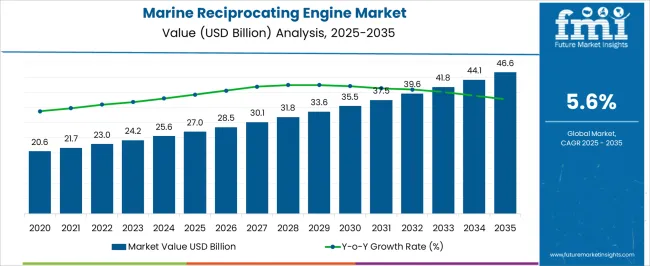

The marine reciprocating engine market is anticipated to expand from USD 27.0 billion in 2025 to USD 46.6 billion by 2035, representing a compound annual growth rate of 5.6%. Technology adoption within this market plays a critical role in driving both efficiency and overall market expansion. Reciprocating engines are primarily differentiated by propulsion types, fuel systems, and emission control technologies, each contributing distinctly to market growth over the forecast period.

Two-stroke and four-stroke engine technologies continue to dominate the marine sector, with two-stroke engines maintaining relevance in large-scale shipping due to higher fuel efficiency, while four-stroke engines are increasingly deployed in smaller vessels for their operational flexibility and lower maintenance requirements. Fuel system innovations, particularly the shift toward dual-fuel and LNG-compatible engines, enhance operational adaptability and regulatory compliance, thereby supporting broader market uptake. Advanced emission control technologies, including selective catalytic reduction and exhaust gas recirculation systems, are progressively integrated, aligning engine performance with international marine emission standards.

Contribution analysis indicates that propulsion efficiency and emission compliance technologies collectively account for a significant portion of value addition, while auxiliary system enhancements such as turbocharging and electronic control modules provide incremental improvements. The technology-driven differentiation allows manufacturers to optimize performance, reduce fuel costs, and comply with evolving regulations, forming the backbone of market expansion through 2035.

| Metric | Value |

|---|---|

| Marine Reciprocating Engine Market Estimated Value in (2025 E) | USD 27.0 billion |

| Marine Reciprocating Engine Market Forecast Value in (2035 F) | USD 46.6 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The marine reciprocating engine market forms a significant segment within the global marine propulsion industry, playing a vital role in powering small to mid-sized vessels. Within the overall ship propulsion systems sector, it accounts for about 7.1%, reflecting its importance in fishing boats, cargo vessels, and passenger ships. In the auxiliary marine engine space, it secures 6.4%, supported by demand for onboard power generation. Across the inland waterways vessel engine category, it maintains 5.6%, highlighting its role in regional freight and passenger transport. In the diesel engine segment of marine machinery, it represents nearly 4.9%, with continued reliance on robust and fuel efficient solutions. Within the marine hybrid propulsion ecosystem, reciprocating engines contribute 3.5%, underscoring their relevance in transitional energy adoption strategies. Recent developments in this market have emphasized efficiency, compliance, and hybrid integration.

Manufacturers are focusing on engines that meet stringent IMO Tier III emission norms through advanced fuel injection, exhaust gas recirculation, and selective catalytic reduction systems. Dual fuel capabilities using LNG and marine gas oil have gained traction, improving flexibility and lowering emissions. Digital monitoring solutions are being integrated for predictive maintenance, enabling enhanced operational reliability. Engine makers are also partnering with shipbuilders to design engines compatible with hybrid and battery-assisted systems, supporting energy transition goals. Furthermore, increasing attention is given to modular designs that simplify overhauls and reduce downtime. These advancements indicate how emission control, fuel adaptability, and digitalization are reshaping the marine reciprocating engine market.

The marine reciprocating engine market is on a steady growth trajectory, fueled by rising demand for durable and efficient propulsion systems in commercial and defense maritime applications. Industry updates and company briefings highlight a continued preference for engines capable of delivering high torque, operational flexibility, and ease of maintenance.

Technological advancements in fuel efficiency and emissions control have enhanced the appeal of these engines, aligning with evolving environmental compliance requirements set by maritime authorities. Increasing seaborne trade volumes and investments in shipbuilding infrastructure have further strengthened market potential.

The market is also benefiting from retrofit projects aimed at upgrading older vessels with modern, more efficient engine systems. Development in hybrid propulsion integration and digital monitoring solutions is expected to create new opportunities. Segmental growth is anticipated to be driven by diesel-powered configurations, mid-range rated power segments, and inline cylinder layouts due to their widespread adoption, operational reliability, and maintenance advantages.

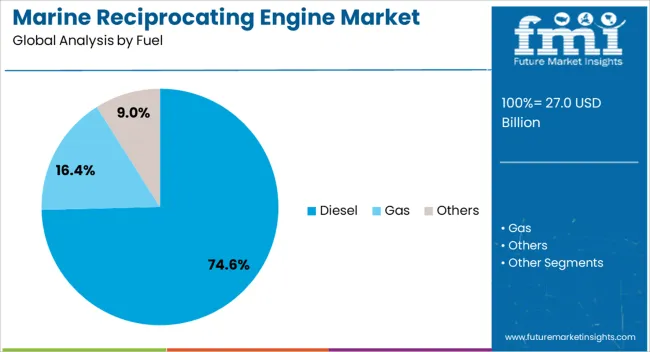

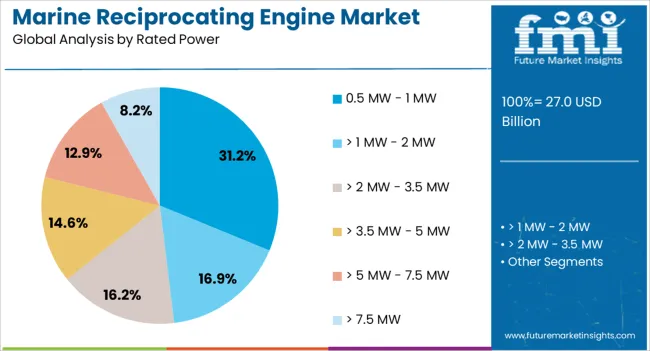

The marine reciprocating engine market is segmented by fuel, rated power, cylinder configuration, and geographic regions. By fuel, marine reciprocating engine market is divided into Diesel, Gas, and Others. In terms of rated power, marine reciprocating engine market is classified into 0.5 MW - 1 MW, > 1 MW - 2 MW, > 2 MW - 3.5 MW, > 3.5 MW - 5 MW, > 5 MW - 7.5 MW, and > 7.5 MW.

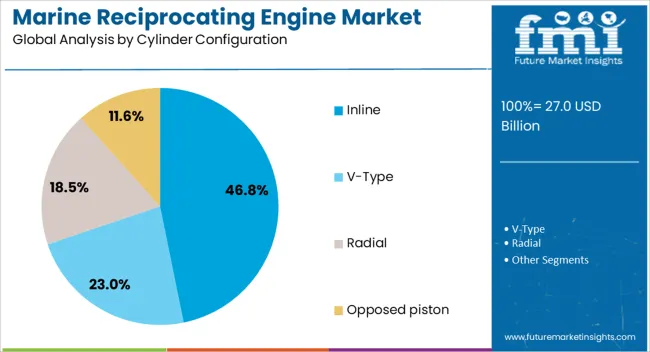

Based on cylinder configuration, the marine reciprocating engine market is segmented into Inline, V-type, Radial, and Opposed piston. Regionally, the marine reciprocating engine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The diesel segment is projected to account for 74.6% of the marine reciprocating engine market revenue in 2025, maintaining its position as the primary fuel type. This dominance is supported by diesel’s proven efficiency, high energy density, and widespread availability in global shipping operations.

Operators continue to favor diesel engines for their robust performance in both high-load and continuous operation scenarios. The segment has also benefited from ongoing advancements in cleaner combustion technologies, enabling compliance with stringent emission standards without compromising power output.

Maintenance familiarity among marine engineers and well-established fueling infrastructure in ports worldwide have further reinforced diesel’s market leadership. With incremental improvements in engine design aimed at reducing fuel consumption and extending service life, the diesel segment is expected to sustain its strong market position.

The 0.5 MW – 1 MW segment is projected to contribute 31.2% of the marine reciprocating engine market revenue in 2025, positioning it as a key rated power category. This range has been widely adopted in medium-sized vessels, including cargo ships, offshore service vessels, and passenger ferries, due to its optimal balance between power output and fuel efficiency.

Shipbuilders have increasingly specified engines within this power range for their ability to support diverse operational requirements while ensuring cost-effective maintenance. The segment’s growth has been further encouraged by its compatibility with auxiliary power needs in larger vessels.

Additionally, advancements in engine components, such as turbochargers and fuel injection systems, have improved the overall performance of engines in this range. As the demand for multipurpose vessels and regional shipping routes grows, the 0.5 MW – 1 MW category is expected to remain a preferred choice in new builds and retrofits.

The inline cylinder configuration segment is projected to hold 46.8% of the marine reciprocating engine market revenue in 2025, establishing itself as the leading configuration choice. Inline engines are valued for their compact design, mechanical simplicity, and ease of maintenance, making them suitable for a wide range of vessel types.

Their streamlined layout allows for straightforward installation and efficient space utilization in engine rooms, which is especially critical in vessels with limited space. The segment has benefited from steady demand in small to mid-sized commercial vessels, fishing boats, and auxiliary applications in larger ships.

Maintenance efficiency, lower manufacturing costs, and consistent performance under varying load conditions have also supported inline engine adoption. With advancements in material durability and lubrication systems enhancing operational lifespan, the inline configuration is expected to retain its strong market share.

The market has been shaped by the essential role these engines play in powering vessels across commercial, naval, and recreational segments. These engines, designed for durability and efficiency, are used for propulsion as well as auxiliary functions such as electricity generation onboard.

Market development has been influenced by shipping traffic growth, offshore exploration, naval modernization, and rising demand for smaller recreational boats. Stringent environmental regulations and the introduction of cleaner fuel technologies have further directed innovation. Hybrid systems and dual-fuel reciprocating engines are being increasingly adopted as the industry balances performance with emission control.

The commercial shipping sector has been a dominant user of marine reciprocating engines, with bulk carriers, container ships, and tankers relying on their power delivery. Global trade expansion and increased shipping routes have supported steady demand for these engines, particularly in medium-speed categories used for propulsion and onboard generation. Reciprocating engines have been favored for their robustness, fuel adaptability, and ease of maintenance in long-haul operations. With maritime trade routes becoming more congested, the need for reliable propulsion has been reinforced. Furthermore, rising demand for feeder vessels in regional shipping has supported the uptake of smaller reciprocating engines.

Companies are increasingly focusing on hybridizing propulsion systems, integrating reciprocating engines with energy storage or alternative fuels. These developments highlight how commercial shipping remains a strong driver for marine reciprocating engine adoption despite rising regulatory pressures on emissions.

Naval forces worldwide have continued to rely on reciprocating engines for patrol boats, submarines, and auxiliary vessels due to their reliability and power density. Defense modernization programs in various regions have fueled the replacement of outdated fleets with vessels powered by modern reciprocating engines that meet operational and efficiency standards. Compact engine design, rapid start-up capability, and adaptability to diverse fuels have strengthened their adoption in defense fleets. The naval operations demand engines with high endurance and operational safety, characteristics provided by advanced reciprocating engines. Integration of digital monitoring systems has also enhanced operational readiness, allowing predictive maintenance and improved uptime. Strategic focus on coastal defense, maritime surveillance, and amphibious operations has ensured consistent demand for reciprocating engines in the naval sector, making defense procurement a significant contributor to market expansion.

Recreational marine activities have become another significant factor driving the reciprocating engine market. Yachts, speedboats, fishing vessels, and leisure crafts increasingly utilize these engines due to their balance of cost-efficiency, durability, and serviceability. Rising popularity of water sports and luxury boating has supported higher demand for compact and efficient engines. Engine manufacturers are developing quieter and vibration-reduced systems to enhance comfort, addressing key consumer preferences in the leisure sector. The improved fuel efficiency and lower emission variants have gained traction among recreational boat owners, aligning with evolving regulatory standards. Hybrid marine engines are also being increasingly integrated into high-end yachts to reduce environmental impact while providing reliable propulsion. With recreational boating markets expanding in regions like North America and Europe, the sector is expected to remain an influential contributor to the broader marine reciprocating engine market.

Stricter emission norms imposed by international bodies have reshaped the marine reciprocating engine market, compelling manufacturers to innovate. Engines are being redesigned for compatibility with low-sulfur fuels, LNG, and biofuels to comply with International Maritime Organization (IMO) standards. Exhaust treatment systems, advanced fuel injection, and electronic control technologies are being integrated to improve combustion efficiency and reduce emissions. Digitalization has also been increasingly deployed, with monitoring systems ensuring optimized performance and predictive maintenance. Hybrid configurations that combine reciprocating engines with batteries or fuel cells are gaining traction, addressing both efficiency and sustainability requirements. The transition to cleaner fuels continues to raise operational cost concerns, particularly for small and mid-sized vessel operators. The regulatory push has therefore become both a challenge and an innovation driver, reshaping the technological landscape of marine reciprocating engines.

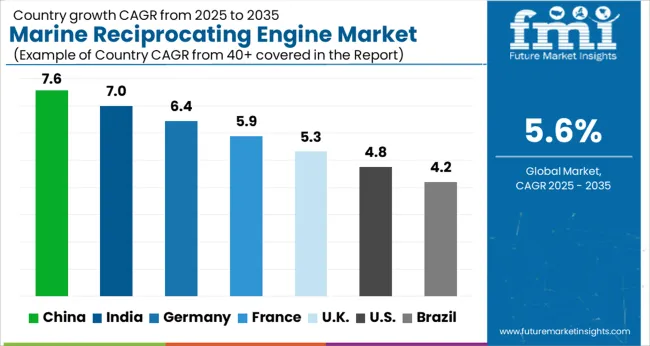

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The market is expanding as global shipping, naval applications, and offshore activities demand efficient propulsion systems. China leads with a 7.6% growth rate, supported by strong shipbuilding capacity and expanding maritime trade. India follows at 7.0%, where increased port development and naval modernization drive adoption. Germany records 6.4%, reflecting advanced engineering expertise and focus on emission compliant marine engines. The United Kingdom secures 5.3%, with growth influenced by marine logistics and offshore energy activities. The United States stands at 4.8%, where modernization of fleets and stricter environmental norms encourage technology upgrades. These markets highlight the importance of robust marine propulsion solutions that support efficiency, durability, and compliance with international maritime standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 7.6%, supported by the country’s leading role in global shipbuilding and its extensive commercial shipping activities. Domestic manufacturers are enhancing engine technologies to comply with stricter emission standards, while also investing in higher fuel efficiency. Demand is rising across bulk carriers, container ships, and coastal vessels as maritime trade volumes increase. Research partnerships are focusing on hybrid and dual-fuel marine engines to reduce reliance on conventional fuels. With China’s shipyards catering to both domestic and international markets, the adoption of advanced reciprocating engines is becoming integral to sustaining competitiveness. The ongoing modernization of inland waterway transport and naval fleets is expected to further strengthen the market outlook.

The market in India is anticipated to advance at a CAGR of 7.0%, driven by increasing investment in port infrastructure and coastal shipping. The government’s initiatives to promote inland water transport are boosting demand for efficient marine engines. Domestic shipyards are collaborating with international engine manufacturers to introduce low-emission and fuel-efficient models. Fishing vessels and small cargo ships represent a significant portion of the demand, with modernization programs creating opportunities for reciprocating engine suppliers. Expansion of defense-related maritime projects is also generating steady growth prospects. The emphasis on reducing operational costs and improving engine reliability is influencing procurement decisions across operators. With India aiming to enhance its role in regional maritime trade, the market outlook for reciprocating engines remains favorable.

Germany is expected to expand at a CAGR of 6.4%, supported by advancements in shipbuilding technologies and focus on cleaner propulsion systems. The country’s strong maritime engineering sector is emphasizing compliance with international environmental standards such as IMO Tier III regulations. Demand for reciprocating engines is driven by cargo vessels, cruise ships, and offshore support vessels. German companies are prioritizing hybrid propulsion integration and alternative fuel adaptability, particularly with LNG and biofuels. Research institutions are actively developing next-generation engines with improved efficiency and reduced carbon emissions. The presence of established engineering firms and strong R&D capabilities positions Germany as an innovator in marine reciprocating engine technologies, with exports playing a key role in its market dynamics.

The market in the United Kingdom is forecast to grow at a CAGR of 5.3%, supported by the country’s active maritime trade routes and offshore energy projects. Demand is particularly strong in commercial shipping, fishing fleets, and offshore supply vessels. Efforts to modernize older fleets with engines meeting international efficiency standards are fueling replacement demand. Marine engine suppliers are collaborating with shipbuilders to integrate low-emission technologies, aligning with the UK’s decarbonization goals for the maritime sector. Research programs are exploring hydrogen and biofuel-compatible reciprocating engines, strengthening the long-term market outlook. The focus on cleaner coastal and inland shipping solutions is also supporting gradual market penetration, with domestic firms adapting to rising sustainability expectations from operators and regulators.

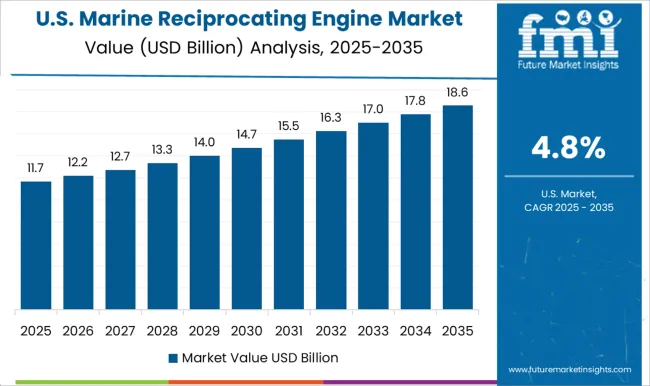

The market in the United States is projected to record a CAGR of 4.8%, influenced by the country’s extensive inland waterways, defense requirements, and offshore activities. Commercial shipping, fishing, and naval modernization are key drivers of demand. USA companies are investing in dual-fuel and hybrid reciprocating engines to meet evolving regulatory requirements from the Environmental Protection Agency (EPA). The defense sector remains a significant consumer, with advanced propulsion systems being integrated into patrol vessels and auxiliary ships. Collaboration between engine manufacturers and research institutes is accelerating the adoption of alternative fuels such as LNG and renewable diesel. Although the market faces cost-related challenges, government support for clean marine technology adoption is fostering a gradual but steady transition toward sustainable reciprocating engine solutions.

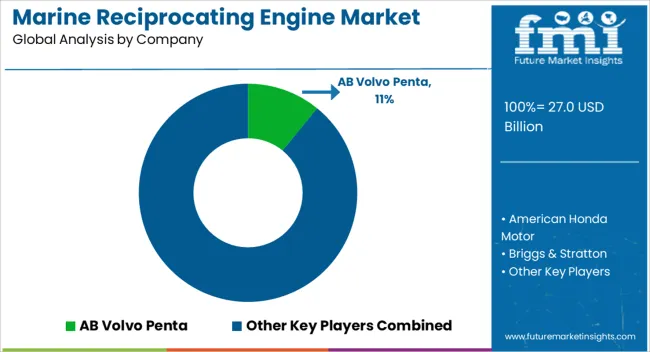

The market is shaped by manufacturers that provide propulsion and auxiliary power solutions for vessels across commercial, defense, and leisure applications. Wärtsilä and MAN Energy Solutions hold strong positions in supplying medium-speed and high-speed engines tailored for cargo ships, ferries, and offshore vessels. Caterpillar and Cummins are influential in heavy-duty marine engines, offering efficient designs that meet global emission standards. Rolls-Royce and Mitsubishi Heavy Industries emphasize advanced propulsion systems for larger vessels, combining reliability with evolving environmental requirements.

Yanmar Holdings and Yamaha Motor lead in small and mid-sized outboard and inboard engines, serving fishing boats, yachts, and coastal crafts. AB Volvo Penta is recognized for its integrated propulsion systems that combine performance with fuel efficiency. American Honda Motor, Briggs & Stratton, and KUBOTA Corporation extend expertise from automotive and industrial engines into marine usage. Scania and Perkins Engines contribute to auxiliary and mid-power segments, while Kawasaki Heavy Industries and IHI Corporation bring engineering depth to specialized marine solutions. Guascor Energy and J C Bamford Excavators offer niche energy and equipment-based approaches, while Rehlko supports regional demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.0 Billion |

| Fuel | Diesel, Gas, and Others |

| Rated Power | 0.5 MW - 1 MW, > 1 MW - 2 MW, > 2 MW - 3.5 MW, > 3.5 MW - 5 MW, > 5 MW - 7.5 MW, and > 7.5 MW |

| Cylinder Configuration | Inline, V-Type, Radial, and Opposed piston |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AB Volvo Penta, American Honda Motor, Briggs & Stratton, Caterpillar, Cummins, General Electric, Guascor Energy, IHI Corporation, J C Bamford Excavators, Kawasaki Heavy Industries, KUBOTA Corporation, MAN Energy Solutions, MITSUBISHI HEAVY INDUSTRIES, Perkins Engines, Rehlko, Rolls-Royce, Scania, Wärtsilä, Yamaha Motor, and Yanmar HOLDINGS |

| Additional Attributes | Dollar sales by engine type and power rating, demand dynamics across cargo ships, passenger vessels, and naval applications, regional trends in marine engine adoption, innovation in fuel efficiency, emission reduction, and digital monitoring, environmental impact of fuel consumption and regulatory compliance, and emerging use cases in hybrid propulsion systems, offshore support vessels, and long-range maritime transport. |

The global marine reciprocating engine market is estimated to be valued at USD 27.0 billion in 2025.

The market size for the marine reciprocating engine market is projected to reach USD 46.6 billion by 2035.

The marine reciprocating engine market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in marine reciprocating engine market are diesel, gas and others.

In terms of rated power, 0.5 mw - 1 mw segment to command 31.2% share in the marine reciprocating engine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Market Size and Share Forecast Outlook 2025 to 2035

Marine Toxin Market Size and Share Forecast and Outlook 2025 to 2035

Marine Thermal Fluid Heaters Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Marine Power Battery System Market Size and Share Forecast Outlook 2025 to 2035

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Marine Trenchers Market Size and Share Forecast Outlook 2025 to 2035

Marine Electronics Tester Market Size and Share Forecast Outlook 2025 to 2035

Marine Steering Systems Market Size and Share Forecast Outlook 2025 to 2035

Marine & Dock Gangways Market Size and Share Forecast Outlook 2025 to 2035

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Marine Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Marine Fuel Injection System Market Size and Share Forecast Outlook 2025 to 2035

Marine Energy Market Size and Share Forecast Outlook 2025 to 2035

Marine Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Marine Fin Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Marine Extract Market Size and Share Forecast Outlook 2025 to 2035

Marine Squalene Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA