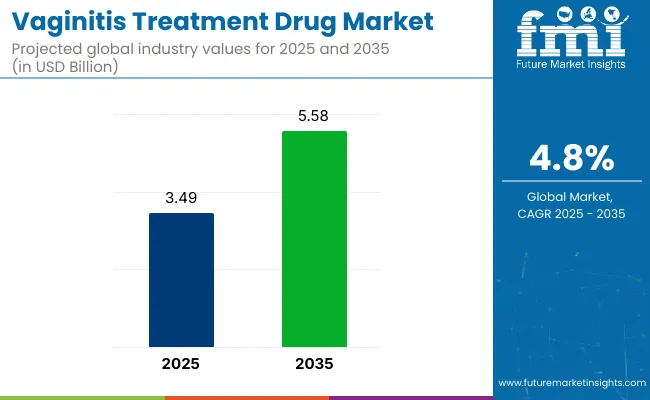

The global vaginitis treatment drug market is valued at USD 3.49 billion in 2025 and is projected to reach USD 5.58 billion by 2035, which shows a CAGR of 4.8% over the forecast period. Rising awareness about women’s reproductive health, increasing prevalence of vaginal infections, and improvements in diagnostic practices are driving the demand for effective vaginitis treatments.

Bacterial vaginosis, yeast infections, and trichomoniasis remain the most common causes of vaginitis globally, requiring targeted antifungal, antibacterial, and antiprotozoal therapies. As healthcare providers emphasize early intervention and patient education, prescription rates for oral and topical treatments are steadily rising across both developed and emerging economies.

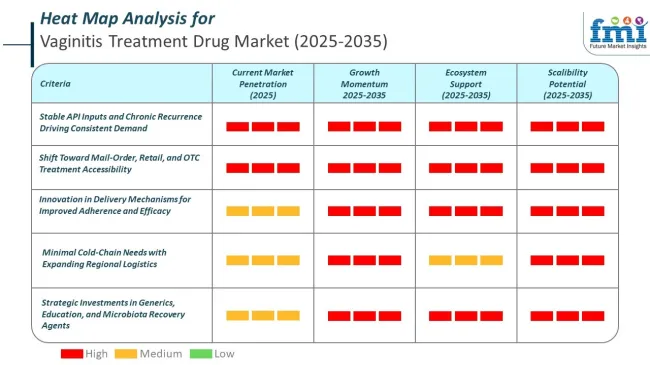

Product innovation and formulation advancements are contributing to market expansion. Pharmaceutical companies are developing combination therapies, extended-release formulations, and pH-balanced vaginal tablets to improve treatment adherence and minimize recurrence. Over-the-counter availability of certain antifungal agents is further enhancing accessibility, especially for recurrent infections.

Additionally, the integration of digital health platforms and teleconsultation services is supporting early diagnosis and timely treatment, particularly in rural and underserved areas. New pipeline drugs targeting resistant strains and microbiome-restoring therapies are also expected to reshape the therapeutic landscape in the coming years.

Supportive regulatory frameworks and government health initiatives focused on sexual and reproductive health are aiding market development. Agencies like the USA, FDA and EMA have streamlined approvals for women’s health medications, while WHO-led campaigns are promoting awareness and prevention of sexually transmitted infections.

In regions such as Asia Pacific and Latin America, improving access to gynecological care and expanding pharmaceutical distribution networks are fueling market growth. With continued innovation, rising public health focus, and an aging female population at higher risk of infections, the vaginitis treatment drug market is expected to grow steadily and play a critical role in women’s health management globally.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.49 billion |

| Industry Value (2035F) | USD 5.58 billion |

| CAGR (2025 to 2035) | 4.8% |

BV prevalence varies widely across regions, with higher levels observed in parts of Asia compared to Europe and Japan. These figures reflect the most recent, quality sources available.

Trichomoniasis rates remain far lower than BV but show notable regional contrasts, with Asia reporting higher figures than Europe and the United States.

BV, vulvovaginal candidiasis, and trichomoniasis are not governed by disease‑specific laws in leading markets. Oversight is handled through reporting practices, drug approval and access rules, diagnostic device regulation, and clinical guidelines.

Drug access and device pathways vary by region, shaping how treatments and diagnostics reach patients and providers.

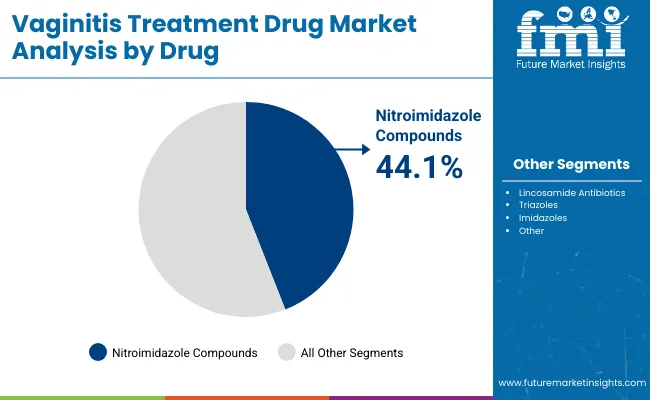

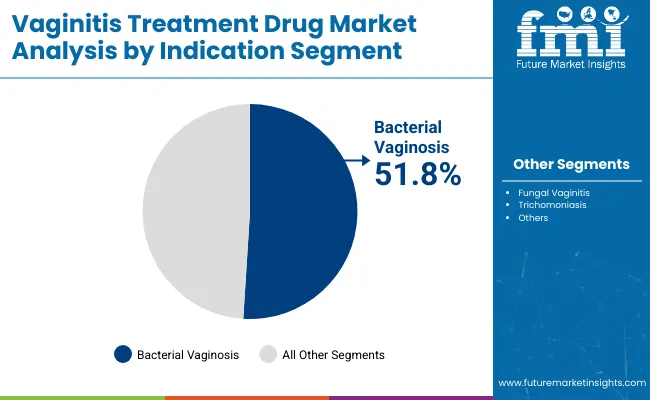

The market is segmented based on drug, indication, route of administration, prescription type, distribution channel, and region. By drug, the market is categorized into nitroimidazole compounds, lincosamide antibiotics, triazoles, and imidazoles. By indication, it includes bacterial vaginitis, fungal vaginitis (yeast infection), trichomoniasis, and others (including atrophic vaginitis, viral vaginitis, parasitic infections, and non-infectious vaginitis).

Based on route of administration, the market is segmented into oral, cutaneous, and vaginal routes. In terms of prescription type, the market is divided into prescription and over-the-counter medications. By distribution channel, the market includes hospital pharmacies, retail pharmacies, drug stores, and mail order pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The nitroimidazole compound segment is projected to dominate the vaginitis treatment drug market with a 44.1% share in 2025. Known for their potent antimicrobial properties, nitroimidazoles such as metronidazole and tinidazole are widely used to treat bacterial vaginosis and trichomoniasis. Their broad-spectrum action against anaerobic bacteria and protozoa makes them highly effective in first-line therapy.

The popularity of this drug class is driven by its affordability, high treatment success rates, and low recurrence. Clinical evidence supports its efficacy in both oral and topical formulations, offering flexibility in patient management. Furthermore, these compounds demonstrate favorable resistance patterns, contributing to their sustained use in clinical practice across global healthcare systems.

Leading pharmaceutical manufacturers continue to invest in novel formulations such as extended-release and combination therapies to enhance patient adherence and reduce treatment duration. These innovations are gaining traction, particularly in developing regions where vaginitis prevalence remains high.

While lincosamides, triazoles, and imidazoles offer targeted options, nitroimidazoles remain the most comprehensive and cost-effective solution. As awareness and diagnosis of vaginal infections rise globally, the demand for reliable, guideline-recommended therapies like nitroimidazole compounds is expected to grow steadily.

| Drug Segment | Market Share (2025) |

|---|---|

| Nitroimidazole Compounds | 44.1% |

The bacterial vaginosis (BV) segment is forecasted to maintain its lead in the vaginitis treatment drug market with a 51.8% share in 2025. BV remains the most prevalent cause of vaginitis among women of reproductive age worldwide, contributing to its dominance. It often recurs within a year in nearly half of the patients, which drives repeated demand for treatment.

The infection is not only discomforting but also linked to increased risks of sexually transmitted infections (STIs), pelvic inflammatory disease, and pregnancy complications. These risks necessitate early diagnosis and treatment, ensuring high prescription volumes across primary and gynecological care. Medical guidelines universally recommend antimicrobial agents such as metronidazole and clindamycin for BV, which strengthens the market demand for nitroimidazoles and lincosamides.

Furthermore, growing awareness of intimate health and the rise of telehealth consultations are making diagnosis and access to treatment more convenient for women globally. With increased funding for women’s health research and better diagnostic tools being adopted in hospitals and clinics, accurate and timely BV detection is improving. The chronic nature of BV, coupled with public health efforts aimed at reducing reproductive health risks, will continue to fuel demand for treatment drugs.

| Indication Segment | Market Share (2025) |

|---|---|

| Bacterial Vaginosis | 51.8% |

The vaginal route of administration is expected to grow at a CAGR of 6.2% from 2025 to 2035, emerging as a preferred option in the vaginitis treatment drug market. This mode of administration provides direct, localized treatment that improves therapeutic outcomes while reducing systemic side effects.

Vaginal formulations including creams, gels, suppositories, and ovules are particularly popular for treating recurrent bacterial vaginosis, yeast infections, and trichomoniasis. These products offer high bioavailability at the site of infection, allowing for faster symptom relief and reduced resistance development. Pharmaceutical companies are innovating with controlled-release and pH-balanced vaginal drug delivery systems to enhance patient adherence and comfort.

These improvements are increasing the appeal of vaginal therapies across both prescription and over-the-counter markets. The segment’s growth is further supported by growing awareness among women regarding self-care and discreet treatment options.

Vaginal products are increasingly available through retail and online pharmacies, making them more accessible for consumers seeking convenience and privacy. As healthcare professionals emphasize patient-specific treatments, especially for recurrent or drug-resistant infections, the vaginal segment is expected to become a critical focus for drug manufacturers and investors alike.

| Route of Administration Segment | CAGR (2025 to 2035) |

|---|---|

| Vaginal | 6.2% |

The over-the-counter (OTC) segment in the vaginitis treatment drug market is expected to expand at a CAGR of 6.7% from 2025 to 2035. Increased consumer preference for self-care, combined with the rising availability of non-prescription antifungal and antibacterial treatments, is driving growth in this segment.

Products such as clotrimazole and miconazole-based creams, gels, and suppositories are commonly used to treat mild to moderate fungal infections without requiring a prescription. Women experiencing recurrent or mild symptoms often prefer OTC medications due to convenience, affordability, and privacy.

Pharmaceutical companies are responding by expanding OTC product lines and offering combination treatments with pH balancing and soothing agents. Enhanced packaging, telehealth consultations, and growing online availability via e-pharmacies and health apps are also fueling accessibility and market penetration.

Moreover, increasing awareness campaigns by health organizations and retail pharmacies are helping educate women about early symptom management, leading to quicker intervention and higher OTC uptake. While prescription treatments remain essential for more severe or resistant infections, the OTC segment is witnessing robust growth due to lifestyle changes and the desire for autonomy in health management. This trend is expected to continue, especially in North America, Europe, and parts of Asia.

| Prescription Type Segment | CAGR (2025 to 2035) |

|---|---|

| Over-The-Counter | 6.7% |

The mail order pharmacy segment is anticipated to grow at a CAGR of 7.1% from 2025 to 2035, making it the fastest-growing distribution channel in the vaginitis treatment drug market. With growing digitalization and changing consumer behavior, patients are increasingly shifting to online channels for privacy, convenience, and contactless access to medications.

Mail order pharmacies offer a discreet solution for patients seeking treatment for sensitive conditions such as bacterial vaginitis or yeast infections. This model supports both prescription and over-the-counter fulfillment with home delivery options, improving adherence and eliminating the stigma often associated with in-person purchases.

The segment is also being driven by expanding e-commerce platforms, partnerships between pharmaceutical companies and digital health players, and advancements in cold-chain logistics ensuring product quality. Subscriptions, auto-refill services, and mobile health tracking tools are being integrated to improve the patient experience and retention.

In regions with rising internet penetration and busy urban lifestyles, mail order services offer a time-saving alternative. Additionally, health insurers and pharmacy benefit managers are increasingly favoring mail-based services for cost efficiency. As demand for home healthcare grows and digital infrastructure matures, mail order pharmacies are expected to play a pivotal role in reshaping the drug distribution landscape.

| Distribution Channel Segment | CAGR (2025 to 2035) |

|---|---|

| Mail Order Pharmacies | 7.1% |

Increase in Recurrent Vaginitis Presents Opportunities

The escalating occurrence of recurrent vaginitis episodes presents a significant opportunity in the pharmaceutical sector. This trend prompts a demand surge for sustained or prophylactic treatment options capable of managing the condition over extended periods.

Responding to this, pharmaceutical firms strategically invest in research and development to formulate drugs tailored explicitly for recurrent vaginitis. They align their product portfolios with this lucrative segment to capture a larger share and drive revenue growth.

Telemedicine and eCommerce Channels Transform the Industry

The proliferation of telemedicine and e-commerce channels revolutionizes healthcare access and delivery mechanisms. These platforms facilitate remote consultations and online medication purchases, circumventing traditional distribution channels.

Consequently, patients can conveniently access vaginitis treatment drugs, driving sales volumes. This industry-wide shift accentuates pharmaceutical firms' importance in adapting distribution strategies to capitalize on emerging sales channels and maintain competitiveness.

Satisfying the Unmet Needs Can be Opportunistic

Despite the prevalence of vaginitis, extant treatment modalities exhibit shortcomings in efficacy, safety, and patient convenience. These shortcomings thereby emphasize a pronounced gap in the industry.

Pharmaceutical enterprises can capitalize on this unmet demand by innovating novel drug formulations targeting specific types of vaginitis, such as recurrent or atrophic variants.

The development of differentiated products can help in addressing these neglected niches. Firms can therefore garner a competitive advantage and capture greater share within the vaginitis treatment drug sector.

The vaginitis treatment drug industry recorded ample sales between 2020 and 2024. The industry size expanded at a 4.5% CAGR during this period. A jump from USD 2.5 billion in 2020 to USD 3.1 billion was observed in this period.

Shifts in healthcare policies and regulations have been pivotal for expansion in recent years. An increase in funding for women’s health initiatives is leading to more demand for these drugs.

Pharmaceutical companies keep investing in research and development for these, which helps the industry prosper. Changes in lifestyles have led to an increase in risk factors for developing vaginitis, leading to higher sales of vaginitis treatment drugs.

With these factors, the future outlook for this industry appears promising. Advancements in medical technology like drug delivery systems can be beneficial. Innovations are likely to lead to more effective and targeted therapies.

The vaginitis treatment drug market growth is estimated at 4.8% from 2025 to 2035. A rise in preventive healthcare and early intervention can be opportunistic for players. Improvements in healthcare infrastructure in emerging countries can lead to more demand and sales of these drugs.

This section covers the future forecast of the vaginitis treatment drug industry in the top three countries. Information on regions like North America, Europe, Asia Pacific, and others is granulated, focusing on the top countries.

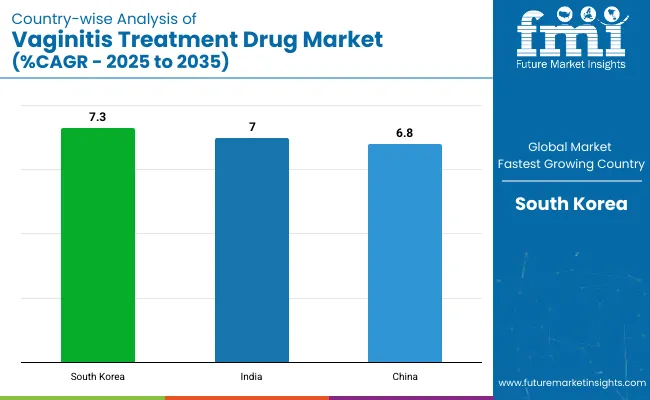

The analysis indicates that South Korea is at the forefront, expanding at a 7.3% CAGR until 2035. India and China follow with 7% and 6.8% CAGRs, respectively, indicating immense growth in the Asia Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

| India | 7% |

| China | 6.8% |

The demand for vaginitis treatment drugs in South Korea is set to amplify at a 7.3% CAGR until 2035. The fading societal stigma related to women's health concerns is leading to greater awareness and treatment-seeking behavior.

The government is focusing on enhancing accessibility and affordability to increase diagnosis and treatment rates for vaginitis. Concurrently, escalating healthcare expenditure, advanced healthcare infrastructure, and technological innovation have augmented diagnostic and therapeutic capabilities.

These developments are fostering a more robust landscape for growth and prosperity for players. Moreover, greater female workforce participation has created a deeper appreciation for women's health issues.

This focus is driving heightened demand for vaginitis treatment drugs among working women keen on safeguarding their well-being.

The vaginitis treatment drug market growth in India is estimated at a 7% CAGR till 2035. Rising female literacy and empowerment cause an increased demand for vaginitis treatment drugs, as women gain autonomy in healthcare decisions.

This trend reflects a shift toward greater health consciousness among the female demographic, stimulating growth. Government and NGO initiatives targeting rural healthcare like Mahila Shakti Kendra and the Women Helpline Scheme bolster expansion by improving access to treatment drugs in underserved regions.

Economic growth and urbanization fuel lifestyle changes associated with higher vaginitis prevalence, particularly in urban areas, further propelling demand for treatment options.

Additionally, government health programs promote maternal and reproductive health in India. The advent of telemedicine and digital health platforms enhances accessibility to vaginitis treatment drugs, fostering the industry’s growth nationwide.

The demand for vaginitis treatment drugs in China is set to rise at a 6.8% CAGR until 2035. China's aging population presents both opportunities and challenges in the healthcare sector. This is particularly evident given the prevalence of age-related conditions like atrophic vaginitis.

This demographic shift drives demand for specialized vaginitis treatment drugs tailored to older women's needs. Additionally, the integration of Traditional Chinese Medicine (TCM) remedies for gynecological conditions like vaginitis complements conventional pharmaceuticals, catering to diverse consumer preferences.

China's flourishing e-commerce and digital health sectors further enhance accessibility by facilitating online access to medical information and vaginitis treatment drugs.

This digital transformation expands reach, particularly among younger generations accustomed to online shopping. This accessibility contributes to sustained expansion and growth in China's healthcare landscape.

The vaginitis treatment drug industry is competitive, with firms such as Pfizer, Bayer, and Sanofi dominating.

These businesses use their substantial research and development capabilities and global reach to develop innovative medicine formulations and increase sales.

Mid-sized firms like Novartis and AstraZeneca, as well as generic manufacturers, all contribute to the landscape. Product efficacy, cost tactics, regulatory compliance, and marketing activities are all key factors in competition. Strategic collaboration and alliances with healthcare organizations are critical for entering this landscape.

Recent Developments

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.49 billion |

| Projected Market Size (2035) | USD 5.58 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| By Drug | Nitroimidazole Compounds, Lincosamide Antibiotics, Triazoles, Imidazoles |

| By Indication | Bacterial Vaginitis, Fungal Vaginitis (Yeast Infection), Trichomoniasis, Others (Atrophic Vaginitis, Viral Vaginitis, Parasitic Infections, Non-infectious Vaginitis) |

| By Route of Administration | Oral, Cutaneous, Vaginal |

| By Prescription Type | Prescription, Over-The-Counter |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Mail Order Pharmacies |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | South Korea, India, China |

| Key Players | Pfizer Inc., Mylan NV, Novartis AS, Bayer AG, Sanofi S.A., Lupin Pharmaceuticals, Dr Reddy's Laboratories Ltd, Cipla Ltd., Sun Pharmaceutical Industries Limited |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market fragments into Nitroimidazole Compounds, Lincosamide Antibiotics, Triazoles, and Imidazoles.

The industry is trifurcated into Bacterial Vaginitis, Fungal Vaginitis (Yeast Infection), and Trichomoniasis.

The industry is trifurcated into Oral Vaginitis Treatment Drugs, Cutaneous Vaginitis Treatment Drugs, and Vaginal Vaginitis Treatment Drugs.

The sector bifurcated into Prescription Vaginitis Treatment Drugs (Rx) and Over-the-counter Vaginitis Treatment Drugs (OTC).

The industry is segmented into Hospital Pharmacies, Retail Pharmacies, Drug Stores, and Mail Order Pharmacies.

Analysis of the market has been conducted in the countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA).

The global vaginitis treatment drug market is forecasted to reach USD 5.58 billion by 2035, growing from USD 3.49 billion in 2025, at a CAGR of 4.8% during the forecast period.

The nitroimidazole compound segment is projected to dominate the market with a 44.1% share in 2025, driven by its broad-spectrum efficacy, affordability, and widespread clinical use in treating bacterial vaginosis and trichomoniasis.

Bacterial vaginosis is expected to lead with a 51.8% market share in 2025, supported by its high recurrence rate, association with reproductive complications, and growing diagnosis rates among women of reproductive age.

The vaginal segment is anticipated to grow at a CAGR of 6.2% from 2025 to 2035, owing to its localized treatment benefits, reduced side effects, and increasing availability of pH-balanced and extended-release formulations.

Mail order pharmacies are projected to expand at a CAGR of 7.1% through 2035, driven by growing consumer demand for privacy, digital prescription fulfillment, and convenience in accessing sensitive treatment drugs.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Candida Vaginitis Rapid Testing Market

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA