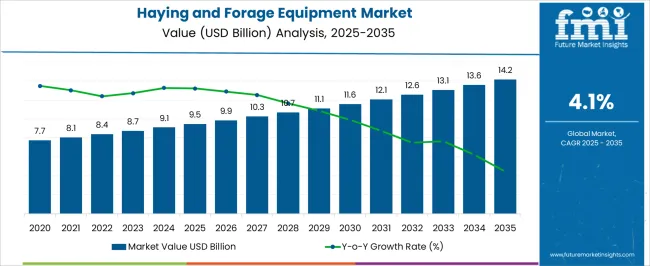

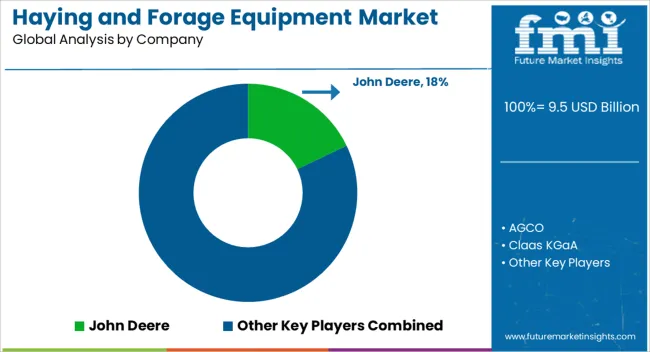

The haying and forage equipment market is projected to grow from USD 9.5 billion in 2025 to USD 14.2 billion by 2035, representing a CAGR of 4.1%. This growth corresponds to an absolute dollar opportunity of USD 4.7 billion over the decade. Expansion is driven by steady demand in livestock farming and commercial agriculture, where reliable and efficient forage handling is critical.

Companies can capitalize on this growth by enhancing manufacturing capacity, optimizing distribution networks, and improving service support. Early investments in market presence and partnerships with agricultural equipment suppliers allow stakeholders to capture a meaningful share of the expanding market. Over the next ten years, the USD 4.7 billion opportunity highlights a consistent and attractive growth trajectory for the haying and forage equipment market.

By 2035, revenue will be supported by both the replacement of older equipment and new installations in growing livestock and forage operations. The CAGR of 4.1% indicates moderate but steady expansion, enabling firms to scale operations efficiently and strengthen regional reach. Companies can align sales, service, and distribution strategies with market demand to maximize returns. The absolute growth potential provides a clear incentive for businesses to maintain operational efficiency while capturing incremental revenue throughout the forecast period.

| Metric | Value |

|---|---|

| Haying and Forage Equipment Market Estimated Value in (2025 E) | USD 9.5 billion |

| Haying and Forage Equipment Market Forecast Value in (2035 F) | USD 14.2 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

In the early growth phase of the haying and forage equipment market, revenue expands gradually from USD 9.5 billion in 2025, reflecting a CAGR of 4.1%. Growth during this period is primarily driven by initial adoption in livestock farms and commercial forage operations. Companies focus on building distribution channels, establishing service networks, and forming partnerships with agricultural equipment suppliers. The absolute dollar opportunity in this phase is moderate, allowing firms to refine production, optimize operations, and gather market feedback. Early growth lays the foundation for scaling, enabling businesses to secure market share and ensure steady revenue capture before entering the late growth stage.

In the late growth phase, approaching 2035 and a market size of USD 14.2 billion, the haying and forage equipment market experiences more noticeable revenue expansion due to broader adoption and replacement of older equipment. Market strategies shift toward scaling production, expanding regional reach, and leveraging established customer relationships.

The absolute dollar opportunity in this stage is significant, representing most of the USD 4.7 billion growth over the decade. Companies benefit from operational efficiencies and strong brand recognition, ensuring the 4.1% CAGR translates into consistent, profitable growth. Late growth reflects a mature stage where market share optimization and service reliability are key for long-term success.

The haying and forage equipment market is gaining momentum due to rising demand for high-quality livestock feed, mechanized farming practices, and precision agriculture. Farmers are increasingly prioritizing equipment that boosts operational efficiency and reduces manual labor, especially as rural labor availability declines.

Government subsidies, rising cattle populations, and the expansion of dairy and meat industries have driven mechanization in forage management. The adoption of modern equipment such as automatic balers and smart mowers is transforming field operations, reducing harvest loss, and improving feed preservation.

Technological integrations, including IoT-based sensors and GPS-enabled automation, are expected to further accelerate the market, particularly in North America and Europe.

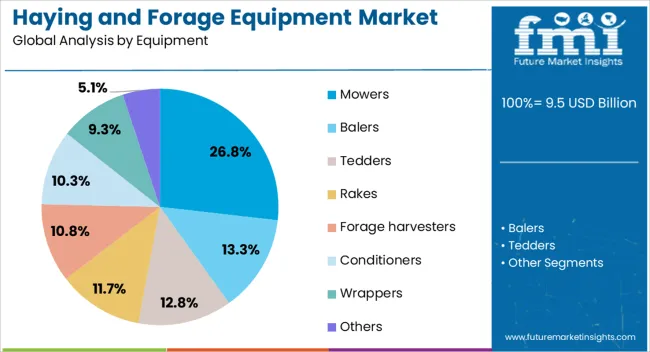

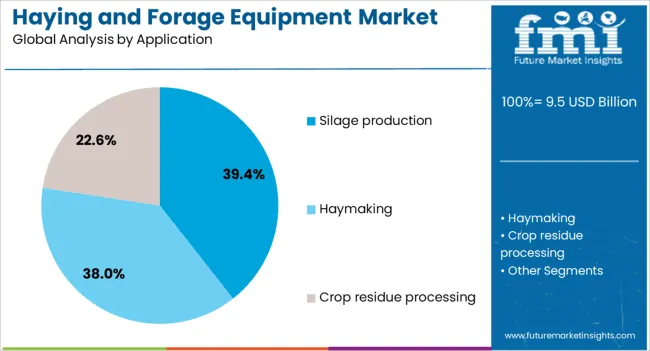

The haying and forage equipment market is segmented by equipment, application, operation, and geographic regions. By equipment, haying and forage equipment market is divided into Mowers, Balers, Tedders, Rakes, Forage harvesters, Conditioners, Wrappers, and Others. In terms of application, haying and forage equipment market is classified into Silage production, Haymaking, and Crop residue processing.

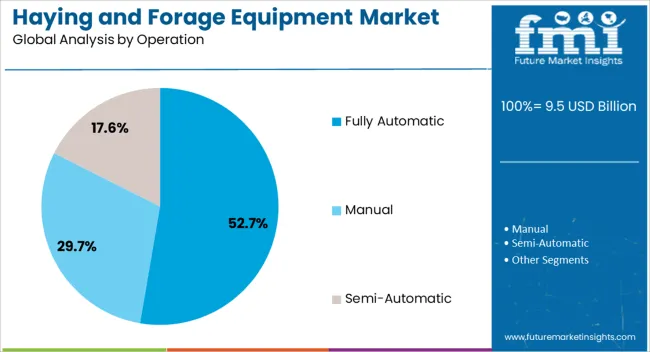

Based on operation, haying and forage equipment market is segmented into Fully Automatic, Manual, and Semi-Automatic. Regionally, the haying and forage equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Mowers are anticipated to lead the haying and forage equipment segment with a 26.8% share by 2025. Their dominance stems from their essential role in initial forage processing, where uniform cutting height and speed significantly influence forage quality.

Technological advancements have introduced disc and drum mowers with enhanced maneuverability, enabling farmers to cover larger fields with minimal energy use. Increased emphasis on forage quality and reduced drying time has made high-performance mowers a core investment in both small- and large-scale operations.

Their compatibility with tractors and other attachments further extends their utility, cementing their market leadership.

Silage production is projected to capture 39.4% of the haying and forage equipment market by 2025, making it the top application segment. This growth is fueled by the rising need to ensure year-round livestock feed supply, especially during non-harvest seasons.

Silage helps preserve essential nutrients and moisture content, and its production requires reliable and efficient harvesting, chopping, and compacting machinery. Farmers across regions with intensive dairy and beef industries are prioritizing equipment optimized for rapid and hygienic silage processing.

The scalability of silage production has further encouraged investments in automated balers, silage choppers, and wrappers, supporting segment expansion.

Fully automatic equipment is expected to account for 52.7% of market share by 2025, leading the operational mode category. The segment’s dominance reflects the industry's shift toward precision farming, labor savings, and productivity maximization.

These machines offer features such as sensor-based crop monitoring, automated cutting and collection, and in-cab control interfaces, allowing seamless operations with minimal human intervention. Farmers are adopting these systems to increase throughput, improve forage consistency, and reduce downtime.

As the cost of automation continues to decline and the ROI becomes clearer, fully automatic solutions are gaining strong traction across both developed and emerging agricultural economies.

The haying and forage equipment market is growing as livestock farmers and commercial agricultural operators increasingly adopt mechanized solutions for harvesting, processing, and storing forage crops. Equipment such as balers, mowers, tedders, rakes, and forage harvesters improves efficiency, reduces labor costs, and maintains feed quality. Rising demand for dairy, beef, and other livestock products is driving adoption globally.

Manufacturers offering durable, high-capacity, and technologically advanced equipment with features like precision cutting, automation, and energy efficiency are well-positioned to capture opportunities across small farms, large-scale operations, and commercial agricultural enterprises. Integration with GPS-guided and IoT-enabled machinery further enhances operational productivity and farm management.

Market growth is constrained by the high cost of advanced haying and forage equipment and the complexity of operation. Large balers, forage harvesters, and automated tedders require significant capital investment, limiting adoption by small-scale farmers. Operators must also manage maintenance tasks such as lubrication, blade sharpening, hydraulic servicing, and periodic calibration to ensure optimal performance.

Improper operation or lack of training can reduce efficiency, damage crops, or shorten equipment lifespan. Manufacturers are addressing these challenges by offering financing solutions, user-friendly interfaces, modular designs, and operator training programs to reduce barriers to adoption and encourage wider utilization of mechanized haying and forage systems.

Market trends are shaped by the integration of precision farming technologies, automation, and IoT-enabled monitoring in haying and forage equipment. GPS-guided mowers, automated balers, and real-time moisture monitoring systems improve harvesting accuracy, reduce crop loss, and optimize field productivity. Remote monitoring and data collection enable operators to track equipment performance, maintenance schedules, and crop conditions.

Smart features enhance operational efficiency, reduce labor requirements, and support sustainable farming practices. These trends highlight the growing demand for technologically advanced, connected equipment that enhances productivity, ensures consistent forage quality, and enables data-driven farm management across commercial and smallholder agricultural operations globally.

Opportunities in the haying and forage equipment market are driven by increasing livestock production, commercial farming, and adoption of mechanization. Expanding dairy, beef, and sheep farming operations require efficient forage harvesting and storage solutions. Emerging markets with growing agricultural mechanization programs present additional demand. Farmers seek durable, high-capacity equipment to maintain feed quality, reduce labor dependency, and increase operational efficiency.

Manufacturers providing reliable, energy-efficient, and technologically advanced haying and forage equipment with strong after-sales support are well-positioned to capture growth. Government initiatives promoting farm mechanization and sustainable agricultural practices further accelerate adoption across small-scale and commercial livestock farming operations globally.

Market growth is restrained by maintenance requirements, seasonal demand fluctuations, and competitive pressures. Haying and forage equipment requires regular servicing, blade replacement, and hydraulic system maintenance, which can be resource-intensive. Seasonal crop cycles create periods of high demand followed by idle equipment, affecting cash flow and utilization rates. Competition from regional manufacturers and low-cost equipment providers puts pressure on pricing and market share for premium brands. Additionally, differences in farm size, terrain, and crop type require specialized equipment configurations, limiting standardized adoption. Until operational costs are reduced, seasonal demand is managed, and equipment differentiation is emphasized, market adoption may remain concentrated in large-scale commercial farms and progressive agricultural operations.

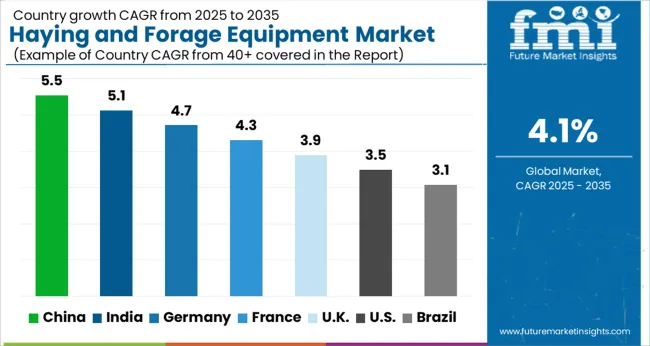

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global haying and forage equipment market is projected to grow at a CAGR of 4.1% through 2035, driven by demand across livestock farms, commercial feed operations, and agricultural cooperatives. Among BRICS nations, China has been recorded with 5.5% growth, where production and deployment of balers, mowers, and rakes have been extensively carried out by companies such as Foton Lovol, YTO Group, and Zoomlion. India has been observed at 5.1%, supported by rising adoption in dairy farms, cooperative feed production, and smallholder livestock operations. In the OECD region, Germany has been measured at 4.7%, where production for mechanized forage harvesting and silage preparation has been steadily maintained. The United Kingdom has been noted at 3.9%, reflecting moderate use in livestock farms and hay production, while the USA has been recorded at 3.5%, with deployment in commercial and industrial-scale forage operations being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The market for haying and forage equipment in China is expanding at a CAGR of 5.5%, driven by the growing livestock sector, commercial farming expansion, and modernization of agricultural practices. Manufacturers supply mowers, balers, rakes, and forage harvesters to enhance efficiency in hay production and animal feed management. Government initiatives promoting agricultural mechanization, livestock productivity, and rural development encourage adoption. Pilot projects on large-scale farms demonstrate operational benefits including improved harvesting efficiency, reduced labor requirements, and better forage quality. Collaborations between equipment manufacturers, agricultural research institutions, and cooperative farming enterprises are advancing machine durability, precision, and automation. Increasing demand for livestock feed and mechanized farming solutions continues to drive the Chinese haying and forage equipment market.

The market for haying and forage equipment in India is growing at a CAGR of 5.1%, supported by increased livestock production, commercial agriculture adoption, and modernization of feed harvesting practices. Manufacturers provide mowers, balers, rakes, and forage harvesters to improve productivity and reduce labor dependency. Government programs promoting agricultural mechanization, dairy sector growth, and rural development foster adoption. Pilot deployments on farms demonstrate operational benefits including faster hay collection, improved forage quality, and optimized feed management. Collaborations between equipment manufacturers, agritech firms, and research institutes are enhancing machine efficiency, durability, and ease of operation. Expanding livestock and commercial farming sectors continue to drive growth in the Indian market.

The market for haying and forage equipment in Germany is recording a CAGR of 4.7%, supported by the dairy industry, commercial farming, and mechanized forage harvesting practices. Manufacturers supply high-precision mowers, balers, and forage harvesters for efficient hay collection and feed quality management. Government programs promoting agricultural sustainability, mechanization, and energy-efficient farming foster adoption. Pilot projects in dairy and livestock farms demonstrate operational benefits including faster harvesting, better forage preservation, and reduced labor intensity. Collaborations between equipment manufacturers, research institutions, and cooperative farms are enhancing machine precision, durability, and energy efficiency. Germany’s emphasis on sustainable and mechanized agriculture sustains growth in the haying and forage equipment market.

The market for haying and forage equipment in the United Kingdom is growing at a CAGR of 3.9%, driven by livestock farming, commercial agriculture, and mechanized feed harvesting requirements. Manufacturers supply mowers, balers, rakes, and forage harvesters to optimize hay production and feed quality. Government programs promoting agricultural modernization, rural development, and sustainable livestock practices support adoption. Pilot deployments on livestock farms demonstrate operational benefits including faster harvesting, improved forage quality, and lower labor needs. Collaborations between equipment manufacturers, research institutes, and farming cooperatives enhance machine durability, performance, and operational efficiency. Expanding livestock and commercial farming activities continue to support market growth in the United Kingdom.

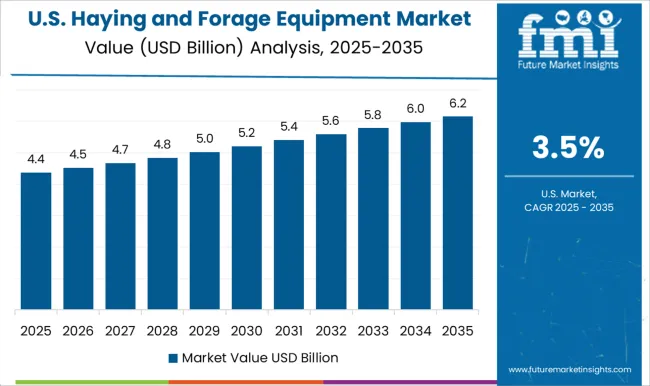

The market for haying and forage equipment in the United States is expanding at a CAGR of 3.5%, fueled by livestock production, commercial farming, and mechanized forage harvesting. Manufacturers supply mowers, balers, rakes, and forage harvesters for efficient hay collection and animal feed management. Government programs supporting agricultural mechanization, dairy and livestock development, and rural infrastructure encourage adoption. Pilot implementations on farms demonstrate operational benefits including faster harvesting, better forage preservation, and reduced labor intensity. Collaborations between equipment manufacturers, agritech firms, and research institutions enhance machine durability, efficiency, and precision. Expanding commercial farming and livestock sectors continue to drive the United States haying and forage equipment market.

John Deere, AGCO Corporation, and Claas KGaA supply haying and forage equipment, including balers, mowers, and rakes, with brochures highlighting cutting width, bale density, and crop adaptability. CNH Industrial and Kongskilde provide forage harvesting machines, with technical literature detailing pick-up width, rotor speed, and PTO compatibility. Krone and Kubota offer large-scale and compact equipment for commercial and smallholder operations, with brochures presenting operational efficiency, material handling capacity, and maintenance intervals.

Kuhn Group and Morra Group focus on modular forage solutions, with datasheets emphasizing multi-crop adaptability, bale formation consistency, and serviceability. Tonutti-Wolagri provides specialized forage machines with literature highlighting rotor configuration, cutting precision, and modular attachments. Other regional players compete through cost-efficient machines, localized service support, and tailored equipment configurations for diverse crop types and field conditions. Market strategies focus on efficiency, durability, and operational versatility.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.5 Billion |

| Equipment | Mowers, Balers, Tedders, Rakes, Forage harvesters, Conditioners, Wrappers, and Others |

| Application | Silage production, Haymaking, and Crop residue processing |

| Operation | Fully Automatic, Manual, and Semi-Automatic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | John Deere, AGCO, Claas KGaA, CNH Industrial, Kongskilde, Krone, Kubota, Kuhn Group, Morra Group, and Tonutti-Wolagri |

| Additional Attributes | Dollar sales by type including balers, mowers, rakes, and forage harvesters, application across livestock farming, dairy farms, and commercial forage production, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for efficient feed production, mechanization in agriculture, and increasing livestock population. |

The global haying and forage equipment market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the haying and forage equipment market is projected to reach USD 14.2 billion by 2035.

The haying and forage equipment market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in haying and forage equipment market are mowers, balers, tedders, rakes, forage harvesters, conditioners, wrappers and others.

In terms of application, silage production segment to command 39.4% share in the haying and forage equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA