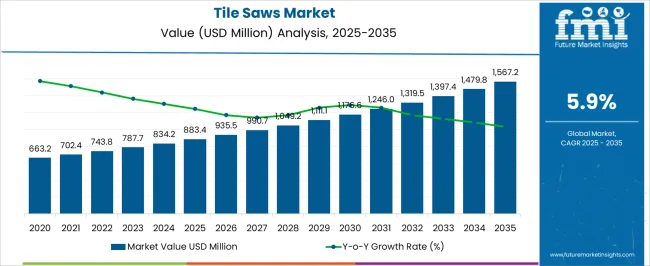

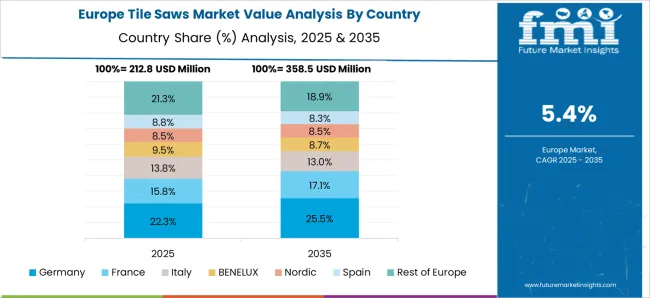

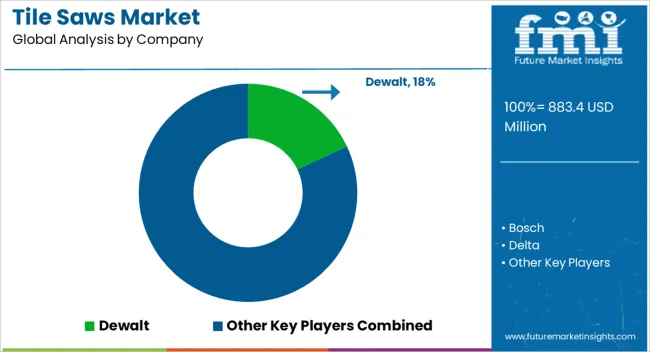

The tile saws market, valued at USD 883.4 million in 2025 and expected to reach USD 1,567.2 million by 2035 at a CAGR of 5.9%, displays distinct regional growth imbalances when comparing Asia-Pacific, Europe, and North America. Asia-Pacific is anticipated to lead expansion, supported by large-scale infrastructure projects, residential construction demand, and strong manufacturing capabilities.

Countries such as China and India are driving equipment adoption due to the growing scale of housing development and commercial construction activities, which directly elevate demand for efficient tile cutting solutions. The region’s cost-effective production ecosystem further reinforces its competitive edge. Europe shows moderate but steady growth, underpinned by renovation and remodeling activities in residential and commercial properties. Regulations around building quality and precision in construction sustain the market for advanced tile saw technologies. The slower population growth and mature construction sectors in Western Europe moderate expansion when compared to Asia-Pacific. North America records stable growth, largely driven by residential remodeling projects and commercial construction in urban centers.

Adoption of precision and professional-grade saws supports market expansion, although relatively higher tool costs and slower new-build momentum limit overall acceleration. Asia-Pacific emerges as the strongest growth engine, while Europe and North America exhibit balanced but less aggressive expansion trajectories, underscoring a clear regional growth imbalance.

| Metric | Value |

|---|---|

| Tile Saws Market Estimated Value in (2025 E) | USD 883.4 million |

| Tile Saws Market Forecast Value in (2035 F) | USD 1567.2 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The tile saws market represents a focused segment within the global construction tools and power equipment industry, emphasizing precision cutting, durability, and efficiency in tile installation projects. Within the broader construction equipment and power tools sector, it accounts for about 4.9%, driven by residential and commercial renovation activities. In the flooring and tiling tools segment, it holds nearly 6.2%, reflecting strong demand from contractors and DIY users. Across the building materials handling and cutting equipment market, the share is 3.8%, supporting applications in ceramics, porcelain, and stone processing. Within the industrial cutting machinery category, it represents 3.4%, highlighting use in specialized fabrication and large-scale projects. In the professional contractor tools market, it secures 3.1%, emphasizing reliance on high-performance wet and dry tile saws. Recent developments in this market have focused on product innovation, efficiency, and ease of use. Advancements include compact and portable tile saws with water management systems, dust control features, and laser-guided cutting. Manufacturers are investing in durable blade technology, improved motor efficiency, and ergonomic designs to cater to professional and consumer demand. Key players are integrating smart sensors for blade alignment and precision, as well as modular designs for quick maintenance and replacement. Cordless and battery-powered tile saws are gaining traction, providing mobility and flexibility on job sites. The partnerships with building contractors and distribution networks are enhancing product reach. These trends indicate how performance, convenience, and innovation are shaping the market.

The Tile Saws market is witnessing robust growth driven by rising construction and renovation activities worldwide. Increasing demand for high-precision cutting tools that enhance efficiency and accuracy in tile installation is shaping the current market scenario.

Technological advancements have led to the development of saws that offer better dust control, cutting speed, and versatility, which are influencing purchasing decisions among professionals and DIY users alike. The market’s future outlook is promising, supported by expanding infrastructure projects and the growing trend of home improvement.

The shift toward safer, more ergonomic, and power-efficient tile saws is also paving the way for sustained adoption As the demand for ceramic, porcelain, and stone tiles grows, the need for reliable tile cutting equipment is expected to remain strong, providing opportunities for manufacturers to innovate and cater to diverse customer requirements.

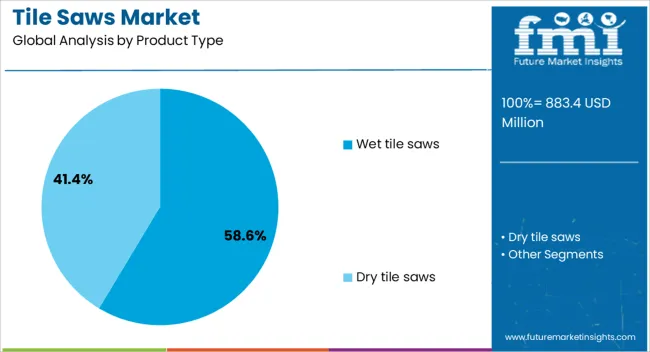

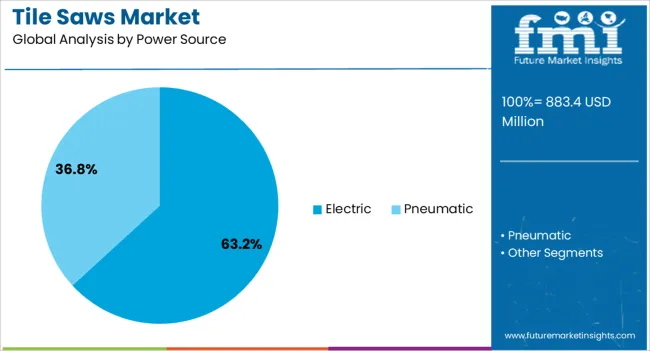

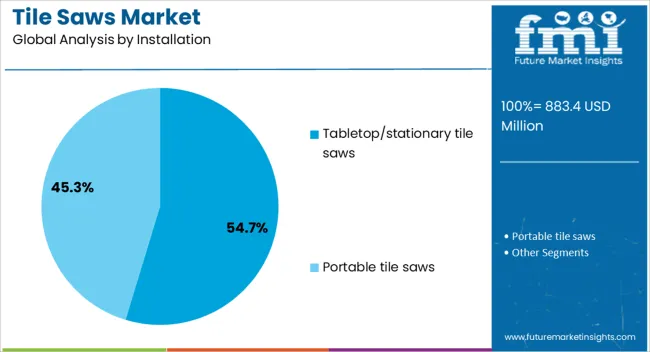

The tile saws market is segmented by product type, power source, installation, blade size, end use, distribution channel, and geographic regions. By product type, tile saws market is divided into Wet tile saws and Dry tile saws. In terms of power source, tile saws market is classified into Electric and Pneumatic. Based on installation, tile saws market is segmented into Tabletop/stationary tile saws and Portable tile saws.

By blade size, the tile saw market is segmented into up to 10 inches, 10 to 15 inches, and above 15 inches. By end use, tile saws market is segmented into Residential, Commercial, and Industrial. By distribution channel, tile saws market is segmented into Offline and Online. Regionally, the tile saws industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wet tile saws segment is projected to hold 58.6% of the Tile Saws market revenue share in 2025, positioning it as the leading product type. This leadership is attributed to the superior cutting performance and precision offered by wet saws, which utilize water to cool blades and reduce dust generation.

Such features enhance safety and prolong blade life, making them favorable in professional construction and renovation projects. The ability to cut a variety of materials, including porcelain, ceramic, and natural stone, with minimal chipping has further accelerated demand.

Additionally, the wet tile saws segment benefits from increasing regulatory focus on workplace safety and environmental standards, driving the adoption of dust-reducing technologies inherent to wet cutting methods.

The electric-powered tile saws segment is expected to capture 63.2% of the overall market revenue in 2025, emerging as the dominant power source. This dominance is explained by the widespread availability of electricity at construction sites and residential locations, which supports the reliable and continuous operation of electric saws.

Electric saws are favored for their consistent power delivery, lower maintenance requirements, and reduced noise levels compared to alternative power sources. The compatibility of electric tile saws with various attachments and safety features has further cemented their position.

As electric infrastructure expands globally and users seek energy-efficient and user-friendly equipment, this segment is poised to maintain its market leadership.

The tabletop or stationary tile saws segment is anticipated to hold 54.7% of the Tile Saws market revenue share in 2025, leading the installation category. The preference for tabletop saws arises from their stability, accuracy, and suitability for repetitive, high-volume tile cutting tasks.

Such saws provide enhanced operator control and safety features, making them ideal for professional workshops and large-scale construction projects. The ergonomic design and ease of use reduce operator fatigue and increase productivity, which are significant factors driving adoption.

Additionally, the growing demand for precision in tile dimensions and finishing quality has favored the use of stationary systems, which deliver consistent results compared to handheld alternatives.

The market has gained momentum as construction, interior remodeling, and infrastructure projects have expanded globally. Tile saws are widely used in flooring, wall installations, and decorative applications, offering precision cutting for ceramic, porcelain, marble, granite, and other hard materials. Rising demand for advanced tiling tools from both professional contractors and DIY consumers has influenced the market trajectory. Electric and wet tile saws with water cooling, laser guides, and dust management systems have improved efficiency, accuracy, and operator safety.

The growth of residential housing projects and commercial building activities has been a significant driver for tile saw demand. Increasing installations of ceramic and porcelain tiles for kitchens, bathrooms, and office spaces have necessitated precision cutting tools. Contractors and construction companies prefer tile saws with advanced blade designs and cooling systems for heavy duty performance. Rapid urban development has expanded flooring, wall, and exterior tiling applications, strengthening demand for durable cutting solutions. DIY adoption has also increased, with compact portable tile saws gaining popularity among homeowners. Construction sector expansion continues to provide a strong foundation for the steady growth of the tile saws market worldwide.

Technological innovation has transformed tile saw functionality, offering enhanced accuracy, speed, and safety features. Laser guided alignment systems, water recycling cooling mechanisms, and noise reduction designs have made tile saws more user friendly. High power electric motors have improved cutting efficiency across tough materials such as granite and quartz. Battery operated cordless models have gained traction among DIY users for small scale projects, offering flexibility without compromising performance. Manufacturers are investing in ergonomic designs to reduce operator fatigue and extend usability. These advancements have positioned modern tile saws as essential precision tools, boosting their acceptance across professional and domestic applications.

Growing interest in DIY home improvement activities has positively impacted the tile saws market. Affordable, portable, and user friendly tile saws are increasingly being purchased by consumers undertaking flooring, kitchen backsplash, and bathroom remodeling projects. Online tutorials and digital platforms have encouraged home renovation culture, fueling tool demand. Compact wet tile saws and handheld models are particularly popular for household projects due to their ease of use and affordability. Retail expansion through hardware chains and online stores has improved accessibility, driving steady sales. The increasing trend of self-managed home renovations is expected to remain a strong contributor to the tile saw market’s long term expansion.

Despite market growth, the tile saws industry faces challenges from safety issues, maintenance requirements, and rising competition from alternative cutting tools. Risks associated with dust exposure, blade accidents, and improper water management remain concerns among users. Strict occupational safety guidelines have required additional product features such as protective guards and dust suppression systems, raising costs for manufacturers. Intense competition from low-cost imports and multipurpose cutting tools has further pressured margins. The demand fluctuations linked to construction sector cycles impact sales consistency. To overcome these challenges, manufacturers are focusing on safety innovations, durable designs, and targeted marketing strategies to differentiate products in a competitive landscape.

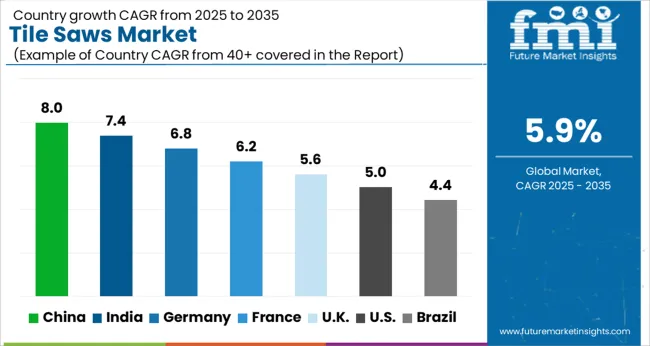

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The market is anticipated to register a forecast CAGR of 5.9% from 2025 to 2035, with production and innovation shaped by leading economies. Demand has been elevated in India at 7.4% and Germany at 6.8%, supported by advances in construction technologies and equipment adoption. China continues to command the largest influence with 8.0%, while markets such as the UK at 5.6% and the USA at 5.0% are sustaining steady contributions. The outlook indicates that leading players are diversifying capabilities to meet regional construction and renovation requirements. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to register a CAGR of 8.0%, with growth stimulated by infrastructure development, housing construction, and remodeling activities. Adoption has been reinforced by increasing demand for precision cutting tools in residential and commercial projects. Domestic manufacturers emphasize cost effective tile saws with diamond blades and water cooling systems, catering to both small contractors and large construction firms. Export of Chinese manufactured tile saws has increased due to competitive pricing and large scale production capacities. The market outlook remains strong as China continues to invest heavily in residential housing and industrial construction, creating consistent demand for tile cutting equipment.

India is expected to post a CAGR of 7.4% in the market, encouraged by rising residential construction and commercial real estate expansion. Demand has been influenced by the preference for ceramic and vitrified tiles in flooring, wall finishes, and renovation projects. Domestic players are focusing on mid-range tile saws equipped with efficient water cooling systems and precision cutting technology. Imports from China supplement demand, especially for high volume construction projects. The market is anticipated to expand further as construction contractors and home improvement segments adopt reliable and durable tile saws for large scale applications.

Germany is projected to record a CAGR of 6.8% in the market, driven by steady renovation activities, residential upgrades, and commercial construction. Adoption has been enhanced by demand for high precision cutting equipment and durable machinery in the professional construction sector. German manufacturers such as Einhell and Metabo continue to lead with innovations in wet tile saws and dust control technologies. Market demand has also been supported by strict construction quality standards, favoring durable and precision cutting tools. Tile saws with advanced safety features and ergonomic design remain highly sought after in German markets.

The United Kingdom market is set to advance at a CAGR of 5.6%, influenced by home renovation projects, commercial developments, and housing construction. Market demand has been reinforced by the preference for ceramic and porcelain tiles in modern interiors. Domestic distributors import significant volumes from European and Asian manufacturers to meet contractor requirements. Compact and portable tile saws with water cooling features are gaining traction among small contractors and home improvement users. The market is projected to grow steadily as renovation activities and housing upgrades increase demand for efficient and precise tile cutting solutions across the U K.

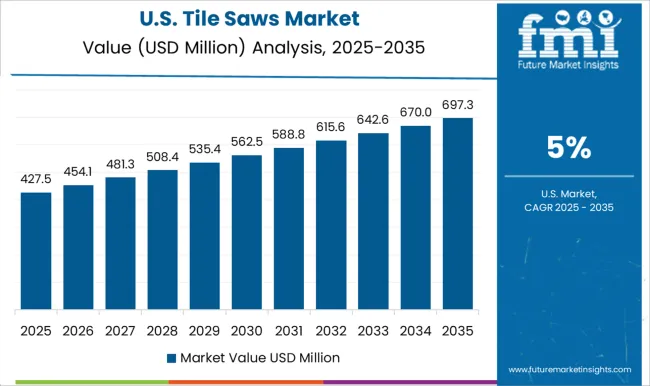

The United States market is expected to grow at a CAGR of 5.0%, supported by demand from residential construction, commercial real estate, and remodeling projects. Adoption has been driven by the popularity of ceramic and stone tiles in flooring and wall applications. U S manufacturers emphasize high quality wet tile saws with diamond blade technology, catering to both professional and DIY users. Home improvement stores and online platforms have strengthened distribution, making tile saws more accessible to end users. The outlook remains stable as the U S continues to witness steady construction and renovation activities in both residential and commercial projects.

The market is shaped by the presence of both global power tool manufacturers and specialized equipment producers. Dewalt and Bosch dominate through diversified portfolios and strong brand equity, offering robust and precise tile cutting solutions widely adopted by professionals. Husqvarna stands out with advanced wet saw systems, emphasizing durability, cutting accuracy, and innovations in dust suppression and water management. Ridgid and Skil cater to both professional contractors and DIY users, focusing on affordability, portability, and user-friendly designs. QEP, Rubi, and Raimondi have established a stronghold in tile installation equipment, leveraging specialized product lines tailored to contractors working with ceramics, porcelain, and natural stone.

Delta and Edco contribute with heavy-duty machines designed for industrial and construction applications, emphasizing high cutting capacity and reliability. Flex, Goldblatt, and Golz strengthen their presence by integrating ergonomic designs, precision engineering, and enhanced blade compatibility. Competitive differentiation is influenced by precision cutting technology, machine durability, dust and water management systems, and brand loyalty in the professional segment. Companies also pursue product innovations, expanding cordless offerings, and integrating advanced safety features to meet evolving contractor and renovation demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 883.4 Million |

| Product Type | Wet tile saws and Dry tile saws |

| Power Source | Electric and Pneumatic |

| Installation | Tabletop/stationary tile saws and Portable tile saws |

| Blade Size | Up to 10 inches, 10 to 15 inches, and Above 15 inches |

| End Use | Residential, Commercial, and Industrial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dewalt, Bosch, Delta, Edco, Flex, Goldblatt, Golz, Husqvarna, QEP, Raimondi, Ridgid, Rubi, and Skil |

| Additional Attributes | Dollar sales by saw type and application, demand dynamics across residential, commercial, and industrial construction sectors, regional trends in professional tool adoption, innovation in cutting precision, portability, and dust management, environmental impact of energy use and material disposal, and emerging use cases in large-scale tiling projects, renovation works, and specialty stone applications. |

The global tile saws market is estimated to be valued at USD 883.4 million in 2025.

The market size for the tile saws market is projected to reach USD 1,567.2 million by 2035.

The tile saws market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in tile saws market are wet tile saws and dry tile saws.

In terms of power source, electric segment to command 63.2% share in the tile saws market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tile Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Tile Abrasion Testing Market Size and Share Forecast Outlook 2025 to 2035

Tile Cutter Market

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Ductile and Grey Iron Casting Products Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tactile Sensors Market Size and Share Forecast Outlook 2025 to 2035

Textile Colorant Market – Trends & Forecast 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Textile Tester Market Growth – Trends & Forecast 2025 to 2035

Textile Colors Market Growth - Trends & Forecast 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Textile Auxiliaries Market Trends 2024-2034

Textile Printing Ink Market

Volatile Corrosion Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA