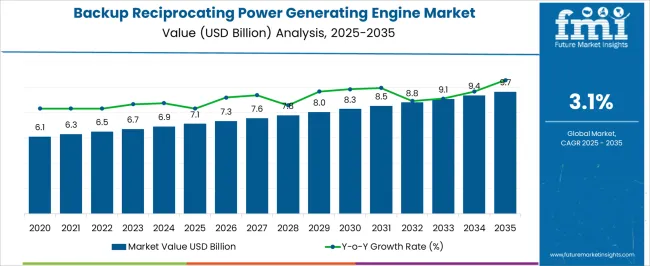

The backup reciprocating power generating engine market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period. Market expansion is being influenced as demand for reliable standby power solutions is increasingly recognized across commercial, industrial, and utility sectors.

Product adoption is being shaped by the need for consistent energy output, operational resilience, and extended engine life, while manufacturers are focusing on optimizing fuel efficiency and maintenance schedules. Supply chains are being strengthened to ensure timely delivery and regional availability of key components. Over the 2025–2035 period, growth in the backup reciprocating power-generating engine market is being driven by increased installations in critical infrastructure and energy-intensive operations. End-users are being influenced by performance reliability, engine durability, and operational cost-effectiveness, leading to a steady rise in market penetration.

The market is being shaped as an essential solution for energy continuity, with service providers emphasizing after-sales support and spare parts accessibility. Industrial demand, particularly in areas with inconsistent grid stability, is being leveraged to reinforce market expansion and support long-term adoption of dependable power generation systems.

| Metric | Value |

|---|---|

| Backup Reciprocating Power Generating Engine Market Estimated Value in (2025 E) | USD 7.1 billion |

| Backup Reciprocating Power Generating Engine Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The backup reciprocating power-generating engine market has established a significant presence across its parent industries, driven by the increasing need for reliable and rapid-response power solutions in critical infrastructure, industrial operations, and commercial properties. Within the power generation equipment market, these engines account for approximately 18–20% share, as they are widely deployed for on-demand power supply and peak-load management.

In the diesel and gas engine market, the segment contributes roughly 12–14% share, reflecting its role in offering versatile fuel options and operational flexibility across diverse installations. Within the backup power solutions market, backup reciprocating engines hold a larger share of around 22–25%, since organizations depend on them to ensure continuous operations during grid failures and emergencies. In the industrial power systems market, the segment represents approximately 15–17% share, supporting manufacturing, mining, and process industries where uninterrupted power is crucial for productivity and safety.

Within the residential and commercial energy systems market, these engines account for about a 10–12% share, as high-rise complexes, office buildings, and mixed-use facilities increasingly incorporate backup generators for energy security. Although fuel costs and maintenance considerations can influence the adoption, the market continues to expand because of the high reliability, rapid startup capability, and robustness of reciprocating engines.

The backup reciprocating power generating engine market is progressing steadily, supported by increasing demand for reliable and flexible power solutions in sectors where uninterrupted energy supply is critical. Industry publications and manufacturer updates have emphasized the growing importance of backup systems due to rising grid instability, frequent outages, and expanding industrial operations in remote or high-demand areas.

Technological advancements in engine efficiency, emissions control, and fuel flexibility have enhanced performance while ensuring compliance with stricter environmental regulations. Additionally, the adoption of backup engines has been reinforced by industrial growth in emerging economies, where infrastructure limitations make auxiliary power crucial.

Investment in manufacturing facilities, data centers, and large-scale commercial complexes has further accelerated market penetration. Future expansion is expected to be driven by hybridized systems combining reciprocating engines with renewable power sources, offering both operational resilience and sustainability benefits.

The backup reciprocating power generating engine market is segmented by fuel type, rated power, application, and geographic regions. By fuel type, the backup reciprocating power generating engine market is divided into Diesel-fired, Gas-fired, Dual fuel, and Others. In terms of rated power, the backup reciprocating power generating engine market is classified into > 1 MW - 2 MW, 0.5 MW - 1 MW, > 2 MW - 3.5 MW, > 3.5 MW - 5 MW, > 5 MW - 7.5 MW, and > 7.5 MW. Based on application, the backup reciprocating power generating engine market is segmented into Industrial, CHP, Energy & utility, Landfill & biogas, and Others. Regionally, the backup reciprocating power generating engine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The diesel-fired segment is projected to hold 41.8% of the backup reciprocating power generating engine market revenue in 2025, making it the leading fuel type. This dominance has been shaped by the fuel’s high energy density, quick start-up capability, and widespread availability, making diesel engines the preferred choice for emergency and standby applications.

Industrial operators have favored diesel-fired units for their robustness, long operational life, and ability to provide reliable performance in harsh environmental conditions. Advancements in fuel injection systems and emissions control technologies have addressed some of the environmental concerns, allowing continued adoption in regulated markets.

Furthermore, the established supply chain for diesel fuel has ensured operational continuity for facilities in both urban and remote locations. With ongoing improvements in engine efficiency and the ability to integrate with automated monitoring systems, the diesel-fired segment is expected to maintain its leadership position.

The > 1 MW – 2 MW rated power segment is expected to account for 28.4% of the market revenue in 2025, representing a crucial capacity range for medium- to large-scale operations. Demand for engines in this range has been driven by their suitability for industrial manufacturing plants, commercial complexes, and institutional facilities requiring substantial backup power without the scale and cost of higher-capacity units.

These engines offer a balance between operational flexibility and output capacity, making them adaptable for varied load requirements. Manufacturers have invested in engineering solutions that optimize fuel efficiency and reduce maintenance downtime for this capacity range, further supporting its adoption.

Additionally, the segment benefits from ease of installation and scalability, enabling operators to expand capacity incrementally based on future demand growth. As industries continue to modernize and expand, this rated power category is expected to see sustained demand.

The industrial segment is projected to contribute 36.2% of the market revenue in 2025, maintaining its status as the largest application category. Growth in this segment has been fueled by the high reliance of industrial facilities on continuous power to avoid costly production downtime and equipment damage.

Sectors such as manufacturing, mining, oil and gas, and heavy engineering have prioritized backup reciprocating engines to ensure operational resilience during power outages or grid instability. Reports from industrial associations have indicated increased investment in backup systems as part of broader risk management strategies.

The industrial segment has also been influenced by the expansion of manufacturing hubs in emerging markets, where power infrastructure may be less reliable. The adaptability of reciprocating engines to various fuels and operational conditions has reinforced their suitability for industrial use, and with industries expanding into more remote areas, demand for reliable on-site power generation is set to grow further.

The backup reciprocating power generating engine market is expanding due to growing demand for reliable and uninterrupted power. Opportunities exist in renewable hybrid integrations and microgrid applications, while trends focus on fuel efficiency and emission reduction. Challenges include high capital costs, regulatory compliance, and competition from alternative backup solutions. Overall, the market outlook remains positive as manufacturers develop reliable, efficient, and environmentally compliant engines to support critical infrastructure, industrial operations, and off-grid energy needs globally.

The backup reciprocating power generating engine market is witnessing strong demand due to the critical need for uninterrupted power in commercial, industrial, and residential sectors. Frequent power outages, unreliable grid infrastructure, and increasing reliance on continuous operations in hospitals, data centers, and manufacturing facilities are driving adoption. These engines provide flexible, fast-start backup power and can operate on multiple fuel types, ensuring operational continuity. The demand is further fueled by expanding infrastructure projects and the need for emergency energy solutions across emerging and developed economies.

Significant opportunities are arising from integration with renewable energy systems and microgrids. Backup reciprocating engines are increasingly deployed alongside solar, wind, and hybrid systems to provide stable, on-demand power. Growing investments in decentralized energy solutions, especially in rural and off-grid areas, create avenues for manufacturers to offer efficient, scalable, and fuel-optimized engines. Customized solutions for critical infrastructure and remote industrial applications provide additional growth potential, as companies focus on reducing operational costs and enhancing energy security for end-users.

A key trend in the market is the development of fuel-efficient engines with lower emissions to comply with evolving environmental regulations. Advanced control systems, waste heat recovery, and dual-fuel capabilities are increasingly incorporated to optimize performance and reduce operational costs. Manufacturers are emphasizing reliability, longer maintenance intervals, and integration with digital monitoring tools for predictive maintenance. These trends reflect the market’s focus on operational efficiency, environmental compliance, and technological enhancements that support long-term adoption in industrial, commercial, and emergency power applications.

The market faces challenges due to the high initial investment required for the purchase and installation of reciprocating power engines. Strict emission standards, noise regulations, and fuel-related compliance requirements increase operational complexity and cost for manufacturers and end-users. Volatility in fuel prices can further impact operational expenses, especially in diesel-based engines. Additionally, competition from alternative backup solutions such as battery storage, gas turbines, and hybrid systems creates pressure on market growth. Companies must invest in cost optimization, regulatory compliance, and high-performance solutions to sustain adoption in diverse applications.

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

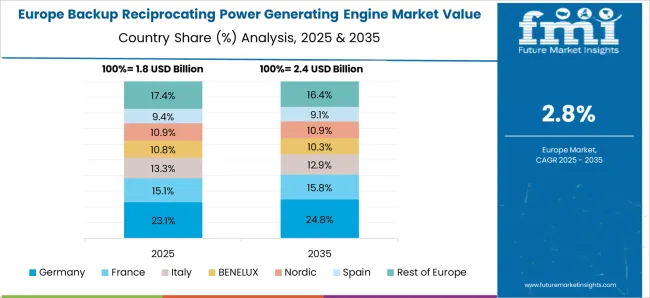

The global backup reciprocating power generating engine market is projected to grow at a CAGR of 3.1% from 2025 to 2035. China leads with a growth rate of 4.2%, followed by India at 3.9% and France at 3.3%. The United Kingdom records a growth rate of 2.9%, while the United States shows the slowest growth at 2.6%. Market expansion is supported by rising demand for reliable backup power in residential, commercial, and industrial sectors, alongside increasing power outages and the need for emergency energy solutions. Emerging economies like China and India experience higher growth due to industrial expansion and infrastructure development, whereas developed markets such as the USA, UK, and France see steady adoption driven by regulatory standards, energy security initiatives, and maintenance of critical facilities. This report includes insights on 40+ countries; the top markets are shown here for reference.

The backup reciprocating power generating engine market in China is projected to grow at a CAGR of 4.2%. Growth is driven by rising industrialization, increasing construction of commercial and residential buildings, and the need for uninterrupted power supply. Demand is also fueled by expansion in data centers, healthcare facilities, and manufacturing plants requiring reliable backup solutions. Government initiatives promoting energy security and incentives for emergency power solutions further support adoption. The market is witnessing investments in modern engine technologies and high-efficiency units to meet growing energy demands.

The backup reciprocating power generating engine market in India is expected to grow at a CAGR of 3.9%. Growth is supported by increasing industrial output, urban infrastructure development, and rising demand for reliable power in commercial and residential sectors. Expansion in data centers, IT parks, and hospitals further fuels adoption. Manufacturers focus on energy-efficient and cost-effective engine solutions. Government policies promoting energy security and stable power supply for critical infrastructure support steady growth. Rising awareness about backup power solutions and reliability also contributes to market adoption.

The backup reciprocating power generating engine market in France is projected to grow at a CAGR of 3.3%. Growth is driven by increasing adoption in commercial buildings, healthcare facilities, and industrial plants. Emphasis on energy security and uninterrupted power supply supports steady demand. Manufacturers are focusing on providing high-efficiency engines compliant with environmental standards. Adoption is further supported by regulatory frameworks promoting reliability and energy performance. Expansion in critical infrastructure and backup power for renewable integration contributes to market growth.

The backup reciprocating power generating engine market in the United Kingdom is expected to grow at a CAGR of 2.9%. Growth is supported by demand for emergency power in commercial and industrial sectors, data centers, and hospitals. Government initiatives to ensure energy reliability and reduce downtime contribute to steady adoption. Manufacturers focus on maintenance-friendly, efficient, and low-emission engine solutions. The integration of backup engines in renewable energy setups and critical infrastructure also enhances market growth. Awareness about energy continuity solutions further supports adoption in the UK

The backup reciprocating power generating engine market in the United States is projected to grow at a CAGR of 2.6%. The need for reliable backup power in commercial, industrial, and residential sectors fuels demand. Adoption is supported by increasing infrastructure development, data centers, healthcare facilities, and regulatory requirements for energy reliability. Manufacturers focus on high-efficiency, low-emission engines to meet energy performance standards. Growing awareness about emergency power solutions and energy continuity for critical facilities continues to drive market growth.

The backup reciprocating power generating engine market is dominated by engine manufacturers competing on reliability, efficiency, and operational flexibility. Caterpillar, AB Volvo Penta, and Atlas Copco lead with brochures highlighting high-performance engines for industrial, commercial, and utility applications. Marketing materials emphasize fuel efficiency, reduced emissions, and rapid start-up capabilities. Clarke Energy, GE Vernova, and HIMOINSA differentiate through turnkey solutions, modular designs, and customized installation support, with brochures showcasing integration ease, remote monitoring, and maintenance-friendly configurations. Mid-sized players such as Kirloskar, MAN Energy Solutions, and Mitsubishi Heavy Industries focus on regional markets, emphasizing robust performance under variable load conditions and product longevity.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Billion |

| Fuel Type | Diesel-fired, Gas-fired, Dual fuel, and Others |

| Rated Power | > 1 MW - 2 MW, 0.5 MW - 1 MW, > 2 MW - 3.5 MW, > 3.5 MW - 5 MW, > 5 MW - 7.5 MW, and > 7.5 MW |

| Application | Industrial, CHP, Energy & utility, Landfill & biogas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, AB Volvo Penta, Atlas Copco, Clarke Energy, GE Vernova, HIMOINSA, Kirloskar, MAN Energy Solutions, Mitsubishi Heavy Industries, Motorenfabrik Hatz, Rehlko, Rolls-Royce, Scania, Wärtsilä, Yamaha Motor, and Yuchai International |

| Additional Attributes | Dollar sales by engine type (natural gas, diesel, dual-fuel) and power capacity (low, medium, high) are key metrics. Trends include rising demand for reliable backup power in residential, commercial, and industrial sectors, preference for fuel-efficient engines, and integration with hybrid power systems. Regional adoption, regulatory compliance, and technological advancements are driving market growth. |

The global backup reciprocating power generating engine market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the backup reciprocating power generating engine market is projected to reach USD 9.7 billion by 2035.

The backup reciprocating power generating engine market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in backup reciprocating power generating engine market are diesel-fired, gas-fired, dual fuel and others.

In terms of rated power, > 1 mw - 2 mw segment to command 28.4% share in the backup reciprocating power generating engine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud-based Backup Services Market by Enterprise, End-User, and Region - Growth, Trends, and Forecast Through 2025 to 2035

Purpose-built Backup Appliance (PBBA) Market Size and Share Forecast Outlook 2025 to 2035

Reciprocating Sabre Saws Market Size and Share Forecast Outlook 2025 to 2035

Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Hermetic Reciprocating Refrigerator Compressor Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Prime Power Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Engine Fixture Market Size and Share Forecast Outlook 2025 to 2035

Engine Piston Ring Set Market Size and Share Forecast Outlook 2025 to 2035

Engine Cylinder Liners Market Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engine Fogging Oil Market Size and Share Forecast Outlook 2025 to 2035

Engine Valve Market Size and Share Forecast Outlook 2025 to 2035

Engine Starter Fluid Market Growth - Demand, Trends & Forecast 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Engineering Analytics Market Growth & Demand 2025 to 2035

Engineering Plastic Market Analysis - Size, Share & Forecast 2025 to 2035

Engineered Cell Therapy - Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA