel and Region Through 2035

Ginseng Extracts Market Analysis by Product Type, Form and Application Through 2035

Gingivitis Treatment Industry Analysis by Drug Class, Route of Administration, End-User, and Region through 2035

Ginger Salt Market Trends – Flavor Innovation & Industry Demand 2025 to 2035

Engineering Machinery Counterweight Iron Market Size and Share Forecast Outlook 2025 to 2035

Engine-Driven Endodontic File Market Size and Share Forecast Outlook 2025 to 2035

Engine Fixture Market Size and Share Forecast Outlook 2025 to 2035

Engine Piston Ring Set Market Size and Share Forecast Outlook 2025 to 2035

Engine Cylinder Liners Market Size and Share Forecast Outlook 2025 to 2035

Alginate Films Market Size and Share Forecast Outlook 2025 to 2035

Vaginal Spetula Market Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA