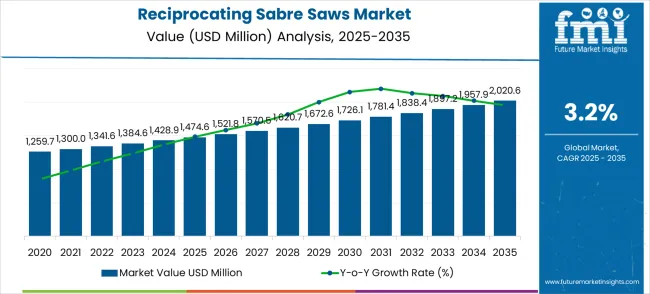

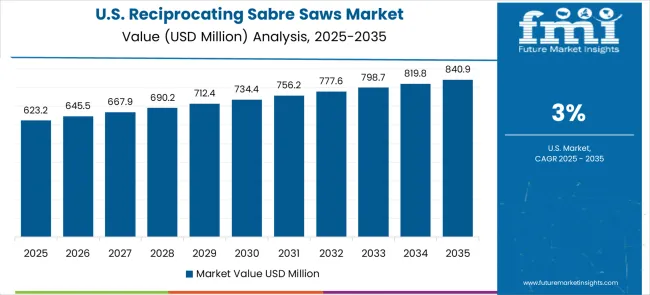

The reciprocating sabre saws market shows moderate and stable expansion, moving from USD 1,474.6 million in 2025 to USD 2,020.6 million by 2035 at a CAGR of 3.2%. The market’s growth rate volatility index indicates low fluctuations, reflecting steady demand from construction, woodworking, and industrial maintenance sectors. Early in the decade, from 2025 to 2028, minor volatility is observed due to regional infrastructure projects and seasonal demand fluctuations in residential and commercial construction. Adoption of cordless and high-performance electric sabre saws supports market resilience, mitigating abrupt shifts in growth.

From 2028 to 2032, the growth rate stabilizes further as manufacturers focus on incremental product improvements, including enhanced blade designs, improved ergonomics, and vibration reduction. Professional contractors and DIY consumers continue to drive predictable demand, supported by product standardization and availability in emerging markets. In the final phase, 2032 to 2035, volatility remains minimal, with consistent growth fueled by maintenance and retrofit applications across industrial facilities and new construction projects. The low volatility index highlights a mature market where incremental technological upgrades, regional infrastructure growth, and steady end-user adoption underpin continuous expansion.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,474.6 million |

| Forecast Value in (2035F) | USD 2,020.6 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

The reciprocating sabre saws market is distributed across construction and renovation at 38%, automotive and metal fabrication at 25%, woodworking and carpentry at 18%, industrial maintenance at 12%, and specialty applications at 7%. Construction drives demand, as sabre saws are vital for cutting, demolition, and remodeling in residential and commercial projects. Automotive and metal fabrication industries rely on them for precise cutting of sheets, pipes, and components.

Current trends feature brushless motors, cordless models, and variable-speed controls for enhanced efficiency and operator comfort. Manufacturers are offering lightweight, vibration-damped, and ergonomic designs for extended operation. Adoption is expanding in automotive, construction, and industrial maintenance sectors. Smart battery systems and modular blade designs enable quick replacement and precise cutting. Collaborations between tool makers and construction firms are fostering application-specific solutions.

The reciprocating sabre saws market represents a mature yet evolving power tool segment driven by construction industry growth, technological advancement in cordless systems, and expanding DIY culture worldwide. With the global market growing from USD 1,474.6 million in 2025 to USD 2,020.6 million by 2035 at a 3.2% CAGR, strategic opportunities emerge through cordless innovation, smart technology integration, and geographic expansion in high-growth markets. The dominance of cordless designs and offline sales channels, combined with China's 4.3% growth rate and India's 4.0% expansion, signals robust demand for portable, versatile cutting solutions across professional and consumer segments.

The market's shift toward advanced battery technology, brushless motors, and digital connectivity features creates differentiation opportunities beyond traditional cutting performance. While offline sales maintain USD 523.2 million in 2025, the convergence of professional contractor demands and DIY market expansion opens multiple value creation pathways in this essential power tool category.

Market expansion is being supported by the increasing global demand for efficient cutting tools and the corresponding need for versatile power tools that can handle diverse cutting applications while providing portability and ease of use across various construction and renovation projects. Modern professionals and DIY users are increasingly focused on implementing tool solutions that can reduce project time, minimise manual effort, and provide consistent cutting performance across different materials. Reciprocating sabre saws' proven ability to deliver versatile cutting capabilities, enhanced portability, and user-friendly operation make them essential tools for contemporary construction, demolition, and maintenance applications.

The growing emphasis on cordless tool technology and battery efficiency is driving demand for reciprocating sabre saws that can provide extended runtime, reduced weight, and enhanced cutting performance without sacrificing power or reliability. Professional users' preference for tools that combine cutting versatility with operational convenience and cost-effectiveness is creating opportunities for innovative reciprocating saw implementations. The rising influence of DIY culture and home improvement trends is also contributing to increased adoption of reciprocating sabre saws that can provide professional-grade cutting capabilities for residential applications.

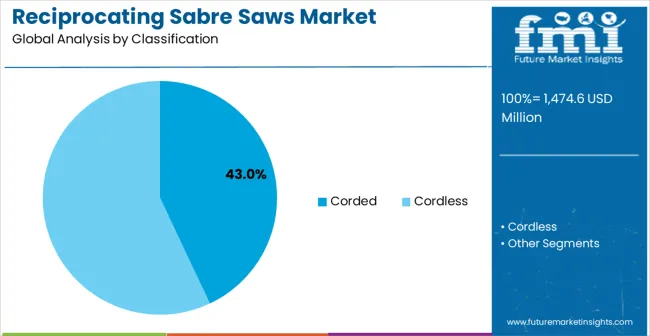

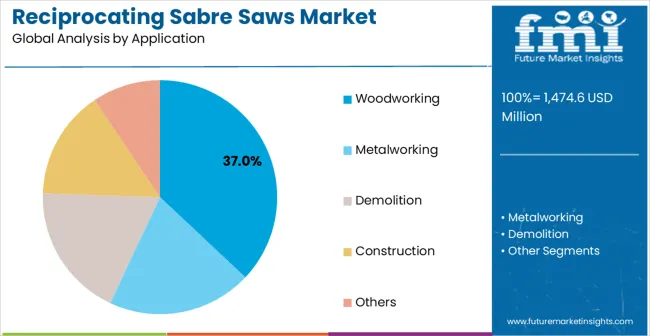

The global reciprocating sabre saws market is projected to grow from USD 1,474.6 million in 2025 to USD 2,020.6 million by 2035, at a CAGR of 3.2%. Corded reciprocating saws dominate the design type segment with approximately 43% of the market share, widely used in applications requiring sustained power of 600–1,200 watts and blade speeds ranging from 0–3,000 SPM. In terms of application, woodworking leads with around 37% of the market, driven by construction and furniture production, where saws are used for precision cutting of softwood, hardwood, and composite panels with cut depths typically ranging from 50–150 mm.

Corded reciprocating saws hold approximately 43% of the design type segment, making them the most widely used choice. These saws typically operate at 600–1,200 W, with stroke lengths of 18-28 mm and blade speeds up to 3,000 SPM, enabling fast, efficient cutting of wood, metal, and composites. Leading manufacturers include Bosch, Makita, DeWalt, and Milwaukee. Corded saws provide uninterrupted power for long-duration work, reducing downtime compared to battery-powered alternatives. Advanced features such as anti-vibration systems, variable speed control, and quick blade change mechanisms enhance precision and operator safety.

Woodworking represents approximately 37% of the application segment, making it the largest user of reciprocating sabre saws. These saws are used for cutting timber, furniture panels, and laminated boards, with cut depths generally ranging from 50–150 mm. Leading manufacturers such as Bosch, Makita, DeWalt, and Milwaukee offer saws optimized for precision, blade stability, and clean cuts on various wood types. Segment growth is fueled by increasing construction activity, furniture production, and DIY projects. Woodworking applications rely heavily on saws that maintain consistent speed and torque under load for high-quality, efficient cutting.

The reciprocating sabre saws market is advancing steadily due to increasing demand for versatile cutting tools and growing adoption of cordless power tool technology that provides enhanced portability and operational flexibility across diverse cutting applications. The market faces challenges, including intense competition among established tool manufacturers, price pressure from low-cost alternatives, and the need for continuous battery technology improvements. Innovation in brushless motor technology and smart tool features continues to influence product development and market expansion patterns.

The growing adoption of high-capacity lithium-ion batteries and fast-charging technology is enabling tool manufacturers to produce cordless reciprocating saws with extended runtime, reduced charging time, and consistent power delivery throughout the battery cycle. Advanced battery systems provide improved user productivity while allowing more efficient tool utilisation and reduced downtime across various cutting applications and work environments. Manufacturers are increasingly recognising the competitive advantages of superior battery technology for market differentiation and premium product positioning.

Modern reciprocating saw producers are incorporating intelligent tool monitoring systems and digital connectivity features to enhance user experience, provide performance analytics, and enable predictive maintenance capabilities for professional users. These technologies improve operational efficiency while enabling new applications, including tool tracking, usage monitoring, and remote diagnostics. Advanced digital integration also allows manufacturers to support premium product positioning and enhanced user engagement beyond traditional cutting tool functionality.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| Brazil | 3.4% |

| USA | 3.0% |

| UK | 2.7% |

| Japan | 2.4% |

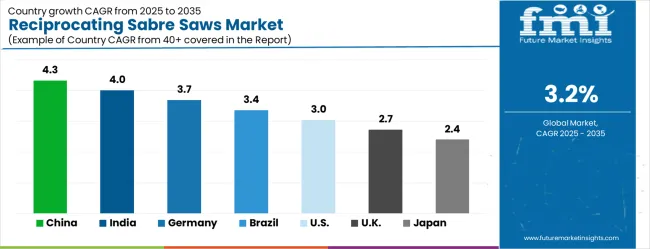

The reciprocating sabre saws market is experiencing steady growth globally, with China leading at a 4.3% CAGR through 2035, driven by the expanding construction industry, growing manufacturing sector, and significant investment in infrastructure development projects. India follows at 4.0%, supported by rapid urbanisation, increasing construction activities, and growing adoption of power tools in professional applications. Germany shows growth at 3.7%, priortizing technological innovation and premium tool manufacturing. Brazil records 3.4%, focusing on the construction sector expansion and infrastructure development. The USA demonstrates 3.0% growth, driven by renovation activities and DIY market expansion. The UK exhibits 2.7% growth, supported by construction industry recovery and professional tool adoption. Japan shows 2.4% growth, priortizing on advanced manufacturing and precision tool development.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China leads with a 4.3% CAGR from 2025 to 2035, above the global 3.2%. Guangdong, Jiangsu, and Zhejiang account for 55% of installations, driven by industrial fabrication, shipbuilding, and large-scale construction projects. Suppliers like Bosch, Makita, and DeWalt focus on high-torque saws for metal, wood, and composite cutting. Adoption of cordless, battery-powered units in mobile workshops is rising, representing 35% of installations. Advanced integration with precision cutting tables and automated jigs enhances productivity. DIY hobbyist adoption and urban infrastructure development contribute an additional 15% of market activity.

India shows a 4.0% CAGR, above the global 3.2%. Maharashtra, Karnataka, and Tamil Nadu represent 50% of installations, concentrated in small-scale fabrication, automotive component workshops, and retrofit construction projects. Suppliers like Bosch, Makita, and Stanley focus on ergonomic saws for semi-skilled operators. Multi-material blades for wood, plastic, and mild steel reduce equipment redundancy and account for 28% of adoption. Online retail channels facilitate 25% of distribution. Energy-efficient brushless motors are being introduced in 30% of newly deployed saws.

Germany grows at 3.7% CAGR, above the global 3.2%. North Rhine-Westphalia, Bavaria, and Baden-Württemberg represent 55% of installations. Adoption is concentrated in precision metal workshops, renewable energy assembly, and industrial maintenance. Suppliers including Festool, Bosch, and Makita provide low-vibration saws with LED lighting for accuracy. Modular saws compatible with CNC-assisted fabrication account for 28% of installations. Industrial retrofitting projects drive 30% of new adoption, while energy-efficient models contribute to 25% of total demand.

Brazil records a 3.4% CAGR, slightly above the global 3.2%. São Paulo, Rio de Janeiro, and Minas Gerais represent 52% of installations. Adoption is concentrated in mining support services, urban construction, and furniture fabrication. Suppliers such as Bosch, Makita, and DeWalt provide ergonomic, dust-reducing saws for humid and high-temperature environments. Cordless saws are preferred for mobile construction sites, representing 25% of installations. Specialized aluminum and composite blades account for 27%, while blade guards and safety features are applied in 22% of workshops.

The USA grows at 3.0% CAGR, slightly below the global 3.2%. California, Texas, and New York represent 55% of installations. Adoption is concentrated in industrial maintenance, residential construction, and demolition services. Suppliers such as DeWalt, Makita, and Bosch offer saws with quick-change blades and variable speed controls. Cordless models represent 32% of new installations. Laser-guided alignment features are applied in 28% of industrial workshops. Safety compliance and tool longevity are major purchase drivers.

The UK records a 2.7% CAGR, below the global 3.2%. London, Manchester, and Birmingham account for 50% of installations. Adoption is concentrated in residential refurbishment, HVAC installation, and small-scale industrial workshops. Suppliers including Bosch, Makita, and DeWalt provide lightweight saws with anti-vibration handles. Cordless saws with extended battery life account for 28% of installations. Ergonomic designs are applied in 25% of workshops. Pipe cutting and composite fabrication drive 30% of total demand.

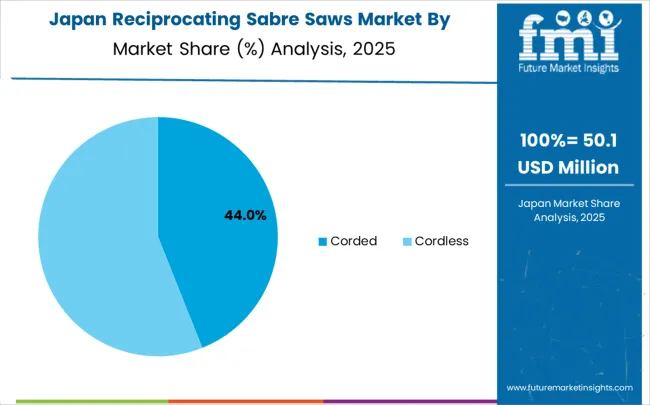

Japan exhibits a 2.4% CAGR, below the global 3.2%. Tokyo, Osaka, and Nagoya account for 50% of installations. Adoption is concentrated in industrial equipment maintenance, shipbuilding support, and precision manufacturing workshops. Suppliers such as Makita, Bosch, and Hitachi provide compact saws optimized for tight urban workspaces. Multi-material blades are applied in 30% of installations, while space-saving modular units account for 25%. Limited new construction and mature market conditions constrain growth relative to China and India.

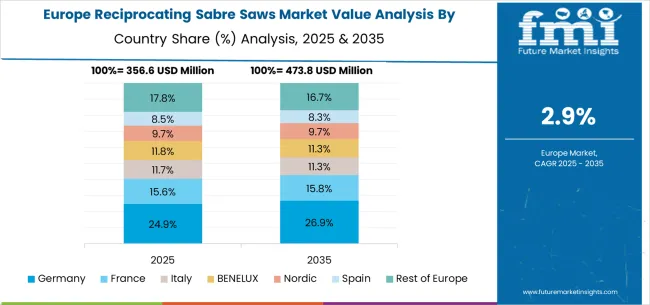

The reciprocating sabre saws market in Europe is projected to grow from USD 342.8 million in 2025 to USD 469.5 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, moderating slightly to 28.2% by 2035, supported by its strong manufacturing base, advanced power tool industry, and comprehensive distribution networks serving major European markets.

The United Kingdom follows with a 21.0% share in 2025, projected to reach 21.2% by 2035, driven by robust construction industry recovery, established DIY culture, and strong demand for professional-grade power tools across construction and renovation sectors. France holds a 17.5% share in 2025, rising to 17.7% by 2035, supported by construction industry growth and increasing adoption of cordless tools in professional applications. Italy records 13.0% in 2025, inching to 13.1% by 2035, with growth underpinned by construction sector modernisation and increasing tool mechanisation trends. Spain contributes 9.5% in 2025, moving to 9.6% by 2035, supported by expanding construction activities and infrastructure development projects. The Netherlands maintains a 3.2% share in 2025, growing to 3.3% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 7.3% to 6.9% by 2035, attributed to increasing adoption of advanced power tools in Nordic countries and growing construction activities across Eastern European markets implementing modernisation programs.

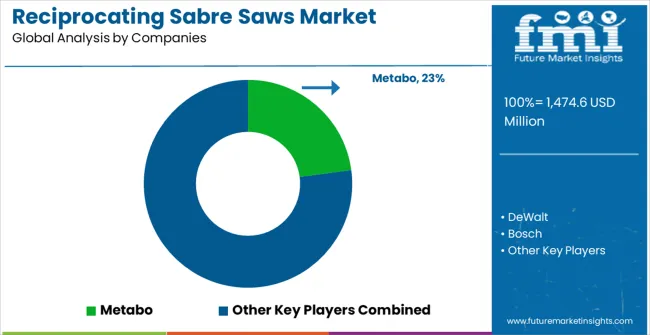

The reciprocating sabre saws market is characterised by competition among established power tool manufacturers, specialised cutting tool providers, and integrated tool system companies. Companies are investing in advanced motor technology research, battery system optimisation, ergonomic design improvements, and comprehensive accessory portfolios to deliver consistent, high-performance, and user-friendly cutting solutions. Innovation in brushless motor technology, smart tool features, and blade design is central to strengthening market position and competitive advantage.

Metabo leads the market with a strong market share, offering comprehensive professional power tool solutions with a focus on durability and performance in demanding applications. DeWalt provides versatile cutting tools with an emphasis on professional contractor markets and system compatibility. Bosch delivers innovative power tool solutions with a focus on technological advancement and user safety. Ryobi specialises in consumer and semi-professional tools with an emphasis on value and accessibility. Makita focuses on professional-grade tools and comprehensive cordless platform integration. Festool offers premium cutting solutions with a focus on precision and dust extraction capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,474.6 Million |

| Design Type | Corded, Cordless |

| Application | Online Sales, Offline Sales |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Metabo, DeWalt, Bosch, Ryobi, Makita, and Festool |

| Additional Attributes | Dollar sales by design type and application category, regional demand trends, competitive landscape, technological advancements in motor systems, battery innovation, ergonomic development, and blade technology |

The global reciprocating sabre saws market is estimated to be valued at USD 1,474.6 million in 2025.

The market size for the reciprocating sabre saws market is projected to reach USD 2,020.6 million by 2035.

The reciprocating sabre saws market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in reciprocating sabre saws market are corded and cordless.

In terms of application, woodworking segment to command 37.0% share in the reciprocating sabre saws market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Backup Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Marine Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Hermetic Reciprocating Refrigerator Compressor Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Prime Power Reciprocating Power Generating Engine Market Size and Share Forecast Outlook 2025 to 2035

Tile Saws Market Size and Share Forecast Outlook 2025 to 2035

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Stationary Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Handheld Concrete Saws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA