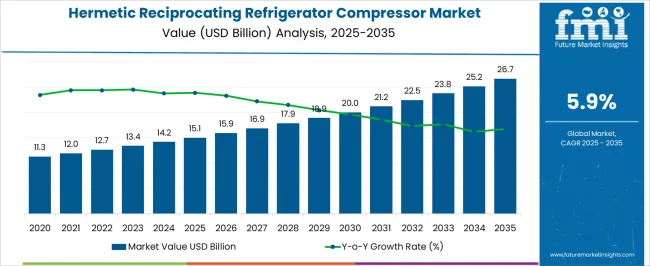

The hermetic reciprocating refrigerator compressor market is estimated to be valued at USD 15.1 billion in 2025 and is projected to reach USD 26.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. Asia-Pacific is projected to maintain a dominant position in the market, driven by large-scale refrigerator production, rising adoption of energy-efficient appliances, and expansion of cold chain infrastructure.

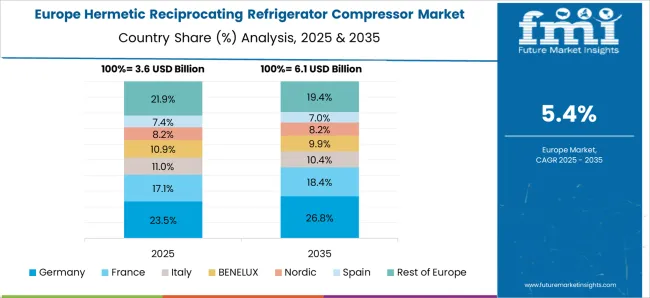

The region’s low manufacturing costs and strong OEM presence contribute to a higher share of both production and consumption, resulting in a consistent year-on-year growth trajectory that significantly outpaces other regions. Europe exhibits moderate growth, fueled by stringent energy efficiency regulations and the replacement demand for residential and commercial refrigeration units. The adoption of environmentally friendly refrigerants and compliance with EU directives further accelerate market penetration, although slower industrial growth and higher capital costs temper overall expansion.

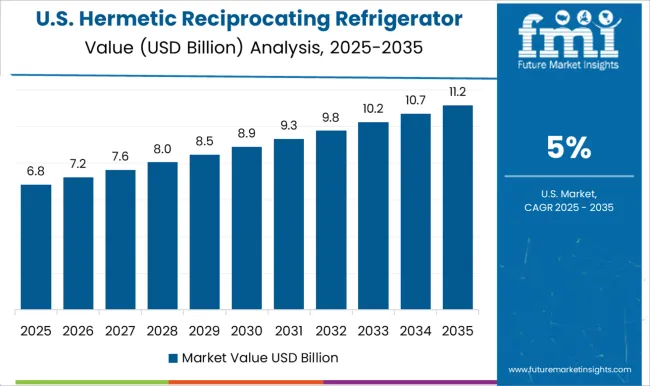

North America demonstrates steady yet comparatively restrained growth, influenced by mature appliance markets and slower replacement cycles, though regulatory frameworks such as ENERGY STAR compliance support gradual uptake. The progression from USD 15.1 billion in 2025 to USD 26.7 billion in 2035 reflects that Asia-Pacific contributes the majority of incremental value, while Europe and North America share a smaller portion of market gains. This regional distribution indicates a market concentrated in high-volume manufacturing and emerging consumption regions, with regulatory environments and appliance replacement patterns shaping adoption disparities across geographies.

| Metric | Value |

|---|---|

| Hermetic Reciprocating Refrigerator Compressor Market Estimated Value in (2025 E) | USD 15.1 billion |

| Hermetic Reciprocating Refrigerator Compressor Market Forecast Value in (2035 F) | USD 26.7 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The hermetic reciprocating refrigerator compressor market represents a specialized segment within the global refrigeration and cooling equipment industry, emphasizing energy efficiency, reliability, and compact design. Within the broader refrigeration equipment sector, it accounts for about 6.1%, driven by demand from household, commercial, and industrial refrigeration applications. In the compressor and cooling systems segment, its share is approximately 5.7%, reflecting reliance on hermetically sealed reciprocating technology for noise reduction and leak prevention.

Across the household appliances and commercial refrigeration market, it holds around 4.9%, supporting refrigerators, freezers, and cold storage units. Within the HVAC and thermal management equipment category, it represents 4.3%, highlighting its role in maintaining optimal cooling performance and energy consumption.

In the industrial refrigeration and food processing sector, the market contributes about 3.8%, emphasizing durability, compliance with environmental regulations, and low-maintenance operation. Recent developments in this market have focused on efficiency improvements, eco-friendly refrigerants, and digital monitoring integration. Innovations include low-vibration, high-capacity compressors with optimized motor designs, and the adoption of R600a and other low-GWP refrigerants to reduce environmental impact. Key players are collaborating with appliance manufacturers and energy solution providers to enhance reliability, reduce energy consumption, and meet evolving regulatory standards.

Adoption of smart compressor systems with IoT-enabled monitoring and predictive maintenance is gaining traction to minimize downtime and improve lifecycle performance. The noise reduction technologies and compact designs are being deployed for residential and commercial applications.

The hermetic reciprocating refrigerator compressor market is witnessing accelerated growth, supported by the rising demand for compact, energy-efficient, and cost-effective refrigeration solutions across domestic and light commercial applications. The ability of hermetic reciprocating compressors to provide stable performance in varying temperature conditions and their relatively lower maintenance requirements are positioning them as a preferred choice for refrigerator manufacturers. The increasing penetration of energy-efficient appliances in emerging economies and the growing replacement rate in mature markets are contributing to rising unit demand.

Regulatory bodies across major regions are enforcing stringent energy consumption norms, driving innovation toward compressors with higher cooling performance and coefficient of performance values. Technological improvements in component design, lubricant quality, and internal motor efficiency are enhancing the performance reliability of hermetic systems.

Additionally, the continued shift toward inverter-based appliances is boosting demand for compressors that can adapt to variable speed operations As end-user preferences evolve toward sustainable and high-performing appliances, the hermetic reciprocating compressor market is expected to expand steadily, supported by investments in R&D and next-generation manufacturing capabilities.

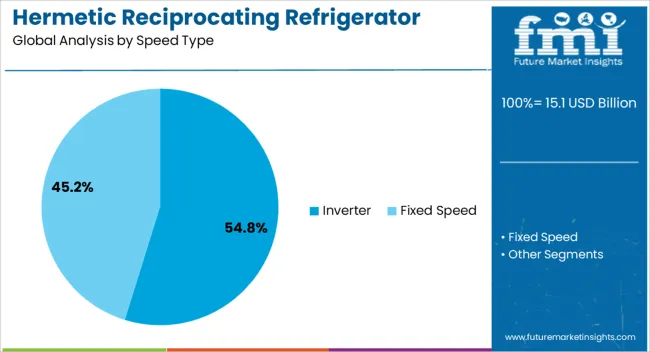

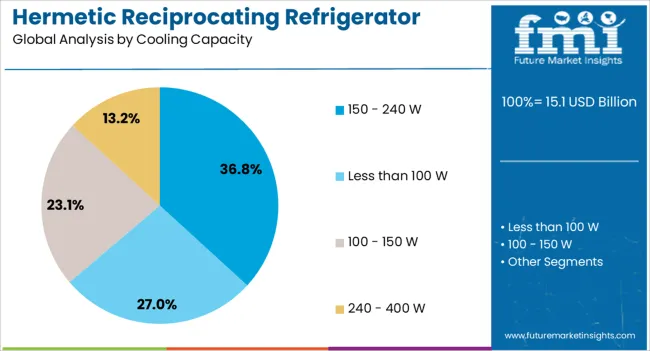

The hermetic reciprocating refrigerator compressor market is segmented by speed type, cooling capacity, cop range, application, and geographic regions. By speed type, hermetic reciprocating refrigerator compressor market is divided into Inverter and Fixed Speed. In terms of cooling capacity, hermetic reciprocating refrigerator compressor market is classified into 150 - 240 W, Less than 100 W, 100 - 150 W, and 240 - 400 W.

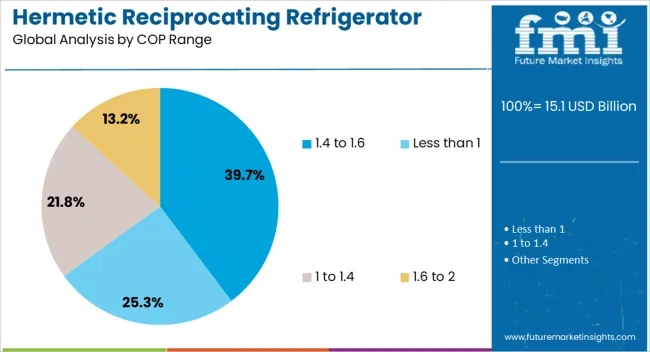

Based on cop range, hermetic reciprocating refrigerator compressor market is segmented into 1.4 to 1.6, Less than 1, 1 to 1.4, and 1.6 to 2. By application, hermetic reciprocating refrigerator compressor market is segmented into Domestic and Commercial. Regionally, the hermetic reciprocating refrigerator compressor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inverter speed type segment is projected to hold 54.8% of the hermetic reciprocating refrigerator compressor market revenue share in 2025, making it the leading segment by speed type. This dominance is being driven by the increasing preference for energy-saving refrigeration appliances that offer adaptive cooling and reduced power consumption. Inverter technology allows compressors to operate at variable speeds based on load conditions, minimizing energy wastage and enabling quieter operation.

Manufacturers are incorporating inverter-based designs to comply with energy efficiency labeling systems and government-mandated environmental standards. The segment is further benefiting from growing consumer awareness regarding electricity savings and the rising adoption of smart appliances that demand responsive compressor control. With better temperature regulation, longer lifespan, and lower noise output, inverter compressors are gaining traction in both residential and commercial refrigeration units.

The expanding middle class and demand for feature-rich appliances in developing economies are expected to further support this segment’s growth. As technological maturity and cost-competitiveness improve, inverter compressors are likely to maintain a leading role in the global market.

The 150 to 240 W cooling capacity segment is anticipated to account for 36.8% of the hermetic reciprocating refrigerator compressor market revenue share in 2025, making it the most prominent range in cooling capacity. This leadership is being supported by its optimal suitability for compact and mid-sized refrigeration systems, particularly in single-door and double-door domestic refrigerators. Compressors within this capacity range offer an effective balance between performance, energy efficiency, and compact design, making them ideal for the majority of household applications.

The segment is further strengthened by its adaptability to varying refrigerant types and its widespread adoption in regions with high residential refrigerator demand. Increasing consumer expectations for faster cooling and consistent temperature control are being met through advancements in internal motor and valve technologies within this power range.

Additionally, product offerings within this segment are being aligned with global energy rating standards, making them the default choice for OEMs targeting compliance and cost-efficiency. As demand grows for high-efficiency yet compact systems, this cooling capacity range is expected to remain dominant.

The 1.4 to 1.6 coefficient of performance range is projected to represent 39.7% of the hermetic reciprocating refrigerator compressor market revenue share in 2025, establishing itself as the most preferred COP category. This dominance is attributed to the segment’s ability to deliver an efficient balance between energy input and cooling output, ensuring optimal operating cost and performance. Compressors within this COP range are increasingly favored in mainstream residential and light commercial appliances where reliability, cost-effectiveness, and regulatory compliance are key.

The rise in eco-conscious consumer behavior and government initiatives to promote energy-efficient appliances are contributing to the adoption of units falling within this range. Technological upgrades such as advanced compression chambers, low-friction materials, and precision control of refrigerant flow are enabling consistent achievement of performance in this efficiency band.

Manufacturers are designing compressor models specifically to meet global minimum efficiency performance standards, making this range the most accessible and scalable. As both manufacturers and consumers prioritize energy-efficient solutions, the 1.4 to 1.6 COP segment is expected to maintain its strong market positioning.

The market has been growing as refrigeration and cold storage demand rises across residential, commercial, and industrial applications. These compressors, which are fully sealed units, offer high reliability, reduced leakage, and lower maintenance requirements. They are widely deployed in household refrigerators, commercial coolers, beverage vending machines, and medical storage units due to their energy efficiency and compact design. The market has been influenced by increasing urban populations, rising demand for food preservation solutions, and expansion of cold chain infrastructure. Technological improvements in noise reduction, vibration control, and refrigerant compatibility have enhanced performance.

Hermetic reciprocating compressors have increasingly focused on energy efficiency and environmentally safe operation to meet regulatory and consumer expectations. Advanced design techniques, including optimized compression cycles and low-friction components, reduce energy consumption and operational costs. Compatibility with modern refrigerants such as R600a and R134a ensures lower greenhouse gas emissions while maintaining cooling performance. Integration of electronic controls allows precise temperature management, further enhancing energy efficiency. Manufacturers are investing in research to develop compressors with reduced heat loss, improved insulation, and variable speed operation. These energy-efficient designs are crucial in regions with high electricity costs and stringent environmental regulations, supporting adoption across residential and commercial refrigeration applications while promoting sustainable cooling solutions.

The compact, hermetically sealed design of reciprocating compressors has been a key factor in their widespread adoption. Sealing of the motor and compressor unit prevents refrigerant leakage, enhances operational reliability, and reduces maintenance frequency. Compact designs facilitate installation in confined spaces such as domestic refrigerators and small commercial units. Vibration damping, noise reduction mechanisms, and robust construction improve user experience and durability. The sealed architecture also reduces contamination risks and ensures consistent cooling performance under varying load conditions. These features make hermetic reciprocating compressors suitable for diverse applications, from food and beverage storage to pharmaceutical refrigeration, driving steady demand and encouraging investment in design improvements for enhanced lifecycle performance.

The expansion of cold chain logistics has been a significant driver for the hermetic reciprocating compressor market. Rising demand for perishable food, pharmaceuticals, and frozen goods necessitates reliable refrigeration units with consistent performance. Compressors are critical components in walk-in coolers, refrigerated transport, and medical storage units, ensuring temperature-sensitive products maintain quality and safety standards. Commercial and industrial sectors are increasingly adopting energy-efficient hermetic compressors to minimize operational costs while complying with environmental regulations. The growth of e-commerce and online grocery sectors has further intensified the need for cold storage solutions. This trend has prompted manufacturers to offer high-capacity, durable compressors capable of continuous operation in demanding commercial environments.

Despite their advantages, hermetic reciprocating compressors face operational and maintenance challenges that impact market dynamics. Sealed units, while reducing leakage, limit the ability to repair or replace internal components, often necessitating full unit replacement in case of failure. Wear of moving parts, lubrication issues, and refrigerant compatibility concerns can reduce compressor lifespan. Industrial and commercial applications with high duty cycles may experience performance degradation over time, affecting cooling efficiency. Manufacturers are addressing these issues by improving materials, enhancing lubrication systems, and offering modular solutions. The training for maintenance personnel and adoption of preventive maintenance practices are critical to ensure reliability, reduce downtime, and maximize operational efficiency across applications.

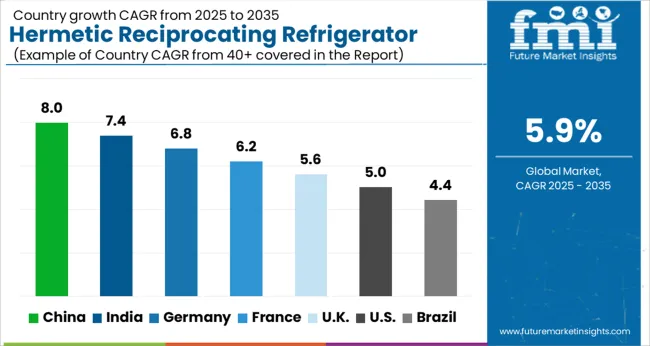

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The market is projected to grow at a CAGR of 5.9% between 2025 and 2035. India recorded 7.4%, driven by rising domestic appliance production and adoption of energy-efficient technologies. Germany reached 6.8%, reflecting advanced engineering capabilities and strong refrigeration manufacturing sectors. China led with 8.0% due to high-volume production and expanding consumer demand. The United Kingdom reached 5.6%, supported by steady industrial output and market integration. The United States recorded 5.0%, showing gradual adoption and technological investments in refrigeration solutions. These regions are actively scaling, engineering, and innovating in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.0%, driven by expansion in residential and commercial refrigeration, cold chain logistics, and food storage industries. Adoption is reinforced by demand for energy-efficient, low-noise, and reliable compressors for household and commercial refrigeration units. Domestic manufacturers focus on compact, durable, and high performance reciprocating compressors. Increasing cold chain infrastructure to support food and pharmaceutical distribution further boosts market potential. Integration of advanced control systems enhances efficiency and reduces operational downtime.

India is expected to grow at a CAGR of 7.4%, supported by growth in household appliance demand, cold storage facilities, and commercial refrigeration. Adoption is reinforced by the need for efficient, low maintenance, and environmentally compliant compressors. Domestic and international players supply compact and high-performance compressors with improved energy efficiency and noise reduction. Growth in the organized food retail and pharmaceutical sectors increases adoption of commercial refrigeration solutions.

Germany is forecast to grow at a CAGR of 6.8%, driven by energy efficient and environmentally compliant refrigeration solutions in industrial, commercial, and residential sectors. Adoption is reinforced by demand for low noise, high performance, and durable reciprocating compressors. Manufacturers emphasize eco-friendly refrigerant compatibility and precision engineering to meet EU regulations. Replacement and modernization of older refrigeration units sustain consistent growth.

The United Kingdom is projected to grow at a CAGR of 5.6%, supported by adoption in household appliances, food and beverage cold storage, and pharmaceutical applications. Demand is reinforced by the need for energy efficient and reliable compressors with low maintenance requirements. Manufacturers emphasize compliance with environmental and noise regulations while offering compact and high performance units for domestic and commercial usage.

The United States is projected to grow at a CAGR of 5.0%, driven by demand for efficient refrigeration in residential, commercial, and industrial sectors. Adoption is reinforced by replacement of aging systems and integration of energy efficient and low noise compressors. Manufacturers focus on compliance with environmental regulations, durability, and reduced operational costs. Expansion of cold chain logistics and commercial refrigeration infrastructure supports steady market growth.

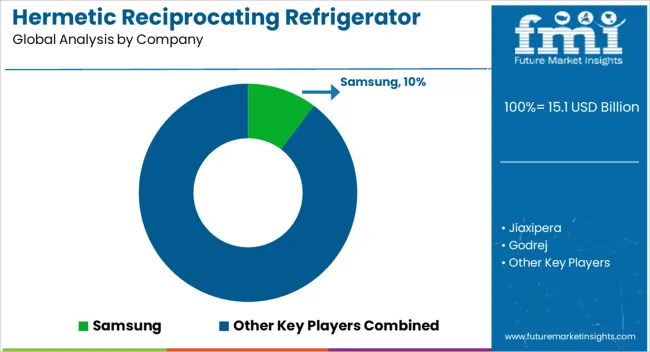

The market features a blend of global appliance giants and specialized compressor manufacturers focused on energy-efficient, durable, and low-noise refrigeration solutions. Samsung and Panasonic are at the forefront, integrating advanced reciprocating compressors into high-performance domestic and commercial refrigerators, leveraging proprietary technologies for energy efficiency and reliability. TECUMSEH, Embraco, Secop GmbH, and GMCC serve as major specialized compressor providers, offering robust, hermetically sealed solutions for both residential and industrial refrigeration, emphasizing long service life, low vibration, and minimal maintenance. Godrej, Huayi, and Kulthorn combine local manufacturing strength with innovation to cater to emerging markets, providing cost-effective yet efficient compressor solutions.

Other players such as Jiaxipera, Donper, Qianjiang, Walton, Arcelik, Cubigel, Zanussi, Sikelan, Taizhou Meilile, Chunlan, Anoudan, and Comptek, Inc. contribute to market diversity, addressing regional and niche requirements with customizable specifications and localized service networks. The market remains highly competitive, driven by innovations in energy efficiency, refrigerant compatibility, and noise reduction, with manufacturers differentiating themselves through durability, cost-effectiveness, and integration with smart appliance systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.1 Billion |

| Speed Type | Inverter and Fixed Speed |

| Cooling Capacity | 150 - 240 W, Less than 100 W, 100 - 150 W, and 240 - 400 W |

| COP Range | 1.4 to 1.6, Less than 1, 1 to 1.4, and 1.6 to 2 |

| Application | Domestic and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Samsung, Jiaxipera, Godrej, Panasonic, TECUMSEH, Embraco, Kulthorn, Huayi, Secop GmbH, GMCC, Donper, Qianjiang, Siberia, Anoudan, Walton, Arcelik, Cubigel, Zanussi, Sikelan, Taizhou Meilile, Chunlan, and Comptek, Inc. |

| Additional Attributes | Dollar sales by compressor type and application, demand dynamics across residential, commercial, and industrial refrigeration, regional trends in energy-efficient appliance adoption, innovation in hermetic sealing, noise reduction, and cooling efficiency, environmental impact of refrigerant use and energy consumption, and emerging use cases in smart refrigerators, low-GWP cooling solutions, and compact commercial refrigeration systems. |

The global hermetic reciprocating refrigerator compressor market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the hermetic reciprocating refrigerator compressor market is projected to reach USD 26.7 billion by 2035.

The hermetic reciprocating refrigerator compressor market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in hermetic reciprocating refrigerator compressor market are inverter and fixed speed.

In terms of cooling capacity, 150 - 240 w segment to command 36.8% share in the hermetic reciprocating refrigerator compressor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hermetic Food Grain Storage Market Size and Share Forecast Outlook 2025 to 2035

Hermetic Packaging Market Size, Share & Forecast 2025 to 2035

Key Players & Market Share in the Hermetic Jars Industry

Hermetic Jars Market Analysis – Trends & Growth Forecast through 2035

Reciprocating Sabre Saws Market Size and Share Forecast Outlook 2025 to 2035

Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Backup Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Prime Power Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Compressor Oil Market Size and Share Forecast Outlook 2025 to 2035

Compressor Rental Market Size, Share, and Forecast 2025 to 2035

Compressors and Vacuum Pumps Market Growth - Trends & Forecast 2025 to 2035

Compressor Control System Market

PAG Compressor Oil Market Size and Share Forecast Outlook 2025 to 2035

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Screw Compressor Market Size and Share Forecast Outlook 2025 to 2035

Chest Compressors Market

Thermocompressors Market

Dental Compressors Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA